Академический Документы

Профессиональный Документы

Культура Документы

Transaction Form For STP & SWP: 1. Applicant Information

Загружено:

Chintan JainОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Transaction Form For STP & SWP: 1. Applicant Information

Загружено:

Chintan JainАвторское право:

Доступные форматы

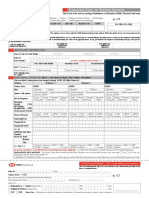

Transaction Form For STP & SWP

Please refer to the General Instructions for assistance. If you are not investing through a Distributor, write DIRECT in the Distributor Code. Time Stamp

Distributor Code Sub-Distributor ARN EUIN Branch Code Relationship Manager’s Name

Sub-Distributor Code Mobile +91-

ARN-

Initial Commission will be paid by the investor directly to the distributor, based on assessment of various factors including the service rendered by the Distributor.

Transaction Charges Investor’s Declaration where EUIN is not furnished

SEBI (Mutual Fund) Regulations allow deduction of transaction charges of I/We confirm that the EUIN box has been intentionally left blank by me/us as this is an “execution

Rs. 100/- from your investment for payment to your distributor if your distributor has opted only” transaction without any interaction or advice by the employee/relationship manager/

to receive transaction charges for investments sourced by him. The transaction charges sales person of the above distributor and/or notwithstanding the advice of inappropriateness,

deductible are Rs. 150/- if you are investing in Mutual Funds for the first time. If you are if any, provided by the employee/relationship manager/sales person of distributor and the

making a SIP Investment, the transaction charges would be deducted over 3-4 instalments. distributor has not charged any advisory fees on this transaction.

No transaction charges would be levied if you are not investing through a Distributor or your

investment amount is less than Rs.10,000/-

If this is the first time, you are investing in any mutual fund, please tick here Sole/1st Applicant 2nd Applicant 3rd Applicant

1. APPLICANT INFORMATION

Name of Sole/1st Unit Holder First Name Middle Name Last Name Folio No.

PAN First Unit Holder Second Unit Holder Third Unit Holder

KYC is mandatory. Please enclose a copy of KYC acknowledgement letters for all applicants.

Mobile No. +91- E-mail ID

2. SYSTEMATIC WITHDRAWAL PLAN (SWP) - Please note that the value of the unit balance in the source scheme should be at least Rs. 25,000

Scheme Name L&T Option (ü) Growth Dividend Reinvestment Dividend Payout

Dividend Frequency (üwherever applicable) Daily Weekly Monthly* Quarterly Annual^ Semi-Annual^

Withdrawal preference (ü) Amount (`) OR Capital Appreciation (Available for GROWTH plan only)

Withdrawal frequency (ü) Monthly* Quarterly Semi-Annual Annual

Withdrawal date (ü) 1st 5th 10th* 15th 20th 25th Withdrawal period From M M Y Y Y Y To M M Y Y Y Y OR Till balance

3. SYSTEMATIC TRANSFER PLAN (STP) - Please note that the value of the unit balance in the source scheme should be at least Rs. 25,000

Scheme Name L&T Option (ü) Growth Bonus^ Dividend Reinvestment Dividend Payout

Dividend Frequency (üwherever applicable) Daily Weekly Monthly* Quarterly Annual^ Semi-Annual^

To Scheme L&T Option (ü) Growth* Dividend Reinvestment Dividend Payout

Dividend Frequency (üwherever applicable) Daily Weekly Monthly* Quarterly Annual^ Semi-Annual^

Transfer preference (ü) Amount (`) OR Capital Appreciation (Available for GROWTH plan only) From M M Y Y Y Y To M M Y Y Y Y OR Till balance

Transfer frequency (ü) Daily Weekly (ü) Mon* Tue Wed Thu Fri Fortnightly(ü) 1st 15th*

Monthly* Quarterly (ü) 1st 5th 10th* 15th 20th 25th

*Default option if not selected ^Available in select schemes only

4. DECLARATION & SIGNATURES (To be signed as per Mode of Holding)

I/We have read and understood the respective Scheme Information Document, Statement of Additional Information and Key Information Memorandum. I/We have neither received

nor been induced by any rebate or gifts, directly or indirectly in making this transaction. I/We understand that the upfront commission will be paid directly by me/us to the AMFI

registered distributors based on my/our assessment of various factors including the service rendered by the distributor. Also, the AMFI registered distributor has disclosed the

commissions to me/us (in trail commission or any other), payable to him for different schemes of mutual funds from amongst which the scheme is being recommended to me/us

