Академический Документы

Профессиональный Документы

Культура Документы

Sample Exercises IT

Загружено:

Cris Joy BiabasИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sample Exercises IT

Загружено:

Cris Joy BiabasАвторское право:

Доступные форматы

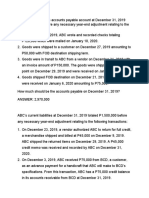

Income Tax - Exercises are P1,000,000 and P600,000, respectively, and with

1. The taxpayer is a married nonresident alien engaged non-operating income of P100,000.

in business in the Philippines with three (3) qualified

dependent children. His country gives a nonresident (a) Assume he signified his intention to be taxed at

Filipino with income therefrom a basic personal 8% income tax rate in his 1st quarter return, the

exemption of P40,000 and P30,000 additional personal total income tax due is:

exemption for each qualified dependent child. For (b) If he did not opt for the 8% income tax , his

taxable year 2017, he is entitled to total personal income tax due is:

exemptions of:

7. On July 1, 2014, Mr. V leased his vacant lot for a

2. Chris, married, supporting his 3 minor children had the period of 12 years to Mr. J at an annual rate of

following data for taxable year 2018: P2,400,000.It was also agreed the Mr. J will pay the

Philippines Abroad following:

Business Income P1,000,000 20,000 P4,800,000 representing rental payment for two

Professional Income 400,000 10,000 (2) years. Subsequent rental payments will be

Salaries 200,000

made every July 1 of the applicable year.

B and P Expenses 250,000 8,000

Income Tax Paid 4,000 Security deposit of P2,400,000.

NOTE= $1– P50 Annual real property tax of P30,000.

(a) If he is a resident citizen, his income tax payable The lease contract provides, among others that the

is: lessee will construct a 5-storey building for parking

(b) If he is a resident alien, his income tax payable purposes at a cost of P36,000,000. Ownership of the

is:

building shall belong to the lessor upon the expiration or

(c) If he is a non-resident citizen, his income tax

due after tax credit, if any is: termination of the lease contract.

(d) If he is a non-resident alien engaged in trade or

business in the Philippines but without the The building was completed on July 1, 2016 with an

benefit of Reciprocity Law, the income tax due estimated useful life of 15 years.

after tax credit, if any is:

(e) If he is a non-resident alien not engaged in trade (a) Mr. V shall report total income from the lease for

or business, disregarding professional &

business data, the total income tax should be 2014 at:

withheld from his income is:

3. Mr. and Mrs. Cruz, both CPAs and residents of the (b) Assuming Mr. V will us the outright method in

Philippines , with 6 minor children, had the following data recognizing income from leasehold

for taxable year 2018: improvements, how much is the total income

Salaries, Wife P600,000 form lease for year 2016?

Bonus (13th Month pay), wife 60,000

Professional Fees, (net of 10% 7,200,000

withholding tax) (c) Assuming Mr. V will use spread-out method in

Expenses (Practice of Profession) 3,200,000 recognizing income from leasehold

Rental Income (Net of 5% 712,500 improvements, how much is the total income

withholding tax)

from lease for year 2016?

Rental Expenses 280,000

Other Income, husband 840,000

(a) The taxable income of Mr. Cruz is:

(d) Assuming that due to the fault of the lessee, the

(b) The taxable income of Ms. Cruz is:

lease contract was terminated on January 1,

2018, how much income is to be reported by the

4. Ms. Niccalou operates a convenience store while she

lessor in 2018?

offers bookkeeping services to her clients. In 2018, her

gross sales amounted to P800,000, in addition to her

receipts from bookkeeping services of P300,000. She

incurred cost of sales and operating expenses

amounting to P600,000 and P200,000, respectively. She

already signified her intention to taxed at 8% income tax

rate in her 1st quarter return.

(a) How much is the income tax liability for the

year?

