Академический Документы

Профессиональный Документы

Культура Документы

Form No. 15CB: B 1. Country To Which Remittance Is Made

Загружено:

Daman GillОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. 15CB: B 1. Country To Which Remittance Is Made

Загружено:

Daman GillАвторское право:

Доступные форматы

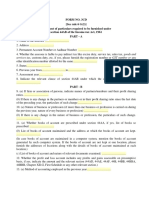

Form No.

15CB

(See rule 37BB)

Certificate of an accountant1

I/We* have examined the agreement (wherever applicable) between Mr./Ms./M/s*……………………….

(Remitters) and Mr./Ms./M/s*…………………………………. (Beneficiary) requiring the above

remittance as well as the relevant documents and books of account required for ascertaining the nature of

remittance and for determining the rate of deduction of tax at source as per provisions of Chapter- XVII-B.

We hereby certify the following :-

A Name and address of the beneficiary of the remittance

B 1. Country to which remittance is made Country: ……………….. Currency:

2. Amount payable In foreign currency: In Indian Rs.

3. Name of the bank Branch of the bank

4. BSR Code of the bank branch (7 digit)

5. Proposed date of remittance (DD/MM/YYYY)

6 Nature of remittance as per agreement/ document

7. In case the remittance is net of taxes, whether tax (Tick) Yes No

payable has been grossed up?

8. Taxability under the provisions of the Income-tax

Act (without considering DTAA)

(i) is remittance chargeable to tax in India (Tick) Yes No

(ii) if not reasons thereof

(iii) if yes, (a) the relevant section of the Act under

which the remittance is covered

(b) the amount of income chargeable to tax

(c) the tax liability

(d) basis of determining taxable income and tax

liability

9. If income is chargeable to tax in India and any relief

is claimed under DTAA-(i) whether tax residency (Tick) Yes No

certificate is obtained from the recipient of

remittance

(ii) please specify relevant DTAA

(ii) please specify relevant article of DTAA

Nature of payment as per DTAA

(iii) taxable income as per DTAA In Indian Rs. ……………..

(iv) tax liability as per DTAA In Indian Rs. ……………..

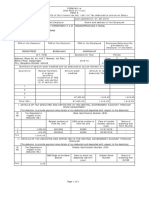

A. If the remittance is for royalties, fee (Tick) Yes No

for technical services, interest, dividend, etc,(not

connected with permanent establishment) please

indicate:-

(a) Article of DTAA

(b) Rate of TDS required to be deducted in terms of As per DTAA (%)

such article of the applicable DTAA ……………..……………..

B. In case the remittance is on account of business (Tick) Yes No

income, please indicate:-

(a) Whether such income is liable to tax in India (Tick) Yes No

(b) If so, the basis of arriving at the rate of deduction

of tax.

(c) If not, please furnish brief reasons thereof,

specifying relevant article of DTAA

C. In case the remittance is on account of capital (Tick) Yes No

gains, please indicate:-

(a) amount of long term capital gains

(b) amount of short-term capital gains

(c) basis of arriving at taxable income

D. In case of other remittance not covered by sub- (Tick) Yes No

items A, B and C

(a) Please specify nature of remittance

(b) Whether taxable in India as per DTAA

(c) If yes, rate of TDS required to be deducted in

terms of such article of the applicable DTAA

(d) if not , please furnish brief reasons thereof,

specifying relevant article of DTAA

10 Amount of TDS In foreign currency

In Indian Rs.

11 Rate of TDS As per Income-tax Act (%) or

As per DTAA (%)

12 Actual amount of remittance after TDS In foreign currency

13 Date of deduction of tax at source, if

(DD/MM/YYYY)

Certificate No.2

Signature : ………………………..…….…….…….….

Name: ………………………..…….…….…….…….…

Name of the proprietorship/ firm: …….…….…….……

Address: ………………………..………………………

Registration No.: ………………………..…….…….….

1. To be signed and verified by an accountant (other than employee) as defined in the Explanation below

sub-section (2) of section 288 of the Income-tax Act,1961.

2. Certificate number is an internal number to be given by the Accountant. * Delete whichever is not

applicable.

