Академический Документы

Профессиональный Документы

Культура Документы

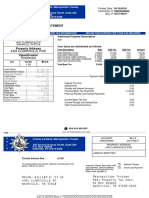

Pre Authorized Payment Application

Загружено:

Stephanie MathersАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pre Authorized Payment Application

Загружено:

Stephanie MathersАвторское право:

Доступные форматы

Amount to be paid prior to registering:

(Please Contact Tax Department for Amount)

Please choose one of the following:

12 Monthly Payments: Start Date: Monthly Payment:

Installments: On required due dates beginning:

Pre-Authorized Payment (PAP) Plan Authorization

Please note: All prior outstanding taxes must be paid. The monthly pre-authorized payment plan begins

on December 1st, for the following year. To join after December 1st, all missed months must be brought

up to date.

This PAP is for: Personal Property Business Property

Property Assessment Roll Number:

Part A – Identification

Name(s):

Property Address:

Phone (Home): Cell Phone:

Phone (Business): Person’s name to contact by phone:

Email Address:

Part B – Bank Account Information

Please attach a “VOID” cheque or personalized deposit slip.

Part C - Authorization

I/We hereby authorize the Municipality of Clarington to debit my/our account for payment of my/our

property taxes on either the 1st day of each month or by installment dates which I/We have indicated in

the selection above. The Municipality of Clarington will inform you in writing prior to any changes in the

amount being deducted.

*** I/We will advise of any changes including enrollment application, bank account or address change,

at least two weeks prior to the next payment.

Authorization is to remain in effect until cancelled by either myself or the Municipality of Clarington by

written notification.

You have certain recourse rights if any debit does not comply with this agreement. For example, you

have the right to receive reimbursement for any debit that is not authorized or is not consistent with this

PAP agreement. To obtain more information on your recourse rights, contact your financial institution or

visit www.cdnpay.ca.

Corporation of the Municipality of Clarington

40 Temperance Street, Bowmanville, ON L1C 3A6 905-623-3379 www.clarington.net

To cancel plan

*** It is the taxpayer’s responsibility (not your lawyer’s) to inform us in writing to stop pre-authorized

payments when property is sold. We will accept cancellations by mail; fax 905-623-4169 or email

tax@clarington.net

You may obtain a sample cancellation form and further information on your right to cancel this

agreement at your financial institution or by visiting www.cdnpay.ca.

I/We acknowledge that I/we have read and understood all the terms and conditions of the Monthly or

Installment Pre-Authorized Tax Payment Plan.

Signature: Date:

Second Signature (if required):

Personal information contained on this form is collected under the authority of the Municipal Act and will

be used to maintain a record of municipal taxes. Questions about this collection should be directed to

the Tax Collector, 40 Temperance Street, Bowmanville, Ontario, L1C 3A6, 905-623-3379.

Corporation of the Municipality of Clarington

40 Temperance Street, Bowmanville, ON L1C 3A6 905-623-3379 www.clarington.net

Pre-Authorized Tax Payment Plan

Introduction

The Municipality of Clarington offers tax payer’s two quick, easy and convenient ways to pay their taxes.

You may choose from Installment due dates or 12 monthly payments. These plans are offered to you

free of administrative charges.

How does the Plan work?

For the Installment Pre-Authorized Plan - Installment amounts will be deducted from the account

provided on the installment dates determined each year by the Tax Collector. Each year, you will

receive your Interim and Final Property Tax Bills which will indicate the amount and installment dates.

For the Monthly Pre-Authorized Plan - Monthly payments will be deducted from the account provided

on the first day of each month commencing each year on December 1, for the following taxation year

for 12 months. You will only receive your final property tax bill in June. Your revised payment schedule

will appear on the front of your tax bill for the months of July to November indicating your equal

payments for the remainder of that calendar year. Your tax bill also shows your payment schedule for

the upcoming tax year which will commence on December 1 until June 1 based on an estimated tax

levy from the previous year.

Regardless of which option you choose, you are automatically enrolled in the program for subsequent

years.

A Monthly withdrawal request not honoured at the bank (i.e. Non-sufficient funds (NSF) or stop

payment etc.) will be subject to a service charge. Your next payment will automatically be increased to

include the dishonoured amount plus the service charge.

