Академический Документы

Профессиональный Документы

Культура Документы

Universiti Teknologi Mara Common Test 1: Confidential AC/JAN 2017/MAF201

Загружено:

amirah zahidahОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Universiti Teknologi Mara Common Test 1: Confidential AC/JAN 2017/MAF201

Загружено:

amirah zahidahАвторское право:

Доступные форматы

CONFIDENTIAL AC/JAN 2017/MAF201

UNIVERSITI TEKNOLOGI MARA

COMMON TEST 1

COURSE : COST AND MANAGEMENT ACCOUNTING 1

COURSE CODE : MAF201

EXAMINATION : JANUARY 2017

TIME : 1 HOUR 30 MINUTES

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of three (3) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of :

i) the Question Paper

ii) an Answer Booklet – provided by the Faculty

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 3 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/FEB 2017/MAF201

QUESTION 1

a) List TWO parties involved in contract costing.

(2 marks)

b) Differentiate between joint products and by products.

(4 marks)

c) Explain the accounting treatment of normal loss and abnormal losses.

(4 marks)

(Total:10 marks)

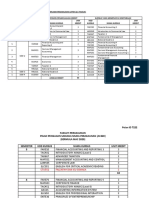

QUESTION 2

Berkat Bhd signed a contract to construct a water theme park located in Pontian, Johor. The

construction work commenced on 1 January 2016 and is estimated to complete on 30 June

2017. The agreed contract price is RM3 million.

The following information relates to the contract transactions as at 31 December 2016.

RM

Plant and Machinery (Cost) 437,500

Prepaid subcontractor’s fees 60,000

Accrued site wages 13,000

Additional Information:

1. The data of the materials are as follow: RM

Material unused at site 71,000

Materials purchased 405,000

Materials transferred from other site 285,000

Materials returned to supplier 35,000

2. The depreciation for the plant and machinery is amounted to RM87,500.

3. Additional site wages incurred for the period is RM100,800.

4. The company has paid the wiring costs amounted to RM95,500.

5. The overhead absorbed is at 15% of the total materials used during the period.

6. The value of work certified is RM1.5 million and is subject to 10% retention money.

7. The provision for future rectification and defective costs for the contract is RM39,000

and the additional cost to complete the contract is estimated at RM1,200,000.

8. It is the company’s policy to determine the profit based on the value of work certified.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2017/MAF201

Required:

a. Prepare the following for the year ended 31 December 2016:

i. Construction in Process Account;

ii. Contractee Account;

iii. An extract of Statement of Financial Position as at 31 December 2016.

(Total: 15 marks)

QUESTION 3

Murnee Enterprise manufactures organic non-fat yogurt. All of the ingredients are added in

the Mixing Process and then will be transferred to the Flavouring Process.

The business expects 5% normal loss of the materials input in the Mixing Process and 7%

normal loss of total production in the Flavouring Process. The normal loss can be sold for

RM0.50 per kg. It is the company policy to value the work in progress using First in First out

(FIFO) method. The details of the processes are as follow:

Mixing Process

Materials input (2,200 kg) RM3,470

Conversion costs RM556

Actual loss 50 kg

Flavouring Process

WIP as at 1 December 2016 (1,400 kg): Degree of Completion

- From Mixing Process 100% RM1,216

- Materials added 100% RM 984

- Conversion cost 70% RM 276

Cost incurred during the period:

- Materials added (500 kg) RM1,320

- Conversion costs RM 300

WIP as at 31 December 2016 (560 kg):

- From Mixing Process 100%

- Material added 80%

- Conversion costs 60%

Actual loss (500kg)

Required:

a. Prepare the Mixing Process Account.

b. Prepare the Flavouring Process Account. Show all the relevant statements.

(Note: All calculations are to be made to the nearest two decimal places)

(Total: 25 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

Вам также может понравиться

- BAAB1014 Accounting - (Group 1 Assignment)Документ10 страницBAAB1014 Accounting - (Group 1 Assignment)Hareen Junior100% (1)

- 4a. Maf201 Fa - Jul2021 - Q Set1Документ9 страниц4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielОценок пока нет

- Programming AssignmentДокумент27 страницProgramming AssignmentYeeHang ChiamОценок пока нет

- Eco 415 Apr07Документ5 страницEco 415 Apr07myraОценок пока нет

- Tutorial 3 (Marketing)Документ12 страницTutorial 3 (Marketing)P'NG RUI XUANОценок пока нет

- FAДокумент8 страницFACassandra AnneОценок пока нет

- Acc116 165 211Документ6 страницAcc116 165 211Mustaqim MustaphaОценок пока нет

- Bkas 2013 - Revision Set Suggested SolutionДокумент8 страницBkas 2013 - Revision Set Suggested SolutionsyuhunniepieОценок пока нет

