Академический Документы

Профессиональный Документы

Культура Документы

BetterInvesting Weekly Stock Screen 10-14-19

Загружено:

BetterInvesting0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров1 страницаThis week's screen from BetterInvesting, featuring a screen from MyStockProspector on October 17.

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis week's screen from BetterInvesting, featuring a screen from MyStockProspector on October 17.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

20 просмотров1 страницаBetterInvesting Weekly Stock Screen 10-14-19

Загружено:

BetterInvestingThis week's screen from BetterInvesting, featuring a screen from MyStockProspector on October 17.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

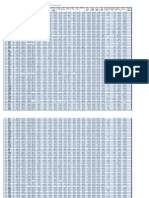

WEEK OF OCTOBER 14, 2019

Sales Hist 5 Yr Hist 5 Yr Last 4Q Last 4Q Rev R2 EPS R2 Trend Current

Company Name Symbol (millions) Rev Gr EPS Gr Rev Gr EPS Gr 5 Yr 5 Yr PTI P/E

BioSpecifics Technologies BSTC $33.0 20.8% 35.0% 27.7% 61.3% 0.86 0.87 + 16.7

Carolina Financial CARO $173.7 32.8% 22.8% 17.1% 55.6% 0.98 0.88 Even 13.3

Communities First Financial CFST $20.6 18.1% 26.0% 31.0% 52.4% 0.99 0.92 ++ 9.6

CenterState Bank CSFL $515.8 28.4% 43.1% 53.8% 53.8% 0.91 0.83 ++ 12.8

Enterprise Financial Services EFSC $230.3 16.0% 24.3% 12.5% 16.8% 0.96 0.82 ++ 12.1

First Foundation FFWM $176.3 28.1% 17.9% 13.1% 72.1% 0.98 0.98 ++ 12.5

Fox Factory Holding FOXF $619.2 18.1% 30.9% 28.3% 46.0% 0.97 0.82 ++ 29.2

FS Bancorp FSBW $68.8 20.0% 38.0% 23.2% 39.3% 0.91 0.94 ++ 8.5

FVCBankcorp FVCB $41.5 19.6% 19.2% 28.7% 17.9% 1.00 0.97 + 19.2

Greene County Bancorp GCBC $48.4 13.9% 25.1% 14.1% 21.3% 1.00 1.00 ++ 13.5

Canada Goose Holdings GOOS $830.5 40.2% 78.7% 41.0% 50.6% 1.00 0.89 ++ 32.9

GRAVITY Co. GRVY $260.9 68.9% 1011.0% 60.7% 100.0% 0.83 0.93 ++ 5.3

goeasy GSY.TO $506.2 17.7% 25.3% 23.4% 59.1% 0.99 0.99 ++ 12.9

Highpower International HPJ $293.9 20.9% 57.7% 18.0% 45.2% 0.91 0.88 ++ 4.5

Independent Bank Group IBTX $368.4 29.0% 22.1% 39.7% 20.2% 0.98 0.95 Even 11.9

Inogen INGN $358.1 31.9% 58.6% 20.7% 30.1% 0.99 0.94 ++ 26.2

Kirkland Lake Gold KL / KL.TO $915.9 52.2% 55.4% 35.8% 68.6% 0.98 0.92 ++ 25.3

Kearny Financial KRNY $168.9 16.6% 54.7% 25.5% 95.8% 0.98 0.87 ++ 28.1

Meritage Hospitality Group MHGU $435.3 27.1% 35.5% 15.1% 15.4% 0.98 0.81 Even 8.0

