Академический Документы

Профессиональный Документы

Культура Документы

Shiva Income 1 CR

Загружено:

PRAVEEN MACHAОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shiva Income 1 CR

Загружено:

PRAVEEN MACHAАвторское право:

Доступные форматы

YOUR PERSONAL DETAILS

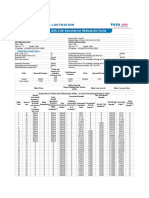

Tata AIA Life Insurance Sampoorna Raksha Proposal No: 3837120

Non-linked Non-participating Term Assurance Plan

UIN: 110N129V02 Proposal Date & Time: 24-01-2018,02:16 PM

INSURED DETAILS PROPOSER DETAILS

Name: SHIVA BALE Smoker / Non Smoker: Non Name: SHIVA BALE

Smoker

Age (yrs): 36 Gender: Male Age (yrs): 36 Gender: Male

Occupation: MANAGER Occupation: MANAGER

YOUR PLAN DETAILS

Plan Option Option 2: "Sum Assured on Death" payable on Death & Income thereafter for 10 years

Policy Term (yrs) 40 Total Modal Premium (C=A+B) 17800

Premium Payment Term (yrs) 40 Modal Premium for Non Standard Age Proof (D) 0

Payment Mode Annual Quoted Modal Premium (E=C+D) 17800

17800 Goods and Services tax including Surcharge and Cess on

Annualised Premium^ 3204

base plan for First Year (F)

Goods and Services tax including Surcharge and Cess on

Basic Sum Assured 10000000 0

rider(s) (G)

Modal Premium for base plan(A) 17800 Total Modal Premium Payable (H = E+F+G) 21004

Modal Premium for rider(s)(B) 0 Currency INR

Goods and Goods and

Services tax Total Renewal Services tax Total

Mode Renewal Renewal including

including Mode Renewal

Premium Premium Premium Surcharge and Premium

Surcharge and

Cess Cess

Annual 17800 3204 21004 Quarterly 4628 833 5461

Semi-annual 9078 1634 10712 Monthly 1572 283 1855

Rider Details

Unique Identification

Rider Name Rider Sum Assured Rider Coverage Term

Number (UIN)

Projection of Values (For Illustration Only)

Quoted Guaranteed Benefits

Annualised

Total Quoted

Premium(1) Annualised

(Exclusive of Premium

Policy Year Insured Age Goods and Rider Premium(s) (Inclusive Surrender Benefit

Services tax

of Death Benefit (3) (4)

Rider Premium)

including (2)

Surcharge and

Cess)

1 36 17800 0 17800 22000000 0

2 37 17800 0 17800 22000000 0

3 38 17800 0 17800 22000000 0

4 39 17800 0 17800 22000000 0

5 40 17800 0 17800 22000000 0

6 41 17800 0 17800 22000000 0

7 42 17800 0 17800 22000000 0

8 43 17800 0 17800 22000000 0

9 44 17800 0 17800 22000000 0

10 45 17800 0 17800 22000000 0

11 46 17800 0 17800 22000000 0

12 47 17800 0 17800 22000000 0

13 48 17800 0 17800 22000000 0

14 49 17800 0 17800 22000000 0

15 50 17800 0 17800 22000000 0

16 51 17800 0 17800 22000000 0

17 52 17800 0 17800 22000000 0

18 53 17800 0 17800 22000000 0

19 54 17800 0 17800 22000000 0

20 55 17800 0 17800 22000000 0

21 56 17800 0 17800 22000000 0

22 57 17800 0 17800 22000000 0

23 58 17800 0 17800 22000000 0

24 59 17800 0 17800 22000000 0

25 60 17800 0 17800 22000000 0

26 61 17800 0 17800 22000000 0

27 62 17800 0 17800 22000000 0

28 63 17800 0 17800 22000000 0

29 64 17800 0 17800 22000000 0

30 65 17800 0 17800 22000000 0

31 66 17800 0 17800 22000000 0

32 67 17800 0 17800 22000000 0

33 68 17800 0 17800 22000000 0

33 68 17800 0 17800 22000000 0

34 69 17800 0 17800 22000000 0

35 70 17800 0 17800 22000000 0

36 71 17800 0 17800 22000000 0

37 72 17800 0 17800 22000000 0

38 73 17800 0 17800 22000000 0

39 74 17800 0 17800 22000000 0

40 75 17800 0 17800 22000000 0

All the benefits under this plan are guaranteed.