- Lab2 Det10013Документ6 страницLab2 Det10013FirdausОценок пока нет

- CT Question April 2019Документ4 страницыCT Question April 2019Nabila RosmizaОценок пока нет

- Healthymagination at Ge Healthcare SystemsДокумент5 страницHealthymagination at Ge Healthcare SystemsPrashant Pratap Singh100% (1)

- MUET Topics For Extended WritingДокумент2 страницыMUET Topics For Extended WritingLingОценок пока нет

- Arthur's First Day (Case Studies) - StaffingДокумент2 страницыArthur's First Day (Case Studies) - StaffingSis LavenderОценок пока нет

- IMC 402 - Chapter 3Документ67 страницIMC 402 - Chapter 3Suzaini SupingatОценок пока нет

- Muet Cefr Reading Paper Part 1 and Part 2 WorksheetДокумент4 страницыMuet Cefr Reading Paper Part 1 and Part 2 Worksheetk8y 1010100% (1)

- SM025 Chapter 10 2018Документ15 страницSM025 Chapter 10 2018siti aisyahОценок пока нет

- Name: Nur Ashikin Binti Mohammad Aidy Class: Unimas21 TOPIC ESSAY: "Courtesy Costs Nothing But Buys Everything"Документ5 страницName: Nur Ashikin Binti Mohammad Aidy Class: Unimas21 TOPIC ESSAY: "Courtesy Costs Nothing But Buys Everything"NurAshikin Mohammad AidyОценок пока нет

- Cover Letter Task 2021Документ2 страницыCover Letter Task 2021Nazrul IzdhamОценок пока нет

- ECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and SupplyДокумент30 страницECO 120 Principles of Economics: Chapter 2: Theory of DEMAND and Supplyizah893640Оценок пока нет

- ACCT 2112 2013/2014 Solution For Tutorial 9Документ6 страницACCT 2112 2013/2014 Solution For Tutorial 9Weiyee WongОценок пока нет

- CC 1Документ11 страницCC 1谦谦君子Оценок пока нет

- Real Muet Speaking Topics Compilation - 230614 - 052657Документ41 страницаReal Muet Speaking Topics Compilation - 230614 - 052657Adam HazriqОценок пока нет

- Muet Speaking TipsДокумент7 страницMuet Speaking Tipskeman mjОценок пока нет

- Muet Mid 2009Документ18 страницMuet Mid 2009Zaharah Hyder67% (3)

- Physics Folio... Simple2 Yg MungkinДокумент15 страницPhysics Folio... Simple2 Yg MungkinMuhammad HaikalОценок пока нет

- Universiti Teknologi Mara Final Examination: Confidential LW/APR 2010/LAW436/119Документ4 страницыUniversiti Teknologi Mara Final Examination: Confidential LW/APR 2010/LAW436/119Hairulanuar SuliОценок пока нет

- Tuisyen BiДокумент134 страницыTuisyen BiwanieОценок пока нет

- Mini Case 4-Investment Property (Student) - A192Документ2 страницыMini Case 4-Investment Property (Student) - A192Chee Mei JeeОценок пока нет

- Tutorial7 AS PDFДокумент2 страницыTutorial7 AS PDFMUHAMMAD SYUKRI MOHD SOMОценок пока нет

- Maf151 Chapter 3Документ63 страницыMaf151 Chapter 3Aiman Zikry bin AzmiОценок пока нет

- Bdap2203 Basics of Management AccountingДокумент13 страницBdap2203 Basics of Management Accountingdicky chongОценок пока нет

- Headcount / Markah Dan Analisis Muet 2019/2020 Kelas: 6Kmk1 & 6Sj1 Guru Muet: PN Parpoor Kaur A/P Indra SinghДокумент3 страницыHeadcount / Markah Dan Analisis Muet 2019/2020 Kelas: 6Kmk1 & 6Sj1 Guru Muet: PN Parpoor Kaur A/P Indra Singhsmile2jing100% (1)

- 2021 SDBL Trial Biology Term 2 STPMДокумент10 страниц2021 SDBL Trial Biology Term 2 STPMRebornNgОценок пока нет

- Assignment 2Документ16 страницAssignment 2Mandy OwxОценок пока нет

- Itt320 Quiz (Question)Документ9 страницItt320 Quiz (Question)tesqОценок пока нет

- Dry Leaf Fire StarterДокумент10 страницDry Leaf Fire StarterDaniel UlulazamiОценок пока нет

- Dee30071 PW 2Документ9 страницDee30071 PW 2ciwawaОценок пока нет

- Contoh Gant Chart PSM 1Документ1 страницаContoh Gant Chart PSM 1Shafiq QailОценок пока нет

