Академический Документы

Профессиональный Документы

Культура Документы

Property Tax Situation PFC2019 1306

Загружено:

Darren KrauseАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Property Tax Situation PFC2019 1306

Загружено:

Darren KrauseАвторское право:

Доступные форматы

PFC2019-1306

Attachment 2

Calgary’s property tax problem – Dr. Paul Fairie

Features of the Calgary economy in combination with the rules of the property tax system have

led to some unintended and unfortunate consequences. This is particularly true for businesses,

with larger than anticipated tax increases for some (especially suburban) commercial properties,

and some very large property tax decreases for others (especially larger downtown properties).

What happened? First, the 2014 economic downturn. In addition to increasing unemployment

rates and decreasing energy royalties, the downturn also hit the property market, cutting the

value of many properties around the city. However, this by itself was not enough -- if (as in past

downturns) property taxes had decreased more or less equally across the city, the problem

described up front wouldn’t have occurred.

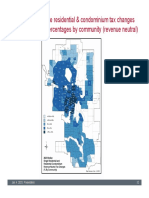

What else happened? This downturn was different because of the extent to which the most

dramatic property value drops were concentrated in the centre of the city, with downtown

properties alone losing more than $10 billion in value. Calgary’s specific status as a

headquarters city is usually a property tax boon (allowing for relative tax decreases elsewhere in

the city), but when these specific high-value properties drop precipitously in value, the property

tax system’s rules automatically make the rest of the city’s businesses pick up the slack.

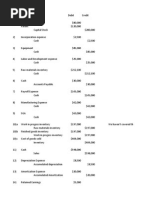

Why does this matter? Let’s look at two fictional examples. Imagine two properties worth $90

and $10. The city needs $1 to pay for services, so it charges Property 1 90¢ and Property 2

10¢. A downturn hits, and the properties are now worth $45 and $5. The city still needs the

same $1 to pay for services, and, after some simple arithmetic, charges the properties 90¢ and

10¢, just like before.

Imagine the same two properties worth $90 and $10, and a city that needs $1 to pay for

services. Property 1 is charged 90¢ and property 2 10¢. An economic crisis now hits just

Property 1, and they’re now valued at $40 and $10. The city still needs $1, but now Property 1’s

bill is 80¢ and Property 2 has to pay 20¢ -- a 100% increase, even though overall taxes stayed

the same! Swap in some real numbers and some real businesses, and this is more or less what

happened in Calgary in the 2014 downturn.

Some property tax solutions that have been tried elsewhere might seem tempting, but they don’t

address Calgary’s specific issue. Attempts in California to limit property tax increases ultimately

disincentivized selling property and led to the creation of other taxes to fill in the funding gaps

for local services like police and fire protection. Minnesota tried limiting property assessment

changes, but taxes based on old assessments are unfair in various ways, and they abandoned

this.

The tools developed by this working group can help council more explicitly consider the effects

of their decisions on the taxes paid by homeowners and businesses across the city. Ultimately,

regardless of how council proceeds, these short-term ideas will not stop the problem described

above from happening again, and longer-term fixes (including full municipal tax reform) are the

only real solution.

City of Calgary – Tax Shift Assessment Working Group (TSAWG)

Вам также может понравиться

- Order 2850743Документ9 страницOrder 2850743Paul OumaОценок пока нет

- Budget Reforms To Solve New York City's High-Tax Crisis Cato Policy Analysis No. 522Документ20 страницBudget Reforms To Solve New York City's High-Tax Crisis Cato Policy Analysis No. 522Cato Institute100% (1)

- CTL Implications For Local GovernmentsДокумент23 страницыCTL Implications For Local GovernmentsThe Capitol PressroomОценок пока нет

- Kaegi City Club Chicago 2021 SpeechДокумент16 страницKaegi City Club Chicago 2021 SpeechCrainsChicagoBusinessОценок пока нет

- Prop 13 and Split Roll Economic Study Final 5-29-14 SKДокумент23 страницыProp 13 and Split Roll Economic Study Final 5-29-14 SKRachel LaingОценок пока нет

- Alexander (2013)Документ7 страницAlexander (2013)nita_andriyani030413Оценок пока нет

