Академический Документы

Профессиональный Документы

Культура Документы

Problems Basic Actg

Загружено:

Marian EstradaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Problems Basic Actg

Загружено:

Marian EstradaАвторское право:

Доступные форматы

ADJUSTING THE ACCOUNTS, WORKSHEET AND FINANCIAL STATEMENTS, AND COMPLETING THE ACCOUNTING CYCLE| 1

EXERCISE PROBLEM

Remulla, CPA Consulting is a new firm organized last January 1, 2018. Some of its clients

pay in advance for the advisory service while the others are billed after the service has been

rendered. The company adjusted & closes its account every month. At December 31, 2018, the

Trial balance appeared as follows:

Remulla, CPA Consulting

Trial Balance

For the month ended December 31, 2018

Account Titles Debit Credit

Cash 308,940

Accounts Receivable 120,000

Office Supplies 29,700

Prepaid Insurance 30,000

Prepaid Rent 88,500

Office Equipment 187,920

Accum. Depreciation – Office Equipment 6,960

Notes Payables 70,000

Accounts Payable 28,500

Unearned Revenue 378,000

Remulla, Capital 320,000

Remulla, Withdrawal 13,500

Service Revenue 285,000

Insurance Expense 6,000

Salaries Expense 266,700

Miscellaneous Expense 37,200

1,088,460 1,088,460

Consider the following information:

a) The firm’s monthly rent is P 17,700.

b) The office supplies on hand on December 31, 2018, amounted to P 19,500.

c) Purchased office equipment on August 1, 2018 with an estimated useful life of 9 years.

d) Last October 1, 2018, the firm purchased insurance for 1 year from Morado’s Insurance

Company which amounted to P 36,000.

Junior Philippine Institute of Accountants – CvSU Chapter

ADJUSTING THE ACCOUNTS, WORKSHEET AND FINANCIAL STATEMENTS, AND COMPLETING THE ACCOUNTING CYCLE| 2

e) Service rendered during the month and chargeable to Unearned Revenue (Subscription

Basis) amounted to P 87,000.

f) The firm rendered consulting services (Non-subscription Basis) during the month but not

yet billed which amounted to P 16,800.

g) Salaries earned by the employees during the month but not yet paid amounted to

P 6,900.

h) Issued a note to Ladines Company on December 1, 2018 amounted to P 70,000, 12%

annually, that will mature on December 1, 2019.

Requirement:

1) Prepare adjusting entries for each transaction.

2) Prepare a 10-column worksheet.

3) Prepare the Statement of Financial Performance for the year ended December 31, 2018.

4) Prepare the Statement of Changes in Equity as of December 31, 2018.

5) Prepare the Statement of Financial Position as of December 31, 2018.

6) Prepare closing entries.

7) Prepare a post-closing trial balance.

8) Prepare reversing entries (if there’s any).

Junior Philippine Institute of Accountants – CvSU Chapter

ADJUSTING THE ACCOUNTS, WORKSHEET AND FINANCIAL STATEMENTS, AND COMPLETING THE ACCOUNTING CYCLE| 3

COMPREHENSIVE PROBLEM

The Trial Balance for Cris John Cleaners appears as follows:

Cris John Cleaners

Trial Balance

For the Year Ended December 31, 2018

Debit Credit

Cash P158,000

Accounts Receivable 61,350

Notes Receivable 80,000

Cleaning Supplies 92,040

Prepaid Insurance 60,000

Prepaid Rent 150,000

Cleaning Equipment 270,000

Accounts Payable P 98,290

Notes Payable 250,000

Unearned Cleaning Revenues 144,,000

John, Capital 159,540

John, Withdrawal 10,000

Cleaning Revenues 600,000

Salaries Expense 155,560

Utilities Expense 74,000

Delivery Truck Expense 95,540

Other Expenses 45,340

Total P 1,251,830 P 1,251,830

Consider the following information:

a.) A review of insurance policies showed that P7,500 is unexpired at year-end.

b.) An Inventory of Cleaning Supplies showed P20,520 on hand.

c.) The Cleaning Equipment was purchased on February 1, 2018. The useful life is 8

years and can be sold for P20,000 at the end of its useful life.

d.) The P250,000 note was issued on March 1, 2018. It will be repaid in 12 months

together with interest at an annual rate of 15%.

e.) The P80,000 note was received on May 1, 2018 from Victoria Clinic. The interest on

the note is 10% per annum and will mature on April 30, 2019

Junior Philippine Institute of Accountants – CvSU Chapter

ADJUSTING THE ACCOUNTS, WORKSHEET AND FINANCIAL STATEMENTS, AND COMPLETING THE ACCOUNTING CYCLE| 4

f.) On June 1, 2018, Cris John Cleaners signed a contract, effective immediately, with

Amazing Hospital to dry clean, for a fixed monthly charge of P12,000, the uniforms

to be used by doctors in surgery. Amazing Hospital paid for 1 year service in

advance.

g.) On September 1, 2018, Cris John Cleaners Paid Susan Realtors 150,000 for 8 months’

rent on the office building commencing that day.

h.) At December 31, 2018, P15,050 salaries have accrued.

