Академический Документы

Профессиональный Документы

Культура Документы

2306 Jan 2018 ENCS v4

Загружено:

Mary Ann PacariemАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2306 Jan 2018 ENCS v4

Загружено:

Mary Ann PacariemАвторское право:

Доступные форматы

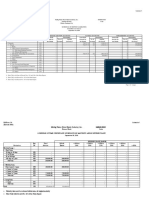

Republic of the Philippines

For BIR BCS/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Final Tax

2306

January 2018 (ENCS) Withheld at Source 2306 01/18ENCS

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Period From (MM/DD/YYYY) To (MM/DD/YYYY)

Part I – Income Recipient/Payee Information

2 Taxpayer Identification Number (TIN) - - -

3 Payee’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

4 Registered Address 4A ZIP Code

5 Foreign Address, if applicable 5A ICR No. (For Alien Payee Only)

Part II – Withholding Agent/Payor Information

6 Taxpayer Identification Number (TIN) - - -

7 Payor’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

8 Registered Address 8A ZIP Code

Part III – Details of Income Payment and Tax Withheld (Attach additional sheet if necessary)

Nature of Income Payment ATC Amount of Payment Tax Withheld

Total

We declare under the penalties of perjury that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, we give our consent to

the processing of our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

Date Signed (MM/DD/YYYY)

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

CONFORME:

Date Signed (MM/DD/YYYY)

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

To be accomplished for Value-Added Tax/Percentage Tax Withholding (substituted filing)

I declare, under the penalties of perjury, that the information herein stated are reported under BIR Form No. 1600 which have been filed with the Bureau of Internal

Revenue.

Signature over Printed Name of Payor/Payor’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

I declare under the penalties of perjury that I am qualified under substituted filing of Percentage Tax/Value-Added Tax Returns (BIR Form 2551Q/2550M/Q), since I

have only one payor from whom I earn our income; that, in accordance with RR 14-2003, I have availed of the Optional Registration under the 3% Final Percentage Tax

Withholding/12% Final VAT Withholding in lieu of the 3% Percentage Tax/12% VAT in order to be entitled to the privileges accorded by the Substituted Percentage Tax

Return/Substituted VAT Return System prescribed in the aforesaid Regulations; that, this Declaration is sufficient authority of the withholding agent to withhold 3% Final

Percentage Tax/12% Final VAT from myr sale of goods and/or services.

Signature over Printed Name of Payee/Payee’s Authorized Representative/Tax Agent

(Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable) (MM/DD/YYYY) (MM/DD/YYYY)

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

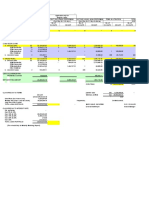

SCHEDULES OF ALPHANUMERIC TAX CODES

ATC

Nature of Income Payment

Individual Corporate

Income Tax

Fringe Benefit

1 In General, for Citizen, Resident Alien and Non-Resident Alien Engaged in Trade or Business Within the Philippines WF360

2 Non-Resident Alien Not Engaged in Trade or Business Within the Philippines WF330

Interest/Yield from Bank Deposits/Deposit Substitutes/Government Securities

3 Savings Deposit WI161 WC161

4 Time Deposit WI161 WC161

5 Government Securities WI162 WC162

6 Deposit Substitutes/Others WI163 WC163

7 Pre-terminated Long-Term Deposits/Investment

Less than three (3) years WI440 WC440

Three (3) years to less than four (4) years WI441

Four (4) years to less than five (5) years WI442

8 Foreign Currency Deposit WI170 WC170

9 On Amounts Withdrawn from Decedent’s Deposit Account WI165

Interest/Yield from Bank Deposits/Deposit Substitutes/Government Securities

10 Interest on foreign loans payable to Non-Resident Foreign Corporations (NRFCs) WC180

11 Interest and other income payments on foreign currency transactions/loans payable to Offshore Banking Units (OBUs) WC190

12 Interest and other income payments on foreign currency transactions/loans payable to Foreign Currency Deposit Unit (FCDUs) WC191

13 Cash dividend payment by domestic corporation to citizens and resident aliens/NRFCs WI202 WC212

14 Property dividend payment by domestic corporation to citizens and resident aliens/NRFCs WI203 WC213

15 Cash dividend payment by domestic corporation to NRFCs whose countries allowed tax deemed paid credit (subject to tax sparing rule) WC222

