Академический Документы

Профессиональный Документы

Культура Документы

Ratios

Загружено:

anjali kukreja0 оценок0% нашли этот документ полезным (0 голосов)

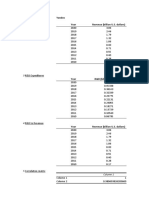

9 просмотров8 страницThe document contains financial ratios for the years 2016-17, 2017-18, and 2018-19. Current ratio, quick ratio, and inventory turnover ratio increased each year from 2016-17 to 2018-19. Return on assets ratio and return on equity decreased from 2016-17 to 2018-19, while return on capital employed and net profit margin decreased from 2017-18 to 2018-19. Fixed assets turnover ratio increased each year.

Исходное описание:

calculation on excel

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document contains financial ratios for the years 2016-17, 2017-18, and 2018-19. Current ratio, quick ratio, and inventory turnover ratio increased each year from 2016-17 to 2018-19. Return on assets ratio and return on equity decreased from 2016-17 to 2018-19, while return on capital employed and net profit margin decreased from 2017-18 to 2018-19. Fixed assets turnover ratio increased each year.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

9 просмотров8 страницRatios

Загружено:

anjali kukrejaThe document contains financial ratios for the years 2016-17, 2017-18, and 2018-19. Current ratio, quick ratio, and inventory turnover ratio increased each year from 2016-17 to 2018-19. Return on assets ratio and return on equity decreased from 2016-17 to 2018-19, while return on capital employed and net profit margin decreased from 2017-18 to 2018-19. Fixed assets turnover ratio increased each year.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 8

