Академический Документы

Профессиональный Документы

Культура Документы

Handout No.05 PDF

Загружено:

ajanthahnИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Handout No.05 PDF

Загружено:

ajanthahnАвторское право:

Доступные форматы

DEPARTMENT OF ACCOUNTING

UNIVERSITY OF JAFFNA- SRI LANKA

Programme Title : Bachelor of Engineering Technology

Course Unit : CST307NT2: Fundamentals of Financial Accounting

Handout : 05 – Double Entry System

Prepared by : Mr. A. Ajanthan

Issued on : 06th of September, 2019

Learning Objectives:

After you have studied this chapter, you should be able to:

understand the double entry bookkeeping

identify the elements of accounting

understand the process of recording of transactions

prepare a trial balance

Double entry bookkeeping

This is a scientific method and is recognised as a universally accepted system. Simply,

the double entry book keeping is based on the principle that every financial transaction

involves the simultaneous receiving and giving of value, and is therefore recorded twice.

Double entry bookkeeping, in accounting, is a system of bookkeeping so named

because every entry to an account requires a corresponding and opposite entry to a

different account. The following are the advantages of double entry system:

a) Availability of complete record

b) Facilitates the control of operations

c) Provides arithmetical accuracy

d) Preparation of financial statements

Elements of accounting

According to the conceptual framework for the financial reporting, elements of financial

statements are as follows:

Assets

Liabilities

Capital

Income (revenue)

Expenses

CST307NT2: Fundamentals of Financial Accounting Page 1

These five elements can be put into two categories, according to whether they appear

on the statement of financial position or income statement. The elements directly related

to financial position (statement of financial position) are:

Assets

Liabilities

Equity

The elements directly related to financial performance (income statement) are:

Income

Expenses

Classification of ledger accounts

General ledger is the complete record of financial transactions and events. This ledger

holds account information that is needed to prepare financial statements, and includes

accounts for assets, liabilities, capital, income and expenses. This is considered as the

principal book of accounts and it contains all the accounts of a business.

What is a ledger account?

An account is a record of the transactions involving a particular item. You may have a

bank account which provides you with a record of the transactions you make through

your bank. Likewise, a ledger account may be thought of as a record kept as a page in a

book. The book contains many pages - many accounts and is referred to as ledger.

Each account comprises two sides: the left-hand side is referred to as the debit side and

the right-hand side is referred to as the credit side. The title of each account is written

across the top of the account at the centre. The format is shown below.

Account title

Date Narrative Ref Rs. Date Narrative Ref Rs.

Balance c/f XXX

Balance b/f XXX

Recording of transactions

Double entries for elements in financial position statement:

Assets - Increase in assets - Debit (Dr)

- Decrease in assets - Credit(Cr)

Liabilities - Decrease in liabilities - Debit (Dr)

- Increase in liabilities - Credit (Cr)

CST307NT2: Fundamentals of Financial Accounting Page 2

Capital - Decrease in capital - Debit (Dr)

- Increase in capital - Credit (Cr)

Asset Account

Increases Decreases

+ -

Liability Account

Decreases Increases

- +

Capital Account

Decreases Increases

- +

Example: 01

Vishwa Fernando Enterprise has the following opening balances (assets, liabilities and

capital) as at 01/01/2019.

“Rs”

Assets

Land 400,000

Motor vehicle 800,000

Building 1,000,000

Inventories 500,000

Cash in hand 100,000

Trade receivables 50,000

Total assets 2,850,000

Liabilities

Bank loan 850,000

Capital ?

CST307NT2: Fundamentals of Financial Accounting Page 3

When the opening balances are given, first of all we have to enter the opening balances

into the ledger accounts. Assets have debit balances and liabilities and capital have

credit balances.

Note: 01

Balance is also known as balance brought forward (balance b/fwd) or balance brought

down (balance b/d).

