Академический Документы

Профессиональный Документы

Культура Документы

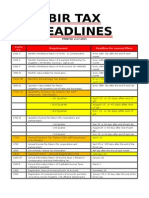

Form No. Requirement Deadline For Manual Filers

Загружено:

LhyraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. Requirement Deadline For Manual Filers

Загружено:

LhyraАвторское право:

Доступные форматы

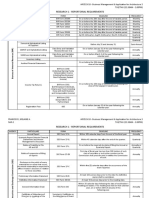

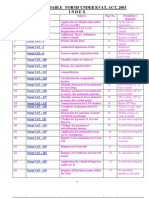

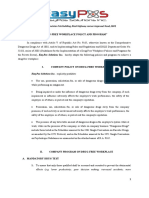

Form

Requirement Deadline for manual filers

No.

0605 Payment Form 0 Annual Registration January 31

1601-C Monthly Remittance Return of Income Taxes Withheld on Compensation Every 10th day of after the end of each month

1619-E Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) Every 10th day of after the end of each month

1619-F Monthly Remittance Form for Final Income Taxes Withheld Every 10th day of after the end of each month

Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)

1601-EQ Every Last Day of the month after the end of each quarter

(together with the Quarterly Alphabetical List of Payees)

1601-FQ Quarterly Remittance Return of Final Income Taxes Withheld Every Last Day of the month after the end of each quarter

Annual Information Return of Income Taxes Withheld on Compensation of Final

1604-CF January 31

Withholding Taxes

1604-E Annual Information Return of Creditable Income Taxes Withheld (Expanded) March 1

2550-M Monthly Value Added Tax Declaration Every 20th day after the end of each month

2551-M Monthly Percentage Tax Return Every 20th day after the end of each month

2550-Q Quarterly Value Added Tax Return Every 25th day after the end of each month

2551-Q Quarterly Percentage Tax Return Every 25th day after the end of each month

1701 Annual Income Tax Return (for self-employed individuals) April 15

1701-Q Quarterly Income Tax Return (for self-employed individuals)

- 1st Quarter May 15 or 45 days after end of each quarter

- 2nd Quarter August 15 or 45 days after end of each quarter

- 3rd Quarter November 15 or 45 days after end of each quarter

1702 Annual Income Tax Return (for corporations and partnerships) April 15

1702-Q Quarterly Income Tax Return (for corporations and partnerships)

- 1st Quarter May 29 or 60 days after end of each quarter

- 2nd Quarter August 29 or 60 days after end of each quarter

- 3rd Quarter November 29 or 60 days after end of each quarter

2000 Documentary Stamp Tax Declaration 5th day after the end of transaction month

1905 Registration renewal of manual books of accounts December 29

1905 Registration for New Corporation

1902 Registration for Single Proprietor

Registration of computerized books of accounts and other accounting records

1900 (together with affidavit attesting the completeness of the computerized accounting January 30 or 30 days after the end of the fiscal year

books/records)

Registration of permanently bound computer-generated/loose leaf books of accounts

1900 January 15 or 15 days after the end of the fiscal year

and other accounting records

no form Submission of Inventory List January 30 or 30 days after the end of the year

Вам также может понравиться

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- BIR FormsДокумент3 страницыBIR FormsLuis JoseОценок пока нет

- Bir FilingsДокумент2 страницыBir FilingsJehiel ImbocОценок пока нет

- Form No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesДокумент7 страницForm No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesromarcambriОценок пока нет

- Bir Tax DeadlinesДокумент1 страницаBir Tax DeadlinesJomar VillenaОценок пока нет

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsДокумент2 страницыBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCОценок пока нет

- Bir Tax Deadlines 2015Документ2 страницыBir Tax Deadlines 2015Mary Grace BanezОценок пока нет

- Reminders - Due DatesДокумент7 страницReminders - Due Datesdhuno teeОценок пока нет