Current Ratio

Year Current Ratio 0.85

0.8

2016-17 0.73 0.75 Current

0.7 Ratio

2017-18 0.76 0.65

7 9

2018-19 0.81 6 -1 8 -1

2 01 2 01

Year Quick ratio

Quick ratio

2016-17 0.23 0.4

0.2

2017-18 0.25 0

Quick ratio

2018-19 0.33 17 18 19

1 6- 17- 18-

20 20 20

Inventory Turnover Ratio

10.00 Inventory

Year Inventory Turnover Ratio 5.00 Turnover

0.00 Ratio

2016-17 5.47

2017-18 6.00

2018-19 6.84

cogs 527,692.69 424,038.70 359,942.15

77,127.00 70,567.90 65,724.06

6.8418671801 6.0089459939 5.4765659638

inc 16,894.15 21,346.12 19,106.40

112,469.00 113,873.82 102,096.10

0.1502116139 0.1874541488 0.1871413306

15.02 18.75 18.71

TA 335,155.00 295,672.29 273,561.04

CL 160,719.00 139,864.07 132,685.54

NP 25,126.92 32,564.28 26,321.24

CE 174,436.00 155,808.22 140,875.50

0.1440466417 0.2090023235 0.1868404371

14.4046641748 20.9002323497 18.6840437124

NP 16,894.15 21,346.12 26,321.24

Total

530,821.20 427,453.32 364,142.77

Revenue

0.0318264417 0.0499378973

3.1826441747

cash 1,064.00 494.28 409.75

cl 160,719.00 139,864.07 132,685.54

0.0066202503 0.0035340027 0.0030881285

0.662025025 0.3534002693 0.3088128518

53,559.00 39,080.51 33,284.10

39,152.00 23,060.51 25,545.93

total debt 92,711.00 62,141.02 58,830.03

ta 335,155.00 295,672.29 273,561.04

0.2766212648 0.210168562 0.2150526625

ebit 25,126.92 32,564.28 26,321.24

tax exp 8,232.77 11,218.16 7,214.84

icr 3.0520614568 2.9028182875 3.6482084149

sales 528,148.93 415,775.07 353,712.34 Fixed Assets t/o Ratio

Assets 160,774.00 143,182.34 132,735.15 3.5

3

Year Fixed Assets t/o Ratio 2.5 Fixed

2

2016-17 2.66 1.5 Assets t/o

1 Ratio

0.5

2017-18 2.9 0

2018-19 3.28

Net Income 16,894.15 21,346.12 19,106.40

avg total assets 335,155.00 295,672.29 273,561.04 231,555.43

ory Turnover Ratio 18-19

17-18

335,155.00

295,672.29

295,672.29

273,561.04

630,827.29 315413.645

569,233.33 284616.665

Inventory

Turnover 16-17 273,561.04 231,555.43 505,116.47 252,558.24

Ratio

Year Return on Assets Ratio Return on Assets Ratio

Return on

10

2016-17 7.37 5

0

Assets

Ratio

2017-18 7.6

2018-19 5.35

Year Return on Equity Return on Equity

2016-17 18.71 20

Return on

Equity

2017-18 18.75 10

0

2018-19 15.02 2016-17

ROCE

Year ROCE 30

20

10 ROCE

2016-17 18.68 0

2017-18 20.9

6 -1

7

-1

8

8 -1

9

7

2018-19 2 01 2 01 2 01

14.4

Net Profit Margin

8.00

7.00

Year Net Profit Margin 6.00

5.00 Net Profit Margin

2016-17 7.20

4.00

3.00

2017-18 7.6 2.00

1.00

2018-19 4.74 0.00

2016-17 2017-18 2018-19

Year Cash Ratio

Cash Ratio

2016-17 0.31 1

0.5 Cash Ratio

2017-18 0.35 0

2018-19 0.66

Year Total Debt ratio Total Debt ratio

2016-17 0.22 0.30

0.25

0.20

2017-18 0.21 0.15

0.10

Total Debt

0.05 ratio

2018-19 0.27 0.00

7 8 9

6 -1 7 -1 8 -1

2 01 2 01 2 01

Year Interest Coverage Ratio

2016-17 3.65 Interest Coverage Ratio

Interest

4 Coverage

2017-18 2.91 2

0 Ratio

2018-19 3.05

ets t/o Ratio

Fixed

Assets t/o

Ratio

0.053561887 5.3561886963

0.074999544 7.4999543684

0.08 7.57

ssets Ratio

Return on

Assets

Ratio

0.187141331

Вам также может понравиться

- Ocean Carriers ModelДокумент18 страницOcean Carriers ModelJay ModiОценок пока нет

- Bata India LTDДокумент18 страницBata India LTDAshish DupareОценок пока нет

- Ocean CarriersДокумент17 страницOcean CarriersMridula Hari33% (3)

- Akash 5yr PidiliteДокумент9 страницAkash 5yr PidiliteAkash DidhariaОценок пока нет

- Curret Ratio Acid Test RatioДокумент7 страницCurret Ratio Acid Test RatioNIKHIL MATHEWОценок пока нет

- Fin 201 - SДокумент10 страницFin 201 - SAhsanur HossainОценок пока нет

- Grafik Price Earnig Ratio: Axis TitleДокумент7 страницGrafik Price Earnig Ratio: Axis Titleعبد الرحمنОценок пока нет

- Internsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchДокумент19 страницInternsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchShafayet JamilОценок пока нет

- Nigeria's Economy and Recession-Outlook For 2017 RTC Business and Economic Review October 2016Документ63 страницыNigeria's Economy and Recession-Outlook For 2017 RTC Business and Economic Review October 2016ABIODUN MicahОценок пока нет

- Firts Finance Ltd. Money CountersДокумент11 страницFirts Finance Ltd. Money CountersJarin tasnim tamimОценок пока нет

- Leverage AnalysisДокумент8 страницLeverage AnalysisShubhangi GargОценок пока нет

- Chapter - V Data Analysis & InterpretationДокумент26 страницChapter - V Data Analysis & InterpretationMubeenОценок пока нет

- Group 07 22657 Sandeep S SДокумент21 страницаGroup 07 22657 Sandeep S SSandeep ShirasangiОценок пока нет

- Ratio AnalysisДокумент97 страницRatio Analysissatyansh blackОценок пока нет

- S.No Years Cumulative Cash FlowsДокумент10 страницS.No Years Cumulative Cash Flowsambica bishoyiОценок пока нет

- Year Current RatioДокумент13 страницYear Current Ratiopsana99gmailcomОценок пока нет

- Hindustan Unilever Limited Amount: in CroresДокумент7 страницHindustan Unilever Limited Amount: in CroresSakshi Jain Jaipuria JaipurОценок пока нет

- Organic WhiteДокумент29 страницOrganic WhiteVeeralОценок пока нет

- FIM TPДокумент7 страницFIM TPAfroza VabnaОценок пока нет

- Ratio Analysis Al Anwar Ceramic Tiles SAOG CoДокумент16 страницRatio Analysis Al Anwar Ceramic Tiles SAOG CoDevender SharmaОценок пока нет

- Year Revenue Net Profit EPS ROE Debt To Equit Current Ratio: Column B Column CДокумент6 страницYear Revenue Net Profit EPS ROE Debt To Equit Current Ratio: Column B Column Cteen agerОценок пока нет

- Klinbac 1-2Документ14 страницKlinbac 1-2Compras BPacificoОценок пока нет

- Case Study #2 - Ocean CarriersДокумент11 страницCase Study #2 - Ocean CarriersrtrickettОценок пока нет

- Linde Bangladesh Limited Balance Sheet: ParticularsДокумент16 страницLinde Bangladesh Limited Balance Sheet: ParticularsShajidul Haq Shahi 173-11-5661Оценок пока нет

- Appraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Документ11 страницAppraisal of Dividend Policy of Navana CNG Limited: Presented by Easmin Ara Eity ID: 2018-2-10-048Movie SenderОценок пока нет

- INfyДокумент14 страницINfyswaroop shettyОценок пока нет

- Oc&c Ot速算表 - used 0117Документ14 страницOc&c Ot速算表 - used 0117Charlotte CheungОценок пока нет

- Financial Performance of Interloop Limited (Ilp)Документ2 страницыFinancial Performance of Interloop Limited (Ilp)Muhammad NadeemОценок пока нет

- Schedule Showing Changes in Working Capital For The Financial Year 2017-18 (Rs. in Million)Документ6 страницSchedule Showing Changes in Working Capital For The Financial Year 2017-18 (Rs. in Million)Shobhit ShuklaОценок пока нет

- 1 Company Name 2 Revenue TTM: Yandex Year Revenue (Billion U.S. Dollars)Документ8 страниц1 Company Name 2 Revenue TTM: Yandex Year Revenue (Billion U.S. Dollars)Дмитриий БулгаковОценок пока нет

- Budget Brief 2017Документ70 страницBudget Brief 2017shahzad32552372Оценок пока нет

- Ratios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51Документ5 страницRatios Formula 2017: Current Ratio 1.96 Quick Ratio 1.51HAMMADHRОценок пока нет

- PSO Shell Report - Financial ManagementДокумент7 страницPSO Shell Report - Financial ManagementChaudhary Hassan ArainОценок пока нет

- Index ModelДокумент1 страницаIndex ModelVISHAL PATILОценок пока нет

- Management & Cost Accounting: Economic-Industry-AnalysisДокумент11 страницManagement & Cost Accounting: Economic-Industry-AnalysisRajan BaaОценок пока нет

- Corporate Finance: Submitted By: - Submitted ToДокумент9 страницCorporate Finance: Submitted By: - Submitted ToMahima BhatnagarОценок пока нет

- Daftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsДокумент14 страницDaftar Koleksi Saham Dan Strategi Investasi: Roe Eps PBV P/E CR Der Dy GepsGiyantoОценок пока нет

- Financiero SmuckersДокумент9 страницFinanciero SmuckerserickОценок пока нет

- Ratio Analysis Reliance IndustriesДокумент5 страницRatio Analysis Reliance IndustriesTamish Gambhir0% (1)

- FMT Project - ACC CementДокумент7 страницFMT Project - ACC CementMridula HariОценок пока нет

- Rekap Harga TBS CPOДокумент98 страницRekap Harga TBS CPOGlobal MapindoОценок пока нет

- Pie ChartДокумент14 страницPie ChartPhalangmiki NohriangОценок пока нет

- Mai LinhДокумент227 страницMai LinhNhật HạОценок пока нет

- FinancialsДокумент2 страницыFinancialsclendeavourОценок пока нет

- Data ImportДокумент24 страницыData ImportAnkit VermaОценок пока нет

- Nestle PresentationДокумент10 страницNestle PresentationHashir AliОценок пока нет

- Annex - 25 - Life Cycle Cost Comparison of Different STP ProcessesДокумент10 страницAnnex - 25 - Life Cycle Cost Comparison of Different STP ProcessesDien NoelОценок пока нет

- Section 1: Representative company-MCBДокумент13 страницSection 1: Representative company-MCBHussainОценок пока нет

- YesBank - DuPoint AnalysisДокумент26 страницYesBank - DuPoint AnalysisJAKKU SRI HARSHAОценок пока нет

- Project ValuesДокумент30 страницProject ValueshariharanpОценок пока нет

- PEST Analysis of PakistanДокумент36 страницPEST Analysis of PakistanArslan Ahmed RajputОценок пока нет

- All Companies Ratio Data FINALДокумент24 страницыAll Companies Ratio Data FINALAnsab ArfanОценок пока нет

- Book 1Документ10 страницBook 1Sakhwat Hossen 2115202660Оценок пока нет

- Piramal Glass CompanyДокумент2 страницыPiramal Glass CompanyGimme FiveОценок пока нет

- COMPRASLAVALLE202Документ1 страницаCOMPRASLAVALLE202diana.estudiocontableОценок пока нет

- Summary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)Документ4 страницыSummary of Financial Performance For The Period Ended November 2018 (With Budget Estimates)salini jhaОценок пока нет

- Lupin LTD.: Presentation OnДокумент26 страницLupin LTD.: Presentation OnawishmirzaОценок пока нет

- Campaign Report: All TimeДокумент1 страницаCampaign Report: All TimeRestorani za Svadbe i ostale proslaveОценок пока нет

- Education and Health Sector in PakistanДокумент17 страницEducation and Health Sector in PakistanMuhammad UmairОценок пока нет