Land A/c

1 Jan Balance b/d 400,000

Motor Vehicle A/c

1 Jan Balance b/d 800,000

Building A/c

1 Jan Balance b/d 1,000,000

Inventories A/c

1 Jan Balance b/d 500,000

Cash in hand A/c

1 Jan Balance b/d 100,000

Trade receivable A/c

1 Jan Balance b/d 50,000

Bank loan A/c

1 Jan Balance b/d 850,000

Capital A/c

1 Jan Balance b/d 2,000,000

CST307NT2: Fundamentals of Financial Accounting Page 4

Note: 02

As explained earlier equity or capital is the residual interest in the assets of the

enterprise after deducting all the liabilities.

Equity = Total assets – Total liabilities

Rs. 2,000,000 = Rs. 2,850,000 – Rs. 850,000

Note that the following transactions have been occurred in the month of January 2019:

05/01/2019 bought office equipment worth Rs. 10,000 on cash basis.

Now, we enter this transaction into the ledger accounts. Office equipment is an

asset, and is increasing. Therefore, we have to debit the new asset account called

“office equipment account”. For purchasing this asset, the business has paid Rs.

10,000 by cash. Accordingly, cash, an asset is decreasing, so we want to credit the

cash account. And also, you have to interchange the names of the two accounts

when entering the transaction.

Office equipment A/c

5 Jan Cash 10,000

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10/01/2019 received Rs. 20,000 from the business’s receivables.

Receivable is an asset, and is decreasing now because of the settlement of their due

amounts. Therefore, we have to credit the “receivables account”. Since the business

is getting cash, again, asset is increasing. That is the cash account. So we want to

debit the cash account.

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000

Receivable A/c

1 Jan Balance b/f 50,000 10 Jan Cash 20,000

CST307NT2: Fundamentals of Financial Accounting Page 5

12/01/2019 the business has obtained a bank loan of Rs. 100,000.

Bank loan is a liability, and is increasing. Therefore, we have to credit the “bank loan

account”. At the same time, business’s cash balance will go up and we have to debit

the cash account.

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000

12 Jan Bank loan 100,000

Bank loan A/c

1 Jan Balance b/f 850,000

12 Jan Cash 100,000

20/01/2019 the owner has invested Rs. 500,000 in cash as additional capital

Cash is an asset and is increasing now with the additional capital introduction.

Therefore, we have to debit the “cash account”. At the same time, owner’s equity will

go up and we have to credit it to the capital account.

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000

12 Jan Bank loan 100,000

20 Jan Capital 500,000

Capital A/c

1 Jan Balance b/f 2,000,000

20 Jan Cash 500,000

Double entries for elements in income statement:

Income - Decrease in income - Debit (Dr)

- Increase in income - Credit (Cr)

Expenses - Increase in expenses - Debit (Dr)

- Decrease in expenses - Credit (Cr)

CST307NT2: Fundamentals of Financial Accounting Page 6

Income Account

Decreases Increases

- +

Expense Account

Increases Decreases

+ -

Continue with the example discussed above… (Vishwa Fernando Enterprise)

25/01/2019 the entity received rent income from the rented out buildings Rs.

20,000.

Rent income is come under the income category and is increasing now with the

receipt of rent income. Therefore, we have to credit the income account called “rent

income”. Because of this income, cash balance goes up and we have to debit the

cash account.

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000

12 Jan Bank loan 100,000

20 Jan Capital 500,000

25 Jan Rent income 20,000

Rent Income A/c

25 Jan Cash 20,000

30/01/2019 electricity expense of the entity has been paid by cash Rs. 15,000

Electricity expense is coming under the expense category and is increasing now.

Therefore, we have to debit the expense account called “electricity”. Because of this

expense, cash balance reduces and we have to credit the cash account.

Cash in hand A/c

1 Jan Balance b/f 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000 30 Jan Electricity 15,000

12 Jan Bank loan 100,000

20 Jan Capital 500,000

25 Jan Rent income 20,000

CST307NT2: Fundamentals of Financial Accounting Page 7

Electricity expense A/c

30 Jan Cash 15,000

Example: 02 [Joe Simple: a sole trader]

The following information relates to Joe Simple, who started a new business on 1

January 2018:

1. 1.1.18 Joe started the business with Rs. 500,000 in cash.

