Академический Документы

Профессиональный Документы

Культура Документы

Edoc - Pub - ch04 TB Hoggetta8e PDF

Загружено:

Bích PhạmОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Edoc - Pub - ch04 TB Hoggetta8e PDF

Загружено:

Bích PhạmАвторское право:

Доступные форматы

Testbank

to accompany

Accounting

8th Edition

by

John Hoggett, Lew Edwards,

John Medlin, Matthew Tilling

Tilling

& Evelyn Hogg

Prepared by

Barbara Burns

© John iley & !ons "ustralia, Ltd #$%#

Testbank to accompany Accounting 8e

Chapter 4: Adjusting the accounts and preparing financial

statements

Multiple Choice

% The statem

statement

ent concern

concerning

ing accrua

accruall accountin

accountingg that is true

true is'

a (ro)it is

is the e*cess o) cash in)lows

in)lows )rom

)rom income

income over cash cash out)lows

out)lows )or e*penses

b +ncome is recognised in the period when the )low )lo w o) economic bene)its can be reliably

measured

c or most

most businesses

businesses the cash approach

approach gives

gives a better

better measure

measure o) economic

economic per)ormance

per)ormance

than does the accrual approach

d +ncome )rom sales is is recognised

recognised in

in the period when thethe che-ue

che-ue is cashed

".!E/ B

!ection 0%

# The cash

cash approach

approach to pro)it

pro)it measurement

measurement will not give a reliabl

reliablee pro)it )igure

)igure )or an entity

entity

that conducts a signi)icant portion o) its business'

a 1verseas

b ith subsidiaries

c ith

ith bor

borro

rowe

wedd mon

money

ey

d 1n cr

credit

".!E/ 2

!ection 0%

3 4nder the

the cash approach

approach to

to pro)it measurem

measurement

ent income

income is recorded

recorded in

in the accounting

accounting period

period

when'

a 5ash

5ash is rece

receiv

ived

ed

b 6oods are sold or services

serv ices per)ormed

c " cont

contra

ract

ct is sign

signed

ed

d "n orde

orderr is

is pla

place

ced

d

".!E/ "

!ection 0%

0 Harry 5ompany

5ompany uses

uses cleaning

cleaning supplies

supplies on a daily basis 4nder the

the accrual

accrual basis o)

accounting these supplies would be an e*pense o) the period in which they are'

a 1rdered

b /eceived

c (aid )or

d 4sed

© John iley & !ons "ustralia, Ltd #$%# 0#

Chapter 4: Adjusting the accounts and preparing financial statements

".!E/ 2

!ection 0%

7 +t is corre

correct

ct that

that each

each balanc

balancee day ad8us

ad8ustme

tment

nt

a "))ect

"))ect eithe

eitherr the incom

incomee stateme

statement nt or the bala

balance

nce sheet

sheet

b Has one e))ect on the income statement

sta tement and one e))ect on the balance

balanc e sheet

c 1nly

1nly a))ec

a))ectt the

the incom

incomee state

stateme

mentnt

d "lways

"lways have

have an e))ec

e))ectt on the

the ban9

ban9 accoun

accountt

".!E/ B

!ection 0#

: 2uring #$%%

#$%% The !tyle

!tyle Hairdressing

Hairdressing !alon paid

paid out ;0% $$$ in wages )rom

)rom its ban9

ban9

account "t year<end #$%% wages owing but unpaid were ;# 0$$ The salon uses accrual

accounting How much would be reported as wages e*pense )or #$%%=

a ;3> :$$

b ;0% $$$

c ;03 0$$

d ;0# :$$

".!E/ 5

!ection 07

? The (repaid

(repaid +nsurance

+nsurance account

account o) (@/ Traders

Traders shows

shows a balance

balance o) ;A$$ net

net o) 6!TC

6!TC

representing a payment on % July #$%% o) a three<year insurance premium The correct

ad8usting entry on 3% 2ecember #$%%, the close o) the annual accounting period, is'

; ;

a +nsurance E*pense % 7$

(repaid +nsurance % 7$

b +nsurance E*pense

E*pens e 3$$

(repaid +nsurance 3 $$

c (repaid +nsurance % 7$

+nsurance E*pense % 7$

d (repaid +nsurance ? 7$

+nsurance E*pense ? 7$

".!E/ "

!ection 00

© John iley & !ons "ustralia, Ltd #$%# 03

Testbank to accompany Accounting 8e

> hich statement

statement relating

relating to the "ccumulated

"ccumulated 2epreciat

2epreciation

ion account is correct=

correct=

a +t nor

norma

malllly

y has

has a debi

debitt bala

balance

nce

b +t re)lects the portion

portio n o) the cost o) the asset that has been assigned as an e*pense since

purchase

c +t provide

providess in)orma

in)ormation

tion on

on the mar9et

mar9et valu

valuee o) the asset

asset

d +t is clas

classi)i

si)ied

ed as a liabi

liabilit

lity

y in the

the balance

balance sheet

sheet

".!E/ B

!ection 00

A Michael purchased

purchased two

two vehicles

vehicles )or his business

business on % January #$%%

#$%% These vehicles

vehicles cost

;7$,$$$ each and have a use)ul li)e o) 7 years with an e*pected residual o) ;#$,$$$ each

