Академический Документы

Профессиональный Документы

Культура Документы

How To Automate SSS

Загружено:

info0 оценок0% нашли этот документ полезным (0 голосов)

758 просмотров3 страницыHOW TO AUTOMATE SSS

Оригинальное название

HOW TO AUTOMATE SSS

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документHOW TO AUTOMATE SSS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

758 просмотров3 страницыHow To Automate SSS

Загружено:

infoHOW TO AUTOMATE SSS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

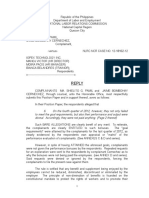

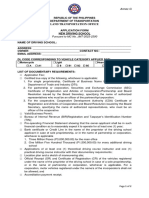

How to Automate the Computation of SSS EE, ER, and EC using MS

Excel VBA Codes?

Is it possible to automate the computation of the SSS EE, ER, and EC components? The answer is Yes! With

the use of MS Excel VBA Codes which is built-in with your MS Office, you can easily automate the

computation of the SSS contributions. It is simple and you can follow these simple steps

1. Open a blank MS Excel Application

2. Press Alt+F11 to open the Visual Basic Editor

3. Make a module in the Visual Basic Editor

4. Copy and paste the following in the module created

Option Explicit

Function SssEECont(SalaryBase)

'SssEECont = Social Security Services Employee Contribution

Select Case SalaryBase

Case 1000 To 1249.999999: SssEECont = 33.3

Case 1250 To 1749.999999: SssEECont = 50

Case 1750 To 2249.999999: SssEECont = 66.7

Case 2250 To 2749.999999: SssEECont = 83.3

Case 2750 To 3249.999999: SssEECont = 100

Case 3250 To 3749.999999: SssEECont = 116.7

Case 3750 To 4249.999999: SssEECont = 133.3

Case 4250 To 4749.999999: SssEECont = 150

Case 4750 To 5249.999999: SssEECont = 166.7

Case 5250 To 5749.999999: SssEECont = 183.3

Case 5750 To 6249.999999: SssEECont = 200

Case 6250 To 6749.999999: SssEECont = 216.7

Case 6750 To 7249.999999: SssEECont = 233.3

Case 7250 To 7749.999999: SssEECont = 250

Case 7750 To 8249.999999: SssEECont = 266.7

Case 8250 To 8749.999999: SssEECont = 283.3

Case 8750 To 9249.999999: SssEECont = 300

Case 9250 To 9749.999999: SssEECont = 316.7

Case 9750 To 10249.999999: SssEECont = 333.3

Case 10250 To 10749.999999: SssEECont = 350

Case 10750 To 11249.999999: SssEECont = 366.7

Case 11250 To 11749.999999: SssEECont = 383.3

Case 11750 To 12249.999999: SssEECont = 400

Case 12250 To 12749.999999: SssEECont = 416.7

Case 12750 To 13249.999999: SssEECont = 433.3

Case 13250 To 13749.999999: SssEECont = 450

Case 13750 To 14249.999999: SssEECont = 466.7

Case 14250 To 14749.999999: SssEECont = 483.3

Case Is >= 14750: SssEECont = 500

End Select

End Function

Function SssERCont(SalaryBase)

