Академический Документы

Профессиональный Документы

Культура Документы

SemV - Labour Law II - Nayan.project.102

Загружено:

Avishek PathakОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SemV - Labour Law II - Nayan.project.102

Загружено:

Avishek PathakАвторское право:

Доступные форматы

IN THE

HON’BLE

SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION OF THE HON’BLE SUPREME COURT OF INDIA

FILED UNDER ARTICLE 133 OF THE CONSTITUTION OF INDIA

In the matter of,

ROYAL WESTERN INDIA TURF CLUB LTD. ………………...………..……………… APPELLANT

VERSUS

E.S.I. CORPORATION & ORS. ……………...……………………………...…….…. RESPONDENT

COUNSELS APPEARING ON BEHALF OF APPELLANT

MOST RESPECTFULLY SUBMITTED

COUNSEL FOR THE APPELLANT

NAYAN JAIN

Semester- V (A)

Roll No. 102

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

TABLE OF CONTENTS

TABLE OF CONTENTS………………………………………………………………..………1

LIST OF ABBREVIATIONS……………………………………………………………...……2

INDEX OF AUTHORITIES………………………………………………………...………….3

STATEMENT OF JURISDICTION …………………………………………………………..5

STATEMENT OF FACTS…………………………………………………………………...…6

ISSUES RAISED………………………………………………………………………………...7

SUMMARY OF ARGUMENTS………………………………………………………………..8

PLEADINGS/ARGUMENTS ADVANCED…………………………………………………..9

ISSUE A: THAT THE EMPLOYEES’ STATE INSURANCE ACT IS NOT APPLICABLE TO ROYAL

WESTERN INDIA TURF CLUB LTD.…..………………............................................................ 9

A.1. - That ‘turf club’ doesn’t fall under the category of establishment……………...9

A.2. - That ‘turf club’ doesn’t fall within the common parlance of the term ‘shop’..10

ISSUE B: THAT CASUAL WORKERS ARE NOT COVERED UNDER DEFINITION OF EMPLOYEE

AS DEFINED IN SECTION 2(9) ………………………………………………………………. 11

B.1. - That judicial decisions affirms the same ……………………………………...11

B.2. - That ‘temporary staff’ does not qualify engage test. .…………....................... 12

B.2. - That intention of the legislature affirms the same …………………………... 12

PRAYER FOR RELIEF………………………………………………………………..…….. 14

1 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

TABLE OF ABBREVIATIONS AND SYMBOLS

S. NO. ABBREVIATION DEFINITION

1. & And

2. AIR All India Reporter

3. Art. Article

4. Ed. Edition

5. Hon’ble Honourable

6. Ors. Others

7. SC Supreme Court

8. SCC Supreme Court Cases

9. SCR Supreme Court Reporter

10. Supp. Supplement

11. Supra Pages above

12. S. Section

13. UOI The Union of India

14. U.P. Uttar Pradesh

15. v. Versus

16. Vol. Volume

17. ESIC Employees’ State Insurance Corporation

2 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

INDEX OF AUTHORITIES

CASES CITED-

S. NO. CASES CITATION

1. Employees State Insurance Corporation v. Hyderabad Race (2004) 6 SCC 191

Club

2. The Bangalore Turf Club Ltd. v. Regional Director, AIR 2015 SC 221

Employees State Insurance Corporation

3. M/s. Hindu Jea Band v. Employees’ State Insurance (1987) 2 SCC 101

Corporation

4. M/s. Cochin Shipping Co. v. Employees’ State Insurance (1992) 4 SCC 245

Corporation

5. Transport Corporation of India v. Employees’ State Insurance (2000) 1 SCC 332

Corporation

6. Southern Agencies, Rajamundry v. Andhra Pradesh AIR 2000 SC 3718

Employees’ State Insurance Corporation

7. E.S.I. Corpn. v. Gnanambikai Mills Ltd. (1974) 2 LLJ 530

8. Regional Director ESI Corporation v. P.R. Narahari Rao 1986 KLJ 994

9. Regional director, Employees State Insurance Corporation v. (1990) I LLJ 348

Suresh Trading Company (Kerala)

10. Cemendia Company Limited v. Employees State Insurance (1995) II LLJ 519

Corporation (Bom.)

11. Regional director, Employees State Insurance Corporation v. (1990) II LLJ 464

Vijaya Mohini Mills (Kerala)

12. Employees' State Insurance Corporation v. Gnanambikai Mills (1974) 2 LLJ 530

Ltd. (Mad.)

