Академический Документы

Профессиональный Документы

Культура Документы

Chapter 7 Test Bank: ©2009 Pearson Education, Inc. Publishing As Prentice Hall 7-1

Загружено:

Alfred ValenzuelaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 7 Test Bank: ©2009 Pearson Education, Inc. Publishing As Prentice Hall 7-1

Загружено:

Alfred ValenzuelaАвторское право:

Доступные форматы

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.

com

Chapter 7 Test Bank

INTERCOMPANY PROFIT TRANSACTIONS – BONDS

Multiple Choice Questions

LO1

1. The intercompany purchase of the parent company bonds by a

subsidiary has the same effect on the consolidated financial

statements as the

a. purchase of the bonds by a non-affiliate.

b. parent's retirement of the bonds using funds from newly

issued common stock.

c. parent's retirement of the bonds using funds from a

subsidiary loan.

d. parent's retirement of the bonds using funds from the sale

of new bonds to non-affiliates.

LO1

2. If an affiliate purchases bonds in the open market, the

intercompany bond liability book value is

a. always assigned to the parent company because it has

control.

b. the par value of the bonds less the discount or plus the

premium and issuance costs at the time of issuance.

c. par value.

d. the par value of the bonds plus unamortized discount.

LO2

3. Material constructive gains and losses from intercompany bond

holdings are

a. realized gains and losses from the issuing affiliate’s

perspective.

b. always assigned to the parent company because it has

control.

c. realized and recognized from the consolidated entity’s

perspective.

d. excluded from the consolidated income statement until the

period in which they become realized.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-1

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Use the following information in answering questions 4 and 5.

Australian Owl Company owns an 80% interest in Glider Company. On

January 1, 2006, Australian Owl had $600,000, 8% bonds outstanding

with an unamortized premium of $9,000. The bonds mature on December

31, 2010. Glider acquired one-third of Australian Owl’s bonds in the

open market for $198,000 on January 1, 2006. On December 31, 2006,

the books of the two affiliates held the following balances:

Australian Owl’s books

8% bonds payable $600,000

Premium on bonds 7,200

Interest expense 46,200

Glider’s books

Investment in Australian Owl bonds $198,400

Interest income 16,400

LO2

4. The gain from the bond purchase that appeared on the December

31, 2006 consolidated income statement was

a. $ 0.

b. $4,400.

c. $4,800.

d. $5,000.

LO2

5. Consolidated Interest Expense and consolidated Interest Income,

respectively, that appeared on the consolidated income

statement for the year ended December 31, 2006 was

a. $30,800 and $ 0.

b. $30,800 and $16,400.

c. $46,200 and $ 0.

d. $46,200 and $16,400.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-2

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2

6. Kingfisher Corporation owns 80% the voting stock of Tunnel

Corporation. On January 1, 2006, Kingfisher paid $391,000 cash

for $400,000 par of Tunnel’s 10% $1,000,000 par value

outstanding bonds, due on April 1, 2011. Tunnel’s bonds had a

book value of $1,045,000 on January 1, 2006. Straight-line

amortization is used. The gain or loss on the constructive

retirement of $400,000 of Tunnel bonds on January 1, 2006 was

reported in the 2006 consolidated income statement in the

amount of

a. $14,000.

b. $21,000.

c. $23,000.

d. $27,000.

Use the following information in answering questions 7, 8, and 9.

Rufous Owl Inc. had $800,000 par of 10% bonds payable outstanding on

January 1, 2006 due January 1, 2010 with an unamortized discount of

$16,000. Bird is a 90%-owned subsidiary of Rufous. On January 1,

2006, Bird Corporation purchased $160,000 par value of Rufous’s

outstanding bonds for $152,000. The bonds have interest payment dates

of January 1 and July 1, and mature on January 1, 2009. Straight-line

amortization is used.

LO2

7. With respect to the bond purchase, the consolidated income

statement of Rufous Owl Corporation and Subsidiary for 2006

showed a gain or loss of

a. $ 4,000.

b. $ 4,800.

c. $ 8,000.

d. $10,200.

LO2

8. Bond Interest Receivable for 2006 of Owl’s bonds on Bird’s

books was

a. $ 7,600.

b. $ 8,000.

c. $15,200.

d. $16,000.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-3

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2

9. Bonds Payable appeared in the December 31, 2006 consolidated

balance sheet of Rufous Owl Corporation and Subsidiary in the

amount of

a. $624,000.

b. $628,000.

c. $630,400.

d. $637,800.

Use the following information for questions 10 through 15.

Dollarbird Corporation issued five thousand, $1,000 par, 12% bonds on

January 1, 2004. Interest is paid on January 1 and July 1 of each

year; the bonds mature on January 1, 2009. On January 1, 2006, Branch

Corporation, an 80%-owned subsidiary of Dollarbird, purchased 3,000

of the bonds on the open market at 101.50. Dollarbird's separate net

income for 2006 included the annual interest expense for all 3,000

bonds. Branch’s separate net income was $300,000, which included the

bond interest received on July 1 as well as the accrual of bond

interest revenue earned on December 31.

LO2

10. What was the amount of gain or (loss) from the intercompany

purchase of Dollarbird’s bonds on January 1, 2006?

a. $(60,000).

b. $(45,000).

c. $ 45,000.

d. $ 60,000.

LO2

11. If the bonds were originally issued at 106, and 80% of them

were purchased by Branch on January 1, 2007 at 98, the gain or

(loss) from the intercompany purchase was

a. $(224,000).

b. $(176,000).

c. $ 176,000.

d. $ 224,000.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-4

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2

12. If the bonds were originally issued at 103, and 70% of them

were purchased on January 1, 2008 at 104, the constructive gain

or (loss) on the purchase was

a. $(119,000).

b. $(35,000).

c. $35,000.

d. $119,000.

