Академический Документы

Профессиональный Документы

Культура Документы

China Banking Corporation Vs CA

Загружено:

robbyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

China Banking Corporation Vs CA

Загружено:

robbyАвторское право:

Доступные форматы

CHINA BANKING CORPORATION vs.

COURT OF APPEALS

G.R. No. 146749; June 10, 2003

FACTS:

PET paid P12,354,933.00 as gross receipts tax on its income from interests on loan investments, commissions, services,

collection charges, foreign exchange profits and other operating earnings during the second quarter of 1994.

Citing Asian Bank Corp. v, CIR, PET argued that it was not liable for the gross receipts tax - amounting

to P1,140,623.82 - on the sums withheld by the Bangko Sentral ng Pilipinas as final withholding tax on its passive

interest income in 1994.

Disputing PET’s claim, CIR asserted that PET paid the gross receipts tax pursuant to Section 119 (now Section 121),

NIRC and other pertinent BIR regulations. Further, it argued that the final withholding tax on a bank’s interest income

forms part of its gross receipts in computing the gross receipts tax. Contending that the term "gross receipts" means the

entire income or receipt, without any deduction.

CA and CTA ruled in favor of PET, ordering a partial refund of P123,778.73 and holding that the 20% final withholding tax

on interest income does not form part of PET’s taxable gross receipts.

Revenue Regulations No. 12-80 provides that the rates of tax to be imposed on the gross receipts of banking and

financial institution shall be based on all items on income actually received. Hence, subject tax, not having been

received by PET but instead went to the coffers of the government, should no longer form part of its gross

receipts for the purpose of computing the gross receipt tax.

ISSUE:

a. WON the 20% final withholding tax on interest income should form part of CBC’s gross receipts in computing the gross

receipts tax on banks - YES.

The concept of a withholding tax necessarily implies that the tax withheld comes from the income earned by the taxpayer.

Since the amount of the tax withheld constitutes income earned by the taxpayer, then that amount manifestly forms part of

the taxpayer’s gross receipts.

Absent a statutory definition, the term "gross receipts" is understood in its plain and ordinary meaning. Words in a statute

are taken in their usual and familiar signification, with due regard to their general and popular use.

NIRC does not define the term "gross receipts" for purposes of tax on finance companies. Despite the absence of a

statutory definition, these taxes have been collected in this country for over half a century on the general and common

understanding that they are based on all receipts without any deduction.

BIR has consistently ruled that the term "gross receipts" does not admit of any deduction, which remained unchanged

despite various legislative re-enactments of the provision on gross receipt tax on banks under Sec. 249 of the Tax Code

(RA 39 in 1946; PD 69 in 1972; PD 1158 and RA 8424 in 1977).

The only conclusion is that the legislature has adopted the BIR’s interpretation, following the principle of

legislative approval by re-enactment. Under this principle, it is presumed that the Legislature reenacted the law on

the tax with full knowledge of the contents of the regulations then in force, and that it approved or confirmed them

because they carry out the legislative purpose.

The presumption is that the legislature is familiar with the contemporaneous interpretation of a statute given by

the administrative agency tasked to enforce the statute.

ITC, subsequent re-enactments of the present Section 121 of the Tax Code, without changes on the term interpreted by

the BIR, confirm that the BIR’s interpretation carries out the legislative purpose.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Facture - Fartech2023 Numero 2Документ1 страницаFacture - Fartech2023 Numero 2Axel ChablozОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 02 de Leon v. RodriguezДокумент2 страницы02 de Leon v. Rodriguezrobby100% (2)

- TATA 1MG Healthcare Solutions Private Limited: Chhatarpur Extn.,, New Delhi, 110074, IndiaДокумент1 страницаTATA 1MG Healthcare Solutions Private Limited: Chhatarpur Extn.,, New Delhi, 110074, Indiaanupam chauhan0% (1)

- University of The Philippines Diliman: Check With Respective CollegesДокумент1 страницаUniversity of The Philippines Diliman: Check With Respective CollegesMeowthemathicianОценок пока нет

