Академический Документы

Профессиональный Документы

Культура Документы

Mayor Jeff Porter Reporting Violations On City Disclosure

Загружено:

Ben KellerОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mayor Jeff Porter Reporting Violations On City Disclosure

Загружено:

Ben KellerАвторское право:

Доступные форматы

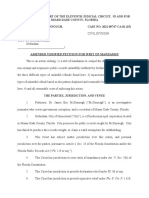

FD017546

FORMl ST A TEMENT OF 2018

Please print or type your name, mailing

address, agency name, and position below:

I FINANCIAL INTERESTS

I FOR OFFICE USE ONLY:

LAST NAM E -- FIRST NAME -- MIDDLE NAME : ,. . _

li".l r,..:,

PORTER. JEFF

MAILING ADDRESS : ;:i (/)

...

"'O

fTT'l-~

\) .

-Ill>

°"'.;)"

-

\J:>

.):,a ;(J

650 NE 22ND TER

s· £

ao. :::I

0

(")

(t)

~:} -

z,..·

C:

C'")

:.. , j

::::, VI {/} ~ :· ~-)

!a (~

0.

(f) ,•~'"

.... (1)

--

Ci)

a. C:J c. \.0 ;~J

C: 0 n 1r ,

,...

Q) 0

:i1c--) ,.-.....

CITY : ZIP : COUNTY: "'C? C".l P.l

......

<v :::CC)

::t:aa

:x

HOMESTEAD, FL 33033 MIAMI-DADE

0

0. -1 .s:· s..

,.. ~

NAME OF AGENCY : .... -- -< .c-

,..,-, ..

l

I-

OS:::. .,

METROPOLITAN PLANNING ORGANIZATION (MIAMI). GOVERNING BOARD r:::::- -,

~

::..,,: c.n

NAME OF OFFICE OR POSITION HELD OR SOUGHT :

t--

MPO BOARD MEMBER

.....

You are not limited to the space on the lines on this form. Attach additional sheets, if necessary.

'I:

11111111111111111111111 Ill Ill

CHECK ONLY IF D CANDIDATE OR 0 NEW EMPLOYEE OR APPOINTEE FD017546

**** BOTH PARTS OF THIS SECTION MUST BE COMPLETED ****

DISCLOSURE PERIOD:

THIS STATEMENT REFLECTS YOUR FINANCIAL INTERESTS FOR THE PRECEDING TAX YEAR, WHETHER BASED ON A CALENDAR

YEAR OR ON A FISCAL YEAR. PLEASE STATE BELOW WHETHER THIS STATEMENT IS FOR THE PRECEDING TAX YEAR ENDING

EITHER (must check one):

D DECEMBER 31, 20 18 OR D SPECIFY TAX YEAR IF OTHER THAN THE CALENDAR YEAR:

MANNER OF CALCULATING REPORTABLE INTERESTS:

FILERS HAVE THE OPTION OF USING REPORTING THRESHOLDS THAT ARE ABSOLUTE DOLLAR VALUES, WHICH REQUIRES FEWER

CALCULATIONS, OR USING COMPARATIVE THRESHOLDS , WHICH ARE USUALLY BASED ON PERCENTAGE VALUES (see instructions

for further details). CHECK THE ONE YOU ARE USING (must check one):

D COMPARATIVE (PERCENTAGE) THRESHOLDS OR D DOLLAR VALUE THRESHOLDS

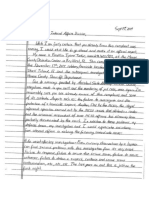

PART A -- PRIMARY SOURCES OF INCOME [Major sources of income to the reporting person - See instructions]

(If you have nothing to report, write "none" or "n/a")

NAME OF SOURCE SOURCE'S DESCRIPTION OF THE SOURCE'S

OF INCOME ADDRESS PRINCIPAL BUSINESS ACTIVITY

li)O//dw1r') oJ ,~u.o/Jlv /.<;"<is(0 -5. (71/de111,1V~ IA.u-e.. f<.f<,A J.,, U>.

c~'J,lAh ' (\ l\ ) '\

!...,)-

J,,A)(

/

f/{)mf?ff-e11-cf r::-r 3~:>s

PART B ·· SECONDARY SOURCES OF INCOME

[Major customers, clients, and other sources of income to businesses owned by the reporting person - See instructions]

(If you have nothing to report, write "'none"' or "'n/a")

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

BUSINESS ENTITY OF BUSINESS' INCOME OF SOURCE ACTIVITY OF SOURCE

/, 1:-v

I

!Jr.:. J-k/11~ <ilYAd 1/(J() /!/, J, ~ /!-/. !l<YYJtJf111& 0JO/f /'(t)l'Y) ~ IV -/. ·

-

if Y't/AfhtiA-tft. }fi)tf If\JA+ 1') /\ A { J.<hrl() 41J. 0?8S ·r //-o(f)()~f, fl.J 63d33 'Go1:u1il-,1 l-fu/'liAc.ls

PART C -- REAL PROPERTY [Land , buildings owned by the reporting person - See instructions]

(If you have nothing to report, write "'none"' or "'n/a") FILING INSTRUCTIONS for when

and where to file this form are

located at the bottom of page 2.