- BIR FormsДокумент1 страницаBIR FormsBSA MaterialsОценок пока нет

- Bir Filings When To FileДокумент1 страницаBir Filings When To FileJehiel ImbocОценок пока нет

- Deadlines TaxДокумент3 страницыDeadlines TaxLouremie Delos Reyes MalabayabasОценок пока нет

- New Business Registration (BIR)Документ27 страницNew Business Registration (BIR)CrizziaОценок пока нет

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineДокумент2 страницыFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoОценок пока нет

- SSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineДокумент1 страницаSSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineIvy ValcarcelОценок пока нет

- BIR RDO 113 Taxpayers' Compliance Guide 2019Документ4 страницыBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- Bir FormДокумент3 страницыBir FormChelsea Anne VidalloОценок пока нет

- Period When Returns Are Filed: BIR Form 1801Документ4 страницыPeriod When Returns Are Filed: BIR Form 1801I Am Not DeterredОценок пока нет

- BIR Registration & Due Dates-1Документ6 страницBIR Registration & Due Dates-1jessicamarieogbinar37Оценок пока нет

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsДокумент1 страницаModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesОценок пока нет

- Taxation Reviewer - REOДокумент202 страницыTaxation Reviewer - REOtmica7260Оценок пока нет

- Bright Sun Production Corporation Bir Forms - Train Law (For Corporations)Документ1 страницаBright Sun Production Corporation Bir Forms - Train Law (For Corporations)Joyce Hidalgo PreciaОценок пока нет

- Deadline For Govt Reports & FormsДокумент6 страницDeadline For Govt Reports & FormsKrisha AlcozerОценок пока нет

- Briefing MADE EASY-LUCILLEДокумент51 страницаBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezОценок пока нет

- New Tax Campaign 2024 DumagueteДокумент14 страницNew Tax Campaign 2024 DumaguetebugsparОценок пока нет

- W11-Module Tax Return Preparation and Tax Payments - PPTДокумент14 страницW11-Module Tax Return Preparation and Tax Payments - PPTVirgilio Jay CervantesОценок пока нет

- Reportorial RequirementsДокумент3 страницыReportorial RequirementsMark Anthony P. TarroquinОценок пока нет

- W11-Module Tax Return Preparation and Tax PaymentsДокумент20 страницW11-Module Tax Return Preparation and Tax PaymentsVirgilio Jay CervantesОценок пока нет

- Pananaw 2020 PDFДокумент93 страницыPananaw 2020 PDFKobi SaibenОценок пока нет

- Compliances Under GST & Income Tax Act-KinexinДокумент3 страницыCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanОценок пока нет

- Guidelines On Compliances and DocumentationДокумент4 страницыGuidelines On Compliances and DocumentationJfm A Dazlac100% (1)

- Corporate CalenderДокумент12 страницCorporate CalenderNikhil DaroliaОценок пока нет

- Reportorial RequirementsДокумент5 страницReportorial RequirementsMelaine A. FranciscoОценок пока нет

- TaxДокумент19 страницTaxjhevesОценок пока нет

- How To Become Tax CompliantДокумент1 страницаHow To Become Tax CompliantNGANJANI WALTERОценок пока нет

- Bir Form 1701Q: Creditable Income Taxes Withheld (Expanded) )Документ3 страницыBir Form 1701Q: Creditable Income Taxes Withheld (Expanded) )April Lynn Ursal-BelciñaОценок пока нет

- Recurring Dates For Statutory CompliancesДокумент2 страницыRecurring Dates For Statutory CompliancesDeepika BathinaОценок пока нет

- Chapter 01 - AnswerДокумент3 страницыChapter 01 - Answermenche galuraОценок пока нет

- TAX PAYER GUIDE MannualДокумент7 страницTAX PAYER GUIDE MannualLevi Lazareno EugenioОценок пока нет

- Acca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsДокумент2 страницыAcca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsSumiya YousefОценок пока нет

- Tax Remedies of The GovernmentДокумент16 страницTax Remedies of The GovernmentrmsenyoritaОценок пока нет

