Академический Документы

Профессиональный Документы

Культура Документы

Dimension Data India PVT LTD: Pay Slip For The Month of August 2019

Загружено:

Ashok Chauhan0 оценок0% нашли этот документ полезным (0 голосов)

55 просмотров1 страницаH

Оригинальное название

PDFReports (1)

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документH

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

55 просмотров1 страницаDimension Data India PVT LTD: Pay Slip For The Month of August 2019

Загружено:

Ashok ChauhanH

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

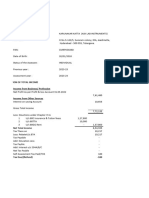

Dimension Data India Pvt Ltd

1701 to 1704, B WING, ONE BKC, G BLOCK BANDRA KURLA COMPLEX, BANDRA EAST, Mumbai - 400051

Pay Slip for the month of August 2019 Print Date : 30/08/2019 06:22:05PM

Emp. Code IN705913 Grade : Location : Manesar

:Name : Ashok Chauhan Gender : Male Bank A/c No. : 50100285554933

Designation : Technical Specialist Team : ESI No. :

Department : TSS - Managed Services - Team Empowerment PAN : AMRPC6078P

Cost Centre : INDLTMS303 0.00 PF No. : MHBAN00434470000021152

DOJ 02/07/2019 Payable Days : 31.00 PF UAN. : 100101047436

:

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic Salary 30,125 30,125 30,125 Provident Fund 3,615

HRA 18,075 18,075 18,075 Income Tax 8,367

Conveyance 1,600 1,600 1,600 Lic Deduction 84

Additional All 45,752 45,752 45,752

Medical All 1,250 1,250 1,250

GROSS PAY 96,802 96,802 GROSS DEDUCTION 12,066

NET PAY 84736

Income Tax Worksheet for the Period July 2019 - March 2020

Description Gross Exempt Taxable Deduction Under Chapter VI-A

Basic 270,153 270,153 Investments u/s 80C

HRA 162,092 162,092 PROV. FUND 32,418

Conv All 14,348 14,348 L I P 753

Add All 410,292 410,292

Medical 11,210 11,210

Gross Salary 868,095 868,095 Total of Investment u/s 80C 33,171

Deduction

Standard Deduction 50,000 U/S 80C 33,171 Car Perk

Previous Employer Professional Tax Car HP/Capacity >1.6HP

Professional Tax From

Under Chapter VI-A 33,171 To

Any Other Income Driver Perk

Taxable Income 784,924 From

Total Tax 69,485 To

Tax Rebate Taxable Car Perk

Surcharge

Tax Due 69,485

Educational Cess 2,779

Net Tax 72,264

Tax Deducted (Previous Employer)

Tax Deducted Till Date 5,329

Tax to be Deducted 66,935

Tax / Month 8,367 Total of Ded Under Chapter VI-A 33,171

Tax on Non-Recurring Earnings

Tax Deduction for this month 8,367 Interest on Housing Loan

HRA Exemption:

From To Rent Paid Actual HRA 40/50% of Basic Rent - 10% of Basic Exempt HRA

Total

Personal Note :

Вам также может понравиться

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Документ1 страницаAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarОценок пока нет

- SlipДокумент1 страницаSlipPratikDuttaОценок пока нет

- Slip PDFДокумент1 страницаSlip PDFPratikDutta0% (1)

- Slip PDFДокумент1 страницаSlip PDFPratikDuttaОценок пока нет

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Документ1 страницаGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuОценок пока нет

- March PDFДокумент1 страницаMarch PDFRОценок пока нет

- Upgrad PayslipДокумент1 страницаUpgrad PayslipSantanu SauОценок пока нет

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsДокумент1 страницаPay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANEОценок пока нет

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsДокумент1 страницаPay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANEОценок пока нет

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Документ1 страницаSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakОценок пока нет

- 1% Stock Movement StrategyДокумент1 страница1% Stock Movement Strategyashish10mca9394Оценок пока нет

- HTMLReportsДокумент1 страницаHTMLReportsRashmi Awanish PandeyОценок пока нет

- April Payment SleepДокумент1 страницаApril Payment Sleepizajahamed1Оценок пока нет

- Aug PDFДокумент1 страницаAug PDFRОценок пока нет

- PDFReports PDFДокумент1 страницаPDFReports PDFTuhin ChakrabortyОценок пока нет

- Book 1Документ2 страницыBook 1Rajat NayakОценок пока нет

- Payslip For The Month of May 2020: Earnings DeductionsДокумент1 страницаPayslip For The Month of May 2020: Earnings DeductionsRОценок пока нет