- 2010 State Business Tax Climate IndexДокумент60 страниц2010 State Business Tax Climate IndexThe West Virginia Examiner/WV WatchdogОценок пока нет

- Getting Real About Reform: Estimating Revenue Gains From Changes To California's System of Assessing Commercial Real EstateДокумент20 страницGetting Real About Reform: Estimating Revenue Gains From Changes To California's System of Assessing Commercial Real EstateProgram for Environmental And Regional Equity / Center for the Study of Immigrant Integration100% (1)

- Fulton Tax Assessors Undervalue Commercial Property in AtlantaДокумент10 страницFulton Tax Assessors Undervalue Commercial Property in AtlantaCristiana NobileОценок пока нет

- Economic Focus 12-12-11Документ1 страницаEconomic Focus 12-12-11Jessica Kister-LombardoОценок пока нет

- GST Collection From The New Zealand Property Sector: Iris ClausДокумент14 страницGST Collection From The New Zealand Property Sector: Iris ClausAli NadafОценок пока нет

- Solution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesДокумент5 страницSolution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesThanhTrúcc100% (1)

- Bermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchДокумент8 страницBermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchRG-eviewerОценок пока нет

- Short Rated Assessment No. 2: ARCH 159Документ4 страницыShort Rated Assessment No. 2: ARCH 159Rona JoseОценок пока нет

- Tax Evasion Practices in Philippine Estate TaxДокумент68 страницTax Evasion Practices in Philippine Estate Taxepra83% (6)

- HF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFДокумент5 страницHF2480 Article 1 Section 8-9 Incidence Analysis 1 PDFminnesoda238Оценок пока нет

- States, Rates and DebatesДокумент12 страницStates, Rates and DebatesAlves Real EstateОценок пока нет

- Solucionario Ejercicios Capitulo 20 Gruber Tax Efficiencies and Their Implications For Optimal TaxationДокумент7 страницSolucionario Ejercicios Capitulo 20 Gruber Tax Efficiencies and Their Implications For Optimal TaxationDemetrio Pardo HerreraОценок пока нет

- 1-4 Major Types of TaxesДокумент1 страница1-4 Major Types of TaxesMeriton KrivcaОценок пока нет

- 2020 Tax Updates by Atty. Jackie Lou Lamug, CPA PDFДокумент112 страниц2020 Tax Updates by Atty. Jackie Lou Lamug, CPA PDFNhel JoeОценок пока нет

- Baltimore Case StudyДокумент5 страницBaltimore Case StudyShane MastroОценок пока нет

- Economic Focus 12-19-11Документ1 страницаEconomic Focus 12-19-11Jessica Kister-LombardoОценок пока нет

- Calgary Residential and Commercial Real Estate Markets: Briefing Note #6Документ14 страницCalgary Residential and Commercial Real Estate Markets: Briefing Note #6sladurantayeОценок пока нет

- Bibliography Research Questions/ Objectives Themes/ Variables Methods Used Major FindingsДокумент8 страницBibliography Research Questions/ Objectives Themes/ Variables Methods Used Major FindingsAndreiОценок пока нет

- Agriculture Law: RS20609Документ3 страницыAgriculture Law: RS20609AgricultureCaseLawОценок пока нет

- U20 A2.editedДокумент15 страницU20 A2.editedShabi ZeeОценок пока нет

- FINAL Greater Minnesota Advocate 102511Документ2 страницыFINAL Greater Minnesota Advocate 102511Bill SpitzerОценок пока нет

- Group 12Документ18 страницGroup 12Dump LenseОценок пока нет

- Transforming The Internal Revenue ServiceДокумент20 страницTransforming The Internal Revenue ServiceCato InstituteОценок пока нет

- RTV 202 Study Unit 1 - Taxes in South Africa Lecture Notes (Part 1)Документ30 страницRTV 202 Study Unit 1 - Taxes in South Africa Lecture Notes (Part 1)Asanda KhumaloОценок пока нет

- TAXREV D2019 Reviewer Transcript PDFДокумент193 страницыTAXREV D2019 Reviewer Transcript PDFAleezah Gertrude Raymundo100% (1)

- Final Report On TaxДокумент8 страницFinal Report On TaxNana Hana KamidОценок пока нет

