Академический Документы

Профессиональный Документы

Культура Документы

2010 01 13 - 004112 - P3 2a

Загружено:

Joshua WinartoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2010 01 13 - 004112 - P3 2a

Загружено:

Joshua WinartoАвторское право:

Доступные форматы

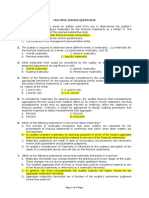

Accounting Adjusting Entries, Posting and Preparing an Adjusted Trial Balance MASASI

COMPANY, INC. Trial Balance June 30, 2008 Account Number Debit Credit 101 Cash $

7,150 112 Accounts Receivable 6,000 126 Supplies 2,000 130 Prepaid Insurance 3,000

157 Office Equipment 15,000 201 Accounts Payable $ 4,500 209 Unearned Service

Revenue 4,000 311 Common Stock 21,750 400 Service Revenue 7,900 726 Salaries

Expense 4,000 729 Rent Expense 1,000 Total $38,150 Total $38,150 In addition to those

accounts listed on the trial balance, the chart of accounts for Masasi Company,Inc. also

contains the following accounts and account numbers:No. 158 Accumulated Depreciation

—Office Equipment, No. 212 Salaries Payable,No. 244 Utilities Payable,No. 631

Supplies Expense,No. 711 Depreciation Expense,No. 722 Insurance Expense, and No.

732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are $600. 2. A utility

bill for $150 has not been recorded and will not be paid until next month. 3. The

insurance policy is for a year. 4. $2,500 of unearned service revenue has been earned at

the end of the month. 5. Salaries of $2,000 are accrued at June 30. 6. The office

equipment has a 5-year life with no salvage value. It is being depreciated at $250 per

month for 60 months. 7. Invoices representing $1,000 of services performed during the

month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries

for the month of June. Use J3 as the page number for your journal. (b) Post the adjusting

entries to the ledger accounts. Enter the totals from the trial balance as beginning account

balances and place a check mark in the posting reference column. (c) Prepare an adjusted

trial balance at June 30, 2008. Use the templates in Appendix D. Complete all three tabs.

(a)

J3

Date Account Titles and Explanation Ref. Debit Credit

2008

June 30 Supplies Expense............................................... 631 1,400

Supplies................................................... 126 1,400

($2,000 – $600)

30 Utilities Expense................................................ 732 150

Utilities Payable..................................... 244 150

30 Insurance Expense............................................. 722 250

Prepaid Insurance.................................. 130 250

($3,000 ÷ 12 months)

30 Unearned Service Revenue............................... 209 2,500

Service Revenue..................................... 400 2,500

30 Salaries Expense................................................ 726 2,000

Salaries Payable..................................... 212 2,000

30 Depreciation Expense........................................ 711 250

Accumulated Depreciation—

Office Equipment............................... 158 250

($15,000 ÷ 60 months)

30 Accounts Receivable.......................................... 112 1,000

Service Revenue..................................... 400 1,000

(b)

Cash No. 101

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 7,150

Accounts Receivable No. 112

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 6,000

30 Adjusting J3 1,000 7,000

Supplies No. 126

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 2,000

30 Adjusting J3 1,400 600

Prepaid Insurance No. 130

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 3,000

30 Adjusting J3 250 2,750

Office Equipment No. 157

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 15,000

Accumulated Depreciation—Office EquipmentNo. 158

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 250 250

Accounts Payable No. 201

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 4,500

Unearned Service Revenue No. 209

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 4,000

30 Adjusting J3 2,500 1,500

Salaries Payable No. 212

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 2,000 2,000

Utilities Payable No. 244

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 150 150

Common Stock No. 311

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 21,750

Service Revenue No. 400

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 7,900

30 Adjusting J3 2,500 10,400

30 Adjusting J3 1,000 11,400

Supplies Expense No. 631

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 1,400 1,400

Depreciation Expense No. 711

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 250 250

Insurance Expense No. 722

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 250 250

Salaries Expense No. 726

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 4,000

30 Adjusting J3 2,000 6,000

Rent Expense No. 729

Date Explanation Ref. Debit Credit Balance

2008

June 30 Balance 1,000

Utilities Expense No. 732

Date Explanation Ref. Debit Credit Balance

2008

June 30 Adjusting J3 150 150

(c) MASASI COMPANY, INC.

