Академический Документы

Профессиональный Документы

Культура Документы

Working Capital: APPLE INC. Financial Resources

Загружено:

prins kyla SaboyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Working Capital: APPLE INC. Financial Resources

Загружено:

prins kyla SaboyАвторское право:

Доступные форматы

Working Capital

APPLE INC. Financial Resources

Net Working Capital is a measure of both a company’s efficiency and its short-term financial health. The working capital ratio is calculated as Working C

– Current liabilities. Accounting, the system of recording and summarizing a business and financial transactions and analyzing, verifying, and reporting the results is

communication process used by every company whether small or large. Positive working capital means that the company is able to pay off its short term liabilities. Ne

means that a company currently is unable to meet its short term liabilities with its current assets. When a company’s assets do not exceed its current liabilities, it may r

back creditors in the short term. The worst scenario is bankruptcy. Apple Inc. working capital over the last 5 years has constantly increased in enormous numbers. Sin

has consistently maintained a magnificent working capital ratio.

Working capital gives investors an idea of how Apple’s operational efficiency. Evidently, Apple Inc. without question maintains at the top, if not one of the bes

The goal of working capital management is to ensure that a firm is able to continue its operations and that is has sufficient ability to satisfy both maturing short term de

operational expenses. It is vital that a company managing its working capital be able to use its net working capital as a tool to measure the liquidity. With Apple Inc., I

few companies in the world that have absolutely no debt, Apple has many investors that worry whether the company can still maintain its proficiency and efficiency if

investors. I feel that Apple Investors need not to worry as Apple has done a brilliant job investing it funds back into market and in the economy. This is clearly shown

between the 2007 and 2011 Apple Inc.’s net Investing cash flow soared from 3.25 billion to 40.25 billion, making it the wealthiest company in the world.

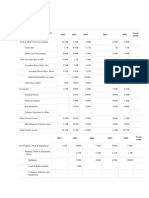

Operating Activities

Changes in Working Capital 1.33B 4.12B (586M) 1.21B

Receivables (385M) (785M) (939M) (4.86B)

Accounts Payable 1.49B 596M 92M 6.31B

Other Assets/Liabilities 292M 4.47B 207M 361M

Net Operating Cash Flow 5.47B 9.6B 10.16B 18.6B

Investing Activities

2007 2008 2009 2010

Capital Expenditures (986M) (1.2B) (1.21B) (2.12B)

Capital Expenditures (Fixed Assets) (735M) (1.09B) (1.14B) (2.01B)

Capital Expenditures (Other Assets) (251M) (108M) (69M) (116M)

Capital Expenditures Growth - -21.60% -1.17% -74.86%

Capital Expenditures / Sales -4.11% -3.69% -2.85% -3.26%

Net Assets from Acquisitions 0 (220M) 0 (638M)

Sale of Fixed Assets & Businesses 0 0 0 0

Purchase/Sale of Investments (2.31B) (6.76B) (16.15B) (11.09B)

Purchase of Investments (11.74B) (23B) (46.83B) (57.81B)

Sale/Maturity of Investments 9.42B 16.24B 30.68B 46.72B

Other Uses 0 (10M) (74M) (2M)

Other Sources 49M 0 0 0

Net Investing Cash Flow (3.25B) (8.19B) (17.43B) (13.85B)

Вам также может понравиться

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- Annual Financials For Apple IncДокумент3 страницыAnnual Financials For Apple IncFaye BelenОценок пока нет

- P&G Company AnaylsisДокумент13 страницP&G Company AnaylsisMehmet SahinОценок пока нет

- Total Accounts Receivable: Best Buy Balance Sheet 2015 2016 2017Документ10 страницTotal Accounts Receivable: Best Buy Balance Sheet 2015 2016 2017Krista ElieОценок пока нет

- View Previous Years Download: AnnualДокумент10 страницView Previous Years Download: AnnualsandeepОценок пока нет

- (74.03M) (7.19M) (616.51M) (1.63B) (366.52M) (109M) (41.65M) (126.97M)Документ8 страниц(74.03M) (7.19M) (616.51M) (1.63B) (366.52M) (109M) (41.65M) (126.97M)Chirayu ThapaОценок пока нет

