Академический Документы

Профессиональный Документы

Культура Документы

Comprehensive Class Example - 2017.2

Загружено:

jayОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Comprehensive Class Example - 2017.2

Загружено:

jayАвторское право:

Доступные форматы

UNSW Business School

School of Accounting

ACCT1501 Accounting and Financial Management 1A

Session 2 2017

Weeks 4 – 6

COMPREHENSIVE CLASS EXAMPLE

– PIANO SERVICES LTD

Adapted from Hoggett, Medlin and Edwards (2012)

Student Handout

Moodle: https://moodle.telt.unsw.edu.au

Session 2, 2017 ACCT1501 1

Alex Schubert emigrated from Austria to Australia in 2000 to fulfil his big dream to

become a star pianist in the Sydney Opera House. He has been saving all his money

from his concert plays in Vienna for the last five years to buy his flight ticket to the

great southern land. Times were tough though since Daniel Beethoven has been

around Australia for three years already travelling from one concert hall to the other

with his famous programme “European Classic Meets Red Earth”. Daniel has even

become popular throughout the remotest areas in Northern Territory. Just recently he

has been giving a charity concert in Katherine for both locals and the hundreds of

European and other Australian tourists that had just travelled there to see the new born

piano star.

Alex tried hard to attract the same crowds of people but they only wanted to

see Daniel. Being very disappointed about the unforeseen obstacles, Alex thought

about new possibilities how to stay in Australia anyway because by now he has been

fallen in love with this beautiful vast country. One day he went to a smaller concert in

Alice Springs where a young group of Australians performed a play combining

didgeridoo sounds with classical piano music. He arrived a bit earlier and found the

pianist being all shocked because the piano was totally out of tune.

At that moment his idea was born: he would open a business and offer piano

tuning and repair services throughout the country. That way he could combine both

his love for pianos and travelling through Australia. Now in 2017, Alex has been the

owner of Piano Service Ltd. for several years and is doing pretty well. The post-

closing trial balance of his company at 30 June 2016 is shown below.

Account

Account number Debit Credit

Cash at bank A1 3 280

Accounts receivable A2 3 880

Prepaid insurance A3 190

Supplies A4 210

Motor vehicle A5 21 400

Accumulated depreciation – motor A5.1 8 026

vehicle

Accounts payable L1 1 940

Interest payable L2 440

Bank loan L3 7 000

Share capital SE1 11 000

Retained profits SE2 554

$28 960 $28 960

The Chart of Accounts is shown below:

Account Account

Account number Account number

Cash at bank A1 Retained profits SE2

Accounts receivable A2 Profit and loss SE3

summary

Prepaid insurance A3 Piano tuning fees R1

Supplies A4 Piano repair fees R2

Motor vehicle A5 Petrol and oil expense E1

Session 2, 2017 ACCT1501 2

Accumulated depreciation – Depreciation expense

motor vehicle A5.1 – motor vehicle E2

Accounts payable L1 Supplies expense E3

Interest Payable L2 Insurance expense E4

Bank loan L3 Telephone expense E5

Telephone expense payable L4 Interest expense E6

Share capital SE1

Transactions completed during the year ended 30 June 2017 are summarised below:

1. Tuning fees of $28 600 were receivable during the year; $23 940 of this total

was received in cash predominantly from customers in the outback. The

remainder consisted of transactions on credit.

2. Revenue from piano repairs was $24 380. Cash received totalled $16 800, and

accounts receivable increased by $7 580. A major customer this year was

Daniel Beethoven whose piano broke during an outdoor play under the stars.

3. Supplies costing $340 were purchased during the year on credit.

4. On 1 January 2017, Piano Service Ltd paid $3 000 off the bank loan, plus

interest of $860. The interest payment consisted of $440 accrued up to 30 June

2016 and a further $420 which accrued for the period to 31 December 2016.

5. Petrol and oil for the vehicle in order to get around the vast countryside cost

$2 680 in cash.

6. Insurance on the vehicle, paid in advance was $840.

7. Telephone expense of $2 240 was paid.

8. Accounts receivable of $13 900 were collected, and $2 000 was paid on

accounts payable.

The following information relating to adjusting entries is available at the end of June

2017.

9. A physical count showed supplies costing $180 on hand at 30 June 2017.

10. Accrued interest on the bank loan is $240.

11. Insurance costing $820 expired during the year.

12. Depreciation on the vehicle is $5 350.

13. The June telephone account for $180 has not been paid or recorded.

Required:

A. Prepare transaction analysis using excel sheet.

B. Prepare journal entries to record the transactions completed in the year to 30

June 2017.