2. 3.1.18 He paid Rs. 50,000 of the cash into a business bank account.

3. 5.1.18 Joe bought a van for Rs. 200,000 paying by cheque.

4. 7.1.18 He bought some goods, paying Rs. 25,000 in cash.

5. 9.1.18 Joe sold some of the goods, receiving Rs. 20,000 in cash.

Required:

Enter the above transactions in Joe’s ledger accounts.

Balancing ledger accounts

At the end of an accounting period, a balance is drawn on each account in turn. This

means that all the debits on the account are totalled and so are all the credits. If the total

debits exceeded the total credits there is said to be a debit balance on the account; if the

credits exceed the debits then the account has a credit balance. Balancing the ledger

accounts in the above example is as follows:

Land A/c

1 Jan Balance b/d 400,000 31 Jan Balance c/d 400,000

400,000 400,000

31 Jan Balance b/d 400,000

Motor Vehicle A/c

1 Jan Balance b/d 800,000 31 Jan Balance c/d 800,000

800,000 800,000

31 Jan Balance b/d 800,000

Building A/c

1 Jan Balance b/d 1,000,000 31 Jan Balance c/d 1,000,000

1,000,000 1,000,000

31 Jan Balance b/d 1,000,000

CST307NT2: Fundamentals of Financial Accounting Page 8

Inventories A/c

1 Jan Balance b/d 500,000 31 Jan Balance c/d 500,000

500,000 500,000

31 Jan Balance b/d 500,000

Trade Receivable A/c

1 Jan Balance b/d 50,000 10 Jan Cash 20,000

31 Jan Balance c/d 30,000

50,000 50,000

31 Jan Balance b/d 30,000

Bank loan A/c

1 Jan Balance b/d 850,000

31 Jan Balance c/d 950,000 12 Jan Cash 100,000

950,000 950,000

31 Jan Balance b/d 950,000

Capital A/c

1 Jan Balance (b/f) 2,000,000

31 Jan Balance c/d 2,500,000 20 Jan Cash 500,000

2,500,000 2,500,000

31 Jan Balance b/d 2,500,000

Office equipment A/c

5 Jan Cash 10,000 31 Jan Balance c/d 10,000

10,000 10,000

31 Jan Balance b/d 10,000

Rent Income A/c

25 Jan Cash 20,000

31 Jan Balance c/d 20,000

20,000 20,000

31 Jan Balance b/d 20,000

Electricity expense A/c

30 Jan Cash 15,000 31 Jan Balance c/d 10,000

10,000 10,000

31 Jan Balance b/d 10,000

CST307NT2: Fundamentals of Financial Accounting Page 9

Cash in hand A/c

1 Jan Balance 100,000 5 Jan Office equipment 10,000

10 Jan Receivables 20,000 30 Jan Electricity 15,000

12 Jan Bank loan 100,000 31 Jan Balance c/d 715,000

20 Jan Capital 500,000

25 Jan Rent income 20,000

740,000 740,000

31 Jan Balance b/d 715,000

Trial balance (TB)

Double-entry accounting requires the sum of debit account balances to equal the sum of

credit account balances. It does not form part of the double-entry procedure. It has three

main purposes:

a) To check that all of the transactions for a particular period have been entered

correctly in the ledger system;

b) To confirm that the balance on each account is correct; and

c) To assist in the preparation of the profit and loss account and the balance sheet.

The trial balance lists each debit and each credit balance in columns side by side. The

total of each column is then added up. If the two totals agree we can be reasonably

confident that the double-entry procedures have been carried out correctly.

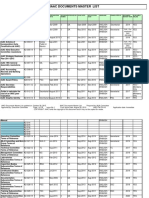

Example: 03

Prepare a trial balance for the above example 01.