'SssERCont = Social Secutiry Services Employer Contribution

Select Case SalaryBase

Case 1000 To 1249.999999: SssERCont = 70.7

Case 1250 To 1749.999999: SssERCont = 106

Case 1750 To 2249.999999: SssERCont = 141.3

Case 2250 To 2749.999999: SssERCont = 176.7

Case 2750 To 3249.999999: SssERCont = 212

Case 3250 To 3749.999999: SssERCont = 247.3

Case 3750 To 4249.999999: SssERCont = 282.7

Case 4250 To 4749.999999: SssERCont = 318

Case 4750 To 5249.999999: SssERCont = 353.3

Case 5250 To 5749.999999: SssERCont = 388.7

Case 5750 To 6249.999999: SssERCont = 424

Case 6250 To 6749.999999: SssERCont = 459.3

Case 6750 To 7249.999999: SssERCont = 494.7

Case 7250 To 7749.999999: SssERCont = 530

Case 7750 To 8249.999999: SssERCont = 565.3

Case 8250 To 8749.999999: SssERCont = 600.7

Case 8750 To 9249.999999: SssERCont = 636

Case 9250 To 9749.999999: SssERCont = 671.3

Case 9750 To 10249.999999: SssERCont = 706.7

Case 10250 To 10749.999999: SssERCont = 742

Case 10750 To 11249.999999: SssERCont = 777.3

Case 11250 To 11749.999999: SssERCont = 812.7

Case 11750 To 12249.999999: SssERCont = 848

Case 12250 To 12749.999999: SssERCont = 883.3

Case 12750 To 13249.999999: SssERCont = 918.7

Case 13250 To 13749.999999: SssERCont = 954

Case 13750 To 14249.999999: SssERCont = 989.3

Case 14250 To 14749.999999: SssERCont = 1024.7

Case Is >= 14750: SssERCont = 1060

End Select

End Function

Function SssEC(SalaryBase)

'SssEC = Employer Contribution

Select Case SalaryBase

Case 1 To 14749.999999: SssEC = 10

Case Is >= 14750: SssEC = 30

End Select

End Function

5. Save the VB Editor and the Excel File with “filename.xlsm” format

6. Test the functions in excel

1.

=SSSEECont(salary base)

=SSSERCont(salary base)

=SSSEC(salary base)

A video tutorial on step-by-step process will be uploaded soon including the blank excel file. Do not forget to

subscribe to our pressroom for free information. Thank you for reading.

Вам также может понравиться

- SSS RTPLДокумент124 страницыSSS RTPLgarcia_ronaОценок пока нет

- Citigroup Memo - Cut SpendingДокумент4 страницыCitigroup Memo - Cut Spendingcutem100% (5)

- Fire Code Sale TaxДокумент2 страницыFire Code Sale TaxDanilo MuñozОценок пока нет

- Sample Self Certification FormДокумент1 страницаSample Self Certification FormSai PastranaОценок пока нет

- Membership Savings Remittance Form (MSRF) : HQP-PFF-053Документ2 страницыMembership Savings Remittance Form (MSRF) : HQP-PFF-053Steve SmithОценок пока нет

- FPIP Vehicle Sticker Application FormДокумент2 страницыFPIP Vehicle Sticker Application FormBryan Amerna100% (2)

- FSCS02 Granting Liquidation and Accounting For Cash AdvancesДокумент12 страницFSCS02 Granting Liquidation and Accounting For Cash AdvancesPauline Caceres AbayaОценок пока нет

- CCTV Technician Job DescriptionДокумент2 страницыCCTV Technician Job DescriptionCyril Rei Raymundo100% (1)

- Driver As Ordinary Employee: No OT Pay For Drivers Who Are Field PersonnelДокумент3 страницыDriver As Ordinary Employee: No OT Pay For Drivers Who Are Field PersonnelNewCovenantChurchОценок пока нет

- Annual Work Accident ReportДокумент2 страницыAnnual Work Accident ReportrevertlynОценок пока нет

- AAO Electronic Online System Form - 18mar2021-1Документ1 страницаAAO Electronic Online System Form - 18mar2021-1CherryMaeRamirezAustinОценок пока нет

- IADM Driver's OT ACCOMPLISHMENT REPORTДокумент2 страницыIADM Driver's OT ACCOMPLISHMENT REPORTJocelyn NapiereОценок пока нет

- Memo To Suppliers - Invoicing Requirements - 2019Документ5 страницMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesОценок пока нет

- Alpha ListДокумент22 страницыAlpha ListArnold BaladjayОценок пока нет

- Sec MC 28 S2020Документ1 страницаSec MC 28 S2020mildredОценок пока нет

- State of Emergency Leave MemoДокумент2 страницыState of Emergency Leave MemoJon OrtizОценок пока нет

- Biodata Revised As of 11.5.18Документ1 страницаBiodata Revised As of 11.5.18Oceanspeed LogisticsОценок пока нет

