Академический Документы

Профессиональный Документы

Культура Документы

Section 47 General Banking Law of 2000

Загружено:

AngelaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Section 47 General Banking Law of 2000

Загружено:

AngelaАвторское право:

Доступные форматы

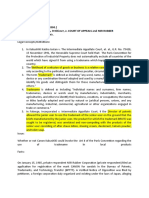

GENERAL BANKING LAW OF 2000, SECTION 47

“Sec. 47. Foreclosure of Real Estate Mortgage. - In the event of foreclosure,

whether judicially or extra-judicially, of any mortgage on real estate which

is security for any loan or other credit accommodation granted, the

mortgagor or debtor whose real property has been sold for the full or

partial payment of his obligation shall have the right within one year after the

sale of the real estate, to redeem the property by paying the amount due

under the mortgage deed, with interest thereon at rate specified in the mortgage,

and all the costs and expenses incurred by the bank or institution from the sale

and custody of said property less the income derived therefrom. However, the

purchaser at the auction sale concerned whether in a judicial or extra-judicial

foreclosure shall have the right to enter upon and take possession of such

property immediately after the date of the confirmation of the auction sale

and administer the same in accordance with law. Any petition in court to enjoin

or restrain the conduct of foreclosure proceedings instituted pursuant to this

provision shall be given due course only upon the filing by the petitioner of a

bond in an amount fixed by the court conditioned that he will pay all the

damages which the bank may suffer by the enjoining or the restraint of the

foreclosure proceeding.

Notwithstanding Act 3135, juridical persons whose property is being sold

pursuant to an extrajudicial foreclosure, shall have the right to redeem the

property in accordance with this provision until, but not after, the registration

of the certificate of foreclosure sale with the applicable Register of Deeds which

in no case shall be more than three (3) months after foreclosure, whichever is

earlier.

Owners of property that has been sold in a foreclosure sale prior to the effectivity

of this Act shall retain their redemption rights until their expiration.”

NOTES:

1. For judicial foreclosure, the redemption period is within one year. For

extrajudicial, it’s 90 days from sale or registration.

2. The purpose is to give concession to the banks. Banks cannot get

properties mortgaged by those in financial distress.

3. The redemption price would be the mortgaged obligation plus the

interest as stipulated in the original obligation. Compare this with judicial

foreclosure wherein the redemption price is the original price. In this case,

you have to pay more when redeeming from a bank.

4. There is immediate possession

5. A motion to enjoin would not be entertained unless secured by a bond.

6. Court will fix the amount of the bond. Normally, this would be the liability of

the bank plus costs. This remedies the loopholes in Act 3135—protect the bank

during foreclosures. This makes it hard to secure injunctions and it

shortens the redemption period. (https://www.batasnatin.com/law-library/civil-

law/obligations-and-contracts/823-foreclosure-of-mortgage-redemption.html)

Вам также может понравиться

- Notice Invoking ArbitrationДокумент3 страницыNotice Invoking ArbitrationVaidehiPaul80% (25)

- Lease ContractДокумент2 страницыLease ContractFerdz Pascual BadilloОценок пока нет

- Durable Power of AttorneyДокумент6 страницDurable Power of Attorneyapi-3743487100% (7)

- Aguilar vs. Citytrust Finance CorporationДокумент20 страницAguilar vs. Citytrust Finance CorporationChap ChoyОценок пока нет

- Air France vs. Charles Auguste Raymond M. ZaniДокумент15 страницAir France vs. Charles Auguste Raymond M. ZaniGret HueОценок пока нет

- Salient Features of The Revised Guidelines For Continuous Trial of Criminal CasesДокумент5 страницSalient Features of The Revised Guidelines For Continuous Trial of Criminal CasesEunice IquinaОценок пока нет

- Bakery Franchise Application Form TemplateДокумент6 страницBakery Franchise Application Form TemplateardhenduchatterjeeОценок пока нет