Solution:

“Vishwa Fernando Enterprise”

Trial balance as at 31 / 01 / 2019

Debit Credit

Description

“Rs” “Rs”

Land 400,000

Motor vehicle 800,000

Building 1,000,000

Inventories 500,000

Office equipment 10,000

Cash in hand 715,000

Trade receivables 30,000

Bank loan 950,000

CST307NT2: Fundamentals of Financial Accounting Page 10

Electricity expense 15,000

Rent income 20,000

Capital 2,500,000

3,470,000 3,470,000

Demonstration problem: 01

After several months of planning, Dhananjaya De Silva (DDS) started a haircutting

business. The following events occurred during its first month.

a. On August 1, Dhananjaya invested Rs. 300,000 cash and Rs. 150,000 of

equipment in business.

b. On August 2, business paid Rs. 60,000 cash for furniture for the shop.

c. On August 3, business paid Rs. 50,000 cash to rent space in a strip mall for

August.

d. On August 4, it purchased Rs. 120,000 of equipment on credit for the shop (using

a long-term loan).

e. On August 5, cash received from services provided in the first week and a half of

business (ended August 15) is Rs. 82,500.

f. On August 15, business provided Rs. 10,000 value of haircutting services on

account (credit basis).

g. On August 17, business received a Rs. 10,000 amount of cheque for services

previously rendered on account.

h. On August 17, business paid Rs. 12,500 to an assistant for working during the

grand opening.

i. Cash received from services provided during the second half of August is Rs.

93,000.

j. On August 31, business paid a Rs. 40,000 installment toward principal on the

loan entered into on August 4.

k. On August 31, Dhananjaya withdrew Rs. 9,000 cash for personal use.

Required:

1. Prepare general journal entries for the transactions.

2. Open the ledger accounts and post the journal entries to the ledger accounts.

3. Prepare a trial balance as of August 31.

CST307NT2: Fundamentals of Financial Accounting Page 11

Solution:

1. General journal entries

Date Account titles and Explanation Debit Credit

‘Rs’ ‘Rs’

Aug 1 Cash a/c 300,000

Equipment a/c 150,000

Capital a/c 450,000

[Owner’s investment]

Aug 2

CST307NT2: Fundamentals of Financial Accounting Page 12

2. Open the ledger accounts and post the journal entries to the ledger accounts.

3. Prepare a trial balance from the ledger

Dhananjaya De Silva (DDS)

Trial Balance

August 31

Debit (Rs) Credit (Rs)

CST307NT2: Fundamentals of Financial Accounting Page 13

Demonstration problem: 02

Edward started a new business on 1 January 2019. The following transactions took

place during his first month in business.

1.1. 2019 Edward commenced business with Rs.750,000 in cash.

3.1 2019 He paid Rs. 400,000 of the cash into a business bank account.

6.1 2019 He bought a van on credit from Perkin’s garage for Rs. 300,000.

9.1 2019 Edward rented shop premises for Rs. 10,000 per quarter; he paid for the first

quarter immediately by cheque.

12.1 2019 He bought goods on credit from Roy Limited for Rs. 40,000.

15.1 2019 He paid shop expenses amounting to Rs. 15,000 by cheque.

18.1 2019 Edward sold goods on credit to Scott and Company for Rs. 40,000.

21.1 2019 He settled Perkin’s account by cheque.

24.1 2019 Edward received a cheque from Scott and Company for Rs. 30,000; this

cheque was paid immediately into the bank.

27.1 2019 Edward sent a cheque to Roy Limited for Rs. 5,000.

31.1 2019 Goods costing Rs. 30,000 were purchased from Roy Limited on credit.

31.1 2019 Cash sales for the month amounted to Rs. 20,000.

Required:

a) Enter the above transactions in appropriate ledger accounts, balance off each

account as at 31 January 2019, and bring down the balances as at that date.

b) Extract a trial balance as at 31 January 2019.

