Академический Документы

Профессиональный Документы

Культура Документы

2019 Withholding Exemption Certificate 590

Загружено:

Minh Nguyen0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страницаZxcasdqwec

Оригинальное название

19_590

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документZxcasdqwec

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страница2019 Withholding Exemption Certificate 590

Загружено:

Minh NguyenZxcasdqwec

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

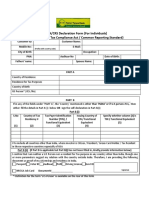

TAXABLE YEAR CALIFORNIA FORM

2019 Withholding Exemption Certificate 590

The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records.

Withholding Agent Information

Name

Payee Information

Name SSN or ITIN FEIN CA Corp no. CA SOS file no.

Address (apt./ste., room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.) State ZIP code

Exemption Reason

Check only one box.

By checking the appropriate box below, the payee certifies the reason for the exemption from the California income tax withholding

requirements on payment(s) made to the entity or individual.

Individuals — Certification of Residency:

I am a resident of California and I reside at the address shown above. If I become a nonresident at any time, I will promptly

notify the withholding agent. See instructions for General Information D, Definitions.

Corporations:

The corporation has a permanent place of business in California at the address shown above or is qualified through the

California Secretary of State (SOS) to do business in California. The corporation will file a California tax return. If this

corporation ceases to have a permanent place of business in California or ceases to do any of the above, I will promptly notify

the withholding agent. See instructions for General Information D, Definitions.

Partnerships or Limited Liability Companies (LLCs):

The partnership or LLC has a permanent place of business in California at the address shown above or is registered with the

California SOS, and is subject to the laws of California. The partnership or LLC will file a California tax return. If the partnership

or LLC ceases to do any of the above, I will promptly inform the withholding agent. For withholding purposes, a limited liability

partnership (LLP) is treated like any other partnership.

Tax-Exempt Entities:

The entity is exempt from tax under California Revenue and Taxation Code (R&TC) Section 23701 ______ (insert letter) or

Internal Revenue Code Section 501(c) _____ (insert number). If this entity ceases to be exempt from tax, I will promptly notify

the withholding agent. Individuals cannot be tax-exempt entities.

Insurance Companies, Individual Retirement Arrangements (IRAs), or Qualified Pension/Profit-Sharing Plans:

The entity is an insurance company, IRA, or a federally qualified pension or profit-sharing plan.

California Trusts:

At least one trustee and one noncontingent beneficiary of the above-named trust is a California resident. The trust will file a

California fiduciary tax return. If the trustee or noncontingent beneficiary becomes a nonresident at any time, I will promptly

notify the withholding agent.

Estates — Certification of Residency of Deceased Person:

I am the executor of the above-named person’s estate or trust. The decedent was a California resident at the time of death.

The estate will file a California fiduciary tax return.

Nonmilitary Spouse of a Military Servicemember:

I am a nonmilitary spouse of a military servicemember and I meet the Military Spouse Residency Relief Act (MSRRA)

requirements. See instructions for General Information E, MSRRA.

CERTIFICATE OF PAYEE: Payee must complete and sign below.

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information,

go to ftb.ca.gov/forms and search for 1131. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined the information on this form, including accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare under penalties of perjury that

if the facts upon which this form are based change, I will promptly notify the withholding agent.

Type or print payee’s name and title____________________________________________________ Telephone (_____)___________

Payee’s signature Date ______________________

7061193 Form 590 2018

Вам также может понравиться

- 19 590 PDFДокумент1 страница19 590 PDFMinh NguyenОценок пока нет

- 19 590 PDFДокумент1 страница19 590 PDFMinh NguyenОценок пока нет

- Form W-8BEN Rev 920Документ2 страницыForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Request For Copy of Personal Income or Fiduciary Tax ReturnДокумент2 страницыRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsОценок пока нет

- 2018 Instructions For Form 590: General Information D DefinitionsДокумент2 страницы2018 Instructions For Form 590: General Information D DefinitionsicanadaaОценок пока нет

