Академический Документы

Профессиональный Документы

Культура Документы

Government College University, Faisalabad

Загружено:

Ladla AnsariИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Government College University, Faisalabad

Загружено:

Ladla AnsariАвторское право:

Доступные форматы

College of Commerce,

Government College University, Faisalabad

Second Assignment Last Date:19-01-2019

Subject Title: Business Taxation Code: Com. 407 Instructor’s Name: Mian Niaz Shaki

Q. No. 1 What is the return of income? Write in detail the legal provisions governing the filing of

return of total income under income tax law.

Q. No. 2 What is assessment? Discuss the various types of assessment made by commissioner of

Inland Revenue.

Q. No. 3 Explain at least ten offences and their penalties that can be imposed under income tax

ordinance 2001.

Q. No. 4 Discuss the powers and functions of Chief Commissioner Inland Revenue (CCIR).

Q. No. 5 Discuss the composition and functions of Appellate Tribunal and discuss the procedure

of appeal to appellate tribunal.

Q. No. 6 Discuss in detail the various payments where the tax is deducted at source under Income

Tax Ordinance 2001.

Q. No. 7 Discuss the legal provision regarding furnishing of return of income under Income tax

ordinance 2001.

Q. No. 8 Explain the self-assessment scheme for tax year 2017

Q. No. 9 Define Agricultural Income. Discuss different types of Agricultural Income. Explain

your answer with the help of different examples.

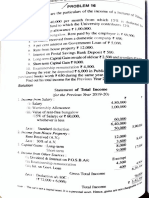

Q. No. 10 Compute the taxable income and Tax payable of Mr. Almas who is working as

Manager in a Public Limited Company. Data regarding his salary for the year ended on 30th June

2017 is given below.

1 Basic Salary Rs. 14,00,000

2 Medical Allowance 1,60,000

3 Interest free loan provided by employer 7,00,000

4 Conveyance Facility (for personal use only), value of conveyance 16,00,000

5 Zakat paid under Zakat and Usher Ordinance 80,000

6 Donation to Bait ul Mal 50,000

7 Employee’s Contribution to APF 1,00,000

8 Employer’s contribution to APF 1,00,000

9 Interest on accumulated balance of APF @10% 1,50,000

10 Income from property (collection charges Rs.10,000, legal charges 2,50,000

Rs.5000)

11 Income from poultry farm 2,00,000

12 Gain on sale of shares of Private company (sold within 12 months) 80,000

13 Utility allowance 50,000

15 Tax deducted at source 25,000

16 Dividend received from a public company 60,000

17 Tax deducted on cash withdrawal from a bank 6,000

He is provided rent free furnished accommodation.

Вам также может понравиться

- Wealth Management Planning: The UK Tax PrinciplesОт EverandWealth Management Planning: The UK Tax PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Taxation Law PDFДокумент3 страницыTaxation Law PDFSmag SmagОценок пока нет

- Taxation Law PDFДокумент3 страницыTaxation Law PDFSmag SmagОценок пока нет

- 0456Документ4 страницы0456Usman Shaukat Khan100% (1)

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityДокумент3 страницыBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedОценок пока нет

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Документ2 страницыAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)ilyas muhammadОценок пока нет

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Документ3 страницыAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Adeel AbbasОценок пока нет

- Exercise CorporationДокумент3 страницыExercise CorporationJefferson MañaleОценок пока нет

- Income Taxation ExamДокумент2 страницыIncome Taxation ExamyezaqueraОценок пока нет

- Financial ManagementДокумент20 страницFinancial Managementsanthanaaknal22Оценок пока нет

- Individual b4 B PracticeДокумент4 страницыIndividual b4 B Practicedavid.ellis1245Оценок пока нет

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Документ12 страницPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadОценок пока нет

- Accounts Home Test 2Документ7 страницAccounts Home Test 2Ashish RaiОценок пока нет

- Corporation Income Tax ProblemsДокумент3 страницыCorporation Income Tax ProblemsRandy Manzano50% (2)

- Computation of Total IncomeДокумент2 страницыComputation of Total Income2154 taibakhatunОценок пока нет

- 23-Wealth Statement and Reconciliation (334-343)Документ10 страниц23-Wealth Statement and Reconciliation (334-343)Wajahat Ghafoor100% (2)

- Tax DeductionsДокумент4 страницыTax DeductionsAnonymous LC5kFdtcОценок пока нет

- IAET TaxationДокумент2 страницыIAET TaxationRandy Manzano100% (1)

