Академический Документы

Профессиональный Документы

Культура Документы

Since Its Inception Notes

Загружено:

Jakobe BusseyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Since Its Inception Notes

Загружено:

Jakobe BusseyАвторское право:

Доступные форматы

Since its inception on December 23, 1913, the Federal Reserve’s goal to “provide the

nation with a safer, more flexible, and more stable monetary and financial system.” Has had

extremely mixed results. From the constraint of the Money Supply during The Great Depression,

to the intense stagflation of the 1970s (where the peak inflation rose to 10 percent), the Federal

Reserve might very well represent the ultimate example of governmental mismanagement that

seems to seep out of every pour of our US institutions. However, we have also had periods of

great Federal Reserve management. For example, the reigning in of the Money Supply post the

catastrophic inflation of the stagflation period during the 1980s led to a relatively stable period of

inflation and expansion throughout the rest of the decade. So, as we scour through the history of

the Federal Reserve, it is important that we preface that things aren’t so “black and white” where

the Federal Reserve is either all good or all evil. There are no angels, there are no demons, just

people and people flub it sometimes.

Before we can actually go into the history of Monetary Policy, we need to define its

primary function and its inner mechanisms. Most of monetary theory follows along something

called the quantity theory of money which, in its most simplistic form, states that the Money

Supply in an economy has a very direct effect on inflation in the economy. To quote perhaps the

most popular economist of the latter half of the 20th century, Milton Friedman, “Inflation is

always and everywhere a monetary phenomenon.” In fact, one of the hallmarks of Friedman’s

Macro Economic theory was the importance of Monetary Policy and its effects on the national

and global economies. But why is this true? One of the ways I explain inflation to my less

economically inclined friends is to give them a basic example of supply and demand. If I had a

diamond, and it was the only diamond in the entire world, the intrinsic worth of the diamond,

given that there is at least some demand for the product, is worth much more than if there was a

million diamonds in the world. When you have more of some thing (increased supply) then the

value of that good is less. This pivotal economic law also governs money as well, inflation

occurs when the supply of money outmatches the demand for that money. Sometimes it can be

hard to consider that money is just like any other good like bread or computers but just as people

buy and sell those goods, people also sell currencies in something called the foreign exchange

market.

Вам также может понравиться

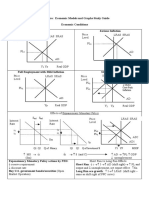

- AP Macro Cheat SheetДокумент23 страницыAP Macro Cheat SheetGabriel Jimenez100% (7)

- The Money Masters PDFДокумент31 страницаThe Money Masters PDFvenurao1100% (6)

- Philip Haslam, Russell Lamberti - When Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations THДокумент207 страницPhilip Haslam, Russell Lamberti - When Money Destroys Nations - How Hyperinflation Ruined Zimbabwe, How Ordinary People Survived, and Warnings For Nations THWeni Meilita75% (4)

- Brazilian Stagflation 2015Документ1 страницаBrazilian Stagflation 2015Victor Zhiyu Lee100% (4)

- The Globalization Gamble: The Dollar-WallStreet Regime and Its Consequences - Peter GowanДокумент121 страницаThe Globalization Gamble: The Dollar-WallStreet Regime and Its Consequences - Peter GowanpeterVoterОценок пока нет

- The Forgotten Depression: 1921: The Crash That Cured ItselfОт EverandThe Forgotten Depression: 1921: The Crash That Cured ItselfРейтинг: 4 из 5 звезд4/5 (2)

- Jorg Guido Hulsmann - Deflation and Liberty (2008)Документ46 страницJorg Guido Hulsmann - Deflation and Liberty (2008)Ragnar DanneskjoldОценок пока нет

- Mauldin October 20Документ18 страницMauldin October 20richardck61Оценок пока нет

- President Ronald Reagan's Initial Actions ProjectОт EverandPresident Ronald Reagan's Initial Actions ProjectРейтинг: 3 из 5 звезд3/5 (2)

- SIN Dark Money Rv0 1Документ6 страницSIN Dark Money Rv0 1monday125Оценок пока нет

- Krugman-Money Is Not EverythingДокумент5 страницKrugman-Money Is Not EverythingJasmin HalebićОценок пока нет

- Coming Commodity BoomДокумент8 страницComing Commodity BoompuretrustОценок пока нет

- Great Myths of The Great DepressionДокумент28 страницGreat Myths of The Great DepressionAhmad Cendana100% (1)

- Manipulating The World Economy or Just Understanding How It Really Functions?Документ7 страницManipulating The World Economy or Just Understanding How It Really Functions?Tom BaccoОценок пока нет

- See Into The Future."Документ67 страницSee Into The Future."MatthewmanojОценок пока нет

- A Century of Money Mischief: in This EditionДокумент7 страницA Century of Money Mischief: in This EditionalphathesisОценок пока нет

- 6 BaruchelloLintner Final DraftДокумент21 страница6 BaruchelloLintner Final DraftTo-boter One-boterОценок пока нет