- FRM W8DM HRДокумент2 страницыFRM W8DM HRmiscribeОценок пока нет

- Fillable W-8BEN 2023Документ2 страницыFillable W-8BEN 2023marioОценок пока нет

- W-9 FormДокумент2 страницыW-9 FormTrish HitОценок пока нет

- California DE-4Документ4 страницыCalifornia DE-4Tuğrul SarıkayaОценок пока нет

- De 4Документ4 страницыDe 4fschalkОценок пока нет

- Edoc Profile Apr092021Документ2 страницыEdoc Profile Apr092021Ryan ReidОценок пока нет

- NQ Non-Spouse Rind - 0080Документ5 страницNQ Non-Spouse Rind - 0080Alexander HerbertОценок пока нет

- Government Form 1310Документ3 страницыGovernment Form 1310EmilyОценок пока нет

- Substitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Документ1 страницаSubstitute Form W-8BEN: (Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding)Manuel Aguilar100% (1)

- MW507Документ2 страницыMW507Thirunavukkarasu AnandanОценок пока нет

- Generic Form Preview DocumentДокумент4 страницыGeneric Form Preview Documentelena.69.mxОценок пока нет

- 3911 Taxpayer Statement Regarding Refund: Section IДокумент2 страницы3911 Taxpayer Statement Regarding Refund: Section IFrancis King SingОценок пока нет

- Maryland Tax ExemptionДокумент2 страницыMaryland Tax ExemptionVenkatesh GorurОценок пока нет

- CAN Declaration Tax Residence Rc518 Fill 18eДокумент2 страницыCAN Declaration Tax Residence Rc518 Fill 18eMax PowerОценок пока нет

- Request For Taxpayer Identification Number and CertificationДокумент1 страницаRequest For Taxpayer Identification Number and CertificationJude Thomas SmithОценок пока нет

- std686 PDFДокумент2 страницыstd686 PDFnmkeatonОценок пока нет

- CannaLife Capital Corp. - Form of Subscription Agreement For Units at $0.20 PDFДокумент37 страницCannaLife Capital Corp. - Form of Subscription Agreement For Units at $0.20 PDFjeet1970Оценок пока нет

- FS Form 1071 (Statement of Ownership)Документ2 страницыFS Form 1071 (Statement of Ownership)Benne James100% (3)

- Vendor Onboard PackageДокумент6 страницVendor Onboard PackageNick BlanchetteОценок пока нет

- 2020 TaxReturnДокумент6 страниц2020 TaxReturnRicko CooperОценок пока нет

- LG FFДокумент1 страницаLG FFfeem743Оценок пока нет

- FATCA RBSC Certification Consent Waiver Form 072015Документ4 страницыFATCA RBSC Certification Consent Waiver Form 072015Mary Nespher DelfinОценок пока нет

- File by Mail Instructions For Your 2019 Federal Tax ReturnДокумент7 страницFile by Mail Instructions For Your 2019 Federal Tax ReturnKevin Osorio100% (2)

- Income Payee'S Sworn Declaration of Gross Receipts/SalesДокумент4 страницыIncome Payee'S Sworn Declaration of Gross Receipts/SalesLeslie Darwin DumasОценок пока нет

- FW 10Документ1 страницаFW 10Florence Smith SlusarskiОценок пока нет

- FW 9Документ1 страницаFW 9Alfredo NavaОценок пока нет

- Confidential Domestic PartnershipДокумент3 страницыConfidential Domestic PartnershipgodardsfanОценок пока нет

- One Man Out Debt AssessmentДокумент4 страницыOne Man Out Debt AssessmentRb100% (3)

- 4.fatca Self Declaraton Form Individuals PDFДокумент2 страницы4.fatca Self Declaraton Form Individuals PDFbala krishnanОценок пока нет

- Administrative Affidavit of Specific Negative Averment, Opportunity To Cure and CounterclaimДокумент4 страницыAdministrative Affidavit of Specific Negative Averment, Opportunity To Cure and CounterclaimMikeDouglas100% (2)

- Request For Taxpayer Identification Number and CertificationДокумент1 страницаRequest For Taxpayer Identification Number and CertificationGreat Northern Insurance AgencyОценок пока нет

