Академический Документы

Профессиональный Документы

Культура Документы

CIR v. Smart Communication

Загружено:

neneneneneАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CIR v. Smart Communication

Загружено:

neneneneneАвторское право:

Доступные форматы

CIR v. Smart Communication, GR 179045-46, 25 August 2010.

DEL CASTILLO, J.

FACTS: Smart is a corporation duly registered with the Board of Investments. On May

25, 2001, Smart entered into 3 Agreements for Programming and Consultancy Services

with Prism Transactive, a non-resident corporation duly organized and existing under

the laws of Malaysia. Under the agreements, Prism was to provide programming and

consultancy services for the installation of the Service Download Manager and the

Channel Manager, and for the installation and implementation of Smart Money and

Mobile Banking Service SIM Applications and Private Text Platform.

Prism billed Smart in the amount of US $547,822.45. Thinking that these payments

constitute royalties, Smart withheld representing the 25% royalty tax under the RP-

Malaysia Tax Treaty. 3 months after, Smart filed its Monthly Remittance Return of Final

Income Taxes Withheld. On Sept 24, 2003 or within the two-year period to claim a

refund, Smart filed with the BIR, through ITAD, an administrative claim for refund.

ISSUES: Has Smart the right to file the claim for refund, and if it has, are the payments

made to Prism constitute profits or royalties?

RULING: Yes. Smart has a right as a withholding agent to file a claim for refund based

on two reasons. First, he is considered a taxpayer under the NIRC as he is personally

liable for the withholding tax as well as for deficiency assessments, surcharges, and

penalties, should the amount of the tax withheld be finally found to be less than the

amount that should have been withheld under law. Second, as an agent of the taxpayer,

his authority to file the necessary income tax return and to remit the tax withheld to the

government impliedly includes the authority to file a claim for refund and to bring an

action for recovery of such claim.

The payments for the CM and the SIM application agreements constitute business

profits. The provisions in the said agreements are clear. Prism has intellectual property

right over the SDM program, but not over the CM and SIM application programs as

the proprietary rights of these programs belong to Smart. In other words, out of the

payments made to Prism, only the payment for the SDM program is a royalty subject

to a 25% withholding tax. A refund of the erroneously withheld royalty taxes for the

payments pertaining to the CM and SIM application agreement is therefore in order.

Note: The right of a withholding agent to claim a refund of erroneously or illegally

withheld taxes comes with the responsibility to return the same to the principal

taxpayer.

Вам также может понравиться

- Cir V Smart CommunicationДокумент2 страницыCir V Smart CommunicationAnonymous Ig5kBjDmwQОценок пока нет

- CIR vs. Smart CommunicationsДокумент1 страницаCIR vs. Smart Communicationscorky01Оценок пока нет

- Restorative JusticeДокумент22 страницыRestorative JusticePatricia Mae Aberin PilotinОценок пока нет

- Taxation Case DigestДокумент4 страницыTaxation Case DigestArden KimОценок пока нет

- AFP General Insurance v. CIRДокумент19 страницAFP General Insurance v. CIRUlyssesОценок пока нет

- Income Tax Syllabus. Rev. Jan. 2021Документ13 страницIncome Tax Syllabus. Rev. Jan. 2021Macapado HamidahОценок пока нет

- Lutz vs. Araneta, 98 Phil. 148, December 22, 1955Документ6 страницLutz vs. Araneta, 98 Phil. 148, December 22, 1955milkteaОценок пока нет

- Insurance Reviewer - DiscussedДокумент40 страницInsurance Reviewer - DiscussedApril IsidroОценок пока нет

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsДокумент9 страницCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988 FactsPer PerОценок пока нет

- Municipality of San Fernando vs. Sta. RomanaДокумент2 страницыMunicipality of San Fernando vs. Sta. RomanaMACОценок пока нет

- Problem Areas in Legal EthicsДокумент12 страницProblem Areas in Legal EthicsLeah MarshallОценок пока нет

- CIR Vs SuyocДокумент3 страницыCIR Vs SuyocPatrick TanОценок пока нет

- DBP Pool of Accredited Insurance Companies Vs Radio Mindanao Network IncДокумент2 страницыDBP Pool of Accredited Insurance Companies Vs Radio Mindanao Network IncCarmz SumileОценок пока нет

- Commissioner of Internal Revenue v. Unioil Corp., G.R. No. 204405, (August 4, 2021)Документ23 страницыCommissioner of Internal Revenue v. Unioil Corp., G.R. No. 204405, (August 4, 2021)Kriszan ManiponОценок пока нет

- Saura Import & Export Co., Inc. v. DBPДокумент2 страницыSaura Import & Export Co., Inc. v. DBPsophiaОценок пока нет

