Академический Документы

Профессиональный Документы

Культура Документы

Financial Statements 2017 PDF

Загружено:

Brahmam GuruОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statements 2017 PDF

Загружено:

Brahmam GuruАвторское право:

Доступные форматы

General information about the company

Company information

Company name: INTERPOLIMERI SPA

Headquarters: VIA CAPITANO GUIDO NEGRI NO. 11 LIMENA PD

Share capital: 10,000,000.00

Fully paid-in share capital: Yes

Chamber of Commerce ID code: PD

VAT number: 01830880280

Tax code: 01830880280

EAR number: 183448

Legal form: SOCIETA' PER AZIONI (JOINT-STOCK COMPANY)

Main sector of activity (ATECO): 467620

Company in liquidation: no

Company with sole shareholder: no

Company subject to third-party management and no

coordination:

Name of the company or institution that carries out

management and coordination activities:

Belonging to a group: no

Name of the parent company:

Country of the parent company:

Cooperative company registration number:

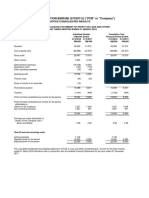

Financial Statements at 31/12/2017

Balance sheet

31/12/2017 31/12/2016

Assets

B) Fixed assets

I - Intangible fixed assets - -

3) industrial patents and intellectual property rights 31,648 52,519

7) others 47,792 36,747

Total intangible fixed assets 79,440 89,266

II - Tangible fixed assets - -

1) lands and buildings 372 3,718

Financial Statements in XBRL format 1

INTERPOLIMERI SPA Financial Statements at 31/12/2017

31/12/2017 31/12/2016

2) plants and machinery 10,224 11,856

3) industrial and commercial equipment 33,058 16,778

4) other assets 395,680 403,146

Total tangible fixed assets 439,334 435,498

III - Financial fixed assets - -

1) equity investments in - -

a) controlled companies 1,988,569 1,925,986

d-bis) other companies 940 940

Total equity investments 1,989,509 1,926,926

2) receivables - -

a) from controlled companies 2,981,507 1,626,918

due during the following year 751,635 872,580

due after the following year 2,229,872 754,338

Total receivables 2,981,507 1,626,918

Total financial fixed assets 4,971,016 3,553,844

Total fixed assets (B) 5,489,790 4,078,608

C) Current assets

I - Inventories - -

4) finished products and goods 21,791,786 17,381,337

Total inventories 21,791,786 17,381,337

II - Receivables - -

1) trade receivables 47,368,816 43,597,657

due during the following year 47,368,816 43,597,657

2) due from controlled companies 9,919,336 8,958,906

due during the following year 9,919,336 8,958,906

5-bis) tax credits 73,734 20,703

due during the following year 73,734 20,703

5-ter) prepaid taxes 72,662 72,543

5-quater) due from others 333,054 313,471

due during the following year 317,324 298,539

due after the following year 15,730 14,932

Total receivables 57,767,602 52,963,280

IV - Cash and cash equivalents - -

1) bank and post office deposits 1,220,122 417,026

Financial Statements in XBRL format 2

INTERPOLIMERI SPA Financial Statements at 31/12/2017

31/12/2017 31/12/2016

3) cash and equivalents on hand 5,491 2,756

Total cash and cash equivalents 1,225,613 419,782

Total current assets (C) 80,785,001 70,764,399

D) Accruals and prepayments 277,750 185,169

Total assets 86,552,541 75,028,176

Liabilities

A) Shareholders' equity 21,059,523 19,728,439

I - Share capital 10,000,000 10,000,000

IV - Legal reserve 842,885 772,835

VI - Other reserves (with corresponding details) - -

Extraordinary reserve 8,885,557 7,554,611

Miscellaneous other reserves - (3)

Total other reserves 8,885,557 7,554,608

IX- Profit (loss) for the year 1,331,081 1,400,996

Total shareholders' equity 21,059,523 19,728,439

B) Provisions for liabilities and charges

1) for severance & pension liabilities and similar obligations 165,675 77,136

Total provisions for liabilities and charges 165,675 77,136

C) Staff severance indemnity 575,788 473,876

D) Payables

4) payables due to banks 43,412,531 36,406,799

due during the following year 41,353,298 32,085,110

due after the following year 2,059,233 4,321,689

6) advances 8,598 -

due during the following year 8,598 -

7) trade payables 18,787,422 16,400,603

due during the following year 18,787,422 16,400,603

9) payables due to controlled companies 707,802 232,606

due during the following year 707,802 232,606

12) tax payables 512,938 591,198

due during the following year 512,938 591,198

13) payables due to pension and social security institutions 149,589 151,776

due during the following year 149,589 151,776

14) other payables 1,172,675 965,743

Financial Statements in XBRL format 3

INTERPOLIMERI SPA Financial Statements at 31/12/2017

31/12/2017 31/12/2016

due during the following year 1,077,675 695,743

due after the following year 95,000 270,000

Total payables 64,751,555 54,748,725

Total liabilities 86,552,541 75,028,176

Income statement

31/12/2017 31/12/2016

A) Value of production

1) sales and services revenues 162,290,029 148,297,406

5) other revenues and income - -

grants for current expenses - 4,570

others 269,695 365,748

Total other revenues and income 269,695 370,318

Total value of production 162,559,724 148,667,724

B) Production costs

6) for raw, ancillary and consumable materials and goods 150,803,673 133,949,614

7) for services 9,322,380 8,364,831

8) for use of third-party assets 1,464,283 1,463,295

9) for personnel - -

a) salaries and wages 2,047,795 1,744,458

b) social security contributions 566,986 477,844

c) staff severance indemnity 146,235 123,979

e) other costs 13,793 9,893

Total personnel costs 2,774,809 2,356,174

10) amortisation, depreciation and write-downs - -

a) amortisation of intangible fixed assets 66,552 71,395

b) depreciation of tangible fixed assets 163,105 137,060

d) write-downs of current receivables and of cash and cash equivalents 100,784 83,037

Total amortisation, depreciation and write-downs 330,441 291,492

11) changes in inventories of raw and ancillary materials, consumables and goods (4,410,449) (140,060)

14) sundry operating expenses 171,081 221,645

Total production costs 160,456,218 146,506,991

Financial Statements in XBRL format 4

INTERPOLIMERI SPA Financial Statements at 31/12/2017

31/12/2017 31/12/2016

Difference between value and costs of production (A - B) 2,103,506 2,160,733

C) Financial income and charges

16) other financial income - -

a) from non-current receivables - -

from controlled companies 22,883 4,889

Total financial income from non-current receivables 22,883 4,889

d) other income - -

others 3,648 282

Total other income 3,648 282

Total other financial income 26,531 5,171

17) interest and other financial charges - -

others 182,368 169,376

Total interest and other financial charges 182,368 169,376

17-bis) exchange rate gains and losses (8) (27)

Total financial income and charges (15+16-17+-17-bis) (155,845) (164,232)

Profit (loss) before taxes (A-B+-C+-D) 1,947,661 1,996,501

20) Current, deferred and prepaid income tax for the year

current taxes 616,699 585,816

deferred and prepaid taxes (119) 9,689

Total current, deferred and prepaid income tax for the year 616,580 595,505

21) Profit (loss) for the year 1,331,081 1,400,996

Financial Statements in XBRL format 5

INTERPOLIMERI SPA Financial Statements at 31/12/2017

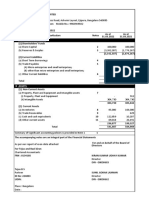

Cash Flow Statement - indirect method

Amount as of Amount as of

31/12/2017 31/12/2016

A) Cash flow from operating activities (indirect method)

Profit (loss) for the year 1,331,081 1,400,996

Income taxes 616,580 595,505

Interest payable/(interest receivable) 155,837 164,205

(Gains)/Losses from the sale of assets (3,697) (16,292)

1) Profit (loss) for the year before income taxes, interest, dividends and gains/losses from disposals 2,099,801 2,144,414

Adjustments for non-monetary items without an offsetting counterpart in net working capital

