Академический Документы

Профессиональный Документы

Культура Документы

12 Accountancy Lyp 2014 Compt Outside Delhi Set3

Загружено:

Ashish GangwalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

12 Accountancy Lyp 2014 Compt Outside Delhi Set3

Загружено:

Ashish GangwalАвторское право:

Доступные форматы

Question

Paper 2014 Compt. Outside Delhi set 3

CBSE Class 12 ACCOUNTANCY

General Instruction:

(i) This question paper contains three parts A, B and C.

(ii) Part A is compulsory for all candidates.

(iii) Candidates can attempt only one part of the remaining part B and C.

(iv) All parts of the questions should be attempted at one place.

PART – A

(Accounting for Partnership Firms and Companies)

1. What is meant by over-subscription? (1)

2. Give the meaning of a ‘Bond’. (1)

3. Identify a situation for the compulsory dissolution of a partnership firm. (1)

4. Name the accounts which are maintained for the partners when capitals of the partners

are fixed. (1)

5. List any two items that need adjustments in books of accounts of a firm at the time of

admission of a partner. (1)

6. What is meant by ‘paid up capital’? (1)

7. What is meant by sacrificing ratio? (1)

8. Mukesh and Ramesh are partners sharing profits and losses in the ratio of 2 : 1

respectively. They admit Rupesh as partner with 1/4 share in profits with guarantee that his

share of profit shall be at least Rs. 55,000. The net profit of the firm for the year ending 31st

March, 2013 was Rs. 1,60,000. Prepare Profit and Loss Appropriation Account. (3)

Material downloaded from myCBSEguide.com. 1 / 11

9. P Ltd. redeemed 10,000, 8% debentures of Rs. 100 each which were issued at par, by

converting them into equity shares of Rs. 100 each issued at a premium of 25%.

Pass necessary journal entries in the books of P Ltd. (3)

10. Fena Ltd. issued Rs. 7,00,000 12% debentures of Rs. 100 each at a premium of 5%

redeemable at a premium of 20%. Pass necessary journal entries at the time of issue of

debentures. (3)

11. X Ltd. purchased a running business from G Ltd. for a sum of Rs. 18,00,000 payable by

issue of equity shares of Rs. 100 each at a premium of Rs. 20 per share. The assets and

liabilities consisted of the following:

Plant – Rs. 3,50,000: Land – Rs. 6,00,000

Stock – Rs. 4,50,000 and Creditors – Rs. 1,00,000

Pass necessary journal entries in the books of X Ltd. for the above transactions. (4)

12. Priya and Divya were partners in a firm sharing profits in the ratio of 7 : 3 respectively.

Their capitals were Rs. 1,60,000 and Rs. 1,00,000 respectively. They admitted Hina in the firm

on 1st January, 2013 as a new partner for 1/5 share in the future profits. Hina brought <

1,20,000 as her capital. Calculate the value of goodwill of the firm and record necessary

journal entries on Hina’s admission. (4)

13. (a) K, L and Z are partners sharing profits in the ratio of 4 : 3 : 2 respectively. L retired

and surrendered 1/9th of his share of profit to K and remaining in favour of Z. Calculate the

new profit sharing ratio of K and Z.( 4)

(b) Arun, Varun and Charan are partners sharing profits in the ratio of 1/2, 3/10 and 1/5

respectively. Varun retired from the firm and Arun and Charan decided to share future

profits in 3 : 2 ratio. Calculate gaining ratio of Arun and Charan.

14. B Ltd. was registered with an authorised capital of Rs. 20,00,000 divided into equity

shares of Rs. 10 each. The company invited applications for the issue of 1,00,000 shares.

Applications for 96,000 shares were received. All calls were made and were duly received

except the final call of Rs. 2 per share on 2,000 shares. All these shares were forfeited and

later on re-issued at Rs. 18,000 as fully paid. (4)

Material downloaded from myCBSEguide.com. 2 / 11

(i) Show how ‘Share Capital’ will appear in the Balance Sheet of B Ltd. as per Schedule VI,

Part I of the Companies Act, 1956.

(ii) Also prepare ‘Notes to Accounts’ for the same.

