Академический Документы

Профессиональный Документы

Культура Документы

Business Mirror, Sept. 10, 2019, House Hastens Vote On Citira, 2 Tax Bills P4.2B PDF

Загружено:

pribhor2Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Mirror, Sept. 10, 2019, House Hastens Vote On Citira, 2 Tax Bills P4.2B PDF

Загружено:

pribhor2Авторское право:

Доступные форматы

*ry.triiaih**!*tlix # Tuesday, Sepieinber f0,2019 .

Hotrse h stens vote r

onn titira ztnxb{[[s By JovEE MARIE N. D Et.A ('.truz t @iovcenloie

remaining three packages of

the Comprehensive Tax Reform

P4,2F

sl{!!@Sb48rsrlussgibg&lis it

.

Estimatedrevenuefrom .i

Program (CTRP) are no\ / ,Package 4 ofthe Pifita,

CIRP or

rationalizing taxation of the

inching their way to becoming laws as financial sector

the House of Representatives prioritized Under the bill", interests, divi

dends and capital gains will be

' their swift approval on Monday. levied with a unified income tax

rate of 15 percent. It also unifies

d--*"s**-*"-l**..4!d;-..&-s*".!,--"*..*.- .,

" *"-../,.-.",,",.s. andlowers the tax rates on interest

VotinglB6 affirmative, sixnega- Bil1304 to rationalize the taxation The measure, known as Package income andwillbenefit 75 Percent

tive and two abstentions, lawmalc- of th-. financial sector so that it 4 of the CTRP, reviews the taxes ofdeposit account holders who are

ers passed onthird and final read- becomes simpler, fairer, more ef- imposed on-f inancial intermediar- mostlysmall savers, correcting the

ing the proposed Passive Income ficient and regionally competitive. ies and the products they offer: on inequitabie distribution of the tax

and Financial lntermediary Taxa- The billwill nowbe transmitted savings andiDVestments; and debt burden,

tion ReformAct (Pifita), or House to the Senate. and equity instruments. CoNTINUED oN A2

u 4trAp,ae A)eci< a Nev-f PA+€ ta6 - -->

(t)

House hastens vote

on Citira,2

,SLJ

tax bills

coNrrNUBDFRoMA1 Ii -- ' ..

The bill appr0priatesa structural adjustment

ft a raruuaSiuesinvestorswhowillsituate

fund for displaced workers; P500 million

Meanwhile,in(0mefromassetsWhiCh.outsidc0fllleoManilasixyearsoflTHandfour for targeted (ash grants and other support

0nlylherich haveac(esst0,su(ha5l0ng term years0f additionaltaxperks,

- pr0grams for displaced worken; P500 million

deposits, foreign Cunency Deposit Uniis, and

-

ltalsoremovesthepelpetual5per(ent0n

it fortargeted training f0rdisplaced workersand

(Glt) Underthe bill'

OiuiO.ni, tot

stocks, ai. sublect to lower gtoss income ealned

P5 billi0n forthe skills upgrade program 0fthe

ratesftom zero t0 15 percent. Tire Pifita aims *illtt,iuatoantou'ugeinvestorsandlo(ators

IT BPO.

to generally harmoniie all 0f these rates t0 a t0 reappty afteI the five-yenr 0r.sevtn-year

Jhe measure seeks to encourage

tiniform percent.Thiswillimprove the equity perioi, to qualify for another five years of

t5

investments by bringing down the (orporate

ol the tax system. incentives.

in(ome tax (ClT) rate from 30 pelcent t0

This bili makes insuran(e produds more The bill provides for the removal 0f

not

20 percent and modernize investment tax

affoldable by lowering the tax 0n insurance 0nly preferentialtax rateofcertain corporate

in(entives t0 enhance faitness, improve

It willfixthe un eq ua I treatment f0r insuran(e taxpayersbutals0the0ptr0nf0r(0rp0rati0ns'

(0rp0Iati0ns' t0 r0mpetitiveness, plug tax leakages and attain

products wirh simiiar naturesu(h as llfe;health, inciuding resident f0reign-

fis(al sunainability,

ilMq preneed and pension, and lower the

avail th"mJelves of the 15-perc€nt qloss

lhe measure pr0poses t0 bring down the

documentary stamp taxes (DST5) 0n nonlife in(0me tax

CIT by 2 percentage points starting 2021.

insurdnce i

lMeanwhile' the Home Development

llnder the measure, tax 0n savings will l\'lutualFundshallbeexemptedfrominc0me

- Package 3

go down from 20 percent t0 15 per(ent taxatign given that lhe s.cial Secu{ity MEANWHILE, the House (ommittee on