The ad8usting entry )or depreciation on 3% 2ecember #$%%, using the straight<line

method, is'

a 2r "ccum

"ccumulat

ulated

ed 2eprecia

2epreciation

tion ;:$$$D

;:$$$D 5r 2epreciat

2epreciation

ion E*pense

E*pense ;:$$$

;:$$$

b 2r 2epreciation E*pense ;:$$$D

; :$$$D 5r "ccumulated 2epreciation ;:$$$

c 2r "ccum

"ccumulat

ulated

ed 2eprecia

2epreciation

tion ;%# $$$D

$$$D 5r 2eprecia

2epreciation

tion E*pens

E*pensee ;%# $$$

d 2r 2epreciati

2epreciation

on E*pense

E*pense ;%# $$$ 5r "ccumulated

"ccumulated 2eprecia

2epreciation

tion ;%# $$$

".!E/ 2

!ection 00

%$ Tan Traders

Traders received a ;?7$ advance payment )rom a customer )or wor9 to be carried out in

the ne*t accounting period The accounting entry to initially record the ;?7$ is'

a 2ebit

2ebit unearn

unearned

ed incom

incomee ;?7$D

;?7$D credi

creditt ban9

ban9 ;?7$

;?7$

b 2ebit ban9 ;?7$D credit

cred it unearned income ;?7$

; ?7$

c 2ebit

2ebit ban9

ban9 ;?7$

;?7$DD credi

creditt credi

creditor

tor ;?7$

;?7$

d 2ebit

2ebit incom

incomee earned

earned ;?7$D

;?7$D credit

credit ban9 ;?7$

".!E/ B

!ection 00

%% The o))ice supplies inventory account o) Tan

Tan Traders

Traders shows a balance o) ;% :$$ on 3%

2ecember #$%% The ad8usting entry to record o))ice supplies o) ;77$ issued to sta))

sta)) in the

%# months up to 3% 2ecember #$%% is'

a 2ebit o))ice

o))ice supplies

supplies inventory

inventory ;77$D

;77$D credit

credit o))ice

o))ice supplies

supplies e*pense

e*pense ;77$

b 2ebit o))ice supplies inventory

inven tory ;% $7$D credit o))ice supplies

su pplies e*pense ;% $7$

$7 $

c 2ebit o))ice

o))ice supplies

supplies e*pense

e*pense ;77$D

;77$D credit

credit o))ice

o))ice supplies

supplies inventory

inventory ;77$

d 2ebit o))ice

o))ice supplies

supplies e*pense

e*pense ;% :$$D credit

credit o))ice

o))ice supplies

supplies inventory

inventory ;% :$$

".!E/ 5

!ection 00

© John iley & !ons "ustralia, Ltd #$%# 00

Chapter 4: Adjusting the accounts and preparing financial statements

%# !ampras 5ompany

5ompany purchased a machine )or ;3$ $$$ on % January #$%$ with an estimated

li)e o) 7 years and a residual value o) ero The straight<line method o) depreciation is

used hat is the carrying value o) the machine on the 3% 2ecember #$%% in the balance

sheet o) !ampras 5ompany=

a ;3$ $$$

b ;#0 $$$

c ;%> $$$

d ;%# $$$

".!E/ 5

!ection 0?

%3 1n July % #$%% the (epper

(epper 2iner rented

rented out part o) its property and collected

collected ;A$$$ in

advance )or a nine<month period The receipt was credited to a liability account "t 3%

2ecember #$%%, (epper 2inerFs year<end, which o) the )ollowing ad8usting 8ournal entries

should be made=

a 2r

2r 5ash,

5ash, ;:$$$D

;:$$$D 5r

5r /ent

/ent +ncom

+ncome,e, ;:$$$

;:$$$

b 2r /ent

/ent +ncome, ;3$$$D 5r 4nearned

4nearn ed /ent +ncome, ;3$$$

c 2r

2r 4nearne

4nearnedd /ent +ncom

+ncome, e, ;:$$$D

;:$$$D 5r

5r /ent +ncom

+ncome,e, ;:$$$

;:$$$

d 2r

2r /ent /eceiv

/eceivable

able,, ;:$$$D 5r

5r /ent +ncome

+ncome,, ;:$$$

".!E/ 5

!ection 00

%0 +) an ad8ustment )or depreciation

depreciation is omitted )rom the )inancial

)inancial reports the a))ect is'

a "ssets

"ssets are

are underst

understate

atedD

dD pro)it

pro)it is unders

understat

tated

ed

b "ssets are overstatedD pro)it is understated

c "ssets

"ssets are

are underst

understate

atedD

dD pro)it

pro)it is overst

overstated

ated

d "ssets

"ssets are

are overst

overstated

atedDD pro)it

pro)it is

is oversta

overstated

ted

".!E/ 2

!ection 0%$

%7 1n % July

Ju ly #$%%

#$ %% Tan

Tan Traders

Traders paid ;:$$, representing

representing a two<year insurance premium

premium The

;:$$ was initially recorded in the +nsurance e*pense account ")ter ad8ustment at 3%

2ecember #$%#, the close o) the annual accounting period'

a +nsurance

+nsurance e*pense in the income statement

statement is ;:$$

;:$$ and prepaid

prepaid insurance

insurance in the balance

balance

sheet is ;$

b +nsurance e*pense in the income statement is ;%7$ and prepaid insurance

insura nce in the balance

sheet is ;07$

c +nsurance e*pense in the income

income statemen

statementt is ;07$ and prepaid

prepaid insurance

insurance in the balance

balance

sheet is ;$

d +nsurance e*pense in the income

income statemen

statementt is ;3$$ and prepaid

prepaid insurance

insurance in the balance

balance

sheet is ;%7$

".!E/ 2

© John iley & !ons "ustralia, Ltd #$%# 07

Testbank to accompany Accounting 8e

!ection 0?

%: Tan Traders

Traders paid salaries o) ;%3$ $$$ during the year and owes ;# %$$ )or three days

wor9 carried out be)ore the 3% 2ecember #$%% which will not be paid until January 3

#$%# ")ter the ad8usting entry )or the year ended 3% 2ecember #$%%'

a !alaries

!alaries in the income stateme

statement

nt are ;%3#

;%3# %$$ and

and accrued

accrued salaries

salaries in the

the balance

balance sheet

are ;# %$$

b !alaries in the income statement

state ment are ;%3$ $$$ and accrued salaries in the balance

b alance sheet

are ;# %$$

c !alaries

!alaries in the income stateme

statement

nt are ;%#?

;%#? A$$ and

and accrued

accrued salaries

salaries in the

the balance

balance sheet

are ;# %$$

d !alaries

!alaries in the income stateme

statement

nt are ;%3#

;%3# %$$ and

and accrued

accrued salaries

salaries in the

the balance

balance sheet

are ;%3# %$$

".!E/ "

!ection 0?