- Summary of Filing Deadlines of Internal Revenue TaxesДокумент1 страницаSummary of Filing Deadlines of Internal Revenue TaxesColleen GuimbalОценок пока нет

- Lesson 9Документ17 страницLesson 9Win OziracОценок пока нет

- Tax Compliance and Tax RemediesДокумент2 страницыTax Compliance and Tax RemediesWinz Valerie JoseОценок пока нет

- Forms KvatДокумент63 страницыForms KvatShashi KanthОценок пока нет

- PPE - Basic Taxes For The Sale of REДокумент1 страницаPPE - Basic Taxes For The Sale of RElowell madrilenoОценок пока нет

- PPE - Basic Taxes For The Sale of RE PDFДокумент1 страницаPPE - Basic Taxes For The Sale of RE PDFrobina56Оценок пока нет

- Tax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesДокумент2 страницыTax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesArvin GarciaОценок пока нет

- Statutory - Compliance IIДокумент2 страницыStatutory - Compliance IIKapil BhardwajОценок пока нет

- TAX-304 (VAT Compliance Requirements)Документ4 страницыTAX-304 (VAT Compliance Requirements)Ryan AllanicОценок пока нет

- CHECKLIST OF DOCUMENTS For HOAДокумент5 страницCHECKLIST OF DOCUMENTS For HOAJfm A Dazlac100% (6)

- Statutory Due Date For F y 15 16Документ1 страницаStatutory Due Date For F y 15 16rajdeeppawarОценок пока нет

- Tax 304 - Vat Compliance RequirementsДокумент5 страницTax 304 - Vat Compliance RequirementsiBEAYОценок пока нет

- Statutory Compliance TrackerДокумент6 страницStatutory Compliance TrackerHemanth KanakamedalaОценок пока нет

- Proposal To Lalaine GandaДокумент1 страницаProposal To Lalaine GandaJM Valonda Villena, CPA, MBAОценок пока нет

- Relevant Dates: 15-Apr QuarterlyДокумент6 страницRelevant Dates: 15-Apr Quarterlysanyu1208Оценок пока нет

- SEC MC 17 AFS DeadlinesДокумент3 страницыSEC MC 17 AFS DeadlinesjvpvillanuevaОценок пока нет

- About The VAT (PДокумент11 страницAbout The VAT (PAmie Jane MirandaОценок пока нет

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodДокумент2 страницыGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosОценок пока нет

- Final Withholding Taxation and Capital Gains TaxationДокумент10 страницFinal Withholding Taxation and Capital Gains TaxationKatrina MaglaquiОценок пока нет

- Workplace Policy and Program On Drugs - 2022Документ5 страницWorkplace Policy and Program On Drugs - 2022LhyraОценок пока нет

- 2nd Floor Precision Tek Building, Rizal Highway Corner Argonaut Road, SBFZДокумент1 страница2nd Floor Precision Tek Building, Rizal Highway Corner Argonaut Road, SBFZLhyraОценок пока нет

- Work From Set Up Due To Zambales Border RestrictionДокумент1 страницаWork From Set Up Due To Zambales Border RestrictionLhyraОценок пока нет

- 2nd Floor Precision Tek Building, Rizal Highway Corner Argonaut Road, SBFZДокумент4 страницы2nd Floor Precision Tek Building, Rizal Highway Corner Argonaut Road, SBFZLhyraОценок пока нет

- For Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionДокумент2 страницыFor Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionLhyraОценок пока нет

- For Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionДокумент2 страницыFor Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionLhyraОценок пока нет

- 議書藷rf。 - Ce巾監禁聖:禦聖丁ax 2307: Withheld At SourceДокумент1 страница議書藷rf。 - Ce巾監禁聖:禦聖丁ax 2307: Withheld At SourceLhyraОценок пока нет

- 1905 January 2018 ENCS FinalДокумент3 страницы1905 January 2018 ENCS FinalSunmi GashinaОценок пока нет