An Installment withdrawal request not honoured at the bank (i.e. Non-sufficient funds (NSF) or stop

payment etc.) will be subject to a service charge. It will be the tax payer’s responsibility to make an

alternative method of payment, including the service charge, by the 15th of the following month or the

tax account may be removed from the plan.

If two or more payments (Monthly or Installments) fail to be honoured, The Director of

Finance/Treasurer may revoke continued enrolment in the plan as well as cancel your privilege to

participate in the plan for one (1) year. Tax accounts disqualified from the program shall revert to the

regular installment billing system and be subject to penalty and interest in accordance with Municipal

By-Laws.

If you pay taxes through your mortgage company but wish to join one of our Plans, it is your

responsibility to ask your mortgage company if they will allow you to do so.

The tax department must be notified, in writing, at least 15 days before the next withdrawal for any

changes or cancellations to your PAP and/or banking information.

Corporation of the Municipality of Clarington

40 Temperance Street, Bowmanville, ON L1C 3A6 905-623-3379 www.clarington.net

How do you enroll in the Plan?

1. All prior outstanding taxes must be paid.

2. Complete the “Pre-Authorized Payment Form” which allows the Municipality to automatically

withdraw the applicable monthly/installment payments from your bank, trust company or credit

union account.

3. Submit a void cheque or a personalized pre-authorized debit slip along with your completed

application form to our office via fax 905-623-4169, email to tax@clarington.net or forward to the

Municipality of Clarington, Tax Department, 40 Temperance Street, Bowmanville, ON L1C 3A6.

4. If you wish to join the Monthly Pre-Authorized Payment Plan during the year, please contact Tax

Department.

It is the taxpayer’s responsibility, not your lawyer’s, to inform us in writing to stop the

pre-authorized payment plan at least two weeks before the next payment is processed.

Thank you.

Corporation of the Municipality of Clarington

40 Temperance Street, Bowmanville, ON L1C 3A6 905-623-3379 www.clarington.net

Вам также может понравиться

- University National Bank ("Bank") Refund Transfer Application and AgreementДокумент6 страницUniversity National Bank ("Bank") Refund Transfer Application and AgreementMètrès Rosie-Rose AimableОценок пока нет

- F 9465Документ3 страницыF 9465Pat PlanteОценок пока нет

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredДокумент6 страницNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- Credit Repair Plan B Expedite Agreement 05-13-16Документ9 страницCredit Repair Plan B Expedite Agreement 05-13-16Plan B CRSОценок пока нет

- DR 15 NДокумент8 страницDR 15 Napi-114866560Оценок пока нет

- Feb 2012Документ8 страницFeb 2012Donna J ForgasОценок пока нет

- Estmt - 2016 08 31 PDFДокумент4 страницыEstmt - 2016 08 31 PDFAnonymous dVQ61xYОценок пока нет

- Income Tax Course Manual (2021 T1) PDFДокумент138 страницIncome Tax Course Manual (2021 T1) PDFMrDorakonОценок пока нет

- Nationstar 122016Документ6 страницNationstar 122016kathy bechtleОценок пока нет

- FedLoanServicing - Direct DepositДокумент2 страницыFedLoanServicing - Direct DepositEric Li Cheungtastic100% (1)

- My Statements ControlДокумент4 страницыMy Statements Controlleinad423100% (1)

- Statement Aug 2013Документ10 страницStatement Aug 2013berstuck100% (2)

- County of Riverside Treasurer-Tax Collector Application and Agreement To Enter Into An Installment Payment PlanДокумент1 страницаCounty of Riverside Treasurer-Tax Collector Application and Agreement To Enter Into An Installment Payment PlandeeОценок пока нет

- QC 16161Документ12 страницQC 16161john englishОценок пока нет

- Postponing Bill Payment: Pōst PōnДокумент9 страницPostponing Bill Payment: Pōst PōnwalitedisonОценок пока нет

- eTAX Terms & ConditionsДокумент4 страницыeTAX Terms & ConditionsAccounts100% (1)

- EPCORPaymentPlanApplication EdmontonFortisДокумент3 страницыEPCORPaymentPlanApplication EdmontonFortiskevinatstarburstОценок пока нет

- Bcbs - HCSC IllinoisДокумент2 страницыBcbs - HCSC IllinoisShirley Pigott MDОценок пока нет

- Automatic Payment Agreement 20221215Документ1 страницаAutomatic Payment Agreement 20221215guapacha2001Оценок пока нет

