Академический Документы

Профессиональный Документы

Культура Документы

Cfas Reviewer

Загружено:

Jedi DuenasИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cfas Reviewer

Загружено:

Jedi DuenasАвторское право:

Доступные форматы

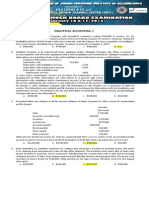

Conceptual Frameworks and Accounting Standards

RA 9298: The Philippine Accountancy Act of 2004 Qualifications:

-stipulates that the Professional Regulatory Board 1. Must be natural born Filipino Citizen

of Accountancy (PRBOA), which operates under the 2. Must be a duly registered CPA with atlest

Professional Regulations Commission (PRC) is 10 yrs. Of experience in any field of

responsible for the regulations of the professional accountancy

accountant in the Philippines. 3. Must not be convicted of any crimes

including moral turpitude.

Areas of Accountancy

4. Must not be a director or officer in any

1. Academe school that offers the BSA course.

a. 2 or 3 sem = I year of service

Process:

2. Public

a. Managerial and above= 1 yr: 1 1. PRC will shortlist the 5 to 3 nominees.

b. Below Managerial= 3 yrs : 1 2. President will choose the members.

3. Commerce and Industry 3. Maximum of 12 yrs. To serve the board.

4. Government 4. After 2 yrs of consecutive reappointment,

he/she needs at least 1 cooling period.

Philippine Regulations Commission

PRBOA Financial Reporting Standards Council

- Oversees a particular profession

(FRSC)

Professional Regulatory Board of Accountancy

Standards council tasked for the adoption

(PRBOA)

of IFRS and IAS in the Philippines

- 7 members including the chairman 16 members

- Chairman is appointed or revoked by the

Auditing and Assurance Standards Council (AASC)

President of the Philippines

Philippine Standards Accounting (PSA)

Members:

Philippine Framework for Assurance

1 vice chairman: 1 yr: 1 term Engagement (PFAE)

17 members

5 members: 3 yrs: 1 term

Financial Accounting Standards Board (FASB)

Electing a Chairman

- The Financial Accounting Standards Board

National Accredited Professional Organization has the authority to establish and interpret

(NAPO) generally accepted accounting principles

(GAAP).

Philippine Institute of the Certified Public

Accountant (PICPA) IFRS PFRS

Within 60 days prior to the term of the IAS PAS

incumbent member, they shall have the 5

IFRIC PIC INTERPRETATIONS

nominees submitted to the Philippine

Interpretations Committee (PIC)

Conceptual Frameworks and Accounting Standards

INTERNATIONAL Indirect Users: provides assistances or advice to

the direct users.

IFRS Foundation > International

Accounting Standards Board (IASB) – 22 Branches of Accounting

members

1. Financial Accounting: focuses on external

IFRS Interpretations Committee

users

Advisory Council

2. Management Accounting: Focuses on

International Organization of Securities Internal Users

Commission – in 271 countries in the world 3. Cost Accounting: measurement and

recognition of cost of services provided and

Formation of a Standard products manufactured.

1. Agenda - identify the issues and problems 4. Tax Accounting

2. Issuance of exposure draft for public 5. Government Accounting

comments 6. Bookkeeping: refers to the recording stage

3. Consideration of comments 7. Auditing : independent examination of

4. IFRS issuance ( with a majority vote; 9 financial Information

members) CHAPTER 2

*interpretations committee will interpret the Purpose of the Conceptual Framework

gray areas

- Describe the objective of and the concept

FASB- PFRS includes IFRS, IAS and Interpretation for general purpose financial reporting.

FRSC a. Assist the IASB to develop IFRS that are

based on consistent concepts.

1. Considers the IASB b. Assist preparers to develop consistent

2. Exposure draft accounting policies when no standards

3. Consideration of Comments applies to a particular transaction.

4. Issuance of the PFRS c. Assist all parties to understand and

interpret the standard.

*all standards are based on the conceptual

frameworks. Objective of General Purpose Financial

Reporting

CHAPTER 1

a. Provide financial information about the

Types of Users

entity that is useful to existing and potential

External Users: not directly involve on managing investor, lenders and other in making a

the entity decision about providingfunds/ resources to

the entity.

