Академический Документы

Профессиональный Документы

Культура Документы

Preference Shares - September 22 2019

Загружено:

Tiso Blackstar Group0 оценок0% нашли этот документ полезным (0 голосов)

1 просмотров1 страницаPreference Shares - September 22 2019

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPreference Shares - September 22 2019

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

1 просмотров1 страницаPreference Shares - September 22 2019

Загружено:

Tiso Blackstar GroupPreference Shares - September 22 2019

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

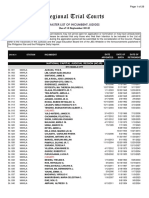

Markets and Commodity figures

22 September 2019

Company Close (cents)

Day move (cents)

Day move (%)

High Low Volume trade

12m

(000)

% move12m high 12m low Market cap Yield

(R'm) P/E ratio

KRUGER RANDS 0 0 0 0 0 0 0 0 0 0 0 0 0

KR 2300000 0 0 0 0 0 29.2 2510000 1735000 0 0 0 0

KRHALF 805001 0 0 0 0 0 -5.3 850000 800000 0 0 0 0

KRQRTR 400000 0 0 0 0 0 -3.6 400000 400000 0 0 0 0

KRTENTH 160000 0 0 0 0 0 0 160000 160000 0 0 0 0

EXCHANGE TRADED PRODUCTS

0 0 0 0 0 0 0 0 0 0 0 0 0

2YRDOLLARCST 149790 2665 1.8 149790 149790 0 4.7 155690 132510 67.7 0 0 0.8

AFRICAGOLD 22087 437 2 22087 21805 0 28.4 23481 16385 151.6 0 0 0

AFRICAPALLAD 24101 768 3.3 24307 23862 8 60.7 24307 12022 3217.6 0 0 0

AFRICAPLATIN 13862 308 2.3 13862 13660 0 16.9 16000 10620 2107.6 0 0 0

AFRICARHODIU 75516 4190 5.9 75516 72000 1 110.3 75516 22222 407 0 0 0

AGLSBR 12 -1 -7.7 12 12 0 -57.1 33 11 13 0 0 0

AMIBIG50EX-S 1270 6 0.5 1270 1256 0 -4.5 3232 1195 21.8 0 0 0

AMIRLSTTEX-S 4126 -1 0 4126 4126 0 -6.2 6900 1998 1.2 0 0 0

ANGSBV 2 -1 -33.3 2 2 0 -92 25 2 3 0 0 0

ANGSBW 13 -2 -13.3 14 12 385 0 29 5 15 0 0 0

ANGSBX 31 -2 -6.1 31 31 0 6.9 36 29 33 0 0 0

ASHBURTONGBL 4817 94 2 4830 4735 2 3.4 4999 3754 559.6 0 0 1.6

ASHBURTONINF 2028 0 0 2028 2026 0 0.5 2143 1918 325.2 0 0 2.6

ASHBURTONMID 703 7 1 709 696 81 1.4 759 636 355 0 0 2.1

ASHBURTONTOP 5097 23 0.5 5113 5082 50 -0.2 5576 4367 1536.8 0 0 1.8

ASHBURTONWOR 757 13 1.7 761 750 6 7.1 801 603 120 0 0 0.8

BHPSBP 4 0 0 4 4 0 -87.1 31 4 4 0 0 0

CORE DIVTRAX 2533 -8 -0.3 2543 2513 14 -8.2 2797 2309 301.3 0 0 1.3

CORE GLPROP 4082 72 1.8 4082 4014 10 9.3 4173 3330 493.3 0 0 2.6