- Property Tax Levy 2022Документ10 страницProperty Tax Levy 2022inforumdocsОценок пока нет

- The Automated Payment Transaction Tax: Taxation For The 21ST CenturyДокумент16 страницThe Automated Payment Transaction Tax: Taxation For The 21ST Centurygure gureОценок пока нет

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFДокумент36 страницDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (8)

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualДокумент36 страницFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (38)

- Solutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickДокумент7 страницSolutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDiya ReddyОценок пока нет

- Economic Impact Analysis: Proposed New York State Tax Increases On Carried Interest of The Private Funds IndustryДокумент28 страницEconomic Impact Analysis: Proposed New York State Tax Increases On Carried Interest of The Private Funds IndustryCharles SwensonОценок пока нет

- Ferrer Vs Bautista DigestДокумент2 страницыFerrer Vs Bautista DigestJea ulangkayaОценок пока нет

- Pillar 2 Exceptionalism - Our Minimum Tax Is Bigger Than YoursДокумент10 страницPillar 2 Exceptionalism - Our Minimum Tax Is Bigger Than YoursJenny Natividad100% (1)

- Empire State Freedom Plan - 9-28-18Документ23 страницыEmpire State Freedom Plan - 9-28-18MolinaroОценок пока нет

- Kofler, Georg and Sinning, Julia - Equalization Taxes and The EU DSTДокумент25 страницKofler, Georg and Sinning, Julia - Equalization Taxes and The EU DSTJenny NatividadОценок пока нет

- IG CH 01Документ27 страницIG CH 01Basa TanyОценок пока нет

- Texans, Fight Property Tax Increase Amidst COVID 19!Документ7 страницTexans, Fight Property Tax Increase Amidst COVID 19!cutmytaxesОценок пока нет

- SSRN Id3309920Документ10 страницSSRN Id3309920Faqiatul Maria WahariniОценок пока нет

- Targeting Scams ACCC Report 1657224460Документ74 страницыTargeting Scams ACCC Report 1657224460Connie da CunhaОценок пока нет

- Principles of Taxation: Introduction and Chapter 1 Types of Taxes and The Jurisdictions That Use ThemДокумент17 страницPrinciples of Taxation: Introduction and Chapter 1 Types of Taxes and The Jurisdictions That Use ThemprasadkulkarnigitОценок пока нет

- Retail Tax Ecommerce White PaperДокумент5 страницRetail Tax Ecommerce White PaperArdi ChenОценок пока нет

- Shabbar Z - Pakistan Ecnomic Policies 2008-2009Документ26 страницShabbar Z - Pakistan Ecnomic Policies 2008-2009atifasОценок пока нет

- 10 Real Property Tax in The Philippines - Things To Know - AllPropertiesДокумент4 страницы10 Real Property Tax in The Philippines - Things To Know - AllPropertiesjrstockholmОценок пока нет

- Alsip December 21 2009 Board SpecialДокумент2 страницыAlsip December 21 2009 Board SpecialMy Pile of Strange 2013 Election CollectionОценок пока нет

- Indirect TaxesДокумент10 страницIndirect TaxesValerio CastelliniОценок пока нет

- Esd #2Документ10 страницEsd #2FarzanОценок пока нет

- Medicine Hat Gas Conspiracy HelpДокумент2 страницыMedicine Hat Gas Conspiracy HelpJosh HudsonОценок пока нет

- Solution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689Документ36 страницSolution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689ericakaufmanctpkanfyms100% (23)

- Tax Roundtable 2019Документ4 страницыTax Roundtable 2019Danielle BrodyОценок пока нет

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОт EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОценок пока нет

- The King Takes Your Castle: City Laws That Restrict Your Property RightsОт EverandThe King Takes Your Castle: City Laws That Restrict Your Property RightsОценок пока нет

- Richmond CA Slide Deck Nov 14 2023 Updated Nov 13 2023 OPT 1Документ14 страницRichmond CA Slide Deck Nov 14 2023 Updated Nov 13 2023 OPT 1Darren KrauseОценок пока нет

- CREST Final ReportДокумент21 страницаCREST Final ReportDarren KrauseОценок пока нет

- Coyote Conflict Response Guide - City of CalgaryДокумент33 страницыCoyote Conflict Response Guide - City of CalgaryDarren KrauseОценок пока нет

