Академический Документы

Профессиональный Документы

Культура Документы

Aggregate Turnover: New Composition Scheme

Загружено:

Aman Singh0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаThis document outlines the key conditions for a registered person to opt for a new composition scheme with a tax rate of 6%. Specifically:

- The registered person's aggregate turnover in the previous financial year must be below Rs. 50 lakh.

- They are not eligible to collect or avail any input tax credits.

- Supplies of ice cream, pan masala and tobacco products are excluded from the scheme.

- If a registered person had previously availed input tax credits, they must pay an equivalent amount by debiting their electronic ledger before opting for this scheme.

Исходное описание:

Question

Оригинальное название

5_6280556893421174944

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document outlines the key conditions for a registered person to opt for a new composition scheme with a tax rate of 6%. Specifically:

- The registered person's aggregate turnover in the previous financial year must be below Rs. 50 lakh.

- They are not eligible to collect or avail any input tax credits.

- Supplies of ice cream, pan masala and tobacco products are excluded from the scheme.

- If a registered person had previously availed input tax credits, they must pay an equivalent amount by debiting their electronic ledger before opting for this scheme.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаAggregate Turnover: New Composition Scheme

Загружено:

Aman SinghThis document outlines the key conditions for a registered person to opt for a new composition scheme with a tax rate of 6%. Specifically:

- The registered person's aggregate turnover in the previous financial year must be below Rs. 50 lakh.

- They are not eligible to collect or avail any input tax credits.

- Supplies of ice cream, pan masala and tobacco products are excluded from the scheme.

- If a registered person had previously availed input tax credits, they must pay an equivalent amount by debiting their electronic ledger before opting for this scheme.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

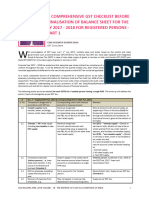

whose aggregate turnover in the preceding financial year was

fifty lakh rupees or below

who is not eligible to pay tax under sub-section (1) of section

10 of the said Act;

who is not engaged in making any supply which is not leviable to

tax under the said Act; If opted by one registered Mandatory for all registered

PAN based not GSTIN Based

person person having same PAN

who is not engaged in making any inter-State outward supply

The registered person shall not

collect any tax from the

who is neither a casual taxable person nor a non-resident Restriction on collecting Taxes recipient on supplies made by

taxable person him nor shall he be entitled to

Supplies are made by a

Registered Person any credit of input tax.

who is not engaged in making any supply through an electronic

commerce operator who is required to collect tax at source The registered person shall

under section 52 mention the following words at

the top of the bill of supply,

Ice cream and other edible ice, The registered person shall namely: - 'taxable person

whether or not containing Bill of Supply issue, instead of tax invoice, a paying tax in terms of

cocoa. bill of supply notification No. 2/2019-Central

Tax (Rate) dated 07.03.2019,

who is not engaged in making not eligible to collect tax on

Pan masala

supplies of supplies

All goods, i.e. Tobacco and

िजसने पहले ITC िलया था और अब

manufactured tobacco Where any registered person who has availed of input tax credit

Other Conditions वो इस नोिटिफ़केशन मेंटैक्स पाय

substitutes opts to pay tax under this notification,

करना चाहता है

New composition Scheme

CGST 3

he shall pay an amount, by way of debit in the electronic credit

Rate 6%

ledger or electronic cash ledger,

SGST /UTGST 3

inputs held in stock and

aggregate

upto an

turnover of fifty lakh After that

inputs contained in semi-

rupees Treat of ITC 18(4) equivalent to the credit of input tax in respect of finished or finished goods held

in stock

Shall not include the supplies

from the first day of April of a and on capital goods

financial year to the date from

which he becomes liable for

For Payment of Tax registration under the Act. as if the supply made under this notification attracts the provisions

of section 18(4) of the said Act and the rules made there-under

and after payment of such amount,

Will also include supplier which

First Supplies of G/S/B are exempt

the balance of input tax credit, if any, lying in his electronic credit

ledger shall lapse

include the supplies from the first day of April of a

financial year to the date from which he becomes liable

for registration

In computing aggregate turnover in order to determine

For Determining Eligibility eligibility of a registered person to pay central tax at the

rate of three percent under this notification, value of

supply of exempt services by way of extending deposits,

loans or advances in so far as the consideration is

represented by way of interest or discount, shall not be

taken into account.