- Affidavit of Ownership of Birth CertificateДокумент14 страницAffidavit of Ownership of Birth CertificateLeon Bell60% (5)

- CRS Individual Self-Certification FormДокумент6 страницCRS Individual Self-Certification FormsamОценок пока нет

- FATCA CRS Individual Declaration FormДокумент2 страницыFATCA CRS Individual Declaration FormSrigandh's WealthОценок пока нет

- MW 507Документ2 страницыMW 507sosureyОценок пока нет

- Pacific Guardian Life Policy Change FormДокумент2 страницыPacific Guardian Life Policy Change FormharjsandhuОценок пока нет

- PennsylvaniaREV 419Документ1 страницаPennsylvaniaREV 419Vikram rajputОценок пока нет

- Certificate of Foreign Status of Beneficial Owner For United States Tax WithholdingДокумент4 страницыCertificate of Foreign Status of Beneficial Owner For United States Tax WithholdingYudia0% (1)

- Business Banking Entity Self Certification FormДокумент4 страницыBusiness Banking Entity Self Certification Formyogeshahire166Оценок пока нет

- Redetermination: Statement of Facts Supporting Eligibility For The Approved Relative Caregiver (Arc) Funding Option ProgramДокумент2 страницыRedetermination: Statement of Facts Supporting Eligibility For The Approved Relative Caregiver (Arc) Funding Option ProgramLOLAОценок пока нет

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionДокумент4 страницыUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerОценок пока нет

- Annex B-2Документ1 страницаAnnex B-2Von Virchel VallesОценок пока нет

- Clear Form: Enter Personal InformationДокумент4 страницыClear Form: Enter Personal InformationreddymspОценок пока нет

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnДокумент31 страницаElectronic Filing Instructions For Your 2019 Federal Tax ReturnJose Miguel Hernandez CarelaОценок пока нет

- Request For Taxpayer Identification Number and CertificationДокумент4 страницыRequest For Taxpayer Identification Number and Certificationapi-259574251Оценок пока нет

- Sample Letter Managing Agent To Out-of-State Owner-Client: Step 1 - About ExemptionsДокумент2 страницыSample Letter Managing Agent To Out-of-State Owner-Client: Step 1 - About ExemptionsAmina SrkОценок пока нет

- Traffic TRL I93Документ2 страницыTraffic TRL I93ciejhae3111Оценок пока нет

- 2024iaw-4 (44019) 0Документ4 страницы2024iaw-4 (44019) 0ahmedzahi964Оценок пока нет

- ECWANDC Funding - Vendor W9 FormДокумент1 страницаECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilОценок пока нет

- BondedPromissoryNoteExample PackageToPayOffPublicDebtДокумент7 страницBondedPromissoryNoteExample PackageToPayOffPublicDebtLucy Maysonet94% (36)

- Edd AfДокумент4 страницыEdd Afcsl K360Оценок пока нет

- Income Certification JRДокумент2 страницыIncome Certification JRAn AdmirerОценок пока нет

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!От EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Оценок пока нет

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsОт EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Limitations On Applications in Australia: Previous Protection Visa RefusalДокумент1 страницаLimitations On Applications in Australia: Previous Protection Visa RefusalMinh NguyenОценок пока нет

- PDF Editor, PDF Book Reader: User's ManualДокумент3 страницыPDF Editor, PDF Book Reader: User's ManualMinh NguyenОценок пока нет

- PDF Editor, PDF Book Reader: User's ManualДокумент3 страницыPDF Editor, PDF Book Reader: User's ManualMinh NguyenОценок пока нет

- PDF Editor, PDF Book Reader: User's ManualДокумент3 страницыPDF Editor, PDF Book Reader: User's ManualMinh NguyenОценок пока нет

- Cyril Grace Booc - ASSIGNMENT 1 Cost ConceptsДокумент7 страницCyril Grace Booc - ASSIGNMENT 1 Cost ConceptsCyril Grace BoocОценок пока нет

- Financial Rehabilitation and Insolvency Act - Test BankДокумент6 страницFinancial Rehabilitation and Insolvency Act - Test BankHads LunaОценок пока нет