Meanwhile, the ri(h who invest in dividends System (5SS), Philippim Hedlth l;sul}n(e Appropriati0ns on Monday apptoved the

will pay 5 pelcent more in taxes. "C0rp0rati0;-{PHIC),

and 6ovtrnmenl funding pr0visi0n 0f the bill ref0rming

Ihebillseekst0redu(ethecurrentunique 5ervice lnsuran(e System (6515) are already real property valuati0n 0r Package 3 01

nu mber oftax rates and bases from the (u lrent ex€ m pted.

thE.CTR P

80t036. . The brll grants the President the fruower H0use Bill 105 seeks P58 milli0n for the

House Committee on Ways and Means io grant incentives iT the\rbjea tras a establishment 0f a Real Property Valuati0n

Chairman Joey Salceda said thdbill will gil/e -comprehensivesustainabledevelopmentplan

5ervicewithin the Bureau 0f Lo(al G0vernment

the g0vernment P4.2 billion in revenues. ' and will bring in at least $200 million.

Finance (BLGt) for 2020.

Also, the measure allows enterprises The bill institutes ref0rms in realpr0p€rty

Package 2 .presently availing 0f incentives t0 enjoy valuation and assessment in the country and

Al50 0n Monday, the House approved 0n qlfe same for two years after its eff€(tivity.

reorganizes the BtGF.

second reading Package 2 0f the CTRP 0r the Thereaftet they c n rea pplyf0 r in centives under It seeks t0 grant ea(h LGIJ the p0wer t0

proposed Corporate lncome Tax and lncentive the Strategic lnvestments Priority PIan (5lPP).

ceate its own sources of revenue and to levy

Rationalization Ad (Citira). Those enjoying the IIH are further permitted taxes, fees and charqes.

Thr0uqh viva v0(e v0ting, members 0fthe t0 enioy thh for the remaining period or for

The bill wjll be transmitted t0 the plenary

lowerchamberapprovedHouseBill4l5T,which i.five yea15, whichever c0mes first.

for another round ofapproval.

amends sections 0f Republic Act 8424 0r the 'l goardUnderthe bill, the Fisca I ln centives Review

National lntetnal R€venue Code 0f 1997.

The bill will be approved on third and final

will be chaired by the Department 0f

finan(e and willhavethe p0wert0 appr0vethe

\fle*outls Neuls/

reading on Thursday. - grant0f incentivest0 pr0p0salsf rom investment

Under the bill, investments in Metr0 bromotion agencies. @l

l\4anilawill now enjoy ln(0me Tax H0liday . HB 4157 also apor0priates a P]s-billion

(lTH) f0it+rreeyearsandadditional incentives stru(ural adjustment fund f0r infrastructure

for two years. Those in areas adjacent t0 projects 0fec0z0nes and freeports, t0 be used

Metro l\4anila, on.the 0ther hand, will have ' ,for tlsearch and dev€lopment, utilities and

four years of tax break and three years of lease.

exemptions.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- M4e PDFДокумент699 страницM4e PDFRahul Singh100% (3)

- What Is Public Choice Theory PDFДокумент8 страницWhat Is Public Choice Theory PDFSita SivalingamОценок пока нет

- Peoples Tonight, Mar. 12, 2020, House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFДокумент1 страницаPeoples Tonight, Mar. 12, 2020, House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFpribhor2Оценок пока нет

- Philippine Star, Mar. 12, 2020, Sara Gets CA Nod As Army Reserve Colonel PDFДокумент1 страницаPhilippine Star, Mar. 12, 2020, Sara Gets CA Nod As Army Reserve Colonel PDFpribhor2Оценок пока нет

- Philippine Star, Mar. 12, 2020, House Approves OFW Department Bill PDFДокумент1 страницаPhilippine Star, Mar. 12, 2020, House Approves OFW Department Bill PDFpribhor2Оценок пока нет

- Philippine Star, Mar. 12, 2020, Lack of Test Kits Equipment Hamper Fight Vs COVID-19 PDFДокумент1 страницаPhilippine Star, Mar. 12, 2020, Lack of Test Kits Equipment Hamper Fight Vs COVID-19 PDFpribhor2Оценок пока нет

- Philippine Star, Mar. 12, 2020, House OKs Bill Doubling Road Users Tax PDFДокумент1 страницаPhilippine Star, Mar. 12, 2020, House OKs Bill Doubling Road Users Tax PDFpribhor2Оценок пока нет