Вам также может понравиться

- BFB Housing Loan Application Form v2016.HmcДокумент2 страницыBFB Housing Loan Application Form v2016.HmcJoy Ramos100% (3)

- Chapter 12Документ11 страницChapter 12Kim Patrice NavarraОценок пока нет

- 4 Step Trading Protocol Discretionary FrameworkДокумент42 страницы4 Step Trading Protocol Discretionary Frameworkfake.mОценок пока нет

- BIR Form No. 1700 (Nov. 2011) GuideДокумент1 страницаBIR Form No. 1700 (Nov. 2011) GuideEllen Grace MadriagaОценок пока нет

- 2010 - Consolidated Tax CasesДокумент18 страниц2010 - Consolidated Tax CasesZairah Nichole PascacioОценок пока нет

- GST Chapter 2Документ24 страницыGST Chapter 2premium info2222Оценок пока нет

- Indian Tax SystemДокумент17 страницIndian Tax SystemSachin RanaОценок пока нет

- Indian Tax System - An: Habibullah & Co. Chartered Accountants IndiaДокумент17 страницIndian Tax System - An: Habibullah & Co. Chartered Accountants IndiaAnonymous reIq4DHr2Оценок пока нет

- Ey TB Nov 2019 ApacДокумент10 страницEy TB Nov 2019 ApacAlvin Lozares CasajeОценок пока нет

- TRAIN (Changes) ???? Pages 7, 10 - 12Документ4 страницыTRAIN (Changes) ???? Pages 7, 10 - 12blackmail1Оценок пока нет

- 07) CIR V Seagate Tech PhilsДокумент3 страницы07) CIR V Seagate Tech PhilsAlfonso Miguel LopezОценок пока нет

- Unit 6 - Preparation of Annua ITR BIR Compliance RequirementsДокумент13 страницUnit 6 - Preparation of Annua ITR BIR Compliance RequirementsRomero Joseph AnthonyОценок пока нет

- Registration of CGSTДокумент3 страницыRegistration of CGSTambikaagarwal1934Оценок пока нет

- Withholding Tax Regime-PaksitanДокумент2 страницыWithholding Tax Regime-Paksitanusmansss_606776863Оценок пока нет

- Imports Under Gst02june2017Документ2 страницыImports Under Gst02june2017shahruchirОценок пока нет

- (Tax-Ho) Ease of Paying Taxes ActДокумент8 страниц(Tax-Ho) Ease of Paying Taxes ActJoshua Neil AdrinedaОценок пока нет

- Income Tax BocДокумент75 страницIncome Tax BocJenica Anne DalaodaoОценок пока нет

- BIR Forms and Deadlines ReviewerДокумент8 страницBIR Forms and Deadlines ReviewerJuday MarquezОценок пока нет

- Casual Taxable Person Brochure - 10 November 2022Документ2 страницыCasual Taxable Person Brochure - 10 November 2022KumariОценок пока нет

- Kjaefncl (Complete)Документ42 страницыKjaefncl (Complete)Kenzo RodisОценок пока нет

- A Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered PersonsДокумент8 страницA Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered Personsजयकरण शर्माОценок пока нет

- BIR Form No. 1700Документ2 страницыBIR Form No. 1700mijareschabelita2Оценок пока нет

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationДокумент49 страницNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorОценок пока нет

- Income Tax Rates of Individual Income TaxДокумент3 страницыIncome Tax Rates of Individual Income TaxGe LineОценок пока нет

- TDS On Commission To Non ResidentДокумент6 страницTDS On Commission To Non ResidentAdityaОценок пока нет

- Module 1 - Introduction To Business TaxesДокумент14 страницModule 1 - Introduction To Business TaxesfrecymaebaraoОценок пока нет

- Penalty TAX: Ax Distinguished From Other ChargesДокумент4 страницыPenalty TAX: Ax Distinguished From Other Chargesmaria cruzОценок пока нет