(Sole/First Unit Holder) (Second Unit Holder) (Third Unit Holder)

Acknowledgement Slip (To be filled in by the Applicant)

Folio No. Received from Name of the Sole/First Unit Holder

Scheme/Plan/Option

For Office Use Only

SWP Instalment amount Frequency(ü) Monthly Quarterly

STP Instalment amount Frequency(ü) Monthly Quarterly Weekly Fortnightly

Acknowledgement

Stamp & Date

General Instructions

Please read the below instructions carefully before filling the form. Please fill up the form in English in BLOCK LETTERS with black or dark ink. All information sought in

the form is mandatory except where it is specifically indicated as optional. All instructions & notes are subject to SEBI & AMFI guidelines as amended from time to time.

Please note in case of any error while filling the form all applicants must sign against the corrections.

1. Applicant Information: Please furnish the Folio Number, Name and PAN of Sole d. If the plan/option if the source scheme is not mentioned and there is only one

/ First Applicant Section 1 of the Form. Your investment would be processed in the plan/option available in the folio, the STP will be processed.

specified folio.

e. If the plan/option of the target scheme is not mentioned, the STP will be processed

Your personal information and bank account details would apply to this investment as as per the default options mentioned in the Scheme Information Document of the

well. respective scheme.

Contact Details: Please provide the Mobile Number and E-Mail Address of the f. In case the criterion of the minimum amount for the purpose of transfer of units

Sole / First Applicant in the form in case of Individuals and Key Contact in case under the STP facility is not met, the AMC reserves the right to discontinue the

of Non Individuals. This would help us seamlessly communicate with you on your STP/cancel the registration for STP..

investments.

g. Daily STP is availble only for fixed amounts.

2. Systematic Withdrawal Plan (SWP):

h. STP transfers can be made on a daily basis i.e. Monday to Friday subject to such

a. The minimum withdrawal size is Rs 500. days being business days..

b. SWP will be registered within 7 calendar days from the date of your request. 4. Signatures: All signatures should be in English or any other Indian Language.

Thumb impressions should be from the left hand in case of males and right hand in

c. You can cancel a registered SWP at any time by submitting a written request. The

case of females. All such thumb impressions need to be attested by a Magistrate,

cancellation will be processed within 15 days.

Notary Public or Special Executive Magistrate under his/her official seal.

d. If your SWP request specifies both amount and units, the SWP will be processed

5. Employees Unique Identification Number (EUIN): If you are making this investment

on the basis of amount.

based on an investment advise received from your distributor, please quote the

e. If the scheme/plan/option is not mentioned and there is only one scheme/plan/ Employees Unique Identification Number (EUIN) of your relationship manager in the

option available in the folio, the same will be processed. Application Form.

3. Systematic Transfer Plan (STP): If your distributor has, however, not given you any advice pertaining to the investment

or your investment decision is not withstanding the advice provided by your distributor

a. The minimum transfer size is Rs 500.

regarding inappropriateness of the scheme vis-a-vis your investment needs, the

b. STP will be registered within 7 calendar days from the date of your request. EUIN box may be left blank. In this case, please sign in the space provided in Section

B to confirm your acceptance to the declaration stated therein.

c. You can cancel a registered STP at any time by submitting a written request. The

cancellation will be processed within 15 days.

call 1800 2000 400 or 1800 4190 200 email investor.line@lntmf.co.in www.lntmf.com

Please note our lines are open from 9 am to 6 pm, Monday to Friday and 9 am to 1 pm on Saturday.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. CL03428

Вам также может понравиться

- Transaction Form SummaryTITLE Transaction Form SummaryДокумент2 страницыTransaction Form SummaryTITLE Transaction Form Summaryakshay moreОценок пока нет

- Systematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationДокумент2 страницыSystematic Investment Plan (SIP) / Micro SIP Form: 1. Applicant InformationAnonymous MAQrYFQDzVОценок пока нет

- Sip Enrolment FormДокумент1 страницаSip Enrolment FormYankit SoniОценок пока нет

- SIP Facility Appl Form V 1Документ4 страницыSIP Facility Appl Form V 1DBCGОценок пока нет

- Av Birla Sip FormДокумент1 страницаAv Birla Sip FormVikas RaiОценок пока нет

- Equity SIP Application Form April 2022Документ8 страницEquity SIP Application Form April 2022Selva KumarОценок пока нет