- Claim FormsДокумент4 страницыClaim FormsThaworn ThaweeaphiradeemaitreeОценок пока нет

- CrypTax Engagement LetterДокумент7 страницCrypTax Engagement LetterSloane BrakevilleОценок пока нет

- 2015 Battle Creek Individual Income Tax Forms and InstructionsДокумент24 страницы2015 Battle Creek Individual Income Tax Forms and InstructionsHelpin HandОценок пока нет

- 01-19-2016 PDFДокумент4 страницы01-19-2016 PDFAnonymous 1AcflUxYCОценок пока нет

- LT Bill 05001185713 201601Документ2 страницыLT Bill 05001185713 201601joramОценок пока нет

- Minimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13Документ3 страницыMinimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13nates280100% (1)

- HST Business enДокумент6 страницHST Business enSОценок пока нет

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Документ4 страницыSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313Оценок пока нет

- 11-13-2015 PDFДокумент4 страницы11-13-2015 PDFAnonymous ZgROrLNLCjОценок пока нет

- Property Tax BillДокумент2 страницыProperty Tax BillAnonymous GF8PPILW5Оценок пока нет

- BIR Form 1601 c1Документ2 страницыBIR Form 1601 c1Ver ArocenaОценок пока нет

- Important Information To Include On Your Tax Return Before Sending It To UsДокумент10 страницImportant Information To Include On Your Tax Return Before Sending It To UsChristopherJonesОценок пока нет

- 197 - Excess Contribution and Deposit Correcti..Документ1 страница197 - Excess Contribution and Deposit Correcti..tdrkОценок пока нет

- Your Reliance Bill: Summary of Current Charges Amount (RS.)Документ4 страницыYour Reliance Bill: Summary of Current Charges Amount (RS.)Mohd Farman SajidОценок пока нет

- Application For POSB Loan Assist Plus: Eligibility Important Information To Take NoteДокумент3 страницыApplication For POSB Loan Assist Plus: Eligibility Important Information To Take NoteinabansОценок пока нет

- Card Autopay Request: Section 1 Customer DetailsДокумент3 страницыCard Autopay Request: Section 1 Customer DetailsaksynОценок пока нет

- 2012sep15 2012oct15Документ3 страницы2012sep15 2012oct15nancy1358Оценок пока нет

- 20140118053700Документ3 страницы20140118053700Jalal GogginsОценок пока нет

- LT Bill 48000348869 201602Документ2 страницыLT Bill 48000348869 201602प्रतीक प्रकाशОценок пока нет

- Your Direct Debit For Vehicle Tax Has Been Successfully Set Up / RenewedДокумент3 страницыYour Direct Debit For Vehicle Tax Has Been Successfully Set Up / RenewedDave AsanteОценок пока нет

- Sonia Chassagne: Questions? Go ToДокумент2 страницыSonia Chassagne: Questions? Go Tojaycee chazneОценок пока нет

- 2014sep11 2014oct10Документ3 страницы2014sep11 2014oct10Karen JoyОценок пока нет

- Enrollment Form For Eft BrinkerДокумент2 страницыEnrollment Form For Eft BrinkerSusanaОценок пока нет

- November 07, 2016 PDFДокумент8 страницNovember 07, 2016 PDFChristine HogueОценок пока нет

- Interest Rates and Interest ChargesДокумент9 страницInterest Rates and Interest ChargesCesar LazaroОценок пока нет

- Direct Debit Form 200010-2259-A4Документ2 страницыDirect Debit Form 200010-2259-A4bluffboy55Оценок пока нет

- Please Affix Stamp HereДокумент4 страницыPlease Affix Stamp HereleomhorОценок пока нет

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS.)Документ5 страницYour Reliance Communications Bill: Summary of Current Charges Amount (RS.)amritabhosleОценок пока нет

- NDR 2022 To 23 Bill Back AFДокумент1 страницаNDR 2022 To 23 Bill Back AFJames William GregoryОценок пока нет

- Discover Statement 20150825 5843Документ6 страницDiscover Statement 20150825 5843teudyОценок пока нет

- The City of Calgary: Tax Installment Payment PlanДокумент2 страницыThe City of Calgary: Tax Installment Payment PlanMykel VelasquezОценок пока нет