(I)V.45.00/FY2017-2018_Q4/RELEASE 14-01-18/EXPIRY 31-03-18 004499404LPSRRPV2N2

Notes to the Illustrations

1. "Quoted Annualised Premium" shall be the premium paid in a year with respect to the basic sum assured chosen by the Proposer,

including the underwriting extra premiums and loading for modal premiums, if any.

"Quoted Annualised Premium" will be equal to the Quoted Modal premium multiplied by the frequency of the modal premium payment.

2. Total Quoted Annualised Premium is exclusive of Goods and Services tax and applicable Surcharge/Cess.All taxes, duties, surcharge,

cesses or levies, (including but not limited to Goods and Services tax and TDS), as may be imposed by Government or any statutory

authority from time to time, on the premiums payable and benefits secured under Policy, shall be borne and paid by the Policyholder.

^"Annualised Premium" shall be the premium paid in a year with respect to the basic sum assured chosen by the policyholder, excluding

the underwriting extra premiums and loading for modal premiums, if any.

3. Death Benefit is the Sum Assured on death.

For Option 1 & 2, Sum Assured on death shall be the highest of (a) 10 times Annualised Premium (b) 105% of all the Premiums Paid

(excluding the underwriting extra premiums and modal loading), as on the date of death (c) Minimum Guaranteed Sum Assured on

Maturity or (d) Absolute amount assured to be paid on death.

For Option 3 & 4, Enhanced Sum Assured on death shall be the highest of (a) 10 times the Annualised Premium (b) 105% of all the

Premiums Paid (excluding the underwriting extra premiums and modal loading), as on the date of death (c) Minimum Guaranteed Sum

Assured on Maturity or (d) Absolute amount assured to be paid on death.

Enhanced Sum Assured at the time of death shall be the Basic Sum Assured increased by a simple rate of 5% per annum at each policy

anniversary subject to maximum of 200% of Basic Sum Assured chosen at policy inception. Absolute amount assured to be paid on death

for Option 1 & 2 is the Basic Sum Assured & for Option 3 & 4 is the Enhanced Sum Assured at the time of death. Minimum Guaranteed

Sum Assured on Maturity is nil for each of the 4 options as there is no maturity benefit under the plan.

On selection of Plan Option 2 and 4 - Along with the Sum Assured on Death, the Nominee shall also receive an Income Benefit i.e. a

monthly income equal to 1% of Basic Sum Assured for 10 years starting from the next monthly anniversary following the date of death

of the Insured. Please note, for illustration purpose the amount shown under Death Benefit above is inclusive of Sum Assured on Death

and Income Benefit.

The Goods and Services tax and applicable Surcharge/ Cess shall be collected separately over and above the policy premiums.

4. There is no surrender benefit for Regular pay policies. In case of Limited pay policies, the policy can be surrendered provided full 2 and

3 years premiums have been paid for 5 and 10 Pay policies respectively. The surrender value payable is Surrender Value Factor * all the

premiums paid (excluding underwriting extra premiums and modal loading).

5. Insurance cover is available under this product

6. For more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale

Basic Policy Exclusion:

In case of death due to suicide by the Insured, whether sane or insane, within 12 months from the date of commencement which is same as

the date of inception, the nominee shall be entitled to all the Premiums Paid (excluding the underwriting extra premiums and modal

loading), provided the Policy is in force. In case of death due to suicide by the Insured, whether sane or insane, within 12 months from the

date of revival, the nominee shall be entitled to higher of all the Premiums Paid (excluding the underwriting extra premiums and modal

loading) or the acquired surrender value as on the date of death, provided the Policy is in force.

Disclaimers:

1. The illustration on page 1 is not an insurance contract.

2. Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata

AIA Life Insurance Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please

consult your own tax consultant to know the tax benefits available to you.

3. This product is underwritten by Tata AIA Life Insurance Company Ltd.

DECLARATION

Declaration of the Proposer Agent / Intermediary of Tata AIA Life Insurance Company Ltd.

I have understood the information in the sales illustration mentioned I have explained the information in the Sales illustration to the

above as explained to me by the intermediary or agent and I am Proposer and he has understood the same. I am affixing my signature

affixing my signature for the proof. for the proof.

Proposer's Name:_________________________________ Agent/Intermediary Name:_______________________

Agent/Intermediary Number:_____________________

Proposer's Signature / Thumb impression:_____________

Agent/Intermediary Signature:__________________

Date:____________________ Agent/Intermediary Contact Number:_____________

Date:_________________

IN CASE THE PROPOSER AFFIXES A THUMB IMPRESSION OR SIGNING IN VERNACULAR:

I _____________________________________ holding ______________ (Identity Card type) ____________________ (Identity Card no.)

hereby declare that I have explained the contents and benefits of the illustration to the Proposer in ______________ language and that the

Proposer has affixed his/her signature/thumb impression on the illustration after fully understanding the contents thereof.