- Guide To Non Operative Financial Holding Companies For New Banks in India PDFДокумент32 страницыGuide To Non Operative Financial Holding Companies For New Banks in India PDFvishnu pОценок пока нет

- Temenos T24 Interest Rate Swaps: User GuideДокумент68 страницTemenos T24 Interest Rate Swaps: User GuideHasyim IbnuОценок пока нет

- Anti ChresisДокумент21 страницаAnti ChresisKaren Sheila B. Mangusan - DegayОценок пока нет

- Insurance SalaoДокумент16 страницInsurance SalaoJohn Robert BautistaОценок пока нет

- Voting Rules Under The Revised Corporation CodeДокумент2 страницыVoting Rules Under The Revised Corporation CodeSha MagondacanОценок пока нет

- Answer BP 22Документ1 страницаAnswer BP 22Yen055Оценок пока нет

- PNC SDAS FO 35 Affidavit of Undertaking 20230505100423Документ3 страницыPNC SDAS FO 35 Affidavit of Undertaking 20230505100423roelparallagОценок пока нет

- City of Manila vs. CA G.R. No. 100626Документ1 страницаCity of Manila vs. CA G.R. No. 100626Marianne AndresОценок пока нет

- First Case Digest PoolДокумент3 страницыFirst Case Digest PoolAnjela Ching0% (2)

- Banking ReviewerДокумент5 страницBanking ReviewerChristianHarveyWongОценок пока нет

- AffidavitДокумент1 страницаAffidavitclaudОценок пока нет

- DM Wenceslao Vs Readycon TradingДокумент3 страницыDM Wenceslao Vs Readycon TradingJonelyn Jan AtonОценок пока нет

- Certification (Sample)Документ1 страницаCertification (Sample)Patrick Pelare EchalicoОценок пока нет

- BP22Документ62 страницыBP22PhilipBrentMorales-MartirezCariagaОценок пока нет

- 2023 Property Old CurriculumДокумент19 страниц2023 Property Old CurriculumAleiah Jean LibatiqueОценок пока нет

- Contract.: The Formation of Contract of SaleДокумент4 страницыContract.: The Formation of Contract of SaleNasri MkaliОценок пока нет

- Secretary'S Certificate: Republic of The Philippines) City of Baguio .) S.SДокумент1 страницаSecretary'S Certificate: Republic of The Philippines) City of Baguio .) S.ScaicaiiОценок пока нет

- BIR Ruling 27-02Документ2 страницыBIR Ruling 27-02erikagcv100% (1)

- Malting DoctrineДокумент1 страницаMalting DoctrineKJPL_1987Оценок пока нет

- Leave AgreementДокумент3 страницыLeave AgreementJb Allig ReyesОценок пока нет

- Spec Pro Week 1Документ9 страницSpec Pro Week 1Thea Faith SonОценок пока нет

- 50 Willex Plastic Industries Corp vs. CAДокумент8 страниц50 Willex Plastic Industries Corp vs. CAPaoloОценок пока нет

- Employee Loan/Payroll Advance AgreementДокумент1 страницаEmployee Loan/Payroll Advance AgreementDeurod InovejasОценок пока нет

- SC Adopts Revisions To The Law Student Practice Rule: July 16, 2019Документ2 страницыSC Adopts Revisions To The Law Student Practice Rule: July 16, 2019SS0% (1)

- Application For Cba Registration: PART I. General Information A. PartiesДокумент3 страницыApplication For Cba Registration: PART I. General Information A. PartiesHERMAN DAGIOОценок пока нет

- Pre-Need CodeДокумент20 страницPre-Need CodeJoanОценок пока нет

- ADR - Domestic ArbitrationДокумент5 страницADR - Domestic ArbitrationMarie Mariñas-delos ReyesОценок пока нет

- NHA v. Iloilo DigestДокумент1 страницаNHA v. Iloilo DigestJai HoОценок пока нет