- Taxation 1 DigestsДокумент133 страницыTaxation 1 DigestsAldrich AlmirezОценок пока нет

- Castellvi de Higgins CaseДокумент2 страницыCastellvi de Higgins CaserengieОценок пока нет

- Lucman V MalawiДокумент2 страницыLucman V MalawiVanessa Grace TamarayОценок пока нет

- Pedro Arce Vs Capital InsuranceДокумент2 страницыPedro Arce Vs Capital InsuranceJVMОценок пока нет

- Vera vs. Fernandez, G.R. No. L-31364, March 30, 1979 (FULL CASE)Документ4 страницыVera vs. Fernandez, G.R. No. L-31364, March 30, 1979 (FULL CASE)Sharliemagne B. Bayan100% (1)

- 05 Aznar vs. CIRДокумент2 страницы05 Aznar vs. CIRAlec Ventura100% (1)

- Part I - Tech - DigestДокумент12 страницPart I - Tech - DigestJessieRealistaОценок пока нет

- Phil. Match vs. City of CebuДокумент1 страницаPhil. Match vs. City of CebuPilyang SweetОценок пока нет

- G.R. No. 188550 August 19, 2013 Deutsche Bank Ag Manila Branch, Petitioner, Commissioner of Internal Revenue, RespondentДокумент2 страницыG.R. No. 188550 August 19, 2013 Deutsche Bank Ag Manila Branch, Petitioner, Commissioner of Internal Revenue, Respondentgin hooОценок пока нет

- PALE Discussion - The Lawyer and The Money or Properties of His ClientsДокумент3 страницыPALE Discussion - The Lawyer and The Money or Properties of His ClientsGiee De GuzmanОценок пока нет

- G.R. No. 213394 - Spouses Pacquiao V PDFДокумент21 страницаG.R. No. 213394 - Spouses Pacquiao V PDFindie100% (1)

- Arsenio Dizon v. CTA / G.R. No. 140944 / April 30, 2008Документ1 страницаArsenio Dizon v. CTA / G.R. No. 140944 / April 30, 2008Mini U. SorianoОценок пока нет

- RCBC Vs CIR, GR No. 168498, April 24, 2007Документ1 страницаRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonОценок пока нет

- CCC INSURANCE CORPORATION VДокумент2 страницыCCC INSURANCE CORPORATION Vliks5poyonganОценок пока нет

- Fitness Vs CIR - Powers of The CIRДокумент3 страницыFitness Vs CIR - Powers of The CIRCarl MontemayorОценок пока нет

- XIX. CIR vs. Filinvest Development CorpДокумент12 страницXIX. CIR vs. Filinvest Development CorpStef OcsalevОценок пока нет

- MWSS Vs CAДокумент4 страницыMWSS Vs CAInez Monika Carreon PadaoОценок пока нет

- Case Digest GR l-12518 L-66160 105208Документ2 страницыCase Digest GR l-12518 L-66160 105208Gian Paula MonghitОценок пока нет

- XXII. CIR vs. Procter & GambleДокумент12 страницXXII. CIR vs. Procter & GambleStef OcsalevОценок пока нет

- Revenue Memorandum Circular No 48-90Документ2 страницыRevenue Memorandum Circular No 48-90UGHNESSОценок пока нет

- Auyong Hian vs. Court of Tax Appeals, Et. Al.Документ1 страницаAuyong Hian vs. Court of Tax Appeals, Et. Al.Ellen Glae DaquipilОценок пока нет

- Compagnie Financiere Sucres Et Denrees vs. Commissioner of Internal RevenueДокумент5 страницCompagnie Financiere Sucres Et Denrees vs. Commissioner of Internal RevenuejafernandОценок пока нет

- A. Tax Assessment - Xiii. RCBC vs. CIR, GR No. 170257, 7 September 2011Документ2 страницыA. Tax Assessment - Xiii. RCBC vs. CIR, GR No. 170257, 7 September 2011VINCENTREY BERNARDOОценок пока нет

- CONFLICTSДокумент7 страницCONFLICTSIrish PrecionОценок пока нет

- TrustДокумент3 страницыTrustLm RicasioОценок пока нет

- Digest WT Construction v. CaneteДокумент1 страницаDigest WT Construction v. CanetemunirahОценок пока нет

- Lotto Restaurant Corp Vs BPIДокумент5 страницLotto Restaurant Corp Vs BPIEricson Sarmiento Dela CruzОценок пока нет

- CIR Vs CTA and CitysuperДокумент3 страницыCIR Vs CTA and CitysuperEllaine BernardinoОценок пока нет