Allocations to provisions 202,846 165,099

Amortisation and depreciation of fixed assets 229,657 208,455

Write-downs due to value impairments 100,784 83,037

Other increases/(decreases) for non-monetary items (447) 751

Total adjustments for non-monetary items without an offsetting counterpart in net working capital 532,840 457,342

2) Cash flow before changes to net working capital 2,632,641 2,601,756

Changes to net working capital

Decrease/(increase) in inventories (4,410,449) (140,060)

Decrease/(increase) in trade receivables (3,871,943) 460,829

Increase/(decrease) in trade payables 2,386,819 (2,207,309)

Decrease/(increase) in accrued income and prepaid expenses (92,581) (49,247)

Increase/(decrease) in accrued liabilities and deferred income (700)

Other decreases/(Other increases) to net working capital (352,902) (3,437,811)

Total changes to net working capital (6,341,056) (5,374,298)

3) Cash flow after changes to net working capital (3,708,415) (2,772,542)

Other adjustments

Collected/(paid) interest (155,837) (164,205)

(Income taxes duly paid) (686,562) (1,074,543)

(Use of provisions) (61,961)

Other proceeds/(payments) (11,945)

Total other adjustments (854,344) (1,300,709)

Cash flow from operating activities (A) (4,562,759) (4,073,251)

Financial Statements in XBRL format 6

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Amount as of Amount as of

31/12/2017 31/12/2016

B. Cash flows from investment activity

Tangible fixed assets

(Investments) (168,168) (278,609)

Divestments 4,924 22,791

Intangible fixed assets

(Investments) (56,726) (78,330)

Financial fixed assets

(Investments) (1,417,172) (2,085,419)

Divestments 11,850

Cash flow from investment activity (B) (1,637,142) (2,407,717)

C. Cash flows from financing activity

Third-party financing

Increase/(decrease) in short-term payables due to banks 9,099,781 3,052,447

Raising finance 3,000,000 6,500,000

(Repayment of loans) (5,094,049) (3,415,853)

Cash flow from financing activity (C) 7,005,732 6,136,594

Increase (decrease) of cash and cash equivalents (A ± B ± C) 805,831 (344,374)

Cash and cash equivalents at the beginning of the year

Bank and post office deposits 417,026 758,510

Cash and equivalents on hand 2,756 5,646

Total cash and cash equivalents at the beginning of the year 419,782 764,156

Cash and cash equivalents at the end of the year

Bank and post office deposits 1,220,122 417,026

Cash and equivalents on hand 5,491 2,756

Total cash and cash equivalents at the end of the year 1,225,613 419,782

Balancing difference

Explanatory notes - Initial part

Dear Shareholders,

these Explanatory Notes, together with the Balance Sheet, Income Statement and Cash Flow Statement, form

an integral part of the financial statements at 31/12/2017. The financial statements are compliant with the

provisions of art. 2423 et seq. of the (Italian) Civil Code and the national accounting principles as issued by the

Financial Statements in XBRL format 7

INTERPOLIMERI SPA Financial Statements at 31/12/2017

‘Organismo Italiano di Contabilità’ (‘Italian Accounting Board’). They provide a true and correct representation

of the company’s balance sheet and financial position, as well as the result for the year.

The content of the Balance Sheet and Income Statement is that envisaged by arts. 2424 and 2425 of the

(Italian)Civil Code, while the Cash Flow Statement has been drawn up pursuant to art. 2425-ter).

The purpose of these Explanatory Notes, drawn up pursuant to art. 2427 of the (Italian) Civil Code, is to

illustrate, analyse and, in certain cases, integrate financial statement data. They also contain all necessary or

useful information to provide a true and correct representation of the company’s balance sheet and financial

position, as well as its result for the year, even though such information is not specifically required by specific

legal provisions.

It is to be noted that the publication of (Italian) Legislative Decree no.139 dated 18th August 2016 in the Italian

Official Journal of 4th September 2015 (Italian Legislative Decree no. 139/2015), completed implementation of

the Directive 2013/34/EU. As a result, the provisions of the (Italian) Civil Code regarding financial statements

were duly updated.

It also hereby specified that, when drawing up these financial statements, the Italian accounting standards

referred to by art. 9 bis, paragraph 1, letter a) of (Italian) Legislative Decree no. 38 dated 28/02/2015 were

applied, as updated by the Organismo Italiano di Contabilità (OIC - the Italian Accounting Board) based on the

provisions included in the same Decree and amended by the document issued on 29th December 2017.

With regard to the preparation of support documents to the financial statements, please be informed that the

Directors' Report has been drawn up as per art. 2428 of the (Italian) Civil Code.

These Explanatory Notes do not provide the information referred to by article 2427-bis, second paragraph, of

the (Italian) Civil Code, as the conditions stated therein do not apply.

Company activities

As you know, your company operates in the plastics distribution sector, in particular as a distributor of

thermoplastic granules.

Accounting principles

The principles used to prepare the financial statements are the same as those provided for by art. 2423-bis of

the (Italian) Civil Code; in particular:

individual items were assessed with due caution and with the prospect of normal company activity

continuing;

income and expenses were recorded on an accrual basis regardless of when the associated cash

movements took place;

any risks and losses for the year were taken into consideration, even if they became known after the close

of the financial year;

only profits actually made during the year were taken into account;

different elements making up the single items under assets and liabilities were indicated separately, in

order to avoid any item compensation;

items were reported and presented taking into account the scope of the transaction or the scope of the

contract;

during the previous year and in the months prior to the approval of the financial statements, there were no

exceptional circumstances requiring recourse to the exceptions provided for by art. 2423 of the (Italian)

Civil Code in order to provide a true and correct representation of the financial statements.

Pursuant to article 2423, paragraph 5, of the (Italian) Civil Code, amounts stated in the financial statements and

the explanatory notes are expressed in EURO.

Structure and contents of the financial statements

The Balance Sheet, Income Statement and Cash Flow Statement and accounting information contained in the

present Explanatory Notes are directly taken from the duly kept accounting records.

No items preceded by Arabic numerals were grouped together in the Balance Sheet and Income Statement, as

is optionally provided for by art. 2423 ter of the (Italian) Civil Code.

Financial Statements in XBRL format 8

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Pursuant to art. 2424 of the (Italian) Civil Code, it is hereby confirmed that there are no assets or liabilities that

fall under more than one financial statement item.

Accounting criteria

The criteria used to assess financial statement items and value adjustments comply with the provisions of the

(Italian) Civil Code and the accounting principles issued by the ‘Organismo Italiano di Contabilità’ (‘Italian

Accounting Board’).

In particular, the accounting criteria used to assess each individual item comply with the provisions of art. 2426

of the (Italian) Civil Code, as integrated and amended with the implementation of EEC Directive no.

2013/34/EU. The criteria applied were the same as those used to draw up the financial statements for the

previous year.

The information contained in this document is presented in the order in which the relevant items are listed in the

Balance Sheet and Income Statement. The accounting criteria adopted are specifically commented upon for

each individual item.

Explanatory notes - Assets

In relation to the information provisions required by art. 2427, no. 6 and 6-ter, of the (Italian) Civil Code, with

respect to all receivable items preliminarily recorded under assets, it is to be noted that:

- there are no receivables due after five years;

- there are no receivables relating to transactions involving repurchase agreement obligations for the buyer.

The items recorded under ‘assets’ in the balance sheet are presented below.

Fixed assets

Intangible fixed assets

Intangible fixed assets are recorded at acquisition cost, including the relative ancillary costs, with separate

presentation of the provisions that cover the amortisation that is systematically calculated and accrued over the

assets’ remaining useful life.

Amortisation of intangible fixed assets is carried out using constant rates in relation to the remaining useful

future economic life of each individual asset or expense.

Expenses incurred for the acquisition of software and applications needed to manage the company are

amortised over three years.

Improvements to third-party assets are amortised at rates based on the duration of the contract.

Pursuant to art. 10 of (Italian) law no. 72 dated 19th March 1983, and as also drawn from subsequent monetary

revaluation laws, it should be noted that, as far as existing intangible fixed assets are concerned, there has

never been any monetary revaluation.

It should be noted that there was no need to make any write-downs on said non-current expenses, as per art.