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularДокумент6 страниц027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006Оценок пока нет

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualДокумент9 страниц(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualRENZ ALFRED ASTREROОценок пока нет

- Allowable Deductions Part 1Документ3 страницыAllowable Deductions Part 1John Rich GamasОценок пока нет

- E-Filling of Returns (Shivdas 10 Years)Документ122 страницыE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderОценок пока нет

- Analysis of Financial StatementДокумент23 страницыAnalysis of Financial StatementMohammad Tariq AnsariОценок пока нет

- Account 1srsДокумент5 страницAccount 1srsNayan KcОценок пока нет

- Co 2101Документ3 страницыCo 2101PRIYA LAKSHMANОценок пока нет

- IPCC Gr.I Paper 4 TaxationДокумент10 страницIPCC Gr.I Paper 4 TaxationAyushi RajputОценок пока нет

- Final TaxДокумент1 страницаFinal TaxEun Ice0% (3)

- Paper 1Документ19 страницPaper 1GianОценок пока нет

- Review MaterialsДокумент3 страницыReview MaterialsAngie S. Rosales100% (1)

- QuickBooks For BeginnersДокумент9 страницQuickBooks For BeginnersZain U DdinОценок пока нет

- BBS 1st Year QuestionДокумент2 страницыBBS 1st Year Questionsatya100% (1)

- Problem CH 11 Alfi Dan Yessy AKT 18-MДокумент4 страницыProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Accounting 2Документ18 страницAccounting 2cherryannОценок пока нет

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Документ45 страницSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaОценок пока нет

- Taxation: The Institute of Chartered Accountants of PakistanДокумент4 страницыTaxation: The Institute of Chartered Accountants of PakistanadnanОценок пока нет

- IT QuestionДокумент3 страницыIT QuestionSathish SmartОценок пока нет

- Identify The Choice That Best Completes The Statement or Answers The QuestionДокумент5 страницIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaОценок пока нет

- Franchise AccountingДокумент4 страницыFranchise AccountingJeric IsraelОценок пока нет

- AfB1 Tutorial Questions For Week 3Документ3 страницыAfB1 Tutorial Questions For Week 3zhaok0610Оценок пока нет

- Question Paper 2010: Punjab UniversityДокумент2 страницыQuestion Paper 2010: Punjab UniversitySajid YaqoobОценок пока нет

- Profit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaДокумент8 страницProfit and Gains of Business or Profession (PGBP) : Dr. Sonam Topgay BhutiaUmesh SharmaОценок пока нет

- Review Notes #2 - Comprehensive Problem PDFДокумент3 страницыReview Notes #2 - Comprehensive Problem PDFtankofdoom 4Оценок пока нет

- F Business Taxation 671079211Документ4 страницыF Business Taxation 671079211anand0% (1)

- Problems - Cash FlowДокумент5 страницProblems - Cash FlowKevin JoyОценок пока нет

- Aac M 2 Cash Flow Prob Answer 1 5Документ11 страницAac M 2 Cash Flow Prob Answer 1 5Micah Danielle S. TORMON0% (1)

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AДокумент9 страницMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurОценок пока нет

- Practice Exam FinalsДокумент2 страницыPractice Exam FinalsPauline Jasmine Sta AnaОценок пока нет

- Quiz Allowable DeductionsДокумент18 страницQuiz Allowable DeductionsceistОценок пока нет

- Comprehensive JEV Preparation NGAs 2Документ2 страницыComprehensive JEV Preparation NGAs 2Eizzel SamsonОценок пока нет

- Accountancy Term-2 Practical QuestionsДокумент3 страницыAccountancy Term-2 Practical QuestionsAnoushka ReddyОценок пока нет

- Tax1 Q Chapter-11 12 13 With-AnswerДокумент2 страницыTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorОценок пока нет

- Preparation & Analysis of Cash Flow StatementsДокумент27 страницPreparation & Analysis of Cash Flow StatementsAniket PanchalОценок пока нет

- Practice Question Paper - Financial AccountingДокумент6 страницPractice Question Paper - Financial AccountingNaomi SaldanhaОценок пока нет

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationДокумент4 страницыTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifОценок пока нет

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsДокумент7 страницQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshОценок пока нет

- 1234 Statement of Cash FlowДокумент9 страниц1234 Statement of Cash Flowahmie banez100% (1)

- Profits Tax Computation QuestionДокумент2 страницыProfits Tax Computation Question何健珩Оценок пока нет