%? G 5os

5os employees carry

carry out wor9 to the value o) ;? 7$$ They

They are paid ;0 7$$

immediately with the balance to be settled in the ne*t accounting period 4nder the

accrual approach to pro)it measurement the amount o) wages e*pense that will be

recorded in the current period is'

a .il

b ;0 7$$

c ;3 $$$

d ;? 7$$

".!E/ 2

!ection 0?

%> "t year<end it was )orgotten

)orgotten to accrue an income item This This will result in an'

a 4ndersta

4nderstatem

tement

ent o) assets

assets and

and an overstat

overstateme

ement

nt o) pro)it

pro)it and e-uity

e-uity

b 1verstatement o) liabilities

liabili ties and an understatement

understate ment o) pro)it and e-uity

e-u ity

c 1verstat

1verstateme

ement

nt o) assets,

assets, pro)it,

pro)it, and e-uity

e-uity

d 4ndersta

4nderstatem

tement

ent o) asset

assets,

s, pro)it

pro)it,, and e-uit

e-uity

y

".!E/ 2

!ection 0%$

© John iley & !ons "ustralia, Ltd #$%# 0:

Chapter 4: Adjusting the accounts and preparing financial statements

%A 2e)erral type ad8ustments

ad8ustments occur when cash )or e*penses

e*penses is paid in advance or cash )rom

incomes is pre<collected

pre <collected How many o) the )ollowing

)ollowing will re-uire

re-uire a de)erral type

ad8ustment=

/ent paid )or in advance

Buildings to be depreciated

/ent collected in advance )rom tenants

!tationery used by the o))ice sta)) during the period

a %

b #

c 3

d 0

".!E/ 2

!ection 03

#$ 1n the )irst day o) the year Tan Traders

Traders purchased

purchased a )or9li)t

)or9li)t truc9 )or ;%# $$$ wh which

ich is to be

depreciated by #7I a year

year "t the end o) the )irst year'

a 2epreciation

2epreciation in the income

income statement

statement is ;3 $$$ and the carrying

carrying value

value o) the

the )or9li)t

)or9li)t in

the balance sheet is ;%# $$$

b 2epreciation in the income

in come statement is ;3 $$$ andan d the carrying value o) o ) the )or9li)t in

the balance sheet is ;%7 $$$

c 2epreciation

2epreciation in the income

income statement

statement is ;3 $$$ and the carrying

carrying value

value o) the

the )or9li)t

)or9li)t in

the balance sheet is ;A $$$

d 2epreciation

2epreciation in the income statement

statement is

is ;$ and the

the carrying value o) thethe )or9li)t

)or9li)t in the

balance sheet is ;%#

;% # $$$

".!E/ 5

!ection 0?

#% The wages e*pense account )or 6erry Mander,

Mander, political consultants,

consultants, showed the

)ollowing entries )or #$%% hat was the portion o) wages that was treated as an e*pense

in #$%$ but was not paid until #$%%=

ages E*pense

2ate (articulars 2 eb i t 5redit Balance

#$%% ; ; ;

Jan % "ccrued e*penses % #$$ % #$$ 5r

ear Karious cash

cas h payments 7% $$$ 0A >$$ 2r

2ec "ccrued e*penses # #$$ 7# $$$ 2r

3%

a ;0A >$$

b ;7% $$$

c ;% #$$

d ;# #$$

".!E/ 5

!ection 07

© John iley & !ons "ustralia, Ltd #$%# 0?

Testbank to accompany Accounting 8e

## +) a company has earned income

income which has not been received

received in cash at the end o) the

accounting period an ad8ustment should be made which will'

a 2ebit

2ebit an asset

asset accou

account

nt and

and credit

credit an incom

incomee account

account

b 2ebit an e*pense account

acco unt and credit cash

c 2ebit

2ebit an incom

incomee account

account and

and credit

credit an asset

asset account

account

d 2ebit

2ebit an asset

asset accoun

accountt and credit

credit an e*pen

e*pense

se account

account

".!E/ "

!ection 07

#3 "B5 collects

collects rents )rom several properties

properties (rior to recording ad8usting entries,

entries, assume

the /ent +ncome account has a credit balance o) ;>$$$ Two ad8ustments are to be made

at the end o) the )inancial year %C an accrual )or accrued rent income o) ;:$$ #C the

4nearned /ent +ncome account is to be decreased by ;#$$ ")ter processing these

ad8usting entries the amount o) /ent +ncome to be shown in the income statement is'

a ;>>$$

b ;>0$$

c ;?:$$

d ;?#$$

".!E/ "

!ection 0?

#0 The publishers o) 6uide to the !toc9 Mar9et, a magaine published monthly,

monthly, received

;%#% in advance, including ;%% 6!T on % March, )or a % years subscription %% issuesC

beginning with the March

Mar ch issue 1n receipt o) the subscription

su bscription which entry will the

th e

company ma9e=

a 2ebit

2ebit 5ash

5ash ;%#%D

;%#%D credit

credit !ubscrip

!ubscription

tionss +ncome

+ncome ;%#%

;%#%

b 2ebit 5ash ;%#%D credit 6!T 5ollections ;%%, credit 4nearned

4nearn ed !ubscriptions liabilityC

liability C

;%%$

c 2ebit 5ash

5ash ;%#%D credit

credit 6!T 5ollections

5ollections ;%%,

;%%, credit !ubscriptions

!ubscriptions /eceived

/eceived in "dvance

assetC ;%%$

d 2ebit

2ebit 5ash ;%%$D

;%%$D credit

credit !ubscr

!ubscript

iptions

ions +ncom

+ncomee ;%%$

;%%$

".!E/ B

!ection 00

© John iley & !ons "ustralia, Ltd #$%# 0>

Chapter 4: Adjusting the accounts and preparing financial statements

#7 The publishers o) 6uide to the !toc9 Mar9et, a magaine published monthly,

monthly, received

;%#% in advance, including ;%% 6!T on % March, )or a % years subscription %% issuesC