Internal Users: uses the information for internal b. Used by: Employees, government and

decision making public

Direct Users: protect their own investment or

interest

Conceptual Frameworks and Accounting Standards

Liquidity- ability or availability of cash in the 4. Income: increases asset, decreases liability.

near future Except those that were contributed by the equirt

participants.

Solvency- availability of cash over long term to

a. Revenues: Principal operation activities of the

pay liabilities as they fall due

business

Profitability- general cash flows from existing - carrying value of the revenue is not subtracted by

resource base the cost of asset

b. Gains- subtracted from the carrying value of the

Financial Flexibility- ability to adjust to asset.

unexpected downturns

5.Expenses: Decreases the asset, increases liability-

Financial Position- information about entity’s

other than those that were distributed to the

resource and claims

equity participant

Comprehensive income- changes in entity’s a. Expenses- arises from normal operations

resource and claims b. losses- other then expenses (equipment

depreciation)

* Accrual Accounting is the basis

1. Asset: present economic resource Capital Maintenance Approach

a. right - There is profit only if the physical

b. potential economic benefits productive capacity of the entity at the end

c. control of the period exceeds the physical

productive capacity at the beginning of the

same period.

2. Liability: present obligation

a. Based on past event

Net assets, beg xxx

b. outflow of resources (transfer of economic

Net Income(loss) xxx(xxx)

benefits)

Contributions from xxx

Distributions to (xxx)

3. Equity- residual interest (E= A-L)

Net assets xxx

a. claims that did not meet the definition of

liability

Physical Concept of capital

b. owners= equity participants

- Operational assets

Example:

Productive Capacity, beg xxx

Bonds payable Net Income(loss) xxx(xxx)

Fair value= 1,200,000 Contributions from xxx

Face Value= 1,100,000 Contributions to (xxx)

Liability- 1,100,000 Productive capacity, end xxx

Equity- 100,000

*compound instrument: composed of equity and

liability

Conceptual Frameworks and Accounting Standards

QUALITATIVE CHARACTERISTICS PAS 1: Presentation of Financial Statement

A. Fundamental Scope

1. Relevance 1. To apply the standard in applying the IFRS

a. Predictive Value (PFRS)

(forecast/predictive) 2. Recognition, measurement, classification,

b. Confirmatory (feedback) and presentation principles in preparing the

c. MATERIALITY financial statements.

2. Faithful Representation (PRUDENCE) 3. Structure of Financial Statements

a. Neutral 4. Does not apply to financial statements

b. Complete- free from bias under the PAS 34 (Interim FS)

2.1 window dressing- overstating Objective

the income and understating 1. Requirement for presentation- minimum

expense requirements

c. free from error 2. Show stewardship of the management

B. Enhancing 3. Use as a basis of user for the decision

1. Verifiability- same method and making

principles A. General Purpose Financial Statements

2. Comparability- key: consistency - Provides information of the reporting entity

a. Inter-comparability (1) horizontal- 2 financial position, performance and cash

periods (2) vertical- same period flows.

b. Intra-comparability- industry B. Materiality

analysis (same industry- same size) - Omission or commission of information will

3. Understandability- responsibility and affect the financial statements

purpose C. Offsetting- General Rule not allowed

a. Notes to financial statements a. Should not affect the asset and liability

(disclosures) b. Should not offset income/expense

4. Timeliness- Reliability (timely and valid) EXCEPTIONS

1. Recognition 1. Required by the standard

a. Initial Recognition PAS 19: Employee Benefits

b. Subsequent Recognition - Long term benefits

2. Measurement - Defined benefit obligation

a. Historical Cost- including historical cost - Plan Asset

b. Current Cost- Fair value, value in use, 2. Immaterial/Insignificant

fulfillment value. - Judgment /disclosure

3. The same transactions

- Equity investment at fair value through

profit and loss.