CST307NT2: Fundamentals of Financial Accounting Page 14

Вам также может понравиться

- .BAC NotesДокумент46 страниц.BAC NotesDaniel kitukuОценок пока нет

- Journalizing, Posting and Trial Balance: For Non-WiredДокумент8 страницJournalizing, Posting and Trial Balance: For Non-WiredCj ArquisolaОценок пока нет

- Introduction To Accounting (Sheet.1)Документ9 страницIntroduction To Accounting (Sheet.1)Rithvik SangilirajОценок пока нет

- SOAL AkuntansiДокумент13 страницSOAL AkuntansiArum MashitoОценок пока нет

- Solutions Totutorial 1-Fall 2022Документ8 страницSolutions Totutorial 1-Fall 2022chtiouirayyenОценок пока нет

- Business Transactions and Their Analysis As Applied To Service BusinessДокумент57 страницBusiness Transactions and Their Analysis As Applied To Service BusinessRhona Primne ServañezОценок пока нет

- Statement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementДокумент10 страницStatement of Financial Position (SFP) : TNHS Main - SHS - Accountancy, Business and ManagementPedana RañolaОценок пока нет

- 2.accounting Cycle JOURNALДокумент36 страниц2.accounting Cycle JOURNALArisha LiaqatОценок пока нет

- Fundamental Accounting Principles By: Wild Larson ChiappettaДокумент25 страницFundamental Accounting Principles By: Wild Larson ChiappettaMuseera IffatОценок пока нет

- Chapter 3the Accounting CycleДокумент10 страницChapter 3the Accounting CycleonakhogxamsheОценок пока нет

- 2-Balance Sheet PDFДокумент44 страницы2-Balance Sheet PDFDiane ApostolОценок пока нет

- 2 Understanding Financial Information-1Документ32 страницы2 Understanding Financial Information-1Tijana DjurdjevicОценок пока нет

- CHAPTER 1 - PPT Intro To AccountingДокумент14 страницCHAPTER 1 - PPT Intro To AccountingAmrinОценок пока нет

- Session 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurДокумент48 страницSession 5-6: Accounting Records: Instructor Dr. Jagan Kumar SurBabusona SahaОценок пока нет

- Session 5Документ28 страницSession 5Sarvesh ChandraОценок пока нет

- Fabm 2 - q3 - Week 1 - Module 1 - Statement of Financial Position - For Reproduction-4Документ25 страницFabm 2 - q3 - Week 1 - Module 1 - Statement of Financial Position - For Reproduction-4Gian Lorence A. JaballaОценок пока нет

- Rules in Debit and CreditДокумент17 страницRules in Debit and CreditWenibet SilvanoОценок пока нет

- Lesson Eleven-AccountingДокумент9 страницLesson Eleven-AccountingKovács Zsuzsanna BorókaОценок пока нет

- Lesson 3 - Accounting Equation - For StudentsДокумент39 страницLesson 3 - Accounting Equation - For StudentsJessОценок пока нет

- VU Accounting Lesson 24Документ6 страницVU Accounting Lesson 24ranawaseemОценок пока нет

- The Accounting Cycle - Part1Документ12 страницThe Accounting Cycle - Part1RaaiinaОценок пока нет

- The Rules of Debit and CreditДокумент7 страницThe Rules of Debit and CreditJay Dequilato TumaleОценок пока нет

- Lec 5Документ56 страницLec 5Sara Abdelrahim MakkawiОценок пока нет

- 1) Week 2 Slides - Statement of Financial PositionДокумент56 страниц1) Week 2 Slides - Statement of Financial PositionTaimoor BaigОценок пока нет

- Financial Accounting and ReportingДокумент12 страницFinancial Accounting and ReportingDiane GarciaОценок пока нет

- Financial Accounting & Analysis-1Документ10 страницFinancial Accounting & Analysis-1Abhishek JhaОценок пока нет

- Accountancy: Shaheen Falcons Pu CollegeДокумент13 страницAccountancy: Shaheen Falcons Pu CollegeMohammed RayyanОценок пока нет

- T10 Managing Finance Notes by SeahДокумент43 страницыT10 Managing Finance Notes by SeahSeah Chooi KhengОценок пока нет