- How To Request Direct DepositДокумент1 страницаHow To Request Direct DepositalithebigbossОценок пока нет

- Account Activity: Mar 18-Apr 19, 2011Документ3 страницыAccount Activity: Mar 18-Apr 19, 2011Yusuf OmarОценок пока нет

- Statement Apr 2012Документ14 страницStatement Apr 2012ksj5368100% (2)

- PricingДокумент3 страницыPricingapi-285145795Оценок пока нет

- TIPP Application VXHДокумент1 страницаTIPP Application VXHyofuckinmamaОценок пока нет

- STMNT 112013 9773Документ3 страницыSTMNT 112013 9773redbird77100% (1)

- Bill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Документ4 страницыBill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Ashish NaikОценок пока нет

- Company Account Opening Branch Account NoДокумент16 страницCompany Account Opening Branch Account Nosaw hung yeatОценок пока нет

- Petty Cash TestДокумент6 страницPetty Cash TestEhsan Elahi100% (4)

- Chapter 6 - Revenue Recognition IssuesДокумент3 страницыChapter 6 - Revenue Recognition Issuessablu khanОценок пока нет

- MF0012 - Summer 2014Документ2 страницыMF0012 - Summer 2014Rajesh SinghОценок пока нет

- Big GroupДокумент31 страницаBig Groupvanita kunnoОценок пока нет

- TFW Application Forms NEW - 20210809102815Документ5 страницTFW Application Forms NEW - 20210809102815doney PhilipОценок пока нет

- Excel RepublicДокумент4 страницыExcel RepublicAlfia safraocОценок пока нет

- RR 10-76Документ4 страницыRR 10-76cheska_abigail950Оценок пока нет

- Ingenico Telium Guide enДокумент7 страницIngenico Telium Guide enhanzwyОценок пока нет

- Bank DocumentДокумент1 страницаBank DocumentgolamsadequeОценок пока нет

- Basics of LCДокумент26 страницBasics of LCRidhesh RaoОценок пока нет

- PreviewДокумент4 страницыPreviewandrealhepburnОценок пока нет

- Solution Capital StatementДокумент10 страницSolution Capital StatementhilmanОценок пока нет

- Sep 22Документ1 страницаSep 22austin LevisОценок пока нет

- 20 2023 12 03 05 PMДокумент4 страницы20 2023 12 03 05 PMChidinma NnoliОценок пока нет

- Tan vs. Del Rosario, JRДокумент5 страницTan vs. Del Rosario, JRAnonymous KgOu1VfNyBОценок пока нет

- Kaplan - Exam Tips For Paper F5Документ10 страницKaplan - Exam Tips For Paper F5Daniyal Raza KhanОценок пока нет

- BVP Order Form - Google - 16042021Документ1 страницаBVP Order Form - Google - 16042021Janelyn GarinОценок пока нет

- Tax Invoice: Excitel Broadband Pvt. LTDДокумент1 страницаTax Invoice: Excitel Broadband Pvt. LTDSeema BhagatОценок пока нет

- Lesco - Web BillДокумент1 страницаLesco - Web BillRai SahibОценок пока нет

- Wa0024.Документ9 страницWa0024.revathirajakrishnanОценок пока нет

- Invoice DocumentДокумент1 страницаInvoice DocumentALL IN ONEОценок пока нет

- Tax Code FTXPДокумент12 страницTax Code FTXPロドリゲスマルセロОценок пока нет

- Chartered Accountant 2 0Документ3 страницыChartered Accountant 2 0RkОценок пока нет

- THURONYI, Victor. Comparative Tax LawДокумент400 страницTHURONYI, Victor. Comparative Tax LawChristiano Valente100% (1)

- T24 TellerДокумент57 страницT24 TellerJaya NarasimhanОценок пока нет

- 02ib - Bozza FT 20-06E - Lame 2Документ1 страница02ib - Bozza FT 20-06E - Lame 2Gáry IbntrОценок пока нет

- Taxation Review: General PrinciplesДокумент175 страницTaxation Review: General Principlessha marananОценок пока нет

- Affidavit of Exempt Sale StandardДокумент2 страницыAffidavit of Exempt Sale StandardAnna AtienzaОценок пока нет

- Status Update: Features of CREATEДокумент18 страницStatus Update: Features of CREATEMarkie GrabilloОценок пока нет