Conceptual Frameworks and Accounting Standards

D. Profit/loss – Net Income (Net Loss)

- INCOME-EXPENSES 2. Statement of financial comprehensive

E. Other Comprehensive (Income after tax) income / statement of profit and loss

- Items of income profit/loss and directly (income statement)

reported in equity.

a. Revaluation surplus a. Income

b. Unrealized Gain/loss- changes in FV b. Expense

c. Foreign Exchange Translation gain(loss) c. OCI items (net of tax)

1. Asset (liab)- closing rate *for a period of time

2. Income or expense- average rate

d. Re-measurement gain/loss defined 3. Statement of Cash flows

Benefit Plan

1. Defined Benefit Obligation (DBO) – a. Operating

due to changes in actuarial b. Investing

assumptions c. Financing

2. Plan Asset- difference of actual *for a period of time

return and return based on high

quality corporate bonds. 4. Statement of changes in Owner’s equity

e. Effective portion of hedging transaction 5. Notes to financial statement

using cash flow hedge. - accompanying information of all FS

F. Comprehensive income (CI) components

- Sum of amount in profit or loss and other a. explanation of events/transactions

comprehensive income b. nature of business

- P&L +OCI=CI c. compliance with pfrs

G. PFRS includes d. accounting standards applied

- PFRS (IASB) e. accounting policies adopted

- PAS f. judgement and estimates

- Interpretations(IFRIC;SIC)

H. Reclassification of Entries 6. Statement of Financial Position

- To classify, one item to another item - the beginning of earliest period presented

I. Adjusting entries (no errors) as a result of retrospective application of

- Update the balances the entity.

J. Correcting Entries(w/errors) a. A change in accounting estimates

- To correct classification, measurement and (prospective; current and future)

values of the accounts b. A change in accounting Policy

(retrospective;prior,current and future)

COMPONENTS OF FINANCIAL STATEMENTS (PAS1)

1. Components of financial position

a. Asset

b. Liability

c. Equity

*as of specific date

Conceptual Frameworks and Accounting Standards

STATEMENT OF FINANCIAL POSITION Criteria For Current Liabilities

Naming convention: 1. Held for trading

Name of the company and/or logo 2. Expected to be settled within normal

Statement of Financial Position operating cycle

As at / as of (ending period) 3. Expected to be settled within 12 months after

reporting period

Line ItemS 4. Entity does not have an unconditional right to

(a) property, plant and equipment (NCA) NCA defer, the settlement of obligation for atleast

(b) investment property (NCA) NCA 12 months of the reporting period.

(c) intangible assets (NCA) NCA a. Payable on Demand

(d) financial assets (excluding amounts EI b. Breach of contract (breached contracts

shown under (e), (h), and (i)) DI

needs refinancing)

(e) investments accounted for using the NCA

equity method Refinancing agreement

(f) biological assets NCA

(g) inventories CA - on or before the end of the reporting period

(h) trade and other receivables CA for atleast 12 months after the reporting

(i) cash and cash equivalents CA period.

(j) assets held for sale CA

(k) trade and other payables Discretion to refinance

(l) provisions

(m) financial liabilities (excluding amounts a. the entity has discretion (NCL)

shown under (k) and (l)) b. the entity does not have the discretion (CL)

(n) current tax liabilities and current tax

assets, as defined in IAS 12 EI >NI = DISCOUNT

(o) deferred tax liabilities and deferred tax NCA

assets, as defined in IAS 12 NI>EI=PREMIUM

(p) liabilities included in disposal groups Nominal Interest/ Stated Interest=

(q) non-controlling interests, presented

received/paid

within equity

(r) issued capital and reserves attributable Effective Interest = earned

to owners of the parent.

Criteria for Current Assets Face value xxx

1. Cash and Cash Equivalents Unamortized discount (xxx)

CV XXX

2. Expected to be collected within the normal

operating cycle (TRADE)

Face value xxx

3. Expected to be collected within 1 yr. after

the reporting period (current portion of long Unamortized premium xxx

term receivables) CV XXX

4. Held for trading (inventories.

FA@FVTPL,NCAHFS)

Вам также может понравиться

- TRUE-FALSE-Conceptual: CFAS SET 2 and 3 Reviewer Mark Angelo Enriquez, CPAДокумент7 страницTRUE-FALSE-Conceptual: CFAS SET 2 and 3 Reviewer Mark Angelo Enriquez, CPARamsys Attaban100% (1)

- Conceptual Framework Reviewer Chap. 1-4Документ10 страницConceptual Framework Reviewer Chap. 1-4Serge Ann Idiesca100% (9)

- Cfas Reviewer PDFДокумент44 страницыCfas Reviewer PDFAndrea MalazaОценок пока нет

- CFAS PAS 1 10 Answer Key1Документ4 страницыCFAS PAS 1 10 Answer Key1Mickey Moran86% (7)