- Verendia Vs CA and Fidelity & SuretyДокумент1 страницаVerendia Vs CA and Fidelity & SuretyBryan-Charmaine ZamboОценок пока нет

- International Express Travel & Tour Services, Inc., PetitionerДокумент2 страницыInternational Express Travel & Tour Services, Inc., PetitionerAnthonyms SingzonОценок пока нет

- Legal Ethics Case ReportДокумент32 страницыLegal Ethics Case ReportKarl Rigo AndrinoОценок пока нет

- AMERICAN POWER CONVERSION CORPORATION Vs LIMДокумент23 страницыAMERICAN POWER CONVERSION CORPORATION Vs LIMRothea SimonОценок пока нет

- 20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931Документ7 страниц20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931joyeduardoОценок пока нет

- RCBC V CIRДокумент2 страницыRCBC V CIRPJ Hong100% (1)

- 67 Medicard Philippines, Inc. v. CIRДокумент5 страниц67 Medicard Philippines, Inc. v. CIRclarkorjaloОценок пока нет

- Larranaga v. Philippines, Comm. 1421:2005, U.N. Doc. A:61:40, Vol. II, at 406 (HRC 2006)Документ24 страницыLarranaga v. Philippines, Comm. 1421:2005, U.N. Doc. A:61:40, Vol. II, at 406 (HRC 2006)Jezzene Gail R. PalerОценок пока нет

- (Insurance) (David) (Phil. Health Care Providers v. CIR)Документ4 страницы(Insurance) (David) (Phil. Health Care Providers v. CIR)Dennice Erica DavidОценок пока нет

- PCIB Vs Escolin - G.R. Nos. L-27860 & L-27896. March 29, 1974Документ78 страницPCIB Vs Escolin - G.R. Nos. L-27860 & L-27896. March 29, 1974Ebbe DyОценок пока нет

- Tan vs. CA and PhilamДокумент2 страницыTan vs. CA and PhilamJanelle ManzanoОценок пока нет

- VDA DE MAGLANA VДокумент2 страницыVDA DE MAGLANA Vxerah0808Оценок пока нет

- Nieva vs. PeopleДокумент8 страницNieva vs. PeopleMp CasОценок пока нет

- CIR Vs Smart CommunicationsДокумент1 страницаCIR Vs Smart CommunicationsHoreb FelixОценок пока нет

- CIR V SmartДокумент9 страницCIR V SmartChristiane Marie BajadaОценок пока нет

- 13 CIR Vs SmartДокумент13 страниц13 CIR Vs SmartEMОценок пока нет

- Factual Antecedents: Today Is Friday, September 19, 2014Документ7 страницFactual Antecedents: Today Is Friday, September 19, 2014annabanana07Оценок пока нет

- Jerry Mapili vs. Philippine Rabbit Bus Lines:, Inc., GR 172506, July 27, 2011. First Division Del CastilloДокумент1 страницаJerry Mapili vs. Philippine Rabbit Bus Lines:, Inc., GR 172506, July 27, 2011. First Division Del CastilloneneneneneОценок пока нет

- Navia vs. PardicoДокумент1 страницаNavia vs. PardiconeneneneneОценок пока нет

- Manila Electric Company v. BeltranДокумент1 страницаManila Electric Company v. BeltranneneneneneОценок пока нет

- Facts:: Kalaw v. Fernandez, G.R. No. 166357, September 19, 2011Документ1 страницаFacts:: Kalaw v. Fernandez, G.R. No. 166357, September 19, 2011neneneneneОценок пока нет

- Mahinay v. Gako, G.R. No. 165338, 179375, 28 November 2011. (First Division)Документ2 страницыMahinay v. Gako, G.R. No. 165338, 179375, 28 November 2011. (First Division)neneneneneОценок пока нет

- Duarte v. Duran, GR 173038, Sept 14, 2011 (Civil Law Contract of Sale)Документ1 страницаDuarte v. Duran, GR 173038, Sept 14, 2011 (Civil Law Contract of Sale)neneneneneОценок пока нет

- Pigcaulan v. Security and Credit Investigation, GR 173648, 16 January 2012Документ1 страницаPigcaulan v. Security and Credit Investigation, GR 173648, 16 January 2012neneneneneОценок пока нет

- MoF Company Inc Vs Shin Brokerage CorpДокумент2 страницыMoF Company Inc Vs Shin Brokerage CorpneneneneneОценок пока нет

- Bacolor vs. VL Makabali Memorial Hospital, Inc., GR No. 204325, Apr 18, 2016.Документ2 страницыBacolor vs. VL Makabali Memorial Hospital, Inc., GR No. 204325, Apr 18, 2016.neneneneneОценок пока нет