- Legal OpinionДокумент10 страницLegal OpinionbelteshazzarОценок пока нет

- Ang-Abaya v. AngДокумент6 страницAng-Abaya v. AngbearzhugОценок пока нет

- Verification and CertificationДокумент1 страницаVerification and CertificationRita Therese SantiagoОценок пока нет

- Registration of Corporations and Partnerships PDFДокумент2 страницыRegistration of Corporations and Partnerships PDFJeremiash ForondaОценок пока нет

- Contract of TransportationДокумент4 страницыContract of TransportationPJr MilleteОценок пока нет

- Corporation Law: Articles of Incorporation To Bylaws CasesДокумент138 страницCorporation Law: Articles of Incorporation To Bylaws CasesonlineonrandomdaysОценок пока нет

- HEIRS OF DOMINADOR S. ASIS, JR Vs GG Sportswear Manufacturing CorporationДокумент2 страницыHEIRS OF DOMINADOR S. ASIS, JR Vs GG Sportswear Manufacturing CorporationRizza Angela MangallenoОценок пока нет

- Chiquita Brands, Inc. vs. Omelio G.R. No. 189102. June 7, 2017Документ12 страницChiquita Brands, Inc. vs. Omelio G.R. No. 189102. June 7, 2017Keziah Eden . TuazonОценок пока нет

- Escrow AgreementДокумент2 страницыEscrow Agreementlexman88Оценок пока нет

- Sample Company Letter ReplyДокумент3 страницыSample Company Letter ReplyHerchel Hayes ArchesОценок пока нет

- Letter To Supreme Court - SALN GuidelinesДокумент3 страницыLetter To Supreme Court - SALN GuidelinesBlogWatchОценок пока нет

- Philippine Deposit Insurance Corporation ActДокумент7 страницPhilippine Deposit Insurance Corporation ActArwin HernandezОценок пока нет

- Simex International (Manila) Inc. vs. Court of Appeals G.R. No. 88013, March 19, 1990Документ2 страницыSimex International (Manila) Inc. vs. Court of Appeals G.R. No. 88013, March 19, 1990shortsandcutsОценок пока нет

- LAW 4 Notes 2Документ23 страницыLAW 4 Notes 2FateОценок пока нет

- Bulk Sales LawДокумент12 страницBulk Sales LawManuel VillanuevaОценок пока нет

- DIMAYUGA V COMELECДокумент3 страницыDIMAYUGA V COMELECShinji NishikawaОценок пока нет

- LAND TITLES and DEEDS 3rd Volunteer PowerpointДокумент58 страницLAND TITLES and DEEDS 3rd Volunteer PowerpointJD LG100% (1)

- Reviewer Negotiable Instruments Law 2014-02-16Документ3 страницыReviewer Negotiable Instruments Law 2014-02-16Edwin VillaОценок пока нет

- 100 Manuel Labor Notes PDFДокумент20 страниц100 Manuel Labor Notes PDFTopnotch2015Оценок пока нет

- Pesticide Regulatory Policies SPRTДокумент23 страницыPesticide Regulatory Policies SPRTprecauteОценок пока нет

- Section 60 (B) of The LGC 1991Документ5 страницSection 60 (B) of The LGC 1991Eis Pattad MallongaОценок пока нет

- Contract of Lease: ALEXANDER C. ADVINCULA, of Legal Age, Filipino, Married and A Resident of Toril, DavaoДокумент2 страницыContract of Lease: ALEXANDER C. ADVINCULA, of Legal Age, Filipino, Married and A Resident of Toril, DavaoRonald Allan Vencer BarilОценок пока нет

- Rule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFДокумент2 страницыRule 6 Interim Rules of Procedure For Intra-Corporate Controversies PDFiptrinidadОценок пока нет

- Chapter 9 Special Rules of Court On Alternative Dispute ResolutionДокумент15 страницChapter 9 Special Rules of Court On Alternative Dispute ResolutionloschudentОценок пока нет

- RR 16-99Документ6 страницRR 16-99matinikkiОценок пока нет

- An Indifferent Person Between The Parties To A CauseДокумент64 страницыAn Indifferent Person Between The Parties To A CauseJerickson A. ReyesОценок пока нет