C. Open ledger accounts for each of the accounts, and post the journal entries to

the ledger.

D. Prepare a 10-column worksheet.

E. Prepare an adjusted trial balance as at 30 June 2017.

F. Prepare and post the closing entries.

G. Prepare a post-closing trial balance as at 30 June 2017.

H. Prepare Income Statement for the year ended 30 June 2017 and Balance Sheet

as at 30 June 2017.

Session 2, 2017 ACCT1501 3

At the end of the fiscal year, Alex received a thank you card from Daniel for his great

work on the piano repair in 2017. The card also included an invitation for Alex to play

with Daniel on New Year’s Eve in the Sydney Opera House. Alex was very happy

about that. He thought that his dream has finally come true and that being the owner

of Piano Service Ltd. AND being able to play in the Opera House was even better

than just being an ordinary star pianist.

Session 2, 2017 ACCT1501 4

A. TRANSACTION ANALYSIS

Cash Accounts Prepaid Supplies Motor Accumulated Accounts Interest Telephone Bank Share Retained

receivable insurance vehicle depreciation payable payable expense loan capital profits

payable

Opening

balance

1

2

3

4

5

6

7

8a

8b

9

10

11

12

13

Closing

balance

Session 1, 2017 ACCT1501 5

B. General Journal

Account Debit Credit

Code

1

8a

8b

10

11

Session 2, 2017 ACCT1501 6

12

13

Session 2, 2017 ACCT1501 7

C. General Ledger

Cash at bank A1

Accounts receivable A2

Prepaid insurance A3

Supplies A4

Motor vehicle A5

Accumulated depreciation – motor vehicle A5.1

Accounts Payable L1

Session 2, 2017 ACCT1501 8

Interest Payable L2

Bank loan L3

Telephone expense payable L4

Share capital SE1

Retained profits SE2

Profit and Loss Summary SE3

Piano tuning fees R1

Piano repair fees R2

Session 2, 2017 ACCT1501 9

Petrol and oil expense E1

Depreciation expense – motor vehicle E2

Supplies expense E3

Insurance expense E4

Telephone expense E5

Interest expense E6

Session 2, 2017 ACCT1501 10

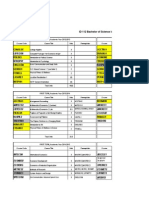

D. WORKSHEET

Piano Service Ltd Worksheet

Adjusted

Trial Balance Adjustments Trial Balance Income statement Balance Sheet

Acc.

Co. Account Name Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

A1 Cash at bank 150

A2 Accounts receivable 2,268

A3 Prepaid insurance 9,930

A4 Supplies 170

A5 Motor vehicle 6,580

A5.1 Accumulated depreciation – MV

L1 Accounts payable

L2 Interest payable 80,000

L3 Bank loan 288,000

L4 Telephone expense payable 24,000

SE1 Share capital 25,800

SE2 Retained profits

SE3 Profit and loss summary 6,260

R1 Piano tuning fees

R2 Piano repair fees

E1 Petrol and oil expense 50,000

E2 Depreciation expense – MV 24,300

E3 Supplies expense 308,920

E4 Insurance expense 700

E5 Telephone expense

E6 Interest expense

NET PROFIT (LOSS)