beginning with the March

Mar ch issue "t the end o) the )inancial year on 3$ June

Ju ne what entry

will the company ma9e=

a 2ebit 4nearned !ubscriptions

!ubscriptions liabilit

liabilityC

yC ;0$D credit !ubscriptions

!ubscriptions +ncome

+ncome ;0$

;0$

b 2ebit 5ash ;0$D credit !ubscriptions

!ubs criptions +ncome ;0$

c 2ebit 5ash

5ash ;%#%D credit

credit 6!T 5ollections

5ollections ;%%,

;%%, credit 4nearned !ubscriptions

!ubscriptions liabilityC

liabilityC

;%%$

d 2ebit 4nearned

4nearned !ubscriptions

!ubscriptions liability

liabilityCC ;0$D credit

credit !ubscripti

!ubscriptions

ons +ncome

+ncome ;3:D credit

credit

6!T 5ollections ;0

".!E/ "

!ection 00

#: +n preparing its #$%% ad8usting entries,

entries, the (hilippoussis 5ompany

5ompany neglected to ad8ust the

1))ice !upplies assetC account )or the amount o) supplies used up during the year "s a

result o) this error'

a #$%% pro)it is understated,

understated, the

the balance

balance o) e-uity

e-uity is understated,

understated, and assets are

are understated

understated

b #$%% pro)it is overstated, the balance

ba lance o) e-uity is overstated,

overs tated, and assets are correctly

cor rectly

stated

c #$%% pro)it is overstated,

overstated, the

the balance

balance o) e-uity

e-uity is overstated,

overstated, and assets are

are overstated

overstated

d Liab

Liabili

ilitie

tiess are und

under

ersta

state

ted

d

".!E/ 5

!ection 0?

#? 2etermine

2etermine the cash payments made during the year )or insurance premiums

premiums )rom the

)ollowing in)ormation'

;

+n

+nsurance e*pense income statementC 0? 7

Prepaid Insurance:

Insurance:

Begi

Beginni

nning

ng Balan

Balance

ce ##$

Ending Balance %A 7

"ssume all insurance premiums are paid in cash

a ;0?7

b ;%A7

c ;:A7

d ;07$

".!E/ 2

!ection 00

© John iley & !ons "ustralia, Ltd #$%# 0A

Testbank to accompany Accounting 8e

#> The primary basis )or the classi)ication

classi)ication o) assets and liabilities

liabilities in the balance sheet is'

a (ro)

(ro)it

itab

abil

ilit

ity

y

b Tangibility

c Li-uidity

d 2egr

2egree

ee o) ris9

ris9

".!E/ 5

!ection 0>

#A The capital account o) a sole trader was credited with

with ;7$$$ hich o) these items would

not give rise to such a credit=

a Th

Thee busine

business

ss earn

earned

ed a pro)i

pro)itt o) ;7$$$

;7$$$

b The owner brought in a private

p rivate car valued at ;7$$$

;7$ $$ )or business use

c The owner

owner intro

introduce

duced

d ;7$$$

;7$$$ new capital

capital

d The owner

owner paid an outstanding

outstanding private

private gambling

gambling debt

debt o) ;7$$$

;7$$$ )rom the business

business ban9

account

".!E/ 2

!ection 0?

3$ 5urrent assets

assets may be listed in the balance sheet in the order o) their li-uidity

li-uidity Li-uidity

Li-uidity

is'

a "nothe

"notherr name

name )or the

the oper

operat

ating

ing cycl

cyclee

b " measure

measure o) how many buyers

buy ers there are )or the asset

ass et

c hether

hether the

the asset

asset is

is secured

secured over a liabil

liability

ity

d The averag

averagee length

length o) time

time it ta9es

ta9es to convert

convert an asset

asset into

into cash

".!E/ 2

!ection 0>

3% The current

current liability

liability is'

is'

a "ccru

"ccrueded 2eli

2elive

very

ry E*

E*pen

penses

ses

b "ccounts /eceivable

c Elec

Electr

tric

icit

ity

y E*p

E*pen

ense

se

d Lo

Long

ng<t

<ter

erm

m Loan

oan

".!E/ "

!ection 0>

© John iley & !ons "ustralia, Ltd #$%# 0%$

Chapter 4: Adjusting the accounts and preparing financial statements

3# The e*cess o) current

current assets over current liabiliti

liabilities

es is 9nown as'

a E-uity

b or9ing capital

c +nta

+ntang

ngib

ible

le ass

asset

etss

d .et assets

".!E/ B

!ection 0>

33 1bligations

1bligations o) the entity that do not re-uire payment within one year o) the balance sheet

date are classi)ied as'

a 5urr

5urren

entt lia

liabi

bili

liti

ties

es

b .on<current assets

c 5urr

5urren

entt asse

assets

ts

d .on<cu

.on<currerrent

nt liabi

liabili

liti

ties

es

".!E/ 2

!ection 0>

30 hich o) these is not an advantage

advantage o) using a wor9sheet to assist

assist in preparing the

)inancial statements=

a "ll the

the in)or

in)ormat

mation

ion is assembl

assembleded in one place

place

b +t aids in the preparation

prepara tion o) interim )inancial statements )or internal use

u se

c /eports

/eports can

can be prepare

preparedd be)ore

be)ore ma9ing

ma9ing closin

closing

g entries

entries

d +t means

means that

that the

the ledger

ledger can be

be dispens

dispensed

ed with

with

".!E/ 2

!ection 0A

37 hich o) the )ollowing is not an advantage o) preparing an ad8usted trial trial balance=

a +t veri)ies

veri)ies that the debits

debits e-ual the credits

credits in the

the ledger

ledger a)ter the preparation

preparation o) the

ad8usting entries

b +t reduces the possibility

poss ibility o) errors being carried )orward )rom the ledger

ledg er into the

accounting reports

c +t is a shortcut which means

means that

that the ad8usting

ad8usting entries

entries do not have

have to be entered into the

ledger

d +t assists

assists in the

the preparat

preparation

ion o) the )inan

)inancia

ciall statemen

statementsts

".!E/ 5

!ection 0:

© John iley & !ons "ustralia, Ltd #$%# 0%%

Testbank to accompany Accounting 8e

Fill in the blanks

% 4nder the

the

basis

basis o) accounting

accounting,, income

income is recognised

recognised when

when earned

earned and

e*penses when incurred

".!E/ accrual

!ection 0%

# The c

c basis o) accounting

accounting is not a generally

generally accepted

accepted method

method o)

determining pro)it )or businesses that have signi)icant credit transactions

".!E/ cash

!ection 0%

3 The o

o cycle is the average

average time

time it ta9es

ta9es )or a )irm to ac-uire

ac-uire and sell

sell

inventory and collect the cash )rom the sale

".!E/ operating

!ection 0>

0 4nearned income is classi)ied

classi)ied as a l

l in the balance sheet as, i)

i) the

the

income is not earned, it may need to be repaid

".!E/ liability

!ection 00

7 "ccumulated

"ccumulated depreciation

depreciation is

is re)erred

re)erred to as

as a c asset account

account because

because it

o))sets a related asset account

".!E/ contra

!ection 0?

: The c

c v

v o) an asset is its original

original cost

cost less accumulated

accumulated

depreciation

".!E/ carrying value

!ection 00

? 6oodwil

6oodwilll is classi)i

classi)ied

ed in the balance

balance sheet

sheet as an i

i

asset

asset

".!E/ intangible

!ection 0>

© John iley & !ons "ustralia, Ltd #$%# 0%#

Chapter 4: Adjusting the accounts and preparing financial statements

> 5

5 l are obligations o) the )irm that are e*pected, in the

normal course o) business, to be settled in the ne*t twelve months

".!E/ 5urrent liabilities

!ection 0>

A " spreadsheet,

spreadsheet, prepared

prepared either

either manually

manually or electronically

electronically and

and used by accountants

accountants to

organise in)ormation, is 9nown as a w

".!E/ wor9sheet

!ection 0A

%$ Because income

income and e*pense accounts

accounts are reduced to ero at the end o) the year they are

9nown as t accounts

".!E/ temporary

!ection 0%

© John iley & !ons "ustralia, Ltd #$%# 0%3

Testbank to accompany Accounting 8e

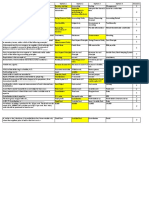

Exam tpe !uestions

"#E$T%&' 4()

The )ollowing trial balance was prepared )rom the ledger accounts o) !ingapore Enterprises,

a service business

Trial *alance

*al ance as

a s at +) ,ecemb

,e cember

er -.))

2ebit 5redit

; ;

Ban9 overdra)t 7,%$$

(repaid rent 0 ,7 $ $

1))ice e-uipment and )ittings % > ? ,$ $ $

"ccumulated depreciation, o))ice e-uipment 3$,$$$

"ccounts payable %A,:$$

6!T collections 3,?$$

6!T outlays # ,> $$

"ccounts receivable 33 , $$ $

+ncome earned #07,$$$

!alaries A7 ,$ $ $

+nternet service provider 7$ $

4tilities e*penses %> ,$$ $

"dministrative e*penses % 7 ,$ $$

+nterest e*pense % # ,$ $ $

5apital N L Tan % January #$%% A0,0$$

2rawings N L Tan 3 $ ,$ $ $

; 3 A ? ,> $$ ;3A?,>$$

"d8ustments'

/ent e*pired )or the year was ;#,7$$

2epreciation o) o))ice e-uipment is at %7I per annum using the straight line method

!alaries owing at 3% 2ecember #$%% were ;3,$$$

/E@4+/E2'

aC (repare general 8ournal entries

entries )or

)or the balance day

day ad8ustments

ad8ustments .arrations

.arrations are not

re-uired

bC (repare an +ncome !tatement )or the year ended 3$ 2ecember #$%%

cC (repare

(repare a classi)

classi)ied

ied Balan

Balance

ce !heet

!heet as at 3% 2ecemb

2ecemberer #$%%

#$%%

© John iley & !ons "ustralia, Ltd #$%# 0%0

Chapter 4: Adjusting the accounts and preparing financial statements

"#E$T%&' 4(-

The )ollowing trial balance was prepared )rom the ledger accounts o) Taiwan 5onsultants a

)irm o) management consultants

Taiwan Consultants

4nad8usted Trial Balance as at 3$ June #$%%

2ebit 5redit

; ;

Ban9 0%,7#$

!toc9 o))ice supplies on hand %%,>A$

1))ice e-uipment %7#,$$$

"ccumulated depreciation, o))ice e-uipment #0,0$$

(remises > $ $ ,$ $ $

"ccumulated depreciation, premises :0,$$$

"ccounts payable 33,$$$

6!T collections 7,7$$

6!T outlays 3 ,7 $$

"ccounts receivable 0: , $$ $

ees revenue >>$,:$$

/ent revenue %:,$$$

"dvertising e*pense # 7 ,$ $$

"dministrative e*penses 3 $ ,$ $$

!alaries 3 A$ , $ $$

+nternet service provider # ,$ $ $

+nterest e*pense % A ,$ $ $

Telephone e*pense > ,$ $ $

Loan due % !ept #$%7C #$$,$$$

5apital N L Lee 307,0%$

2rawings N L Lee 0 $ ,$ $$

;%,7:>,A%$ ;%,7:>,A%$

"d8ustments'

!alaries are ;%7$$ per day They are paid wee9ly in arrears The ne*t pay day is July 3

which is a ednesday

2epreciation on premises is #I pa, on a straight<line basis

2epreciation o) o))ice e-uipment is %$I o) the e-uipments cost

1n % January, #$%% Taiwan 5onsultants rented part o) its premises to T Light )or %#

months and received a che-ue )or ;%:,$$$ representing the whole years rental

1))ice supplies o) ;:,3A$ had been used during the year 1))ice supplies o) ;7,7$$ were

on hand at the end o) the period

"dvertising o) ;#,$$$ was prepaid )or an advertising campaign starting in July #$%%

;:,$$$ is owing )or consulting wor9 completed but not yet billed to the client

/E@4+/E2'

aC (repare general 8ournal entries )or the balance day ad8ustments

ad8ustments

bC (repare an +ncome !tatement )or) or the year ended 3$ June

Ju ne #$%%

cC (repa

(repare

re a class

classi)i

i)ied

ed Bala

Balance

nce sheet

sheet asas at 3$ June

June #$%

#$%%

%

© John iley & !ons "ustralia, Ltd #$%# 0%7

Testbank to accompany Accounting 8e

$olution "uestion 4()

aC 6eneral Journal !+.6"(1/E E.TE/(/+!E!