16 Property dividend payment by domestic corporation to NRFCs whose countries allowed tax deemed paid credit (subject to tax sparing rule) WC223

17 Cash dividend payment by domestic corporation to Non-resident Alien engage in Trade or Business within the Philippines (NRAETB) WI224

18 Property dividend payment by domestic corporation to NRAETB WI225

19 Share of NRAETB in the distributable net income after tax of a partnership (except General Professional Partnership) of which he is a partner,

or share in the net income after tax of an association, joint account or a joint venture taxable as a corporation of which he is a member or a WI226

co-venturer

20 On other payments to NRFCs WC230

21 Distributive share of individual partners in a taxable partnership, association, joint account or joint venture or consortium WI240

22 All kinds of royalty payments to citizens, residents aliens and NRAETB (other than WI380 and WI341), domestic and resident foreign

WI250 WC250

corporations

23 On prizes exceeding P10,000 and other winnings paid to individuals WI260

24 Branch profit remittances by all corporations except PEZA/SBMA/CDA registered WC280

25 On the gross rentals, lease and charter fees derived by non-resident owner or lessor of foreign vessels WC290

26 On the gross rentals, charters and other fees derived by non-resident lessor or aircraft, machineries and equipment WC300

27 On payments to oil exploration service contractors/sub-contractors WI310 WC310

28 Payments to non-resident alien not engage in trade or business within the Philippines (NRANETB) except on sale of shares in domestic

WI330

corporation and real property

29 On payments to non-resident individual/foreign corporate cinematographic film owners, lessors or distributors WI340 WC340

30 Royalties paid to NRAETB on cinematographic films and similar works WI341

31 Final tax on interest or other payments upon tax-free covenant bonds, mortgages, deeds of trust or other obligations under Sec. 57C of the

WI350

National Internal Revenue Code of 1997, as amended

32 Royalties paid to citizens, resident aliens and NRAETB on books, other literary works and musical compositions WI380

33 On interest payments to taxpayers enjoying preferential tax rates (i.e. PEZA Registered Enterprises) WC390

34 Informers Cash Reward to individuals/juridical persons WI410 WC410

35 Income Payments on Capital Gains Tax on sale/exchange or other disposition of Real Property - Individual WI450

36 Income Payments on Capital Gains Tax on the sale/exchange or other disposition of Land and Building - Corporate WC450

37 Cash or property dividend paid by a Real Estate Investment Trust (REIT) WI700 WIC700

For Business Tax

38 VAT Withholding on Purchase of Goods WV010

39 VAT Withholding on Purchase of Services WV020

40 VAT Withholding on Purchases of Goods (with waiver of privilege to claim input tax credit) (final) WV014

41 VAT Withholding on Purchases of Services (with waiver of privilege to claim input tax credit) (final) WV024

42 Persons Exempt from VAT under Section 109BB (Section 116 applies) WB084

43 Tax on Winnings and Prizes (Sec. 126) (double/forecast/quinella/trifecta bets) – Gov’t. Withholding Agent (4%) WB191

44 Tax on Winnings and Prizes on horse races/owners of winning racehorses (Sec. 126)–Gov’t. Withholding Agent (10%) WB192

45 Tax on Winnings and Prizes (Sec. 126) (double/forecast/quinella/trifecta bets) – Private Withholding Agent (4%) WB193

46 Tax on Winnings and Prizes on horse races/owners of winning racehorses (Sec. 126)–Private Withholding Agent (10%) WB194

47 VAT Withholding from non-residents (Government Withholding Agent) WV040

48 VAT Withholding from non-residents (Private Withholding Agent) WV050

Вам также может понравиться

- 2307 Jan 2018 ENCS v3 Annex BДокумент2 страницы2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- COA Circular 2014-002Документ4 страницыCOA Circular 2014-002sedanzamОценок пока нет

- OLIGOPSONYДокумент3 страницыOLIGOPSONYBernard Okpe100% (1)

- TAXATION 2 Chapter 8 Percentage Tax PDFДокумент4 страницыTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoОценок пока нет

- Tax SemisДокумент50 страницTax SemisTeam MindanaoОценок пока нет

- CTA Rules in Favor of Agrinurture, Orders Cancellation of Tax AssessmentsДокумент18 страницCTA Rules in Favor of Agrinurture, Orders Cancellation of Tax AssessmentsMarcy BaklushОценок пока нет