15. Hot, Cold and Warm were partners. They were sharing profits in the ratio 3 : 2 : 1

respectively. They all decided that in the event of death of a partner the amount payable to

his legal representative will be donated for constructing community service centre in the

village. (6)

Due to ill health, Cold died on 30th June, 2013. The Balance Sheet of Hot, Cold and Warm on

31st March, 2013 was as follows:

On the date of Cold’s death i.e. on 30th June, 2013, the following was agreed upon:

(i) Goodwill is to be valued at two years purchase of average profit of last three completed

years which were : In first year Rs. 35,000; in second year Rs. 30,000 and in third year Rs.

Material downloaded from myCBSEguide.com. 3 / 11

25,000.

(ii) Cold’s share of profit till the date of his death will be calculated on the basis of average

profits of last three years.

(iii) Land was undervalued by Rs. 5,000 and Investments were overvalued by Rs. 10,000.

(iv) Provision for doubtful debts will be created at 5% of debtors.

(v) Claim of workmen’s compensation was estimated at Rs. 8,000.

Prepare Cold’s capital account to be presented to his representatives and identify a value that

Hot, Cold and Warm wanted to communicate to the society.

16. A, B and C were partners. They started business in one of the remote tribal areas of

Orissa. They were interested in the development of the tribal community by providing good

education and health. (6)

On 31st March, 2013, after making adjustments for profits and drawings their capitals were A

– Rs. 4,00,000, B – Rs. 3,00,000 and C – Rs. 2,00,000. The drawings of the partners were A – Rs.

4,000 per month, B – Rs. 3,000 per month and C – Rs. 2,000 per month.

The profit of the firm for the year ended 31st March, 2013 was Rs. 6,00,000. Subsequently it

was found that the interest on capital @ 6% p.a due had been omitted.

Showing your working notes clearly, pass necessary adjustment entry for the above. Also

identify any two values highlighted in the above question.

17. W and R were partners in a firm sharing profits in the ratio of 3 : 2 respectively. On 31st

March, 2013, their Balance Sheet was as follows: (8)

Material downloaded from myCBSEguide.com. 4 / 11

B was admitted as a new partner on the following conditions:

(i) B will get 4/15th share of profits.

(ii) B had to bring Rs. 15,000 as his capital.

(iii) B would pay cash for his share of goodwill based on years purchase of average

profit of last 4 years.

(iv) The profits of the firm for the years ending 31st March, 2010, 2011, 2012 and 2013 were

Rs. 10,000; Rs. 7,000; Rs. 8,500; and Rs. 7,500 respectively.

(v) Stock was valued at Rs. 10,000 and provision for doubtful debts was raised up to Rs. 500.

(vi) Plant was revalued at Rs. 20,000.

Material downloaded from myCBSEguide.com. 5 / 11

Prepare Revaluation Account, Partners’ Capital A/cs and the Balance Sheet of the new firm.

OR

Kumar, Shyam and Ratan were partners in a firm sharing profits in the ratio of 5 : 3 : 2

respectively. They decided to dissolve the firm with effect from 01-04-2013. On that date the

Balance Sheet of the firm was as follows:

The dissolution resulted in the following:

(i) Plant of Rs. 40,000 was taken over by Kumar at an agreed value of Rs. 45,000 and

remaining plant realised Rs. 50,000.

(ii) Furniture realised Rs. 40,000.

(iii) Motor van was taken over by Shyam for Rs. 30,000.

(iv) Debtors realised Rs. 1,000 less.

Material downloaded from myCBSEguide.com. 6 / 11

(v) Creditors for Rs. 20,000 were untraceable and the remaining creditors were paid in full.

(vi) Realisation expenses amounted to Rs. 5,000.

Prepare the Realisation Account, Capital Accounts of Partners and Bank Account of the firm.

18. Bhagwati Ltd. invited applications for issuing 2,00,000 equity shares of Rs. 10 each. The

amounts were payable as follows: (8)

On application – Rs. 3 per share

On allotment – Rs. 5 per share

On first and final call – Rs. 2 per share

Applications were received for 3,00,000 shares and pro-rata allotment was made to all the

applicants. Money overpaid on application was adjusted towards allotment money. B, who

was allotted 3,000 shares, failed to pay the first and final call money. His shares were

forfeited. Out of the forfeited shares, 2,500 shares were reissued as fully paid up @ Rs. 8 per

share.