2426, paragraph 1, no. 3 of the (Italian) Civil Code, since there were no indicators of potential impairment to the

value of intangible fixed assets, as provided for by accounting standard OIC 9 (issued by the Italian Accounting

Board).

Financial Statements in XBRL format 9

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Changes in intangible fixed assets

The breakdown of and changes to intangible fixed asset costs and relative accumulated amortisation are

reported in the following table.

Industrial patents and

Other intangible fixed assets Total intangible fixed assets

intellectual property rights

Value at the beginning of the

year

Cost 228,160 756,689 984,849

Amortisation (accumulated

175,641 719,942 895,583

amortisation)

Book value 52,519 36,747 89,266

Changes during the year

Increases for acquisitions 15,226 41,500 56,726

Amortisation for the year 36,097 30,455 66,552

Total changes (20,871) 11,045 (9,826)

Value at the end of the year

Cost 243,386 798,189 1,041,575

Amortisation (accumulated

211,738 750,397 962,135

amortisation)

Book value 31,648 47,792 79,440

Industrial patents and intellectual property rights

This item includes the expenses incurred for the purchase of software and applications necessary for the

company’s IT management.

Other intangible fixed assets

Other intangible fixed assets refer to expenses incurred for the improvement of leased property.

Tangible fixed assets

Changes in tangible fixed assets

Tangible fixed assets are recorded at purchase cost or at internal production cost, including direct ancillary

costs.

Pursuant to the information obligations provided for by art. 10 of (Italian) law no. 72/83 and by arts. 2423 and

2423-bis of the (Italian) Civil Code, it is hereby specified that, as far as existing assets are concerned, there

have been no monetary or economic revaluations, nor has there ever been the basis for any exceptions to

standard accounting criteria.

Depreciation recorded in the income statement is calculated systematically and constantly on the basis of rates

that are representative of the estimated economic-technical useful life of the assets in question.

The depreciation rates representing residual useful life are as follows:

- lightweight constructions: 10%

- communication systems: 20%

Financial Statements in XBRL format 10

INTERPOLIMERI SPA Financial Statements at 31/12/2017

- equipment: 15%

- vehicles: 25%

- furniture: 12%

- heavy trucks: 20%

- electronic office equipment: 20%

- furnishings: 15%

- anti-theft system: 30%

- neon sign: 10%

- company transport: 20%

- data processor: 20%

All goods with a unit cost not exceeding € 516.46 are fully depreciated over the year, since their value of use is

not significant. Moreover, this criterion complies with the relevant tax provision (article 102, paragraph 5, of the

TUIR - Italian Income Tax Consolidation Act).

It should be noted that there was no need to make any write-downs as per art. 2426, paragraph 1, no. 3, of the

(Italian) Civil Code since there were no indicators of potential impairment to the value of tangible assets, as

provided for by accounting standard OIC 9 (issued by the Italian Accounting Board)

The residual value of assets, taking into account the depreciation applied, is in fact proportionate to their

remaining useful life.

Industrial and

Plants and Other tangible fixed Total tangible fixed

Lands and buildings commercial

machinery assets assets

equipment

Value at the

beginning of the

year

Cost 33,463 103,639 53,013 1,249,215 1,439,330

Depreciation

(accumulated 29,745 91,783 36,235 846,069 1,003,832

depreciation)

Book value 3,718 11,856 16,778 403,146 435,498

Changes during the

year

Increases for

- 2,090 21,894 144,184 168,168

acquisitions

Decreases for

disposals (of book - - - 29,248 29,248

value)

Depreciation for the

3,346 3,722 5,615 150,422 163,105

year

Other changes - - - 28,020 28,020

Total changes (3,346) (1,632) 16,279 (7,466) 3,835

Value at the end of

the year

Cost 33,463 105,729 74,908 1,364,151 1,578,251

Depreciation 33,091 95,505 41,850 968,471 1,138,917

Financial Statements in XBRL format 11

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Industrial and

Plants and Other tangible fixed Total tangible fixed

Lands and buildings commercial

machinery assets assets

equipment

(accumulated

depreciation)

Book value 372 10,224 33,058 395,680 439,334

Financial fixed assets

Equity investments in controlled companies and other companies

Investments in controlled companies and other companies, representing strategic and long-term investments

for the company, are accounted for using the method based on the acquisition or subscription cost, including

any ancillary investment costs.

Where applicable, said cost is increased for subsequent capital contributions or for the purchase of new shares

or stocks or in order to cover losses, even in the case of renouncing previous financing.

The book value of each equity investment is monitored every year so as to determine whether there is a need

for a write-down. A write-down is necessary in the event that the shareholders’ equity of the investee company

records a long-term loss in value (i.e. an ongoing tendency to record values below the book value, taking into

account the investee company’s developments and future prospects).

Receivables from controlled companies

Receivables recorded under financial fixed assets - made up of loans to controlled companies - are shown at

nominal value.

Changes in equity investments, other securities and non-current derivative financial instruments

The breakdown of and changes to financial fixed asset costs are reported in the following table.

Equity investments in Equity investments in other

Total equity investments

controlled companies companies

Value at the beginning of the

year

Cost 1,925,986 940 1,926,926

Book value 1,925,986 940 1,926,926

Changes during the year

Increases for acquisitions 62,583 - 62,583

Total changes 62,583 - 62,583

Value at the end of the year

Cost 1,988,569 940 1,989,509

Book value 1,988,569 940 1,989,509

Over the course of 2017, the company acquired an additional 1% of the share capital of INTERPOLIMERI

SPAIN (SPE), giving it a shareholding equal to 73.5% of the company.

Financial Statements in XBRL format 12

INTERPOLIMERI SPA Financial Statements at 31/12/2017

On 30/10/2017, INTERPOLIMERI HUNGARY was established, a company incorporated under Hungarian law,

with headquarters in Budapest, Andrássy út 100. The share capital of the newly-established subsidiary is HUF

15,000,000, of which Interpolimeri holds an 85% stake (HUF 12,750,000), equal to Euro 41,083.

Changes and due date of non-current receivables

All items related to the financial investments made by the company and/or directly attributable to the equity

investments held are recorded under non-current receivables.

The following table shows the breakdown of and changes to the item in question.

Value at the

Changes during Value at the end Amount due Amount due after

beginning of the

the year of the year during the year the year

year

Receivables from controlled

1,626,918 1,354,589 2,981,507 751,635 2,229,872

companies

Total 1,626,918 1,354,589 2,981,507 751,635 2,229,872

The company has interest-bearing/non-interest bearing loans in place granted to controlled companies, in order

to allow them to carry out their planned investments. Since the aforementioned loans are intended to serve the

financial needs of the controlled companies over the long term, they have been considered, in part, due after

the financial year.

In particular, the company granted an interest-bearing loan to the controlled company IP Portugal SA for Euro

750,000, and a new interest-bearing loan to the controlled company Interpolimeri Spain for Euro 1,100,000.

Changes to the loans granted to controlled companies are shown below:

Net value at Net value at

Description Increase Decrease Moving items

31/12/2016 31/12/2017

Interpolimeri Spain S.L. 1,376,918 1,100,000 (495,411) - 1,981,507

IP Interpolimeri Portugal S.A. 250,000 750,000 - - 1,000,000

TOTAL 1,626,918 1,850,000 (495,411) - 2,981,507

Information on equity investments in controlled companies recorded under fixed assets

Pursuant to art. 2427, no. 5), of the (Italian) Civil Code, the main figures for controlled companies, as of the

closing date of the financial year at 31/12/2017, as reported in the last approved financial statements, are

presented below:

City, if in Italy, Profit (loss) for Book value or

Company Shareholders’ Shareholding %

or foreign Capital in Euro the last year in corresponding

name equity in Euro in Euro Shareholding

country Euro receivable

Interpolimeri

Spain 2,000,000 438,356 2,576,938 1,894,049 73.500 1,914,486

Spain SL

Financial Statements in XBRL format 13

INTERPOLIMERI SPA Financial Statements at 31/12/2017

City, if in Italy, Profit (loss) for Book value or

Company Shareholders’ Shareholding %

or foreign Capital in Euro the last year in corresponding

name equity in Euro in Euro Shareholding

country Euro receivable

IP Portugal SA Portugal 50,000 99,199 90,453 59,699 66.000 33,000

Interpolimeri

Hungary 48,336 (16,602) 31,734 26,974 85.000 41,083

Hungary

Total 1,988,569

Interpolimeri Spain S.L. markets, imports, exports and distributes processed plastics and raw materials.