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Документ1 страницаVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Документ1 страницаEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerОценок пока нет

- Razorpay Software P.L: Pay Slip For The Month of April 2021Документ1 страницаRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SОценок пока нет

- PDFReports PDFДокумент1 страницаPDFReports PDFTuhin ChakrabortyОценок пока нет

- HTML ReportsДокумент8 страницHTML Reportsdpkch4141Оценок пока нет

- Income From Salaries: Rs. Rs. Rs. SCH - NoДокумент2 страницыIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriОценок пока нет

- Dec Payslip - Rekrut IndiaДокумент1 страницаDec Payslip - Rekrut IndiafkadirОценок пока нет

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoДокумент3 страницыProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoAkhil ThannikalОценок пока нет

- Nov PayslipДокумент1 страницаNov Payslipsuresh1.somisettyОценок пока нет

- CompДокумент4 страницыCompCorman LimitedОценок пока нет

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationДокумент3 страницыAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneОценок пока нет

- Direct Tax Solution PDFДокумент8 страницDirect Tax Solution PDFGaurav SoniОценок пока нет

- Compensation ExamplesДокумент26 страницCompensation ExamplesNAFEES NASRUDDIN PATELОценок пока нет

- HTMLReportsДокумент1 страницаHTMLReportsps5927510Оценок пока нет

- Profits and Gains of Business or ProfessionДокумент3 страницыProfits and Gains of Business or ProfessionKumar GajulaОценок пока нет

- Ed 9Документ2 страницыEd 9Sanjay DuaОценок пока нет

- 1519732537814Документ1 страница1519732537814vinod kumarОценок пока нет

- HTML ReportsДокумент2 страницыHTML Reportsdpkch4141Оценок пока нет

- Ask Fy 2022-23 FNLДокумент3 страницыAsk Fy 2022-23 FNLsgnvsureshОценок пока нет

- Ilovepdf MergedДокумент3 страницыIlovepdf MergedShashank DixitОценок пока нет

- May 2023 Pay SlipДокумент2 страницыMay 2023 Pay Slipgomathi7777_33351404Оценок пока нет

- Tata Consultancy Services Payslip August 2017Документ2 страницыTata Consultancy Services Payslip August 2017Ajay Chowdary Ajay Chowdary79% (14)

- June 2023 PayslipДокумент2 страницыJune 2023 Payslipgomathi7777_33351404100% (1)

- Salary Slip AprilДокумент1 страницаSalary Slip AprilDaya Shankar100% (2)

- Salary Slip - Quess)Документ1 страницаSalary Slip - Quess)gamersingh098123Оценок пока нет

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Документ1 страницаTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediОценок пока нет

- Kirandeep September SalaryДокумент1 страницаKirandeep September Salaryprince.gill07Оценок пока нет

- Vishal Thakkar ComputationДокумент4 страницыVishal Thakkar ComputationHemant SurgicalОценок пока нет

- Income From Salaries: Rs. Rs. Rs. SCH - NoДокумент2 страницыIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriОценок пока нет

- Mitali Garg E01392Документ1 страницаMitali Garg E01392Mitali GargОценок пока нет

- Payslip MAY 2019 PDFДокумент1 страницаPayslip MAY 2019 PDFKushal Malhotra100% (1)

- Payslip: Employee Details Payment & Leave DetailsДокумент1 страницаPayslip: Employee Details Payment & Leave DetailsKushal MalhotraОценок пока нет

- $RN8C7G2Документ3 страницы$RN8C7G2akxerox47Оценок пока нет

- SalaryДокумент1 страницаSalarypankajОценок пока нет

- Nov Salary SlipДокумент1 страницаNov Salary Slipvarunyadav3050Оценок пока нет

- Income Tax Computation FormatДокумент2 страницыIncome Tax Computation Formatrathan100% (1)

- TCS Feb Payslip PDFДокумент2 страницыTCS Feb Payslip PDFNikhilreddy SingireddyОценок пока нет

- Pay Slip OctДокумент1 страницаPay Slip Octchahalnikita7Оценок пока нет

- Nicc0 23-24Документ2 страницыNicc0 23-24tejasgauba1989Оценок пока нет

- Ay 22-23 Dattatri Kadam With Sign & StampДокумент13 страницAy 22-23 Dattatri Kadam With Sign & StampRAJESH DОценок пока нет

- Profits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoДокумент2 страницыProfits and Gains of Business or Profession: Rs. Rs. Rs. SCH - NoSatyasheel ChandaneОценок пока нет