- Ward 9 GreenLine Station Design FeedbackДокумент17 страницWard 9 GreenLine Station Design FeedbackDarren KrauseОценок пока нет

- New Investment Recommendations - 2024 Calgary BudgetДокумент65 страницNew Investment Recommendations - 2024 Calgary BudgetDarren KrauseОценок пока нет

- Roadside Naturalization Project CalgaryДокумент4 страницыRoadside Naturalization Project CalgaryDarren KrauseОценок пока нет

- Calgary Police Employee Survey ResultsДокумент118 страницCalgary Police Employee Survey ResultsDarren KrauseОценок пока нет

- 18 ST SE StudyДокумент4 страницы18 ST SE StudyDarren KrauseОценок пока нет

- 2023 Calgary DT Report 3 Reduced FinalДокумент78 страниц2023 Calgary DT Report 3 Reduced FinalCTV Calgary DigitalОценок пока нет

- Additional City of Calgary InvestmentsДокумент36 страницAdditional City of Calgary InvestmentsDarren KrauseОценок пока нет

- Home Is Here City of Calgary Housing Strategy 2024 2030Документ38 страницHome Is Here City of Calgary Housing Strategy 2024 2030Darren Krause100% (1)

- City of Calgary Anti-Racism Program Strategic PlanДокумент36 страницCity of Calgary Anti-Racism Program Strategic PlanDarren KrauseОценок пока нет

- Attach 3 - Harvie Passage Facility Enhancement Plan - CD2023-0522Документ70 страницAttach 3 - Harvie Passage Facility Enhancement Plan - CD2023-0522Darren KrauseОценок пока нет

- Housing and Affordability Taskforce RecommendationsДокумент10 страницHousing and Affordability Taskforce RecommendationsDarren Krause100% (1)

- Assessing A Closed System As Part of The City of Calgary Transit Safety Strategy - IP2023-0368Документ14 страницAssessing A Closed System As Part of The City of Calgary Transit Safety Strategy - IP2023-0368Darren KrauseОценок пока нет

- 18th ST SE Adaptive Bike Lane (ABL) Pilot Result Summary Feb 2023Документ3 страницы18th ST SE Adaptive Bike Lane (ABL) Pilot Result Summary Feb 2023Darren KrauseОценок пока нет

- CED 2023 Highlights2022Документ34 страницыCED 2023 Highlights2022Darren KrauseОценок пока нет

- Revenue Neutral Tax Impact 2023Документ1 страницаRevenue Neutral Tax Impact 2023Darren KrauseОценок пока нет

- Updated Transit Capital Project Prioritization List 2022 - Route AheadДокумент8 страницUpdated Transit Capital Project Prioritization List 2022 - Route AheadDarren KrauseОценок пока нет

- Alberta Medical Emergency Services Dispatch ReviewДокумент186 страницAlberta Medical Emergency Services Dispatch ReviewDarren KrauseОценок пока нет

- 2023 2026 Calgary Police Budget 1Документ5 страниц2023 2026 Calgary Police Budget 1Darren KrauseОценок пока нет

- Brawn Family Foundation Rotary Park - DesignДокумент1 страницаBrawn Family Foundation Rotary Park - DesignDarren KrauseОценок пока нет

- Primary Transit NetworkДокумент1 страницаPrimary Transit NetworkDarren KrauseОценок пока нет

- 2022 FINAL Quality of Life ReportДокумент24 страницы2022 FINAL Quality of Life ReportDarren KrauseОценок пока нет

- 2022 Quality of Life Report - Calgary FoundationДокумент24 страницы2022 Quality of Life Report - Calgary FoundationDarren KrauseОценок пока нет

- 2023 - 2026 Service Plans and Budgets PreviewДокумент41 страница2023 - 2026 Service Plans and Budgets PreviewDarren KrauseОценок пока нет

- Executive Summary Airport Transit LineДокумент17 страницExecutive Summary Airport Transit LineDarren KrauseОценок пока нет

- Primary Transit NetworkДокумент1 страницаPrimary Transit NetworkDarren KrauseОценок пока нет

- Dan McLean - Elections Alberta ReviewДокумент6 страницDan McLean - Elections Alberta ReviewDarren KrauseОценок пока нет