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldДокумент2 страницыKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoОценок пока нет

- 01 Gen Prov & Proc OrgДокумент63 страницы01 Gen Prov & Proc OrgPatrick Maguyon VillafuerteОценок пока нет

- CPA Review School Philippines Tax Filing PenaltiesДокумент7 страницCPA Review School Philippines Tax Filing PenaltiesLisa ManobanОценок пока нет

- TAX-303 (Input VAT)Документ8 страницTAX-303 (Input VAT)Fella GultianoОценок пока нет

- Notes On Value Added TaxДокумент7 страницNotes On Value Added TaxPines MacapagalОценок пока нет

- TAX-402 (Other Percentage Taxes - Part 2)Документ6 страницTAX-402 (Other Percentage Taxes - Part 2)VKVCPlaysОценок пока нет

- OPTДокумент4 страницыOPTMarie MAy MagtibayОценок пока нет

- Bir Itad Ruling No. Da-065-07Документ23 страницыBir Itad Ruling No. Da-065-07Emil A. MolinaОценок пока нет

- Financial Statement Analysis Lecture v2Документ8 страницFinancial Statement Analysis Lecture v2Yaj CruzadaОценок пока нет

- Law On PartnershipДокумент26 страницLaw On PartnershipJinuel PodiotanОценок пока нет

- Value Added TaxДокумент4 страницыValue Added TaxAllen KateОценок пока нет

- 1701Q Jan 2018 Final Rev2Документ2 страницы1701Q Jan 2018 Final Rev2Balot EspinaОценок пока нет

- Sison vs. Ancheta, 130 SCRA 654 (1984)Документ4 страницыSison vs. Ancheta, 130 SCRA 654 (1984)Christiaan CastilloОценок пока нет

- Revised Financial Management Syllabus 2019Документ16 страницRevised Financial Management Syllabus 2019Juclyde Cespedes CababatОценок пока нет

- Operating Segment: Pfrs 8Документ28 страницOperating Segment: Pfrs 8Giellay OyaoОценок пока нет

- Chapter 18 Test BankДокумент67 страницChapter 18 Test BankEzatullah SiddiqiОценок пока нет

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerДокумент2 страницыBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangОценок пока нет

- Hewlett-Packard (HP) and Autonomy AcquisitionДокумент21 страницаHewlett-Packard (HP) and Autonomy AcquisitionPhạm Thu HuyềnОценок пока нет

- Accounting for Income TaxesДокумент18 страницAccounting for Income TaxesAndrea Marie CalmaОценок пока нет

- Civil Law Bar Examination 2010-2019Документ124 страницыCivil Law Bar Examination 2010-2019Justine SisonОценок пока нет

- Income Taxation-FinalsДокумент14 страницIncome Taxation-FinalsTheaОценок пока нет

- REGULATORY FRAMEWORK MCQДокумент17 страницREGULATORY FRAMEWORK MCQabcdefgОценок пока нет

- Tax Review Notes 2018 19 Part 6 PDFДокумент24 страницыTax Review Notes 2018 19 Part 6 PDFKeziah HuelarОценок пока нет

- Prescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorДокумент2 страницыPrescription of Bir'S Right To Assess: (BDB Law'S "Tax Law For Business" BusinessmirrorBobby Olavides SebastianОценок пока нет

- Chapter 01 Introduction To Internal Revenue TaxesДокумент12 страницChapter 01 Introduction To Internal Revenue TaxesNikki BucatcatОценок пока нет

- RR 2-98 - Withholding TaxesДокумент99 страницRR 2-98 - Withholding TaxesbiklatОценок пока нет

- Documentary Stamp TaxДокумент10 страницDocumentary Stamp TaxDura LexОценок пока нет

- Document 1Документ31 страницаDocument 1sofiaОценок пока нет

- Taxation of IndividualsДокумент12 страницTaxation of Individualsaj lopezОценок пока нет

- Value Added TaxДокумент8 страницValue Added TaxErica VillaruelОценок пока нет

- Donor's TaxДокумент25 страницDonor's TaxMark Erick Acojido RetonelОценок пока нет

- AC19 MODULE 5 - UpdatedДокумент14 страницAC19 MODULE 5 - UpdatedMaricar PinedaОценок пока нет