3 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

BOOKS REFERRED-

S. NO. NAME

1. S.N. Mishra, Labour and Industrial Laws, Central Law Publications (27th ed. 2013).

2. Dr. D.D. Basu, Introduction to the Constitution of India, LexisNexis (21st ed. 2013)

3. Black’s Law Dictionary, Bryan A. Garner, 8th edition

4. Oxford English Dictionary, 2nd edition

1. S.N. Mishra, Labour and Industrial Laws, Central Law Publications (27th ed. 2013).

STATUTES REFERRED-

S. NO. NAME

1. Employees’ State Insurance Act, 1948

2. The Constitution of India, 1950

4 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

STATEMENT OF JURISDICTION

THE HON’BLE SUPREME COURT OF INDIA IS EMPOWERED TO HEAR THIS CASE BY THE VIRTUE

OF ARTICLE 133 OF THE CONSTITUTION OF INDIA, 1950. THIS CIVIL APPEAL ARISES FROM THE

JUDGEMENT DATED 21ST OCTOBER, 2005 PASSED BY THE HIGH COURT OF BOMBAY.

ARTICLE 133 OF THE CONSTITUTION OF INDIA, 1950 READS AS FOLLOWS-

133. Appellate jurisdiction of Supreme Court in appeals from High Courts in regard to

civil matters

(1) An appeal shall lie to the Supreme Court from any judgment, decree or final order

in a civil proceeding of a High Court in the territory of India if the High Court certifies

under Article 134A-

(a) that the case involves a substantial question of law of general importance; and

(b) that in the opinion of the High Court the said question needs to be decided by

the Supreme Court.

(2) Notwithstanding anything in Article 132, any party appealing to the Supreme Court

under clause (1) may urge as one of the grounds in such appeal that a substantial

question of law as to the interpretation of this Constitution has been wrongly decided

(3) Notwithstanding anything in this article, no appeal shall, unless Parliament by law

otherwise provides, lie to the Supreme Court from the judgment, decree or final order

of one Judge of a High Court.

5 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

STATEMENT OF FACTS

1. Royal Western India Turf Club Ltd. (Appellant) is an Indian sports club, into horse racing,

established in 1802, which runs the Mahalaxmi Racecourse in Mumbai, and the Pune Race

Course.

2. The main question involved in the present appeal is whether the Employees’ State

Insurance Act is applicable to Royal Western India Turf Club Ltd.

3. The appellant employed temporary staff engaged on race-days for issue of tickets.

4. The next questions involved for decision in this appeal is whether casual workers are

covered under definition of employee as defined in Section 2(9) of the Employees State

Insurance Act, 1948 (hereinafter referred to as 'ESI Act') and whether the appellant is

obliged to pay contribution in respect of them.

6 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

ISSUES RAISED

ISSUE A: WHETHER THE EMPLOYEES’ STATE INSURANCE ACT IS APPLICABLE TO ROYAL

WESTERN INDIA TURF CLUB LTD.?

ISSUE B: WHETHER CASUAL WORKERS ARE COVERED UNDER DEFINITION OF EMPLOYEE AS

DEFINED IN SECTION 2(9) OF THE EMPLOYEES STATE INSURANCE ACT, 1948?

7 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

SUMMARY OF ARGUMENTS

ISSUE A: THAT THE EMPLOYEES’ STATE INSURANCE ACT IS NOT APPLICABLE TO ROYAL

WESTERN INDIA TURF CLUB LTD.

It is humbly submitted before the Hon’ble Court that Section 1 of the Employees’ State Insurance

Act, 1948 define application and scope of the Act. Under Section 1(5) of the said Act, all

establishments are not automatically covered by the said Act but only such establishments as are

mentioned in the notification issued by the appropriate Government under Section 1(5). It is

humbly submitted that the Appellant-club is not a shop within the meaning of the Act or the

notification issued by the appropriate government

ISSUE B: THAT CASUAL WORKERS ARE NOT COVERED UNDER DEFINITION OF EMPLOYEE AS

DEFINED IN SECTION 2(9) OF THE EMPLOYEES STATE INSURANCE ACT, 1948.

It is humbly submitted that Section 2(9) of the Employees’ State Insurance Act, 1948 defines

‘employee’ under the said Act. A person who is employed for wages in the factory or establishment

on any work of, or incidental or preliminary to or connected with the work is covered under this

definition. It is, however, submitted that temporary staff engaged on race-days for issue of tickets

falls under the category of casual workers and hence they are not covered under the definition of

employee as defined under the aforesaid section.

8 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

WRITTEN SUBMISSION

ISSUE A: THAT THE EMPLOYEES’ STATE INSURANCE ACT IS NOT APPLICABLE TO ROYAL

WESTERN INDIA TURF CLUB LTD.