- Computation of Total Income Income From Business or Profession (Chapter IV D) 470243Документ4 страницыComputation of Total Income Income From Business or Profession (Chapter IV D) 470243Aman AggarwalОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- OferAle26nov Pharmacist AachenДокумент4 страницыOferAle26nov Pharmacist AachenRoxana Cristina Rosu RosuОценок пока нет

- Apodaca v. NLRC, Mirasol and IntransДокумент11 страницApodaca v. NLRC, Mirasol and IntransApriel May SolimenОценок пока нет

- SkyHigh Liability WaiverДокумент1 страницаSkyHigh Liability WaiverZach HunterОценок пока нет

- 300+ TOP Labour Law MCQs and Answers 2021Документ8 страниц300+ TOP Labour Law MCQs and Answers 2021Ashley D’cruzОценок пока нет

- Skippers United Pacific, Inc. vs. Lagne DigestДокумент4 страницыSkippers United Pacific, Inc. vs. Lagne DigestEmir MendozaОценок пока нет

- Supplier Code of ConductДокумент6 страницSupplier Code of ConductRobert K Medina-LoughmanОценок пока нет

- MCQ SYBCOM 231 Business-CommunicationДокумент40 страницMCQ SYBCOM 231 Business-Communicationmitranjalee sandha0% (1)

- Becoming A Super AchieverДокумент8 страницBecoming A Super AchieverShaun SmithОценок пока нет

- Padasalai Simple Calculator New Version 7.6 M.tamilarasanДокумент36 страницPadasalai Simple Calculator New Version 7.6 M.tamilarasanramОценок пока нет

- QHSE ManualsДокумент20 страницQHSE Manualswasiull100% (1)

- Business AnalyticsДокумент9 страницBusiness AnalyticsNoman AkhtarОценок пока нет

- Construction Industry KPI Report FINAL PDFДокумент78 страницConstruction Industry KPI Report FINAL PDFAbdulrahmanОценок пока нет

- Tcs Employment Application FormДокумент6 страницTcs Employment Application FormAnkit WankhedeОценок пока нет

- Skills Development Levy (SDL)Документ2 страницыSkills Development Levy (SDL)Jody KingОценок пока нет

- Managing Attrition in The Indian Information Technology IndustryДокумент5 страницManaging Attrition in The Indian Information Technology IndustrybaladvОценок пока нет

- Bosh Rule 1050 Q AДокумент4 страницыBosh Rule 1050 Q ALyka GarceraОценок пока нет

- Department of Computer Engineering Mega Project Report IN Online Recruitment System FOR T.Y - 2020-2021Документ16 страницDepartment of Computer Engineering Mega Project Report IN Online Recruitment System FOR T.Y - 2020-2021priyanka patilОценок пока нет

- Oman Business GuideДокумент17 страницOman Business GuideZadok Adeleye50% (2)

- Department of Labor and Employment: Profile of Affected WorkersДокумент2 страницыDepartment of Labor and Employment: Profile of Affected WorkersLeonardo GabisОценок пока нет

- INSTRUCTIONS: Candidates Are Required To Answer ALL Questions in SECTION A and B and Any TWO Questions in SECTION CДокумент10 страницINSTRUCTIONS: Candidates Are Required To Answer ALL Questions in SECTION A and B and Any TWO Questions in SECTION CShantol EdwardsОценок пока нет

- NULM Mission DocumentДокумент38 страницNULM Mission DocumentChouhan Akshay SinghОценок пока нет

- Chapter 13 Employee Rights and DisciplineДокумент3 страницыChapter 13 Employee Rights and DisciplineRajan ManchandaОценок пока нет

- State Magazine, July-August 2011Документ64 страницыState Magazine, July-August 2011State MagazineОценок пока нет

- CS Form No. 34-C Plantilla of Casual Appointment - LGU RegulatedДокумент1 страницаCS Form No. 34-C Plantilla of Casual Appointment - LGU RegulatedBhabes Belen CreusОценок пока нет

- IATG 01.90 Personnel Competences v.2 RevДокумент54 страницыIATG 01.90 Personnel Competences v.2 RevDOC LABОценок пока нет

- Arco GulДокумент65 страницArco Gulharsh1100.hОценок пока нет

- Amendments MLC 2018 enДокумент5 страницAmendments MLC 2018 enAbdel Nasser Al-sheikh YousefОценок пока нет

- CV Resume ExampleДокумент8 страницCV Resume Exampleoyutlormd100% (1)

- Holiday Shipping WarsДокумент8 страницHoliday Shipping WarsRajat RameshОценок пока нет