- Peoples Tonight, Mar. 12, 2020, House OKs Creation of Department For OFWs PDFДокумент1 страницаPeoples Tonight, Mar. 12, 2020, House OKs Creation of Department For OFWs PDFpribhor2Оценок пока нет

- Tempo, Mar. 12, 2020, House OKs Hike in Road Users Tax PDFДокумент1 страницаTempo, Mar. 12, 2020, House OKs Hike in Road Users Tax PDFpribhor2Оценок пока нет

- Philippine Star, Mar. 12, 2020, Ex-Catanduanes Lawmaker Charged Over Shabu Lab PDFДокумент1 страницаPhilippine Star, Mar. 12, 2020, Ex-Catanduanes Lawmaker Charged Over Shabu Lab PDFpribhor2Оценок пока нет

- Peoples Tonight, Mar. 12, 2020, P46B Masisisngil Sa Power Firms PDFДокумент1 страницаPeoples Tonight, Mar. 12, 2020, P46B Masisisngil Sa Power Firms PDFpribhor2Оценок пока нет

- Peoples Tonight, Mar. 12, 2020, House Panel Approves Parking Fee Regulations PDFДокумент1 страницаPeoples Tonight, Mar. 12, 2020, House Panel Approves Parking Fee Regulations PDFpribhor2Оценок пока нет

- Philippine Daily Inquirer, Mar. 12. 2020, ABS - CBN To Get Provisional License PDFДокумент1 страницаPhilippine Daily Inquirer, Mar. 12. 2020, ABS - CBN To Get Provisional License PDFpribhor2Оценок пока нет

- Philippine Daily Inquirer, Mar. 12, 2020, Duque Pressed On Social Distancing To Kiss or Not To Kiss PDFДокумент1 страницаPhilippine Daily Inquirer, Mar. 12, 2020, Duque Pressed On Social Distancing To Kiss or Not To Kiss PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, Yedda Welcome Leyte Local Execs Tingog Party-List Rep. Yedda Marie K. Romualdez PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, Yedda Welcome Leyte Local Execs Tingog Party-List Rep. Yedda Marie K. Romualdez PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, COVID-19 Patient in Caloocan Hospital A Resident of Bulacan PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, COVID-19 Patient in Caloocan Hospital A Resident of Bulacan PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, Power Firms To Pay Debt PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, Power Firms To Pay Debt PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, House Panel Approves Parking Regulation Measure PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, House Panel Approves Parking Regulation Measure PDFpribhor2Оценок пока нет

- Manila Times, Mar. 12, 2020, House Passes Bill Creating OFW Dept PDFДокумент1 страницаManila Times, Mar. 12, 2020, House Passes Bill Creating OFW Dept PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, Ribbon Cutting House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, Ribbon Cutting House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal-Arroyo PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, House Okays Higher Road Users Tax PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, House Okays Higher Road Users Tax PDFpribhor2Оценок пока нет

- Manila Bulletin, Mar. 12, 2020, House Panel Finally Okays Parking Regulation Measure PDFДокумент1 страницаManila Bulletin, Mar. 12, 2020, House Panel Finally Okays Parking Regulation Measure PDFpribhor2Оценок пока нет

- Peoples Journal, Mar. 12, 2020, House Okays Bill Creating Department of Filipinos Overseas PDFДокумент1 страницаPeoples Journal, Mar. 12, 2020, House Okays Bill Creating Department of Filipinos Overseas PDFpribhor2Оценок пока нет

- Ngayon, Mar. 12, 2020, Tricycle Ban, Maka-Mayaman - Solon PDFДокумент1 страницаNgayon, Mar. 12, 2020, Tricycle Ban, Maka-Mayaman - Solon PDFpribhor2Оценок пока нет

- Manila Standard, Mar. 12, 2020, Panel Sets 3 Conditions in Tax Amnesty Ok PDFДокумент1 страницаManila Standard, Mar. 12, 2020, Panel Sets 3 Conditions in Tax Amnesty Ok PDFpribhor2Оценок пока нет

- Manila Standard, Mar. 12, 2020, Labor Group Slams Bill On Foreign Ownership PDFДокумент1 страницаManila Standard, Mar. 12, 2020, Labor Group Slams Bill On Foreign Ownership PDFpribhor2Оценок пока нет

- Manila Standard, Mar. 12, 2020, QC Court To Hear Damage Suit vs. Garin PDFДокумент1 страницаManila Standard, Mar. 12, 2020, QC Court To Hear Damage Suit vs. Garin PDFpribhor2Оценок пока нет

- Manila Times, Mar. 12, 2020, Court Orders Garin Trial PDFДокумент2 страницыManila Times, Mar. 12, 2020, Court Orders Garin Trial PDFpribhor2Оценок пока нет