It is humbly submitted before the Hon’ble Court that Section 11 of the Employees’ State Insurance

Act, 1948 define application and scope of the Act. Under Section 1(5)2 of the said Act, all

establishments are not automatically covered by the said Act but only such establishments as are

mentioned in the notification issued by the appropriate Government under Section 1(5). This

provision is not like Sub-section (4) of Section 1 by which all factories are automatically covered

by the ESI Act.

A.1. That ‘turf club’ doesn’t fall under the category of establishment under ESI Act.

The Government of Maharashtra issued a Notification3 dated 18.09.1978 whereby the State,

exercising its power under Sub-section (5) of Section 1 of the ESI Act, extended the provision of

the ESI Act to certain classes of establishments as found mentioned therein. The relevant portion

of the notification reads as under-

“The following establishments wherein twenty or more employees are employed,

or were employed for wages on any day of the preceding twelve months, namely:

hotels; restaurants; shops; etc.”

The notifications issued Under Section 1(5) in these cases use the word 'shop' and it has been held

in Employees State Insurance Corporation v. Hyderabad Race Club4 that 'race-club' is an

'establishment' within the meaning of the ‘said expression’ as used Under Section 1(5) of the ESI

Act.

1

Section 1- Short title, extent, commencement and application.

2

Section 1(5)- “The appropriate Government may, in consultation with the corporation and where the appropriate

Government is a State Government, with the approval of the Central Government], after giving one month's notice of

its intention of so doing by notifi-cation in the Official Gazette, extend the provisions of this Act or any of them, to

any other establishment or class of establis-hments, industrial, commercial, agricultural or otherwise..”

3

Notification No. ESI. 1677/3910/PH-15.

4

Employees State Insurance Corporation v. Hyderabad Race Club, (2004) 6 SCC 191.

9 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

It is humbly submitted that this decision was reconsidered in The Bangalore Turf Club Ltd. v.

Regional Director, Employees State Insurance Corporation5 and it was stated in this case that-

“The word 'shop' has not been defined either in the ESI Act or in the notification issued by the

appropriate government Under Section 1(5). Hence, in our opinion, the meaning of 'shop' will be

that used in common parlance. In common parlance when we go for shopping to a market, we do

not mean going to a racing club. Hence, prima facie, we are of the opinion that the Appellant-club

is not a shop within the meaning of the Act or the notification issued by the appropriate

government.”

A.2. That ‘turf club’ doesn’t fall within the common parlance of the term ‘shop’.

It is further submitted that the meaning of 'shop' must be understood in common parlance, i.e., as

per its traditional meaning. It is submitted that in M/s. Hindu Jea Band v. ESIC6 it was stated

that the Court should not prefer a liberal or expansive interpretation to ascertain the meaning of a

'shop', and that the literal rule of construction would be best suited to the given case. The common

thread for ascertaining whether a premises may be called a shop, would be that such a place is

commonly used for the sale of goods or services or to facilitate the same.

It is submitted that a 'shop', in its traditional meaning, would necessarily be a building where goods

are sold or kept for sale and therefore it would require a well-defined and enclosed premises. It is

stated that a permanent structure consisting of four-walls and a roof would be essential for any

premises or establishment to be called a 'shop'. “The race-club had large open area for conducting

the actual race, that is the track, stables, etc. and it cannot be called a 'shop' by any stretch of

imagination as it lacked the necessary enclosed space or roof.”7

In Southern Agencies, Rajamundry v. Andhra Pradesh Employees’ State Insurance

Corporation8 it was stated that the word ‘shop’ has acquired an expanded meaning. Where in a

5

The Bangalore Turf Club Ltd. v. Regional Director, Employees State Insurance Corporation, AIR 2015 SC

221.

6

M/s. Hindu Jea Band v. ESIC, (1987) 2 SCC 101; M/s. Cochin Shipping Co. v. ESIC, (1992) 4 SCC 245;

Transport Corporation of India v. ESIC (2000) 1 SCC 332.

7

The Bangalore Turf Club Ltd. v. Regional Director, Employees State Insurance Corporation, AIR 2015 SC

221.

8

Southern Agencies, Rajamundry v. Andhra Pradesh Employees’ State Insurance Corporation, AIR 2000 SC

3718.

10 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

premises any economic activity is being carried on leading to sale and purchase than that premises

will be held as a shop. However, one of the condition precedent to this is that there must be actual

giving and taking of goods in such premises. In the present facts, appellant is an Indian sports club,

into horse racing and in no way it can fall within the common parlance of the term ‘shop’.

Hence, on these grounds, it is most humbly submitted that the Employees’ State Insurance Act is

not applicable to the Appellants.

ISSUE B: THAT CASUAL WORKERS ARE NOT COVERED UNDER DEFINITION OF EMPLOYEE AS

DEFINED IN SECTION 2(9) OF THE EMPLOYEES STATE INSURANCE ACT, 1948.