CORE PREF 954 6 0.6 957 943 6 11.3 965 816 344.5 0 0 6.4

CORE S&P500 4529 87 2 4546 4443 10 5.9 4561 3500 879.9 0 0 1.2

CORE SAPY 4883 8 0.2 4908 4838 2 -9.3 5460 4684 152.5 0 0 8.5

CORE TOP50 2280 10 0.4 2280 2261 2 -2.7 2421 2041 1397.9 0 0 2

CORESHARESGL 1313 23 1.8 1316 1295 53 7.9 1316 1065 454.7 0 0 1.3

CORESHARESPR 1530 8 0.5 1539 1506 4 -8.9 1732 1449 260.9 0 0 9.1

CORESHARESSC 4515 19 0.4 4531 4515 3 -3.6 4787 4208 121.6 0 0 1.8

DOLLARCSTDL 151610 2785 1.9 151610 151610 0 13.6 159000 125465 126.5 0 0 1.3

EXXSBT 10 -2 -16.7 10 10 0 -67.7 32 7 12 0 0 0

FSRSBW 20 2 11.1 20 20 0 -35.5 43 17 18 0 0 0

GFISBR 25 -4 -13.8 26 25 15 -21.9 35 11 29 0 0 0

HARSBU 4 0 0 4 4 0 -86.2 29 4 4 0 0 0

HARSBV 35 -2 -5.4 35 35 0 9.4 39 32 37 0 0 0

IMPSBT 14 -2 -12.5 14 14 71 -54.8 35 14 16 0 0 0

IMPSBU 20 -2 -9.1 20 20 0 -9.1 26 20 22 0 0 0

KIOSBV 4 0 0 4 4 0 -87.1 32 3 4 0 0 0

KIOSBW 24 -2 -7.7 24 24 0 -25 44 16 26 0 0 0

KRCSTDLCRTFC 2317900 44300 1.9 2317900 2317900 0 26.6 2443450 1150398 756.3 0 0 0

MTNSBQ 17 -1 -5.6 17 17 0 -46.9 34 17 18 0 0 0

NEWFUNDSEQUI 3556 19 0.5 3556 3540 1 22.1 3632 2500 187.1 0 0 2.8

NEWFUNDSGOVI 6678 85 1.3 6710 6599 45 12 6999 5790 908.2 0 0 7.8

NEWFUNDSILBI 6853 4 0.1 6853 6818 0 3 6988 6555 61.6 0 0 2.6

NEWFUNDSMAPP 2178 6 0.3 2178 2167 1 1.8 2294 1610 39.2 0 0 2.7

NEWFUNDSNEWS 4843 -6 -0.1 4844 4842 0 -1.6 5318 4258 37.5 0 0 1.8

NEWFUNDSS&P 3083 -59 -1.9 3097 3083 0 -17.2 3774 2798 41.5 0 0 4.6

NEWFUNDSSHAR 316 3 1 316 316 0 -4 350 270 48.8 0 0 2.4

NEWFUNDSSWIX 1734 -6 -0.3 1734 1724 1 0.5 1860 1517 23.5 0 0 1.2

NEWFUNDSTRAC 2579 1 0 2581 2577 8 7.2 2599 2399 214.4 0 0 5.9

NEWGOLD 13789 337 2.5 13841 13600 197 17 14330 10536 13774.8 0 0 0

NEWGOLDISSUE 21170 426 2.1 21213 20784 91 28.6 22570 15742 14371 0 0 0

NEWGOLDPLLDM 24132 926 4 24132 23650 71 61 24132 14500 1063.9 0 0 0

NFEQUITYVALU 925 -1 -0.1 925 925 0 -6.8 1038 876 111.3 0 0 2.8

NFLOWVLTLTY 1071 4 0.4 1071 1071 0 5 1072 907 124.3 0 0 2

NFVMDFNSV 957 0 0 957 957 0 0 997 939 49.6 0 0 1.4

NFVMHIGH 1017 10 1 1017 1017 0 7.1 1025 917 54.1 0 0 1.3

NFVMMDRT 971 4 0.4 971 970 5 0 981 879 53.8 0 0 1.2

NPNSBY 11 -1 -8.3 11 11 0 -65.6 44 9 12 0 0 0

NPNSBZ 34 -2 -5.6 34 34 0 -2.9 36 34 36 0 0 0