- Transaction Form: Sole/First Unit Holder PANДокумент2 страницыTransaction Form: Sole/First Unit Holder PANSilparajaОценок пока нет

- SIP Form DebtДокумент6 страницSIP Form DebtNilesh MahajanОценок пока нет

- Common Application Form: Time StampДокумент4 страницыCommon Application Form: Time Stamparshadjafri123Оценок пока нет

- SBI SIP Registration FormДокумент3 страницыSBI SIP Registration FormPrakash JoshiОценок пока нет

- Family Solutions Transaction FormДокумент2 страницыFamily Solutions Transaction FormSelva KumarОценок пока нет

- HDFC Sip Nach FormДокумент6 страницHDFC Sip Nach FormPraveen KumarОценок пока нет

- IIFL MF Common Transaction Unit Holders 022819Документ2 страницыIIFL MF Common Transaction Unit Holders 022819Sabyasachi ChatterjeeОценок пока нет

- Commen Trasaction FormДокумент1 страницаCommen Trasaction Formsandip vishwakarmaОценок пока нет

- SIP Pause/Cancellation FormДокумент1 страницаSIP Pause/Cancellation Formdatadisk10Оценок пока нет

- SIP Pause-Cancellation - Form PDFДокумент1 страницаSIP Pause-Cancellation - Form PDFdatadisk10Оценок пока нет

- Nippon SWPДокумент1 страницаNippon SWPManu S KashyapОценок пока нет

- Sip STP SWP Cancellation FormДокумент2 страницыSip STP SWP Cancellation FormMahesh ChandranОценок пока нет

- Common Transaction Form Financial Transaction Kk3i5z51Документ8 страницCommon Transaction Form Financial Transaction Kk3i5z51Balraj SinghОценок пока нет

- PAN BASED NACH MANDATE CUM SIP REGISTRATIONДокумент2 страницыPAN BASED NACH MANDATE CUM SIP REGISTRATIONDevesh SinghОценок пока нет

- Amc Copy: Enrolment FormДокумент4 страницыAmc Copy: Enrolment FormAhmad ZaibОценок пока нет

- CTF BlankДокумент1 страницаCTF BlankMoney Manager OnlineОценок пока нет

- Transaction Form For Financial Transactions - CL04059Документ4 страницыTransaction Form For Financial Transactions - CL04059Professional positiveОценок пока нет

- Debit Mandate FormДокумент4 страницыDebit Mandate FormAshishОценок пока нет

- SIP Application FormДокумент3 страницыSIP Application FormspeedenquiryОценок пока нет

- Axis CTF FillableДокумент1 страницаAxis CTF FillablemayankОценок пока нет

- SIP Pause-Cancellation - FormДокумент1 страницаSIP Pause-Cancellation - FormSatya Prakash TrivediОценок пока нет

- Common Transaction FormДокумент7 страницCommon Transaction FormSSE CNCОценок пока нет

- Sip Cum Nach FormДокумент8 страницSip Cum Nach FormAmit GuptaОценок пока нет

- Multi Scheme CSIP Facility Application FormatДокумент6 страницMulti Scheme CSIP Facility Application FormatKiranmayi UppalaОценок пока нет

- Reliance Mutual Funds Compelete Application FormДокумент10 страницReliance Mutual Funds Compelete Application FormARVINDОценок пока нет

- Application Form STP / SWP: Distributor InformationДокумент1 страницаApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediОценок пока нет

- Baroda BNP Paribas SIP Form 127Документ2 страницыBaroda BNP Paribas SIP Form 127custodian.archiveОценок пока нет

- UTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormДокумент1 страницаUTI - Systematic Transfer Investment Plan UTI-STP New Editable Application FormAnilmohan SreedharanОценок пока нет

- HSBC Common Transaction Form EditableДокумент2 страницыHSBC Common Transaction Form EditableadwanidsОценок пока нет

- Common Application Form: For Lump Sum/Systematic InvestmentsДокумент4 страницыCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157Оценок пока нет

- STP and SWP Form May17 FillPrintДокумент2 страницыSTP and SWP Form May17 FillPrintRohan KapoorОценок пока нет

- ARN-156449 E282034: 0369910844010 Franklin India Prima Fund - GrowthДокумент1 страницаARN-156449 E282034: 0369910844010 Franklin India Prima Fund - GrowthAnuj SharmaОценок пока нет

- HDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantДокумент7 страницHDFC Retirement Savings Fund: First/ Sole Applicant/ Guardian Third Applicant Second ApplicantAltamash FaridОценок пока нет

- Transaction Form For Existing InvestorsДокумент4 страницыTransaction Form For Existing InvestorsRRKОценок пока нет

- Surrender Form SummaryДокумент3 страницыSurrender Form SummaryDevendra RawoolОценок пока нет

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormДокумент2 страницыCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharОценок пока нет

- Payment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Документ4 страницыPayment Options: (Include Tax, TDS, TCS, Corporate Tax Etc.) (Central Excise & Service Tax)Raju Ram PrajapatОценок пока нет

- Tata Mutual Fund Transaction StatementДокумент5 страницTata Mutual Fund Transaction Statementmaakabhawan26Оценок пока нет

- Enrolment Form For SIP/ Micro SIPДокумент4 страницыEnrolment Form For SIP/ Micro SIPmeatulОценок пока нет

- Lic Nomura MF Capital Protection Oriented Fund - Series 3: ARN-32141 E047160 M351Документ4 страницыLic Nomura MF Capital Protection Oriented Fund - Series 3: ARN-32141 E047160 M351iqbal100% (1)

- Systematic Investment Plan S I P: SIP Enrolment FormДокумент4 страницыSystematic Investment Plan S I P: SIP Enrolment FormRahul SinghОценок пока нет

- Additional Purchase Transaction SlipДокумент1 страницаAdditional Purchase Transaction SlipSuresh SharmaОценок пока нет

- Borang Permintaan Untuk Pertukaran: Request For Change FormДокумент3 страницыBorang Permintaan Untuk Pertukaran: Request For Change FormbrodtmtОценок пока нет

- UTI Transaction SlipДокумент2 страницыUTI Transaction SlipSanjay Puri0% (1)

- Multi Scheme SIP Facility Appl Form SIP With Micro SIP V 1Документ6 страницMulti Scheme SIP Facility Appl Form SIP With Micro SIP V 1rohan ladeОценок пока нет

- Sip & Micro Sip PDC Form - 29.04.2013Документ4 страницыSip & Micro Sip PDC Form - 29.04.2013Aayush ShahОценок пока нет

- Futuregensurrenderform 25Документ2 страницыFuturegensurrenderform 25accountsОценок пока нет

- Common Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoДокумент2 страницыCommon Application Form: Broker Name / ARN Sub Broker Code Appl. No. MA-CAF-ISC Date, Time Stamp Number Reference NoVaibhav BansalОценок пока нет

- Transaction SlipДокумент2 страницыTransaction SlipCavikram JainОценок пока нет

- Application Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Документ2 страницыApplication Form: Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP)Gargi ShuklaОценок пока нет

- Common Application Form for Equity Oriented SchemesДокумент2 страницыCommon Application Form for Equity Oriented SchemesARVINDОценок пока нет

- SIP Registration RenewalForm Dec15Документ2 страницыSIP Registration RenewalForm Dec15singenaadamОценок пока нет

- SERIES 7 EXAM STUDY GUIDE + TEST BANKОт EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKРейтинг: 2.5 из 5 звезд2.5/5 (3)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKРейтинг: 5 из 5 звезд5/5 (1)

- Dhruv Global School Summer Holiday Home Assignment Grade: JR - KGДокумент6 страницDhruv Global School Summer Holiday Home Assignment Grade: JR - KGChintan JainОценок пока нет

- Nursery Holiday Home Assignment EnglishДокумент2 страницыNursery Holiday Home Assignment EnglishChintan JainОценок пока нет

- Show & Tell My Sweet Family: April 2021Документ2 страницыShow & Tell My Sweet Family: April 2021Chintan JainОценок пока нет

- Dhruv Global School, Pune Summer Holiday Home Assignment Grade: JR - KGДокумент7 страницDhruv Global School, Pune Summer Holiday Home Assignment Grade: JR - KGChintan JainОценок пока нет

- Transaction Form For STP & SWP: 1. Applicant InformationДокумент2 страницыTransaction Form For STP & SWP: 1. Applicant InformationChintan JainОценок пока нет

- Nursery Holiday Home Assignment EvsДокумент1 страницаNursery Holiday Home Assignment EvsChintan JainОценок пока нет

- Happy Holidays!: Things To Do Daily'Документ2 страницыHappy Holidays!: Things To Do Daily'Chintan JainОценок пока нет