- Den of ThievesДокумент18 страницDen of ThievesBrett Buchanan100% (1)

- The Great DepressionДокумент24 страницыThe Great DepressionGaby1503100% (1)

- The Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargДокумент10 страницThe Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargcportzОценок пока нет

- Politics: Bread and Circuses: by Kenneth James Michael MacleanДокумент7 страницPolitics: Bread and Circuses: by Kenneth James Michael MacleankjmacleanОценок пока нет

- The Deep StateДокумент42 страницыThe Deep StateDiego Ramirez100% (2)

- A Critique of The Recession of 1920Документ32 страницыA Critique of The Recession of 1920Zerohedge100% (1)

- Freedom Chatter Blog - Spring 2009Документ41 страницаFreedom Chatter Blog - Spring 2009David Kretzmann100% (2)

- Big Picture: Reflections, Assessments, Outlook, ApproachДокумент17 страницBig Picture: Reflections, Assessments, Outlook, ApproachHenry BeckerОценок пока нет

- Debt Dynamite DominoesДокумент46 страницDebt Dynamite DominoesRedzaОценок пока нет

- When the New Deal Came to Town: A Snapshot of a Place and Time with Lessons for TodayОт EverandWhen the New Deal Came to Town: A Snapshot of a Place and Time with Lessons for TodayРейтинг: 2.5 из 5 звезд2.5/5 (2)

- What Is Economic DepressionДокумент4 страницыWhat Is Economic DepressionFarhana RahmanОценок пока нет

- Principles for Dealing with the Changing World Order: Why Nations Succeed and FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed and FailОценок пока нет

- What Would Milton Friedman Have Thought of The Great Recession?Документ27 страницWhat Would Milton Friedman Have Thought of The Great Recession?Nicholas RedickОценок пока нет

- Economics PPT: Group MembersДокумент6 страницEconomics PPT: Group MembersAhmarОценок пока нет

- The Money ChangersДокумент27 страницThe Money Changersanon-881710100% (14)

- 28 Countries Have Experienced Hyperinflation in The Last 25 Years (+111K Views)Документ7 страниц28 Countries Have Experienced Hyperinflation in The Last 25 Years (+111K Views)GoKi VoregisОценок пока нет

- Texto MundellДокумент42 страницыTexto MundellInês SantosОценок пока нет

- The Enigma of Capital and The Crisis This Time, David HarveyДокумент14 страницThe Enigma of Capital and The Crisis This Time, David HarveyquadranteRDОценок пока нет

- Promise To Pay Wilson R McNairДокумент128 страницPromise To Pay Wilson R McNairLatitude WineОценок пока нет

- Short Circuiting Hyper-InflationДокумент26 страницShort Circuiting Hyper-InflationDaniel SaarinenОценок пока нет

- Inflation Causes and ConsequencesДокумент7 страницInflation Causes and ConsequencesKwasi Owusu-AnsahОценок пока нет

- The Great Depression Q&A: David WheelockДокумент2 страницыThe Great Depression Q&A: David WheelockABM2014100% (1)

- 21st Century Global EconomicsДокумент9 страниц21st Century Global EconomicsMary M HuberОценок пока нет

- The Return of the Public: Democracy, Power and the Case for Media ReformОт EverandThe Return of the Public: Democracy, Power and the Case for Media ReformОценок пока нет

- The (Short) Case Against Universal Basic Income: Central Banking and World EmpireДокумент16 страницThe (Short) Case Against Universal Basic Income: Central Banking and World EmpiresbysОценок пока нет

- Modern Money, Debt Slavery and Destructive EconomicsДокумент4 страницыModern Money, Debt Slavery and Destructive EconomicsLuiz CorleoneОценок пока нет

- The Enigma of Capital and The Crisis This Time: David HarveyДокумент14 страницThe Enigma of Capital and The Crisis This Time: David HarveydaladaldalaОценок пока нет

- The Production of Money - Ann Pettifor's LSE LectureДокумент20 страницThe Production of Money - Ann Pettifor's LSE LectureemontesaОценок пока нет

- The Money Changers - Carmack Patrick S. JДокумент27 страницThe Money Changers - Carmack Patrick S. Jjaime.bvr7416100% (1)

- Bernanke, Ben - 2004 Money, Gold & The Great DepressionДокумент16 страницBernanke, Ben - 2004 Money, Gold & The Great DepressionkevinОценок пока нет

- Independence + Accountability: Why The Fed Is A Well-Designed Central BankДокумент10 страницIndependence + Accountability: Why The Fed Is A Well-Designed Central BanketfarvaqueОценок пока нет

- Beware of LeavenДокумент12 страницBeware of LeavenA. CampbellОценок пока нет

- August 252010 PostsДокумент313 страницAugust 252010 PostsAlbert L. PeiaОценок пока нет

- ReedLawrence W When Money Goes BadДокумент107 страницReedLawrence W When Money Goes BadIo PanОценок пока нет

- Economic HistoryДокумент6 страницEconomic HistoryAndrew PontanalОценок пока нет