It is humbly submitted that Section 2(9) of the Employees’ State Insurance Act, 1948 defines

‘employee’ under the said Act. A person who is employed for wages in the factory or establishment

on any work of, or incidental or preliminary to or connected with the work is covered under this

definition. It is, however, submitted that temporary staff engaged on race-days for issue of tickets

falls under the category of casual workers and hence they are not covered under the definition of

employee as defined under the aforesaid section.

B.1. That judicial decisions affirms the same.

In E.S.I. Corpn. v. Gnanambikai Mills Ltd.9, Madras High Court took the view that the casual

workmen concerned were not employees under Section 2(9) of the Act. Further, in Regional

Director ESI Corporation v. P.R. Narahari Rao10, it was stated that a person engaged casually in

connection with processes which are not integral parts of or incidental or preliminary to or

connected with the operations of the establishment, though such engagement may be for longer

periods, other than casual employment on a contract of service, such casual workman may not be

employee as defined in the Act.

9

E.S.I. Corpn. v. Gnanambikai Mills Ltd., (1974) 2 LLJ 530.

10

Regional Director ESI Corporation v. P.R. Narahari Rao, 1986 KLJ 994.

11 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

B.2. That ‘temporary staff’ does not qualify engage test.

In Regional Director ESI Corporation v. P.R. Narahari Rao11, the Hon’ble court enunciated

engage test to find the inclusion of casual labour under the definition of the ‘employee’. It stated

that, “if a person is engaged casually for a process unconnected with the operations of the

establishment, or some work which does not form the integral part of such operations, he may not

be an employee since there would be no employer-employee relationship between them only in

consequence of the casual engagement for purposes unconnected with the main operations of the

establishment.” This test was reaffirmed in the case of Regional director, Employees State

Insurance Corporation v. Suresh Trading Company12.

It is humbly submitted that in the present case, ‘temporary staff engaged on race-days’ are just

engaged casually and they in no way integral part of any operations of the ‘’turf club’. Further,

they are just ticket vendors and such vending cannot be termed as the integral part of horse racing.

This vending has a remote connection with horse racing and therefore these casual employees does

not fulfill the engagement test as enunciated in the aforementioned case.

B.3. That intention of the legislature affirms the same.

It is humbly submitted that the object of Employees’ State Insurance Act, 1948 is “to provide for

certain benefits to employees in case of sickness, maternity, and employment injury and to make

provision for certain other matters in relation thereto.” Section 49 of the aforesaid Act provides

for sickness benefit.

However, in Employees' State Insurance Corporation v. Gnanambikai Mills Ltd.13 it was stated

that under Section 2(9) of the Act, casual employees may not be entitled to sickness benefits in

case their employment is less than the benefit period or contribution period and that it does not

appear from the Act that casual employee should be brought within its purview.

11

Regional Director ESI Corporation v. P.R. Narahari Rao, 1986 KLJ 994.

12

Regional director, Employees State Insurance Corporation v. Suresh Trading Company, (1990) I LLJ 348

(Kerala); Cemendia Company Limited v. Employees State Insurance Corporation, (1995) II LLJ 519 (Bom.);

Regional director, Employees State Insurance Corporation v. Vijaya Mohini Mills, (1990) II LLJ 464 (Kerala).

13

Employees' State Insurance Corporation v. Gnanambikai Mills Ltd, (1974) 2 LLJ 530 (Mad.).

12 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

It is therefore submitted that even legislature did not intended to bring casual employees under the

purview of this Act.

Hence, on these grounds, it is most humbly submitted that casual workers are not covered under

definition of employee as defined in section 2(9) of the Employees State Insurance Act, 1948.

13 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

ROYAL WESTERN INDIA TURF CLUB LTD. v. E.S.I. CORPORATION & ORS.

PRAYER FOR RELIEF

WHEREFORE, IN LIGHT OF THE FACTS STATED, ARGUMENTS ADVANCED AND AUTHORITIES

CITED, THE APPELLANTS, HUMBLY PRAYS BEFORE THE HON’BLE SUPREME COURT OF INDIA,

TO ADJUDGE AND DECLARE:

1. That the Employees’ State Insurance Act is not applicable to the appellants.

2. That ‘turf club’ doesn’t fall under the category of establishment under ESI Act.

3. That ‘turf club’ doesn’t fall within the common parlance of the term ‘shop’.

4. That casual workers are not covered under definition of employee as defined in section

2(9) of the Employees State Insurance Act, 1948.

5. That ‘temporary staff’ does not qualify engage test.

THE COURT MAY ALSO BE PLEASED TO PASS ANY OTHER ORDER, WHICH THE COURT MAY

DEEM FIT IN LIGHT OF JUSTICE EQUITY AND GOOD CONSCIENCE.