Session 2, 2017 ACCT1501 11

E. ADJUSTED TRIAL BALANCE

Account

Account code Debit Credit

Cash at bank A1

Accounts receivable A2

Prepaid insurance A3

Supplies A4

Motor vehicle A5

Accumulated depreciation – motor A5.1

vehicle

Accounts payable L1

Interest payable L2

Bank loan L3

Telephone expense payable L4

Share capital SE1

Retained profits SE2

Piano tuning fees R1

Piano repair fees R2

Petrol and oil expense E1

Depreciation expense – motor vehicle E2

Supplies expense E3

Insurance expense E4

Telephone expense E5

Interest expense E6

F. CLOSING ENTRIES

Account Debit Credit

code

1

Session 2, 2017 ACCT1501 12

G. POST-CLOSING TRIAL BALANCE

Account

Account code Debit Credit

Cash at bank A1

Accounts receivable A2

Prepaid insurance A3

Supplies A4

Motor vehicle A5

Accumulated depreciation – motor A5.1

vehicle

Accounts payable L1

Interest payable L2

Bank loan L3

Telephone expense payable L4

Share capital SE1

Retained profits SE2

H. FINANCIAL STATEMENTS

PIANO SERVICE LTD

INCOME STATEMENT

for the year ended 30 June 2017

Revenue

Piano tuning fees 12,135

Piano repair fees 900 11,235

GROSS PROFIT

Expenses

Petrol and oil expenses 12,015

Depreciation expense – motor vehicle 5,455 6,570

Supplies expense

Insurance expense

Telephone Expense 4,665

Interest Expense

19

NET PROFIT/LOSS

4,684

Session 2, 2017 ACCT1501 13

PIANO SERVICE LTD

BALANCE SHEET

as at 30 June 2017

Current Assets

Cash at bank 150

Accounts receivable 2,268

Prepaid insurance 9,930

Supplies 199 9,731

5,445

Non-current Assets 880

Motor vehicle 19

Accumulated depreciation – motor vehicle

18,493

TOTAL ASSETS

80,000

Current Liabilities 288,000

Accounts payable 25,200 262,800

Interest payable 25,800

Telephone expense payable 269 25,531

Non-current Liabilities

Bank loan 368,331

386,824

TOTAL LIABILITIES

6,260

Shareholder’s Equity 1,176

Share capital 784

Retained profits

8,220

TOTAL SHAREHOLDER’S EQUITY

50,000

TOTAL LIABILITIES AND SHAREHOLDER’S

EQUTIY

Session 2, 2017 ACCT1501 14

Вам также может понравиться

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОт EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОценок пока нет

- CH 02Документ5 страницCH 02Tien Thanh Dang0% (1)

- Ffa/F3 Financial AccountingДокумент16 страницFfa/F3 Financial AccountingArt and Fashion galleryОценок пока нет

- PDFДокумент28 страницPDFdaryll0% (1)

- Far 129 Notes PayableДокумент3 страницыFar 129 Notes PayableJemwell Pagalanan100% (1)

- CH 3 HomeworkДокумент6 страницCH 3 HomeworkAxel OngОценок пока нет

- Week 3 Illustrative Lecture QuestionsДокумент4 страницыWeek 3 Illustrative Lecture QuestionsKristel AndreaОценок пока нет

- FORM TP2008115: Caribbean Examinations Council Secondary Education Examination of AccountsДокумент9 страницFORM TP2008115: Caribbean Examinations Council Secondary Education Examination of AccountsJael BernardОценок пока нет

- Ems p1 Grade 9 June 2022 QPДокумент6 страницEms p1 Grade 9 June 2022 QPSekani Dior100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1От EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Оценок пока нет

- Assignment 12Документ4 страницыAssignment 12Joey BuddyBossОценок пока нет

- Case Study Assessment (Event 3 of 3) : CriteriaДокумент26 страницCase Study Assessment (Event 3 of 3) : CriteriaFiona AzgardОценок пока нет

- Methods of Project Financing: Project Finance Equity Finance The ProjectДокумент9 страницMethods of Project Financing: Project Finance Equity Finance The ProjectA vyasОценок пока нет

- Terms and Conditions: (Receipt For The Recipient)Документ1 страницаTerms and Conditions: (Receipt For The Recipient)sagar aroraОценок пока нет

- N5 Financial Accounting June 2018Документ18 страницN5 Financial Accounting June 2018Anil HarichandreОценок пока нет

- ACCOUNTING P2 GR11 QP NOV2022 - EnglishДокумент10 страницACCOUNTING P2 GR11 QP NOV2022 - Englishora mashaОценок пока нет

- Page 10f5 University of Swaziland Department of Accounting Resit/Supplementary Exam Paper - Semester - IДокумент5 страницPage 10f5 University of Swaziland Department of Accounting Resit/Supplementary Exam Paper - Semester - ISEBENELE SIMELANEОценок пока нет

- Accounting P1 Nov 2021 EngДокумент12 страницAccounting P1 Nov 2021 EngnicholasvhahangweleОценок пока нет

- Accounting GR 11 Paper 1Документ11 страницAccounting GR 11 Paper 1Muneebah HajatОценок пока нет

- 2018 GR 10 Case Study 2Документ2 страницы2018 GR 10 Case Study 2Ghostgirl 437Оценок пока нет

- IFRS Edition-2nd: The Accounting Information SystemДокумент88 страницIFRS Edition-2nd: The Accounting Information SystemmariaОценок пока нет

- Page 1 Of5 University of Swaziland Department of Accounting Main Exam Paper - Semester - IДокумент5 страницPage 1 Of5 University of Swaziland Department of Accounting Main Exam Paper - Semester - ISEBENELE SIMELANEОценок пока нет

- N5 Financial Accounting November 2016Документ10 страницN5 Financial Accounting November 2016TsholofeloОценок пока нет

- Gr08 Ems Term2 Pack01 Practice PaperДокумент4 страницыGr08 Ems Term2 Pack01 Practice Paperkehindekevan223Оценок пока нет