PRXSBP 34 -1 -2.9 34 34 0 -8.1 37 34 35 0 0 0

SATRIX40PRTF 5098 23 0.5 5114 5066 53 -0.9 5375 4400 8703.2 0 0 1.7

SATRIXDIVIPL 246 1 0.4 248 243 329 2.5 267 224 1644.9 0 0 1.3

SATRIXFINI 1632 -27 -1.6 1690 1623 53 -3.1 1811 1437 772 0 0 4

SATRIXILBI 576 0 0 579 573 19 2.5 601 552 92.2 0 0 2.9

SATRIXINDI 7029 59 0.8 7036 6980 12 -0.8 7299 6090 1884.6 0 0 1.3

SATRIXMMNTM 1053 4 0.4 1053 1046 14 10.8 1095 906 24.2 0 0 0.2

SATRIXMSCI 4403 68 1.6 4403 4341 105 6.1 4528 3350 2213.9 0 0 0

SATRIXMSCIEM 4112 71 1.8 4112 4045 6 3 4237 3557 572.7 0 0 0

SATRIXNASDAQ 6614 78 1.2 6614 6535 10 8.6 6689 4896 517.7 0 0 0

SATRIXPRTFL 1510 26 1.8 1510 1480 13 -16.1 1900 1401 231.1 0 0 5.2

SATRIXQLTY 829 3 0.4 835 829 0 -0.5 930 746 137.4 0 0 3

SATRIXRAFI40 1461 3 0.2 1473 1447 7 1.1 1554 1261 1010.1 0 0 1.9

SATRIXRESI 4534 58 1.3 4534 4466 29 -0.2 5002 3709 375.4 0 0 1.4

SATRIXS&P500 4454 67 1.5 4465 4379 39 8.1 4496 3406 700.8 0 0 0

SATRIXSWIXTO 1082 2 0.2 1084 1076 45 -2 1180 954 381.4 0 0 1.7

SBKSBQ 8 1 14.3 8 8 0 -77.8 37 5 7 0 0 0

SGLSBR 4 -1 -20 4 4 0 -83.3 24 4 5 0 0 0

SGLSBS 13 -2 -13.3 13 12 1354 -51.9 29 9 15 0 0 0

SGLSBT 37 -5 -11.9 37 36 200 5.7 49 28 42 0 0 0

SHPSBR 62 1 1.6 62 62 0 93.8 92 22 61 0 0 0

SOLSBS 47 -1 -2.1 47 47 0 67.9 76 24 48 0 0 0

STANLIB 4735 6 0.1 4739 4678 0 -9.6 6485 4529 95.3 0 0 9

STANLIBBOND 7149 -30 -0.4 7171 7149 0 3.5 7262 6887 7.2 0 0 0

STANLIBG7GOV 8449 143 1.7 8449 8314 0 10.7 8930 7125 13.4 0 0 1.6

STANLIBGLOBA 2103 38 1.8 2106 2061 0 11.9 2250 1658 66 0 0 3.9

STANLIBMSCI 4313 -17 -0.4 4313 4313 0 3.9 4545 3473 85 0 0 0

STANLIBS&P50 22332 340 1.5 22399 22177 0 8.4 23098 15318 18.7 0 0 0

STANLIBSWIX4 1077 2 0.2 1077 1077 0 -3.9 1164 905 1848.3 0 0 1.4

STANLIBTOP40 5073 24 0.5 5073 5073 0 -0.4 5353 4305 1088 0 0 2.1

SYGNIAITRIX 2747 30 1.1 2749 2715 22 5.5 2791 1985 718.2 0 0 0.1

SYGNIAITRIXG 4222 68 1.6 4222 4189 8 11.7 4390 3400 305.4 0 0 1.1

SYGNIAITRIXS 4562 68 1.5 4568 4517 19 7.5 4822 3505 1084.9 0 0 1.4

SYGNIAITRIXT 5110 22 0.4 5110 5110 0 0.1 5397 4218 213.7 0 0 2.8

TOPSBT 14 -1 -6.7 14 12 1671 -39.1 46 9 15 0 0 0

TOPSBU 10 0 0 10 10 0 -58.3 24 7 10 0 0 0

TOPSBV 22 -1 -4.3 22 21 350 0 45 16 23 0 0 0

TOPSKP 375 -24 -6 391 369 3 0 576 12 399 0 0 0