- DHRUV GLOBAL SCHOOL NURSERY MATH HOMEWORK ON SAME DIFFERENT BIG SMALL THICK THIN CONCEPTSДокумент3 страницыDHRUV GLOBAL SCHOOL NURSERY MATH HOMEWORK ON SAME DIFFERENT BIG SMALL THICK THIN CONCEPTSChintan JainОценок пока нет

- DAILY HABITS FOR SUCCESSДокумент2 страницыDAILY HABITS FOR SUCCESSChintan JainОценок пока нет

- Fun Activities: Dhruv Global School, Pune Holiday Home Assignment NurseryДокумент14 страницFun Activities: Dhruv Global School, Pune Holiday Home Assignment NurseryChintan JainОценок пока нет

- Hha Cover LetterДокумент1 страницаHha Cover LetterChintan JainОценок пока нет

- Dhruv Global School, Pune Holiday Home Assignment NurseryДокумент2 страницыDhruv Global School, Pune Holiday Home Assignment NurseryChintan JainОценок пока нет

- LESSON 1: Comparing QualitiesДокумент3 страницыLESSON 1: Comparing QualitiesChintan JainОценок пока нет

- Recapitulation:: Dhruv Global School Nursery Foundation Assignment DATE:24 April 2020Документ4 страницыRecapitulation:: Dhruv Global School Nursery Foundation Assignment DATE:24 April 2020Chintan JainОценок пока нет

- LESSON 1: Comparing QualitiesДокумент3 страницыLESSON 1: Comparing QualitiesChintan JainОценок пока нет

- Dhruv Global School Nursery Foundation Assignment DATE:23 April 2020Документ2 страницыDhruv Global School Nursery Foundation Assignment DATE:23 April 2020Chintan JainОценок пока нет

- Fun Activities: Dhruv Global School, Pune Holiday Home Assignment NurseryДокумент14 страницFun Activities: Dhruv Global School, Pune Holiday Home Assignment NurseryChintan JainОценок пока нет

- Dhruv Global School Nursery Foundation Assignment DATE:24 April 2020Документ1 страницаDhruv Global School Nursery Foundation Assignment DATE:24 April 2020Chintan JainОценок пока нет

- Activity Time: Playdough: Dhruv Global School Nursery Foundation Assignment DATE:30 April 2020Документ1 страницаActivity Time: Playdough: Dhruv Global School Nursery Foundation Assignment DATE:30 April 2020Chintan JainОценок пока нет

- DHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEДокумент2 страницыDHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEChintan JainОценок пока нет

- Dhruv Global School Nursery Foundation Assignment DATE:24 April 2020Документ2 страницыDhruv Global School Nursery Foundation Assignment DATE:24 April 2020Chintan JainОценок пока нет

- DHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEДокумент2 страницыDHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEChintan JainОценок пока нет

- Nursery EVS Worksheet on Conceptual UnderstandingДокумент4 страницыNursery EVS Worksheet on Conceptual UnderstandingChintan JainОценок пока нет

- Conceptual Understanding: Nursery MathsДокумент4 страницыConceptual Understanding: Nursery MathsChintan JainОценок пока нет

- Matching Objects: Dhruv Global School Nursery Foundation Assignment DATE:23 April 2020Документ1 страницаMatching Objects: Dhruv Global School Nursery Foundation Assignment DATE:23 April 2020Chintan JainОценок пока нет

- Dhruv Global School Nursery Foundation Assignment DATE:21 April 2020Документ2 страницыDhruv Global School Nursery Foundation Assignment DATE:21 April 2020Chintan JainОценок пока нет

- InitiateSingleEntryPaymentSummary10 07 2020 PDFДокумент1 страницаInitiateSingleEntryPaymentSummary10 07 2020 PDFChintan JainОценок пока нет

- LESSON 1: Myself: Dhruv Global School Nursery Foundation Assignment DATE:21 April 2020Документ3 страницыLESSON 1: Myself: Dhruv Global School Nursery Foundation Assignment DATE:21 April 2020Chintan JainОценок пока нет

- Dhruv Global School Nursery Foundation Assignment DATE:29 April 2020Документ1 страницаDhruv Global School Nursery Foundation Assignment DATE:29 April 2020Chintan JainОценок пока нет

- DHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEДокумент2 страницыDHRUV GLOBAL SCHOOL NURSERY CIRCLE TIMEChintan JainОценок пока нет