IIA

- INSTRUCTIONS on who must file

this form and how to fill it out

begin on page 3.

CE FORM 1 • Effective: January 1, 2019 (Continued on reverse side) PAGE 1

Incorporated by reference in Rule 34-8 .202( 1), F.A.C.

PORTER, JEFF FD017546

PART D - INTANGIBLE PERSONAL PROPERTY [Stocks, bonds, certificates of deposit, etc. - See instructions]

(If you have nothing to report, write "none" or "n/a")

TYPE OF INTANGIBLE BUSINESS ENTITY TO WHICH THE PROPERTY RELATES

~-f:0c/r s Affler1l/V\I r;::CA. rt/ j ~

PART E - LIABILITIES [Major debts - See instructions]

(If you have nothing to report, write "none" or "n/a")

NAME OF CREDITOR ADDRESS OF CREDITOR

('p ttkt' r .5-+1t-f f ~fhvk Pu 6ox qlnd Z.. /;.fi ·v vh, l-vtu1"' f I. 33fiE3 -8-002..

/JP.N IA, PJ Bl'ix 77'--/DL/ !=:(JJ N-:S 0~h7.8

I .(\JC

PART F - INTERESTS IN SPECIFIED BUSINESSES [Ownership or positions in certain types of businesses - See instructions]

(If you have nothing to report, write "none" or "n/a")

BUSINESS ENTITY# 1 BUSINESS ENTITY# 2

NAME OF BUSINESS ENTITY /vA NA

ADDRESS OF BUSINESS ENTITY

PRINCIPAL BUSINESS ACTIVITY

POSITION HELD WITH ENTITY

I OWN MORE THAN A 5% INTEREST IN THE BUSINESS

NATURE OF MY OWNERSHIP INTEREST

PART G - TRAINING

For elected municipal officers required to complete annual ethics training pursuant to section 112.3142, F.S.

~ I CERTIFY THAT I HAVE COMPLETED THE REQUIRED TRAINING.

IF ANY OF PARTS A THROUGH G ARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE D

SIGNATURE OF FILER: CPA or ATTORNEY SIGNATURE ONLY

If a certified public accountant licensed under Chapter 473, or attorney

Signature: ~ in good standing with the Florida Bar prepared this form for you , he or

she must complete the following statement:

I, , prepared the CE

Form 1 in accordance with Section 112.3145, Florida Statutes, and the

instructions to the form . Upon my reasonable knowledge and belief, the

disclosure herein is true and correct.

Date Signe&/11

f - Jb-l°t CPNAttorney Signature :

Date Signed : ----- . - -

FILING lNSTRUCTIONS:

If you were mailed the form by the Commission on Ethics or a County Candidates file this form together with their filing papers.

Supervisor of Elections for your annual disclosure filing, return the

form to that location. To determine what category your position falls MULTIPLE FILING UNNECESSARY: A candidate who files a Form

1 with a qualifying officer is not required to file with the Commission

under, see page 3 of instructions.

!,- or Supervisor of Elections.

Local officers!Jfjp_loy,.e&K: file with the Supervisor of Elections

WHEN TO FILE: Initially, each local officer/employee, state officer,

of the county in ••whict"t-~y permanently reside. (If you do not and specified state employee must file within 30 days of the

permanel'\tly res@ in Fl~a, file with the Supervisor of the county date of his or her appointment or of the beginning of employment.

where yciyr age~ has:tt~eadquarters.) Form 1 filers who file with Appointees who must be confirmed by the Senate must file prior to

the Supervisor lect~e@' may file by mail or email. Contact your

confirmation , even if that is less than 30 days from the date of their

Supervisor' of Electionsc.foothe mailing address or email address to appointment.

use. Dd Mt em§.il'lyouc;J&tn to the Commission on Ethics, it will be

returned.'. - ,-..; ~ Candidates must file at the same time they file their qualifying

ii' , ., <:..!) I~_. -

papers.

State officers ~ sp1fclfJed state employees who file with the

Commis~on o;fJ-thi~y file by mail or email. To file by mail , Thereafter, file by July 1 following each calendar year in which they

send the com ed :for. to P.O. Drawer 15709, Tallahassee , FL hold their positions.