Witness Signature: _______ Signature/ Thumb Impression of Proposer: _______ Signature of the Person making the Declaration: _______

Unique Reference Number: L&C/Advt/2017/May/109

Tata AIA Life Insurance Company Ltd. (IRDA of India Regn. No. 110) CIN - U66010MH2000PLC128403

Registered and Corporate Office: 14th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai- 400013.

For more information, Call the Tata AIA Life Insurance Company Ltd Helpline number 1860-266-9966

(local charges apply) or Visit us at: www.tataaia.com or SMS 'LIFE' to 58888

(I)V.45.00/FY2017-2018_Q4/RELEASE 14-01-18/EXPIRY 31-03-18 004499404LPSRRPV2N2

Вам также может понравиться

- Mahalife GoldДокумент5 страницMahalife GoldFiniscope - Investment AdvisorsОценок пока нет

- Your Personal DetailsДокумент5 страницYour Personal DetailsAmareswar SahuОценок пока нет

- IllustrationДокумент3 страницыIllustrationBLOODY ASHHERОценок пока нет

- Computation Sheet 2022-11Документ4 страницыComputation Sheet 2022-11Harsha KumarОценок пока нет

- IllustrationДокумент2 страницыIllustrationInvest Aaj for kal Life insuranceОценок пока нет

- CTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceДокумент12 страницCTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceNamita BhattОценок пока нет

- Hdfc-Illustration - 2022-09-09T113844.627Документ3 страницыHdfc-Illustration - 2022-09-09T113844.627srinivasangsrinivasaОценок пока нет

- Aviva Life Insurance Company India Limited Premium QuotationДокумент4 страницыAviva Life Insurance Company India Limited Premium QuotationMohan BNОценок пока нет

- IllustrationДокумент2 страницыIllustrationMayank guptaОценок пока нет

- IllustrationДокумент3 страницыIllustrationVamsi Krishna BОценок пока нет

- Jupiter Insurance PolicyДокумент2 страницыJupiter Insurance PolicyshyamchepurОценок пока нет

- Illustration - 2022-10-15T114040.772Документ3 страницыIllustration - 2022-10-15T114040.772BLOODY ASHHERОценок пока нет

- Manual RFQ - SPDДокумент2 страницыManual RFQ - SPDronОценок пока нет

- IllustrationДокумент2 страницыIllustrationInvest Aaj for kal Life insuranceОценок пока нет

- IllustrationДокумент3 страницыIllustrationVamsi Krishna BОценок пока нет

- Shivang 10Документ2 страницыShivang 10Ameet ChandanОценок пока нет

- IllustrationДокумент2 страницыIllustrationVikas MaheshwariОценок пока нет

- BenefitIllustration-1679808210447 230326 105345Документ1 страницаBenefitIllustration-1679808210447 230326 105345Ameet ChandanОценок пока нет

- IllustrationДокумент3 страницыIllustrationsukh37949Оценок пока нет

- SMP 15 Year 1 LAKHДокумент3 страницыSMP 15 Year 1 LAKHTamil Vanan NОценок пока нет

- Illustration - 2022-11-04T161802.609Документ3 страницыIllustration - 2022-11-04T161802.609BLOODY ASHHERОценок пока нет

- 7 Tax PartnershipДокумент14 страниц7 Tax Partnershipgwynethvm03Оценок пока нет

- IllustrationДокумент2 страницыIllustrationVikas MaheshwariОценок пока нет

- SMP 25 Years 1 LakhДокумент3 страницыSMP 25 Years 1 LakhTamil Vanan NОценок пока нет

- Kotak Policy PDFДокумент6 страницKotak Policy PDFMayank GubreleОценок пока нет

- Singal 10lakh BIДокумент1 страницаSingal 10lakh BIdharam singhОценок пока нет

- Date: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022Документ2 страницыDate: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022sandeep kumarОценок пока нет

- SIS With LSPO and Regular PayДокумент3 страницыSIS With LSPO and Regular PayJyoti PandeyОценок пока нет

- Insurance Co.Документ28 страницInsurance Co.sejal ambetkarОценок пока нет

- Illustration For Your HDFC Life Click 2 Protect 3D PlusДокумент2 страницыIllustration For Your HDFC Life Click 2 Protect 3D Plusanjan0Оценок пока нет