#$%% ; ;

2e c 3 % /ent #,7$$

(repaid rent #,7$$

2epreciation o))ice e-uipment #>,$7$

"ccumulated depreciation o))ice e-uip & )ittings #>,$7$

;%>?,$$$ * %7IC

!alaries 3,$$$

!alaries payable 3,$$$

bC !ingapore Enterprises

+ncome !tatement )or the year ended 3% 2ecember #$%%

; ;

+ncome earned #07,$$$

Less E*penses

!alaries A> ,$ $ $

/ent # , 7$ $

+nternet service provider 7$ $

4tilities e*penses %> ,$$ $

"dministrative e*penses % 7 ,$ $$

2epreciation o))ice e-uipment # > ,$ 7 $

+nterest e*pense % # ,$ $ $ %?0,$7$

(/1+T ; ?$,A7$

cC !ingapore Enterprises

Balance sheet as at 3% 2ecember #$%%

; ; ;

© John iley & !ons "ustralia, Ltd #$%# 0%:

Chapter 4: Adjusting the accounts and preparing financial statements

54//E.T "!!ET!

(repaid rent #,$$$

"ccounts receivable 33,$$$ 37,$$$

.1.<54//E.T "!!ET!

1))ice e-uipment & )ittings %>?,$$$

Less "ccumulated depreciation 7>,$7$ %#>,A7$

;%:3,A7$

54//E.T L+"B+L+T+E!

Ban9 overdra)t 7,%$$

!alaries payable 3,$$$

"ccounts payable %A,:$$

6!T payable ;3,?$$ < ;#>$$ ) A $$ #>,:$$

E@4+T

5apital, L Tan N % January #$%% A0,0$$

O (ro)it ?$,A7$

%:7,37$

< 2rawings 3

3$

$,$$$ %37,37$

;%:3,A7$

$olution 4(-

aC 6eneral

6ener al Journal

Jour nal T"+".

"+". 51.!4LT".T!

51.!4LT".T!

#$%% ; ;

June 3$ !alaries 3,$$$

!alaries payable 3,$$$

;?,7$$P7 Q ;%,7$$ * # days

2epreciation premises %:,$$$

"ccumulated depreciation premises %:,$$$

;>$$,$$$ * #I

2epreciation o))ice e-uipment %7,#$$

"ccumulated depreciation o))ice e-uip %7,#$$

;%7#,$$$ * %$I

/ent revenue >,$$$

4nearned rent revenue >,$$$

;%:,$$$P#

1))ice supplies e*pense :,3A$

!toc9 o))ice supplies on hand :,3A$

1))ice supplies used

(repaid advertising #,$$$

"dvertising e*pense #,$$$

"ccounts receivable :,$$$

ees revenue :,$$$

© John iley & !ons "ustralia, Ltd #$%# 0%?

Testbank to accompany Accounting 8e

T"+". 51.!4LT

51.! 4LT".T!".T!

bC +ncome !tatement )or the year

ye ar ended 3$ June #$%%

; ;

ees revenue >>:,:$$

/ent revenue >,$$$

>A0,:$$

Less EG(E.!E!

"dvertising #3 ,$$ $

"dministrative e*penses 3 $ ,$ $$

!alaries 3 A3 , $ $$

+nternet service provider # ,$ $ $

+nterest e*pense % A ,$ $ $

Telephone e*pense >,$$$

2epreciation o))ice e-uipment % 7 ,# $ $

2epreciation premises % : ,$ $ $

1))ice supplies e*pense : ,3 A$ 7%#,7A$

(/1+T ;3>#,$%$

cC T"+". 51.!4L

51.! 4LT T".T!

Balance sheet as at 3$ June #$%%

; ; ;

CURRENT ASSETS

Ban9 0%,7#$

1))ice supplies on hand 7,7$$

"ccounts receivable 7#,$$$

(repaid advertising #,$$$ %$%,$#$

NON-CURRENT ASSETS

1))ice e-uipment %7#,$$$

Less "ccumulated depreciation 3A,:$$ %%#,0$$

(remises >$$,$$$

Less accumulated depreciation >$,$$$ ?#$,$$$ >3#,0$$

;A33,0#$

© John iley & !ons "ustralia, Ltd #$%# 0%>

Chapter 4: Adjusting the accounts and preparing financial statements

CURRENT LIABILITIES

!alaries payable 3,$$$

"ccounts payable 33,$$$

6!T payable ;7,7$$< ;3,7$$C #,$$$

4nearned rent revenue >,$$$ 0:,$$$

NON-CURRENT LIABILITIES

Loan #$$,$$$

EQUITY

5apital, L Lee N % July #$%$ 307,0%$

O (ro)it 3>#,$%$

?#?,0#$

< 2rawings 0$,$$$ ;:>?,0#$

;A33,0#$

© John iley & !ons "ustralia, Ltd #$%# 0%A

Вам также может понравиться

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentДокумент6 страницA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- 01 1531APCRDAProjectReportEditionNo3StatusDecember2017 PDFДокумент156 страниц01 1531APCRDAProjectReportEditionNo3StatusDecember2017 PDFIsaac JebОценок пока нет

- Choudhry FTP Principles Jan 2018Документ133 страницыChoudhry FTP Principles Jan 2018James BestОценок пока нет