The equity investment has been recorded at a higher purchase cost than the corresponding share of

Shareholders’ Equity at 31/12/2017 due to the expected cash flows resulting from the various initiatives.

IP Interpolimeri Portugal S.A. markets, imports, exports and distributes processed plastics and raw materials.

Interpolimeri Hungary markets, imports, exports and distributes processed plastics and raw materials.

The equity investment has been recorded at a higher purchase cost than the corresponding share of

Shareholders’ Equity at 31/12/2017 due to the expected cash flows resulting from the various initiatives.

There are no share availability restrictions for the investor company and there are no option rights or other

privileges, without prejudice to the pre-emption right in favour of other shareholders as provided for by the

articles of association.

Breakdown of non-current receivables by geographic area

The breakdown of non-current receivables at 31/12/2017 by geographic area is shown in the following table

(article 2427, paragraph 1, no. 6 of the Italian Civil Code).

Non-current receivables due from

Geographic area Total non-current receivables

controlled companies

EU 2,981,507 2,981,507

Current assets

Current assets refer to the items stated below.

Inventories

Inventories relating to finished products and goods are valued at either their acquisition or production cost or at

their net realizable value based on market conditions, whichever is lower, applying the moving weighted

average method.

Should the cost, as determined above, be higher than the market value at the end of the year, then inventories

are valued at said lower value.

The market value, which is compared with the cost, refers to the average repurchase price as determined by

ICIS LOR lists.

Value at the beginning of Value at the end of the

Changes during the year

the year year

Financial Statements in XBRL format 14

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Value at the beginning of Value at the end of the

Changes during the year

the year year

finished products and goods 17,381,337 4,410,449 21,791,786

Total 17,381,337 4,410,449 21,791,786

Receivables recorded under current assets

Receivables recorded under current assets have been recorded at their estimated realizable value and

therefore at their nominal value adjusted for probable losses based on conservative estimates. As far as the

‘receivables’ item is concerned, pursuant to art. 2423 paragraph 4 of the (Italian) Civil Code, it has been

established that the application of the amortised cost and/or discounted cash flow method is irrelevant for the

purpose of providing a true and correct representation of the company’s balance sheet and financial position as

well as its result for the year.

Adjustment to their estimated realizable value has been carried out using a specific bad debt provision.

Changes and due date of current receivables

The table below provides information on changes to receivables recorded under current assets and, if relevant,

information on their due date.

Value at the

Changes during Value at the end Amount due Amount due after

beginning of the

the year of the year during the year the year

year

Trade receivables 43,597,657 3,771,159 47,368,816 47,368,816 -

Receivables from controlled

8,958,906 960,430 9,919,336 9,919,336 -

companies

Tax credits 20,703 53,031 73,734 73,734 -

Prepaid taxes 72,543 119 72,662 - -

Other accounts receivable 313,471 19,583 333,054 317,324 15,730

Total 52,963,280 4,804,322 57,767,602 57,679,210 15,730

As far as the single items are concerned, the following should be noted.

Trade receivables

The breakdown of trade receivables is illustrated with the aid of the following tables, which also document the

changes in the bad debt provision.

Total Variation

Details 2017 2016

variations %

Invoices to be issued to third-party clients 210,415 191,087 19,328 10

Credit notes to be issued to third-party clients - (23,163) 23,163 (100)

Third-party clients in Italy 15,208,615 5,070,362 10,138,253 200

Entitlements 32,892,662 39,290,934 (6,398,272) (16)

Bad debt provision for trade receivables (942,876) (931,563) (11,313) 1

Financial Statements in XBRL format 15

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Details 2017 2016

variations %

Total 47,368,816 43,597,657 3,771,159

The nominal value of receivables was adjusted to their estimated realizable value using a specific bad debt

provision, which underwent the following changes over the course of the financial year:

Description Balance at 31/12/2016 (Uses) Provisions Balance at

31/12/2017

Taxable bad debt provision 455,216 - - 455,216

Deducted bad debt provision 476,347 (89,471) 100,784 487,660

Total 931,563 (89,471) 100,784 942,876

Receivables from controlled companies

The following table shows the positive balance at 31/12/2017 for commercial supplies and interest on the

interest-bearing loans granted to controlled companies.

Total Variation

Details 2017 2016

variations %

Controlled companies as clients 9,919,336 8,958,906 960,430 11

Total 9,919,336 8,958,906 960,430

Tax credits

Total Variation

Details 2017 2016

variations %

Recovery of sums paid L.D. 66/2014 3,822 867 2,955 341

IRES (corporate income tax) 69,912 6,461 63,451 982

IRAP (regional income tax) - 13,375 (13,375) (100)

Total 73,734 20,703 53,031

As shown in the table above, tax credits at the closing date of these financial statements relate to:

• the tax credit in place at the end of the financial year with regard to the so-called “Renzi Bonus”;

• the tax credit related to the balance of income taxes for the year, made up of the IRES surplus, the

composition of which can be found in the table below:

Description Values

IRAP (regional income tax) for the year:

current IRAP 147,903

Financial Statements in XBRL format 16

INTERPOLIMERI SPA Financial Statements at 31/12/2017

(Credit carried forward from the previous year) -

(Advances paid) (133,605)

Balance of IRAP payable 14,298

IRES (corporate income tax) for the year:

current IRES 468,796

(Credit carried forward from the previous year) -

(Advances paid) (552,957)

(Withholding tax applied) (49)

(Tax credits for energy saving) -

Balance of IRES receivable (84,210)

IRES-IRAP compensation

Total net balance receivable (69,912)

Receivables for prepaid taxes

The receivable for prepaid taxes is estimated in relation to the temporary downward changes - considered net

of temporary upward changes - to be made in following tax years.

In particular, the amount recorded in the balance sheet at year end was calculated taking as a basis, with

respect to each individual set-off tax period, the negative income components which contributed to the final

statutory net result for the year - and that will be deductible for tax purposes in a different tax year (next) - net of

income items for the same financial year that will be taxed in following tax years.

Total Variation

Details 2017 2016

variations %

IRES credits for prepaid taxes 68,000 67,363 637 1

IRAP credits for prepaid taxes 4,662 5,180 (518) (10)

Total 72,662 72,543 119

Pursuant to art. 2427 no. 14 of the (Italian) Civil Code, the following table provides details of the temporary

differences leading to deferred and prepaid taxes. The tax rate used was equal to 24% for IRES (corporate

income tax) and 3.9% for IRAP (regional income tax).

Description Amount for the 2017 Tax effect Amount for the 2016 Tax effect

financial year financial year

PREPAID TAXES

Maintenance in excess 64,204 15,409 36,351 8,724

Bad debt provision 99,514 28,545 99,514 23,883

Amounts of goodwill tax depreciation 119,616 28,708 132,907 37,078

Supplementary provisions for agents - - 11,910 2,858

Total prepaid taxes 283,334 72,662 280,682 72,543

Financial Statements in XBRL format 17

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Other accounts receivable

This item contains all receivable items that cannot be classified differently under current assets.

The balance is broken down as follows:

Total Variation

Details 2017 2016

variations %

Advances to third-party suppliers 233,972 35,520 198,452 559

Deposits for utilities 3,774 2,976 798 27

Miscellaneous deposits 11,956 11,956 - -

Miscellaneous receivables from third parties 70,886 109,840 (38,954) (35)

Invoices to be received from third-party suppliers - 153,179 (153,179) (100)

Advances to INAIL 12,466 - 12,466 -

Total 333,054 313,471 19,583

Breakdown of current receivables by geographic area

The breakdown of receivables at 31/12/2017 by geographic area is shown in the following table (article 2427,

paragraph 1, no. 6 of the Italian Civil Code).