Вам также может понравиться

- Form 15 CBДокумент2 страницыForm 15 CBAdarsh Singh KshatriyaОценок пока нет

- Form 15CB TDS CertificateДокумент3 страницыForm 15CB TDS CertificateParth UpadhyayОценок пока нет

- Form 15ca FormatДокумент4 страницыForm 15ca FormattejashtannaОценок пока нет

- (See Rule 31 (1) (A) ) : Form No. 16Документ8 страниц(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeОценок пока нет

- Form 16 TDS CertificateДокумент3 страницыForm 16 TDS CertificateBijay TiwariОценок пока нет

- Form No 16Документ4 страницыForm No 16Md ZhidОценок пока нет

- A SimДокумент4 страницыA Simsana_rautОценок пока нет

- Flytxt - ECB Interest - Form 15CB - 21 Nov 22Документ4 страницыFlytxt - ECB Interest - Form 15CB - 21 Nov 22RahulОценок пока нет

- ITR62 Form 15 CAДокумент5 страницITR62 Form 15 CAMohit47Оценок пока нет

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Документ3 страницыLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Оценок пока нет

- Form 16Документ4 страницыForm 16harit sharmaОценок пока нет

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Документ5 страницIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaОценок пока нет

- Form 16 TDS certificateДокумент8 страницForm 16 TDS certificateVikas PattnaikОценок пока нет

- (See Rule 31 (1) (B) )Документ2 страницы(See Rule 31 (1) (B) )B RОценок пока нет

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент4 страницыForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxОценок пока нет

- Form 15CB - Filed FormДокумент4 страницыForm 15CB - Filed FormBhagya RajoriaОценок пока нет

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AДокумент16 страницForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalОценок пока нет

- Form27d Applicable From 01.04Документ2 страницыForm27d Applicable From 01.04sudhrengeОценок пока нет

- CertificateДокумент2 страницыCertificateapi-3822396Оценок пока нет

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Документ2 страницы(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarОценок пока нет

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NДокумент6 страниц(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashОценок пока нет

- Itr 62 Form 16Документ4 страницыItr 62 Form 16Hardik ShahОценок пока нет

- Form 16 FormatДокумент2 страницыForm 16 FormatParthVanjaraОценок пока нет

- Form 15CB - Filed FormДокумент3 страницыForm 15CB - Filed Formprachi12gargОценок пока нет

- Umesh C-Form16 - 2020-21Документ10 страницUmesh C-Form16 - 2020-21Umesh CОценок пока нет

- As Approved by Income Tax DepartmentДокумент5 страницAs Approved by Income Tax DepartmentRicha JoshiОценок пока нет

- Kanya KarungalДокумент13 страницKanya KarungalramОценок пока нет

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Документ4 страницыPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilОценок пока нет

- Income Declaration Scheme Rules FormДокумент5 страницIncome Declaration Scheme Rules FormDeepaDivyavarthiniОценок пока нет

- Ministry of Finance (Department of Revenue)Документ24 страницыMinistry of Finance (Department of Revenue)grameshchandraОценок пока нет

- TDS Certificate Form 16 SummaryДокумент3 страницыTDS Certificate Form 16 SummarySvsSridharОценок пока нет

- Form 15CAДокумент4 страницыForm 15CAManoj MahimkarОценок пока нет

- Form 12BBДокумент2 страницыForm 12BBPintu pajaiОценок пока нет

- Form 12Документ2 страницыForm 12sarathОценок пока нет

- FORM 16 TAX DEDUCTION CERTIFICATEДокумент3 страницыFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiОценок пока нет

- Form 16aaДокумент2 страницыForm 16aaJayОценок пока нет

- Form No 16 - Ay0607Документ4 страницыForm No 16 - Ay0607api-3705645100% (1)

- Form 15 CA and 15 CBДокумент6 страницForm 15 CA and 15 CBscrana7480Оценок пока нет

- Itr 62 Form 67Документ2 страницыItr 62 Form 67busuuuОценок пока нет

- Form 16 2019 20Документ4 страницыForm 16 2019 20Kishan SinghОценок пока нет

- 15 CaДокумент8 страниц15 CadamanОценок пока нет

- Form 16 AДокумент2 страницыForm 16 Asatyampandey7986659533Оценок пока нет

- ITC-claim-replyДокумент5 страницITC-claim-replyABUBAKARОценок пока нет

- Form16fy10 11Документ3 страницыForm16fy10 11atishroyОценок пока нет

- TDS certificate form 16Документ4 страницыTDS certificate form 16yogesh.b.lokhande9022Оценок пока нет

- Form No. 15Cb: (See Rule 37BB)Документ3 страницыForm No. 15Cb: (See Rule 37BB)Live GracefullyОценок пока нет

- Anspg5953f 2018-19Документ3 страницыAnspg5953f 2018-19virajv1Оценок пока нет

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AДокумент16 страницForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - Ak.leela.kОценок пока нет

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AДокумент16 страницForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AVidhi MiraniОценок пока нет

- Crypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationОт EverandCrypto Taxation in USA: A Comprehensive Guide to Navigating Digital Assets and TaxationОценок пока нет

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)От EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Оценок пока нет

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionОт EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionОценок пока нет