AND FOR THIS ACT OF KINDNESS THE APPELLANTS SHALL DUTY BOUND EVER PRAY.

COUNSEL ON BEHALF OF APPELLANTS

NAYAN JAIN

14 | P a g e _ _ _ _ _ _ _ _ _ _ _ ____________MEMORIAL ON BEHALF OF APPELLANTS

Вам также может понравиться

- Case Analysis Planning Chart Exam CASE 3 DEFENCEДокумент12 страницCase Analysis Planning Chart Exam CASE 3 DEFENCESat ParkashОценок пока нет

- Form No 45 Bail BondДокумент5 страницForm No 45 Bail BondKulwinder SinghОценок пока нет

- Class Moot 1-Akash (1735)Документ17 страницClass Moot 1-Akash (1735)akash tiwariОценок пока нет

- MD Wasif ZeeshanДокумент19 страницMD Wasif ZeeshanVishal GoswamiОценок пока нет

- Narendra Kumar v. Union of IndiaДокумент2 страницыNarendra Kumar v. Union of IndiaRai DuttaОценок пока нет

- S. S. Maniyar Law College, Jalgaon Dr. Annasaheb G.D.Bendale Memorial 15 National Moot Court CompetitionДокумент3 страницыS. S. Maniyar Law College, Jalgaon Dr. Annasaheb G.D.Bendale Memorial 15 National Moot Court CompetitionPrakash KumarОценок пока нет

- Shabana Bano Vs Imran Khan CaseДокумент14 страницShabana Bano Vs Imran Khan Casevishwas jaiswalОценок пока нет

- Case Summary DOC-IPR2NotesДокумент25 страницCase Summary DOC-IPR2NotesSat ParkashОценок пока нет

- Gayatri Balaswamy Vs ISG Novasoft Technologies LtdT142318COM619766Документ32 страницыGayatri Balaswamy Vs ISG Novasoft Technologies LtdT142318COM619766R ManimaranОценок пока нет

- The Hon'ble Speaker, Rajasthan Legislative Assembly Petitioner Versus Prithviraj Meena & Ors. RespondentsДокумент37 страницThe Hon'ble Speaker, Rajasthan Legislative Assembly Petitioner Versus Prithviraj Meena & Ors. RespondentsMeghan PaulОценок пока нет

- Memorial Appeal PDFДокумент12 страницMemorial Appeal PDFJay Tamakuwala0% (1)

- 5th Year Moot 1 PropsДокумент9 страниц5th Year Moot 1 PropsSarthak SharmaОценок пока нет

- Client CounsellingДокумент4 страницыClient CounsellingRanvidsОценок пока нет

- S. S. Maniyar Law College, Jalgaon Dr. Annasaheb G.D.Bendale Memorial 15 National Moot Court CompetitionДокумент3 страницыS. S. Maniyar Law College, Jalgaon Dr. Annasaheb G.D.Bendale Memorial 15 National Moot Court CompetitionAishwaryaОценок пока нет

- E.M.S Namboodiripad v. T. Narayanan Nambiyar AIR 1970 SC 2015Документ1 страницаE.M.S Namboodiripad v. T. Narayanan Nambiyar AIR 1970 SC 2015mb11.3Оценок пока нет

- Moot Problem (7th Sem)Документ5 страницMoot Problem (7th Sem)36 Mohd AnasОценок пока нет

- 14 - Habeas Corpus PetitionДокумент4 страницы14 - Habeas Corpus PetitionViraat TripathiОценок пока нет

- Essay, 71Документ4 страницыEssay, 71Ritisha ChoudharyОценок пока нет

- LBMC09 Memorial of AppellantДокумент21 страницаLBMC09 Memorial of AppellantSubhashreeОценок пока нет

- Drafting, Pleading and Conveyance (SAndeep Kumar)Документ55 страницDrafting, Pleading and Conveyance (SAndeep Kumar)Gaurav kumar RanjanОценок пока нет

- Khushal Kolwar v. FIITJEEДокумент6 страницKhushal Kolwar v. FIITJEELatest Laws TeamОценок пока нет

- Case LawДокумент15 страницCase LawPridhi SinglaОценок пока нет

- Rahul Case AnalysisДокумент3 страницыRahul Case AnalysisUbaid Ullah100% (1)

- Moot Problem 3 Respondent Side Mohit YadavДокумент19 страницMoot Problem 3 Respondent Side Mohit YadavNitish Kumar SinghОценок пока нет

- Alok Kumar Vs StateДокумент8 страницAlok Kumar Vs StateHarsh SrivastavaОценок пока нет