32317-5709; pi§licar'a' ess: 325 John Knox Rd, Bldg E, Ste 200, Finally, file a final disclosure form (Form 1F) within 60 days of

Tallahassee , FL 32303. l:f6 file with the Commission by email , scan leaving office or employment. Filing a CE Form 1F (Final Statement

your completed form and any attachments as a pdf (do not use any of Financial Interests) does not relieve the filer of filing a CE Form 1

other format) and send it to CEForm1@leg.state.fl.us. Do not file by if the filer was in his or her position on December 31 , 2018.

both mail and email. Choose only one filing method. Form 6s will not

be accepted via email.

CE FORM 1 • Effective: January 1, 2019. PAGE 2

Incorporated by reference in Rule 34-8.202(1 ), F.A.C.

Вам также может понравиться

- Motion To Dismiss Franklin TuckerДокумент27 страницMotion To Dismiss Franklin TuckerBen KellerОценок пока нет

- Illegal For Texas CPS Social Workers To Lie in Affidavit To Take Seisure of Children Without DUe ProcessДокумент10 страницIllegal For Texas CPS Social Workers To Lie in Affidavit To Take Seisure of Children Without DUe ProcessBen KellerОценок пока нет

- Homestead Emergency and Pursuit Operation of Police VehiclesДокумент13 страницHomestead Emergency and Pursuit Operation of Police VehiclesBen KellerОценок пока нет

- Amended Petition - Open Records Request - Homestead, FloridaДокумент42 страницыAmended Petition - Open Records Request - Homestead, FloridaBen KellerОценок пока нет

- ACH Form, Round (Ed) TableДокумент1 страницаACH Form, Round (Ed) TableBen KellerОценок пока нет

- Defendant.: Opposition To Motion For Summary JudgmentДокумент13 страницDefendant.: Opposition To Motion For Summary JudgmentBen KellerОценок пока нет

- Petition For Mandamus 2022Документ57 страницPetition For Mandamus 2022Ben KellerОценок пока нет

- Odl Order DeniedДокумент1 страницаOdl Order DeniedBen KellerОценок пока нет

- Disorderly Conduct Statute For TexasДокумент4 страницыDisorderly Conduct Statute For TexasBen KellerОценок пока нет

- Terry V Ohio BuckДокумент64 страницыTerry V Ohio BuckBen KellerОценок пока нет

- Underage Rape Victim of Teacher Jason Edward Myers Wins $6 Million in Civil SuitДокумент22 страницыUnderage Rape Victim of Teacher Jason Edward Myers Wins $6 Million in Civil SuitBen KellerОценок пока нет

- Verdict in Favor of Jason Edward Meyers' Rape VictimДокумент2 страницыVerdict in Favor of Jason Edward Meyers' Rape VictimBen KellerОценок пока нет

- Open Letter & Public Record Request: BCSO's Arrest Report (Click Below Link)Документ4 страницыOpen Letter & Public Record Request: BCSO's Arrest Report (Click Below Link)Ben KellerОценок пока нет

- Initial DisclosuresДокумент6 страницInitial DisclosuresBen KellerОценок пока нет

- Higgins LetterДокумент2 страницыHiggins LetterBen KellerОценок пока нет

- Transcript-Oct2320-Motion To Add Dunne As WitnessДокумент70 страницTranscript-Oct2320-Motion To Add Dunne As WitnessBen KellerОценок пока нет

- Complaint Jane Doe Brownsville Middle CaseДокумент6 страницComplaint Jane Doe Brownsville Middle CaseBen KellerОценок пока нет

- Open Letter & Public Record Request: BCSO's Arrest Report (Click Below Link)Документ4 страницыOpen Letter & Public Record Request: BCSO's Arrest Report (Click Below Link)Ben KellerОценок пока нет

- Edwards ArrestДокумент9 страницEdwards ArrestBen KellerОценок пока нет

- Jane Doe vs. Miami-Dade County Public School Board - 1501871495226 - 10236595 - Ver1.0Документ20 страницJane Doe vs. Miami-Dade County Public School Board - 1501871495226 - 10236595 - Ver1.0Ben KellerОценок пока нет

- Oscar de La RosaДокумент3 страницыOscar de La RosaBen KellerОценок пока нет

- Ty1 PGДокумент4 страницыTy1 PGBen KellerОценок пока нет

- Rule 4 Federal Civil Procedure Summons - 2Документ9 страницRule 4 Federal Civil Procedure Summons - 2Ben KellerОценок пока нет

- Candidate and Committee InformationДокумент6 страницCandidate and Committee InformationBen KellerОценок пока нет

- Military Affairs Council Request For Hijacked FundsДокумент1 страницаMilitary Affairs Council Request For Hijacked FundsBen KellerОценок пока нет