- Instructions On How To Create A Units of Production Depreciation ScheduleДокумент2 страницыInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Discussion 3 Accounting Cycle For Manufacturing BusinessДокумент12 страницDiscussion 3 Accounting Cycle For Manufacturing BusinessRHEGIE WAYNE PITOGOОценок пока нет

- Bab 8 Manajemen MO Dan MP DLM BisnisДокумент38 страницBab 8 Manajemen MO Dan MP DLM BisnisrizkaОценок пока нет

- Assignment # 4Документ4 страницыAssignment # 4Butt ArhamОценок пока нет

- IM Ch14-7e - WRLДокумент25 страницIM Ch14-7e - WRLCharry RamosОценок пока нет

- Financial Accounting: A Managerial Perspective: Sixth EditionДокумент15 страницFinancial Accounting: A Managerial Perspective: Sixth EditionKARISHMA SANGHAIОценок пока нет

- SAP Standard ReportsДокумент18 страницSAP Standard ReportsVenkat Reddy MomulaОценок пока нет

- BMAN23000 Online Exam 2019-20Документ5 страницBMAN23000 Online Exam 2019-20Munkbileg MunkhtsengelОценок пока нет

- Internship Report On Performance Measurment System of BRAC EPL Stock Brokerage Ltd. by M AnwaruzzamanДокумент69 страницInternship Report On Performance Measurment System of BRAC EPL Stock Brokerage Ltd. by M AnwaruzzamanMohammed AnwaruzzamanОценок пока нет

- Financial Accounting Journal Entries and Accounting Cycle Study Guide PDFДокумент10 страницFinancial Accounting Journal Entries and Accounting Cycle Study Guide PDFshaankkОценок пока нет

- A Study On The Financial and Operational Efficiency of Sakthi Finance LimitedДокумент88 страницA Study On The Financial and Operational Efficiency of Sakthi Finance LimitedmaheswariОценок пока нет

- 04 Assignments Practical Questions NEWДокумент21 страница04 Assignments Practical Questions NEWBhupendra MendoleОценок пока нет

- 12 Fabm 2 Module 2 of First Quarter OlshcoДокумент33 страницы12 Fabm 2 Module 2 of First Quarter OlshcoPrincess Alyssa BarawidОценок пока нет

- Salem Telephone CompanyДокумент8 страницSalem Telephone Companyasheesh0% (1)

- Q1-Results Bal 2019-20Документ5 страницQ1-Results Bal 2019-20Krish PatelОценок пока нет

- Accounting HandbookДокумент42 страницыAccounting Handbookinfoyazid5Оценок пока нет

- 2018 08 30 Andrew Bernstein Expert Report Exhibits SignedДокумент57 страниц2018 08 30 Andrew Bernstein Expert Report Exhibits SignedJoab St100% (1)

- Pa101: Fundamentals of Accounting: Jabatan Pengajian PoliteknikДокумент11 страницPa101: Fundamentals of Accounting: Jabatan Pengajian PoliteknikHaiyree AdnОценок пока нет

- Basic Accounting - Part 1Документ62 страницыBasic Accounting - Part 1Shayne Aldrae Cacalda100% (1)

- Eum Edgenta Sofp & Sopl 2020Документ4 страницыEum Edgenta Sofp & Sopl 2020ariash mohdОценок пока нет

- HW On Statement of Changes in EquityДокумент2 страницыHW On Statement of Changes in EquityCharles TuazonОценок пока нет

- Accounting Principles (Theory) CMA Questions & SolutionsДокумент32 страницыAccounting Principles (Theory) CMA Questions & SolutionsKamrul HassanОценок пока нет

- The Asset-Based ApproachДокумент13 страницThe Asset-Based ApproachGeorge PanagiotidisОценок пока нет

- BUS FPX4060 - Assessment1 1Документ17 страницBUS FPX4060 - Assessment1 1AA TsolScholarОценок пока нет

- Group 1 - Chapter 20 - Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeДокумент18 страницGroup 1 - Chapter 20 - Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeRhad Lester C. MaestradoОценок пока нет

- Focus Questions For Laura MartinДокумент10 страницFocus Questions For Laura MartinAgnik DuttaОценок пока нет

- Financial Statements:: Review, Analysis, and InterpretationДокумент5 страницFinancial Statements:: Review, Analysis, and InterpretationbethОценок пока нет

- Psak Vs Ifrs 2022Документ11 страницPsak Vs Ifrs 2022kiswonoОценок пока нет

- CEBU PacificДокумент62 страницыCEBU PacificacesmaelОценок пока нет

- Ch2 ConceptДокумент164 страницыCh2 ConceptChristian Laguio100% (2)