- BombayHC Maintenance 2008 NoMaintenanceIfWifeCantProveCrueltyДокумент12 страницBombayHC Maintenance 2008 NoMaintenanceIfWifeCantProveCrueltyPrasadОценок пока нет

- Legal Language and Writing: How To Draft A PleadingДокумент8 страницLegal Language and Writing: How To Draft A PleadingPratham SaxenaОценок пока нет

- IN THE Hon'Bl E High Court of DelhiДокумент12 страницIN THE Hon'Bl E High Court of DelhiShaman KingОценок пока нет

- Mock Trial Final PDFДокумент20 страницMock Trial Final PDFsonup9007100% (1)

- Moot Problem 2 Petitioner 3Документ19 страницMoot Problem 2 Petitioner 3Harshit Singh100% (1)

- Salim Kallu AffidavitДокумент3 страницыSalim Kallu Affidavitvyas621995Оценок пока нет

- Memorial For AppellantДокумент17 страницMemorial For AppellantKandlagunta Gayathri PraharshithaОценок пока нет

- Drafting AssignmentДокумент33 страницыDrafting Assignmentvatsal pandeyОценок пока нет

- Jai GaneshДокумент17 страницJai GaneshPiyush TyagiОценок пока нет

- Jay Mock TrialДокумент22 страницыJay Mock TrialDIVYAОценок пока нет

- Case Analysis Madhu Limaye & Ors.Документ4 страницыCase Analysis Madhu Limaye & Ors.Vivek Gutam100% (2)

- Narsingh Ispat LTD Vs Oriental Insurance Company LTDДокумент1 страницаNarsingh Ispat LTD Vs Oriental Insurance Company LTDsunny badugu100% (1)

- Campus Law Centre Freshers Induction Moot 2015Документ13 страницCampus Law Centre Freshers Induction Moot 2015Shubham Nath33% (3)

- TA 10 Plaint PDFДокумент21 страницаTA 10 Plaint PDFHarshitОценок пока нет

- Jai Narain Vyas University: Submitted To: Submitted By: Raghav DagaДокумент13 страницJai Narain Vyas University: Submitted To: Submitted By: Raghav DagaKaushlya DagaОценок пока нет

- Moot Problem 5 SolutionДокумент21 страницаMoot Problem 5 SolutionGhanshyam Chauhan100% (1)

- Civil Case ReportДокумент10 страницCivil Case ReportRISHABH SINGHОценок пока нет

- Statement of DefenseДокумент4 страницыStatement of DefenseVISHAL ADITYA K 1850236Оценок пока нет

- 2 Intra Trial Advocacy Competition, 2022 Before The Honourable Family Court of DelhiДокумент16 страниц2 Intra Trial Advocacy Competition, 2022 Before The Honourable Family Court of DelhiVAIDEHI YADAVОценок пока нет

- Petitioner Final PDFДокумент34 страницыPetitioner Final PDFArijОценок пока нет

- Case Planning Chart FinalДокумент2 страницыCase Planning Chart FinalVaibhav SinghОценок пока нет

- Chander Prakash Tyagi V Benarasi Das (2015) 8 SCC 506Документ12 страницChander Prakash Tyagi V Benarasi Das (2015) 8 SCC 506Sandeepani NeglurОценок пока нет

- Writ Habeas Corpus FormatДокумент6 страницWrit Habeas Corpus Formataditi todariaОценок пока нет

- Mukul Nautiyal ComplaintДокумент4 страницыMukul Nautiyal ComplaintBhava SharmaОценок пока нет

- Dalpat Kumar v. Prahlad SinghДокумент3 страницыDalpat Kumar v. Prahlad Singhdaisy jainОценок пока нет

- Draft Sale Deed DeepaДокумент8 страницDraft Sale Deed DeepaKalpesh Shah100% (1)

- Case Analysis: TopicДокумент34 страницыCase Analysis: TopicKandarpОценок пока нет

- 2015 (Suppl.) CIVIL COURT CASES 0723Документ2 страницы2015 (Suppl.) CIVIL COURT CASES 0723RakeshShekhawatОценок пока нет

- Moot For RespondentДокумент14 страницMoot For RespondentASangeetha PriyaОценок пока нет

- Mock Trial Advocacy Memorial DefenceДокумент26 страницMock Trial Advocacy Memorial Defenceishmeet kaurОценок пока нет

- Application For BailДокумент1 страницаApplication For BailAdan HoodaОценок пока нет

- Moot Problems Criminal LLBДокумент5 страницMoot Problems Criminal LLBS KSОценок пока нет

- Air 2006 SC 3275Документ3 страницыAir 2006 SC 3275Anant KulkarniОценок пока нет

- Simmonds v. Cockell (1920) All ER Rep. 162Документ2 страницыSimmonds v. Cockell (1920) All ER Rep. 162s2151986100% (1)