Pass necessary journal entries to record the above transactions in the books of Bhagwati Ltd.

OR

(a) A company forfeited 200 shares of Rs. 20 each, Rs. 15 per share called up on which Rs. 10

per share had been paid. Directors reissued all the forfeited shares to B as Rs. 15 per share

paid up for a payment of Rs. 10 each. Give journal entries in the books of the company for

forfeiture and reissue of shares.

(b) A Ltd. forfeited 100 equity shares of the face value of Rs. 10 each, for the non-payment of

first call of Rs. 2 per share. Rs. 6 per share had already been called and paid. These shares

were subsequently reissued as fully paid at the rate of Rs. 7 per share. Give journal entries in

the books of the company for forfeiture and reissue of shares.

Part B

(Financial Statement Analysis)

Material downloaded from myCBSEguide.com. 7 / 11

19. Which item is assumed to be 100 while preparing common size Statement of Profit and

Loss? (1)

20. Dividend paid by a financial company is classified under which type of activity, while

preparing cash flow statement? (1)

21. What is meant by ‘Cash Flow Statement’? (1)

22. State under which major headings the following items will be presented in the Balance

Sheet of a company as per revised Schedule VI Part I of the Companies Act, 1956:( 3)

(i) Trade Marks

(ii) Capital Redemption Reserves

(iii) Income received in advance

(iv) Stores and Spares

(v) Office Equipments

(vi) Current Investments

23. From the following Calculate: (4)

(a) Operating Profit Ratio; and

(b) Working Capital Turnover Ratio.

Amount Rs.

(i) Revenue from operation 2,00,000

(ii) Gross Expenses 75,000

(iii) Office Expenses 15,000

(iv) Selling Expenses 26,000

(v) Interest on Debentures 5,000

(vi) Accidental Losses 12,000

(vii) Income form Rent 2,500

Material downloaded from myCBSEguide.com. 8 / 11

(viii) Commission Received 2,000

(ix) Current Assets 60,000

(x) Current Liabilities 10,000

24. On the basis of the following information extracted from the Statement of Profit and Loss

for the year ended 31st March, 2012 and 2013, prepare a Comparative Statement of Profit

and Loss: (4)

Particulars Note No. 31.03.2013 31.03.2012

Revenue from operations 10,00,000 8,00,000

Expenses 5,00,000 4,00,000

Other Income 50,000 10,000

Tax Rate 50% 50%

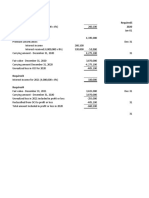

25. . Prepare a Cash Flow Statement from the following Balance Sheet: (4)

Material downloaded from myCBSEguide.com. 9 / 11

Notes to Accounts

Note No. 1

Additional Information:

Material downloaded from myCBSEguide.com. 10 / 11

(i) An old machinery having book value of Rs. 50,000 was sold for Rs. 60,000.

(ii) Depreciation provided on Machinery during the year was Rs. 30,000.

Part C

(Computerised Accounting)

19. What is represented by the 5th to 7th digits allotted to an account in codification? (1)

20. What is relational database? (1)

21. What are the components of Computerised Accounting System? (1)

22. Explain any two features of Computerised Accounting System. (3)

23. What is meant by ‘Data Audit’ and ‘Data Vault’? (4)

24. Explain Modules, Pages, Reports, and Queries as Database objects. (4)

25. (a) Name and explain the financial function of spreadsheet which calculates the periodic

payment for an annuity, assuming equal payments and a constant rate of interest. (4)

(b) Calculate the formula from the following information on Excel for computing Tax

Deductible:

Basic salary up to Rs. 20,000 at 30% and above it at 35%

Material downloaded from myCBSEguide.com. 11 / 11

Вам также может понравиться

- Language Development English: Affiliated To The CISCE, New DelhiДокумент4 страницыLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalОценок пока нет

