Академический Документы

Профессиональный Документы

Культура Документы

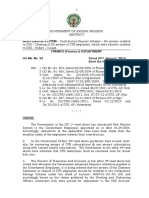

Business World, Sept. 10, 2019, Three Economic Reforms Bag House Approval PDF

Загружено:

pribhor20 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров1 страницаBusiness World, Sept. 10, 2019, Three economic reforms bag House approval.pdf

Оригинальное название

Business World, Sept. 10, 2019, Three economic reforms bag House approval.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBusiness World, Sept. 10, 2019, Three economic reforms bag House approval.pdf

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров1 страницаBusiness World, Sept. 10, 2019, Three Economic Reforms Bag House Approval PDF

Загружено:

pribhor2Business World, Sept. 10, 2019, Three economic reforms bag House approval.pdf

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

S$as s&$?

essWorld Ilff lil,*,0,,0,,

tax reform program (CTRP) also cates of no mardage record, bap-

bagged the chamber's final ap- tismal certificates and marriage

Three economic reforms proval.

The bill, introduced by Al-

license certifrcates.

bay 2'd district Rep, Jose Ma. S. CoRPORATE ll{COl,lE TAX

bag House approral Salceda, proposes a unified 15%

income tax rate on interest, divi-

HB 4l5Z or the proposed "Corpo-

rate Incohe Tax and Incentives

THREE ECONOMIC REFORMS sions' from the coverage of the dend, ard capital gains from the Reform Acf' CITIRA (in tlle past

gained ground in the House of Foreign Investments Act so as to current range ofzero to 3070. Congress, called the "Tax Reform

Representatives on Monday eve- attract foreign professionals to Package 4 of the CTRP also for Attracting Better and High-

ning, with the measure removing practice in the Philippines where- proposes the reduction of the quality Oppodunities" or TRA-

restrictions on foreigners from in they would be able to bring in stock transaction tax from 0.6% BAHO), was approved on second

practicing their professions in the technology and knorv-how from to 0.170 and imposition of a 0.170 reading,

Philippines and another sirnpli{y- abroad and attract foreign direct transactiod tax on debt instru- The bill seeks to cut the cur-

ing taxes on financiil instrumeits investments, and help generate ments listed and traded on the rent 30% corporate indome tax

both bagging final approval. more employment opportunities Philippine Dealing Exchange. It rate - described as the highest

Meanwhile, the tax reform in the country." will also remove the initial public among major Asian markets -

which slashes corporate ilcome Thebill also reduces to 15 from offer tax. by one percentage points every

tax rates but also removes re- 50 cu[ently the minimum num- The measure will also impose a othet year to 2OEo in 2029.

dundant perks was approved on ber of direct local hires required ,uniform five percent gross receipt Amendments to the original

second reading. of foreign investors setting up tax on banks and other financigl version so far include a provisibn-

small- and medium-sized enter- intermediaries, ard will reduce that businesses in ereas beside

FoRElGll PRoFESSIoNAI' Sl,lEs prises (SMEs) with minimum the tzz iatue added tax (VAT) Metro Manila will have four

With 201 afirmative votes, six paid-in capital of $10o,00o. to a two percent premium tax on years of income tax holiday and

negative votes and seven absten- Counteryart bills - Senate Bill health insurance organizations, three years of reduced corporate

tions, House Bi No. 300, which No.4I8 and 419 - havebeen filed pension and pre-rieed insurance. income tax, while those farther

proposes to amend Republic Act anew in'the Senate by Selators Amendments to the original away will benefit from six years of

No. 7042, or the "Foreign Invest- Francis N. Pangiliqan and Sher- version of thebill so far include: income tax holiday and four years

ments Act (FIA) of 1991", was win T. Gatchalian, respectively. . dividends received by a do- of reduced corporate income tax.

passed by the chamber on third mestic corporation from another It also gives fiscal incentives

and final reading. FOURTH TAX REFORI'I domestic firm will not be subject only to exporters and industries

The measure - authored prin- With 186 affirmative votes, six to tax; listed iu the Strategic Invest-

cipally by Tarlac 2"d District Rep. negatives and two abstentions, . exemption from document ments Priority Plan, taking into