- Analysis of Financial StatementsДокумент17 страницAnalysis of Financial StatementsRajesh PatilОценок пока нет

- Financial StatementДокумент12 страницFinancial StatementCecilia CajipoОценок пока нет

- Financial Accounting and AnalysisДокумент7 страницFinancial Accounting and AnalysisShubh JainОценок пока нет

- Principles of Accounting Second Year, Semester 1Документ38 страницPrinciples of Accounting Second Year, Semester 1Sara Abdelrahim MakkawiОценок пока нет

- MD Fabm1 Q2Документ41 страницаMD Fabm1 Q2Maia's MomentoОценок пока нет

- Accounting ProcessДокумент45 страницAccounting ProcessRAVI DWIVEDIОценок пока нет

- Chapter 2 - Financial AnalysisДокумент66 страницChapter 2 - Financial AnalysisRAHKAESH NAIR A L UTHAIYA NAIR100% (1)

- TOPIC 2 Duality of TransactionsДокумент4 страницыTOPIC 2 Duality of TransactionsMwai MuthoniОценок пока нет

- Topic 1 - The Accounting EquationДокумент10 страницTopic 1 - The Accounting Equationgabriellemorgan714Оценок пока нет

- Module 1 - Business Transaction and Their Analysis Part 1Документ12 страницModule 1 - Business Transaction and Their Analysis Part 11BSA5-ABM Espiritu, CharlesОценок пока нет

- Chapter 5Документ19 страницChapter 5Flordeliza HalogОценок пока нет

- Fundamentals of Accountancy, Business, and Management 2: ExpectationДокумент131 страницаFundamentals of Accountancy, Business, and Management 2: ExpectationAngela Garcia100% (1)

- Financial Accounting AnalysisДокумент11 страницFinancial Accounting AnalysisRajni KumariОценок пока нет

- Financial AccountingДокумент8 страницFinancial AccountingNILESH JETHWAОценок пока нет

- Chapter 2 AccountingДокумент12 страницChapter 2 Accountingmoon loverОценок пока нет

- Financial AccountingДокумент8 страницFinancial AccountingHimani SachdevОценок пока нет

- CashДокумент11 страницCashCharles Andrew De VeraОценок пока нет

- Basic Accounting EquationДокумент42 страницыBasic Accounting Equationlily smithОценок пока нет

- 1 September 2023 Regent - Financial Administartion 102 Presentation 1 September 2024Документ36 страниц1 September 2023 Regent - Financial Administartion 102 Presentation 1 September 202421620168Оценок пока нет

- 4ACCN002W Lecture 2 - TaggedДокумент47 страниц4ACCN002W Lecture 2 - Taggedredwaanmo19Оценок пока нет

- Fundamentals of Accountancy, Business and Management 2Документ20 страницFundamentals of Accountancy, Business and Management 2Noor Yassin H. Jamel100% (1)

- FundamentalsofABM2 Q1 M5Revised.-1Документ12 страницFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Accounting ProcessesДокумент80 страницAccounting ProcessesTikMoj Tube100% (1)

- CH 6 Classpack With SolutionsДокумент20 страницCH 6 Classpack With SolutionsjimenaОценок пока нет

- Week 3-4 Financial Statements - TopicДокумент5 страницWeek 3-4 Financial Statements - TopicApril Raylin RodeoОценок пока нет

- Financial Accounting & Analysis 1Документ7 страницFinancial Accounting & Analysis 1Yogesh BhapkarОценок пока нет

- Module 2Документ6 страницModule 2Maria Andres100% (1)

- Module4 AccountsReceivablePartIДокумент6 страницModule4 AccountsReceivablePartIGab OdonioОценок пока нет

- Account and Finacial AssigmentДокумент8 страницAccount and Finacial Assigmentefrata AlemОценок пока нет

- ACCOUNTING5Документ9 страницACCOUNTING5Natasha MugoniОценок пока нет

- Lecture NotesДокумент5 страницLecture NotesLyaman TagizadeОценок пока нет

- Chapter 01,02 Birasanth Corrected 01 - 05 - 2020Документ19 страницChapter 01,02 Birasanth Corrected 01 - 05 - 2020ajanthahnОценок пока нет