- Vardhman International School: Holiday Homework (AY: 2022-23) Research WorkДокумент2 страницыVardhman International School: Holiday Homework (AY: 2022-23) Research WorkAshish GangwalОценок пока нет

- Class 6 P.A.1 Syllabus and DatesheetДокумент2 страницыClass 6 P.A.1 Syllabus and DatesheetAshish GangwalОценок пока нет

- Academic Remarks For MarksheetДокумент2 страницыAcademic Remarks For MarksheetAshish GangwalОценок пока нет

- Mock Test 2 Datesheet FinalДокумент1 страницаMock Test 2 Datesheet FinalAshish GangwalОценок пока нет

- S Subject: ARTS: Affiliated To The CISCE, New DelhiДокумент3 страницыS Subject: ARTS: Affiliated To The CISCE, New DelhiAshish GangwalОценок пока нет

- S Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalДокумент3 страницыS Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalAshish GangwalОценок пока нет

- Business Studies Class XII I Pre-Board Paper (2021-22)Документ4 страницыBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalОценок пока нет

- Math Readiness: Affiliated To The CISCE, New DelhiДокумент4 страницыMath Readiness: Affiliated To The CISCE, New DelhiAshish GangwalОценок пока нет

- Language Development English: Affiliated To The CISCE, New DelhiДокумент4 страницыLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalОценок пока нет

- Class XI Entrepreneurship Ii Term Examination Answer KeyДокумент3 страницыClass XI Entrepreneurship Ii Term Examination Answer KeyAshish GangwalОценок пока нет

- BST Test 20 DecДокумент4 страницыBST Test 20 DecAshish GangwalОценок пока нет

- Office Order - Class 1 To 12 Teachers For ERP Marks EntryДокумент2 страницыOffice Order - Class 1 To 12 Teachers For ERP Marks EntryAshish GangwalОценок пока нет

- Ashish CertificateДокумент1 страницаAshish CertificateAshish GangwalОценок пока нет

- 25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurДокумент3 страницы25th Wedding Anniversary: Mr. Murli Manohar Mathur Mrs. Suman MathurAshish GangwalОценок пока нет

- KizaksaknaДокумент2 страницыKizaksaknaT Suan Lian TonsingОценок пока нет

- Pa 2 Datesheet Class I - Ix & XiДокумент1 страницаPa 2 Datesheet Class I - Ix & XiAshish GangwalОценок пока нет

- 1 Entrepreneurship - What, Why and HowДокумент17 страниц1 Entrepreneurship - What, Why and HowAshish Gangwal100% (1)

- 12 HouseДокумент20 страниц12 HouseRomani Bora100% (1)

- Unit Ii-An Entrepreneur Multiple Choice QuestionsДокумент16 страницUnit Ii-An Entrepreneur Multiple Choice QuestionsAshish Gangwal100% (1)

- Academic Remarks For MarksheetДокумент2 страницыAcademic Remarks For MarksheetAshish Gangwal100% (1)

- 3 Entrepreneurial JourneyДокумент20 страниц3 Entrepreneurial JourneyAshish GangwalОценок пока нет

- Seedling Group of Schools: Warm RegardsДокумент1 страницаSeedling Group of Schools: Warm RegardsAshish GangwalОценок пока нет

- SEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDДокумент3 страницыSEEDLING Modern High School Class IX Protor Details: S No. School Code Role User Name Login IDAshish GangwalОценок пока нет

- KP Horary Table 1 249 PDFДокумент5 страницKP Horary Table 1 249 PDFSunil ThombareОценок пока нет

- 31 Circular 2021Документ3 страницы31 Circular 2021Ashish GangwalОценок пока нет

- Aissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashДокумент1 страницаAissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashAshish GangwalОценок пока нет

- Notification: CBSE/Training Unit/2020 18.09.2020Документ2 страницыNotification: CBSE/Training Unit/2020 18.09.2020Ashish GangwalОценок пока нет

- Touch and See Your Solution: Finding Solutions For Your Problems in Bhagvad GitaДокумент1 страницаTouch and See Your Solution: Finding Solutions For Your Problems in Bhagvad Gitaanu50% (2)