- Assignment Pad101Документ4 страницыAssignment Pad101NURUL IZZATI AHMAD FERDAUSОценок пока нет

- Maf151 (Group Assignment)Документ35 страницMaf151 (Group Assignment)Dont RushОценок пока нет

- MUET Past Year Extended Writing Questions 2008-2018Документ2 страницыMUET Past Year Extended Writing Questions 2008-2018LingОценок пока нет

- Sample Structured Questions. ECN3010Документ4 страницыSample Structured Questions. ECN3010Hazim BadrinОценок пока нет

- Name: Nur Alia Najwa Binti Mohd Sakri MATRIC NUMBER: 2020462342 GROUP: BA2321A Title: The Type of Economies Lecture'S Name: PN Noor Dalila Binti MusaДокумент7 страницName: Nur Alia Najwa Binti Mohd Sakri MATRIC NUMBER: 2020462342 GROUP: BA2321A Title: The Type of Economies Lecture'S Name: PN Noor Dalila Binti MusaAlia najwaОценок пока нет

- Traditional Malaysia ClothingДокумент3 страницыTraditional Malaysia ClothingHarfizzie FatehОценок пока нет

- HSP Muet 2023 & 2024Документ4 страницыHSP Muet 2023 & 2024lynn mohamad31Оценок пока нет

- Course Outline: Jabatan Kejuruteraan Elektrik. Politeknik Ibrahim SultanДокумент7 страницCourse Outline: Jabatan Kejuruteraan Elektrik. Politeknik Ibrahim SultanSe RiОценок пока нет

- MC9 - Hire Purchase A202 - StudentДокумент3 страницыMC9 - Hire Purchase A202 - Studentlim qs0% (1)

- MUET Speaking Past YearДокумент3 страницыMUET Speaking Past Yearasang50% (2)

- TG AR15 9.qxp - Layout 1 11/11/15 9:24 AM Page AДокумент188 страницTG AR15 9.qxp - Layout 1 11/11/15 9:24 AM Page ASanthiya MogenОценок пока нет

- A191 Mini Case Ppe QuestionДокумент4 страницыA191 Mini Case Ppe Questiondini sofiaОценок пока нет

- Due10012 - Communicative English 1: Semester 1, June 2019 Session Q Assessment Assignment (Group) 30%Документ4 страницыDue10012 - Communicative English 1: Semester 1, June 2019 Session Q Assessment Assignment (Group) 30%Reoneil Romie100% (1)

- MFRS 116 - PpeДокумент26 страницMFRS 116 - Ppeizzati zafirahОценок пока нет

- The Elc231 Evaluative Commentary - Outline Template TITLE: Are Young People's Social Skills Declining?Документ3 страницыThe Elc231 Evaluative Commentary - Outline Template TITLE: Are Young People's Social Skills Declining?NUR AMNI NABILAH MOHD ZAMRIОценок пока нет

- Gerak Gempur Sem 1 2023Документ11 страницGerak Gempur Sem 1 2023Siva RajaОценок пока нет

- Tutorial 5 Eco 415Документ7 страницTutorial 5 Eco 415ZhiXОценок пока нет

- Tutorial 11 Preparation of Financial Statements (Q)Документ6 страницTutorial 11 Preparation of Financial Statements (Q)lious liiОценок пока нет

- Group 5 - Iron BoardДокумент6 страницGroup 5 - Iron BoardMuhammadAliffAdnan0% (1)

- WRITING MuetДокумент14 страницWRITING MuetAhmad Ismail100% (2)

- SPM Jun 2011 Math AnswerДокумент4 страницыSPM Jun 2011 Math Answerwaichunko38% (8)

- Assignment 1Документ4 страницыAssignment 1Yean Liew33% (3)

- Presentation Obm310 Event ManagementДокумент22 страницыPresentation Obm310 Event ManagementadekramlanОценок пока нет

- Solution Aud589 - Dec 2018Документ8 страницSolution Aud589 - Dec 2018LANGITBIRU100% (1)

- Aud589 (Pya 2019 Dec)Документ7 страницAud589 (Pya 2019 Dec)amirah zahidahОценок пока нет

- Aud589 Dec2019Документ6 страницAud589 Dec2019LANGITBIRU0% (1)

- Pelan Pengajian & PC Untuk Pelajar Lepasan Diploma UitmДокумент3 страницыPelan Pengajian & PC Untuk Pelajar Lepasan Diploma Uitmamirah zahidahОценок пока нет

- Islamic Finance Transactions: 1) IntroductionДокумент10 страницIslamic Finance Transactions: 1) Introductionamirah zahidahОценок пока нет