Old Line Bancshares OLBK $101.9 19.6% 25.4% 30.4% 62.0% 0.93 0.96 ++ 13.9

OP Bancorp OPBK $50.3 19.3% 22.6% 12.4% 41.2% 0.99 0.94 ++ 10.1

Preferred Bank PFBC $163.6 22.2% 25.1% 16.1% 34.8% 1.00 0.95 + 10.6

Pacific Premier Bancorp PPBI $410.5 49.7% 21.9% 41.4% 14.2% 0.99 0.96 ++ 13.2

RBB Bancorp RBB $89.9 24.6% 31.9% 38.3% 12.4% 0.96 0.99 + 9.8

Sandy Spring Bancorp SASR $321.5 14.5% 15.2% 22.0% 41.3% 0.82 0.96 ++ 10.4

Southern First Bancshares SFST $70.4 15.5% 22.8% 16.1% 46.6% 0.99 0.86 ++ 12.3

Southern Missouri Bancorp SMBC $85.8 12.9% 14.0% 14.9% 31.4% 0.94 0.91 + 11.6

TriState Capital Holdings TSC $161.3 13.9% 33.4% 12.3% 19.3% 0.98 0.99 + 11.2

Valley Republic Bancorp VLLX $25.4 19.4% 29.1% 16.3% 36.5% 1.00 0.95 ++ 11.4

Western Alliance Bancorp WAL $946.1 23.4% 24.8% 13.9% 26.2% 0.98 0.99 Even 9.9

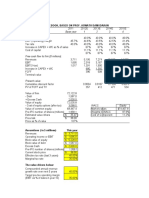

Screen Notes

MyStockProspector screen on Oct. 17

Annual revenues ≤ $1 billion

5-year annual sales, EPS growth ≥ 12%

Last 4Q sales, earnings growth ≥ 6%

5-year annual sales, EPS growth ≥ 0.80

Trend in pretax profitability ≥ Even

Current P/E ≤ 35

Вам также может понравиться

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsОт EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsОценок пока нет

- BetterInvesting Weekly Stock Screen 4-22-19Документ1 страницаBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 11-19-18Документ1 страницаBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 1-1-18Документ1 страницаBetterInvesting Weekly Stock Screen 1-1-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 8-6-18Документ1 страницаBetterInvesting Weekly Stock Screen 8-6-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-2-17Документ1 страницаBetterInvesting Weekly Stock Screen 10-2-17BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 4-16-18Документ1 страницаBetterInvesting Weekly Stock Screen 4-16-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-30-16Документ1 страницаBetterInvesting Weekly Stock Screen 5-30-16BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 7-18-16Документ1 страницаBetterInvesting Weekly Stock Screen 7-18-16BetterInvestingОценок пока нет

- Top 15 Stocks With Highest Predictability Rank Based on Discounted Cash Flow ValuationДокумент56 страницTop 15 Stocks With Highest Predictability Rank Based on Discounted Cash Flow ValuationSokhomОценок пока нет

- BetterInvesting Weekly Stock Screen 7-17-17Документ1 страницаBetterInvesting Weekly Stock Screen 7-17-17BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 6-25-18Документ1 страницаBetterInvesting Weekly Stock Screen 6-25-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 6-24-19Документ1 страницаBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 4-9-19Документ1 страницаBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 2-5-18Документ1 страницаBetterInvesting Weekly Stock Screen 2-5-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 8-28-17Документ1 страницаBetterInvesting Weekly Stock Screen 8-28-17BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-6-17.xlxsДокумент1 страницаBetterInvesting Weekly Stock Screen 11-6-17.xlxsBetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 4-15-19Документ1 страницаBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-15-17Документ1 страницаBetterInvesting Weekly Stock Screen 5-15-17BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 11-11-19Документ1 страницаBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-10-16Документ1 страницаBetterInvesting Weekly Stock Screen 10-10-16BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-27-19Документ1 страницаBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingОценок пока нет

- ModelДокумент103 страницыModelMatheus Augusto Campos PiresОценок пока нет

- BetterInvesting Weekly Stock Screen 3-27-17Документ1 страницаBetterInvesting Weekly Stock Screen 3-27-17BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 9-12-16Документ1 страницаBetterInvesting Weekly Stock Screen 9-12-16BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 9-11-17Документ1 страницаBetterInvesting Weekly Stock Screen 9-11-17BetterInvesting100% (1)

- Stock Watchlist Sheet - IanДокумент2 страницыStock Watchlist Sheet - Ianoc389641Оценок пока нет

- BetterInvesting Weekly Stock Screen 2-25-19Документ1 страницаBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingОценок пока нет

- $ in Millions, Except Per Share DataДокумент59 страниц$ in Millions, Except Per Share DataTom HoughОценок пока нет

- BetterInvesting Weekly Stock Screen 10-1-18Документ1 страницаBetterInvesting Weekly Stock Screen 10-1-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-28-18Документ1 страницаBetterInvesting Weekly Stock Screen 5-28-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 3-11-19Документ1 страницаBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingОценок пока нет

- Outreach Networks Case Study SolutionДокумент2 страницыOutreach Networks Case Study SolutionEaston Griffin0% (1)

- BetterInvesting Weekly Stock Screen 5-23-16Документ1 страницаBetterInvesting Weekly Stock Screen 5-23-16BetterInvestingОценок пока нет

- Valuation - CocacolaДокумент14 страницValuation - CocacolaLegends MomentsОценок пока нет