- Assignment FinalДокумент10 страницAssignment FinalJamal AbbasОценок пока нет

- Income StatementДокумент7 страницIncome StatementZahidRiazHaansОценок пока нет

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesДокумент7 страницSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyОценок пока нет

- Individual/Group Assignments (Optional) Assignment 1Документ3 страницыIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaОценок пока нет

- End Term Paper FACD 2020Документ4 страницыEnd Term Paper FACD 2020Saksham SinhaОценок пока нет

- Bank of AmericaДокумент21 страницаBank of AmericaRavish SrivastavaОценок пока нет

- Financial Statements ForecastingДокумент5 страницFinancial Statements ForecastingRimpy Sondh0% (1)

- Financial AnalysisДокумент15 страницFinancial AnalysisRONALD SSEKYANZIОценок пока нет

- Preparation of Financial Statements - QBДокумент26 страницPreparation of Financial Statements - QBHindutav arya100% (1)

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyДокумент3 страницыQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- L07 Extra Practice Problems PDFДокумент2 страницыL07 Extra Practice Problems PDFanadi mittalОценок пока нет

- Exercise 1 - Practice For The Final: ABC Asset (Unlevered) Beta 0.70Документ10 страницExercise 1 - Practice For The Final: ABC Asset (Unlevered) Beta 0.70Mariale RamosОценок пока нет

- Financial Position Report & Cash Flow Statement Analyze Transactions To The AccountДокумент32 страницыFinancial Position Report & Cash Flow Statement Analyze Transactions To The AccountRafi EffendyОценок пока нет

- 5 Year Bank StatementsДокумент6 страниц5 Year Bank StatementsZahidRiazHaansОценок пока нет

- Case 21Документ14 страницCase 21Gabriela LueiroОценок пока нет

- MS04Документ34 страницыMS04Varun MandalОценок пока нет

- Chapter 4-Profitability Analysis: Multiple ChoiceДокумент30 страницChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderОценок пока нет

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Документ36 страницFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (28)

- FABVДокумент10 страницFABVdivyayella024Оценок пока нет

- Topic 3.5 Ratio AnalysisДокумент22 страницыTopic 3.5 Ratio AnalysisSevarakhon UmarovaОценок пока нет

- Chapter Two HandoutДокумент24 страницыChapter Two HandoutNati AlexОценок пока нет

- Vishal Dwivedi Analysis of Financial Statement MBADFB 2022Документ3 страницыVishal Dwivedi Analysis of Financial Statement MBADFB 2022Vishal DwivediОценок пока нет

- Ratio Analysis Review QuestionsДокумент5 страницRatio Analysis Review QuestionsPASTORYОценок пока нет

- Accounts Important Questions by Rajat Jain SirДокумент31 страницаAccounts Important Questions by Rajat Jain SirRajiv JhaОценок пока нет

- Financial AnaДокумент8 страницFinancial AnaMica AvilaОценок пока нет

- Aba FДокумент1 страницаAba Fjerik960Оценок пока нет

- Aqua Logistics IPO NoteДокумент14 страницAqua Logistics IPO NotemainstreetresearchОценок пока нет

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFДокумент5 страниц5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosОценок пока нет

- 4Q18 Earnings ReleaseДокумент15 страниц4Q18 Earnings ReleaseEMS Metalworking MachineryОценок пока нет

- ACC203 Solutions - 2T2018 - Week 11 - Workshop 10 PDFДокумент19 страницACC203 Solutions - 2T2018 - Week 11 - Workshop 10 PDFHanskumar MotianiОценок пока нет

- AFA Tut11 Anaylsis & Interpretation of FSДокумент9 страницAFA Tut11 Anaylsis & Interpretation of FSJIA HUI LIMОценок пока нет

- Cash Flow Estimation Brigham Case SolutionДокумент8 страницCash Flow Estimation Brigham Case SolutionShahid MehmoodОценок пока нет

- Maf5102 Fa Cat 2 2018Документ4 страницыMaf5102 Fa Cat 2 2018Muya KihumbaОценок пока нет

- Group and Individual Exercises COTEM 6022Документ12 страницGroup and Individual Exercises COTEM 6022China AlemayehouОценок пока нет

- GGP Final2010Документ23 страницыGGP Final2010Frank ParkerОценок пока нет

- FINA 3330 - Notes CH 9Документ2 страницыFINA 3330 - Notes CH 9fische100% (1)

- FIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinДокумент16 страницFIN501 - Financial Management Mid Term Assignment - Zin Thet Nyo LwinZin Thet InwonderlandОценок пока нет

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Документ5 страницBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarОценок пока нет

- Evaluacion Salud FinancieraДокумент17 страницEvaluacion Salud FinancieraWilliam VicuñaОценок пока нет

- Topic 3 5 Ratio AnalysisДокумент16 страницTopic 3 5 Ratio AnalysisEren BarlasОценок пока нет

- Case 1 - Tutor GuideДокумент3 страницыCase 1 - Tutor GuideKAR ENG QUAHОценок пока нет

- MT - Examination Solution 2018 FSaДокумент6 страницMT - Examination Solution 2018 FSaRamrajОценок пока нет

- Fostering Growth Opportunities: Hong Leong Finance LimitedДокумент144 страницыFostering Growth Opportunities: Hong Leong Finance LimitedSassy TanОценок пока нет

- 1.a. Divisional Performance Revision Questions ROI V RIДокумент3 страницы1.a. Divisional Performance Revision Questions ROI V RIK Lam LamОценок пока нет

- Financial Accounting & AnalysisДокумент5 страницFinancial Accounting & AnalysisINFO MerisaaОценок пока нет

- Test 2 Financial MGTДокумент4 страницыTest 2 Financial MGTBervie RondonuwuОценок пока нет

- Chemalite, Inc. (B) Case BackgroundДокумент2 страницыChemalite, Inc. (B) Case BackgroundAnuragОценок пока нет

- Course: PGDM Trimester III Div. Finance Group 1, 2 and 3 Marks 25 Date: 28 March 2022 Time: 1:30 Hours Subject: Analysis of Financial StatementsДокумент3 страницыCourse: PGDM Trimester III Div. Finance Group 1, 2 and 3 Marks 25 Date: 28 March 2022 Time: 1:30 Hours Subject: Analysis of Financial StatementsUmang GadaОценок пока нет

- Project Work ICMATДокумент31 страницаProject Work ICMATAvishi KushwahaОценок пока нет

- Assignment 7 - Clarkson LumberДокумент5 страницAssignment 7 - Clarkson Lumbertesttest1Оценок пока нет

- Reading 13 Integration of Financial Statement Analysis Techniques - AnswersДокумент21 страницаReading 13 Integration of Financial Statement Analysis Techniques - Answerstristan.riolsОценок пока нет

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamДокумент4 страницыÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinОценок пока нет

- Corporate Finance 3rd Edition Graham Solution ManualДокумент15 страницCorporate Finance 3rd Edition Graham Solution ManualMark PanchitoОценок пока нет

- ANCHETAДокумент1 страницаANCHETAprins kyla SaboyОценок пока нет

- ReflectionДокумент3 страницыReflectionprins kyla Saboy80% (5)

- CATBAGANДокумент5 страницCATBAGANprins kyla SaboyОценок пока нет

- Zeus (Roman Name: Jupiter)Документ2 страницыZeus (Roman Name: Jupiter)prins kyla SaboyОценок пока нет

- What Is Informational Text?: Expository TextsДокумент2 страницыWhat Is Informational Text?: Expository Textsprins kyla SaboyОценок пока нет

- Multiple Choice Questions: Responsibility Accounting and Transfer PricingДокумент2 страницыMultiple Choice Questions: Responsibility Accounting and Transfer Pricingprins kyla SaboyОценок пока нет

- Solution Manual For Principles of ManageДокумент3 страницыSolution Manual For Principles of Manageprins kyla SaboyОценок пока нет

- 01 The Role and Environment of Managerial FinanceДокумент28 страниц01 The Role and Environment of Managerial Financeprins kyla SaboyОценок пока нет

- True or FalseДокумент1 страницаTrue or Falseprins kyla SaboyОценок пока нет

- Chapter 02 Stock Investment Investor Accounting and ReportingДокумент3 страницыChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyОценок пока нет

- Module14 Version 2Документ47 страницModule14 Version 2prins kyla SaboyОценок пока нет

- Test BankДокумент42 страницыTest Bankprins kyla Saboy100% (1)

