Академический Документы

Профессиональный Документы

Культура Документы

11 Paper

Загружено:

Somesh DhingraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

11 Paper

Загружено:

Somesh DhingraАвторское право:

Доступные форматы

Q.1 Enter the following transaction in the Cash Book with cash and bank column.

8 Iron Chrest @ Rs 3400 each 26 Plastic tools @ Rs. 170 15 % Trade Discount June

2013 (6) 22:

May 1: Cash in hand Rs.4400 Cash at bank Rs. 5000 (Overdrft) Sold goods to Vishal Enterprise in cash (Delhi)

May 6: Received a cheque from Rahul for Rs. 5000 in full settlement of his due 5 Wooden shelves @ Rs.1620 each.

Rs.5200 June 30: sold old cartons to Divya Sons. 125 cartons @ Rs.16 each. 4

May 12: Cash and cheque of Rs.7000 (including cheque of Rahul) has been

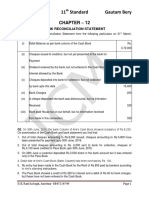

deposited into bank. Q4. Chhabra & Sons find that overdraft shown by their cash Book on 31st March 2013

May 18: Received a cheque of Rs.8000 from Hariom. is Rs. 30,500 but the Pass Book shows a difference due to the following reasons. (6)

May 22: Hariom’s cheque endorsed to Vineet as a full settlement of his claim i. A cheque for Rs. 6000 drawn in favour of Shyam has not been presented for payment.

Rs.8250. ii. A post-dated cheque for Rs. 1000 has been debited in the Bank column of the

May 26 Hariom’s cheque returned dishonoured and bank charged Rs.100 for this Cashbook but it could not have been presented in Bank.

matter. iii. Cheque totalling Rs. 12,000 deposited with the bank have not yet been collected.

May 31: Deposited into bank after keeping a cash balance of Rs.1000 iv. A bill for Rs. 5,000 was retired by the bank under a rebate of Rs. 120 but the full

amount of the bill was credited in the bank column of the Cash Book. Prepare a Bank

reconciliation statement.

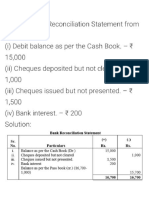

Q.2 Prepare a Bank reconciliation statement as on 30 September 2013 from the

following particulars Pass book M/S Kanchan Brothers showed a debit balance of Q5. Enter the following transactions in the Two Column Cash Book of Mr.

Rs. 12150. (6) Mohan:-(6)

a) Cheque issued on September for Rs. 20000 but only Cheque of Rs 8000 has been 2018 Rs.

presented for payment upto 30th September.

Jan. Cash in Hand 2,200

b) Cheque of Rs.16500 received and deposited into the bank in September, but a

1

cheque of Rs.2500 has not been credited by the bank till 30 th September.

c) Payment side of cash Book (Bank colum) overcast by Rs.800. Cash at Bank 50,000

d) Bank credited Rs.400 as dividend and also debited Rs. 150 as interest on 3 Purchased goods for 75,000; Trade Discount 20%; CGST 6%,

overdraft on 30 th September. SGST 6%; Payment made by Cheque

e) Cheque of Rs.2600 received recorded properly in cash book on 30th September 4 Sold goods for Rs.40,000; Trade Discount 15%; IGST 12%;

but not yet deposited in the bank. Payment received by Cheque

f) Cheque issued Rs. 7200 on 30 th September was not recorded in cash book and 5 Received a cheque from Naresh 1,000

the cheque is not yet presented for payment.

8 Cheque received from Naresh endorsed to Suresh in full settlement

of his account of Rs.1,050

Q.3 Prepare a suitable day book for the following transaction as furnished by M/S

10 Paid Life Insurance premium of Mr. Mohan 100

Super & Co.-furniture dealer of U.P. CGST @ 6% and SGST @ 6% : (6)

2013 June 16: Sold goods to Ramana & Sons Lucknow (U.P) 13 Received a cheque from Pawan in full settlement of his account of

700

750.

2 Steel Almirah@ Rs.7200 each 15 Plastic Chairs @ Rs. 330 each. 10 % Trade

Discount 16 Pawan's cheque returned dishonoured by bank –

June 22: Sold goods to Kamlesh & Sons. Kanpur (U.P.) 20 Deposited into Bank, balance of Cash in excess of Rs. 250

Вам также может понравиться

- CA FND M23 - Cash Book QuestionsДокумент4 страницыCA FND M23 - Cash Book QuestionsRaaja YoganОценок пока нет

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationДокумент2 страницыWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulОценок пока нет

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationДокумент2 страницыWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulОценок пока нет

- Tally PracticalДокумент5 страницTally PracticalArchana DeyОценок пока нет

- WS - Xi BRS - 2Документ5 страницWS - Xi BRS - 2richshivamshahОценок пока нет

- Question Bank-Accountancy 11thДокумент26 страницQuestion Bank-Accountancy 11thshaurya goyalОценок пока нет