- Dying of MoneyДокумент236 страницDying of MoneyNYCicero100% (2)

- 601 PrivateControlOfMoney1Документ7 страниц601 PrivateControlOfMoney1hanibaluОценок пока нет

- Edwin Vieira, Jr. - 2009.11.04 - Smashing The Axis of Financial FraudДокумент9 страницEdwin Vieira, Jr. - 2009.11.04 - Smashing The Axis of Financial FraudgkeraunenОценок пока нет

- Money MastersДокумент108 страницMoney Mastersapanisile14142100% (1)

- The Great Debasement PDFДокумент286 страницThe Great Debasement PDFErwin Padilla100% (1)

- Crashed: More The How, Than The WhyДокумент71 страницаCrashed: More The How, Than The WhyMarcelo AraújoОценок пока нет

- What Greenspan's Latest Talk Means For GoldДокумент4 страницыWhat Greenspan's Latest Talk Means For GoldeliforuОценок пока нет

- Straightening The RecordДокумент4 страницыStraightening The Record7xgardnerОценок пока нет

- Economics McqsДокумент85 страницEconomics McqsRashid Khan Safi60% (5)

- Economics McqsДокумент56 страницEconomics McqsAtif KhanОценок пока нет

- Classification of Government Accounting in India For A Specific Treatment of Government Accounts in IndiaДокумент49 страницClassification of Government Accounting in India For A Specific Treatment of Government Accounts in Indiasheelamethu75% (4)

- Reaganomics SacДокумент6 страницReaganomics Sacapi-246198445Оценок пока нет

- BEC 121 Introduction To Macroeconomics Lecture NotesДокумент15 страницBEC 121 Introduction To Macroeconomics Lecture NotesVefya SimluОценок пока нет

- List of Contents: Dhyeya Educational Services Pvt. LTDДокумент143 страницыList of Contents: Dhyeya Educational Services Pvt. LTDVidya Singh 67Оценок пока нет

- LB5229 Business Study Report ExampleДокумент28 страницLB5229 Business Study Report ExampleSuriya PrasanthОценок пока нет

- There Is An Old Joke Among Economists That StatesДокумент52 страницыThere Is An Old Joke Among Economists That StatesAbhijot SinghОценок пока нет

- ECONOMY 700 MCQs With Explanatory Notes PDFДокумент234 страницыECONOMY 700 MCQs With Explanatory Notes PDFvarunОценок пока нет

- Economies Are Facing Soaring Inflation Rates Despite Tepid GrowthДокумент3 страницыEconomies Are Facing Soaring Inflation Rates Despite Tepid GrowthKelsie PrestonОценок пока нет

- Advanced Macroeconomics IIДокумент48 страницAdvanced Macroeconomics IIZemichael SeltanОценок пока нет

- DecolonizationДокумент8 страницDecolonizationshayy0803100% (1)

- CurrentДокумент12 страницCurrentAnthony CabonceОценок пока нет

- Cfo10e Ch28 GeДокумент29 страницCfo10e Ch28 GeRd Indra AdikaОценок пока нет

- Economics Mcqs PDFДокумент88 страницEconomics Mcqs PDFmehwish karamatОценок пока нет

- SEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveДокумент7 страницSEBI GRADE A 2020: ECONOMICS-Inflation & Phillips CurveThabarak ShaikhОценок пока нет

- Inflation Rate in The Philippines: Activity 6Документ24 страницыInflation Rate in The Philippines: Activity 6JBОценок пока нет

- Aggregate Demand (AD) : AD and AS OnlineДокумент52 страницыAggregate Demand (AD) : AD and AS OnlineM Shubaan Nachiappan(Student)Оценок пока нет

- Final Exam TutorialДокумент40 страницFinal Exam Tutorialloor chidiacОценок пока нет

- QuizДокумент26 страницQuizEram SheikhОценок пока нет

- MoralДокумент36 страницMoralEngelyn BondocОценок пока нет

- Macro AauДокумент49 страницMacro AauMohammed AdemОценок пока нет

- MCQ - Chapter 6Документ14 страницMCQ - Chapter 6Rohit BadgujarОценок пока нет

- 1992 - 2007 KPDS Reading SorularıДокумент121 страница1992 - 2007 KPDS Reading SorularıBurak SayınОценок пока нет

- Imposed Higher Tariffs - Forbade Colonies To Trade With Other Nations - Restricted Trade Routes - Subsidized ExportsДокумент3 страницыImposed Higher Tariffs - Forbade Colonies To Trade With Other Nations - Restricted Trade Routes - Subsidized ExportsJim MangalimanОценок пока нет

- InflationДокумент30 страницInflationyogitha ThakurОценок пока нет

- Short-Run Economic FluctuationsДокумент55 страницShort-Run Economic FluctuationsBhavdeepsinh JadejaОценок пока нет

- Macroeconomics For Life Smart Choices For All Canadian 2nd Edition Cohen Test BankДокумент57 страницMacroeconomics For Life Smart Choices For All Canadian 2nd Edition Cohen Test Bankjerryholdengewmqtspaj100% (29)