- Chapter 01,02 Birasanth Corrected 23 - 04 - 2020Документ19 страницChapter 01,02 Birasanth Corrected 23 - 04 - 2020ajanthahnОценок пока нет

- Chapter 01,02,03,04,05birasanth 3 - 10 - 2020 - NewДокумент63 страницыChapter 01,02,03,04,05birasanth 3 - 10 - 2020 - NewajanthahnОценок пока нет

- Chapter 01,02 Birasanth Corrected 23 - 04 - 2020Документ19 страницChapter 01,02 Birasanth Corrected 23 - 04 - 2020ajanthahnОценок пока нет

- Chapter 01,02 Birasanth Corrected 01 - 05 - 2020Документ19 страницChapter 01,02 Birasanth Corrected 01 - 05 - 2020ajanthahnОценок пока нет

- Chapter One: 1.0 Background of The StudyДокумент6 страницChapter One: 1.0 Background of The StudyajanthahnОценок пока нет

- Chapter Three Methodology: and ConceptualizationДокумент13 страницChapter Three Methodology: and ConceptualizationajanthahnОценок пока нет

- CV New PDFДокумент1 страницаCV New PDFajanthahnОценок пока нет

- Chapter Three Methodology: and ConceptualizationДокумент12 страницChapter Three Methodology: and ConceptualizationajanthahnОценок пока нет

- Chapter One: 1.0 Background of The StudyДокумент6 страницChapter One: 1.0 Background of The StudyajanthahnОценок пока нет

- Statement of PurposeДокумент3 страницыStatement of PurposeajanthahnОценок пока нет

- MR A Ajanthan-CVДокумент4 страницыMR A Ajanthan-CVajanthahnОценок пока нет

- MathuДокумент14 страницMathuajanthahnОценок пока нет

- Department of Accounting University of Jaffna-Sri Lanka Programme TitleДокумент8 страницDepartment of Accounting University of Jaffna-Sri Lanka Programme TitleajanthahnОценок пока нет

- BIAN and SP-AbstractДокумент1 страницаBIAN and SP-AbstractajanthahnОценок пока нет

- Faculty of Science University of Jaffna-Sri Lanka Level 2G/2S - 2016/2017 ACC (I) 2229: Cost and Management Accounting Tutorial QuestionsДокумент2 страницыFaculty of Science University of Jaffna-Sri Lanka Level 2G/2S - 2016/2017 ACC (I) 2229: Cost and Management Accounting Tutorial QuestionsajanthahnОценок пока нет

- 0623 PDFДокумент41 страница0623 PDFajanthahnОценок пока нет

- BCOM 22031 Practice Question-Varaince AnalysisДокумент4 страницыBCOM 22031 Practice Question-Varaince Analysisajanthahn0% (1)

- Bbaa 3272Документ3 страницыBbaa 3272ajanthahnОценок пока нет

- Department of Commerce University of Jaffna-Sri Lanka Programme Title: Third in Bachelor of Commerce - 2016/2017Документ6 страницDepartment of Commerce University of Jaffna-Sri Lanka Programme Title: Third in Bachelor of Commerce - 2016/2017ajanthahnОценок пока нет

- G O Ms No 143Документ62 страницыG O Ms No 143Naveen Kumar PagadalaОценок пока нет

- A Report On Institutional Training: The Oriental Insurance Company LimitedДокумент11 страницA Report On Institutional Training: The Oriental Insurance Company LimitedKai MK4Оценок пока нет

- The Influence of Internal Audit On Information Security Effectiveness: Perceptions of Internal AuditorsДокумент26 страницThe Influence of Internal Audit On Information Security Effectiveness: Perceptions of Internal AuditorsEnvisage123Оценок пока нет

