Академический Документы

Профессиональный Документы

Культура Документы

Suzlon Energy Press Release Q1 PDF

Загружено:

gaurav chaudharyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Suzlon Energy Press Release Q1 PDF

Загружено:

gaurav chaudharyАвторское право:

Доступные форматы

For Immediate Release 14th August 2019

Suzlon announces Q1 FY20 results

Pre-forex EBITDA of Rs 61 crores and EBITDA margin of 7.4% in Q1 FY20

Concerted efforts on-going towards a holistic solution for debt reduction

Pune, India: Suzlon Group, India’s largest renewable energy solutions provider, announced its first

quarter results for financial year 2019-20 (Q1 FY20).

J. P. Chalasani, Group CEO, said, “We continue to witness sectoral slowdown, owing to the

prolonged industry transition to the bidding regime and policy uncertainty in few states. On

the positive side, tariffs are stabilizing and the volume growth in the long-term augur well

for sustainable growth of the sector. Our Operation and Maintenance Services (OMS)

division continues to deliver high machine performance for the customers, surpassing

industry benchmarks. We will fuel the growth for OMS with our value added products and

services. India is expected to be a relatively high volume market once the transitional

problems of the sector are addressed. We are well poised to capitalize on this growth.”

Kirti Vagadia, Group CFO, said, “Post default scenario, the company operations are at a sub-optimal

level. However, we have continued to focus on cost optimization across the board including Cost of

goods sold (COGS), fixed costs, working capital and thereby curtailed losses in this lean period. This is

reflected in the fact that inspite of minimal volumes, the impact on the bottom line as compared both

on Q-o-Q and Y-o-Y basis has been limited. We are committed and tirelessly working towards debt

resolution and fixing the capital structure at a sustainable level and are exploring various funding

options like raising fresh equity, disposal of subsidiaries, etc.”

Suzlon Group Q1 FY20 at a glance (consolidated):

Q1 FY20 revenue at Rs. 833 crores

Operating Performance (Pre-forex)

o EBIDTA : Rs 61 crores in Q1 FY20; EBITDA margin at 7.4%

o EBIT : Loss of Rs 12 crores in Q1 FY20

Reported Net Loss of Rs 337 crores in Q1 FY20

Net Debt (including FCCB)

o Consolidated net term debt at Rs 7,751 crores

o Working capital debt at Rs 4,000 crores

Key highlights:

Operations and Maintenance Services (OMS)

Achieved 97.25% fleet machine availability for our customers for whom we operate and

maintain a fleet of over 12.5 GW

Industry update

The Ministry of New and Renewable Energy (MNRE) has made amendments to the

competitive bidding guidelines for the procurement of power from grid-connected wind

energy projects for the first time since formulation of the guidelines in December 2017

i. Land to be secured by Solar Energy Corporation of India (SECI) Commercial

Operation Date (SCOD), not by Financial Closure (extended period from 7

months to 18 months)

ii. Requirement of “ownership of land” changed to “possession of land”

iii. SCOD 18 months from the date of PPA or PSA signing whichever is earlier

iv. Part commissioning also eligible for full tariff

v. Window for revision of declared Capacity Utilisation Factor (CUF) of wind power

project has been increased to three years

As per MNRE, the amendments are intended to not only reduce the investment risks

related to the land acquisition and CUF but also to provide incentives for early part

commissioning of project

SECI has invited bids to set up an aggregate 1,200 MW of capacity with Inter-State

Transmission System (ISTS)-connected wind/solar/wind-solar hybrid projects, along with

energy storage, throughout India. The projects will be awarded through an e-bidding

process, followed by a reverse auction

About Suzlon Group:

Suzlon Group is one of the leading renewable energy solutions provider in the world with a global presence

across 18 countries in Asia, Australia, Europe, Africa and Americas. Headquartered at Suzlon One Earth in

Pune, India; the Group is comprised of Suzlon Energy Limited (NSE & BSE: SUZLON) and its subsidiaries. A

vertically integrated organization, with over two decades of operational track record, the group has a

cumulative global installation of over 18 GW of wind energy capacity, over 7,500 employees with diverse

nationalities and world-class manufacturing facilities. Suzlon is the only Indian wind energy company with a

large in-house Research and Development (R&D) set-up in Germany, the Netherlands, Denmark and India.