Current Receivables for Other accounts

Current trade receivables due Current tax prepaid taxes receivable Total current

Geographic area

receivables from controlled credits recorded under recorded under receivables

companies current assets current assets

Italy 46,436,524 - 73,734 72,662 333,054 46,915,974

EU 790,679 9,919,336 - - - 10,710,015

Non-EU 141,613 - - - - 141,613

Total 47,368,816 9,919,336 73,734 72,662 333,054 57,767,602

Cash and cash equivalents

Cash on hand and available bank liquidity are recorded at nominal value.

Value at the beginning of Value at the end of the

Changes during the year

the year year

bank and post office deposits 417,026 803,096 1,220,122

cash and equivalents on hand 2,756 2,735 5,491

Total 419,782 805,831 1,225,613

The amount of cash and other equivalents is limited to immediate liquidity needs.

Other cash and cash equivalents correspond to the accounting of temporary positive balances relating to

ordinary bank accounts, including interest receivable accrued during the year.

Financial Statements in XBRL format 18

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Accrued income and prepaid expenses

These are calculated on an accrual basis, applying the principle of matching expenses and revenues.

Value at the beginning of the

Changes during the year Value at the end of the year

year

Accrued income - 71 71

Prepaid expenses 185,169 92,510 277,679

Total accrued income and

185,169 92,581 277,750

prepaid expenses

Details of the breakdown of this item are as follows (art. 2427, first paragraph, no. 7, of the Italian Civil Code).

Description Value

Pre-paid expenses - telephone bills 7,534

Pre-paid expenses - insurance 28,386

Pre-paid expenses - vehicle tax 2,319

Pre-paid expenses - commercial information 42,432

Pre-paid expenses - vehicle rental 9,475

Pre-paid expenses - vehicle maintenance 3,483

Pre-paid expenses - hardware/software assistance 12,764

Pre-paid expenses - entertainment expenses 7,260

Pre-paid expenses - surety guarantee fees 118,453

Pre-paid expenses - assistance with miscellaneous equipment 504

Pre-paid expenses - magazine and journal subscriptions 4,578

Pre-paid expenses - other fees and taxes 135

Pre-paid expenses - bank fees 1,026

Pre-paid expenses - advertising 15,263

Pre-paid expenses - financing fees 24,067

Total 277.679

Explanatory notes - Liabilities and shareholders' equity

Please see below the items included under shareholders' equity and balance sheet liabilities.

Financial Statements in XBRL format 19

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Shareholders' equity

Items are presented in the balance sheet at their book value according to accounting standard OIC 28 (issued

by the Italian Accounting Board).

Changes in shareholders' equity

The table below highlights the changes to the single items making up shareholders’ equity over the course of

the financial year.

Value at 31/12/2015

Analysis of changes in shareholders' equity items

Allocation of

Value at the

previous year's Other changes - Other changes - Profit (loss) for Value at the end

beginning of the

profit - Other Increases Decreases the year of the year

year

allocations

Share capital 5,000,000 - 5,000,000 - - 10,000,000

Legal reserve 605,266 56,824 - - - 662,090

Extraordinary

8,870,810 1,079,651 - 4,500,000 - 5,450,461

reserve

Miscellaneous

1 - - - - 1

other reserves

Total other

8,870,811 1,079,651 - 4,500,000 - 5,450,462

reserves

Profit (loss) for the

1,136,475 (1,136,475) - - 2,214,894 2,214,894

year

Total 15,612,552 - 5,000,000 4,500,000 2,214,894 18,327,446

Value at 31/12/2016

Allocation of

Value at the

previous year's Other changes - Other changes - Profit (loss) for Value at the end

beginning of the

profit - Other Increases Decreases the year of the year

year

allocations

Share capital 10,000,000 - - - - 10,000,000

Legal reserve 662,090 110,745 - - - 772,835

Extraordinary

5,450,461 2,104,149 1 - - 7,554,611

reserve

Miscellaneous

1 - - 4 - (3)

other reserves

Total other

5,450,462 2,104,149 1 4 - 7,554,608

reserves

Profit (loss) for the

2,214,894 (2,214,894) - - 1,400,996 1,400,996

year

Total 18,327,446 - 1 4 1,400,996 19,728,439

Financial Statements in XBRL format 20

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Value at 31/12/2017

Allocation of

Value at the

previous year's Other changes - Profit (loss) for the Value at the end of

beginning of the

profit - Other Increases year the year

year

allocations

Share capital 10,000,000 - - - 10,000,000

Legal reserve 772,835 70,050 - - 842,885

Extraordinary reserve 7,554,611 1,330,946 - - 8,885,557

Miscellaneous other

(3) - 3 - -

reserves

Total other reserves 7,554,608 1,330,946 3 - 8,885,557

Profit (loss) for the

1,400,996 (1,400,996) - 1,331,081 1,331,081

year

Total 19,728,439 - 3 1,331,081 21,059,523

Share capital

The share capital as of 31/12/2017, fully issued and paid-up, is equal to Euro 10,000,000.00, made up of

10,000,000.00 ordinary shares each with a nominal value of Euro 1.00.

Legal reserve

Pursuant to art. 2430, paragraph 1, of the (Italian) Civil Code, the reserve has been increased by 1/20 of the

profit made in the previous financial year.

Other reserves

As of 31st December 2017, this item was made up of the "Extraordinary reserve", which was increased using

the profit from the 2016 financial year for a sum of

Euro 1,330,946, as per the resolution passed to approve the corresponding annual financial statements.

Availability and use of shareholders’ equity

Pursuant to art. 2427, no. 7-bis) of the (Italian) Civil Code, the table below provides details of the potential uses

of shareholders’ equity for share capital increases, loss coverage, distributions to shareholders and other uses,

as well as showing the uses from the previous years.

Summary of uses in

the three previous

Description Amount Origin/Nature Possible use Available share

years - for other

reasons

Share capital 10,000,000 Capital - -

Legal reserve 842,885 Profits B - -

Extraordinary reserve 8,885,557 Profits A;B;C 8,885,557 4,500,000

Total other reserves 8,885,557 Profits - -

Total 19,728,442 8,885,557 4,500,000

Financial Statements in XBRL format 21

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Summary of uses in

the three previous

Description Amount Origin/Nature Possible use Available share

years - for other

reasons

Non-distributable

-

amount

Residual distributable

8,885,557

amount

Key: A: for capital increase; B: to cover losses; C: for distribution to shareholders; D: for other statutory constraints; E: other

The use of the Extraordinary Reserve for Euro 4,500,000 refers to the free share capital increase carried out

over the course of the 2015.

Provisions for liabilities and charges

In compliance with the principle of prudence and accrual basis accounting, provisions for liabilities and charges

include provisions made to cover losses or payables of a specific nature and whose existence is certain or

probable, but for which it was not possible to determine either the actual amount or date of occurrence. When

assessing the liabilities and charges whose actual occurrence is subject to future events, all information made

available since the end of the year, and until the date of preparation of these financial statements, have been

taken into consideration.

Contingent liabilities have been recorded in the balance sheet and in the provisions as they are considered

likely to happen, and their amount may be reasonably estimated.

Value at the Changes during

Changes during Changes during Value at the end

beginning of the the year -

the year - Others the year - Total of the year

year Provision

Severance & pension liabilities

77,136 88,989 (450) 88,539 165,675

and similar obligations

Total 77,136 88,989 (450) 88,539 165,675

The following table provides a breakdown and details of the changes to this item:

Total Variation

Details 2017 2016

variations %

Provision for supplementary customer allowances 19,173 10,336 8,837 85

Provision for directors' TFM (end of mandate indemnity) 146,502 66,800 79,702 119

Total 165,675 77,136 88,539

Staff severance indemnity

This represents the actual amount due to employees in accordance with laws, labour contracts and company

agreements currently in force.

Financial Statements in XBRL format 22

INTERPOLIMERI SPA Financial Statements at 31/12/2017

The table below shows the changes to this item during the financial year.

Value at the Changes during

Changes during Changes during Value at the end

beginning of the the year -

the year - Use the year - Total of the year

year Provision

STAFF SEVERANCE

473,876 113,857 11,945 101,912 575,788

INDEMNITY

Total 473,876 113,857 11,945 101,912 575,788

The provision for staff severance indemnity has been calculated by taking into account the existing rules on

severance indemnities in accordance with art . 2120 of the (Italian) Civil Code and covers the amounts accrued

for employees at 31/12/2017 in relation to existing contractual obligations and applicable legislation.