LO2

13. Using the original information, the amount of consolidated

Interest Expense for 2006 was

a. $ 120,000.

b. $ 240,000.

c. $ 300,000.

d. $ 600,000.

LO2

14. Using the original information, the balances for the Bonds

Payable and Bond Interest Payable accounts, respectively, on

the consolidated balance sheet for December 31, 2007 were

a. $2,000,000 and $120,000.

b. $2,000,000 and $240,000.

c. $5,000,000 and $120,000.

d. $5,000,000 and $240,000.

LO2

15. The elimination entries on the consolidation working papers

prepared on December 31, 2006 included at least

a. debit to Bond Interest Expense for $360,000.

b. credit to Bond Interest Expense for $360,000 and a debit to

Bond Interest Payable for $180,000.

c. credit to Bond Interest Receivable for $360,000.

d. debit to Bond Interest Revenue for $360,000.

LO3

16. No constructive gain or loss arises from the purchase of an

affiliate’s bonds if the

a. affiliate is a 100%-owned subsidiary.

b. bonds are purchased at book value.

c. bonds are purchased with arm’s-length bargaining from

outside entities.

d. gain or loss cannot be reasonably estimated.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-5

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO3

17. Constructive gains or losses are allocated between purchasing

and issuing affiliates according to

a. the agency theory.

b. the par value theory.

c. either the agency theory or the par value theory.

d. neither the agency theory nor the par value theory.

LO3

18. No allocation of gain or loss on the constructive retirement of

intercompany bonds will occur

a. when the subsidiary is the issuing affiliate.

b. when the effective interest rate method is applied.

c. in the consolidated income statement.

d. when the parent company is the issuing affiliate.

Use the following information in answering questions 19 and 20.

Mistletoebird Corporation owns an 80% interest in Berries Company

acquired at book value several years ago. On January 1, 2006, Berries

purchased $100,000 par of Mistletoebird’s outstanding bonds for

$103,000. The bonds were issued at par and mature on January 1, 2009.

Straight-line amortization is used. Separate incomes of Mistletoebird

and Berries for 2006 are $350,000 and $120,000, respectively.

LO4

19. Consolidated net income for 2006 was

a. $443,600.

b. $444,000.

c. $444,400.

d. $448,000.

LO4

20. Minority interest income for 2006 was

a. $23,000.

b. $23,600.

c. $24,000.

d. $24,400.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-6

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO1

Exercise 1

Separate company and consolidated income statements for Pitta and New

Guinea Corporations for the year ended December 31, 2006 are

summarized as follows:

Consoli-

Pitta New dated

Guinea

Sales Revenue $ 500,000 $ 100,000 $ 600,000

Income from New Guinea 19,900

Bond interest income 6,000

Gain on bond retirement 3,000

Total revenues 519,900 106,000 603,000

Cost of sales $ 280,000 $ 50,000 $ 330,000

Bond interest expense 9,000 3,600

Other expenses 120,900 31,000 151,900

Minority interest income 7,500

Total expenses 409,900 81,000 493,000

Net income $ 110,000 $ 25,000 $ 110,000

The interest income and expense eliminations relate to a $100,000, 9%

bond issue that was issued at par value and matures on January 1,

2011. On January 1, 2006, a portion of the bonds was purchased and

constructively retired.

Required: Answer the following questions.

1. Which company is the issuing affiliate?

2. What is the dollar effect of the constructive retirement on

consolidated net income for 2006?

3. What portion of the bonds remains outstanding at December 31,

2006?

4. Is New Guinea a wholly-owned subsidiary? If not, what percentage

does Pitta own?

5. Does the purchasing affiliate use straight-line or effective

interest amortization?

6. Explain the calculation of Pitta’s $19,900 income from New

Guinea.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-7

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO1

Exercise 2

Jacky Winter Corporation owns a 90% interest in Park Company. The

following information is from the adjusted trial balances at December

31, 2005, at which time the bonds have four years to maturity. Jacky

Winter acquired Park’s bonds at the beginning of the year. The bonds

have interest payment dates of January 1 and July 1.

Jacky Park

Winter

Investment in Park Bonds, $200,000 par 196,000

10% Bonds payable, $400,000 400,000

Bond premium 16,000

Interest expense 36,000

Interest receivable 10,000

Interest income 21,000

Interest payable 20,000

Required:

Prepare the necessary consolidation working paper entries on December

31, 2006 with respect to the intercompany bonds.

LO2

Exercise 3

Pheasant Corporation owns 80% of Rural Corporation’s outstanding

common stock that was purchased at book value and fair value on

January 1, 1999.

Additional information:

1. Pheasant sold inventory items that cost $3,000 to Rural during

2006 for $6,000. One-half of this merchandise was inventoried by

Rural at year-end. At December 31, 2006, Rural owed Pheasant

$2,000 on account from the inventory sales. No other

intercompany sales of inventory have occurred since Pheasant

acquired its interest in Rural.

2. Pheasant sold a plant asset with a book value of $5,000 and a 5-

year useful life to Rural for $10,000 on December 31, 2004. This

plant asset remains in use by Rural and is depreciated by the

straight-line method.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-8

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

3. On January 2, 2006, Rural paid $10,800 for $10,000 par value of

Pheasant’s 10-year, 10% bonds. These bonds have interest payment

dates of January 1 and July 1, and mature on January 1, 2010.

Straight-line amortization has been applied by Rural to the

Pheasant bond investment.

4. Pheasant uses the equity method in accounting for its investment

in Rural.