- Withholding Taxes: Pagaduan & DongaДокумент11 страницWithholding Taxes: Pagaduan & DongaKobe BullmastiffОценок пока нет

- Facilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Документ41 страницаFacilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Raza312Оценок пока нет

- Introduction To Business Taxes: A Transaction Is Subject To Business Tax If: A Transaction Is Subject To Business Tax IfДокумент2 страницыIntroduction To Business Taxes: A Transaction Is Subject To Business Tax If: A Transaction Is Subject To Business Tax IfCherrie Mae FloresОценок пока нет

- Ease of Paying TaxesДокумент2 страницыEase of Paying TaxesLET ReviewerОценок пока нет

- Demands and Recovery: After Studying This Chapter, You Will Be Able ToДокумент38 страницDemands and Recovery: After Studying This Chapter, You Will Be Able ToAnkitaОценок пока нет

- 1704 MqyДокумент1 страница1704 MqyRizza Mae RodriguezОценок пока нет

- Tax Rate For EntityДокумент5 страницTax Rate For EntitySantosh ChhetriОценок пока нет

- TAXXXXДокумент2 страницыTAXXXXKeigrah Adelaine Gamban Pangilinan0% (1)

- Provisional Tax Webinar Presentation 24 August 2023Документ31 страницаProvisional Tax Webinar Presentation 24 August 2023lebomaedi5Оценок пока нет

- Registration Under GST Law NewДокумент3 страницыRegistration Under GST Law NewSunilОценок пока нет

- TRAIN (Changes) ???? Pages 1, 3, 7Документ3 страницыTRAIN (Changes) ???? Pages 1, 3, 7blackmail1Оценок пока нет

- Guide 04 Tax Overview For BusinessesДокумент4 страницыGuide 04 Tax Overview For BusinessesHamid PopalОценок пока нет

- PDF Taxation 1 NotesДокумент24 страницыPDF Taxation 1 NotesLeuОценок пока нет

- ING Bank v. CIRДокумент23 страницыING Bank v. CIRevelyn b t.Оценок пока нет

- WHT Rates Tax Year 2023-24 - 230630 - 222611Документ2 страницыWHT Rates Tax Year 2023-24 - 230630 - 222611Ammad ArifОценок пока нет

- Business ConnectionДокумент12 страницBusiness ConnectionvihankaОценок пока нет

- Chpater 5 - Final Income TaxationДокумент31 страницаChpater 5 - Final Income TaxationKeziah YpilОценок пока нет

- TAX-1401 (Income Tax Return & Payment of Tax)Документ5 страницTAX-1401 (Income Tax Return & Payment of Tax)Hilo MethodОценок пока нет

- Specified Domestic TransactionДокумент3 страницыSpecified Domestic TransactionangeetОценок пока нет

- Filepay Ver2Документ1 страницаFilepay Ver2Aries ParazoОценок пока нет

- TRAIN (Changes) ???? Pages 6 - 8Документ3 страницыTRAIN (Changes) ???? Pages 6 - 8blackmail1Оценок пока нет

- Commissioner of Internal Revenue vs. PLDTДокумент19 страницCommissioner of Internal Revenue vs. PLDTRustom IbañezОценок пока нет

- GST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAIДокумент45 страницGST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAIkОценок пока нет

- Cir vs. Seagate TechnologyДокумент1 страницаCir vs. Seagate Technologygeorge almedaОценок пока нет

- Kinds of TaxpayersДокумент3 страницыKinds of TaxpayersAisaia Jay ToralОценок пока нет

- Introduction To Income TaxationДокумент10 страницIntroduction To Income TaxationKatrina MaglaquiОценок пока нет

- G. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005Документ32 страницыG. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005WAYNEОценок пока нет

- Withholding Income Tax Regime (WHT Rates Card) : Facilitation GuideДокумент48 страницWithholding Income Tax Regime (WHT Rates Card) : Facilitation GuideKamran KhanОценок пока нет

- Egistration: Learning OutcomesДокумент56 страницEgistration: Learning OutcomesghsjgjОценок пока нет