Any amounts paid out to employees who terminated their employment during the year, amounts optionally

allocated to pension funds and, where appropriate, amounts paid as an advance on the liquidation, were

deducted from the provision. The provision includes the allocations made for employees of the Company at

31/12/2017, net of the substitute tax of 17%.

Payables

Payables are recorded under liabilities at their nominal value, considered equal to their estimated realizable

value; they have not been recorded in the financial statements according to the amortised cost method since,

pursuant to art. 2423, paragraph 4 of the (Italian) Civil Code, it has been established that the application of said

method is irrelevant for the purpose of providing a true and correct representation of the company’s balance

sheet and financial position as well as its result for the year.

Payables originating from the acquisition of assets are recorded when the relative risks, charges and benefits

are transferred; payables for services are recorded when the service is carried out; financial payables and other

payables are recorded when the payable amount is due.

Pursuant to paragraph 6 and 6-ter of art. 2427 of the (Italian) Civil Code, it is hereby specified that:

there are no payables due after five years;

there are no payables secured by real guarantees on company assets;

there are no payables relating to transactions involving repurchase agreement obligations for the buyer.

Changes and due date of payables

The below table highlights the changes to the single posts making up this item over the course of the financial

year.

Value at the

Changes during Value at the end Amount due Amount due after

beginning of the

the year of the year during the year the year

year

Payables due to banks 36,406,799 7,005,732 43,412,531 41,353,298 2,059,233

Advances - 8,598 8,598 8,598 -

Trade payables 16,400,603 2,386,819 18,787,422 18,787,422 -

Payables due to controlled

232,606 475,196 707,802 707,802 -

companies

Financial Statements in XBRL format 23

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Value at the

Changes during Value at the end Amount due Amount due after

beginning of the

the year of the year during the year the year

year

Tax payables 591,198 (78,260) 512,938 512,938 -

Payables due to pension and

151,776 (2,187) 149,589 149,589 -

social security institutions

Other payables 965,743 206,932 1,172,675 1,077,675 95,000

Total 54,748,725 10,002,830 64,751,555 62,597,322 2,154,233

As far as the single items are concerned, the following should be noted.

Payables due to banks

Total Variation

Details 2017 2016

variations %

Bank accounts 39,344 19,058 20,286 106

Banks - advances 5,741,198 3,557,403 2,183,795 61

Short-term bank loans 11,553,802 2,604,760 8,949,042 344

Medium/long-term bank loans 6,885,745 8,979,796 (2,094,051) (23)

Bank receipts - subject to collection 19,192,442 21,245,783 (2,053,341) (10)

Total 43,412,531 36,406,800 7,005,731

The balance of payables due to banks at 31/12/2017 expresses the actual payable amount due for capital,

interest and matured ancillary costs.

With reference to art. 2427, point no. 6 of the (Italian) Civil Code, it should be noted that the Company has no

payables in place that are backed by company assets.

Advances

The table below shows the advances received from clients with reference to commercial transactions.

Total Variation

Details 2017 2016

variations %

Advances from third-party clients and expense accounts 8,598 - 8,598 100

Total 8,598 - 8,598

Trade payables

Trade payables are recorded net of trade discounts and are rectified on the basis of rebates and returns

(invoicing adjustments) according to the amount defined with the counterpart; details are as follows:

Total Variation

Details 2017 2016

variations %

Invoices to be received from third-party suppliers 358,851 393,646 (34,795) (9)

Third-party suppliers Italy 18,428,571 16,006,957 2,421,614 15

Financial Statements in XBRL format 24

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Details 2017 2016

variations %

Total 18,787,422 16,400,603 2,386,819

Payables due to controlled companies

The following table shows the debit balance at 31/12/2017 for commercial supplies received from controlled

companies.

Total Variation

Details 2017 2016

variations %

Controlled companies as suppliers 707,802 232,606 475,196 204

Total 707,802 232,606 475,196

Tax payables

Tax payables are represented by liabilities for certain and specific taxes.

Total Variation

Details 2017 2016

variations %

VAT 151,068 280,860 (129,792) (46)

Withholding tax on employment income 361,488 297,871 63,617 21

Withholding tax on self-employment income - 12,174 (12,174) (100)

Substitute taxes on staff severance indemnity 382 293 89 30

Total 512,938 591,198 (78,260)

As shown in the table, Tax Payables at the closing date of these financial statements relate to:

the payable in place at the end of the year in relation to the deductions made on self-employment income

and employees’ income, paid in the first months of the following year;

the payable relating to the VAT balance for the month of December 2017;

the payable relating to the substitute tax on matured staff severance indemnity.

Payables due to pension and social security institutions

This item classifies payables due to pension and social security institutions. Payables include the amounts due

from both service providers and the company.

Total Variation

Details 2017 2016

variations %

INPS - employees 116,858 115,982 876 1

INPS - contract staff 24,165 27,293 (3,128) (11)

INAIL - employees/contract staff 4,132 3,366 766 23

ENASARCO 4,434 5,135 (701) (14)

Financial Statements in XBRL format 25

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Details 2017 2016

variations %

Total 149,589 151,776 (2,187)

Other payables

The “Other payables” item is made up of the following:

Total Variation

Details 2017 2016

variations %

Payables due to supplementary pension funds 11,254 10,363 891 9

Payables due to directors 259,761 - 259,761 -

Payables due to contract staff 3,050 - 3,050 -

Payables for third-party deductions 370 - 370 -

Payables due to credit card suppliers 11,668 12,235 (567) (5)

Sundry payables due to third parties 416,642 523,716 (107,074) (20)

Staff salaries 155,591 188,597 (33,006) (18)

Expense reimbursements to staff 1,031 1,974 (943) (48)

Deferred salary payments to employees 313,308 208,079 105,229 51

Invoices to be issued to third-party clients - 1,855 (1,855) (100)

Clients with advances in the name and on behalf of - 18,924 (18,924) (100)

Total 1,172,675 965,743 206,932

Sundry payables to third parties also include payables due to the previous shareholders of the controlled

companies CHEMITEC PLASTICOS SLU and Interpolimeri Spain SA for Euro 270,000, following the

acquisition of shares in said companies completed in 2014.

Breakdown of payables by geographic area

The breakdown of Payables at 31/12/2017 by geographic area is shown in the table below (article 2427, first

paragraph, no. 6, of the Italian Civil Code).

Payables due

Payables due to pension

Geographic Payables due Trade Other

Advances to controlled Tax payables and social Payables

area to banks payables payables

companies security

institutions

Italy 43,412,531 8,598 6,929,608 - 512,938 149,589 902,675 51,915,939

EU - - 8,364,549 707,802 - - 270,000 9,342,351

Non-EU - - 3,493,265 - - - - 3,493,265

Total 43,412,531 8,598 18,787,422 707,802 512,938 149,589 1,172,675 64,751,555

Financial Statements in XBRL format 26

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Explanatory notes - Income statement

Expenses and revenues are recorded in the financial statements in accordance with the principle of prudence

and accrual basis accounting, recognising the relative accruals and deferrals.

Pursuant to art. 2425-bis of the (Italian) Civil Code, it is hereby stated that:

revenues and income, costs and charges are recorded net of any returns, discounts, allowances and

bonuses;

there are no expenses and revenues relating to transactions with a repurchase obligation;

there are no capital gains arising from transactions with financial leasing.

Value of production

Revenues from sales of products are recognized upon transfer of ownership, normally coinciding with the

delivery or shipment of goods.

Revenues from services are recognized upon obtaining the right to their perception and therefore on a legal

and accrual basis.

Breakdown of sales and services revenues by geographic area

Sales revenues are divided by geographic area as follows:

Geographic area Current year value

Italy 148,816,154

EU 11,927,776

Non-EU 1,546,099

Total 162,290,029

The value of production can be broken down as follows.