Required:

Complete the working papers to consolidate the financial statements

of Pheasant Corporation and Rural for the year ended December 31,

2006.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-9

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

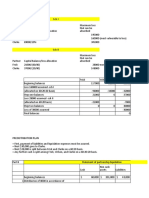

Pheasant Corporation and Subsidiary

Consolidation Working Papers

at December 31, 2006

Eliminations Balance

Pheasant Rural Debit Credit Sheet

INCOME STATEMENT

Sales $ 50,000 $ 24,000

Income from 6,900

Gain or loss on

bonds

Interest Income 800

Cost of sales ( 14,000) ( 9,000)

Depreciation ( 3,900) ( 5,800)

Interest expense ( 2,000)

Net income 37,000 10,000

Retained

Earnings 1/1 12,000 8,000

Add: Net income 37,000 10,000

Dividends ( 6,000) ( 2,000)

Retained

Earnings 12/31 $ 43,000 $ 16,000

BALANCE SHEET

Cash 8,000 1,400

Interest Rec 500

Receivables 11,000 3,500

Inventories 5,000 3,000

Equipment-net 43,000 31,000

Investment in

Rural stock 30,100

Investment in

Pheasant bonds 10,600

TOTAL ASSETS $ 97,100 $ 50,000

LIAB. & EQUITY

Accounts payable 3,100 6,000

Interest payable 1,000

Bonds payable 20,000

Capital stock 30,000 28,000

Retained

Earnings 43,000 16,000

1/1 Noncontrl.

Interest

12/31 Noncontrl.

Interest

Expense

TOTAL LIAB. & $

EQUITY 97,100 $ 50,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-10

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2

Exercise 4

December 31, 2006 balance sheets for Wren Corporation, and Schrub

Corporation, its 90%-owned subsidiary, are presented in the first two

columns of partially completed balance sheet working papers. Wren

paid $160,000 for its 90% interest in Schrub on January 1, 2003 when

Schrub had $150,000 of total stockholders’ equity. The $25,000 cost-

book differential was assigned to plant assets with a 10-year

remaining life.

On January 1, 2006, Wren purchased $50,000 of Schrub Corporation’s

10% bonds for $48,000, at which time the unamortized premium on the

bonds was $2,000. The bonds pay interest on June 30 and December 31

and mature on December 31, 2010. Both Wren and Schrub use straight-

line amortization. Wren uses the equity method of accounting for its

investment in Schrub.

Required:

Complete the consolidated balance sheet working papers.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-11

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Wren Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2006

Eliminations Non- Consol-

Wren Schrub Debit Credit Cntl. idated

BALANCE SHEET

Cash $ 39,100 $ 30,000

Receivables 80,000 75,000

Interest

Receivable 2,500

Inventories 70,000 40,000

Land 50,000 45,000

Plant assets-net 160,000 120,000

Investment in

Schrub bonds 48,400

Investment in

Schrub stock 179,160

TOTAL ASSETS $ 629,160 $310,000

LIAB. & EQUITY

Accounts payable 47,000 23,400

Bond interest

payable 10,000 5,000

10% Bonds

Payable 200,000 100,000

Premium on bonds

payable 1,600

Capital stock 280,000 120,000

Retained

Earnings 92,160 60,000

Minority

Interest

TOTAL LIAB. &

EQUITY $ 629,160 $310,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-12

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2

Exercise 5

Sunbird Corporation owns a 70% interest in Veranda Corporation. At

December 31, 2005, Veranda had $3,000,000 of par value 12% bonds

outstanding with an unamortized premium of $60,000. The bonds have

interest payment dates of January 1 and July 1 and mature on January

1, 2010.

On January 2, 2006, Sunbird purchased $1,200,000 par value of

Veranda’s outstanding bonds for $1,209,600. Assume straight-line

amortization.

Required:

Prepare the necessary consolidation working paper entries on December

31, 2006 with respect to the intercompany bonds.

LO2

Exercise 6

Rock is an 80%-owned subsidiary of Gibberbird. On January 1, 2005,

Rock issued $450,000 of $1,000 face amount 6% bonds at par. The bonds

have interest payments on January 1 and July 1 of each year and

mature on January 1, 2009. On July 1, 2006, Gibberbird purchased all

450 bonds on the open market for $1,030 per bond.

Required: With respect to the bonds, use General Journal format to:

1. Record the 2006 journal entries from July 1 to December 31 on

Rock’s books.

2. Record the 2006 journal entries from July 1 to December 31 on

Gibberbird’s books.

3. Record the elimination entries for the consolidation working

papers at December 31, 2006.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-13

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2 & 3

Exercise 7

Caterpillar Inc. is an 80%-owned subsidiary of Bellbird Corp. On

January 1, 2005, Caterpillar issued $600,000 of $1,000 face amount 6%

bonds at $964 per bond. Interest is paid on January 1 and July 1 of

each year and covers the preceding six months. On July 1, 2006,

Bellbird purchased all 600 bonds on the open market for $1,030 per

bond. The following table shows selected amounts of amortization on

the bonds:

Amortization Table for the Bond Discount

Date Remaining Balance

01-01-05 $21,600

12-31-05 14,400

07-01-06 10,800

12-31-06 7,200

12-31-07 0

Required: With respect to the bonds, use General Journal format to:

1. Record the 2006 journal entries from July 1 to December 31 on

Caterpillar’s books.

2. Record the 2006 journal entries from July 1 to December 31 on

Bellbird’s books.

3. Record the elimination entries for the consolidation working

papers at December 31, 2006.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-14

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO2&3

Exercise 8

Thornbill Corporation owns 90% of the outstanding voting common stock

of Hangout Corporation. On January 1, 1998, Hangout issued $1,000,000

face amount of 12%, $1,000 bonds payable at 119.20. The bonds pay

interest on January 1 and July 1 of each year and mature on for on

January 1, 2009. On July 1, 2006, Thornbill purchased all of the

outstanding bonds at a price of 107.50.

Required:

1. Explain the relationship between the balances in the Investment

in Hangout Bonds account on Thornbill’s books and the bond-

related accounts, i.e., Bonds Payable and Discount/Premium on

Bonds Payable, on Hangout’s books.

2. Using your written rationale from Requirement 1, determine the

balance in the Investment in Hangout Bonds account on December

31, 2006, October 31, 2007, May 31, 2008 and November 30, 2008,

assuming that amortization is recorded monthly.