Victor A. Yap

- \r'ill allow foreign- HB 304, or the proposed Passive stamp tax of non-monetary docu- account amount of investments,

ers to practice their piofessions Income and Financial Interme- ments like diplomas, transcripts employment generation, use of

in the Philippines in order to fa- diary Tax Act (PIFITA), which of records and other school certi- new technologies, adequate en-

cilitate transfer ofknowledge and makes up the fourth package of fications; oath of office for bann- vironmental protection systems,

technologies to locals. It "aims to the government's comprehensive gays; good standing certification promotion of competitiveness,

exclude the 'practice of profes- Reforms, S1/3 from the Professional Regulation and added SME output, among

Commission, affidavits, certifi- others. - v,.4,. C. trbireraa

?/€€s\/r

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Photon Trading Market StructureДокумент13 страницPhoton Trading Market Structurekoko90% (10)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- QuickBooks New Client ChecklistДокумент4 страницыQuickBooks New Client Checklistangelkhate100% (1)

- Catch Spike PDFДокумент10 страницCatch Spike PDFRomkod's Online Shop100% (3)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Subcontracting Agreement Nominated SubcontractorДокумент16 страницSubcontracting Agreement Nominated SubcontractorRahayu Suran100% (1)

- Bs 50119003519779Документ2 страницыBs 50119003519779janice corderoОценок пока нет

- Management+Consulting+Case+ Club+CompanyДокумент11 страницManagement+Consulting+Case+ Club+CompanyThái Anh0% (1)

- Aci Training Companies v20140926Документ17 страницAci Training Companies v20140926RoninKiОценок пока нет

- FRICTO AnalysisДокумент9 страницFRICTO Analysis/jncjdncjdnОценок пока нет

- Accounting Icom Part1Документ1 страницаAccounting Icom Part1Ayman ChishtyОценок пока нет

- Go.22 Da Arrears of CPS Account in CashДокумент4 страницыGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamОценок пока нет

- The Great U.S. Fiat Currency FRAUDДокумент7 страницThe Great U.S. Fiat Currency FRAUDin1or100% (1)

- InvoiceДокумент1 страницаInvoicePIYUSH CHETARIYAОценок пока нет

- Spring Sales BrochureДокумент13 страницSpring Sales BrochureGuy SparkesОценок пока нет

- Grid Tie Inverter MarketДокумент8 страницGrid Tie Inverter MarketSubhrasankha BhattacharjeeОценок пока нет

- Sow: 134 No Demand: Bar DescriptionДокумент91 страницаSow: 134 No Demand: Bar Description--Оценок пока нет

- 08) RCBC V Royal CargoДокумент2 страницы08) RCBC V Royal CargokathreenmonjeОценок пока нет

- CF Unit 2 Solutions 09-01-2022Документ22 страницыCF Unit 2 Solutions 09-01-2022SuganyaОценок пока нет

- ACCTG 112 Chapter 2Документ1 страницаACCTG 112 Chapter 2C E DОценок пока нет

- Agard Case SummaryДокумент4 страницыAgard Case SummaryQuerpОценок пока нет

- Joel Hasbrouck-Empirical Market Microstructure-Oxford University Press, USA (2007)Документ203 страницыJoel Hasbrouck-Empirical Market Microstructure-Oxford University Press, USA (2007)Saad Tate100% (1)

- Elecon EngineeringДокумент8 страницElecon EngineeringA_KinshukОценок пока нет

- Determinants of Mutual Funds Performance in IndiaДокумент18 страницDeterminants of Mutual Funds Performance in IndiaPrateek SehgalОценок пока нет

- Pre Test Q4Документ3 страницыPre Test Q4Joy NavalesОценок пока нет

- Federal Energy Administration Et Al. v. Algonquin SNG, Inc., Et Al.Документ4 страницыFederal Energy Administration Et Al. v. Algonquin SNG, Inc., Et Al.Maria AnalynОценок пока нет

- Cost of CapitalДокумент32 страницыCost of CapitalJames MutarauswaОценок пока нет

- International Banking & Foreign Exchange ManagementДокумент12 страницInternational Banking & Foreign Exchange ManagementrumiОценок пока нет

- Heriot-Watt University Dubai Campus: ReceiptДокумент2 страницыHeriot-Watt University Dubai Campus: ReceiptMuhammadnasidiОценок пока нет

- MSC Spring 2021 3rd 30-09-2022Документ2 страницыMSC Spring 2021 3rd 30-09-2022Tayyab SaleemОценок пока нет

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsДокумент5 страницTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishОценок пока нет

- Genesis' Trial Balance Reflected The FollowingДокумент1 страницаGenesis' Trial Balance Reflected The FollowingQueen ValleОценок пока нет