- Oscar GPS ReportДокумент2 страницыOscar GPS ReportBen KellerОценок пока нет

- Indictment of Texas DPS Trooper Austin JohnstonДокумент4 страницыIndictment of Texas DPS Trooper Austin JohnstonBen KellerОценок пока нет

- Oscar de La RosaДокумент3 страницыOscar de La RosaBen KellerОценок пока нет

- Email Re: Formation of New MACДокумент4 страницыEmail Re: Formation of New MACBen KellerОценок пока нет

- Treasurer and VP of Lisa Greer of Centerstate Bank Freezes MAC Bank Account - Conflict of InterestДокумент3 страницыTreasurer and VP of Lisa Greer of Centerstate Bank Freezes MAC Bank Account - Conflict of InterestBen KellerОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- TV Antenna Tower CollapseДокумент4 страницыTV Antenna Tower CollapseImdaad ChuubbОценок пока нет

- Basler Electric TCCДокумент7 страницBasler Electric TCCGalih Trisna NugrahaОценок пока нет

- So Tim Penilik N10 16 Desember 2022 Finish-1Документ163 страницыSo Tim Penilik N10 16 Desember 2022 Finish-1Muhammad EkiОценок пока нет

- Blank FacebookДокумент2 страницыBlank Facebookapi-355481535Оценок пока нет

- The Art of Street PhotographyДокумент13 страницThe Art of Street PhotographyDP ZarpaОценок пока нет

- Indian Traditional Musical InstrumentsДокумент3 страницыIndian Traditional Musical InstrumentsPiriya94Оценок пока нет

- Demand Determinants EEMДокумент22 страницыDemand Determinants EEMPrabha KaranОценок пока нет

- Topic 6 Nested For LoopsДокумент21 страницаTopic 6 Nested For Loopsthbull02Оценок пока нет

- Tanque: Equipment Data SheetДокумент1 страницаTanque: Equipment Data SheetAlonso DIAZОценок пока нет

- Harley Davidson U S Reportedly Uses Risk Sharing Agreements With Its Foreign SubsidiariesДокумент1 страницаHarley Davidson U S Reportedly Uses Risk Sharing Agreements With Its Foreign Subsidiariestrilocksp SinghОценок пока нет

- Grammar Practice #2Документ6 страницGrammar Practice #2Constantin OpreaОценок пока нет

- Bloomsbury Fashion Central - Designing Children's WearДокумент16 страницBloomsbury Fashion Central - Designing Children's WearANURAG JOSEPHОценок пока нет

- EC105Документ14 страницEC105api-3853441Оценок пока нет

- Cash Budget Sharpe Corporation S Projected Sales First 8 Month oДокумент1 страницаCash Budget Sharpe Corporation S Projected Sales First 8 Month oAmit PandeyОценок пока нет

- Case Study Analysis - WeWorkДокумент8 страницCase Study Analysis - WeWorkHervé Kubwimana50% (2)

- Singer 900 Series Service ManualДокумент188 страницSinger 900 Series Service ManualGinny RossОценок пока нет

- Space Saving, Tight AccessibilityДокумент4 страницыSpace Saving, Tight AccessibilityTran HuyОценок пока нет

- NDT HandBook Volume 10 (NDT Overview)Документ600 страницNDT HandBook Volume 10 (NDT Overview)mahesh95% (19)

- GT I9100g Service SchematicsДокумент8 страницGT I9100g Service SchematicsMassolo RoyОценок пока нет

- Wire Rope TesterДокумент4 страницыWire Rope TesterclzagaОценок пока нет

- Genie PDFДокумент264 страницыGenie PDFjohanaОценок пока нет

- One Foot in The Grave - Copy For PlayersДокумент76 страницOne Foot in The Grave - Copy For Playerssveni meierОценок пока нет

- Commercial BanksДокумент11 страницCommercial BanksSeba MohantyОценок пока нет

- Business OrganizationДокумент32 страницыBusiness OrganizationSaugandh GambhirОценок пока нет

- Engineering Mathematics John BirdДокумент89 страницEngineering Mathematics John BirdcoutnawОценок пока нет

- PC's & Laptop Accessories PDFДокумент4 страницыPC's & Laptop Accessories PDFsundar chapagainОценок пока нет

- Instruction Manual Twin Lobe CompressorДокумент10 страницInstruction Manual Twin Lobe Compressorvsaagar100% (1)

- Cs205-E S3dec18 KtuwebДокумент2 страницыCs205-E S3dec18 KtuwebVighnesh MuralyОценок пока нет

- Planning Effective Advertising and Promotion Strategies For A Target AudienceДокумент16 страницPlanning Effective Advertising and Promotion Strategies For A Target Audiencebakhoo12Оценок пока нет

- Corporate Valuation WhartonДокумент6 страницCorporate Valuation Whartonebrahimnejad64Оценок пока нет