TOPSKR 894 -25 -2.7 894 894 0 42.6 1396 585 919 0 0 0

TOPSKS 1075 -26 -2.4 1075 1075 0 32.7 1584 772 1101 0 0 0

TOPSKT 0 0 0 0 0 0 0 0 0 0 0 0 0

TOPSKX 17 0 0 0 0 0 0 1666 17 17 0 0 0

TOPSKZ 753 -27 -3.5 753 731 10 0 1295 32 780 0 0 0

DEBT 0 0 0 0 0 0 0 0 0 0 0 0 0

AECI5,5% 1300 0 0 1300 1300 0 -7.1 1400 1275 39 0 0 7.8

AFRICANOVER 1000 0 0 0 0 0 -4.9 1000 1000 2.8 0 0 1.2

BARWORLD6%PR 123 0 0 0 0 0 1.7 123 123 0.5 0 0 9.8

CAPITEC-P 10700 0 0 0 0 0 23.7 10990 8650 88.2 0 0 7.9

CAXTON-P 16000 0 0 0 0 0 -13.5 19000 16000 8 0 0 3.1

DISC-B-P 9325 25 0.3 9325 9325 6 12.3 10000 8160 744 0 0 10.9

FIRSTRANDB-P 8425 45 0.5 8425 8380 12 8 9100 7700 3771 0 0 9.1

FOSCHINI 126 0 0 0 0 0 1.6 126 124 0.3 0 0 10.3

GRINDRODPREF 7500 200 2.7 7500 7400 6 6.8 9000 6960 540.2 0 0 11.9

IBRDMBLPRF1 101210 0 0 0 0 0 -0.1 101723 100279 345.9 0 0 5.6

INVESTEC 8400 550 7 8600 8150 5 15.1 9500 7252 1212.6 0 0 10

INVESTECPREF 8800 0 0 0 0 0 -13.7 11100 8500 242.4 0 0 3.5

INVICTA-P 8000 0 0 0 0 0 3.1 9450 7750 600 0 0 13.7

LIBERTY11C 107 0 0 0 0 0 -0.9 145 98 16.1 0 0 10.3

NAMPAK6%PREF 126 0 0 0 0 0 4.1 126 120 0.5 0 0 9.5

NAMPAK6,5%PR 131 0 0 0 0 0 18 131 121 0.1 0 0 9.9

NEDBANKPREF 941 11 1.2 945 940 145 10.8 1000 848 3332 0 0 9

NETCAREPREF 8050 0 0 0 0 0 10.3 8350 7113 523.3 0 0 10.3

PSGSERV 8175 115 1.4 8175 8175 0 17.5 9500 6950 1403.7 0 0 10.4

RECMANDCLBR 1522 0 0 1580 1522 257 -18.2 1885 1520 721.4 0 0 0

REXTRFRM 130 0 0 0 0 0 -35 130 121 0.2 0 0 9.2

SASFIN-P 7600 0 0 0 0 0 7 8000 6900 136.6 0 0 10.9

STANDARD-P 8665 -10 -0.1 8690 8665 17 9.8 9050 7820 4596.2 0 0 9

STD 71 0 0 71 71 0 2.9 308 68 5.7 0 0 9.2

STEINHOFF-P 4401 0 0 0 0 0 0 0 0 660.2 0 0 9.5

ZAMBEZIRF 7620 0 0 7700 7620 4 24.9 7800 5900 12184.8 0 0 0

OTHER 0 0 0 0 0 0 0 0 0 0 0 0 0

ABSA 97291 -116 -0.1 97291 97291 0 0 98929 80210 25 0 0 0

INVLTD 1077355 1179 0.1 1077355 1077355 0 -4.3 1150676 1021254 11.8 0 0 0

UBSELECA01NV 9397 -64 -0.7 9397 9397 0 -6 10361 8488 473.1 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

UBSELECA01NV 8573 -12 -0.1 8573 8573 0 -14.3 10361 8573 429.3 0 0 0

UBSELECA01NV 8792 131 1.5 8792 8792 0 -12.1 10361 8622 433.1 0 0 0

UBSELECB01NV 8644 -241 -2.7 8644 8644 0 -13.6 10428 8644 133.3 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