- Madamba v. Lara (2009)Документ1 страницаMadamba v. Lara (2009)neneneneneОценок пока нет

- GST - PAO - Clarification Regarding Delegation of Powers To The Departmental OfficersДокумент1 страницаGST - PAO - Clarification Regarding Delegation of Powers To The Departmental OfficersSyed Ibrahim100% (4)

- Form of Declaration To Be Made in Respect of A Motor Vehicle Used or Kept For Use in The StateДокумент2 страницыForm of Declaration To Be Made in Respect of A Motor Vehicle Used or Kept For Use in The StateRohit JainОценок пока нет

- Note On House Rent AllowanceДокумент5 страницNote On House Rent AllowanceAbhisek SarkarОценок пока нет

- GCash Bills Pay ReceiptДокумент1 страницаGCash Bills Pay ReceiptRCVZ BKОценок пока нет

- Chapter 13C Optional Standard DeductionsДокумент3 страницыChapter 13C Optional Standard DeductionsJason Mables100% (1)

- Salary QuestionsДокумент3 страницыSalary QuestionsgixОценок пока нет

- Axis TDS Challan Form PDFДокумент1 страницаAxis TDS Challan Form PDFSiva ReddyОценок пока нет

- Quotation: State Name: Tamil Nadu, Code: 33Документ1 страницаQuotation: State Name: Tamil Nadu, Code: 33prasadmvkОценок пока нет

- Currently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.Документ1 страницаCurrently, Atlas Tours Has $5.88 Million in Assets. This Is A Peak Six-Month Period.laale dijaanОценок пока нет

- Paywithtaxslip 102324 PDFДокумент1 страницаPaywithtaxslip 102324 PDFamitshrivastava154218Оценок пока нет

- Premium Tax Credit PTCДокумент2 страницыPremium Tax Credit PTCpqr1Оценок пока нет

- Grayscale Bitcoin Trust BTC 2019 Tax Information - FinalДокумент17 страницGrayscale Bitcoin Trust BTC 2019 Tax Information - FinalEjikeume DennisОценок пока нет

- Withholding Tax Explained With Example - Sap Concept HubДокумент3 страницыWithholding Tax Explained With Example - Sap Concept HubAnanthakumar AОценок пока нет

- Electronic IRS Tax Form Certification W8Документ1 страницаElectronic IRS Tax Form Certification W8WattamanОценок пока нет

- Income Statement PT/PD . PeriodeДокумент1 страницаIncome Statement PT/PD . PeriodeIski Triana IchiОценок пока нет

- Reviewer On Transfer and Business TaxesДокумент2 страницыReviewer On Transfer and Business TaxesAndre CarrerasОценок пока нет

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Документ1 страницаDetails of Receiver (Billed To) Details of Consignee (Shipped To)VESTIGE JVRATNAMОценок пока нет

- Estimate / Quotation: Activity - Window CostingДокумент1 страницаEstimate / Quotation: Activity - Window CostingM.K. JaiswalОценок пока нет

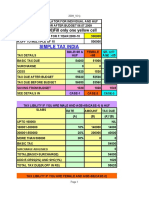

- Tax Calculator AY 09-10Документ4 страницыTax Calculator AY 09-10madhuamsОценок пока нет

- 1 - Raj Laxmi ConstructionДокумент2 страницы1 - Raj Laxmi Constructionpriyanka singhОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- Cargo Agent Presentation For GST March 2018Документ13 страницCargo Agent Presentation For GST March 2018rishi pandeyОценок пока нет

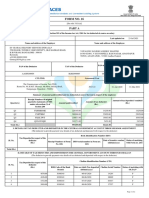

- Form No. 16: Part AДокумент6 страницForm No. 16: Part AVinuthna ChinnapaОценок пока нет

- 894411921500234RPOSДокумент2 страницы894411921500234RPOSÃtúl GàñgwäřОценок пока нет

- Inv 004093Документ1 страницаInv 004093Hyderabad CastingsОценок пока нет

- Quiz 5 Income TaxДокумент9 страницQuiz 5 Income TaxjohndanielsantosОценок пока нет

- Balgruha: Chandrabhan Athare Patil Gram Navodaya TrustДокумент1 страницаBalgruha: Chandrabhan Athare Patil Gram Navodaya TrustJeffery CurtisОценок пока нет

- 3) Howden Vs CIRДокумент2 страницы3) Howden Vs CIRjoyceОценок пока нет

- Authorised SignatoryДокумент2 страницыAuthorised Signatorygaurav tanwarОценок пока нет

- SCALP Handout 044Документ10 страницSCALP Handout 044Angelica PatagОценок пока нет