(b) If Ms. Niccalou failed to signify her intention to

be taxed at 8% income tax rate on gross sales

on her initial Quarterly Income Tax Return , her

income tax liability is:

5. Mr. Izzy, a financial comptroller of WMSU Company,

earned annual compensation income in 2018 of

1,500,000, inclusive of 13th Month Pay and Other

benefits of P120,000 but net of mandatory contributions

to SSS and Philhealth. Aside from employment income,

he owns a convenience store, with gross sales of

P2,400,000. His cost of sales and operating expenses

Вам также может понравиться

- TaxДокумент3 страницыTaxArven FrancoОценок пока нет

- Homework Number 4Документ8 страницHomework Number 4ARISОценок пока нет

- Business and Economic Statistics Quiz 01 06Документ25 страницBusiness and Economic Statistics Quiz 01 06Ariane GaleraОценок пока нет

- Ncpar Cup 2012Документ18 страницNcpar Cup 2012Allen Carambas Astro100% (2)

- Tax LQ1 2Документ21 страницаTax LQ1 2Maddy EscuderoОценок пока нет

- ExerciseonEstateTaxДокумент1 страницаExerciseonEstateTaxJohn Carlo CruzОценок пока нет

- MAS 5 - Module 1Документ11 страницMAS 5 - Module 1Razmen Ramirez PintoОценок пока нет

- VatДокумент13 страницVatJohn Derek GarreroОценок пока нет

- Andiam: January 2, 2019Документ5 страницAndiam: January 2, 2019Avox EverdeenОценок пока нет

- 90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Документ11 страниц90,000 40,000 102,000 Correct Answer 110,000 100,000 300,000 312,000 314,000Hazel Grace PaguiaОценок пока нет

- Sde WRДокумент10 страницSde WRNitinОценок пока нет

- MA PresentationДокумент6 страницMA PresentationbarbaroОценок пока нет

- Dia Mae A. Generoso - Learning Activity 3Документ10 страницDia Mae A. Generoso - Learning Activity 3Dia Mae Ablao GenerosoОценок пока нет

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesДокумент2 страницыThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaОценок пока нет

- Partnership FormationДокумент13 страницPartnership FormationGround ZeroОценок пока нет

- Tax 01 Prefinals Sept 9 2018 BSA4 Answer KeyДокумент11 страницTax 01 Prefinals Sept 9 2018 BSA4 Answer KeyJohn Carlo Dela CruzОценок пока нет

- QUIZ REVIEW Homework Tutorial Chapter 5Документ5 страницQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoОценок пока нет

- NPV - HelicopterДокумент3 страницыNPV - HelicopterAarti J. Kaushal100% (1)

- Activity 2Документ3 страницыActivity 2LFGS Finals0% (1)

- 17002Документ2 страницы17002Alvin YercОценок пока нет

- OPT QuizДокумент5 страницOPT QuizAngeline VergaraОценок пока нет

- Buang Ang TaxДокумент17 страницBuang Ang TaxEdeksupligОценок пока нет

- 2.1.3 Statement of Financial PositionДокумент2 страницы2.1.3 Statement of Financial Positionjoint accountОценок пока нет

- 7.3.1 Topic Test Questions AnswersДокумент34 страницы7.3.1 Topic Test Questions AnswersliamdrlnОценок пока нет

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimДокумент5 страницSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesОценок пока нет

- Finance Review Questions With Answer KeyДокумент14 страницFinance Review Questions With Answer KeyLoranisa BalorioОценок пока нет

- Exercises - Percentage TaxesДокумент2 страницыExercises - Percentage TaxesMaristella GatonОценок пока нет

- TB 5Документ2 страницыTB 5Louiza Kyla AridaОценок пока нет

- Activity 3-Bustax 1Документ4 страницыActivity 3-Bustax 1Nhel AlvaroОценок пока нет

- AST FinalsДокумент20 страницAST FinalsMica Ella San DiegoОценок пока нет

- Chapter 6Документ21 страницаChapter 6Justin TempleОценок пока нет

- Special Revenue Recognition Special Revenue RecognitionДокумент4 страницыSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeОценок пока нет