- Funds Flow Statement MCQs - Schedule of Changes in Financial Position - Multiple Choice Questions and AnswersДокумент10 страницFunds Flow Statement MCQs - Schedule of Changes in Financial Position - Multiple Choice Questions and AnswersPavan Chinnikatti100% (1)

- TBCH 06Документ50 страницTBCH 06Tornike Jashi50% (2)

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeОт EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeОценок пока нет

- Joint Circular No. 01, S. 1998Документ4 страницыJoint Circular No. 01, S. 1998Kinleah Vida100% (1)

- Bar Questions Civil Law 2006-2018Документ34 страницыBar Questions Civil Law 2006-2018Ruth Hazel GalangОценок пока нет

- CNG Station Stnd. Ge 118Документ112 страницCNG Station Stnd. Ge 118sruhil50% (2)

- Activity ProposalДокумент6 страницActivity ProposalJeffre AbarracosoОценок пока нет

- Accounting 2021 U1 P1 PDFДокумент10 страницAccounting 2021 U1 P1 PDFStephano OlliviereОценок пока нет

- 5, Expense Is RecognizedДокумент5 страниц5, Expense Is RecognizedfggfdgdsОценок пока нет

- Chapter 2 Recording ProcessДокумент70 страницChapter 2 Recording ProcessLEE WEI LONGОценок пока нет

- ch17 Cash FlowДокумент51 страницаch17 Cash FlowanjОценок пока нет

- Mock Cpa Board Exams Rfjpia R 12 W AnsДокумент17 страницMock Cpa Board Exams Rfjpia R 12 W AnsRheneir MoraОценок пока нет

- Bookkeeping Cycle: ReadingДокумент1 страницаBookkeeping Cycle: ReadingYanetОценок пока нет

- Wha 1'S Going On: 'Ntheback Offlce?Документ2 страницыWha 1'S Going On: 'Ntheback Offlce?YanetОценок пока нет

- ReceivablesДокумент46 страницReceivableswarsimaОценок пока нет

- Balance of Payment: and Its ComponentsДокумент13 страницBalance of Payment: and Its ComponentsАндрей ГудзьОценок пока нет

- Session 3Документ8 страницSession 3Mohit aswalОценок пока нет

- Scrutiny of Records For Audit Purpose PDFДокумент25 страницScrutiny of Records For Audit Purpose PDFGul Rukh100% (3)

- CH 08Документ46 страницCH 08Sofi KetemaОценок пока нет

- ACC1Документ2 страницыACC1RialeeОценок пока нет

- Cash Flows For AccountingДокумент1 страницаCash Flows For AccountingmyzevelОценок пока нет

- Rulesofdebitandcredit 101029141535 Phpapp01Документ85 страницRulesofdebitandcredit 101029141535 Phpapp01Elyse CameroОценок пока нет

- Lecture 3Документ14 страницLecture 3Lol 123Оценок пока нет

- Financial Ratio AnalysisДокумент5 страницFinancial Ratio AnalysisJun Guerzon PaneloОценок пока нет

- Fabv 2018 Board Question Paper Sem 5Документ11 страницFabv 2018 Board Question Paper Sem 5ASHISH NYAUPANEОценок пока нет

- GraphsДокумент29 страницGraphsFakerPlaymakerОценок пока нет

- Week 02 - 02 - Module 05 - Accounting For CashДокумент13 страницWeek 02 - 02 - Module 05 - Accounting For Cash지마리Оценок пока нет

- Identify Record Communicate Inside Identify Analyze CommunicatingДокумент2 страницыIdentify Record Communicate Inside Identify Analyze Communicatingamir rabieОценок пока нет

- Balance Sheet Theory PDFДокумент2 страницыBalance Sheet Theory PDFDiptesh KunduОценок пока нет

- Chapter 16Документ17 страницChapter 16Kad SaadОценок пока нет

- Financial Management For Non-Finance Manager In-House Training PT Newmont Nusa TenggaraДокумент264 страницыFinancial Management For Non-Finance Manager In-House Training PT Newmont Nusa Tenggaralizaaa 123Оценок пока нет

- Lecture TWO Accounting Fo ManagerДокумент40 страницLecture TWO Accounting Fo Managermohamed elsabahiОценок пока нет

- Loursl: - (L) : (Semester-II)Документ4 страницыLoursl: - (L) : (Semester-II)Riya AgrawalОценок пока нет

- Chapter 3Документ53 страницыChapter 3Josceline JoscelineОценок пока нет

- Chapter 3 - 211031 - 213637Документ38 страницChapter 3 - 211031 - 213637CY YangОценок пока нет

- Financial Reporting: Stice - Stice - SkousenДокумент22 страницыFinancial Reporting: Stice - Stice - SkousenBene RondarioОценок пока нет

- Ratio Analysis FormulaДокумент7 страницRatio Analysis FormulaHozefadahodОценок пока нет

- Chapter 4Документ50 страницChapter 4Nurul AfiqahОценок пока нет

- Lecture ONE Accounting For ManagerДокумент30 страницLecture ONE Accounting For Managermohamed elsabahiОценок пока нет

- Intermediate AccountingДокумент50 страницIntermediate AccountingRОценок пока нет

- Acc101 Mini Exam Review For StudentsДокумент11 страницAcc101 Mini Exam Review For Studentsjan petosilОценок пока нет

- Revenue Recognition - Installment SalesДокумент7 страницRevenue Recognition - Installment SalesAGNES CASTILLOОценок пока нет

- Cash Flow Statements: Get Ready!Документ1 страницаCash Flow Statements: Get Ready!YanetОценок пока нет

- Statement of Cash Flows - Purpose of The Statement of Cash Flows - Reports Cash FlowsДокумент63 страницыStatement of Cash Flows - Purpose of The Statement of Cash Flows - Reports Cash FlowsZaryab WaheedОценок пока нет

- Management Accounting by CabreradocДокумент1 страницаManagement Accounting by CabreradocDaniela RamosОценок пока нет