LO3&4

Exercise 9

Honeyeater Corporation owns a 60% interest in Waterhole Corporation

acquired several years ago at a price equal to book value and fair

value. On December 31, 2005, Waterhole had $900,000 par of 12% bonds

outstanding with an unamortized premium of $30,000. The bonds mature

in five years and pay interest on January 1 and July 1. On January 1,

2006, Honeyeater acquired one-third of Waterhole’s bonds for

$317,000. Honeyeater and Waterhole use straight-line amortization.

Waterhole reports net income of $300,000 for 2006.

Required:

1. Calculate Honeyeater’s income from Waterhole for 2006.

2. Calculate the minority interest income for 2006.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-15

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

LO4

Exercise 10

Willy Wagtail Company has $4,000,000 of 12% bonds outstanding on

December 31, 2004 with unamortized premium of $120,000. These bonds

pay interest semiannually on January 1 and July 1 and mature on

January 1, 2010. Straight-line amortization is used.

Garden Inc., 80%-owned subsidiary of Willy Wagtail, buys $1,000,000

par value of Willy Wagtail’s outstanding bonds in the market for

$980,000. There is only one issue of outstanding bonds of the

affiliated companies and they have consolidated financial statements.

For the year 2005, Willy Wagtail has income from its separate

operations (excluding investment income) of $4,500,000 and Garden

reports net income of $600,000.

Required: Determine the following:

1. Noncontrolling interest expense for 2005.

2. Consolidated net income for Willy Wagtail Company and subsidiary

for 2005.

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-16

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

SOLUTIONS

Multiple Choice Questions

1 c

2 b

3 c

4 d Book value of Australian Owl’s

bonds acquired by Glider equals

1/3 times ($600,000 + $9,000) $ 203,000

Less: Cost of acquiring

Australian Owl bonds 198,000

Constructive gain on Australian $ 5,000

Owl bonds

5 a Consolidated interest expense =

$46,200 x 2/3 $ 30,800

6 d

7 b

8 b

9 c

4 b Australian Owl’s separate $ 350,000

income:

Income from Glider ($120,000 x

80%) = 96,000

Less: Loss on constructive

retirement of Australian Owl’s ( 3,000 )

bonds

Plus: Piecemeal recognition of

the constructive loss ($3,000/3

years) = 1,000

Consolidated net income $ 444,000

5 c Because Australian Owl is the

issuing entity the gain or loss

is not allocated to the

noncontrolling interest. The

noncontrolling interest expense $ 24,000

is ($120,000 x 20%) or

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-17

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

8 c Full interest for 12 months

Equals $920,000 x 10% $ 92,000

Less: interest on $230,000 for 9

months = $230,000 x 10% x 75% 17,250

Consolidated interest expense $ 74,750

9 d $ 4,024,000

Book value of Polecat’s bonds

x % purchased by Seadog 40%

Equals: Book value purchased $ 1,609,600

Purchase price ($970 x 1,600)= 1,552,000

Gain on retirement $ 57,600

10 b Total book value acquired =

$5,000,000 x 60% $ 3,000,000

Purchase price 3,000 bonds x 3,045,000

$1,015

Loss on constructive retirement $ 45,000

11 c Book value at January 1, 2007

equals $5,300,000 minus $ 5,120,000

$180,000=

Percentage of bonds acquired 80%

Equals book value acquired 4,096,000

Purchase price 4,000 bonds x 3,920,000

$980=

Gain on constructive retirement= $ 176,000

12 a Book value at January 1, 2008 $ 5,030,000

equals $5,150,000 minus $120,000

Percentage of bonds acquired 70%

Equals book value acquired 3,521,000

Purchase price 3,500 bonds x 3,640,000

$1,040

Loss on constructive retirement $ 119,000

13 b ($5,000,000 - $3,000,000) x 12% $ 240,000

=

14 a Bonds payable $5,000,000 minus

bonds held by Branch of $ 2,000,000

$3,000,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-18

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Interest accrued on December 31,

2007 will be the interest on

bonds held by non-affiliates or

$2,000,000 x 12% x ½ year = $ 120,000

15 b

16 b

17 c

18 d

19 b Mistletoebird’s separate income: $ 350,000

Income from Berries ($120,000 x

80%) = 96,000

Less: Loss on constructive

retirement of Mistletoebird ( 3,000 )

bonds

Plus: Piecemeal recognition of

the constructive loss ($3,000/3

years) = 1,000

Consolidated net income $ 444,000

20 c Since Mistletoebird is the

issuing entity the gain or loss

is not allocated to the

noncontrolling interest. The

noncontrolling interest income $ 24,000

is ($120,000 x 20%).

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-19

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 1

1. Pitta is the issuing affiliate.

2. Effect on consolidated net income:

Gain on constructive retirement of bonds $ 3,000

Less: Piecemeal recognition of gain ($6,000

interest income - $5,400 interest expense) ( 600 )

Increase in consolidated net income $ 2,400

3. Percent of bonds outstanding on December 31, 2006 is 40%,

computed as $3,600 consolidated interest expense divided by

$9,000 interest expense of Pitta.

4. New Guinea is partially owned as evidenced by the minority

interest income. The ownership percentage is 70% ($7,500

minority interest income divided by $25,000 income of New

Guinea = 30% minority interest.