Adjusted Trial Balance

June 30, 2008

Debit Credit

Cash.............................................................................................. $ 7,150

Accounts Receivable................................................................... 7,000

Supplies........................................................................................ 600

Prepaid Insurance....................................................................... 2,750

Office Equipment........................................................................ 15,000

Accumulated Depreciation—Office

Equipment............................................................................... $ 250

Accounts Payable........................................................................ 4,500

Unearned Service Revenue........................................................ 1,500

Salaries Payable.......................................................................... 2,000

Utilities Payable.......................................................................... 150

Common Stock............................................................................ 21,750

Service Revenue.......................................................................... 11,400

Supplies Expense........................................................................ 1,400

Depreciation Expense................................................................. 250

Insurance Expense...................................................................... 250

Salaries Expense......................................................................... 6,000

Rent Expense............................................................................... 1,000

Utilities Expense.......................................................................... 150

$41,550 $41,550

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Review Jurnal PDFДокумент25 страницReview Jurnal PDFTantriiОценок пока нет

- Simple Problem On ABC: RequiredДокумент3 страницыSimple Problem On ABC: RequiredShreshtha VermaОценок пока нет

- Audit Quality in AustraliaДокумент71 страницаAudit Quality in AustraliaShuyan LiОценок пока нет

- Audit Reports: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/Beasley 3 - 1Документ45 страницAudit Reports: ©2012 Prentice Hall Business Publishing, Auditing 14/e, Arens/Elder/Beasley 3 - 1Setia NurulОценок пока нет

- Continuation in Auditing OverviewДокумент21 страницаContinuation in Auditing OverviewJayОценок пока нет

- Study On Income Tax System1Документ58 страницStudy On Income Tax System1srushti salvi100% (2)

- Chapter 5 Accounting For Short-Term Investments and Accounts ReceivableДокумент47 страницChapter 5 Accounting For Short-Term Investments and Accounts ReceivablePrincess MaheeОценок пока нет

- SFM PDFДокумент731 страницаSFM PDFRam IyerОценок пока нет

- Accounting Entries (OPM)Документ8 страницAccounting Entries (OPM)Ghani7100% (3)

- Deputation Order Shihab Hasan ChowdhuryДокумент1 страницаDeputation Order Shihab Hasan ChowdhuryShihab HasanОценок пока нет

- Fritz Gerald de Ocampo ResumeДокумент3 страницыFritz Gerald de Ocampo ResumeMichelle FelloneОценок пока нет

- Corporate Governance and Firm Risk - Final Thesis (Abdullah) PDFДокумент60 страницCorporate Governance and Firm Risk - Final Thesis (Abdullah) PDFMuhammad Sualeh Khattak100% (4)

- 395-Article Text-1362-2-10-20220720Документ13 страниц395-Article Text-1362-2-10-20220720PipingОценок пока нет

- FASB's Current Expected Credit Loss Model For Credit Loss Accounting (CECL) : Background and FAQ 'S For Bankers June 2016Документ23 страницыFASB's Current Expected Credit Loss Model For Credit Loss Accounting (CECL) : Background and FAQ 'S For Bankers June 2016biswarup1988Оценок пока нет

- P6 and P5 study notes on MABS, IM, and P2 MADMДокумент7 страницP6 and P5 study notes on MABS, IM, and P2 MADMMxolisi NcubeОценок пока нет

- Sem-2 CC3 Notes Unit-VДокумент17 страницSem-2 CC3 Notes Unit-VSneha TolagiОценок пока нет

- CV Laris MotorДокумент20 страницCV Laris Motorriri sri astutiОценок пока нет

- CW6 - MaterialityДокумент3 страницыCW6 - MaterialityBeybi JayОценок пока нет

- BIS 205 Data Tables, Goal Seeking, ScenariosДокумент3 страницыBIS 205 Data Tables, Goal Seeking, ScenariosBame TshiamoОценок пока нет

- IFE Matrix guide for evaluating internal factorsДокумент4 страницыIFE Matrix guide for evaluating internal factorsSudip DhakalОценок пока нет

- AC 103 Midterm Exam PDFДокумент28 страницAC 103 Midterm Exam PDFXyriel RaeОценок пока нет

- Australian Open Risk Management PlanДокумент14 страницAustralian Open Risk Management PlanMannySHОценок пока нет

- Internal Audit Inventory ControlsДокумент4 страницыInternal Audit Inventory ControlsDimple MandigaОценок пока нет

- HR PolicyДокумент6 страницHR PolicyAmbientОценок пока нет

- Module 3: CG Meaning, Models & FailuresДокумент120 страницModule 3: CG Meaning, Models & FailuresMital ParmarОценок пока нет

- Audit of Insurance Companies NotesДокумент38 страницAudit of Insurance Companies NotesHimangshu Hazarika57% (7)

- Public Sector Accounting Exam QuestionsДокумент6 страницPublic Sector Accounting Exam Questionsmia94Оценок пока нет

- Credit Repair Service Business Plan TemplateДокумент24 страницыCredit Repair Service Business Plan Templatesolomon100% (1)

- CG Theories, Board Structure, CommitteesДокумент40 страницCG Theories, Board Structure, CommitteesMohd ThahzinОценок пока нет

- Answers Acct 504 Case Study 2Документ3 страницыAnswers Acct 504 Case Study 2Mohammad IslamОценок пока нет