- Manila Standard, Mar. 12, 2020, Mayor Sara Reporting For Duty As Army Colonel (Res.) PDFДокумент1 страницаManila Standard, Mar. 12, 2020, Mayor Sara Reporting For Duty As Army Colonel (Res.) PDFpribhor2Оценок пока нет

- Manila Standard, Mar. 12, 2020, Inauguration House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal Arroyo PDFДокумент1 страницаManila Standard, Mar. 12, 2020, Inauguration House Speaker Alan Peter Cayetano and Former President and Speaker Gloria Macapagal Arroyo PDFpribhor2Оценок пока нет

- Congo Report Carter Center Nov 2017Документ108 страницCongo Report Carter Center Nov 2017jeuneafriqueОценок пока нет

- Drivers of International BusinessДокумент38 страницDrivers of International BusinessAKHIL reddyОценок пока нет

- Marketing Strategy An OverviewДокумент13 страницMarketing Strategy An OverviewRobin PalanОценок пока нет

- SWOT-ToWS Analysis of LenovoДокумент2 страницыSWOT-ToWS Analysis of Lenovoada9ablao100% (4)

- Kalman Filter and Economic ApplicationsДокумент15 страницKalman Filter and Economic ApplicationsrogeliochcОценок пока нет

- Import - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalДокумент2 страницыImport - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalNguyễn Thanh LongОценок пока нет

- MPPSC Sfs Advt - SFS - 2022 - Dated - 30 - 12 - 2022 PDFДокумент19 страницMPPSC Sfs Advt - SFS - 2022 - Dated - 30 - 12 - 2022 PDFNripeshОценок пока нет

- Pay Slip For The Month of April 2018Документ1 страницаPay Slip For The Month of April 2018srini reddyОценок пока нет

- Daniela Del Bene e Kesang ThakurДокумент23 страницыDaniela Del Bene e Kesang ThakurYara CerpaОценок пока нет

- Balancing Natural Gas Policy Vol-1 Summary (NPC, 2003)Документ118 страницBalancing Natural Gas Policy Vol-1 Summary (NPC, 2003)Nak-Gyun KimОценок пока нет

- Seedling Trays Developed by Kal-KarДокумент2 страницыSeedling Trays Developed by Kal-KarIsrael ExporterОценок пока нет

- Certificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Документ3 страницыCertificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Habibie MikhailОценок пока нет

- Why Poverty Has Declined - Inquirer OpinionДокумент6 страницWhy Poverty Has Declined - Inquirer OpinionRamon T. Conducto IIОценок пока нет

- Breweries ListДокумент15 страницBreweries Listtuscan23Оценок пока нет

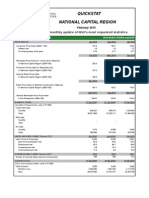

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsДокумент3 страницыQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiОценок пока нет

- TC2014 15 NirdДокумент124 страницыTC2014 15 Nirdssvs1234Оценок пока нет

- ItcДокумент10 страницItcPrabhav ChauhanОценок пока нет

- Chap 3 MCДокумент29 страницChap 3 MCIlyas SadvokassovОценок пока нет

- Q4 Adv 3Документ3 страницыQ4 Adv 3-Оценок пока нет

- Seminar Topic: Fill All ContentДокумент7 страницSeminar Topic: Fill All ContentRanjith GowdaОценок пока нет

- Value ChainДокумент31 страницаValue ChainNodiey YanaОценок пока нет

- Asad Trading Inc Financials (Final)Документ5 страницAsad Trading Inc Financials (Final)ahsan84Оценок пока нет

- How To Start A Travel and Tour BusinessДокумент3 страницыHow To Start A Travel and Tour BusinessGrace LeonardoОценок пока нет

- Rates and ProportionalityДокумент23 страницыRates and ProportionalityJade EncarnacionОценок пока нет

- Template AOI (Non-Stock)Документ5 страницTemplate AOI (Non-Stock)AaronОценок пока нет

- The Nema Act: NEMA ACT: An Official NEMA Documentation. All Rights ReservedДокумент2 страницыThe Nema Act: NEMA ACT: An Official NEMA Documentation. All Rights ReservedjohnОценок пока нет

- Barro and Grossman - A General Disequilibrium Model of Income and Employment PDFДокумент12 страницBarro and Grossman - A General Disequilibrium Model of Income and Employment PDFDouglas Fabrízzio CamargoОценок пока нет

- GDP For 1st QuarterДокумент5 страницGDP For 1st QuarterUmesh MatkarОценок пока нет