- IllustrationДокумент3 страницыIllustrationSoumen BeraОценок пока нет

- Day 8 TaxationДокумент2 страницыDay 8 TaxationKhan Shadab -27Оценок пока нет

- Life Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanДокумент3 страницыLife Insurance: A Non-Linked Non Participating Individual Pure Risk Premium Life Term Insurance PlanPavan Kumar TripurariОценок пока нет

- IllustrationДокумент2 страницыIllustrationsukh37949Оценок пока нет

- Svs Ltd. Trial Balance, January 31, 2013 Amount in Rs. Particulars Debit CreditДокумент6 страницSvs Ltd. Trial Balance, January 31, 2013 Amount in Rs. Particulars Debit CreditVigneswar SundaramurthyОценок пока нет

- Particulars Amount Exemption Net AmountДокумент29 страницParticulars Amount Exemption Net AmountDead Beat's RandomОценок пока нет

- GM - DhanSanchay - 21-7-2022 3.51.32Документ4 страницыGM - DhanSanchay - 21-7-2022 3.51.32GRV KakashiОценок пока нет

- Benefit Illustration For HDFC Life Sanchay Par AdvantageДокумент3 страницыBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERОценок пока нет

- Module 1 - Cherry Alfuerte - Train LawДокумент41 страницаModule 1 - Cherry Alfuerte - Train Lawgerry dacerОценок пока нет

- 109 SIPcomboДокумент2 страницы109 SIPcombo1947 Abhishek TripathiОценок пока нет

- Case Study 2Документ2 страницыCase Study 2Anil NagarajОценок пока нет

- IllustrationДокумент3 страницыIllustrationSoumen BeraОценок пока нет

- Illustration For Your HDFC Life Click 2 Protect 3D PlusДокумент2 страницыIllustration For Your HDFC Life Click 2 Protect 3D PlusCharanОценок пока нет

- IllustrationДокумент3 страницыIllustrationBLOODY ASHHERОценок пока нет

- Policy Details: Page 1 of 5Документ5 страницPolicy Details: Page 1 of 5MURUGAN ASSOCIATESОценок пока нет

- Motor Insurance Two Wheeler ComprehensivДокумент4 страницыMotor Insurance Two Wheeler Comprehensivravi dhimanОценок пока нет

- IllustrationДокумент2 страницыIllustrationSharma RaviОценок пока нет

- TAX Guide 2023 - 2024 For IndividualsДокумент13 страницTAX Guide 2023 - 2024 For IndividualsAbdullahОценок пока нет

- Taxation (CHN) - Dec 2020 FinalДокумент3 страницыTaxation (CHN) - Dec 2020 FinalALEX TRANОценок пока нет

- SMP 20 Years 1 LAKHДокумент3 страницыSMP 20 Years 1 LAKHTamil Vanan NОценок пока нет

- Form 1609042024 112352Документ3 страницыForm 1609042024 112352rs3071029Оценок пока нет

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Документ4 страницыWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Umesh SanuОценок пока нет

- 874 FGPlusДокумент4 страницы874 FGPlusAmit GokhaleОценок пока нет

- Sanchay Par Immediete IncomeДокумент3 страницыSanchay Par Immediete IncomeRavi KumarОценок пока нет

- Pooja & Pooja Team Profit-and-Loss-StatementДокумент5 страницPooja & Pooja Team Profit-and-Loss-StatementPOOJA SUNKIОценок пока нет

- Sukhwinder Fortuneelite 24527 1671441783110Документ6 страницSukhwinder Fortuneelite 24527 1671441783110Harish SharmaОценок пока нет

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFДокумент5 страниц2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazОценок пока нет

- Illustration Qbhlvjke4x8v0Документ2 страницыIllustration Qbhlvjke4x8v0Akshay ChaudhryОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Telugu Pandaga Lu VishayaluДокумент1 страницаTelugu Pandaga Lu VishayaluPRAVEEN MACHAОценок пока нет

- CHT Hfa Boys Z 5 19yearsДокумент1 страницаCHT Hfa Boys Z 5 19yearsRehana AkterОценок пока нет

- Fruit Coloring PagesДокумент11 страницFruit Coloring Pageslipu1982Оценок пока нет

- Wild Flowers Colouring Book: CelebratingДокумент18 страницWild Flowers Colouring Book: CelebratinghenrykylawОценок пока нет

- Fruit Coloring PagesДокумент11 страницFruit Coloring Pageslipu1982Оценок пока нет

- Public Holidays For 2018: All OfficesДокумент1 страницаPublic Holidays For 2018: All OfficesPRAVEEN MACHAОценок пока нет

- ChaNakya Neeti TeluguДокумент357 страницChaNakya Neeti Telugumurali_modem53% (19)