- RULES & REGULATIONS For Ranka National Moot Court-2016Документ8 страницRULES & REGULATIONS For Ranka National Moot Court-2016Avishek PathakОценок пока нет

- Avishek Insurance ProjectДокумент15 страницAvishek Insurance ProjectAvishek PathakОценок пока нет

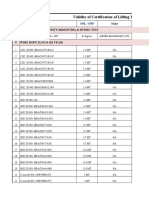

- Validity of Certification of Lifting Tools, Tackles & Pressure Vessels in PP#2Документ6 страницValidity of Certification of Lifting Tools, Tackles & Pressure Vessels in PP#2Avishek PathakОценок пока нет

- DG Rent Ambicapur RA Bill 72 March 2020Документ2 страницыDG Rent Ambicapur RA Bill 72 March 2020Avishek PathakОценок пока нет

- DG Rent Ambicapur RA Bill 72 March 2020Документ2 страницыDG Rent Ambicapur RA Bill 72 March 2020Avishek PathakОценок пока нет

- Validity of Certification of Lifting Tools, Tackles & Pressure Vessels in PP#2Документ6 страницValidity of Certification of Lifting Tools, Tackles & Pressure Vessels in PP#2Avishek PathakОценок пока нет

- Avishek ADR ProjectДокумент26 страницAvishek ADR ProjectAvishek PathakОценок пока нет

- Avishek ADR ProjectДокумент26 страницAvishek ADR ProjectAvishek PathakОценок пока нет

- Sem3 - Rollno.115 - Pranjal Verma - Constitutional GovernanceДокумент21 страницаSem3 - Rollno.115 - Pranjal Verma - Constitutional GovernanceAvishek PathakОценок пока нет

- Avishek ADR ProjectДокумент26 страницAvishek ADR ProjectAvishek PathakОценок пока нет

- 1.IPR in India PDFДокумент77 страниц1.IPR in India PDFகருப்பூர் அபி100% (1)

- Vehicle Sale AgreementДокумент1 страницаVehicle Sale AgreementSaravanan ThangaveluОценок пока нет

- Sem3 - RollNo - 115 - Law of Torts - Pranjal VermaДокумент15 страницSem3 - RollNo - 115 - Law of Torts - Pranjal VermaAvishek PathakОценок пока нет

- SS3 Dividedreleased NC PDFДокумент27 страницSS3 Dividedreleased NC PDFAvishek PathakОценок пока нет

- Avishek Corp ProjectДокумент17 страницAvishek Corp ProjectAvishek PathakОценок пока нет

- Case LawsДокумент1 страницаCase LawsAvishek PathakОценок пока нет

- Federalism - Siddharthshekhar IX 165Документ19 страницFederalism - Siddharthshekhar IX 165Avishek PathakОценок пока нет

- Avishek CPC ProjectДокумент21 страницаAvishek CPC ProjectAvishek PathakОценок пока нет

- Advisor AgreementДокумент8 страницAdvisor AgreementAvishek PathakОценок пока нет

- Attorney Client Retainer AgreementДокумент9 страницAttorney Client Retainer AgreementAvishek PathakОценок пока нет

- 0 - CRPC, 2018 Hiten Sem 7 PDFДокумент17 страниц0 - CRPC, 2018 Hiten Sem 7 PDFAvishek PathakОценок пока нет

- Avishek Crim ProjectДокумент25 страницAvishek Crim ProjectAvishek PathakОценок пока нет

- The Companies Bill 2012Документ7 страницThe Companies Bill 2012Raju ShawОценок пока нет

- Avishek Banking ProjectДокумент20 страницAvishek Banking ProjectAvishek PathakОценок пока нет

- Corporate Finance - hrs.II. Pankajsharma. 100. VII A.Документ16 страницCorporate Finance - hrs.II. Pankajsharma. 100. VII A.Kshitij NawarangОценок пока нет

- Criminal Justice System ProjectДокумент24 страницыCriminal Justice System ProjectAvishek PathakОценок пока нет

- Land Laws Project NiketДокумент19 страницLand Laws Project NiketAvishek PathakОценок пока нет

- Domain Name Issues in IndiaДокумент19 страницDomain Name Issues in IndiaAvishek PathakОценок пока нет

- Nidhi Companies 6nov2008Документ7 страницNidhi Companies 6nov2008Avishek PathakОценок пока нет

- Guerrero v. ComelecДокумент2 страницыGuerrero v. ComelecTeresa Cardinoza100% (1)

- 116 CasesДокумент611 страниц116 CasesJeffrey FuentesОценок пока нет

- 625, G.R. No. 206291 People Vs SalahuddinДокумент12 страниц625, G.R. No. 206291 People Vs SalahuddinnazhОценок пока нет