5. Straight-line amortization

$100,000 par x 60% purchased $ 60,000

Purchase price 5 years before maturity 57,000

Gain 3,000

Nominal interest ($60,000 x 9%) $ 5,400

Discount amortization ($3,000/5 years) 600

Bond interest income $ 6,000

6. Pitta’s income from New Guinea

Share of New Guinea’s reported income

($25,000 x 70%) = $ 17,500

Add: Constructive gain 3,000

Less: Piecemeal recognition of constructive

gain ( 600 )

Income from New Guinea $ 19,900

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-20

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 2

2006 Debit Credit

12/31 Bond Interest Payable 10,000

Bond Interest Receivable 10,000

12/31 Bonds Payable 200,000

Interest Revenue 21,000

Bond premium 8,000

Interest Expense (50% owned) 18,000

Investment in Park’s Bonds 196,000

Gain on bonds 15,000

Supporting Computations:

Cost of bonds to Jacky Winter $ 195,000

196,000-1,000 amortization

Book value acquired 1/1/2005 where

4,000 per year is amortized 210,000

($400,000 + $20,000) x 50% =

Gain on constructive bond retirement $ 15,000

Exercise 3

Pheasant Corporation and Subsidiary

Consolidation Working Papers

at December 31, 2006

Eliminations Non- Consol-

Pheasant Rural Debit Credit contl. idated

INCOME STATEMENT

Sales $ 50,000 $24,000 a $ 6,000 $68,000

Income from 6,900 e 6,900

Loss on bonds d 800 ( 800)

Interest Income 800 d 800

Cost of sales ( 14,000) ( 9,000) b 1,500 a $ 6,000 ( 18,500)

Depreciation ( 3,900) ( 5,800) c 1,000 ( 8,700)

Interest expense ( 2,000) d 1,000 ( 1,000)

Minority income $2,000 ( 2,000)

Net income 37,000 10,000 37,000

Retained

Earnings 1/1 12,000 8,000 f 8,000 12,000

Add: Net income 37,000 10,000 37,000

Dividends ( 6,000) ( 2,000) e 1,600 ( 400) ( 6,000)

Retained

Earnings 12/31 $ 43,000 $16,000 $43,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-21

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

BALANCE SHEET

Cash 8,000 1,400 $ 9,400

Interest Rec 500 h 500

Receivables 11,000 3,500 g 2,000 12,500

Inventories 5,000 3,000 b 1,500 6,500

Equipment-net 43,000 31,000 c 3,000 71,000

Investment in c 4,000 e 5,300

Rural stock 30,100 f 28,800

Investment in

Pheasant bonds 10,600 d 10,600

TOTAL ASSETS $ 97,100 $50,000 $99,400

LIAB. & EQUITY

Accounts payable 3,100 6,000 g 2,000 7,100

Interest payable 1,000 h 500 500

Bonds payable 20,000 d 10,000 10,000

Capital stock 30,000 28,000 f 28,000 30,000

Retained

Earnings 43,000 16,000 43,000

1/1 Noncontl.

Interest f 7,200 7,200

12/31 Noncontl.

Interest Expense 8,800 8,800

TOTAL LIAB. & $ $99,400

EQUITY 97,100 $50,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-22

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 4

Wren Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2006

Eliminations Non- Consol-

Wren Schrub Debit Credit cntl idated

BALANCE SHEET

Cash $ 39,100 $30,000 $69,100

Receivables 80,000 75,000 155,000

Interest

Receivable 2,500 c $ 2,500

Inventories 70,000 40,000 110,000

Land 50,000 45,000 95,000

Plant assets-net 160,000 120,000 b $ 15,000 295,000

Investment in

Schrub bonds 48,400 a 48,400

Investment in a 2,160

Schrub stock 179,160 b 177,000

TOTAL ASSETS $ 629,160 $310,000 $724,100

LIAB. & EQUITY

Accounts payable 47,000 23,400 70,400

Bond interest

payable 10,000 5,000 c 2,500 12,500

10% Bonds

Payable 200,000 100,000 a 50,000 250,000

Premium on bonds

payable 1,600 a 800 800

Capital stock 280,000 120,000 b 120,000 280,000

Retained

Earnings 92,160 60,000 b 60,000 92,160

Noncontroling a 240

Interest b 18,000 18,240

TOTAL LIAB. & $ 248,300 248,300 $724,100

EQUITIES 629,160 $310,000

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-23

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Supporting computations

Book value of bonds

($102,000 x 50%) $ 51,000

Cost of acquiring $50,000 par ( 48,000 )

Constructive gain 3,000

Piecemeal recognition of gain ( 600 )

Unrecognized at December 31,

2006 $ 2,400

Majority share ($2,400 x 90%) $ 2,160

Minority share ($2,400 x 10%) $ 240

Excess allocated to plant

assets $ 25,000

Depreciation for 4 years

($2,500 x 4 years) ( 10,000 )

Remaining excess $ 15,000

Exercise 5

2006 Debit Credit

12/31 Bond Interest Payable 72,000

Bond Interest Receivable 72,000

12/31 Premium on Bonds Payable 18,000

Bonds Payable 1,200,000

Interest Revenue 141,600

Interest Expense 138,000

Investment in Veranda Bonds 1,207,200

Gain on Retirement of Bonds 14,400

Supporting Computations:

Cost of bonds to Sunbird $ 1,209,600

Book value acquired

($3,000,000 + $60,000) x 40% = 1,224,000

Gain on constructive bond retirement $ 14,400

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-24

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

4 years remaining

Premium on Bond Payable

$60,000 x 3/4 x 40% = $18,000

Interest Expense

$1,200,000 x 12% = $144,000

Less: $60,000 x 1/4 x 40% = $ 6,000

$138,000

Interest Revenue

$144,000 - ($9,600 x 1/4) = $141,600

Exercise 6

Date

2006 Account Name Debit Credit

Gibberbird’s books

Jul 01 Investment in Rock Bonds 463,500

Cash 463,500

Dec 31 Bond Interest Receivable 13,500

Bond Interest Revenue 10,800

Investment in Rock Bonds 2,700

Rock’s books

Dec 31 Bond Interest Expense 13,500

Bond Interest Payable 13,500

Consolidated Working Papers

Dec 31 Bond Interest Payable 13,500

Bond Interest Receivable 13,500

Dec 31 Bonds Payable 450,000

Loss on Bonds 13,500

Bond Interest Revenue 10,800

Bond Interest Expense 13,500

Investment in Rock Bonds 460,800

Interest Revenue:

($450,000 x 6% x 1/2) - ($13,500 premium/5 periods) =

$13,500 - $2,700 = $10,800

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-25

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 7

Date

2006 Account Name Debit Credit

Bellbird’s books

Jul 01 Investment in Caterpillar Bonds 618,000

Cash 618,000

Dec 31 Bond Interest Receivable 18,000

Bond Interest Revenue 14,400

Investment in Caterpillar Bonds 3,600

Caterpillar’s books

Dec 31 Bond Interest Expense 21,600

Bond Interest Payable 18,000

Discount on Bonds Payable 3,600

Consolidated Working Papers

Dec 31 Bond Interest Payable 18,000

Bond Interest Receivable 18,000

Dec 31 Bonds Payable 600,000

Loss on Bonds 28,800

Bond Interest Revenue 14,400

Bond Interest Expense 20,600

Discount on Bonds Payable 7,200

Investment in Caterpilllar Bonds 614,400

(Book value of bonds $589,200 - purchase cost $618,000 = $28,800 loss)

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-26

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 8

Requirement 1

The purpose of the Investment in Hangout Bonds account on the

acquirer’s books and the Bonds Payable, Discount on Bonds

Payable/Premium on Bonds Payable accounts on the issuer’s books is

similar in that each set of accounts is tracking the net book value

of the bonds. Since we know that at the maturity date the net book

value of the books must be equal to the face amount of the bonds

being redeemed, then no matter what amounts are initially placed into

these accounts, the balance on the maturity date is equal to the

maturity value of the bonds. Therefore, both sets of accounts are

moving toward the same final number. In this problem, the original

premium on the bonds is a total of $192,000 which is $192 per bond.

Since the bonds have an eight-year or 96-month term, the rate of

amortization is $2 per month per bond or $2,000 per month in total.

When Thornbill acquires the bonds it pays a premium of $75,000 which,

when amortized over the 30-month remaining life of the bond will

produce an amortization rate of $2.50 per month per bond or $2,500

per month in total. When these different rates of amortization are

applied to the Premium on Bonds Payable on Hangout’s books and the

Investment in Hangout Bonds account on Thornbill’s books, the account

balances converge toward the face amount of the bonds.

Requirement 2

Amortization date Months since acquisition Cumulative amortization

Dec 31, 2006 6 months $15,000

Oct 31, 2007 16 months $40,000

May 31, 2008 23 months $57,500

Nov 30, 2008 29 months $72,500

The $75,000 premium on the bonds as acquired by Thornbill will be

amortized at a rate of $2,500 per month ($75,000 premium/30 months to

maturity). The balance in the Investment in Hangout Bonds account

will be the original balance of $1,075,000 minus the cumulative

amortization amounts shown above or:

Dec 31, 2006 $1,060,000

Oct 31, 2007 $1,035,000

May 31, 2008 $1,017,500

Nov 30, 2008 $1,002,500

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-27

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 9

Preliminary computations:

Book value of bonds $930,000 x 1/3 = $ 310,000

Cost of bonds 317,000

Loss on constructive retirement $ 7,000

Requirement 1:

Income from Waterhole:

Share of Waterhole’s income ($300,000 x $ 180,000

60%)

Less: Constructive loss ($7,000 x 60%) ( 4,200 )

Plus: Piecemeal recognition of loss

($7,000/5 years) x 60% 840

Income from Waterhole $ 176,640

Requirement 2:

Minority interest income:

Waterhole’s reported income $ 300,000

Less: Constructive loss on bonds ( 7,000 )

Plus: Piecemeal recognition of loss 1,400

Equals: Adjusted reported income $ 294,400

Minority percentage 40%

Minority interest income $ 117,760

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-28

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 10

Requirement 1

Minority interest income $600,000 x 20% $ 120,000

Requirement 2

Consolidated net income:

Income from Willy Wagtail’s operations $ 4,500,000

Income from Garden:

Willy Wagtail’s share of Garden income

= 80% x $600,000 $ 480,000

Add: Constructive gain on bond

retirement ($4,000,000 + $120,000)*25%- 50,000

980,000

Less: Piecemeal recognition of gain =

$50,000/8 years ( 12,500 )

517,500

Less: Noncontrolling interest expense

20% x $600,000 = ( 120,000 )

Consolidated net income $ 4,897,500

©2009 Pearson Education, Inc. publishing as Prentice Hall

7-29

Вам также может понравиться

- Chapter 8-10 Test BankДокумент80 страницChapter 8-10 Test BankELSA SYAFIRA ANANTAОценок пока нет

- Test Bank CH 3Документ32 страницыTest Bank CH 3Sharmaine Rivera MiguelОценок пока нет

- Chapter 09 Indirect and Mutual HoldingsДокумент12 страницChapter 09 Indirect and Mutual HoldingsNicolas ErnestoОценок пока нет

- Tugas Advanced Acc. 1Документ4 страницыTugas Advanced Acc. 1Astria Arha DillaОценок пока нет

- Akuntansi Keuangan Lanjutan IIДокумент2 страницыAkuntansi Keuangan Lanjutan IINaomi Novelin0% (3)

- Tugas Audit Fix Bener Semua PDFДокумент19 страницTugas Audit Fix Bener Semua PDF「絆笑」HodaeОценок пока нет

- ch4 Solution21Документ25 страницch4 Solution21Melinda Amelia0% (1)

- 02 CVP Analysis PDFДокумент5 страниц02 CVP Analysis PDFJunZon VelascoОценок пока нет

- Audit of Other Income Statement ComponentsДокумент7 страницAudit of Other Income Statement ComponentsIbratama Sukses PratamaОценок пока нет