- WeAccess PAG-IBIG Bills Payment - 18JUNE2014Документ31 страницаWeAccess PAG-IBIG Bills Payment - 18JUNE2014Jonathan Beverly Jane100% (1)

- Wage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductДокумент5 страницWage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductECMH ACCOUNTING AND CONSULTANCY SERVICESОценок пока нет

- CERTIFICATION AgenaДокумент30 страницCERTIFICATION AgenaJohn Ervin AgenaОценок пока нет

- MC 2018-034 - Updated Guidelines On RATAДокумент7 страницMC 2018-034 - Updated Guidelines On RATAKarla KatigbakОценок пока нет

- Pull Out FormДокумент1 страницаPull Out FormMerry Jaine OrtilloОценок пока нет

- AIRB Cover LetterДокумент1 страницаAIRB Cover Letterhazel sabinoОценок пока нет

- Gate Pass FormДокумент77 страницGate Pass FormJessel Emily Shyra PolicarpioОценок пока нет

- DOLE - DO 174.renewal - Version1Документ1 страницаDOLE - DO 174.renewal - Version1amadieu100% (1)

- Personnel Movement FormДокумент1 страницаPersonnel Movement FormCathleya Marie CoОценок пока нет

- Bir Ruling Da 086 08Документ5 страницBir Ruling Da 086 08Orlando O. CalundanОценок пока нет

- PD851Документ1 страницаPD851jenОценок пока нет

- Project ProposalДокумент2 страницыProject ProposalHwahwhhaaОценок пока нет

- OB and Attendance PolicyДокумент2 страницыOB and Attendance PolicyAshna MeiОценок пока нет

- Operations Order SBM NO. 2014-013Документ3 страницыOperations Order SBM NO. 2014-013Thelma Evangelista100% (1)

- NOLCO ReportДокумент9 страницNOLCO ReportfebwinОценок пока нет

- Certification of Separation and Non-Advancement of Sss Sickness BenefitДокумент1 страницаCertification of Separation and Non-Advancement of Sss Sickness BenefitMaria Angela DebuqueОценок пока нет

- eSRS GuideДокумент3 страницыeSRS GuideJulio LuisОценок пока нет

- Osh Rules For Outsourced ProvidersДокумент10 страницOsh Rules For Outsourced ProvidersrobinrubinaОценок пока нет

- Authorisation LetterДокумент1 страницаAuthorisation LetterLalaine MarianoОценок пока нет

- Updated Travel and Meal Allowance (2) 1 1Документ3 страницыUpdated Travel and Meal Allowance (2) 1 1Ja Met PhilОценок пока нет

- Memo For Gate PassДокумент1 страницаMemo For Gate Passanunisha97Оценок пока нет

- Case 017 Nte A5 Absenteeism Daniel Tomas 09142022Документ1 страницаCase 017 Nte A5 Absenteeism Daniel Tomas 09142022NcfPrime RecruitmentОценок пока нет

- Cell Phone Allowance ProcedureДокумент4 страницыCell Phone Allowance ProcedureSIVARAMANJAGANATHAN100% (1)

- Pullout Form Lady NДокумент1 страницаPullout Form Lady NGe Villaver-SalvaneОценок пока нет

- PAMIL - ReplyДокумент2 страницыPAMIL - ReplyGerald HernandezОценок пока нет

- OTGCI Truckers Accreditation Form 2019 PDFДокумент3 страницыOTGCI Truckers Accreditation Form 2019 PDFOmar FrianezaОценок пока нет

- DOLE BWC OHSD IP 5 (Reprot On Health and Safety Organization)Документ1 страницаDOLE BWC OHSD IP 5 (Reprot On Health and Safety Organization)Jerjohn TesorioОценок пока нет

- Saln Summary List Off IlersДокумент3 страницыSaln Summary List Off IlersJoy Fernandez100% (1)

- Articles of Incorporation-Non Stock CorpДокумент6 страницArticles of Incorporation-Non Stock Corpapi-687132962Оценок пока нет