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingДокумент6 страницAccounting Vocabulary: Easy-To-Learn English Terms For AccountingRed WaneОценок пока нет

- 9 Set Off & Carry ForwardДокумент25 страниц9 Set Off & Carry Forward21BAM025 RENGARAJANОценок пока нет

- MakalahДокумент8 страницMakalahAsyam ArkaОценок пока нет

- Chapter3 Students 1Документ22 страницыChapter3 Students 1Leah Mae NolascoОценок пока нет

- CFO Finance Director Controller in Los Angeles CA Resume Keith RowlandДокумент2 страницыCFO Finance Director Controller in Los Angeles CA Resume Keith RowlandKeithRowlandОценок пока нет

- ACT 201 AssignmentДокумент4 страницыACT 201 AssignmentTamzid IslamОценок пока нет

- Module 3. Job Order and Process CostingДокумент16 страницModule 3. Job Order and Process CostingAISLINEОценок пока нет

- LIT1 Task 1Документ6 страницLIT1 Task 1Nate OtikerОценок пока нет

- Acct 2011 Anderson Pty LTD Is An Australian Diversified IndustrialДокумент2 страницыAcct 2011 Anderson Pty LTD Is An Australian Diversified IndustrialCharlotteОценок пока нет

- Chapter 1 Accounting in ActionДокумент76 страницChapter 1 Accounting in Actionsuryasimbolon02Оценок пока нет

- Managerial Accounting - HW Case 5-2 Celtex Feb 05 2011Документ1 страницаManagerial Accounting - HW Case 5-2 Celtex Feb 05 2011Gautam RandhawaОценок пока нет

- ACC 201 Milestone OneДокумент43 страницыACC 201 Milestone Onekhaled83% (6)

- Solution Manual For Financial Reporting and Analysis Using Financial Accounting Information 12th Edition by Charles H GibsonДокумент24 страницыSolution Manual For Financial Reporting and Analysis Using Financial Accounting Information 12th Edition by Charles H GibsonRobertGonzalesyijx100% (36)

- Assignment Chapter Issue of Shares Class 12thДокумент5 страницAssignment Chapter Issue of Shares Class 12thPriya TandonОценок пока нет

- Working Capital Management: TATA SteelДокумент17 страницWorking Capital Management: TATA SteelSaurabh KhandelwalОценок пока нет

- Cost and Management Accounting IIДокумент66 страницCost and Management Accounting IIsamuel debebeОценок пока нет

- Answer KeysДокумент26 страницAnswer Keysmia uyОценок пока нет

- Advance Accounts TestДокумент3 страницыAdvance Accounts Testdivya shahasaneОценок пока нет

- GSP FinanceДокумент89 страницGSP FinancevupatiОценок пока нет

- Difference Between Partnership and CorporationДокумент1 страницаDifference Between Partnership and CorporationDanica Mei DeguzmanОценок пока нет

- Financial Anylsuis of Icic BankДокумент79 страницFinancial Anylsuis of Icic BankStewart DuraiОценок пока нет

- HDFC Balanced Advantage Fund - Apr 22 - 1 PDFДокумент2 страницыHDFC Balanced Advantage Fund - Apr 22 - 1 PDFAkash BОценок пока нет

- Case Tottenham Hotspur-03!03!2015Документ1 страницаCase Tottenham Hotspur-03!03!2015Pi Ka Chu100% (1)

- Larson17ce PPT Ch02Документ81 страницаLarson17ce PPT Ch02AnkyОценок пока нет

- Exon Mobile Financial Data BloombergДокумент32 страницыExon Mobile Financial Data BloombergShardul MudeОценок пока нет

- 09 Elms Quiz - ArgДокумент3 страницы09 Elms Quiz - ArgKim Andrew Duane C. RosalesОценок пока нет

- ByjuДокумент4 страницыByjuAakash ParmarОценок пока нет

- Emtex Engineering Private Limited: Detailed ReportДокумент11 страницEmtex Engineering Private Limited: Detailed ReportAnishОценок пока нет