- ModuДокумент5 страницModuBrian KangОценок пока нет

- FINANCIAL MARKETS AND SERVICES Question BankДокумент2 страницыFINANCIAL MARKETS AND SERVICES Question BankJackson DiasОценок пока нет

- Chapter 15 - Pelaporan Segmen Dan Evaluasi KinerjaДокумент12 страницChapter 15 - Pelaporan Segmen Dan Evaluasi Kinerjaagung yohanesОценок пока нет

- David J. Abrahams Analysis of Heinz Companys Acquisition of Kraft Foods Group IncДокумент20 страницDavid J. Abrahams Analysis of Heinz Companys Acquisition of Kraft Foods Group IncMohamed elamin MaouedjОценок пока нет

- Working Capital Management Thesis DownloadДокумент7 страницWorking Capital Management Thesis Downloadcaseyhudsonwashington100% (1)

- Forecasting FCFF & FCFEДокумент26 страницForecasting FCFF & FCFEAstrid TanОценок пока нет

- Bond Valuation PracticeДокумент2 страницыBond Valuation PracticeMillat Equipment Ltd PakistanОценок пока нет

- ReportДокумент4 страницыReportBakayoko VaflalyОценок пока нет

- 2 Topic 1 Fair Value MeasurementДокумент18 страниц2 Topic 1 Fair Value MeasurementizwanОценок пока нет

- CRA Journal Entries Internal ReconstructionДокумент6 страницCRA Journal Entries Internal Reconstructioncharmi vaghelaОценок пока нет

- An Anecdote of Textile Apparel Sector in Bangladesh (September 2013)Документ7 страницAn Anecdote of Textile Apparel Sector in Bangladesh (September 2013)Al-Imran Bin KhodadadОценок пока нет

- Comprehensive Financial Markets Topics Test BankДокумент15 страницComprehensive Financial Markets Topics Test BankMichelle V. LaurelОценок пока нет

- EBusiness A Canadian Perspective For A Networked World Canadian 4th Edition Trites Solutions Manual 1Документ25 страницEBusiness A Canadian Perspective For A Networked World Canadian 4th Edition Trites Solutions Manual 1ronald100% (30)

- Icbp LK TW Ii 2017Документ116 страницIcbp LK TW Ii 2017DS ReishenОценок пока нет

- Moneylife inДокумент2 страницыMoneylife inRakesh SharmaОценок пока нет

- Team Evolvers - CFA RCДокумент10 страницTeam Evolvers - CFA RCSUMAN SUMANОценок пока нет

- GST 231 Pq&a IiiДокумент4 страницыGST 231 Pq&a IiiMuhammad Ibrahim SugunОценок пока нет

- Brief Exercises For EPSДокумент4 страницыBrief Exercises For EPSanon_225460591Оценок пока нет

- Puma Energy - JPM Bond ConferenceДокумент30 страницPuma Energy - JPM Bond ConferenceKA-11 Єфіменко ІванОценок пока нет

- Operating ExposureДокумент31 страницаOperating ExposureMai LiênОценок пока нет

- Kelompok 5 - ALK Problem 9-3Документ4 страницыKelompok 5 - ALK Problem 9-3UmiUmiОценок пока нет

- Corporate Finance - Mock ExamДокумент8 страницCorporate Finance - Mock ExamLưu Quỳnh MaiОценок пока нет

- Accounting Standard IcaiДокумент867 страницAccounting Standard IcaiKrishna Kanojia100% (2)

- Alerion Annual Report 2022Документ220 страницAlerion Annual Report 2022Muhammad Uzair PanhwarОценок пока нет

- Inventories With Lower Cost, Without Sacrificing Its QualityДокумент4 страницыInventories With Lower Cost, Without Sacrificing Its QualityMark Lyndon YmataОценок пока нет

- Woven Capital Associate ChallengeДокумент2 страницыWoven Capital Associate ChallengeHaruka TakamoriОценок пока нет

- Advance Equity Research and ValuationДокумент4 страницыAdvance Equity Research and ValuationELO OPSОценок пока нет

- Ferrari IPO QuestionsДокумент1 страницаFerrari IPO QuestionsShuОценок пока нет

- Jurnal InternasionalДокумент7 страницJurnal InternasionaldaimisОценок пока нет

- CCFДокумент19 страницCCFDeepak JainОценок пока нет