Total Variation

Item Description Details 2017 2016

variations %

1) Sales and services revenues

Sale of goods 162,290,029 148,297,406 13,992,623 9

Total 162,290,029 148,297,406 13,992,623

5 a) Grants for current expenses

Grants for current expenses - 4,570 (4,570) (100)

Total - 4,570 (4,570)

Miscellaneous revenues and

5 b)

income

Financial Statements in XBRL format 27

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Item Description Details 2017 2016

variations %

Reimbursement of various costs 64,200 101,100 (36,900) (36)

Compensation for loss of

400 5,544 (5,144) (93)

products/accidents

Non-recurring income 2,181 67,173 (64,992) (97)

Expense reimbursements - 791 (791) (100)

Other revenues and income 198,795 169,311 29,484 17

Capital gains from the sale of assets 4,119 21,828 (17,709) (81)

Total 269,695 365,747 (96,052)

Production costs

Costs and expenses are recognized on an accrual basis, respecting the principle of matching them with

revenues, and are recorded under the relative items in accordance with accounting standard OIC 12 (issued by

the Italian Accounting Board).

Costs for the purchase of goods and services are recorded in the income statement net of adjustments for

returns, discounts, allowances and rebates.

It is to be noted that the company has set up fixed-term contracts to hedge the exchange rate risk (for the

dollar) with regard to specific purchase contract commitments; the differences in exchange rates, due to their

business nature, directly rectify the cost of raw materials.

The following tables provide a breakdown of their composition:

Costs for raw and ancillary materials, consumables and goods

Total Variation

Details 2017 2016

variations %

Purchase of consumables 23,883 18,846 5,037 27

Purchase of goods for resale 150,434,304 133,070,373 17,363,931 13

Ancillary costs for purchases 748,399 1,186,307 (437,908) (37)

Discounts on purchases (406,962) (326,466) (80,496) 25

Allowances and rounding on purchases 4,049 554 3,495 631

Total 150,803,673 133,949,614 16,854,059

Costs for services

A breakdown of costs for services at 31/12/2017 is provided below:

Total Variation

Details 2017 2016

variations %

Other production services 32,507 - 32,507 100

Transport of sold/purchased items 5,250,475 4,615,483 634,992 14

Financial Statements in XBRL format 28

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Details 2017 2016

variations %

Warehouse charges for purchases 274,954 264,915 10,039 4

Commission payable 505,902 394,977 110,925 28

Fees for agents and sales representatives 61,935 15,144 46,791 309

Utilities 147,394 140,654 6,740 5

Maintenance and repairs 169,195 150,807 18,388 12

Vehicle handling fees 326,422 298,677 27,745 9

Professional consulting 381,030 388,813 (7,783) (2)

Contract staff fees 40,644 74,048 (33,404) (45)

Remuneration to company bodies 967,444 839,974 127,470 15

Costs for commercial services 183,425 191,997 (8,572) (4)

Cleaning and surveillance 66,377 65,755 622 1

Insurance premiums 290,802 272,667 18,135 7

Employees’ expense reimbursements 264,452 288,307 (23,855) (8)

Miscellaneous expenses 78,457 80,484 (2,027) (3)

Software assistance 107,011 135,762 (28,751) (21)

Bank commissions and fees 173,954 146,367 27,587 19

Total 9,322,380 8,364,831 957,549

Costs for the use of third-party assets

The table below better explains the distinction between rents payable and rental charges.

Total Variation

Details 2017 2016

variations %

Property lease rents 1,339,574 1,337,784 1,790 -

Rents and ancillary costs for vehicle rental 109,116 114,316 (5,200) (5)

Equipment rental fees 15,593 11,195 4,398 39

Total 1,464,283 1,463,295 988

Personnel costs

Total costs for employees are detailed below:

Total Variation

Item Description Details 2017 2016

variations %

9.a) Salaries and wages

Gross salaries for employees 2,047,795 1,744,008 303,787 17

Financial Statements in XBRL format 29

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Item Description Details 2017 2016

variations %

Gross salaries - 450 (450) (100)

Total 2,047,795 1,744,458 303,337

Pension and social security

9 b)

contributions

INPS contributions for employees 533,069 446,559 86,510 19

INPS contributions - 78 (78) (100)

Contributions to other pension and

social security bodies for ordinary 5,473 3,130 2,343 75

employees

INAIL premiums 28,444 28,077 367 1

Total 566,986 477,844 89,142

9 c) Staff severance indemnity

Share of staff severance indemnity for

113,857 93,574 20,283 22

employees (held in the company)

Share of staff severance indemnity for

employees (supplementary pension 32,378 30,405 1,973 6

funds)

Total 146,235 123,979 22,256

9 e) Other personnel costs

Other costs for employees 13,793 9,893 3,900 39

Total 13,793 9,893 3,900

Amortisation, depreciation and write-downs

The following tables show a summary of amortisation and depreciation and provisions of current receivables

and of cash and cash equivalents made during the year.

Total Variation

Item Description Details 2017 2016

variations %

Amortisation of intangible fixed

10 a)

assets

Amortisation of industrial patents and

36,096 37,036 (940) (3)

intellectual property rights

Amortisation of maintenance fees on

30,456 34,358 (3,902) (11)

third-party assets

Total 66,552 71,394 (4,842)

Depreciation of tangible fixed

10 b)

assets

Depreciation of specific equipment 3,722 5,596 (1,874) (33)

Depreciation of miscellaneous and

5,615 3,349 2,266 68

minor equipment

Financial Statements in XBRL format 30

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Item Description Details 2017 2016

variations %

Depreciation of furniture and

13,618 14,079 (461) (3)

furnishings

Depreciation of electronic office

303 397 (94) (24)

equipment

Depreciation of lightweight

3,346 3,346 - -

constructions

Depreciation of vehicles 97,560 78,712 18,848 24

Depreciation of mobile phones 2,237 3,688 (1,451) (39)

Depreciation of company transport 13,673 13,693 (20) -

Depreciation of other material assets 23,031 14,200 8,831 62

Total 163,105 137,060 26,045

Write-downs of current

10 d) receivables and of cash and

cash equivalents

Provision for bad and doubtful trade

100,784 83,037 17,747 21

receivables

Total 100,784 83,037 17,747

Changes in inventories of raw and ancillary materials, consumables and goods

Total Variation

Details 2017 2016

variations %

Final goods inventories (21,791,786) (17,381,337) (4,410,449) 25

Initial goods inventories 17,381,337 17,241,277 140,060 1

Total (4,410,449) (140,060) (4,270,389)

Sundry operating expenses

Sundry operating expenses include cost items that are unable to be classified elsewhere under production

costs. The below table provides details of their composition:

Total Variation

Details 2017 2016

variations %

Taxes on company-owned vehicles 15,913 14,311 1,602 11

Gifts - 2,412 (2,412) (100)

Stamp duties 12,373 12,479 (106) (1)

Non-deductible VAT 1,572 - 1,572 -

Chamber of commerce fees 2,734 - 2,734 -

Registration fee and licence tax 7,198 8,223 (1,025) (12)

Financial Statements in XBRL format 31

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Details 2017 2016

variations %

Waste collection and disposal tax 7,090 5,985 1,105 18

TASI (Italian council tax) 1,624 1,624 - -

Other indirect taxes 12,988 14,763 (1,775) (12)

Expenses, losses and contingent liabilities 16,076 27,938 (11,862) (42)

Sanctions, penalties and fines 6,958 5,526 1,432 26

Contributions to associations 930 480 450 94

Miscellaneous stationary 24,947 28,615 (3,668) (13)

Subscriptions, books and publications 16,754 14,190 2,564 18

Miscellaneous negative roundings 3 1 2 200

Donations 20,000 35,000 (15,000) (43)

Sanctions and compensation payable 23,499 44,562 (21,063) (47)

Capital losses on sale/disposal of assets 422 5,536 (5,114) (92)

Total 171,081 221,645 (50,564)

Financial income and charges

Financial income and charges are recognized on an accrual basis in relation to the amount accrued in the year.

All interest and other financial charges were paid in full during the year. Pursuant to art. 2427, paragraph 1, no.

8 of the (Italian) Civil Code, it is hereby stated that there are no capitalized financial charges.

The table below shows the interest received and the financial charges incurred during the year, broken down

pursuant to article 2427, point 12), of the (Italian) Civil Code.