- BRS PDFДокумент14 страницBRS PDFGautam KhanwaniОценок пока нет

- Exam Type Question of Accountancy, Class XiДокумент3 страницыExam Type Question of Accountancy, Class Xirobinghimire100% (7)

- Worksheet Cash Book and Petty Cash BookДокумент6 страницWorksheet Cash Book and Petty Cash BookHarsh ShahОценок пока нет

- Cashbook WorksheetДокумент3 страницыCashbook WorksheetRavi UdeshiОценок пока нет

- Mid Term Accounts - SubjectiveДокумент4 страницыMid Term Accounts - Subjectivekarishma prabagaranОценок пока нет

- Cashbook and Brs ProblemsДокумент3 страницыCashbook and Brs Problemsmaheshbendigeri5945Оценок пока нет

- QUES19Документ2 страницыQUES19Manish Saini0% (1)

- 6 BRS 08-2023 RegularДокумент7 страниц6 BRS 08-2023 RegularjahnaviОценок пока нет

- Bank Reconciliation Statement AssignmentДокумент3 страницыBank Reconciliation Statement AssignmentDev KumarОценок пока нет

- Question 1Документ3 страницыQuestion 1Mohammad Tariq AnsariОценок пока нет

- Assets:: 2008 Cash in Hand Rs 2,000, Cash at Bank RS, 68,000, Stock of Goods RsДокумент3 страницыAssets:: 2008 Cash in Hand Rs 2,000, Cash at Bank RS, 68,000, Stock of Goods RsPrem PatelОценок пока нет

- Dkgoel BRS 11Документ15 страницDkgoel BRS 11DhruvОценок пока нет

- B.R.S. Test 3Документ5 страницB.R.S. Test 3Sudhir SinhaОценок пока нет

- Accounting Send Up TestДокумент3 страницыAccounting Send Up TestKashifОценок пока нет

- Cbse Class 11 Accountancy Sample Paper Set 2 QuestionsДокумент6 страницCbse Class 11 Accountancy Sample Paper Set 2 QuestionsNishtha 3153Оценок пока нет

- Cash Book ProblemsДокумент6 страницCash Book Problemsshahid sjОценок пока нет

- Cash BookДокумент4 страницыCash BookDivyanka RanjanОценок пока нет

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Документ3 страницыTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifОценок пока нет

- Hotel AccountingДокумент8 страницHotel AccountinglindakuttyОценок пока нет

- Brs Practical QuestionsДокумент5 страницBrs Practical QuestionsSwarupa VОценок пока нет

- Accountancy XI: Pankaj Rajan 9810194206Документ4 страницыAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhОценок пока нет

- BRS WSДокумент2 страницыBRS WSShrajith A NatarajanОценок пока нет

- 10+1 Accounts (Cash Book)Документ1 страница10+1 Accounts (Cash Book)neeraj goyalОценок пока нет

- Tally Assignment (26/3/2020)Документ1 страницаTally Assignment (26/3/2020)Kanishk ChaddhaОценок пока нет

- Sample Paper Commerce Class 11th CBSEДокумент6 страницSample Paper Commerce Class 11th CBSEShreyansh DhruwОценок пока нет

- Sutlej Public Sr. Sec School Class Xi Sub Accountancy T 40 Mnutes M.M 30Документ4 страницыSutlej Public Sr. Sec School Class Xi Sub Accountancy T 40 Mnutes M.M 30mnmehta1990Оценок пока нет

- CA F BRS WithДокумент10 страницCA F BRS WithG. DhanyaОценок пока нет

- Cash Book WorksheetДокумент11 страницCash Book WorksheetRaashiОценок пока нет

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookДокумент10 страницPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaОценок пока нет

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiДокумент4 страницыSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanОценок пока нет

- Worksheet Cash BookДокумент3 страницыWorksheet Cash BookJaijeet SinghОценок пока нет

- Faculty of Commerce: Code No. 10001Документ4 страницыFaculty of Commerce: Code No. 10001Madasu BalnarsimhaОценок пока нет

- Assignment ProblemsДокумент7 страницAssignment ProblemsLowzil AJIMОценок пока нет

- BRS Class 11Документ1 страницаBRS Class 11tarun aroraОценок пока нет

- Valmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Документ3 страницыValmiki Shiksha Sadan H. S. S.: Sent Up Examination-2071Rabindra Raj BistaОценок пока нет

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFДокумент4 страницыKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaОценок пока нет

- Term 1 QP XI - Subjective Paper 40 MarksДокумент3 страницыTerm 1 QP XI - Subjective Paper 40 MarksAditiОценок пока нет

- FA - Bank Rec. QuestionДокумент2 страницыFA - Bank Rec. QuestionAshika JayaweeraОценок пока нет

- AssignmentДокумент8 страницAssignmentSameer SawantОценок пока нет

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Документ4 страницы650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004Оценок пока нет

- Tutorial 06Документ3 страницыTutorial 06Janidu KavishkaОценок пока нет

- BRS Statement IllustrationsДокумент3 страницыBRS Statement Illustrationssurekha khandebharadОценок пока нет