Group’s installation in India, adds upto ~35% of the country’s wind installations, making Suzlon the largest

player in this sector. The Group is the custodian of over 12.5 GW of wind assets under service in India making it

the 2nd largest operations and maintenance company (over 8,500 turbines) in Indian power sector. The Group

also has around 3 GW of wind assets under service outside India. Suzlon corporate website: www.suzlon.com

Follow us on Social media:

Press Contact Suzlon Group Investor Relations Contact

Asha Bajpai / Murlikrishnan Pillai

Suzlon Group

E-mail: investorrelations@suzlon.com

Mobile: +91 98207 83566/ +91 98220 25562

E-mail: ccp@suzlon.com

Вам также может понравиться

- Delhi Prog ScheduleДокумент1 страницаDelhi Prog Schedulegaurav chaudharyОценок пока нет

- 7DeadlyStyleSins M 5th Ed PDFДокумент38 страниц7DeadlyStyleSins M 5th Ed PDFPricope CosminОценок пока нет

- Dakota's PoemsДокумент4 страницыDakota's Poemsgaurav chaudharyОценок пока нет

- 7 Mistakes Men Make Buying Custom Clothing PDFДокумент18 страниц7 Mistakes Men Make Buying Custom Clothing PDFMarian NepotuОценок пока нет

- (Oxford World's Classics) Euripides, James Morwood, Edith Hall - The Trojan Women and Other Plays-Oxford University Press (2009) PDFДокумент939 страниц(Oxford World's Classics) Euripides, James Morwood, Edith Hall - The Trojan Women and Other Plays-Oxford University Press (2009) PDFgaurav chaudhary91% (11)

- Channel List: Search For A ChannelДокумент3 страницыChannel List: Search For A ChannelPappoo Kothari100% (2)

- (Satyajit Ray) The Complete Adventures of Feluda VДокумент651 страница(Satyajit Ray) The Complete Adventures of Feluda VMithu Pal33% (9)

- CPC, 1908Документ271 страницаCPC, 1908kaustubh880% (1)

- Warranty Conditions: Scope of The WarrantyДокумент4 страницыWarranty Conditions: Scope of The Warrantygaurav chaudharyОценок пока нет

- Cupid Q1 PDFДокумент4 страницыCupid Q1 PDFgaurav chaudharyОценок пока нет

- A Textbook On The Indian Penal Code by K D Gaur 9350352532 PDFДокумент5 страницA Textbook On The Indian Penal Code by K D Gaur 9350352532 PDFgaurav chaudhary0% (2)

- Vodafone Idea Q1 PDFДокумент16 страницVodafone Idea Q1 PDFgaurav chaudharyОценок пока нет

- Warranty Conditions: Scope of The WarrantyДокумент4 страницыWarranty Conditions: Scope of The Warrantygaurav chaudharyОценок пока нет

- Cupidlimi: Manufacturers and Suppliers of Male Fern e CondomДокумент4 страницыCupidlimi: Manufacturers and Suppliers of Male Fern e Condomgaurav chaudharyОценок пока нет

- Aditya Birla Capital Press Release Q1 PDFДокумент2 страницыAditya Birla Capital Press Release Q1 PDFgaurav chaudharyОценок пока нет

- Suzlon Energy Press Release Q1 PDFДокумент2 страницыSuzlon Energy Press Release Q1 PDFgaurav chaudharyОценок пока нет

- Suzlon Energy Press Release Q1Документ2 страницыSuzlon Energy Press Release Q1gaurav chaudharyОценок пока нет

- Morepen Laboratories Press Release Q1Документ5 страницMorepen Laboratories Press Release Q1gaurav chaudharyОценок пока нет

- Relatively Speaking: Ethan Coen, Elaine May, Woody AllenДокумент8 страницRelatively Speaking: Ethan Coen, Elaine May, Woody Allengaurav chaudhary0% (2)

- Morepen Laboratories Press Release Q1 PDFДокумент5 страницMorepen Laboratories Press Release Q1 PDFgaurav chaudharyОценок пока нет

- Hudco Q1Документ14 страницHudco Q1gaurav chaudharyОценок пока нет

- How To Analyze PeopleДокумент102 страницыHow To Analyze PeopleAron Stone100% (2)

- Limited: Under and (Listing andДокумент5 страницLimited: Under and (Listing andgaurav chaudharyОценок пока нет

- How To Analyze PeopleДокумент102 страницыHow To Analyze PeopleAron Stone100% (2)

- CharactersДокумент1 страницаCharactersgaurav chaudharyОценок пока нет

- Relatively Speaking: Press Night: Friday 20 April, 7.30pmДокумент3 страницыRelatively Speaking: Press Night: Friday 20 April, 7.30pmgaurav chaudharyОценок пока нет

- M6 Noises Off B501651ce4Документ12 страницM6 Noises Off B501651ce4gaurav chaudharyОценок пока нет