- Lecture 3 Acc N Double Entry RulesДокумент8 страницLecture 3 Acc N Double Entry Rulesamirah zahidahОценок пока нет

- Play ClawДокумент2 страницыPlay ClawFrenda SeivelunОценок пока нет

- Academic Socialization and Its Effects On Academic SuccessДокумент2 страницыAcademic Socialization and Its Effects On Academic SuccessJustin LargoОценок пока нет

- Week - 2 Lab - 1 - Part I Lab Aim: Basic Programming Concepts, Python InstallationДокумент13 страницWeek - 2 Lab - 1 - Part I Lab Aim: Basic Programming Concepts, Python InstallationSahil Shah100% (1)

- Nfpa 1126 PDFДокумент24 страницыNfpa 1126 PDFL LОценок пока нет

- Loop Types and ExamplesДокумент19 страницLoop Types and ExamplesSurendran K SurendranОценок пока нет

- Chapter 20 AP QuestionsДокумент6 страницChapter 20 AP QuestionsflorenciashuraОценок пока нет

- Strategic Marketing: The University of Lahore (Islamabad Campus)Документ3 страницыStrategic Marketing: The University of Lahore (Islamabad Campus)Sumaira IrshadОценок пока нет

- Beyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisДокумент21 страницаBeyond Models and Metaphors Complexity Theory, Systems Thinking and - Bousquet & CurtisEra B. LargisОценок пока нет

- Low Speed Aerators PDFДокумент13 страницLow Speed Aerators PDFDgk RajuОценок пока нет

- Acetylcysteine 200mg (Siran, Reolin)Документ5 страницAcetylcysteine 200mg (Siran, Reolin)ddandan_2Оценок пока нет

- 1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Документ2 страницы1500 Series: Pull Force Range: 10-12 Lbs (44-53 N) Hold Force Range: 19-28 Lbs (85-125 N)Mario FloresОценок пока нет

- Term Paper Inorganic PolymersДокумент24 страницыTerm Paper Inorganic PolymersCasey Karua0% (1)

- Generalized Class of Sakaguchi Functions in Conic Region: Saritha. G. P, Fuad. S. Al Sarari, S. LathaДокумент5 страницGeneralized Class of Sakaguchi Functions in Conic Region: Saritha. G. P, Fuad. S. Al Sarari, S. LathaerpublicationОценок пока нет

- EQ JOURNAL 2 - AsioДокумент3 страницыEQ JOURNAL 2 - AsioemanОценок пока нет

- Matrix PBX Product CatalogueДокумент12 страницMatrix PBX Product CatalogueharshruthiaОценок пока нет

- KundaliniДокумент3 страницыKundaliniAlfred IDunnoОценок пока нет

- Omnitron CatalogДокумент180 страницOmnitron Catalogjamal AlawsuОценок пока нет

- EP001 LifeCoachSchoolTranscriptДокумент13 страницEP001 LifeCoachSchoolTranscriptVan GuedesОценок пока нет

- Benedict Anderson, Imagined CommunitiesДокумент2 страницыBenedict Anderson, Imagined CommunitiesMonir Amine0% (1)

- Coal Bottom Ash As Sand Replacement in ConcreteДокумент9 страницCoal Bottom Ash As Sand Replacement in ConcretexxqОценок пока нет

- KMKT Pra PSPM ANS SCHEMEДокумент16 страницKMKT Pra PSPM ANS SCHEMEElda AldaОценок пока нет

- Procter and Gamble - MarketingДокумент10 страницProcter and Gamble - MarketingIvana Panovska100% (5)

- Directorate of Technical Education, Admission Committee For Professional Courses (ACPC), GujaratДокумент2 страницыDirectorate of Technical Education, Admission Committee For Professional Courses (ACPC), GujaratgamailkabaaaapОценок пока нет

- Camless EnginesДокумент4 страницыCamless EnginesKavya M BhatОценок пока нет

- Module-29A: Energy MethodsДокумент2 страницыModule-29A: Energy MethodsjhacademyhydОценок пока нет

- Angel C. Delos Santos: Personal DataДокумент8 страницAngel C. Delos Santos: Personal DataAngel Cascayan Delos SantosОценок пока нет

- Crisis of The World Split Apart: Solzhenitsyn On The WestДокумент52 страницыCrisis of The World Split Apart: Solzhenitsyn On The WestdodnkaОценок пока нет

- Transparency and Digitalization in The Public Administration of RomaniaДокумент8 страницTransparency and Digitalization in The Public Administration of RomaniaMădălina MarincaşОценок пока нет

- PetrifiedДокумент13 страницPetrifiedMarta GortОценок пока нет