- Composition of LevyДокумент6 страницComposition of LevyYalini MeenakshiОценок пока нет

- Chapter 7Документ8 страницChapter 7Hijrat sahakОценок пока нет

- PLS TAX Review Midterm ExamДокумент72 страницыPLS TAX Review Midterm ExamKim OngОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- BSP C1135 Settlement of Electronic Payments Under NRPSДокумент5 страницBSP C1135 Settlement of Electronic Payments Under NRPSJoanna Robles-TanОценок пока нет

- Risk ManagementДокумент1 страницаRisk ManagementThảo NguyễnОценок пока нет

- Slip Accomodation Dan TransportationДокумент5 страницSlip Accomodation Dan Transportationbovan28Оценок пока нет

- Individual Account ApplicationДокумент5 страницIndividual Account ApplicationZaineb AbbadОценок пока нет

- IfsДокумент23 страницыIfsRahul Kumar JainОценок пока нет

- Vitthal Mandir Audit ReportДокумент4 страницыVitthal Mandir Audit ReportHindu Janajagruti SamitiОценок пока нет

- Lecture - Interest Rate SwapДокумент26 страницLecture - Interest Rate SwapKamran AbdullahОценок пока нет

- FRA Midterm Question@PGEXPДокумент3 страницыFRA Midterm Question@PGEXPsatyam pandeyОценок пока нет

- Vdocuments - MX Internship Report 58bd59f3d6a33Документ68 страницVdocuments - MX Internship Report 58bd59f3d6a33Eyuael SolomonОценок пока нет

- Informal Financial InstitutionsДокумент7 страницInformal Financial InstitutionsDarwin SolanoyОценок пока нет

- Module 1Документ5 страницModule 1Its Nico & SandyОценок пока нет

- Final Reviewer Mathematics InvestmentДокумент2 страницыFinal Reviewer Mathematics InvestmentChello Ann AsuncionОценок пока нет

- Exam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024Документ35 страницExam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024MUSTHARI KHANОценок пока нет

- TaxyДокумент4 страницыTaxyNeevinternational NeevОценок пока нет

- Completing The Audit - NotesДокумент8 страницCompleting The Audit - NotesLovenia M. FerrerОценок пока нет

- BSM Toolbox OriginalДокумент651 страницаBSM Toolbox Originalrdixit2Оценок пока нет

- EEB PPT Session 13 14 Fin Sys CrisisДокумент24 страницыEEB PPT Session 13 14 Fin Sys CrisisRohit PaiОценок пока нет

- Description Tariffs & ChargesДокумент9 страницDescription Tariffs & ChargesMohammed Tabarok HossainОценок пока нет

- Chapter One Extinction of ObligationsДокумент46 страницChapter One Extinction of ObligationsHemen zinahbizuОценок пока нет

- Aud 2Документ7 страницAud 2Raymundo EirahОценок пока нет

- PHD Fee All The BacthesДокумент2 страницыPHD Fee All The BacthesmahadevavrОценок пока нет

- FIN2014 Tutorial 2 - v2023Документ8 страницFIN2014 Tutorial 2 - v2023felicia tanОценок пока нет

- Final Settlement PageДокумент6 страницFinal Settlement Pagemohammad zubairОценок пока нет

- FL Motion To Dismiss, To Strike, or in The Alternative, For More Definite Statement and Court Ordered MediationДокумент23 страницыFL Motion To Dismiss, To Strike, or in The Alternative, For More Definite Statement and Court Ordered Mediationwinstons2311Оценок пока нет

- 2AДокумент14 страниц2ADarshan gowdaОценок пока нет

- ICAI Handbook On Annual Return Under GSTДокумент93 страницыICAI Handbook On Annual Return Under GSTManoj GОценок пока нет

- Media Resume 999 Temp PreviewДокумент1 страницаMedia Resume 999 Temp PreviewRohan JainОценок пока нет

- A Study On Retail Loans, at UTI Bank Retail Asset CentreДокумент74 страницыA Study On Retail Loans, at UTI Bank Retail Asset CentreBilal Ahmad LoneОценок пока нет