- BetterInvesting Weekly Stock Screen 8-19-19Документ1 страницаBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingОценок пока нет

- Capstone Courier Round 5 ResultsДокумент15 страницCapstone Courier Round 5 ResultsSanyam GulatiОценок пока нет

- 2009 Forbes 200 Small CompaniesДокумент3 страницы2009 Forbes 200 Small CompaniesOld School ValueОценок пока нет

- Comparable Companies AnalysisДокумент13 страницComparable Companies AnalysisRehaan_Khan_RangerОценок пока нет

- Round: 2 Dec. 31, 2022: Selected Financial StatisticsДокумент15 страницRound: 2 Dec. 31, 2022: Selected Financial StatisticsAshesh DasОценок пока нет

- Round: 1 Dec. 31, 2021: Selected Financial StatisticsДокумент15 страницRound: 1 Dec. 31, 2021: Selected Financial StatisticsParas DhamaОценок пока нет

- Company Name Exchange:Ticker Price To Book Return On EquityДокумент6 страницCompany Name Exchange:Ticker Price To Book Return On EquitygigiОценок пока нет

- Valuation of AppleДокумент25 страницValuation of AppleQuofi SeliОценок пока нет

- Round: 4 Dec. 31, 2024: Selected Financial StatisticsДокумент15 страницRound: 4 Dec. 31, 2024: Selected Financial StatisticsCRОценок пока нет

- WFMI Whole FoodsДокумент3 страницыWFMI Whole FoodsinanimationОценок пока нет

- Business Evaluation CalculationsДокумент16 страницBusiness Evaluation CalculationsSoham AherОценок пока нет

- Round: 4 Dec. 31, 2023: Selected Financial StatisticsДокумент15 страницRound: 4 Dec. 31, 2023: Selected Financial StatisticsUjjawal MittalОценок пока нет

- BetterInvesting Weekly Stock Screen 9-2-19Документ1 страницаBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingОценок пока нет

- UST Debt Policy Spreadsheet (Reduced)Документ9 страницUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonОценок пока нет

- BVP Nasdaq Emerging Cloud Index ConstituentsДокумент68 страницBVP Nasdaq Emerging Cloud Index Constituentskamit22Оценок пока нет

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranДокумент12 страницDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayОценок пока нет

- BetterInvesting Weekly Stock Screen 10-29-18Документ1 страницаBetterInvesting Weekly Stock Screen 10-29-18BetterInvesting100% (1)

- End Term Paper FACD 2020Документ8 страницEnd Term Paper FACD 2020Saksham SinhaОценок пока нет

- BetterInvesting Weekly Stock Screen 12-18-17Документ1 страницаBetterInvesting Weekly Stock Screen 12-18-17BetterInvestingОценок пока нет

- Valuation - PepsiДокумент24 страницыValuation - PepsiLegends MomentsОценок пока нет

- MFL 1 Cfin2Документ17 страницMFL 1 Cfin2Siddharth SureshОценок пока нет

- Fundamental Sheet Bharat RasayanДокумент28 страницFundamental Sheet Bharat RasayanVishal WaghОценок пока нет

- BetterInvesting Weekly Stock Screen 2-3-2020Документ1 страницаBetterInvesting Weekly Stock Screen 2-3-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 9-23-19Документ1 страницаBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 3-9-2020Документ2 страницыBetterInvesting Weekly Stock Screen 3-9-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 2-24-2020Документ1 страницаBetterInvesting Weekly Stock Screen 2-24-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 9-2-19Документ1 страницаBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-28-19Документ1 страницаBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 1-6-2020Документ1 страницаBetterInvesting Weekly Stock Screen 1-6-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 1-27-2020Документ3 страницыBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 1-20-2020Документ1 страницаBetterInvesting Weekly Stock Screen 1-20-2020BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-14-19Документ1 страницаBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 11-11-19Документ1 страницаBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 8-19-19Документ1 страницаBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 12-23-19Документ1 страницаBetterInvesting Weekly Stock Screen 12-23-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 11-11-19Документ1 страницаBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-7-19Документ1 страницаBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 10-2-19Документ1 страницаBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 7-1-19Документ1 страницаBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 8-13-19Документ1 страницаBetterInvesting Weekly Stock Screen 8-13-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 7-16-18Документ1 страницаBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 6-24-19Документ1 страницаBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 9-9-19Документ1 страницаBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 8-5-19Документ1 страницаBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 6-10-19Документ1 страницаBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 6-3-19Документ1 страницаBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-27-19Документ1 страницаBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-16-19Документ1 страницаBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 5-6-19Документ1 страницаBetterInvesting Weekly Stock Screen 5-6-19BetterInvestingОценок пока нет