- PA2 Blueprint Ep Class 11Документ1 страницаPA2 Blueprint Ep Class 11Ashish GangwalОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- MBTC and BPI RatiosДокумент11 страницMBTC and BPI RatiosarianedangananОценок пока нет

- Ia Vol 3 Valix 2019 Solman 2 PDF FreeДокумент105 страницIa Vol 3 Valix 2019 Solman 2 PDF FreeLJОценок пока нет

- Cole Park CLO LimitedДокумент22 страницыCole Park CLO Limitedeimg20041333Оценок пока нет

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Документ3 страницыQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923Оценок пока нет

- SM 13Документ71 страницаSM 13Mai Anh ĐàoОценок пока нет

- An American Depositary ReceiptДокумент7 страницAn American Depositary ReceiptsushmaОценок пока нет

- Tugas Problem - Kel7Документ3 страницыTugas Problem - Kel7AshdhОценок пока нет

- Kiplinger's Personal Finance - January 2018 PDFДокумент74 страницыKiplinger's Personal Finance - January 2018 PDFjkavinОценок пока нет

- FOREX TRADING MANUAL Beginners To AdvanceДокумент65 страницFOREX TRADING MANUAL Beginners To AdvanceHenryMM75% (4)

- April 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Документ22 страницыApril 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Le NovoОценок пока нет

- Serba Dinamik Holdings Outperform : Upstream DiversificationДокумент5 страницSerba Dinamik Holdings Outperform : Upstream DiversificationAng SHОценок пока нет

- Buffet Checklist v4 PDFДокумент4 страницыBuffet Checklist v4 PDFapluОценок пока нет

- Chap 2Документ15 страницChap 2v lОценок пока нет

- Gabaritorendafixa1 PDFДокумент7 страницGabaritorendafixa1 PDFhmvungeОценок пока нет

- FINM3006 Notes On Past Exams: 2016 Test 1Документ77 страницFINM3006 Notes On Past Exams: 2016 Test 1Navya VinnyОценок пока нет

- What's Stock Market Volatility?Документ6 страницWhat's Stock Market Volatility?Prathap PratapОценок пока нет

- 1.1 Balance Sheet: Balance Sheet Income Statement Cash Flow Statement Statement of Stockholders' EquityДокумент5 страниц1.1 Balance Sheet: Balance Sheet Income Statement Cash Flow Statement Statement of Stockholders' EquityKamran ShahОценок пока нет

- Depreciation, Impairments, and Depletion - PART 1Документ35 страницDepreciation, Impairments, and Depletion - PART 1ditaadeliaОценок пока нет

- Accounting For Government and Non-ProfitДокумент7 страницAccounting For Government and Non-ProfitAbraham ChinОценок пока нет

- Thomas Bulkowski's Trading QuizДокумент253 страницыThomas Bulkowski's Trading QuizBharath Raj Rathod100% (8)

- Zeta Company Required1 Required5 2020 Required2Документ2 страницыZeta Company Required1 Required5 2020 Required2AnonnОценок пока нет

- Chapter 4 Risk and ReturnДокумент19 страницChapter 4 Risk and Returnvaghela_jitendra8Оценок пока нет

- Stock Market I. What Are Stocks?Документ9 страницStock Market I. What Are Stocks?JehannahBaratОценок пока нет

- Mortgage Backed SecuritiesДокумент13 страницMortgage Backed SecuritiessaranОценок пока нет

- Lesson 6Документ7 страницLesson 6Ira Charisse BurlaosОценок пока нет

- Women Investors Awareness Towards Capital MarketДокумент18 страницWomen Investors Awareness Towards Capital MarketpoojaОценок пока нет

- JCP Liquidity, Debt Analysis, and Capital Raising OptionsДокумент3 страницыJCP Liquidity, Debt Analysis, and Capital Raising OptionsSitara QadirОценок пока нет

- M03-Performing Financial CalculationДокумент62 страницыM03-Performing Financial Calculationyared mulatuОценок пока нет

- Partnership Liquidation Question#6Документ2 страницыPartnership Liquidation Question#6Ivy BautistaОценок пока нет

- 1 - MB Group Assignment I 21727Документ2 страницы1 - MB Group Assignment I 21727RoОценок пока нет