- Quiz 2 Answers Aec12Документ3 страницыQuiz 2 Answers Aec12Fenladen AmbayОценок пока нет

- Session 08: Tactical Decision MakingДокумент18 страницSession 08: Tactical Decision MakingFrancisco Pedro SantosОценок пока нет

- Assume The Same Information For Northern Defense As in Exercise 10Документ2 страницыAssume The Same Information For Northern Defense As in Exercise 10Elliot RichardОценок пока нет

- 2010-09-27 104244 AdvancedДокумент11 страниц2010-09-27 104244 Advancedhetalcar100% (1)

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingДокумент4 страницыProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiОценок пока нет

- Management Accounting - HCA16ge - Ch4Документ67 страницManagement Accounting - HCA16ge - Ch4Corliss KoОценок пока нет

- Quiz - FA2 Current Liab AP NP With QuestionsДокумент1 страницаQuiz - FA2 Current Liab AP NP With Questionsjanus lopezОценок пока нет

- IygfigДокумент52 страницыIygfigDelfiaОценок пока нет

- Chapter 9Документ76 страницChapter 9Mohammed S. ZughoulОценок пока нет

- CH 13Документ31 страницаCH 13Natasha GraciaОценок пока нет

- Exercise 4Документ7 страницExercise 4Tania MaharaniОценок пока нет

- This Study Resource Was: Multiple ChoiceДокумент6 страницThis Study Resource Was: Multiple ChoiceNicah AcojonОценок пока нет

- The Partnership of Frick, Wilson, and Clarke Has Elected To Cease All Operations and Liquidate Its Business PropertyДокумент7 страницThe Partnership of Frick, Wilson, and Clarke Has Elected To Cease All Operations and Liquidate Its Business PropertyKailash KumarОценок пока нет

- ABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitДокумент3 страницыABC, Resource Drivers, Service Industry Glencoe Medical Clinic Operates A Cardiology Care Unit and A Maternity Care UnitKailash KumarОценок пока нет

- 2018 4083 3rd Evaluation ExamДокумент7 страниц2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Week 2 Assessment: Accounting For Business CombinationsДокумент12 страницWeek 2 Assessment: Accounting For Business Combinationstasya salfiraОценок пока нет

- Audit 2 - Topic4Документ18 страницAudit 2 - Topic4YUSUF0% (1)

- Problem 12-37 Return On Investment and Economic Value Added Calculations With Varying AssumptionsДокумент2 страницыProblem 12-37 Return On Investment and Economic Value Added Calculations With Varying AssumptionsKath Leynes0% (1)

- Contoh Soal AklanДокумент8 страницContoh Soal AklanVendola YolandaОценок пока нет

- On January 1 2014 Palmer Company Acquired A 90 InterestДокумент1 страницаOn January 1 2014 Palmer Company Acquired A 90 InterestCharlotteОценок пока нет

- INVESTMENTSДокумент9 страницINVESTMENTSKrisan RiveraОценок пока нет

- Chapter 4 - Completing The Accounting CycleДокумент142 страницыChapter 4 - Completing The Accounting Cycleyoantan100% (1)

- 9381 - Soal Uas Akl 2Документ14 страниц9381 - Soal Uas Akl 2Kurnia Purnama Ayu0% (3)

- Final Exam - Inter 1 (Batch 2022) - RevДокумент14 страницFinal Exam - Inter 1 (Batch 2022) - RevVanessa vnssОценок пока нет

- Pilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Документ9 страницPilihan Ganda Exercise: Use The Following Information in Answering Questions 2 and 3Desi AprilianiОценок пока нет

- Individual Business CaseДокумент7 страницIndividual Business CaseKatrina Belarmino100% (1)

- Assignment P18-6Документ2 страницыAssignment P18-6Nur Faizah FauziahОценок пока нет

- Akl Ii TM 11Документ4 страницыAkl Ii TM 11Amalia FillahОценок пока нет

- ACY4001 Individual Assignment 2 SolutionsДокумент7 страницACY4001 Individual Assignment 2 SolutionsMorris LoОценок пока нет

- P 6-3 DrebinДокумент6 страницP 6-3 DrebinJulia Pratiwi ParhusipОценок пока нет

- CH 02 PDFДокумент24 страницыCH 02 PDFAurcus JumskieОценок пока нет

- Chapter 17Документ8 страницChapter 17rahmiamelianazarОценок пока нет

- Exercises On Employee BenefitsДокумент2 страницыExercises On Employee BenefitsPeachyОценок пока нет

- SOLMANny 7Документ15 страницSOLMANny 7Zi Villar100% (1)

- Quiz CH 9-11 SchoologyДокумент8 страницQuiz CH 9-11 SchoologyperasadanpemerhatiОценок пока нет

- Chapter 07 AnsДокумент5 страницChapter 07 AnsDave Manalo100% (1)

- Chapter 09 Indirect and Mutual HoldingsДокумент22 страницыChapter 09 Indirect and Mutual HoldingsKukuh HariyadiОценок пока нет

- Solution Chapter 13Документ22 страницыSolution Chapter 13xxxxxxxxx100% (3)

- Advanced Accounting Chapter 3Документ3 страницыAdvanced Accounting Chapter 3KiwidОценок пока нет

- RWD 05 CVP AnalysisДокумент58 страницRWD 05 CVP Analysishamba allahОценок пока нет

- Soal GSLC-6 Advanced AccountingДокумент2 страницыSoal GSLC-6 Advanced AccountingEunice ShevlinОценок пока нет

- Tugas AKL ANNISA SHABIRA 3111801029Документ7 страницTugas AKL ANNISA SHABIRA 3111801029annisa shabiraОценок пока нет

- Accounting Theory Chapter 4Документ18 страницAccounting Theory Chapter 4gabiОценок пока нет