- Illustrative Work-Paper Template For Testing ROMM and Performing WalkthroughsДокумент19 страницIllustrative Work-Paper Template For Testing ROMM and Performing WalkthroughsGITESH DHINGRAОценок пока нет

- Chapter 2 108 131Документ25 страницChapter 2 108 131Arielle CabritoОценок пока нет

- 1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research MethodologyДокумент55 страниц1.1 Overview-Ratios 1.2 Companies For Analysis 1.3 Objective & Scope of Research Study 1.4 Limitation of Study 1.5 Research Methodologysauravv7Оценок пока нет

- System @: K (IiefcisДокумент3 страницыSystem @: K (IiefcisFahomeda Rahman SumoniОценок пока нет

- (Freory Accounts: Assets Commodities I N-'Rentory Discouni: Gross GrossДокумент12 страниц(Freory Accounts: Assets Commodities I N-'Rentory Discouni: Gross GrossPhilip CastroОценок пока нет

- 03 - Management AccountingДокумент2 страницы03 - Management AccountingCelsozeca2011Оценок пока нет

- The Debating Club: Welcomes You All To A Quiz Competition On "Customs"Документ97 страницThe Debating Club: Welcomes You All To A Quiz Competition On "Customs"Shankhesh MehtaОценок пока нет

- Accounting ConceptsДокумент10 страницAccounting Conceptsabc47Оценок пока нет

- Accounting & Auditing Solved MCQs PDFДокумент224 страницыAccounting & Auditing Solved MCQs PDFMaria QuiОценок пока нет

- Introductionto AccountingДокумент13 страницIntroductionto Accounting--Оценок пока нет

- F AccountingДокумент43 страницыF Accountingvcpc2008Оценок пока нет

- The Balance Sheet and Notes To The Financial StatementsДокумент46 страницThe Balance Sheet and Notes To The Financial StatementsRОценок пока нет

- Accounting ConceptsДокумент26 страницAccounting ConceptsManoj A TalikotiОценок пока нет

- Fundamental Accounting Principles 23rd Edition Wild Solutions ManualДокумент35 страницFundamental Accounting Principles 23rd Edition Wild Solutions Manualpeterrodriguezcwbqomdksi100% (12)

- Chapter 3 Accounting For Provisions, Contingencies and Events After The Reporting PeriodДокумент30 страницChapter 3 Accounting For Provisions, Contingencies and Events After The Reporting Periodsamuel_dwumfourОценок пока нет

- TYBBI Security Anal 10Документ4 страницыTYBBI Security Anal 10Esha JaiswalОценок пока нет

- BSA Review Mod 3Документ11 страницBSA Review Mod 3Johar MesugОценок пока нет

- CHP 04Документ15 страницCHP 04Farhan ShakilОценок пока нет

- Principles of Accounting and Finance Acc1000 Principles of Accounting and Finance CheatsheetДокумент5 страницPrinciples of Accounting and Finance Acc1000 Principles of Accounting and Finance CheatsheetAlison MoklaОценок пока нет

- SCALP Handout 040Документ2 страницыSCALP Handout 040Cher NaОценок пока нет

- Financial Inclusion Policy - An Inclusive Financial Sector For AllДокумент118 страницFinancial Inclusion Policy - An Inclusive Financial Sector For AllwОценок пока нет

- Break Even Analysis, Sensitivity Analysis and Leverage: Management Advisory Services ReviewДокумент15 страницBreak Even Analysis, Sensitivity Analysis and Leverage: Management Advisory Services ReviewAprile Margareth Hidalgo0% (1)

- On KajariaДокумент16 страницOn KajariaPOORVICHIBОценок пока нет

- Excel Budget ProjectДокумент7 страницExcel Budget Projectapi-341205347Оценок пока нет

- Reading 40 - Fixed Income Markets Issuance Trading and FundingДокумент40 страницReading 40 - Fixed Income Markets Issuance Trading and FundingAllen AravindanОценок пока нет

- BDO-EPCI vs. JAPRL DevelopmentДокумент1 страницаBDO-EPCI vs. JAPRL DevelopmentHannah SyОценок пока нет

- L15 Consumer Loans Credit CardsДокумент18 страницL15 Consumer Loans Credit CardsJAY SHUKLAОценок пока нет

- DRF FormДокумент1 страницаDRF FormsrinivasansscОценок пока нет

- Case 2 AuditДокумент8 страницCase 2 AuditReinhard BosОценок пока нет

- Taxes: Part One: Obliged ToДокумент4 страницыTaxes: Part One: Obliged ToStaciaRevianyMegeОценок пока нет

- Class 8 NotesДокумент48 страницClass 8 NotesHamza FayyazОценок пока нет

- Crisis in Indonesia: Economy, Society and PoliticsДокумент2 страницыCrisis in Indonesia: Economy, Society and PoliticslannyОценок пока нет

- Cir Vs MitsubishiДокумент3 страницыCir Vs MitsubishiPacta Sunct ServandaОценок пока нет

- NSE's Certification in Financial MarketДокумент23 страницыNSE's Certification in Financial MarketHesham HeshamОценок пока нет

- Finance Exam 1Документ2 страницыFinance Exam 1yolanda davisОценок пока нет

- Kode BankДокумент4 страницыKode BankZam SdmОценок пока нет

- Different Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4Документ17 страницDifferent Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4anon_855990044Оценок пока нет

- GC-Case Description-En EN PDFДокумент4 страницыGC-Case Description-En EN PDFvlado2meОценок пока нет

- REFLECTION-PAPER-BA233N-forex MarketДокумент6 страницREFLECTION-PAPER-BA233N-forex MarketJoya Labao Macario-BalquinОценок пока нет

- Account FINAL Project With FRNT PageДокумент25 страницAccount FINAL Project With FRNT PageMovies downloadОценок пока нет

- Roland Berger White Paper Automotive Captive Banking Final Mit AnsprechpartnernДокумент27 страницRoland Berger White Paper Automotive Captive Banking Final Mit AnsprechpartnernRei Ning WangОценок пока нет

- Project ReportsДокумент296 страницProject Reportsvyavahareyogesh100% (1)