Академический Документы

Профессиональный Документы

Культура Документы

Bus. Finance (SSS Dominguez)

Загружено:

BlancvitАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bus. Finance (SSS Dominguez)

Загружено:

BlancvitАвторское право:

Доступные форматы

1.

Why do you think the SSS is pursuing higher returns by improving the quality of the

investments?

2. Why would the rise in beneficiary-pensionary possibly affect the growth of fund’s

contributors?

3. How does the retirees increasing population pose as a challenge for SSS?

4. Why does improved financial activity be a convincing factor to the current members?

5. Why does the Finance Secretary propose cutting back on overhead expenses and use modern

technologies to better serve its’ members?

6. What would you suggest that SSS do to further increase its revenues?

Answers:

1. SSS is pursuing higher returns to keep up with the rise in the number of beneficiary-pensioners.

If they do not keep up with the growth of pensioners, profits for the company will diminish. Another

reason is to also reduce overhead expenses like employee salaries and insurance.

2. As long as the number of pensioners increases, then the amount of cash the insurance company

has will continue decreasing. To make up for this, insurance companies will issue a higher premium

cost to contributors in order to break-even.

3. The number of retirees may be increasing due to earlier retirement ages. If the retiree population

continues to increase, the company will have to pay more pension funds. Having more liabilities than

usual means that the company will have fewer profits.

4. Insurance companies want to make contributors feel that their investments are indeed

contributions to the future. They want to make you feel ensured that they will be able to comply with

their policies when an unfortunate accident occurs.

5. The finance secretary proposes investing in technology because modern technologies are far

cheaper to use than real employees. Machinery and equipment have no insurances or salaries. Online

application and submissions are also becoming more popular these days.

6. Insurance companies get a lot of money from premiums and instead of leaving the money lying

around, they should invest it in different assets that would yield profits for them eventually. Aside

from investing in technology as the finance secretary said, you could also invest in real estates and

government bonds so that when the insurance company has claims to deal with, it not only has enough

to settle the claims but also has enough profit left to keep. Insurance companies should always be

careful with investments which is why most of the investments should be in government bonds and

low-risk investments.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

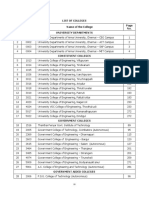

- TNEA Participating College - Cut Out 2017Документ18 страницTNEA Participating College - Cut Out 2017Ajith KumarОценок пока нет

- Manhole DetailДокумент1 страницаManhole DetailchrisОценок пока нет

- SHS StatProb Q4 W1-8 68pgsДокумент68 страницSHS StatProb Q4 W1-8 68pgsKimberly LoterteОценок пока нет

- Iluminadores y DipolosДокумент9 страницIluminadores y DipolosRamonОценок пока нет

- PUERPERAL SEPSIS CoverДокумент9 страницPUERPERAL SEPSIS CoverKerpersky LogОценок пока нет

- PS4 ListДокумент67 страницPS4 ListAnonymous yNw1VyHОценок пока нет

- Emma The Easter BunnyДокумент9 страницEmma The Easter BunnymagdaОценок пока нет

- Ikramul (Electrical)Документ3 страницыIkramul (Electrical)Ikramu HaqueОценок пока нет

- School Games Calendar Part-1Документ5 страницSchool Games Calendar Part-1Ranadhir Singh100% (2)

- Cover Letter For Lettings Negotiator JobДокумент9 страницCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- Post Cold WarДокумент70 страницPost Cold WarZainab WaqarОценок пока нет

- Picc Lite ManualДокумент366 страницPicc Lite Manualtanny_03Оценок пока нет

- Cct4-1causal Learning PDFДокумент48 страницCct4-1causal Learning PDFsgonzalez_638672wОценок пока нет

- DBT Cope Ahead PlanДокумент1 страницаDBT Cope Ahead PlanAmy PowersОценок пока нет

- ANNAPURNA Sanitary Work 3 FinalДокумент34 страницыANNAPURNA Sanitary Work 3 FinalLaxu KhanalОценок пока нет

- Placement TestДокумент6 страницPlacement TestNovia YunitazamiОценок пока нет

- Stress Corrosion Cracking Behavior of X80 PipelineДокумент13 страницStress Corrosion Cracking Behavior of X80 Pipelineaashima sharmaОценок пока нет

- What Is An Ethical Dilemma?: Decision-Making ProcessДокумент7 страницWhat Is An Ethical Dilemma?: Decision-Making ProcessGauravsОценок пока нет

- 978-1119504306 Financial Accounting - 4thДокумент4 страницы978-1119504306 Financial Accounting - 4thtaupaypayОценок пока нет

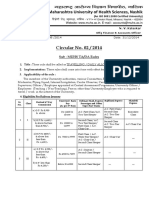

- Circular No 02 2014 TA DA 010115 PDFДокумент10 страницCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Is Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawДокумент6 страницIs Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawChess NutsОценок пока нет

- Foucault, M.-Experience-Book (Trombadori Interview)Документ11 страницFoucault, M.-Experience-Book (Trombadori Interview)YashinОценок пока нет

- Micro TeachingДокумент3 страницыMicro Teachingapi-273530753Оценок пока нет

- Brahm Dutt v. UoiДокумент3 страницыBrahm Dutt v. Uoiswati mohapatraОценок пока нет

- Tesmec Catalogue TmeДокумент208 страницTesmec Catalogue TmeDidier solanoОценок пока нет

- Diva Arbitrage Fund PresentationДокумент65 страницDiva Arbitrage Fund Presentationchuff6675Оценок пока нет

- Reflection On An American ElegyДокумент2 страницыReflection On An American ElegyacmyslОценок пока нет

- Thomas HobbesДокумент3 страницыThomas HobbesatlizanОценок пока нет

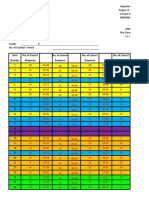

- Item AnalysisДокумент7 страницItem AnalysisJeff LestinoОценок пока нет

- CPGДокумент9 страницCPGEra ParkОценок пока нет