- JKN - Acc - 13 - Question Paper - 131020Документ10 страницJKN - Acc - 13 - Question Paper - 131020adityatiwari122006Оценок пока нет

- Model Question BBS 3rd Taxation in NepalДокумент6 страницModel Question BBS 3rd Taxation in NepalAsmita BhujelОценок пока нет

- Bedb Sme Guide Book (2012)Документ58 страницBedb Sme Guide Book (2012)Mohd FadhilullahОценок пока нет

- Mini CooperДокумент5 страницMini CooperzavrisОценок пока нет

- Kandy Co Draft FSMT and MobyДокумент4 страницыKandy Co Draft FSMT and MobyAliОценок пока нет

- Car Skoda Rapid 2013Документ19 страницCar Skoda Rapid 2013WILLIAM HASSETTОценок пока нет

- Acquisition Checklist - EkinixДокумент4 страницыAcquisition Checklist - EkinixAntonio Nlp HoОценок пока нет

- Konstitusi ArgentinaДокумент23 страницыKonstitusi ArgentinaDon JovianoОценок пока нет

- MicroEconomics ReviewerДокумент8 страницMicroEconomics Reviewervon_montillaОценок пока нет

- RESEARCH FINAL Revised 1Документ60 страницRESEARCH FINAL Revised 1Ian MarianoОценок пока нет

- Bicolandia Drug Corp Vs CIRДокумент1 страницаBicolandia Drug Corp Vs CIRDPMPascuaОценок пока нет

- Sap HR FaqДокумент36 страницSap HR FaqAnonymous 5mSMeP2jОценок пока нет

- 67 CIR Vs Procter & GambleДокумент10 страниц67 CIR Vs Procter & GamblePam ChuaОценок пока нет

- REPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18Документ3 страницыREPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18LawrenceAltezaОценок пока нет

- Zse Investors Guide: A Guide To Investing On The Zimbabwe Stock ExchangeДокумент7 страницZse Investors Guide: A Guide To Investing On The Zimbabwe Stock ExchangeJack SniperОценок пока нет

- Tax 1 Course Outline 2018-2019 Final RevisionДокумент9 страницTax 1 Course Outline 2018-2019 Final Revisionjorg100% (1)

- Assignment On Launching Aarong in Canada: Submitted ToДокумент14 страницAssignment On Launching Aarong in Canada: Submitted ToEnaiya IslamОценок пока нет

- 2.Hola-Kola - The Capital Budgeting DecisionДокумент3 страницы2.Hola-Kola - The Capital Budgeting DecisionGautam D50% (2)

- Measurement by A Lessee and Accounting For A Change in The Lease TermДокумент3 страницыMeasurement by A Lessee and Accounting For A Change in The Lease TermJhon SudiarmanОценок пока нет

- Accounting 15Документ25 страницAccounting 15almira garciaОценок пока нет

- 1 Agreed Upon Procedures GuideДокумент27 страниц1 Agreed Upon Procedures GuideiamnumberfourОценок пока нет

- Libertarianism in One Lesson - David BerglandДокумент107 страницLibertarianism in One Lesson - David BerglandRafael RochaОценок пока нет

- Aviva Life Insurance Company India Limited Premium QuotationДокумент2 страницыAviva Life Insurance Company India Limited Premium QuotationMohan BNОценок пока нет

- MACIG2019 WebVersionДокумент144 страницыMACIG2019 WebVersionRotimi AleОценок пока нет

- Contract To Sell Revised Feb 2022Документ9 страницContract To Sell Revised Feb 2022Darwin LasinОценок пока нет

- Social Security SecretsДокумент13 страницSocial Security SecretsCrane SMS0% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Marmik MankodiОценок пока нет

- The Impact of Covid 19 On Education Insights Education at A Glance 2020Документ31 страницаThe Impact of Covid 19 On Education Insights Education at A Glance 2020Muhammad Kashif100% (1)

- Ak564po1000109 PDFДокумент3 страницыAk564po1000109 PDFgopal thapaОценок пока нет

- 2014-15 Douglas County Secured Assessment RollДокумент97 страниц2014-15 Douglas County Secured Assessment RollcvalleytimesОценок пока нет

- DOSCarmela 1Документ3 страницыDOSCarmela 1Carmela InsigneОценок пока нет

- Personal Reference Letter For CourtДокумент3 страницыPersonal Reference Letter For CourtabrshОценок пока нет