- Brealey. Myers. Allen Chapter 34 TestДокумент7 страницBrealey. Myers. Allen Chapter 34 TestDaman GillОценок пока нет

- Chapter-1 Indian Contract Act 1872Документ100 страницChapter-1 Indian Contract Act 1872aahana77Оценок пока нет

- Case Study On MovieДокумент17 страницCase Study On MovieDaman GillОценок пока нет

- Brand QuizДокумент26 страницBrand QuizDaman GillОценок пока нет

- Abep 160123091000Документ22 страницыAbep 160123091000Daman GillОценок пока нет

- 231 - 35305 - MD211 - 2013 - 1 - 2 - 1 - The Marketing Process - STP PDFДокумент21 страница231 - 35305 - MD211 - 2013 - 1 - 2 - 1 - The Marketing Process - STP PDFmadhab GhoshОценок пока нет

- 15 CaДокумент8 страниц15 CadamanОценок пока нет

- AirtelДокумент7 страницAirtelNishkam John RCBSОценок пока нет

- Learning Curve Concepts ExplainedДокумент15 страницLearning Curve Concepts ExplaineddamanОценок пока нет

- Human Right Note For BCAДокумент2 страницыHuman Right Note For BCANitish Gurung100% (1)

- IDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleaseДокумент50 страницIDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleasekinzaОценок пока нет

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivДокумент2 страницыDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryОценок пока нет

- UWTSD BABS 5 ENT SBLC6001 Assignment and Case Study Apr-Jul 2019Документ16 страницUWTSD BABS 5 ENT SBLC6001 Assignment and Case Study Apr-Jul 2019Hafsa IqbalОценок пока нет

- HR ManagementДокумент7 страницHR ManagementAravind 9901366442 - 9902787224Оценок пока нет

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerДокумент11 страницA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsОценок пока нет

- Parked Tank LayoutДокумент1 страницаParked Tank LayoutAZreen A. ZAwawiОценок пока нет

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFДокумент663 страницыCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2Оценок пока нет

- Oracle ACE WPДокумент23 страницыOracle ACE WPSyed Fahad KhanОценок пока нет

- Contract CoffeeДокумент5 страницContract CoffeeNguyễn Huyền43% (7)

- Israel SettlementДокумент58 страницIsrael SettlementRaf BendenounОценок пока нет

- Contract: Organisation Details Buyer DetailsДокумент4 страницыContract: Organisation Details Buyer DetailsMukhiya HaiОценок пока нет

- TVSM 2004 2005 1ST InterimДокумент232 страницыTVSM 2004 2005 1ST InterimMITCONОценок пока нет

- Child-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)Документ14 страницChild-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)oswar mungkasaОценок пока нет

- VRS NotesДокумент82 страницыVRS NotesrisingiocmОценок пока нет

- Cagayan de Oro Revenue Code of 2015Документ134 страницыCagayan de Oro Revenue Code of 2015Jazz Adaza67% (6)

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSДокумент24 страницыSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersОценок пока нет

- LGEIL competitive advantagesДокумент3 страницыLGEIL competitive advantagesYash RoxsОценок пока нет

- Econ 201 MicroeconomicsДокумент19 страницEcon 201 MicroeconomicsSam Yang SunОценок пока нет

- Griffin Chap 11Документ34 страницыGriffin Chap 11Spil_vv_IJmuidenОценок пока нет

- India's sustainable economic growth scenarioДокумент44 страницыIndia's sustainable economic growth scenariojatt ManderОценок пока нет

- Medical Insurance Premium Receipt 2019-20Документ4 страницыMedical Insurance Premium Receipt 2019-20Himanshu Tater43% (7)

- Accountancy Answer Key Class XII PreboardДокумент8 страницAccountancy Answer Key Class XII PreboardGHOST FFОценок пока нет

- Whitepaper - State of Construction TechnologyДокумент16 страницWhitepaper - State of Construction TechnologyRicardo FigueiraОценок пока нет

- Account Opening ProcessДокумент3 страницыAccount Opening Processsaad777Оценок пока нет

- The Role of Business ResearchДокумент23 страницыThe Role of Business ResearchWaqas Ali BabarОценок пока нет

- AWS Compete: Microsoft's Response to AWSДокумент6 страницAWS Compete: Microsoft's Response to AWSSalman AslamОценок пока нет

- Supreme Court Dispute Over Liquidated DamagesДокумент22 страницыSupreme Court Dispute Over Liquidated DamagesShuva Guha ThakurtaОценок пока нет

- Sample Income StatementДокумент1 страницаSample Income StatementJason100% (34)

- Global Marketing Test Bank ReviewДокумент31 страницаGlobal Marketing Test Bank ReviewbabykintexОценок пока нет