- ConflictsДокумент2 страницыConflictsDenise GordonОценок пока нет

- Digests 10Документ4 страницыDigests 10KristineSherikaChyОценок пока нет

- Important Provisions Under RA 9139Документ2 страницыImportant Provisions Under RA 9139Myn Mirafuentes Sta Ana0% (1)

- Post Midterm DigestДокумент20 страницPost Midterm DigestMark Oliver EvangelistaОценок пока нет

- Boe 13Документ62 страницыBoe 13Dhananjay SinghОценок пока нет

- Dissolution and Liquidation CasesДокумент6 страницDissolution and Liquidation CasesOlan Dave LachicaОценок пока нет

- Promissory Note Payable On DemandДокумент1 страницаPromissory Note Payable On DemandRevamp TwentyoneОценок пока нет

- Outline - Secure Transactions - Harrell - PDPДокумент36 страницOutline - Secure Transactions - Harrell - PDPCaitlin Elizabeth100% (3)

- SPE 2 Module 2Документ3 страницыSPE 2 Module 2Melissa MelancolicoОценок пока нет

- PatentДокумент27 страницPatentSoftware EngineeringОценок пока нет

- NI Act Sections 3 To 15 UNIVERSAL PUBДокумент4 страницыNI Act Sections 3 To 15 UNIVERSAL PUBaditya pariharОценок пока нет

- Nego CodalДокумент4 страницыNego CodalGines LimjucoОценок пока нет

- FRM-Quiz 8Документ2 страницыFRM-Quiz 8Mienh HaОценок пока нет

- Unlad vs. DragonДокумент3 страницыUnlad vs. DragonRichard AmorОценок пока нет

- Schedule BДокумент1 страницаSchedule BjayjonbeachОценок пока нет

- JCPenny Life Insurance ClaimДокумент2 страницыJCPenny Life Insurance ClaimAllison SylteОценок пока нет

- Petronet LNG Limited LNG Master Sale and Purchase Agreement (LNG Mspa)Документ20 страницPetronet LNG Limited LNG Master Sale and Purchase Agreement (LNG Mspa)pks_2410Оценок пока нет

- National Marketing Corporation v. Federation of Namarco Distributors, Inc. - 49 SCRA 238Документ2 страницыNational Marketing Corporation v. Federation of Namarco Distributors, Inc. - 49 SCRA 238Samuel John CahimatОценок пока нет

- Jis C 3401 2002 EngДокумент21 страницаJis C 3401 2002 EngMary MaОценок пока нет

- 4TH PROGRESS REPORT-sachinДокумент9 страниц4TH PROGRESS REPORT-sachinRishabh SinghОценок пока нет

- Indian Contract Act 1655712126840Документ41 страницаIndian Contract Act 1655712126840Numan shaikhОценок пока нет

- Nse Options Strategies Explanation With ExamplesДокумент63 страницыNse Options Strategies Explanation With Exampleskumarmba09Оценок пока нет

- Project Report On LicДокумент36 страницProject Report On LicShruti VikramОценок пока нет

- Simple Property Agreement Format To SellДокумент1 страницаSimple Property Agreement Format To SellPratima KambleОценок пока нет

- Sebi Grade A-Phrase Fullsearch-InДокумент42 страницыSebi Grade A-Phrase Fullsearch-InDepanjan ChowdhuryОценок пока нет

- Canon Kabushiki v. CAДокумент3 страницыCanon Kabushiki v. CAjdg jdgОценок пока нет

- SECTION 4.1 Payment or PerformanceДокумент6 страницSECTION 4.1 Payment or PerformanceMars TubalinalОценок пока нет

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFДокумент50 страницSolution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFYopie ChandraОценок пока нет

- Partnership Agreement (Joining Existing Partnership)Документ9 страницPartnership Agreement (Joining Existing Partnership)Lawrence TanОценок пока нет