- (Deemed University) : The Indian Law InstituteДокумент10 страниц(Deemed University) : The Indian Law InstituteGILLHARVINDERОценок пока нет

- Santobello v. New York, 404 U.S. 257 (1971)Документ10 страницSantobello v. New York, 404 U.S. 257 (1971)Scribd Government DocsОценок пока нет

- Basilio de Vera, Luis de Vera, Felipe de Vera, Heirs of Eustaquia de Vera-Papa Represented byДокумент2 страницыBasilio de Vera, Luis de Vera, Felipe de Vera, Heirs of Eustaquia de Vera-Papa Represented bymichaellaОценок пока нет

- Tanguilig v. CA - Yap Rolan KlydeДокумент3 страницыTanguilig v. CA - Yap Rolan KlydeRolan Klyde Kho YapОценок пока нет

- VCE Legal SDДокумент25 страницVCE Legal SDJack GoldsmithОценок пока нет

- Information - Falsification of Public DocumentsДокумент2 страницыInformation - Falsification of Public DocumentsGenie June100% (1)

- People Vs Pilola Case DigestДокумент1 страницаPeople Vs Pilola Case DigestPauline Vistan GarciaОценок пока нет

- In The Hon'Ble: in The Matter of Aveek Singh Appellant) V. Simranjeetkaur (Respondent)Документ14 страницIn The Hon'Ble: in The Matter of Aveek Singh Appellant) V. Simranjeetkaur (Respondent)jassi nishadОценок пока нет

- Evidence, ChildДокумент16 страницEvidence, ChildPujitОценок пока нет

- The Consumer Protection ActДокумент4 страницыThe Consumer Protection ActRijurahul Agarwal SinghОценок пока нет

- Duty of Care - A Personal ObligationДокумент9 страницDuty of Care - A Personal ObligationKwalar KingОценок пока нет

- Atlanta Industries, Inc. v. SebolinoДокумент3 страницыAtlanta Industries, Inc. v. SebolinoJoseph GabutinaОценок пока нет

- Criminal Law CasesДокумент33 страницыCriminal Law CasesChaОценок пока нет

- Memorandum of Arguments For The PetitionerДокумент31 страницаMemorandum of Arguments For The Petitionerpranav kaushalОценок пока нет

- Torts and Damages Case DigestДокумент26 страницTorts and Damages Case DigestArnel MangilimanОценок пока нет

- The Legal MemorandumДокумент9 страницThe Legal MemorandumDiane Stern100% (3)

- Manuel Rodriguez v. Sunny L. Schriver, Superintendent, Wallkill Correctional Facility, 392 F.3d 505, 2d Cir. (2004)Документ11 страницManuel Rodriguez v. Sunny L. Schriver, Superintendent, Wallkill Correctional Facility, 392 F.3d 505, 2d Cir. (2004)Scribd Government DocsОценок пока нет

- G.R. No. 143513 - Polytechnic University of The Philippines vs. Court of Appeals, Et Al.Документ9 страницG.R. No. 143513 - Polytechnic University of The Philippines vs. Court of Appeals, Et Al.mimiyuki_Оценок пока нет

- People vs. UmaliДокумент5 страницPeople vs. UmaliMichelle Montenegro - AraujoОценок пока нет

- Martires - v. - Heirs - of - Somera PDFДокумент7 страницMartires - v. - Heirs - of - Somera PDFIan Timothy Sarmiento0% (1)

- 18 CSC V JosonДокумент2 страницы18 CSC V JosonfullgrinОценок пока нет

- Jessica Lisseth Lara-Merino, A097 318 914 (BIA July 12, 2016)Документ6 страницJessica Lisseth Lara-Merino, A097 318 914 (BIA July 12, 2016)Immigrant & Refugee Appellate Center, LLCОценок пока нет

- Pre Incorporation ContractsДокумент3 страницыPre Incorporation Contractspranav100% (1)

- DE LEON VS ONG - Casedigest - OwnДокумент2 страницыDE LEON VS ONG - Casedigest - OwnJebelle Puracan-FadriquelaОценок пока нет

- RUSSELL v. LEVI Et Al - Document No. 2Документ5 страницRUSSELL v. LEVI Et Al - Document No. 2Justia.comОценок пока нет

- Brondial Notes - Special ProceedingДокумент34 страницыBrondial Notes - Special ProceedingAedler Jo-lean Atutubo100% (3)

- 1 / Var/www/apps/conversion/tmp/scratch - 5/274153665.d OcxДокумент25 страниц1 / Var/www/apps/conversion/tmp/scratch - 5/274153665.d OcxLive LawОценок пока нет