DBMSCIAFETN 11325 75 0.7 11325 11325 0 3.4 12250 10745 2250 0 0 0

DBMSCICHETN 7623 88 1.2 7623 7450 1 16 41275 6022 1507 0 0 0

DBMSCIEMETN 6347 22 0.3 6347 6250 0 7 47325 5700 1265 0 0 0

FRKBONDGOLD 1720600 -22900 -1.3 1720600 1720600 0 1.3 1942200 1612300 2434.3 0 0 0

FRSFRPT9JUN1 115500 500 0.4 115500 115500 0 -6.3 138800 110700 846 0 0 0

GOLDCMMDTY-L 17986 -194 -1.1 18079 17939 0 -0.6 20534 16911 181.8 0 0 0

IBLUSDZAROCT 134740 -1916 -1.4 134740 134740 0 3.3 145570 116000 478.3 0 0 0.9

IBSWX40TR2ET 18655 281 1.5 18655 18655 0 -0.8 20256 1 918.7 0 0 0

IBTOP40CLIQU 123962 -74 -0.1 123962 123962 0 4.1 130581 119103 1.2 0 0 0

IBTOP40TR2ET 7360 112 1.5 7360 7360 0 0.1 7819 1 924.1 0 0 0

IBVR1ETN 127893 22 0 127893 127893 10 6.8 127893 119796 2129.1 0 0 0

NEWWAVEETN 11088 66 0.6 11088 11088 0 -6.4 13515 10267 23 0 0 0

NEWWAVEEUROE 1560 -22 -1.4 1565 1554 0 3.2 1706 1422 51.5 0 0 0

NEWWAVEGBPET 1752 -21 -1.2 1752 1752 0 3.6 1911 1615 128.7 0 0 0.1

ZA084 77700 0 0 0 0 0 0 0 0 108.8 0 0 0

ASSET BACKED SECURITIES

0 0 0 0 0 0 0 0 0 0 0 0 0

ADBEE(RF) 4815 -80 -1.6 4895 4815 2 45.8 5200 3100 1265 0 0 0

DBGLOBE 19739 0 0 0 0 0 0 0 0 2 0 0 0

DBHAVEN 31452 0 0 0 0 0 0 0 0 3.1 0 0 0

DBMSCIAFETN 11274 6 0.1 11274 11274 0 2.9 55585 8018 2253.6 0 0 0

DBMSCICHETN 6894 47 0.7 6894 6880 0 26.8 7497 5038 1369.4 0 0 0

DBMSCIEMETN 6027 5 0.1 6027 6005 0 16.3 6300 4237 1204.4 0 0 0

FRKBONDGOLD 1774000 -13800 -0.8 1774000 1774000 0 -5.4 1988900 1611900 2496.1 0 0 0

FRSFRPT9JUN1 132050 -400 -0.3 132050 132050 0 -12.1 155600 65901 974.4 0 0 0

GOLDCMMDTY-L 18889 -134 -0.7 18946 18889 0 13 21485 16711 190.2 0 0 0

IBETNT1CT46 1389135 0 0 0 0 0 0.1 1403037 1385563 48.6 0 0 0

IBGOLDENETN 12654 -25 -0.2 12654 12654 0 -18.6 17000 1 352.2 0 0 0

IBLUSDZAROCT 132475 -725 -0.5 132475 132475 0 -1.2 144142 125059 466.2 0 0 0

IBSWX40TRI 17697 32 0.2 17697 17697 0 5.7 17941 12618 883.3 0 0 0

SILVERCOMMOD 14894 -77 -0.5 14894 14894 0 -26.2 22935 13989 74.9 0 0 0

SBCOPPERETN 1329 -4 -0.3 1329 1329 0 8 1439 911 133.3 0 0 0

SBCORNETN 820 -46 -5.3 820 820 0 -16.2 979 765 43.3 0 0 0

SBWHEATETN 764 -41 -5.1 764 764 0 -10.7 856 618 40.3 0 0 0

SBWTIOIL 830 -1 -0.1 830 830 0 -20 1124 750 290.9 0 0 0

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Вам также может понравиться

- Preference Shares - September 11 2019Документ1 страницаPreference Shares - September 11 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 16 2019Документ1 страницаPreference Shares - September 16 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - September 17 2019Документ1 страницаPreference Shares - September 17 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 15 2019Документ1 страницаPreference Shares - September 15 2019Anonymous yid6usiNОценок пока нет

- Preference Shares - October 3 2019Документ1 страницаPreference Shares - October 3 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 26 2019Документ1 страницаPreference Shares - September 26 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 9 2019Документ1 страницаPreference Shares - September 9 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - October 2 2019Документ1 страницаPreference Shares - October 2 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 2 2019Документ1 страницаPreference Shares - September 2 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 7 2019Документ1 страницаPreference Shares - August 7 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - August 28 2019Документ1 страницаPreference Shares - August 28 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - July 16 2019Документ1 страницаPreference Shares - July 16 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 6 2019Документ1 страницаPreference Shares - August 6 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 27 2019Документ1 страницаPreference Shares - August 27 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - March 24 2019Документ1 страницаPreference Shares - March 24 2019Anonymous 7A1d7fjj3Оценок пока нет