- 123Документ13 страниц123Nicole Andrea TuazonОценок пока нет

- Mas MockboardДокумент8 страницMas MockboardMarizza WapinОценок пока нет

- VAT AND OPT Monthly EXAMДокумент20 страницVAT AND OPT Monthly EXAMAlexandra Nicole IsaacОценок пока нет

- Econ2 - No.1Документ2 страницыEcon2 - No.1Junvy AbordoОценок пока нет

- COMEX1 TAX REVIEW Canvas-1Документ18 страницCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoОценок пока нет

- Audit LiabilitiesДокумент16 страницAudit LiabilitiesAnthony Koko CarlobosОценок пока нет

- C-12 Multiple ChoicesДокумент14 страницC-12 Multiple ChoicesKashif Ishrat AzharОценок пока нет

- Auditing ProblemsДокумент4 страницыAuditing ProblemsCristineJoyceMalubayIIОценок пока нет

- Quiz - M1 M2Документ12 страницQuiz - M1 M2Jenz Crisha PazОценок пока нет

- Managerial AccountingMid Term Examination (1) - CONSULTAДокумент7 страницManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Formation of Partnership 1. 1-JanДокумент23 страницыFormation of Partnership 1. 1-Janhae1234100% (1)

- Incremental Analysis Problems 111320Документ4 страницыIncremental Analysis Problems 111320KHAkadsbdhsgОценок пока нет

- Intermediate Accounting 2 Quiz 2: You AnsweredДокумент10 страницIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakОценок пока нет

- Use The Following Information For The Next 2 QuestionsДокумент4 страницыUse The Following Information For The Next 2 QuestionsGlen JavellanaОценок пока нет

- Carlyn Cpa EncodeДокумент215 страницCarlyn Cpa Encodelana del reyОценок пока нет

- Local Media271226407970108268Документ17 страницLocal Media271226407970108268Jana Rose PaladaОценок пока нет

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationДокумент1 страницаAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoОценок пока нет

- 3.2 Exercise - RCIT v. MCITДокумент1 страница3.2 Exercise - RCIT v. MCITGiselle MartinezОценок пока нет

- Name: - : Problem 1Документ2 страницыName: - : Problem 1Samuel FerolinoОценок пока нет

- D6Документ11 страницD6lorenceabad07Оценок пока нет

- D5Документ12 страницD5Mark Lord Morales BumagatОценок пока нет

- Ho Abc0abmДокумент5 страницHo Abc0abmAngel Alejo AcobaОценок пока нет

- Finals Manaco2Документ6 страницFinals Manaco2Kenneth Bryan Tegerero Tegio100% (1)

- 105 PrelimДокумент10 страниц105 PrelimEly DoОценок пока нет

- TX 201Документ4 страницыTX 201Pau SantosОценок пока нет

- Deptals - Docx 1 PDFДокумент34 страницыDeptals - Docx 1 PDFJoana MarieОценок пока нет

- Microsoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Документ9 страницMicrosoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Erika Jamine SantosОценок пока нет

- Individual Taxpayers - Sample ProblemsДокумент4 страницыIndividual Taxpayers - Sample ProblemsBpОценок пока нет

- GovernanceДокумент3 страницыGovernanceCris Joy BiabasОценок пока нет

- Debt FinancingДокумент30 страницDebt FinancingCris Joy BiabasОценок пока нет

- LeasesДокумент9 страницLeasesCris Joy BiabasОценок пока нет

- Deferred TaxesДокумент5 страницDeferred TaxesCris Joy BiabasОценок пока нет

- InvestmentДокумент25 страницInvestmentCris Joy Biabas100% (3)

- Capital Budgeting NotesДокумент5 страницCapital Budgeting NotesCris Joy BiabasОценок пока нет

- Self-Declaration Form For TenantsДокумент8 страницSelf-Declaration Form For TenantsVasile E. UrsОценок пока нет

- House Rental Agreement PDFДокумент2 страницыHouse Rental Agreement PDFIris LangubОценок пока нет

- Municipal Consolidation and Construction ProposalДокумент42 страницыMunicipal Consolidation and Construction ProposalAnnaBrutzmanОценок пока нет

- Pre-Colonial EraДокумент126 страницPre-Colonial Era1400440% (5)