- SPECPRO Week 1 CompilationДокумент26 страницSPECPRO Week 1 CompilationrobbyОценок пока нет

- Foreign Investments Act of 1991Документ5 страницForeign Investments Act of 1991Marien Gonzales LopezОценок пока нет

- Invit. Letter of Army & ResponseДокумент3 страницыInvit. Letter of Army & ResponserobbyОценок пока нет

- Dna ModuleДокумент8 страницDna ModulerobbyОценок пока нет

- Q & A On Batas Kasambahay (RA No 10361) PDFДокумент8 страницQ & A On Batas Kasambahay (RA No 10361) PDFchristimyvОценок пока нет

- 01 Rivera v. ChuaДокумент1 страница01 Rivera v. ChuarobbyОценок пока нет

- PRIL DigestsДокумент12 страницPRIL DigestsrobbyОценок пока нет

- Marcos II V CAДокумент3 страницыMarcos II V CArobbyОценок пока нет

- OXALES v. UNITED LABORATORIESДокумент2 страницыOXALES v. UNITED LABORATORIESrobbyОценок пока нет

- HOLIDAY INN MANILA v. NLRCДокумент2 страницыHOLIDAY INN MANILA v. NLRCrobbyОценок пока нет

- 123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONДокумент4 страницы123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONrobbyОценок пока нет

- 123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONДокумент4 страницы123 VICTORIANO vs. ELIZALDE ROPE WORKERS' UNIONrobbyОценок пока нет

- 3.4 Victoriano V Elizalde Rope Workers' UnionДокумент3 страницы3.4 Victoriano V Elizalde Rope Workers' UnionrobbyОценок пока нет

- Malcolm Cup 2019 PDFДокумент5 страницMalcolm Cup 2019 PDFrobbyОценок пока нет

- PRIL DigestsДокумент14 страницPRIL DigestsrobbyОценок пока нет

- Malcolm Cup 2019 PDFДокумент5 страницMalcolm Cup 2019 PDFrobbyОценок пока нет

- Administrative Remedies of The GovernmentДокумент5 страницAdministrative Remedies of The GovernmentrobbyОценок пока нет

- 03 Jao vs. CAДокумент2 страницы03 Jao vs. CArobbyОценок пока нет

- Malcolm Cup 2019 PDFДокумент5 страницMalcolm Cup 2019 PDFrobbyОценок пока нет

- The Federalist Paper 78Документ5 страницThe Federalist Paper 78robbyОценок пока нет

- 03 Jao vs. CAДокумент2 страницы03 Jao vs. CArobbyОценок пока нет

- Ayala CirДокумент1 страницаAyala CirrobbyОценок пока нет

- Aznar Vs CtaДокумент2 страницыAznar Vs CtarobbyОценок пока нет

- 22 Advocates For Truth in Lending V BSPДокумент3 страницы22 Advocates For Truth in Lending V BSProbby100% (1)

- Maloles II Vs PhillipsДокумент4 страницыMaloles II Vs PhillipsrobbyОценок пока нет

- Ong Chua V. Edward Carr Et AlДокумент4 страницыOng Chua V. Edward Carr Et AlrobbyОценок пока нет

- Sidel RulingДокумент6 страницSidel RulingMarc Exequiel TeodoroОценок пока нет

- LG Electronics V CIRДокумент2 страницыLG Electronics V CIRCarla CucuecoОценок пока нет

- Education Authority PunjabДокумент1 страницаEducation Authority PunjabMuhammad JamilОценок пока нет

- Membership Fee and ProcedureДокумент2 страницыMembership Fee and ProcedureAzhar RanaОценок пока нет

- Personal Taxation Final QuestionsДокумент5 страницPersonal Taxation Final QuestionsKarthik RamanathanОценок пока нет