- Amla CF (Draft)Документ25 страницAmla CF (Draft)Araceli GloriaОценок пока нет

- Internship ContractДокумент8 страницInternship ContractAbelardo DaculongОценок пока нет

- C Ertificate of Creditable Tax W Ithheld at Source C Ertificate of Creditable Tax W Ithheld at SourceДокумент3 страницыC Ertificate of Creditable Tax W Ithheld at Source C Ertificate of Creditable Tax W Ithheld at SourceVher Christopher Ducay0% (1)

- Awol Final1Документ3 страницыAwol Final1071409Оценок пока нет

- Recommendation Letter 3Документ1 страницаRecommendation Letter 3Rnm ZltaОценок пока нет

- Order To Close - D'spot PharmacyДокумент2 страницыOrder To Close - D'spot PharmacyCharmila SiplonОценок пока нет

- Philippine Shippers Bureau AO No. 06 S. 2005Документ22 страницыPhilippine Shippers Bureau AO No. 06 S. 2005PortCalls50% (2)

- Annex G - New Application Form DSДокумент2 страницыAnnex G - New Application Form DSSSJ7Оценок пока нет

- Acknowledgment ReceiptДокумент1 страницаAcknowledgment ReceiptSubStation Otso Pasig CpsОценок пока нет

- Class 6 Maths Notes Knowing Your NumbersДокумент15 страницClass 6 Maths Notes Knowing Your NumbersRamarao ntОценок пока нет

- 106 - Troubleshooting Common Issues EnglishДокумент38 страниц106 - Troubleshooting Common Issues EnglishAtul KaleОценок пока нет

- Module 07Документ39 страницModule 07NDTInstructor100% (1)

- Exercise Chapter 6.1.1Документ3 страницыExercise Chapter 6.1.1Tuấn DũngОценок пока нет

- Fundamentals of Database Systems 6th Edition Elmasri Solutions ManualДокумент9 страницFundamentals of Database Systems 6th Edition Elmasri Solutions ManualEricJacksonfdbpm100% (13)

- Overtime FormДокумент1 страницаOvertime ForminfoОценок пока нет

- Janitorial EquipmentДокумент9 страницJanitorial EquipmentinfoОценок пока нет

- Baguio Escapade May 24-27, 2024Документ6 страницBaguio Escapade May 24-27, 2024infoОценок пока нет

- Gate Pass PuffiДокумент1 страницаGate Pass PuffiinfoОценок пока нет

- Gate Pass PuffiДокумент1 страницаGate Pass PuffiinfoОценок пока нет

- No Overtime FormДокумент1 страницаNo Overtime ForminfoОценок пока нет

- Affidavit of LossДокумент2 страницыAffidavit of LossinfoОценок пока нет

- DOLE Handbook-English Version 2014Документ73 страницыDOLE Handbook-English Version 2014Mark Aguinaldo100% (2)

- Biosecurity Biometric Step by Step Training Guide With Web ServerДокумент89 страницBiosecurity Biometric Step by Step Training Guide With Web ServerinfoОценок пока нет

- Declared Spirit Hail Mary Art ThouДокумент4 страницыDeclared Spirit Hail Mary Art ThouinfoОценок пока нет

- Microsoft ActivationДокумент5 страницMicrosoft ActivationinfoОценок пока нет

- SMBP Payment Thru The Bank Form PDFДокумент2 страницыSMBP Payment Thru The Bank Form PDFAnonymous t4Iy7YiqC0% (1)

- PMRFДокумент2 страницыPMRFKrizel Joy Serrano90% (10)

- Half Yearly Examination, 2017-18: MathematicsДокумент7 страницHalf Yearly Examination, 2017-18: MathematicsSusanket DuttaОценок пока нет

- 2021 Individual 20546 (Lawrence, Stephen R. and Bette F.) ClientДокумент18 страниц2021 Individual 20546 (Lawrence, Stephen R. and Bette F.) ClientVANDA MOOREОценок пока нет

- C103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratoriesДокумент19 страницC103 - General Checklist - ISO-IEC 17025:2017 Accreditation of Field Testing and Field Calibration LaboratorieshuidhyiuodghОценок пока нет