- TGDДокумент1 страницаTGDgaurav chaudharyОценок пока нет

- How To Analyze PeopleДокумент102 страницыHow To Analyze PeopleAron Stone100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Technical Data: @perkinsДокумент8 страницTechnical Data: @perkinsdfheardОценок пока нет

- Katalogas enДокумент20 страницKatalogas enEman AdelОценок пока нет

- Techno-Commercial Proposal: Rooftop Solar Power Plant - 100 KW NTPC LimitedДокумент11 страницTechno-Commercial Proposal: Rooftop Solar Power Plant - 100 KW NTPC LimitedAmit VijayvargiОценок пока нет

- Boiler Water ConditioningДокумент3 страницыBoiler Water ConditioningShahin AfrozОценок пока нет

- M38a1 Carb Chapt9Tm9-1826aДокумент13 страницM38a1 Carb Chapt9Tm9-1826aGeorge PowersОценок пока нет

- FINAL TEST 1 K 2Документ4 страницыFINAL TEST 1 K 2Nguyen Cuong100% (1)

- Operating Instructions and Owner'S Manual Mr. Heater HeatstarДокумент8 страницOperating Instructions and Owner'S Manual Mr. Heater HeatstarcjmОценок пока нет

- Fly Ash Types and BenefitsДокумент31 страницаFly Ash Types and BenefitsEngr Nabeel Ahmad100% (2)

- Title: Boom Cylinder Model Number: E32 Serial Number: A94H11001 & Above, AC2N11001 & AboveДокумент3 страницыTitle: Boom Cylinder Model Number: E32 Serial Number: A94H11001 & Above, AC2N11001 & AboveMateo Londoño UrreaОценок пока нет

- Grid1 - Untitled - gr1S - CompleteRapportДокумент3 страницыGrid1 - Untitled - gr1S - CompleteRapportKhaoula BenОценок пока нет

- Pract 05Документ2 страницыPract 05Timothy CОценок пока нет

- Ieee Tie - 2Документ12 страницIeee Tie - 2kdm007Оценок пока нет

- T H MorayOscTubeДокумент9 страницT H MorayOscTuberocism01100% (1)

- Dhaka Imarat Nirman Bidhimala-2008Документ142 страницыDhaka Imarat Nirman Bidhimala-2008sazeda67% (3)

- Unit 4 Pump: Suction, Delivery, Static and Accelerating HeadДокумент11 страницUnit 4 Pump: Suction, Delivery, Static and Accelerating HeadSurya PalОценок пока нет

- 3 Ortloff NGL LPG and Sulfur Recovery TechnologiesДокумент47 страниц3 Ortloff NGL LPG and Sulfur Recovery TechnologiesYanto Hasudungan LumbantobingОценок пока нет

- Review of Related Studies (Solar Panel) : Charger - BODY FULL PDFДокумент2 страницыReview of Related Studies (Solar Panel) : Charger - BODY FULL PDFMatti NoОценок пока нет

- Data Sheet Belt Feeder 50 20 02Документ6 страницData Sheet Belt Feeder 50 20 02GIANMARCOОценок пока нет

- Ed 00 (EN) PDFДокумент14 страницEd 00 (EN) PDFValentin draceaОценок пока нет

- 30gt 34siДокумент28 страниц30gt 34sijosealfredojlОценок пока нет

- IOTДокумент6 страницIOTKaze KazeОценок пока нет

- Concept PaperДокумент7 страницConcept PaperAejay MacasaОценок пока нет

- DS25A - (1967) Gas Chromatographic Data CompilationДокумент306 страницDS25A - (1967) Gas Chromatographic Data CompilationJacques StrappeОценок пока нет

- Gang SawДокумент55 страницGang SawAstri NgentОценок пока нет

- VLF-6022CM (F) : VLF Cable Testing For Cables Rated To 35kVДокумент1 страницаVLF-6022CM (F) : VLF Cable Testing For Cables Rated To 35kVSelk CLОценок пока нет

- Cl60 Rooftop Iom 0213 eДокумент94 страницыCl60 Rooftop Iom 0213 emikexiiОценок пока нет

- Acid Plan in General Physics 1Документ5 страницAcid Plan in General Physics 1Edralyn PamaniОценок пока нет

- CDM - English - Formato Traducci N PblicaДокумент93 страницыCDM - English - Formato Traducci N PblicaGustavo PreciadoОценок пока нет

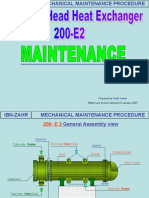

- 200 E 2 Floating Head Heat Exchanger MaintenanceДокумент16 страниц200 E 2 Floating Head Heat Exchanger Maintenancesubha50% (2)