- 309 Repayment of Security Deposits To Tenants: 14 DCMR 309Документ2 страницы309 Repayment of Security Deposits To Tenants: 14 DCMR 309AauОценок пока нет

- The Doctrine of Tenure and EstatesДокумент44 страницыThe Doctrine of Tenure and EstatesCynthia AumaОценок пока нет

- Indian Weekender 6 May 2016Документ32 страницыIndian Weekender 6 May 2016Indian WeekenderОценок пока нет

- Violet Lalgee Jones (Widow) and RUBY PADAVATTON (Married Woman)Документ9 страницViolet Lalgee Jones (Widow) and RUBY PADAVATTON (Married Woman)Khanh TrầnОценок пока нет

- A Model of Housing Tenure ChoiceДокумент17 страницA Model of Housing Tenure ChoicekinshuksОценок пока нет

- Virtual Office Agreement-1Документ9 страницVirtual Office Agreement-1Nikhil TripathiОценок пока нет

- Rights of Residents in An Apartment SocietyДокумент3 страницыRights of Residents in An Apartment SocietysreelaxmiОценок пока нет

- Deptals - Docx 1 PDFДокумент34 страницыDeptals - Docx 1 PDFJoana MarieОценок пока нет

- Land Law LLB NotesДокумент40 страницLand Law LLB Notesdg432170% (20)

- PetitionДокумент11 страницPetitionTom JohanningmeierОценок пока нет

- Continue: Lease Agreement Format in Tamil PDFДокумент2 страницыContinue: Lease Agreement Format in Tamil PDFAlbert vivekОценок пока нет

- Acm Law Final Assessment: 1. Explain The Modes of Transfer Under Transfer of Property ActДокумент4 страницыAcm Law Final Assessment: 1. Explain The Modes of Transfer Under Transfer of Property ActRushikesh ChevaleОценок пока нет

- NRLA Joint Ast Family Couple Individual 2022 (2) 1Документ8 страницNRLA Joint Ast Family Couple Individual 2022 (2) 1martika scottОценок пока нет

- LAB1Документ14 страницLAB1Robert Claustro QuiamcoОценок пока нет

- Definition of Indigenous PeoplesДокумент19 страницDefinition of Indigenous PeoplesJeysan MahmudОценок пока нет

- Model Smoke-Free Lease Addendum: Outdoor Smoking Area, Specify Where It Is Here.)Документ2 страницыModel Smoke-Free Lease Addendum: Outdoor Smoking Area, Specify Where It Is Here.)EdwardОценок пока нет

- AssignmentДокумент12 страницAssignmentFai ZuОценок пока нет

- Bhip Newsletter Winter 2013Документ4 страницыBhip Newsletter Winter 2013api-186958810Оценок пока нет

- Valuation Arab City MelakaДокумент33 страницыValuation Arab City MelakaMambo KingОценок пока нет

- Unit 2, Section 4: Residential Block & Estate Management © ARLA, ARHM, ARMA, ASSET SKILLS, CIH, NAEA, RICSДокумент11 страницUnit 2, Section 4: Residential Block & Estate Management © ARLA, ARHM, ARMA, ASSET SKILLS, CIH, NAEA, RICSFranciska HeystekОценок пока нет

- Landlord and Tenant Bill, 2007 8 June 2007Документ39 страницLandlord and Tenant Bill, 2007 8 June 2007Ahmed Ben BellaОценок пока нет

- Property ManagementДокумент19 страницProperty ManagementRubagumya JuliusОценок пока нет

- Deposit of RentДокумент33 страницыDeposit of RentArunaMLОценок пока нет

- Cuano V CaДокумент1 страницаCuano V CaNic NalpenОценок пока нет

- Valuation Calculations 101 Worked ExamplesДокумент3 страницыValuation Calculations 101 Worked ExamplesPoovarasu ArulmozhiMurugesanОценок пока нет

- RTA Rooming Accomodation Agreement FormR18Документ7 страницRTA Rooming Accomodation Agreement FormR18sefioОценок пока нет