- Linux and The Unix PhilosophyДокумент182 страницыLinux and The Unix PhilosophyTran Nam100% (1)

- (Polish Journal of Sport and Tourism) The Estimation of The RAST Test Usefulness in Monitoring The Anaerobic Capacity of Sprinters in AthleticsДокумент5 страниц(Polish Journal of Sport and Tourism) The Estimation of The RAST Test Usefulness in Monitoring The Anaerobic Capacity of Sprinters in AthleticsAfizieОценок пока нет

- Free ConvectionДокумент4 страницыFree ConvectionLuthfy AditiarОценок пока нет

- 한국항만 (영문)Документ38 страниц한국항만 (영문)hiyeonОценок пока нет

- Swot Analysis of Indian EconomyДокумент2 страницыSwot Analysis of Indian EconomymyeyesrbeautОценок пока нет

- Essay On Stem CellsДокумент4 страницыEssay On Stem CellsAdrien G. S. WaldОценок пока нет

- Furniture AnnexДокумент6 страницFurniture AnnexAlaa HusseinОценок пока нет

- Very Hungry Caterpillar Clip CardsДокумент5 страницVery Hungry Caterpillar Clip CardsARTGRAVETO ARTОценок пока нет

- Final LUS EvaluationДокумент36 страницFinal LUS EvaluationNextgenОценок пока нет

- 3-A Y 3-B Brenda Franco DíazДокумент4 страницы3-A Y 3-B Brenda Franco DíazBRENDA FRANCO DIAZОценок пока нет

- AN44061A Panasonic Electronic Components Product DetailsДокумент3 страницыAN44061A Panasonic Electronic Components Product DetailsAdam StariusОценок пока нет

- Rare Watches (Christie's) 16. 05. 2016.Документ236 страницRare Watches (Christie's) 16. 05. 2016.Simon LászlóОценок пока нет

- GST RATE LIST - pdf-3Документ6 страницGST RATE LIST - pdf-3Niteesh KumarОценок пока нет

- Carbohydrates StainsДокумент43 страницыCarbohydrates StainssupahvyОценок пока нет

- S3 U4 MiniTestДокумент3 страницыS3 U4 MiniTestĐinh Thị Thu HàОценок пока нет

- PID Marcado Operación Del Paquete Del Compresor de Hidrogeno PHP-K-002 PDFДокумент7 страницPID Marcado Operación Del Paquete Del Compresor de Hidrogeno PHP-K-002 PDFDenisОценок пока нет

- Cornish BoilerДокумент3 страницыCornish BoilerDeepak KV ReddyОценок пока нет

- Construction Claims and Contract Admin CPDДокумент40 страницConstruction Claims and Contract Admin CPDCraig FawcettОценок пока нет

- Bearing 1Документ27 страницBearing 1desalegn hailemichaelОценок пока нет

- Coal Mining Technology and SafetyДокумент313 страницCoal Mining Technology and Safetymuratandac3357Оценок пока нет

- ANTINEOPLASTICSДокумент21 страницаANTINEOPLASTICSGunjan KalyaniОценок пока нет

- School Activity Calendar - Millsberry SchoolДокумент2 страницыSchool Activity Calendar - Millsberry SchoolSushil DahalОценок пока нет

- TCGRX BullsEye Tablet SplitterДокумент2 страницыTCGRX BullsEye Tablet SplittermalucОценок пока нет

- Student Research Project Science ReportДокумент8 страницStudent Research Project Science Reportapi-617553177Оценок пока нет

- MATH 304 Linear Algebra Lecture 9 - Subspaces of Vector Spaces (Continued) - Span. Spanning Set PDFДокумент20 страницMATH 304 Linear Algebra Lecture 9 - Subspaces of Vector Spaces (Continued) - Span. Spanning Set PDFmurugan2284Оценок пока нет

- Rosewood Case AnalysisДокумент5 страницRosewood Case AnalysisJayant KushwahaОценок пока нет

- Presentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022Документ9 страницPresentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022dakmts07Оценок пока нет