Required:

1) Prepare adjusting entries for each transaction.

2) Prepare a 10-column worksheet.

3) Prepare the Statement of Financial Performance for the year ended December 31, 2018.

4) Prepare the Statement of Changes in Equity as of December 31, 2018.

5) Prepare the Statement of Financial Position as of December 31, 2018.

6) Prepare closing entries.

7) Prepare post-closing trial balance.

8) Prepare reversing entries (if there’s any).

Prepared by:

KENNETH R. REMULLA

BSACC 4-1

VP for Media and Graphics

CRIS JOHN O. VICTORIA

BSACC 4-1

Consul-General – 4th Year

Junior Philippine Institute of Accountants – CvSU Chapter

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Financial Accounting Practice ProblemsДокумент15 страницFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

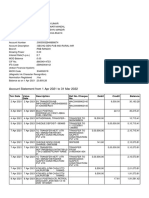

- Account Statement From 18 Jan 2022 To 18 Jul 2022Документ14 страницAccount Statement From 18 Jan 2022 To 18 Jul 2022Rutuja ShindeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Supply Chain ManagementДокумент22 страницыSupply Chain ManagementMario SubašićОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Reviewer: Accounting For Partnership Part 1Документ22 страницыReviewer: Accounting For Partnership Part 1gab mОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Chapter 6Документ13 страницChapter 6Juliet Austria Dimalibot67% (3)

- Inventory Control ModelsДокумент34 страницыInventory Control ModelsBehbehlynn75% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Chapter 12: The Purchasing Process True/FalseДокумент20 страницChapter 12: The Purchasing Process True/FalseKarmina LesmorasОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- JE, GL, TB - Mutual ServicesДокумент17 страницJE, GL, TB - Mutual ServicesJasmine Acta100% (1)

- Chapter 1 Introduction To LogisticsДокумент28 страницChapter 1 Introduction To LogisticsJackson Koli100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- ExamДокумент6 страницExamYoDariusОценок пока нет

- Supply Chain MGTДокумент40 страницSupply Chain MGTGelyn CruzОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Role To T-Code MappingДокумент1 331 страницаRole To T-Code MappingAbdelhamid HarakatОценок пока нет

- Cost Chap 6Документ24 страницыCost Chap 6Peter Paul DeiparineОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Cost AccountingДокумент17 страницCost AccountingFaisal RafiqОценок пока нет

- SHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedДокумент3 страницыSHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedshermanОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Rules of Debits and CreditsДокумент2 страницыRules of Debits and CreditsRadhika PatkeОценок пока нет

- Axis Copy 3Документ188 страницAxis Copy 3ApogeesОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- FormworksДокумент94 страницыFormworksLouie Zavalla LeyvaОценок пока нет

- Accounts Payable Reports: Report ID Report Name Legacy Report Report Description Navigation/Path VouchersДокумент12 страницAccounts Payable Reports: Report ID Report Name Legacy Report Report Description Navigation/Path Voucherssjanjiriya9545Оценок пока нет

- Belay, S. (2009) - Export-Import Theory, Practices, and Procedures. (2 Ed.) - New York: RoutledgeДокумент10 страницBelay, S. (2009) - Export-Import Theory, Practices, and Procedures. (2 Ed.) - New York: RoutledgejaiderОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

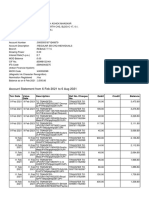

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент14 страницAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRishav AnandОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Supply Chain Operations Director in Madison WI Resume Dwayne WildhagenДокумент2 страницыSupply Chain Operations Director in Madison WI Resume Dwayne WildhagenDwayneWildhagenОценок пока нет

- Account Statement From 6 Feb 2021 To 6 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент14 страницAccount Statement From 6 Feb 2021 To 6 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSantosh MhaskarОценок пока нет

- Adjusting The Accounts: Accounting Principles, 8 EditionДокумент44 страницыAdjusting The Accounts: Accounting Principles, 8 EditionSheikh Azizul IslamОценок пока нет

- Perpetual Inventory Method: Accounting Practice SetДокумент8 страницPerpetual Inventory Method: Accounting Practice SetZyn Marie OccenoОценок пока нет

- Ruin Yf 6 OVLkwzbuzДокумент39 страницRuin Yf 6 OVLkwzbuzDIPAK VINAYAK SHIRBHATEОценок пока нет

- April StatementДокумент9 страницApril Statementyv4pfn8xhhОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Champion TemplateДокумент21 страницаChampion TemplateDamas Pandya JanottamaОценок пока нет

- Account CodesДокумент35 страницAccount CodesKarenОценок пока нет