- CHP 2 - BRSДокумент5 страницCHP 2 - BRSPayal Mehta DeshpandeОценок пока нет

- Test 4Документ6 страницTest 4Jayant MittalОценок пока нет

- Mock Test 1 Class 11 AccountancyДокумент2 страницыMock Test 1 Class 11 AccountancyAbhradeep GhoshОценок пока нет

- Exercises of Bank Reconciliation Statement: Exercise No. IДокумент9 страницExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliОценок пока нет

- QuestionsДокумент9 страницQuestionsCfa Deepti BindalОценок пока нет

- Accountancy XI Half Yearly WorksheetДокумент8 страницAccountancy XI Half Yearly WorksheetDeivanai K CSОценок пока нет

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceДокумент53 страницыBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaОценок пока нет

- 11 Accounts Final First Assessment 1Документ4 страницы11 Accounts Final First Assessment 1khush marooОценок пока нет

- Xi Accountancy 80 Marks General InstructionsДокумент5 страницXi Accountancy 80 Marks General InstructionsJash ShahОценок пока нет

- Exercise Cash BookДокумент3 страницыExercise Cash BookAjay Kumar Sharma33% (3)

- Accounting For Managers - Practical ProblemsДокумент33 страницыAccounting For Managers - Practical ProblemsdeepeshmahajanОценок пока нет

- Acd (Microproject Report)Документ42 страницыAcd (Microproject Report)Gaurav SapkalОценок пока нет

- Types of SlabsДокумент5 страницTypes of SlabsOlga KosuoweiОценок пока нет

- LaxmanДокумент3 страницыLaxmanKANNADIGA ANIL KERURKARОценок пока нет

- GujaratДокумент21 страницаGujaratCreative ServiceОценок пока нет

- A Project Report MercДокумент56 страницA Project Report MercParag RaneОценок пока нет

- Project Report of Research Methodology OnДокумент44 страницыProject Report of Research Methodology OnMohit Sugandh100% (1)

- Failure and Resurgence of The Barbie DollДокумент23 страницыFailure and Resurgence of The Barbie DollrknanduriОценок пока нет

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacДокумент2 страницыTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalОценок пока нет

- David Einhorn Speech To Value InvestorsДокумент10 страницDavid Einhorn Speech To Value InvestorsJohn CarneyОценок пока нет

- Procurement Statement of WorkДокумент4 страницыProcurement Statement of WorkAryaan RevsОценок пока нет

- Industry Analysis of InsuranceДокумент48 страницIndustry Analysis of InsuranceDebojyotiSahoo100% (1)

- Eia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshДокумент3 страницыEia On Galachipa Bridge Project Bangladesheia On Galachipa Bridge Project BangladeshropovevОценок пока нет

- Timo 2019 Heat Round Invitation Invitation To Parents4257063345853157948Документ2 страницыTimo 2019 Heat Round Invitation Invitation To Parents4257063345853157948Eric GoОценок пока нет

- Christmas Tree LCA - EllipsosДокумент91 страницаChristmas Tree LCA - EllipsoscprofitaОценок пока нет

- Designing Grease Distribution Systems: Is Bigger Always Better?Документ2 страницыDesigning Grease Distribution Systems: Is Bigger Always Better?José Cesário NetoОценок пока нет

- Taipei Artist VillageДокумент3 страницыTaipei Artist VillageErianne DecenaОценок пока нет

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesДокумент93 страницыTax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesAnonymous oTRzcSSGunОценок пока нет

- Dialectical Economics An Introduction To Marxist Political TheoryДокумент509 страницDialectical Economics An Introduction To Marxist Political Theoryscottyphx8849100% (1)

- AwbДокумент1 страницаAwbAnonymous RCM8aHgrPОценок пока нет

- National Agriculture PolicyДокумент3 страницыNational Agriculture PolicyImran AfizalОценок пока нет

- EconomicsДокумент322 страницыEconomicsMark John BernaldezОценок пока нет

- UNIT 1 - Grammar Choices For Graduate StudentsДокумент21 страницаUNIT 1 - Grammar Choices For Graduate StudentsDragana BorenovicОценок пока нет

- Candidate Statement - ChicagoДокумент2 страницыCandidate Statement - ChicagoAlan GordilloОценок пока нет

- DG Cement Internship ReportДокумент30 страницDG Cement Internship ReportYasir Haroon100% (2)

- Pricing StrategyДокумент5 страницPricing StrategyShantonu RahmanОценок пока нет

- Azulcocha 43-101 Tailing ReportДокумент80 страницAzulcocha 43-101 Tailing Reportwalter sanchez vargasОценок пока нет

- Economic RRL Version 2.1Документ8 страницEconomic RRL Version 2.1Adrian Kenneth G. NervidaОценок пока нет

- Company Profile PT. Nikkatsu Electric WorksДокумент17 страницCompany Profile PT. Nikkatsu Electric WorksDenny Ilyas Attamimi100% (1)

- Securitization of Trade ReceivablesДокумент2 страницыSecuritization of Trade ReceivablesBhavin PatelОценок пока нет