- Request Budget Sep. 23-28Документ20 страницRequest Budget Sep. 23-28LhyraОценок пока нет

- Tax Calculator (Salaried Person) : Monthly SalaryДокумент5 страницTax Calculator (Salaried Person) : Monthly SalarySheeraz Ahmed MemonОценок пока нет

- Taxation Law & Practice Module-1Документ298 страницTaxation Law & Practice Module-1swapbjspnОценок пока нет

- Taxes: Part One: Obliged ToДокумент4 страницыTaxes: Part One: Obliged ToStaciaRevianyMegeОценок пока нет

- Yanet CollegeДокумент3 страницыYanet CollegeBiniam Hunegnaw BitewОценок пока нет

- Atty. Cabaniero Tax QuestionsДокумент26 страницAtty. Cabaniero Tax QuestionsBon ChuОценок пока нет

- Direct Tax AssignmentДокумент16 страницDirect Tax AssignmentPranjul SahuОценок пока нет

- TAXДокумент10 страницTAXJeana Segumalian100% (3)

- BIR Form No GuidlineДокумент11 страницBIR Form No GuidlineFernando OrganoОценок пока нет

- August 2023 NEWSLETTERДокумент21 страницаAugust 2023 NEWSLETTERshkmjwt7k4Оценок пока нет

- Annex B 2 RR 11 2018 PDFДокумент1 страницаAnnex B 2 RR 11 2018 PDFDnrxsОценок пока нет

- Cir V SMLCДокумент18 страницCir V SMLCTracey FraganteОценок пока нет

- What Is Financial PlanningДокумент3 страницыWhat Is Financial Planningkirang gandhiОценок пока нет

- CH 06Документ31 страницаCH 06cushin200975% (4)

- Acctg ReviewДокумент13 страницAcctg ReviewDymphna Ann CalumpianoОценок пока нет

- Taxation Module 3 5Документ57 страницTaxation Module 3 5Ma VyОценок пока нет

- Basic Principles of Taxation-1Документ82 страницыBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

- Act 311 Term PaperДокумент7 страницAct 311 Term PaperKazi Shariat UllahОценок пока нет

- Taxation Bar Q&A 1994-2006Документ86 страницTaxation Bar Q&A 1994-2006LR FОценок пока нет

- Taxable Income and Tax DueДокумент13 страницTaxable Income and Tax DueSheena Gane Esteves100% (1)

- List of Beneftis For Salaries Income Tax AY 2023 24Документ20 страницList of Beneftis For Salaries Income Tax AY 2023 24Shaik ChandОценок пока нет

- Employee Benefits and Retirement PlanningДокумент20 страницEmployee Benefits and Retirement PlanningchiposityОценок пока нет

- Section 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadДокумент46 страницSection 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadAtul SharmaОценок пока нет

- Chap 12Документ38 страницChap 12mo hongОценок пока нет

- Foreign-Affiliate-Issues-in-Troubled TimesДокумент17 страницForeign-Affiliate-Issues-in-Troubled TimesMelly AnastasyaОценок пока нет

- OBILLOS Vs CIRДокумент1 страницаOBILLOS Vs CIRKrisjan Marie Sedillo OsabelОценок пока нет

- JPSP 2022 434Документ18 страницJPSP 2022 434Florie May HizoОценок пока нет

- Documents World BankДокумент38 страницDocuments World BankTudor CherhatОценок пока нет

- Haleluya Tesfaye RENTAL INCOME AND EOCДокумент71 страницаHaleluya Tesfaye RENTAL INCOME AND EOCAnteneh Gezahegne NegashОценок пока нет

- 19 31 July Final B.Com SYLLABUSДокумент105 страниц19 31 July Final B.Com SYLLABUSGåúràv KûmárОценок пока нет

- Chapter 2 (Compatibility Mode)Документ15 страницChapter 2 (Compatibility Mode)Hay JirenyaaОценок пока нет