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Документ7 страницZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaОценок пока нет

- Accn. Lockdown Worksheet 1Документ3 страницыAccn. Lockdown Worksheet 1Wonder Bee NzamaОценок пока нет

- Accounting P1 Nov 2021 EngДокумент11 страницAccounting P1 Nov 2021 EngLloydОценок пока нет

- FAR - Midterms and FinalsДокумент14 страницFAR - Midterms and FinalsShanley Vanna EscalonaОценок пока нет

- GR 9 June Exam 2023Документ11 страницGR 9 June Exam 2023Rolandi ViljoenОценок пока нет

- Acf 111 S 2018Документ6 страницAcf 111 S 2018SEBENELE SIMELANEОценок пока нет

- 2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceДокумент2 страницы2021 FAC1A TUT Question Unit 3 Acc Equation, GJ, GL and Trial BalanceDaniel OwensОценок пока нет

- CH 02Документ4 страницыCH 02flrnciairnОценок пока нет

- Higher Nationals: Assignment Brief - BTEC (RQF) Higher National Diploma in Business (Business Management)Документ6 страницHigher Nationals: Assignment Brief - BTEC (RQF) Higher National Diploma in Business (Business Management)Ngoc Nga DoanОценок пока нет

- IAL June24 AccДокумент2 страницыIAL June24 Accsinsbell.22Оценок пока нет

- Jasa Ocean Edit FINAL RevisiДокумент5 страницJasa Ocean Edit FINAL RevisiAtalariq BudihartoОценок пока нет

- 2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Question PaperДокумент14 страниц2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Question PaperChantelle IsaksОценок пока нет

- FS Accounting Grade 11 November 2022 P1 and MemoДокумент23 страницыFS Accounting Grade 11 November 2022 P1 and MemoEsihle LwakheОценок пока нет

- Accounts Paper 1 June 2001Документ11 страницAccounts Paper 1 June 2001BRANDON TINASHEОценок пока нет

- Brief Exercises PDFДокумент6 страницBrief Exercises PDFRamzan AliОценок пока нет

- Tugas 5. Siklus Akuntansi-Ricky Andrian K. RumereДокумент66 страницTugas 5. Siklus Akuntansi-Ricky Andrian K. RumererickyОценок пока нет

- Adobe Scan May 02, 2021Документ1 страницаAdobe Scan May 02, 2021dombertucciОценок пока нет

- p67662 Lcci Level 2 Certificate in Bookkeeping and Accounting Ase20093 RB Dec 2021Документ8 страницp67662 Lcci Level 2 Certificate in Bookkeeping and Accounting Ase20093 RB Dec 2021Ei Ei TheintОценок пока нет

- AssignmentДокумент7 страницAssignmentangelnayera7Оценок пока нет

- CXC Principles of Accounts Past Paper Jan 2009Документ8 страницCXC Principles of Accounts Past Paper Jan 2009lordОценок пока нет

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsДокумент6 страницAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- RB Sep 2021Документ8 страницRB Sep 2021ElenaОценок пока нет

- Garing, Aireen - Sa No.12 - Anya's Cleaning ServicesДокумент17 страницGaring, Aireen - Sa No.12 - Anya's Cleaning ServicesAireen GaringОценок пока нет

- Pechtree Exercise 2023Документ3 страницыPechtree Exercise 2023tesfalidetdawitОценок пока нет

- M2.2G Post-Test 2 - Receivables (Questionnaire)Документ6 страницM2.2G Post-Test 2 - Receivables (Questionnaire)soleilОценок пока нет

- Chapter 2 Problems and Solutions EnglishДокумент8 страницChapter 2 Problems and Solutions EnglishyandaveОценок пока нет

- Accounting P2 TR2 2021Документ12 страницAccounting P2 TR2 2021Jinan MahmudОценок пока нет

- Accounting Systems and ProcessesДокумент22 страницыAccounting Systems and ProcessesDrNaveed Ul HaqОценок пока нет

- Accounting P1 May-June 2023 EngДокумент12 страницAccounting P1 May-June 2023 EngKaren ErasmusОценок пока нет

- Phanhoanglong 31201022397Документ22 страницыPhanhoanglong 31201022397Long AnhОценок пока нет

- C 1Документ20 страницC 1Long AnhОценок пока нет

- Date Account Titles and Explanation P.R. Debit Credit: General JournalДокумент50 страницDate Account Titles and Explanation P.R. Debit Credit: General JournalThanh UyênОценок пока нет