- Place-Based Identity and Resentment Paper - Sophie Borwein, Jack LucasДокумент29 страницPlace-Based Identity and Resentment Paper - Sophie Borwein, Jack LucasDarren KrauseОценок пока нет

- Dispensers of California (Jeff)Документ9 страницDispensers of California (Jeff)Jeffery KaoОценок пока нет

- EmploymentДокумент318 страницEmploymentximeresОценок пока нет

- IMFДокумент28 страницIMFfujimukazuОценок пока нет

- Cost of LivingДокумент15 страницCost of Livingapi-325621104Оценок пока нет

- Introduction International Economics From SalvatoreДокумент9 страницIntroduction International Economics From SalvatoreEric James Abarro0% (1)

- Testimony Robert Doar, Commissioner, NYC Human Resource Administration, May 18, 2010.Документ8 страницTestimony Robert Doar, Commissioner, NYC Human Resource Administration, May 18, 2010.Rick ThomaОценок пока нет

- Management Accountant 07 - 2008 PDFДокумент59 страницManagement Accountant 07 - 2008 PDFHakeem Farhan TariqiОценок пока нет

- Chapter 6 - Macroeconomics Big PictureДокумент37 страницChapter 6 - Macroeconomics Big Picturemajor raveendraОценок пока нет

- Introduction To Imf: International Monetary FundДокумент25 страницIntroduction To Imf: International Monetary FundJitin BhutaniОценок пока нет

- Impact of Globalization On Indian EconomyДокумент2 страницыImpact of Globalization On Indian EconomysheenakrishОценок пока нет

- CMA2 P1 A Budgeting Alpha Tech P3694Q3Документ4 страницыCMA2 P1 A Budgeting Alpha Tech P3694Q3Omnia HassanОценок пока нет

- Griffin Introduction To Business Chapter 02Документ28 страницGriffin Introduction To Business Chapter 02Lucky LokeeОценок пока нет

- Statistics and The German State, 1900 1945: More InformationДокумент14 страницStatistics and The German State, 1900 1945: More InformationAlejandro Reza RodríguezОценок пока нет

- Budget For Road ConstructionДокумент1 страницаBudget For Road Constructionvaradsalke100% (1)

- Assessing Nominal GDP Targeting in The South African C 2017 Central Bank RevДокумент10 страницAssessing Nominal GDP Targeting in The South African C 2017 Central Bank RevarciblueОценок пока нет

- Compound Interest Rate and TimeДокумент18 страницCompound Interest Rate and TimeRJRegio50% (2)

- GATT ReportДокумент28 страницGATT Reportpratik3331Оценок пока нет

- Tax Structure in IndiaДокумент33 страницыTax Structure in IndiaVinayak Saxena100% (1)

- Reimbursement TutionДокумент2 страницыReimbursement Tutionpaulug4Оценок пока нет

- Ba5101 IqДокумент15 страницBa5101 IqNISHANT SAHAОценок пока нет

- Great Depression WorksheetsДокумент3 страницыGreat Depression Worksheetsmrkastl901Оценок пока нет

- Untitled 8Документ25 страницUntitled 8Ersin TukenmezОценок пока нет

- Cooperative Economics and Management Project Topics and Materials For Final Year StudentsДокумент4 страницыCooperative Economics and Management Project Topics and Materials For Final Year StudentsNonny Valentine100% (1)

- SaftaДокумент35 страницSaftaKaran KapurОценок пока нет

- DoD Green Book Final FY12Документ253 страницыDoD Green Book Final FY12reflexreactionОценок пока нет

- Form 1040Документ3 страницыForm 1040Peng JinОценок пока нет

- 5 6143088811480973497 PDFДокумент4 страницы5 6143088811480973497 PDFSachin JamadarОценок пока нет

- Intel Case StudyДокумент6 страницIntel Case StudysantiagoОценок пока нет

- CAPE Economics 2017 U2 P2 PDFДокумент13 страницCAPE Economics 2017 U2 P2 PDFIsmadth2918388Оценок пока нет

- R20 International Trade and Capital Flows PDFДокумент36 страницR20 International Trade and Capital Flows PDFROSHNIОценок пока нет