- PreferenceShares - June 27 2018Документ1 страницаPreferenceShares - June 27 2018Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 5 2019Документ1 страницаPreference Shares - August 5 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 19 2019Документ1 страницаPreference Shares - August 19 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - August 12 2019Документ1 страницаPreference Shares - August 12 2019Tiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - October 25 2019Документ1 страницаPreference Shares - October 25 2019Anonymous MZp9gEGg6Оценок пока нет

- Preference Shares - September 1 2019Документ1 страницаPreference Shares - September 1 2019Anonymous 6g229lSxОценок пока нет

- PreferenceShares PDFДокумент1 страницаPreferenceShares PDFTiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - April 11 2018Документ1 страницаPreference Shares - April 11 2018Tiso Blackstar GroupОценок пока нет

- Preference Shares - July 31 2019Документ1 страницаPreference Shares - July 31 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - July 18 2019Документ1 страницаPreference Shares - July 18 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - August 14 2019Документ1 страницаPreference Shares - August 14 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - June 11 2018Документ1 страницаPreference Shares - June 11 2018Tiso Blackstar GroupОценок пока нет

- Preference Shares - August 13 2019Документ1 страницаPreference Shares - August 13 2019Tiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - March 25 2019Документ1 страницаPreference Shares - March 25 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - July 27 2018Документ1 страницаPreference Shares - July 27 2018Tiso Blackstar GroupОценок пока нет

- Preference Shares - October 9 2019Документ1 страницаPreference Shares - October 9 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - May 26 2019Документ1 страницаPreference Shares - May 26 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - July 23 2019Документ1 страницаPreference Shares - July 23 2019Tiso Blackstar GroupОценок пока нет

- PreferenceShares - March 22 2018Документ1 страницаPreferenceShares - March 22 2018Tiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - July 29 2019Документ1 страницаPreference Shares - July 29 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - March 26 2019Документ1 страницаPreference Shares - March 26 2019Tiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - February 27 2018Документ1 страницаPreference Shares - February 27 2018Tiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - September 27 2017Документ1 страницаPreference Shares - September 27 2017Tiso Blackstar GroupОценок пока нет

- Preference Shares - June 19 2017Документ1 страницаPreference Shares - June 19 2017Tiso Blackstar GroupОценок пока нет

- Preference Shares - September 6 2019Документ1 страницаPreference Shares - September 6 2019Anonymous ZXo7Xf4Оценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - August 19 2019Документ1 страницаPreference Shares - August 19 2019Lisle Daverin BlythОценок пока нет

- Preference Shares - June 3 2019Документ1 страницаPreference Shares - June 3 2019Lisle Daverin BlythОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - July 7 2019Документ1 страницаPreference Shares - July 7 2019Anonymous io6Sv9mF9yОценок пока нет

- PreferenceSharesДокумент1 страницаPreferenceSharesTiso Blackstar GroupОценок пока нет

- Preference Shares - March 27 2019Документ1 страницаPreference Shares - March 27 2019Tiso Blackstar GroupОценок пока нет

- Preference Shares - July 14 2019Документ1 страницаPreference Shares - July 14 2019Anonymous C13oy8Оценок пока нет

- PreferenceShares - February 22 2018Документ1 страницаPreferenceShares - February 22 2018Tiso Blackstar GroupОценок пока нет

- Preference Shares - July 30 2018Документ1 страницаPreference Shares - July 30 2018Tiso Blackstar GroupОценок пока нет

- Government Publications: Key PapersОт EverandGovernment Publications: Key PapersBernard M. FryОценок пока нет

- Metals - September 18 2019Документ1 страницаMetals - September 18 2019Anonymous MPsxhBОценок пока нет

- Liberty - September 18 2019Документ1 страницаLiberty - September 18 2019Anonymous MPsxhBОценок пока нет

- Fuel Prices - September 18 2019Документ1 страницаFuel Prices - September 18 2019Anonymous MPsxhBОценок пока нет

- Forward Rates - September 18 2019Документ2 страницыForward Rates - September 18 2019Anonymous MPsxhBОценок пока нет