- NoticeДокумент1 страницаNoticenagesh abbaramainaОценок пока нет

- Top 30 MCQ Goods & Service TaxДокумент3 страницыTop 30 MCQ Goods & Service TaxEthan HuntОценок пока нет

- PaymentReceipt 27522087Документ1 страницаPaymentReceipt 27522087ashish jaiswalОценок пока нет

- Cipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Документ2 страницыCipla Limited Cipla House Lower Parel: Payslip For The Month of NOVEMBER 2021Dhruv RanaОценок пока нет

- 0281 (22-23) (Harsh Priya Constructions)Документ1 страница0281 (22-23) (Harsh Priya Constructions)Ravikant MishraОценок пока нет

- SL No. Time Period Misc Payment Pending Remarks Leave CalculationДокумент1 страницаSL No. Time Period Misc Payment Pending Remarks Leave CalculationKaustabha DasОценок пока нет

- A Donation Inter Vivos Is An Act of Liberality Whereby A Person Disposes Gratuitously of A Property or Night in Favor of Another Who Accepts ItДокумент2 страницыA Donation Inter Vivos Is An Act of Liberality Whereby A Person Disposes Gratuitously of A Property or Night in Favor of Another Who Accepts ItHella Mae RambunayОценок пока нет

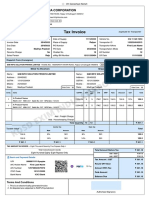

- Tax Invoice: Excitel Broadband Pvt. LTDДокумент1 страницаTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyОценок пока нет

- Act Sep 21 To Mar 22Документ2 страницыAct Sep 21 To Mar 22goldynОценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент2 страницыU.S. Individual Income Tax Return: Filing StatusSammi Bowe100% (1)

- General Income Tax and Benefit Guide 2016 (5000g-16e)Документ78 страницGeneral Income Tax and Benefit Guide 2016 (5000g-16e)brianchen06Оценок пока нет

- Invoice: "Thank You For Staying With Us at Holiday Inn Chandigarh Zirakpur"Документ1 страницаInvoice: "Thank You For Staying With Us at Holiday Inn Chandigarh Zirakpur"dprosenjitОценок пока нет

- Westridge Rawalpindi Job No:: 1St Running Account ReceiptДокумент2 страницыWestridge Rawalpindi Job No:: 1St Running Account Receiptibrahim khanОценок пока нет

- Case 182 - Limitations On Revenue, Appropriations and Tariff MeasuresДокумент3 страницыCase 182 - Limitations On Revenue, Appropriations and Tariff MeasuresannamariepagtabunanОценок пока нет

- MCQ - Unit 2Документ15 страницMCQ - Unit 2Niraj PandeyОценок пока нет

- Sales GST 285Документ2 страницыSales GST 285ashish.asati1Оценок пока нет

- LeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberДокумент12 страницLeAnn Bobleter Sargent Bankruptcy Income Records Maple Grove City Council MemberghostgripОценок пока нет

- Invoice 40 Palmeto MulesoftДокумент6 страницInvoice 40 Palmeto MulesoftSrinivasa HelavarОценок пока нет

- Analytics CloudДокумент1 страницаAnalytics CloudAbhijit SarkarОценок пока нет

- A5 InvoiceДокумент1 страницаA5 InvoiceVaibhav PritwaniОценок пока нет

- Invoice: Page 1 of 3Документ3 страницыInvoice: Page 1 of 3ShivaОценок пока нет

- CA. Mithun Khatry 9810100520Документ3 страницыCA. Mithun Khatry 9810100520Mithun KhatryОценок пока нет

- Purchase Order: Jaquar & Co. Pvt. LTD (Bhiwadi)Документ2 страницыPurchase Order: Jaquar & Co. Pvt. LTD (Bhiwadi)NAGRAJ RAMANОценок пока нет

- Policydownload 230207 000615-43Документ1 страницаPolicydownload 230207 000615-43Anindya SundarОценок пока нет

- Srivari Packing Industries PVДокумент3 страницыSrivari Packing Industries PVBala_9990Оценок пока нет