- PDO Hse AuditДокумент21 страницаPDO Hse Auditnagul kmtcОценок пока нет

- New Functionality SAP ECC 6.0 FinancialsДокумент63 страницыNew Functionality SAP ECC 6.0 FinancialsIlmoyete100% (1)

- PP Woven Bags ContractДокумент21 страницаPP Woven Bags ContractNABILОценок пока нет

- SURVEY QUESTIONNAIRE - Auditor Reshuffling RevisedДокумент4 страницыSURVEY QUESTIONNAIRE - Auditor Reshuffling RevisedJean Monique Oabel-TolentinoОценок пока нет

- mgm4137 1328501852Документ37 страницmgm4137 1328501852rapgracelim100% (1)

- Internal Audit ProceduresДокумент15 страницInternal Audit ProceduresTait G MafuraОценок пока нет

- CPAR - P2 - 7409 - NGAS & Non-Profit Organization PDFДокумент9 страницCPAR - P2 - 7409 - NGAS & Non-Profit Organization PDFAngelo VilladoresОценок пока нет

- Brugg Cables (India) Private LimitedДокумент6 страницBrugg Cables (India) Private LimitedVIJAYОценок пока нет

- Master List IAACДокумент18 страницMaster List IAACGa Ce J ManuelОценок пока нет

- REVENUE CYCLE TEST AnswerДокумент3 страницыREVENUE CYCLE TEST Answermohammedhuseen1789mОценок пока нет

- Activity 2Документ3 страницыActivity 2kathie alegarmeОценок пока нет

- Swot Analysis of Indian EconomyДокумент25 страницSwot Analysis of Indian EconomyDevesh VoraОценок пока нет

- MSC PSCM Changalima, I.A 2016Документ91 страницаMSC PSCM Changalima, I.A 2016Samuel Bruce RocksonОценок пока нет

- Audit Report (EN) Berehiv - 2021Документ12 страницAudit Report (EN) Berehiv - 2021Vladimir SenyukОценок пока нет

- TenderДокумент14 страницTenderBrajendra MohanОценок пока нет

- Singer Annual Report 2019 PDFДокумент119 страницSinger Annual Report 2019 PDFAhm FerdousОценок пока нет

- How Does Internal Auditing Maintain Its Independence and ObjectivityДокумент2 страницыHow Does Internal Auditing Maintain Its Independence and Objectivitysomnathsingh_hydОценок пока нет

- Manual On Non-Bank InstitutionsДокумент888 страницManual On Non-Bank InstitutionsFatima BagayОценок пока нет

- QB Enterprise Solutions Bookkeeper Job Description PDFДокумент3 страницыQB Enterprise Solutions Bookkeeper Job Description PDFnaumanahmad867129Оценок пока нет

- Using Professional JudgmentДокумент2 страницыUsing Professional JudgmentCarlota Nicolas VillaromanОценок пока нет

- Checking Account Simulation Powerpoint Presentation 171g1Документ77 страницChecking Account Simulation Powerpoint Presentation 171g1deepag100% (3)

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksДокумент12 страницPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaОценок пока нет

- Report No 4 of 2019 Social General and Economic Sectors Non PSUs Government of PunjabДокумент210 страницReport No 4 of 2019 Social General and Economic Sectors Non PSUs Government of PunjabersuperОценок пока нет

- Sample Audit ReportsДокумент44 страницыSample Audit ReportsNazia Sultana100% (1)

- Annual Report KIJA 2015 56 - 63Документ210 страницAnnual Report KIJA 2015 56 - 63David Susilo NugrohoОценок пока нет

- Training Manual On: Agrani Bank LimitedДокумент92 страницыTraining Manual On: Agrani Bank LimitedHafizul Hasan50% (2)

- Forensic Accounting and Fraud Examination 2Nd Edition Hopwood Solutions Manual Full Chapter PDFДокумент43 страницыForensic Accounting and Fraud Examination 2Nd Edition Hopwood Solutions Manual Full Chapter PDFqueansaith1cieh9100% (11)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetОт EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОт EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОценок пока нет

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityОт EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityОценок пока нет

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsОт EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)