- Vat On Sale of Goods or PropertiesДокумент7 страницVat On Sale of Goods or Propertiesnohair100% (3)

- Foreign Currency TransactionsДокумент19 страницForeign Currency Transactionsmicaella pasionОценок пока нет

- Income Taxation Finals Quiz 2Документ7 страницIncome Taxation Finals Quiz 2Jericho DupayaОценок пока нет

- ReSA CPA Review Batch 43 Separate & Consolidated Financial StatementsДокумент10 страницReSA CPA Review Batch 43 Separate & Consolidated Financial StatementsHasmin AmpatuaОценок пока нет

- Semis Tax PPTSДокумент271 страницаSemis Tax PPTSTeam MindanaoОценок пока нет

- Strategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingДокумент10 страницStrategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingAnnamarisse parungaoОценок пока нет

- Solution Chapter 17 PDFДокумент87 страницSolution Chapter 17 PDFnashОценок пока нет

- Handouts 56Документ11 страницHandouts 56Omar CabayagОценок пока нет

- Guide to Registering Your Business with the BIRДокумент2 страницыGuide to Registering Your Business with the BIRPaulОценок пока нет

- Session 1 Exercise DrillДокумент5 страницSession 1 Exercise DrillABBIE GRACE DELA CRUZОценок пока нет

- Income Taxation Ind PracticeДокумент3 страницыIncome Taxation Ind PracticeJanine Tividad100% (1)

- On The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountДокумент3 страницыOn The Dot Trading Statement of Financial Position As of December 31 2017 2016 Increase (Decrease) AmountRuthОценок пока нет

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Документ2 страницыCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Aida L.LangbisanОценок пока нет

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Документ2 страницыCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RapRalph GalagalaОценок пока нет

- BIR Certificate Tax DetailsДокумент2 страницыBIR Certificate Tax Detailsmizkee missakiОценок пока нет

- 2306 Jan 2018 ENCS v3 Annex A PDFДокумент2 страницы2306 Jan 2018 ENCS v3 Annex A PDFHarold De Guzman SantosОценок пока нет

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Документ2 страницыCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)ROGER DRIO, JRОценок пока нет

- 2306 Jan 2018 ENCS v4Документ4 страницы2306 Jan 2018 ENCS v4Chan Chanielou JavierОценок пока нет

- 2306 Jan 2018 ENCS v4Документ33 страницы2306 Jan 2018 ENCS v4nicky tampocОценок пока нет

- 2306 Jan 2018 ENCS v4Документ2 страницы2306 Jan 2018 ENCS v4Analyn DomingoОценок пока нет

- Triple L Food Corp 2306 - JollibeeДокумент1 страницаTriple L Food Corp 2306 - JollibeeclarikaОценок пока нет

- Certificate of Final Tax WithheldДокумент1 страницаCertificate of Final Tax WithheldJay-r Dela Cruz CubangbangОценок пока нет

- Dsoc Sept 30Документ11 страницDsoc Sept 30Mary Ann PacariemОценок пока нет

- Dep LiabДокумент6 страницDep LiabMary Ann PacariemОценок пока нет

- Reports Apr 30Документ28 страницReports Apr 30Mary Ann PacariemОценок пока нет

- Oacl SSE: Int.-CurrentДокумент3 страницыOacl SSE: Int.-CurrentMary Ann PacariemОценок пока нет

- Dep LiabДокумент6 страницDep LiabMary Ann PacariemОценок пока нет

- Dsoc-Apr 30Документ17 страницDsoc-Apr 30Mary Ann PacariemОценок пока нет

- Cash Beg. Cash In/Out: Int.-Current - Fees & Commission Inc. 2,454.97 int.-PDДокумент2 страницыCash Beg. Cash In/Out: Int.-Current - Fees & Commission Inc. 2,454.97 int.-PDMary Ann PacariemОценок пока нет

- Ias 2 - InventoriesДокумент4 страницыIas 2 - InventoriesMary Ann PacariemОценок пока нет

- Bills Payable 05-15Документ3 страницыBills Payable 05-15Mary Ann PacariemОценок пока нет

- Aging of Accounts (Individual Assessment)Документ1 страницаAging of Accounts (Individual Assessment)Mary Ann PacariemОценок пока нет