- Fixed Deposits - September 18 2019Документ1 страницаFixed Deposits - September 18 2019Anonymous MPsxhBОценок пока нет

- Cross Rates - September 18 2019Документ1 страницаCross Rates - September 18 2019Anonymous MPsxhBОценок пока нет

- Bonds - September 18 2019Документ3 страницыBonds - September 18 2019Anonymous MPsxhBОценок пока нет

- Africa Investor - September 18 2019Документ4 страницыAfrica Investor - September 18 2019Anonymous MPsxhBОценок пока нет

- Malta in A NutshellДокумент4 страницыMalta in A NutshellsjplepОценок пока нет

- Nissan Leaf - The Bulletin, March 2011Документ2 страницыNissan Leaf - The Bulletin, March 2011belgianwafflingОценок пока нет

- Benetton (A) CaseДокумент15 страницBenetton (A) CaseRaminder NagpalОценок пока нет

- Report of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Документ42 страницыReport of The Committee On Regulatory Regime For Trees Grown On Private Land Nov 2012Ravi Shankar KolluruОценок пока нет

- Revenue Procedure 2014-11Документ10 страницRevenue Procedure 2014-11Leonard E Sienko JrОценок пока нет

- Measuring The Economy TciДокумент2 страницыMeasuring The Economy Tciapi-261761091Оценок пока нет

- Regional Trial Courts: Master List of Incumbent JudgesДокумент26 страницRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaОценок пока нет

- A Study On Green Supply Chain Management Practices Among Large Global CorporationsДокумент13 страницA Study On Green Supply Chain Management Practices Among Large Global Corporationstarda76Оценок пока нет

- Presentation NGOДокумент6 страницPresentation NGODulani PinkyОценок пока нет

- Posting Journal - 1-5 - 1-5Документ5 страницPosting Journal - 1-5 - 1-5Shagi FastОценок пока нет

- Ram Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaДокумент12 страницRam Kumar Mishra, Geeta Potaraju, and Shulagna Sarkar - Corporate Social Responsibility in Public Policy - A Case of IndiaShamy Aminath100% (1)

- TIPS As An Asset Class: Final ApprovalДокумент9 страницTIPS As An Asset Class: Final ApprovalMJTerrienОценок пока нет

- Competition Act: Assignment ONДокумент11 страницCompetition Act: Assignment ONSahil RanaОценок пока нет

- The Relevance of Sales Promotion To Business OrganizationsДокумент40 страницThe Relevance of Sales Promotion To Business OrganizationsJeremiah LukiyusОценок пока нет

- Legal Agreement LetterДокумент1 страницаLegal Agreement LetterJun RiveraОценок пока нет

- Traffic Problem in Chittagong Metropolitan CityДокумент2 страницыTraffic Problem in Chittagong Metropolitan CityRahmanОценок пока нет

- 4 P'sДокумент49 страниц4 P'sankitpnani50% (2)

- Patent Trolling in IndiaДокумент3 страницыPatent Trolling in IndiaM VridhiОценок пока нет

- Seller Commission AgreementДокумент2 страницыSeller Commission AgreementDavid Pylyp67% (3)

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFДокумент10 страниц3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlОценок пока нет

- L&T 2017-18 Annual Report AnalysisДокумент3 страницыL&T 2017-18 Annual Report AnalysisAJAY GUPTAОценок пока нет

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSДокумент8 страницMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnОценок пока нет

- BIR Form 1707Документ3 страницыBIR Form 1707catherine joy sangilОценок пока нет

- Sample Business ProposalДокумент10 страницSample Business Proposalvladimir_kolessov100% (8)

- Final - APP Project Report Script 2017Документ9 страницFinal - APP Project Report Script 2017Jhe LoОценок пока нет

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaДокумент12 страницReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryОценок пока нет

- HPAS Prelims 2019 Test Series Free Mock Test PDFДокумент39 страницHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurОценок пока нет

- The Making of A Global World 1Документ6 страницThe Making of A Global World 1SujitnkbpsОценок пока нет

- Arithmetic of EquitiesДокумент5 страницArithmetic of Equitiesrwmortell3580Оценок пока нет

- RMC 46-99Документ7 страницRMC 46-99mnyng100% (1)