- 1 - Conceptual Framework & Accounting Process - Post TestДокумент6 страниц1 - Conceptual Framework & Accounting Process - Post TestRonieOlarteОценок пока нет

- Toa.m-1401. Conceptual Framework and Accounting ConceptsДокумент12 страницToa.m-1401. Conceptual Framework and Accounting ConceptsRod100% (2)

- Qualifying Reviewer Questions CFASДокумент9 страницQualifying Reviewer Questions CFASReinalyn Larisma MendozaОценок пока нет

- Financial Accounting Valix Summary 1-7Документ13 страницFinancial Accounting Valix Summary 1-7Noel Guerra94% (65)

- InventoriesДокумент9 страницInventoriesDon John David100% (2)

- Conceptual Framework PAS 1 With Answer KeyДокумент11 страницConceptual Framework PAS 1 With Answer KeyRichel Armayan67% (21)

- Cfas ReviewerДокумент12 страницCfas ReviewerRafael Capunpon VallejosОценок пока нет

- Intermediate Accounting 1a 2019 by Millan SummaryДокумент6 страницIntermediate Accounting 1a 2019 by Millan SummaryHannahbea Lindo100% (1)

- Chapter 1 PFRS 1 AnswerДокумент1 страницаChapter 1 PFRS 1 Answer03LJОценок пока нет

- PAS 2 InventoriesДокумент3 страницыPAS 2 InventoriesLary Lou Ventura100% (4)

- Conceptual Framework PAS 1 With Answer KeyДокумент12 страницConceptual Framework PAS 1 With Answer KeyRichel Armayan33% (3)

- CFAS ReviewerДокумент5 страницCFAS ReviewerJester BorresОценок пока нет

- Amework & PAS 1 QuizbowlДокумент9 страницAmework & PAS 1 QuizbowlViancaPearlAmores0% (1)

- Conceptual Framework and Accounting StandardsДокумент5 страницConceptual Framework and Accounting StandardspeejayОценок пока нет

- CFAS - Philippine Accounting StandardsДокумент39 страницCFAS - Philippine Accounting StandardsZerille Lynnelle Villamor Simbajon100% (1)

- Framework of Accounting (TOA) - ValixДокумент42 страницыFramework of Accounting (TOA) - ValixFatima Pasamonte88% (43)

- Cfas StodocuДокумент31 страницаCfas StodocuRosemarie Cruz100% (1)

- Cfas Test BanksДокумент6 страницCfas Test Bankspehik100% (1)

- Conceptual Framework and Accounting StandardsДокумент29 страницConceptual Framework and Accounting StandardsimeemagdangalОценок пока нет

- Conceptual Framework Quiz 1Документ2 страницыConceptual Framework Quiz 1Acissej100% (4)

- Conceptual Framework: & Accounting StandardsДокумент62 страницыConceptual Framework: & Accounting StandardsAmie Jane MirandaОценок пока нет

- Conceptual Frameworks and Accounting Standards PDFДокумент58 страницConceptual Frameworks and Accounting Standards PDFJieyan Oliveros0% (1)

- PAS 28 Investment in Associates and Joint VenturesДокумент29 страницPAS 28 Investment in Associates and Joint Venturesrena chavez100% (2)

- Problems: Problem I: True or FalseДокумент75 страницProblems: Problem I: True or FalseRosemarie Cruz100% (1)

- Chapter 2 Acctg Concepts PrinciplesДокумент17 страницChapter 2 Acctg Concepts PrinciplesRosela Dela Vega100% (6)

- Cfas Mock Test PDFДокумент71 страницаCfas Mock Test PDFRose Dumadaug50% (2)

- FAR 1 Reviewer AnswerДокумент27 страницFAR 1 Reviewer AnswerZace Hayo100% (1)

- Far Set2 A Basic Reviewer For Financial Accounting and Reporting 1Документ6 страницFar Set2 A Basic Reviewer For Financial Accounting and Reporting 1AShley NIcole0% (1)

- Cfas MidtermДокумент38 страницCfas MidtermBruce SolanoОценок пока нет

- BSA Program QUALIFYING 2021Документ6 страницBSA Program QUALIFYING 2021Justin Calina100% (1)

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalДокумент6 страницUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette Lampitoc100% (2)