- Financial Accounting 2012 Exam PaperДокумент28 страницFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- Practice Questions Vol2Документ8 страницPractice Questions Vol2Angelica PostreОценок пока нет

- AccountingДокумент6 страницAccountingaya walidОценок пока нет

- Technician - QA December 2016Документ127 страницTechnician - QA December 2016Biplob K. SannyasiОценок пока нет

- 1st AccДокумент6 страниц1st AccChristine PerezОценок пока нет

- 2023 Accounting Grade 12 Baseline Assessment - QP-1Документ12 страниц2023 Accounting Grade 12 Baseline Assessment - QP-1Ryno de BeerОценок пока нет

- Accounting P1 NSC Nov 2020 EngДокумент11 страницAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaОценок пока нет

- Tee 1as Level QP Acc 2021Документ10 страницTee 1as Level QP Acc 2021Kalash JainОценок пока нет

- Gold Export GhanaДокумент3 страницыGold Export Ghanamusu35100% (4)

- TCS Result Analysis 2023Документ4 страницыTCS Result Analysis 2023vinay_814585077Оценок пока нет

- Personal Account Opening Form: CommunicationdetailsДокумент8 страницPersonal Account Opening Form: CommunicationdetailsOvick AhmedОценок пока нет

- HDFC Apr To As On DateДокумент10 страницHDFC Apr To As On DatePDRK BABIUОценок пока нет

- Mastering Financial Modelling File ListДокумент1 страницаMastering Financial Modelling File ListNamo Nishant M PatilОценок пока нет

- Far Compre DraftДокумент27 страницFar Compre DraftMika MolinaОценок пока нет

- Daftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkДокумент3 страницыDaftar Pustaka: GOKMARIA SIMARMATA, Supriyadi, M.SC., PH.D., CMA., CA., AkMuhammad WildanОценок пока нет

- The Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceДокумент4 страницыThe Use of CML and SML in Taking Investments Decisions by An Investor On His/her Risk PreferenceChanuka Perera100% (1)

- The Accounting Cycle of A Merchandising Business What I KnowДокумент2 страницыThe Accounting Cycle of A Merchandising Business What I KnowAngela MortelОценок пока нет

- Public Financial Management in GhanaДокумент6 страницPublic Financial Management in GhanaKwaku- Tei100% (2)

- Group 1 - Data Automation & Artificial IntelligenceДокумент25 страницGroup 1 - Data Automation & Artificial IntelligenceFATIN 'AISYAH MASLAN ABDUL HAFIZОценок пока нет

- Nestle India Submitted By: GARIMA BHATTДокумент2 страницыNestle India Submitted By: GARIMA BHATTakshayОценок пока нет

- SUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andДокумент4 страницыSUBJECT: Claim Case No. 400264/16 SMT Pooja Kaur and Ors. Vs Ashok andkunal jainОценок пока нет

- FEES SCHEDULE 2011 - 2012: Australian International SchoolДокумент2 страницыFEES SCHEDULE 2011 - 2012: Australian International SchoollephammydungОценок пока нет

- Toshiba Fraud CaseДокумент23 страницыToshiba Fraud CaseShashank Varma100% (1)

- ZPPF Loan Recoverable ApplicationДокумент3 страницыZPPF Loan Recoverable ApplicationNaga ManoharababuОценок пока нет

- Managerial Accounting Und Erst A DingsДокумент98 страницManagerial Accounting Und Erst A DingsDebasish PadhyОценок пока нет

- Analisis Studi Kelayakan Bisnis Pada Kelompok UsahДокумент11 страницAnalisis Studi Kelayakan Bisnis Pada Kelompok UsahPermana Bagas SatriaОценок пока нет

- The Investing EnlightenmentДокумент40 страницThe Investing Enlightenmentlongchempa100% (1)

- Solved International Paint Company Wants To Sell A Large Tract ofДокумент1 страницаSolved International Paint Company Wants To Sell A Large Tract ofAnbu jaromiaОценок пока нет

- Document From VandanaДокумент39 страницDocument From VandanaVandana SharmaОценок пока нет

- Case Studies RiskДокумент34 страницыCase Studies RiskVenkat ReddyОценок пока нет

- RH Perennial - Nov 21Документ46 страницRH Perennial - Nov 21sambitОценок пока нет

- Suryadev 75 InsuranceДокумент15 страницSuryadev 75 InsuranceKaran ChaudharyОценок пока нет

- AE-MGT FlowchartДокумент9 страницAE-MGT FlowchartJean Thor Renzo MutucОценок пока нет

- Mountain State With NotesДокумент12 страницMountain State With NotesKeenan SafadiОценок пока нет