- Proceedings-NOTIFICATION FOR THE GDC - CONTRACT LECTURERSДокумент4 страницыProceedings-NOTIFICATION FOR THE GDC - CONTRACT LECTURERSNarasimha Sastry100% (1)

- Richard M Gergel Financial Disclosure Report For Gergel, Richard MДокумент16 страницRichard M Gergel Financial Disclosure Report For Gergel, Richard MJudicial Watch, Inc.Оценок пока нет

- Evolution of FJGADDДокумент1 страницаEvolution of FJGADDStewart Paul Tolosa TorreОценок пока нет

- Complainants, Vs Vs Respondents: en BancДокумент6 страницComplainants, Vs Vs Respondents: en BancChristie Joy BuctonОценок пока нет

- Corrections PRCДокумент7 страницCorrections PRCJeric Sarmiento100% (1)

- Lim v. Lim, G.R. No. 163209, October 30, 2009Документ1 страницаLim v. Lim, G.R. No. 163209, October 30, 2009Norman CaronanОценок пока нет

- Denver Police Department School Discipline ReportДокумент135 страницDenver Police Department School Discipline ReportMichael_Lee_RobertsОценок пока нет

- Human-Rights AssignmentДокумент115 страницHuman-Rights AssignmentMukul Pratap SinghОценок пока нет

- Succn-Edroso v. SablanДокумент2 страницыSuccn-Edroso v. SablanRaf Ruf100% (1)

- Bachelor of Laws Curriculum PDFДокумент3 страницыBachelor of Laws Curriculum PDFAsenath GuiaОценок пока нет

- 2017 (G.R. No. 210677, People V Saragena) PDFДокумент18 страниц2017 (G.R. No. 210677, People V Saragena) PDFFrance SanchezОценок пока нет

- Order 18 Rule 17Документ2 страницыOrder 18 Rule 17Maria HerminaОценок пока нет

- Historical Perspective of The Philippine Educational SystemДокумент6 страницHistorical Perspective of The Philippine Educational SystemSitti Mushaower Omar33% (3)

- Diplomacy Is The Art and Practice of Conducting Lecture 1Документ42 страницыDiplomacy Is The Art and Practice of Conducting Lecture 1Jeremiah Miko Lepasana100% (1)

- General Orders For The Public Service of BarbadosДокумент110 страницGeneral Orders For The Public Service of BarbadosAndrew Mwamba100% (1)

- Marina Vs American HomeДокумент5 страницMarina Vs American HomeAlyssa joy TorioОценок пока нет

- The English Legal SystemДокумент23 страницыThe English Legal SystemAndrewChes75% (4)

- United States v. Demetrius Spence, 4th Cir. (2014)Документ12 страницUnited States v. Demetrius Spence, 4th Cir. (2014)Scribd Government DocsОценок пока нет

- Working of Institution Full Chapter Explanation - 240113 - 130442Документ31 страницаWorking of Institution Full Chapter Explanation - 240113 - 130442shourya725.725.725Оценок пока нет

- PANELCO V. MONTEMAYOR A.C. 5739 September 12, 2007Документ1 страницаPANELCO V. MONTEMAYOR A.C. 5739 September 12, 2007Donna Grace GuyoОценок пока нет

- PJC Logistics v. Zonar SystemsДокумент5 страницPJC Logistics v. Zonar SystemsPriorSmartОценок пока нет

- Resolution-Creation of Sorsogon Provincial OfficeДокумент2 страницыResolution-Creation of Sorsogon Provincial OfficeLeo Archival ImperialОценок пока нет

- Public Officers - Assigned CasesДокумент13 страницPublic Officers - Assigned CasesFrances Abigail BubanОценок пока нет

- Group 1 HistoryДокумент45 страницGroup 1 HistoryClient Carl Acosta67% (3)

- PT - T Vs LaplanaДокумент7 страницPT - T Vs LaplanaMonica FerilОценок пока нет

- Pimentel vs. COMELEC 2008Документ1 страницаPimentel vs. COMELEC 2008wowomichОценок пока нет

- Trieste v. Sandiganbayan, 145 SCRA 508Документ7 страницTrieste v. Sandiganbayan, 145 SCRA 508Jojo LaroaОценок пока нет

- Filipinno Society of Composers V Tan 148 SCRA 461Документ2 страницыFilipinno Society of Composers V Tan 148 SCRA 461Rey Edward' Concepcion'Оценок пока нет

- AjaxДокумент2 страницыAjaxaccount.enquiry6770Оценок пока нет

- Judgement On ConfessionДокумент8 страницJudgement On ConfessionJudicial100% (1)