- Cfas Quiz 2Документ8 страницCfas Quiz 2Glen Mervin EsguerraОценок пока нет

- Far Reviewer 1Документ13 страницFar Reviewer 1Allyza May Gaspar0% (1)

- CFAS Final ExamДокумент9 страницCFAS Final ExamMarriel Fate CullanoОценок пока нет

- Conceptual Framework: & Accounting Standards Lecture AidДокумент19 страницConceptual Framework: & Accounting Standards Lecture AidFuentes, Ferdelyn F.Оценок пока нет

- Financial Accounting and ReportingДокумент3 страницыFinancial Accounting and ReportingEmma Mariz GarciaОценок пока нет

- QUIZ - PAS 2 - INVENTORIES No AnswerДокумент2 страницыQUIZ - PAS 2 - INVENTORIES No AnswerCarlОценок пока нет

- Financial Accounting and Reporting ReviewerДокумент14 страницFinancial Accounting and Reporting ReviewerRen Kouen100% (4)

- CFAS Chapter 1 20Документ68 страницCFAS Chapter 1 20Marilor Mamaril100% (2)

- Cfas Finals Quiz 1 A4 Set C With Answers PDFДокумент4 страницыCfas Finals Quiz 1 A4 Set C With Answers PDFIts meh SushiОценок пока нет

- Chapter 22 Current LiabilitiesДокумент17 страницChapter 22 Current Liabilitiesnoryn40% (5)

- Pas 16 PpeДокумент4 страницыPas 16 Ppehsjhs100% (1)

- PAS 8 Accounting Policies, Changes in Accounting: Estimates & ErrorsДокумент1 страницаPAS 8 Accounting Policies, Changes in Accounting: Estimates & ErrorsHassanhor Guro BacolodОценок пока нет

- CFAS - Module 1 PDFДокумент22 страницыCFAS - Module 1 PDFKashato BabyОценок пока нет

- This Study Resource Was: PAS 2 InventoriesДокумент3 страницыThis Study Resource Was: PAS 2 Inventorieshsjhs100% (2)

- PAS 7 - Statement of Cash FlowДокумент14 страницPAS 7 - Statement of Cash FlowCarlo Lopez Cantada100% (1)

- CFAS Testbank Answer KeyДокумент14 страницCFAS Testbank Answer KeyPrince Jeffrey FernandoОценок пока нет

- Cfas Reviewer PDF Free PDFДокумент6 страницCfas Reviewer PDF Free PDFDonghyuk LeeОценок пока нет

- BABE1 Reviewer 1Документ13 страницBABE1 Reviewer 1James Ryan AlzonaОценок пока нет

- Development of Financial Reporting Framework, Standard-Setting Bodies and Regulation of The Accountancy ProfessionДокумент3 страницыDevelopment of Financial Reporting Framework, Standard-Setting Bodies and Regulation of The Accountancy ProfessionJUST KINGОценок пока нет

- Conceptual Framework and Accounting Standards: OutlineДокумент6 страницConceptual Framework and Accounting Standards: OutlineMichael TorresОценок пока нет

- ACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkДокумент34 страницыACYFAR NOTES Standard Setting IAS 1 Conceptual FrameworkFritzey Faye RomeronaОценок пока нет

- Module 1 - Framework and RegulationДокумент13 страницModule 1 - Framework and RegulationLuiОценок пока нет

- Quiz NotesДокумент4 страницыQuiz NotesJacqueline OrtegaОценок пока нет

- CfasДокумент6 страницCfasMarianne AguilarОценок пока нет

- Financial Accounting Theory and Practice Vol 1Документ1 страницаFinancial Accounting Theory and Practice Vol 1Jessa BasarteОценок пока нет

- Estate QuizДокумент6 страницEstate QuizJedi DuenasОценок пока нет

- TQM Reflection PaperДокумент2 страницыTQM Reflection PaperJedi Duenas75% (4)

- Internal Processes Part 1: Managing OperationsДокумент13 страницInternal Processes Part 1: Managing OperationsJedi DuenasОценок пока нет

- Module 3 Responsibility Accounting Economic Value AddedДокумент2 страницыModule 3 Responsibility Accounting Economic Value AddedJedi DuenasОценок пока нет

- Reviewees IntaccДокумент6 страницReviewees IntaccKimberly BalontongОценок пока нет