- Ift Class Delivery in NetspaceДокумент2 страницыIft Class Delivery in NetspaceJesús Alcalá EstebanОценок пока нет

- Central Hindu School Class 6th Exam: Model Paper SetДокумент13 страницCentral Hindu School Class 6th Exam: Model Paper SetVikas ChaudharyОценок пока нет

- Medado and DacanayДокумент6 страницMedado and DacanayDatu TahilОценок пока нет

- Mandatory Minimum SentencingДокумент10 страницMandatory Minimum Sentencingapi-302985199Оценок пока нет

- Sholawat Diba, Simtud DhurorДокумент12 страницSholawat Diba, Simtud DhurorMaulana MudrikОценок пока нет

- The Setter - Edward Laverack - 1872Документ93 страницыThe Setter - Edward Laverack - 1872Antoan J. HlebarovОценок пока нет

- Hawthorne Studies / ExperimentsДокумент4 страницыHawthorne Studies / ExperimentsAbhijeet GautamОценок пока нет

- Tieng Anh 6 Friends Plus - Review Unit 5&6 Test 2 (Key)Документ6 страницTieng Anh 6 Friends Plus - Review Unit 5&6 Test 2 (Key)Bui The Dung (K16HCM)Оценок пока нет

- Grammar Present Perfect or Simple PastДокумент1 страницаGrammar Present Perfect or Simple PastAndrea100% (1)

- SNR Digital Product Lead - Job DescriptionДокумент2 страницыSNR Digital Product Lead - Job DescriptionMatthew SlightОценок пока нет

- Pangasinan State UniversityДокумент25 страницPangasinan State UniversityAnna Marie Ventayen MirandaОценок пока нет

- Criminal Law Book 2 PPT P1 AutosavedДокумент131 страницаCriminal Law Book 2 PPT P1 AutosavedantoniovinzОценок пока нет

- 8 DischargeДокумент33 страницы8 DischargelelsocОценок пока нет

- Donna Molinari ResumeДокумент4 страницыDonna Molinari Resumeapi-72678201Оценок пока нет

- Conference Pamphlet English Version (2) - 1Документ3 страницыConference Pamphlet English Version (2) - 1AdelОценок пока нет

- Consumer Behavior Factors in Nike's "Find Your GreatnessДокумент3 страницыConsumer Behavior Factors in Nike's "Find Your GreatnessReynaldo Budi RahardjaОценок пока нет

- Qualitative StudyДокумент7 страницQualitative Studyapi-303681050Оценок пока нет

- GCSE Maths Time Series Sample QuestionsДокумент3 страницыGCSE Maths Time Series Sample QuestionsKryptosОценок пока нет

- RAD Studio LiveBindings GuideДокумент63 страницыRAD Studio LiveBindings Guidewolfie002Оценок пока нет

- Bus Org NotesДокумент37 страницBus Org NotesHonorio Bartholomew ChanОценок пока нет

- Ford v. West, 10th Cir. (1998)Документ9 страницFord v. West, 10th Cir. (1998)Scribd Government DocsОценок пока нет

- Criminal Law Bar Exam 2018 Suggested AnswersДокумент19 страницCriminal Law Bar Exam 2018 Suggested AnswersGean Pearl Icao100% (18)

- Guide To Securing Microsoft Windows XP (NSA)Документ141 страницаGuide To Securing Microsoft Windows XP (NSA)prof_ktОценок пока нет

- So You Found Some Quotes From The MRM and Took To The Fainting Couch HuhДокумент3 страницыSo You Found Some Quotes From The MRM and Took To The Fainting Couch HuhDianaОценок пока нет

- Bad Therapy: Matt Zoller SeitzДокумент3 страницыBad Therapy: Matt Zoller SeitzPatrik TeprakОценок пока нет

- Indian Knowledge SystemsДокумент31 страницаIndian Knowledge Systemssaidaiah cheruvupallyОценок пока нет

- Culminiting ActivityДокумент21 страницаCulminiting ActivityAira Sy Balcueba PablicoОценок пока нет

- Scribd Handy HintsДокумент175 страницScribd Handy Hintsshihad79Оценок пока нет

- Civ Pro - Gordon V SteeleДокумент1 страницаCiv Pro - Gordon V SteeleIlliana ParkerОценок пока нет

- Ertyuikjrewdefthyjhertyujkreytyjthm VCДокумент2 страницыErtyuikjrewdefthyjhertyujkreytyjthm VCCedrick Jasper SanglapОценок пока нет