- BetterInvesting Weekly Stock Screen 4-15-19Документ1 страницаBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingОценок пока нет

- BBA Course Curriculum UGC Approved America Bangladesh UniversityДокумент3 страницыBBA Course Curriculum UGC Approved America Bangladesh UniversityKiron KamruzzamanОценок пока нет

- Memorandum and Articles of AssociationДокумент4 страницыMemorandum and Articles of AssociationRavikiranSharmaSrkОценок пока нет

- Y.B GovernanceДокумент8 страницY.B GovernanceLeul BekaluОценок пока нет

- Dissolution of PartnershipДокумент2 страницыDissolution of PartnershipGail FernandezОценок пока нет

- Public Interest Oct '09Документ32 страницыPublic Interest Oct '09Guillermo CapatiОценок пока нет

- Insuring Members of Armed Groups and Incontestability ClauseДокумент7 страницInsuring Members of Armed Groups and Incontestability ClauseCristine M. LimucoОценок пока нет

- R Vijay Anand Resume - Accounting and Finance ProfessionalДокумент3 страницыR Vijay Anand Resume - Accounting and Finance Professionalrsvs369Оценок пока нет

- CSR of VoafoneДокумент49 страницCSR of VoafoneMukesh ManwaniОценок пока нет

- Cambridge International AS and A Level Accounting Coursebook Answer Section PDFДокумент223 страницыCambridge International AS and A Level Accounting Coursebook Answer Section PDFKasparov T Mhangami80% (5)

- Chapter 11 - InnovationДокумент32 страницыChapter 11 - Innovationjdphan100% (1)

- IBP Iloilo City Chapter Legal FeesДокумент2 страницыIBP Iloilo City Chapter Legal FeesCandice Galanza67% (3)

- PP1Документ7 страницPP1yaminiОценок пока нет

- IssuesДокумент14 страницIssueskaiaceegeesОценок пока нет

- National Power Corporation Vs Provincial Government of BataanДокумент2 страницыNational Power Corporation Vs Provincial Government of BataanRachel LeachonОценок пока нет

- Get Business Licenses and Permits GuideДокумент2 страницыGet Business Licenses and Permits Guidemaureen papio100% (1)

- Kotak ProposalДокумент5 страницKotak ProposalAmit SinghОценок пока нет

- Consumer Satisfaction in Iob BankДокумент132 страницыConsumer Satisfaction in Iob Bankvmktpt100% (2)

- Nasipit V NLRC SCRAДокумент20 страницNasipit V NLRC SCRARenz R.Оценок пока нет

- BFMSДокумент2 страницыBFMSRajat SinghОценок пока нет

- Corporate Social Responsibility (CSR) To Corporate Environmental Responsibility (CER) :an India PerspectiveДокумент14 страницCorporate Social Responsibility (CSR) To Corporate Environmental Responsibility (CER) :an India PerspectiveLAW MANTRA100% (1)

- Curriculum For BSAДокумент4 страницыCurriculum For BSAYeppeuddaОценок пока нет

- Operational Auditing: Ellysa Gail S. Camutin Mike Francis PeñalosaДокумент17 страницOperational Auditing: Ellysa Gail S. Camutin Mike Francis Peñalosajack Gatus100% (4)

- 03-28-2013 Agm Minutes RevisedДокумент2 страницы03-28-2013 Agm Minutes Revisedapi-66493924Оценок пока нет

- RH14051 Harshada OSDC-IIДокумент12 страницRH14051 Harshada OSDC-IIharshada700Оценок пока нет

- Accounting - WikipediaДокумент10 страницAccounting - Wikipediayanachii22Оценок пока нет

- AP Economics Chapter 5 QuizДокумент4 страницыAP Economics Chapter 5 Quizsm729Оценок пока нет

- Summary of IAS 8Документ10 страницSummary of IAS 8pradyp15Оценок пока нет

- Axcelasia Inc Annual Report 2015Документ108 страницAxcelasia Inc Annual Report 2015WeR1 Consultants Pte LtdОценок пока нет

- Hyundai SantroДокумент80 страницHyundai Santrob6_50258983050% (2)

- Renault Nissan Strategic PartnereshipДокумент3 страницыRenault Nissan Strategic PartnereshipMohamed GhalwashОценок пока нет