- Spiceland-9th Edition-Chapter-01-Solution ManualДокумент37 страницSpiceland-9th Edition-Chapter-01-Solution ManualStephen Andrei VillanuevaОценок пока нет

- Chapter 02Документ34 страницыChapter 02Amit ShuklaОценок пока нет

- Afar 2 Module CH 13Документ12 страницAfar 2 Module CH 13Ella Mae TuratoОценок пока нет

- If Land Purchased 15 Years Ago For 40500 Is Now Worth 346000 It Is Still CarriedДокумент10 страницIf Land Purchased 15 Years Ago For 40500 Is Now Worth 346000 It Is Still CarriedAdi DanielОценок пока нет

- Tutorial 1 FA IVДокумент5 страницTutorial 1 FA IVZHUN HONG TANОценок пока нет

- Assessment Ii,,,,prince's GroupДокумент14 страницAssessment Ii,,,,prince's GroupTafadzwaОценок пока нет

- Current Cost AccountingДокумент8 страницCurrent Cost AccountingHarvey Dienne Quiambao100% (2)

- 13.final Theories AДокумент6 страниц13.final Theories AMary Joy AlbandiaОценок пока нет

- Module 1 - Handout 5eДокумент90 страницModule 1 - Handout 5epi_31415Оценок пока нет

- Kieso IFRS Test Bank Ch07 Kieso IFRS Test Bank Ch07Документ45 страницKieso IFRS Test Bank Ch07 Kieso IFRS Test Bank Ch07Adul Luda100% (1)

- Dhofar Foods and Investment (Dfin)Документ9 страницDhofar Foods and Investment (Dfin)Cherry SeasonОценок пока нет

- H One (PVT) LTD 20-21-ExemptДокумент164 страницыH One (PVT) LTD 20-21-ExemptShehara GamlathОценок пока нет

- Cbactg01 Complete ModuleДокумент170 страницCbactg01 Complete ModuleJ LagardeОценок пока нет

- Basic Accounting: Multiple ChoiceДокумент38 страницBasic Accounting: Multiple ChoiceErika GambolОценок пока нет

- Preparation of Financial Statements CompiledДокумент23 страницыPreparation of Financial Statements CompiledMarcus Monocay100% (1)

- Chapter 9Документ15 страницChapter 9RBОценок пока нет

- ReviewerДокумент43 страницыReviewergnim1520Оценок пока нет

- Practical Accounting 1 With AnswersДокумент10 страницPractical Accounting 1 With Answerslibraolrack50% (8)

- The Use of Fair Value in IFRSДокумент19 страницThe Use of Fair Value in IFRSahadiano200Оценок пока нет

- Monetary or Non-Monetary - CPDbox - Making IFRS EasyДокумент97 страницMonetary or Non-Monetary - CPDbox - Making IFRS EasyRachelle Anne M PardeñoОценок пока нет

- As 6 Depreciation AccountingДокумент5 страницAs 6 Depreciation AccountingJagmohanKiruthivasanKameswariОценок пока нет

- Chapter 9 PDFДокумент40 страницChapter 9 PDFJoshua GibsonОценок пока нет

- CH 10 Audit of Insurance Co.Документ66 страницCH 10 Audit of Insurance Co.Raja BahlОценок пока нет

- Financial Asset at Amortized CostДокумент18 страницFinancial Asset at Amortized CostJay-L Tan100% (1)

- Inventories and Investment Theories v2Документ10 страницInventories and Investment Theories v2Joovs JoovhoОценок пока нет

- CFA - Difference Between US GAAP and IFRSДокумент3 страницыCFA - Difference Between US GAAP and IFRSKevin RogersОценок пока нет

- Understanding Australian Accounting Standards 1st Edition Loftus Test BankДокумент36 страницUnderstanding Australian Accounting Standards 1st Edition Loftus Test Bankeyepieceinexact.4h0h100% (30)

- THEORIES PAS 1 and PAS 8Документ28 страницTHEORIES PAS 1 and PAS 8PatrickMendozaОценок пока нет

- Historical Cost.: Theory of Accounts Practical Accounting 1Документ6 страницHistorical Cost.: Theory of Accounts Practical Accounting 1MjhayeОценок пока нет

- Cost AccountancyДокумент197 страницCost AccountancymirjapurОценок пока нет