Total Variation

Item Description Details 2017 2016

variations %

Other financial income from non-

16.a) current receivables from

controlled companies

Interest income on non-current

receivables from controlled 22,883 4,889 17,994 368

companies

Total 22,883 4,889 17,994

Other income from other

16 d)

companies

Interest receivable on bank accounts 182 282 (100) (35)

Miscellaneous interest receivable 3,466 - 3,466 100

Total 3,648 282 3,366

17) Interest and other financial

Financial Statements in XBRL format 32

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Item Description Details 2017 2016

variations %

charges due to other companies

Interest payable to banks 35,053 36,216 (1,163) (3)

Interest payable on third-party

78,014 80,036 (2,022) (3)

financing

Miscellaneous financial charges 69,301 53,124 16,177 30

Total 182,368 169,376 12,992

Exchange rate gains and losses

Any gains and losses on exchange rates are fully realized during the year. Details of currency management are

as follows:

Total Variation

Details 2017 2016

variations %

Exchange rate losses (8) (27) 19 (70)

Total (8) (27) 19

Amount and nature of individual revenue/cost items of exceptional size or incidence

No revenue/cost items or other income/expense items of exceptional size or incidence were reported during the

year.

Current, deferred and prepaid income taxes for the year

Taxes are set aside according to current tax rates and regulations and are recorded under item 22) of the

income statement - Income taxes for the year; in compliance with accounting standard OIC no. 25 (issued by

the Italian Accounting Board), taxes were recorded on an accrual basis by recording and presenting shares of

deferred or prepaid taxes in order to take into account the timing differences between statutory income and

taxable income, whose readjustment in future years is certain.

With that in mind, please see below the financial burden represented by IRES (corporate income tax) and IRAP

(regional income tax) for the year (current, deferred and prepaid):

Total Variation

Item Description Details 2017 2016

variations %

20) Current income tax for the year

current IRES 468,796 452,211 16,585 4

current IRAP 147,903 133,605 14,298 11

Total 616,699 585,816 30,883

Deferred and prepaid income

tax for the year

Financial Statements in XBRL format 33

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total Variation

Item Description Details 2017 2016

variations %

Prepaid IRES for the period (637) - (637) 100

Prepaid IRAP from previous financial

518 518 - -

years

Prepaid IRES from previous financial

- 9,171 (9,171) (100)

years

Total (119) 9,689 (9,808)

Explanatory notes - Other information

Please see below the other information required by art. 2427, 2427-bis and 2428 no. 3 and 4 of the (Italian)

Civil Code, if and insofar as they are relevant to the case in question.

Employment figures

The average company headcount, broken down by category, is detailed below.

Executives White-collar workers Blue-collar workers Total employees

Average number 1 40 12 53

Compared to 2016, the average headcount increased by an average of 5 units.

The national labour contract in force is the one for the TRADE AND SERVICES industry.

Fees, advances and credits granted to directors and statutory auditors and commitments

made on their behalf

Pursuant to the law, the total remuneration due to directors and statutory auditors is provided below (article

2427, first paragraph, no. 16 of the Italian Civil Code).

Directors Statutory auditors

Remuneration 783,000 18,200

Remuneration to the external auditor or audit firm

The annual remuneration paid to the external audit firm for their services in the year 2017 amounts to Euro

13,470.

Financial Statements in XBRL format 34

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Total remuneration due to the external

External audit of annual accounts

auditor or audit firm

Value 13,470 13,470

Category of shares issued by the company

All shares issued by the company are ordinary, each with a nominal value equal to Euro 1.00.

Initial worth, nominal Final worth, nominal

Initial worth, number Final worth, number

value value

10,000,000 1 10,000,000 1

Total 10,000,000 1 10,000,000 1

Securities issued by the company

In accordance with article 2427, no. 18 of the (Italian) Civil Code, it is hereby stated that the company has not

issued any securities or similar value falling under legal provisions.

Information on other financial instruments issued by the company

In accordance with article 2427, no. 19 of the (Italian) Civil Code, it is hereby stated that the company has not

issued any financial instruments falling under legal provisions.

Commitments, guarantees and contingent liabilities not disclosed in the balance sheet

The memorandum accounts show the risks, commitments and guarantees issued by the company in favour of

third parties, which are not already included in the balance sheet.

As of the closing date of the financial year, surety guarantees had been received from Unicredit Banca in favour

of lessors for Euro 26,100.

It should be noted that the company has also received the following guarantees:

- Stand-by credit letter issued by Unicredit Banca in favour of a foreign supplier for Euro 4,000,000;

- Stand-by credit letter issued by Cariveneto in favour of a foreign supplier for Euro 5,000,000;

- Stand-by credit letter issued by Intesa San Paolo in favour of a foreign supplier for Euro 2,000,000;

- 2 surety guarantees issued by Atradius Insurance in favour of the (Italian) Customs Agency for the payment

of customs duties for Euro 950,000.

- 2 stand-by credit letters issued by BPM and BNL in favour of the controlled company Interpolimeri Spain

SA, for Euro 1,100,000 and Euro 1,000,000, respectively;

- 2 stand-by credit letters issued by Unicredit Banca in favour of the controlled company IP Portugal SL, for

Euro 2,000,000 and Euro 1,000,000, respectively;

As of 31/12/2017, the company also held third-party goods on its premises for a value of Euro 76,277.

Financial Statements in XBRL format 35

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Other than the above, there are no memorandum accounts recorded in the financial statements, nor any other

commitments that are not recorded in the Balance Sheet, which would otherwise require mention in the

Explanatory Notes as they would be useful in order to assess the balance sheet and financial position of the

company as of 31/12/2017.

Information on assets and funds for the purposes of a specific business transaction

In relation to the information requirements provided for by art. 2427, no. 21 of the (Italian) Civil Code, it is

hereby stated that, as at the closing date of the financial statements, there were no loans in place for a specific

transaction.

Information on transactions with related parties

In relation to the information requirements provided for by art. 2427, no. 22-bis of the (Italian) Civil Code, it is

hereby stated that, during the year, the company was not involved in any related-party transactions that could

be considered significant or that were not concluded under normal market conditions, the terms and conditions

of which (nature, amount, execution mode) may otherwise influence understanding of the company’s balance

sheet, financial position and result from operations.

Information on agreements not disclosed in the balance sheet

In relation to the information requirements provided for by article 2427, no. 22-ter of the (Italian) Civil Code, it is

hereby stated that, during the year, the company did not make any agreements that weren't disclosed in the

balance sheet and that are not yet subject to being included in the balance sheet categories or in the

memorandum accounts at the bottom of accounting statement, whose risks and benefits are significant and

whose disclosure is necessary in order to assess the company’s balance sheet, financial position and result

from operations.

Significant events after the reporting date

With reference to paragraph 22-quater of art. 2427 of the (Italian) Civil Code, there are no significant events to

report after the end of the financial year which have had a significant impact on the balance sheet, financial

position and result from operations.

Information on derivative financial instruments pursuant to art. 2427-bis of the Italian

Civil Code

In relation to the information requirements provided for by art. 2427-bis of the (Italian) Civil Code, it is hereby

stated that the company does not hold derivative financial instruments, therefore making it exempt from

providing the information required therein.

Financial Statements in XBRL format 36

INTERPOLIMERI SPA Financial Statements at 31/12/2017

Explanatory notes - Final part

Dear Shareholders, on the basis of the considerations presented above, we hereby invite you to approve the

Financial Statements for the year ending 31/12/2017, made up of the Balance Sheet, Income Statement and

Explanatory notes, together with the accompanying Directors’ Report.

The Board of Directors hereby proposes to the Shareholders’ Meeting to distribute the profit for the year, equal

to Euro 1,331,080.86, as follows:

Profit for the year at 31/12/2017 Euro

5% to the Legal reserve 66,554.04

to the Extraordinary reserve 1,264,526.82

as dividends -

Total 1.331.080,86

The financial statements are true and real and correspond to accounting entries.

Limena (PD), 30th March 2018

The Chairman of the Board of Directors

(Claudio Gallo)

Financial Statements in XBRL format 37

Вам также может понравиться