- Ch07 Beams10e TBДокумент29 страницCh07 Beams10e TBjeankoplerОценок пока нет

- ch09 1Документ20 страницch09 1Celestaire LeeОценок пока нет

- Chap 008Документ35 страницChap 008aiza100% (2)

- Changes in Ownership Interest: Multiple ChoiceДокумент19 страницChanges in Ownership Interest: Multiple ChoicepompomОценок пока нет

- Chapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsДокумент22 страницыChapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsOBC LingayenОценок пока нет

- An Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankДокумент32 страницыAn Introduction To Consolidated Financial Statements LO1: Chapter 3 Test BankKaren MagsayoОценок пока нет

- Chapter 10 Subsidiary Preferred StockДокумент15 страницChapter 10 Subsidiary Preferred StockNicolas ErnestoОценок пока нет

- FINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToДокумент2 страницыFINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToAlfred Valenzuela100% (1)

- BU Final PreboardДокумент2 страницыBU Final PreboardAlfred ValenzuelaОценок пока нет

- Business AnalyticsДокумент2 страницыBusiness AnalyticsAlfred ValenzuelaОценок пока нет

- Auditing TheoryДокумент2 страницыAuditing TheoryAlfred ValenzuelaОценок пока нет

- RMYC QuestionsДокумент2 страницыRMYC QuestionsAlfred ValenzuelaОценок пока нет

- FINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToДокумент2 страницыFINAL ROUND-Difficult-AFAR 1. The Home Office Bills Its Branch at 120% of Cost. in Turn, The Branch Sells The Merchandise ToAlfred ValenzuelaОценок пока нет

- FM Butler Grup 2Документ10 страницFM Butler Grup 2Anna Dewi Wijayanto100% (1)

- BUSI 532 Case Study 1Документ5 страницBUSI 532 Case Study 1Maryann BОценок пока нет

- Top 5 Index Funds To Invest in 2020Документ5 страницTop 5 Index Funds To Invest in 2020ramkrishna mahatoОценок пока нет

- PAA 7 Solution SheetДокумент35 страницPAA 7 Solution SheetGabrielle Joshebed AbaricoОценок пока нет

- Methods of Estimating InventoryДокумент46 страницMethods of Estimating Inventoryone formanyОценок пока нет

- WIN Letter To Washington Post Corporation Victoria Dillon Notification Illegal Action Under DE Certification of IncorporationДокумент2 страницыWIN Letter To Washington Post Corporation Victoria Dillon Notification Illegal Action Under DE Certification of IncorporationwapoliveОценок пока нет

- CFA-Level 2 Mock-V1-Exam-2-AfternoonДокумент98 страницCFA-Level 2 Mock-V1-Exam-2-AfternoonHongMinhNguyenОценок пока нет

- Lec 10 Capital Budgeting TechniquesДокумент22 страницыLec 10 Capital Budgeting TechniquesAnikk HassanОценок пока нет

- CH 09Документ13 страницCH 09Sami KhanОценок пока нет

- TP1-W2-S3-R0 Sri Annisa KatariДокумент3 страницыTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariОценок пока нет

- Pfm15e Im Ch11Документ40 страницPfm15e Im Ch11vdav hadhОценок пока нет

- Bharti Airtel LTD (BHARTI IN) - AdjustedДокумент4 страницыBharti Airtel LTD (BHARTI IN) - AdjustedDebarnob SarkarОценок пока нет

- The Joys of Compounding Part4Документ29 страницThe Joys of Compounding Part4daveОценок пока нет

- Meaning of InvestmentДокумент10 страницMeaning of InvestmentAbhishek MishraОценок пока нет

- TCS Annual Report 2023 Pages 191 196Документ6 страницTCS Annual Report 2023 Pages 191 196varshitha reddyОценок пока нет

- Guidance Note - ESOPДокумент68 страницGuidance Note - ESOPSandhya UpadhyayОценок пока нет

- Financial ManagementДокумент200 страницFinancial ManagementAshish raturiОценок пока нет

- Presentation of Capital BudgetingДокумент45 страницPresentation of Capital BudgetingIsmail UmerОценок пока нет

- Corporate GovernanceДокумент16 страницCorporate GovernanceAli DoonОценок пока нет

- Chapter 7: The Regular Output Vat Sources of Regular Output VATДокумент5 страницChapter 7: The Regular Output Vat Sources of Regular Output VATArdee May BayaniОценок пока нет

- Financial Analysis 2Документ2 страницыFinancial Analysis 2Sylvia GynОценок пока нет

- 1.5.1 ActivityДокумент3 страницы1.5.1 ActivityGWYNETTE CAMIDCHOLОценок пока нет

- 10-K Edgar Data 1028215 0001564590-18-023790 1Документ208 страниц10-K Edgar Data 1028215 0001564590-18-023790 1jeetОценок пока нет

- An Analysis of Fraud Triangle and Responsibilities of AuditorsДокумент8 страницAn Analysis of Fraud Triangle and Responsibilities of AuditorsPrihandani AntonОценок пока нет

- A F I R: Ccounts ROM Ncomplete EcordsДокумент69 страницA F I R: Ccounts ROM Ncomplete EcordsYash GoklaniОценок пока нет

- Prof Dev 5 (Users of Accounting Information)Документ3 страницыProf Dev 5 (Users of Accounting Information)Arman CabigОценок пока нет

- Pivot Table ExerciseДокумент11 страницPivot Table ExerciseHasan Babu KothaОценок пока нет

- Cost Systems and Cost Accumulation: Multiple ChoiceДокумент26 страницCost Systems and Cost Accumulation: Multiple ChoiceAdnan KhanОценок пока нет

- Week 2 Financial Planning and Forecasting Financial StatementsДокумент39 страницWeek 2 Financial Planning and Forecasting Financial StatementsSYED MURTAZAОценок пока нет

- Financial Statements PLDT and GLobeДокумент18 страницFinancial Statements PLDT and GLobeArnelli GregorioОценок пока нет