- 2 2Документ5 страниц2 2Mary Ann PacariemОценок пока нет

- SargДокумент1 страницаSargMary Ann PacariemОценок пока нет

- Dsoc-Apr 30Документ17 страницDsoc-Apr 30Mary Ann PacariemОценок пока нет

- Durgesh Singh Charts PDFДокумент11 страницDurgesh Singh Charts PDFHimanshu Jeerawala75% (4)

- Deleveraging Investing Optimizing Capital StructurДокумент42 страницыDeleveraging Investing Optimizing Capital StructurDanaero SethОценок пока нет

- Auditing Inventory Valuation and Cutoff ProceduresДокумент22 страницыAuditing Inventory Valuation and Cutoff ProceduressantaulinasitorusОценок пока нет

- New Format Exam Q Maf620 - Oct 2009Документ5 страницNew Format Exam Q Maf620 - Oct 2009kkОценок пока нет

- Fufeng Annual Report 2017Документ156 страницFufeng Annual Report 2017SrishtiОценок пока нет

- Prelim Quiz 1 and Key AnswersДокумент3 страницыPrelim Quiz 1 and Key AnswersJordan P HunterОценок пока нет

- Velasco v. ApostolДокумент1 страницаVelasco v. Apostold2015memberОценок пока нет

- Mba Eco v6 e F AДокумент108 страницMba Eco v6 e F AantonamalarajОценок пока нет

- Ism PestelДокумент12 страницIsm PestelNitin KansalОценок пока нет

- Azizi Completes 479-Unit Aura in Downtown Jebel Ali - Projects and Tende...Документ20 страницAzizi Completes 479-Unit Aura in Downtown Jebel Ali - Projects and Tende...Sanabel EliasОценок пока нет

- Project Report On Comparison of Mutual Funds With Other Investment OptionsДокумент57 страницProject Report On Comparison of Mutual Funds With Other Investment Optionsdharmendra dadhichОценок пока нет

- Test Bank Far 3 CparДокумент24 страницыTest Bank Far 3 CparBromanineОценок пока нет

- Senior High SchoolДокумент18 страницSenior High SchoolKOUJI N. MARQUEZОценок пока нет

- Telecommunications in Nepal - Current State and NeedsДокумент3 страницыTelecommunications in Nepal - Current State and NeedsSomanta BhattaraiОценок пока нет

- Singer Annual Report 2011Документ88 страницSinger Annual Report 2011Cryptic MishuОценок пока нет

- Chapter 1 Securities Operations and Risk ManagementДокумент32 страницыChapter 1 Securities Operations and Risk ManagementMRIDUL GOELОценок пока нет

- Competition Law and Policy in SingaporeДокумент20 страницCompetition Law and Policy in SingaporeERIA: Economic Research Institute for ASEAN and East AsiaОценок пока нет

- WiproДокумент11 страницWiproUnknown XyzОценок пока нет

- Module B Corporate Financing - Part 2Документ333 страницыModule B Corporate Financing - Part 2Darren Lau100% (1)

- Final Case StudyДокумент24 страницыFinal Case StudyMariya AbroОценок пока нет

- Multiple choice and short problems on accounting topicsДокумент7 страницMultiple choice and short problems on accounting topicsKenny BrownОценок пока нет

- Accounting Equations and Concepts GuideДокумент1 страницаAccounting Equations and Concepts Guidealbatross868973Оценок пока нет

- Kenga Desrtation 2020Документ44 страницыKenga Desrtation 2020kenga michealОценок пока нет

- TNT PreMarketCapsule 22august22Документ13 страницTNT PreMarketCapsule 22august22IMaths PowaiОценок пока нет

- Tertiary sector servicesДокумент2 страницыTertiary sector servicesDaniel RandolphОценок пока нет

- SAP FICO Interview QuestionsДокумент16 страницSAP FICO Interview Questionsdasari008_1973@12Оценок пока нет

- Barron 39 S January 24 2022Документ72 страницыBarron 39 S January 24 2022yazzОценок пока нет

- Delta Spinners 2008Документ38 страницDelta Spinners 2008bari.sarkarОценок пока нет

- TS309 - Financial Management EssentialsДокумент49 страницTS309 - Financial Management EssentialsJosephine LalОценок пока нет

- ch01 ACCOUNTING IN ACTIONДокумент54 страницыch01 ACCOUNTING IN ACTIONpleastin cafeОценок пока нет