Академический Документы

Профессиональный Документы

Культура Документы

Financial Statements, Closing Entries, and Reversing Entries

Загружено:

Kathleen VerboОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statements, Closing Entries, and Reversing Entries

Загружено:

Kathleen VerboАвторское право:

Доступные форматы

Financial Statements, Closing

13 Entries, and Reversing Entries

DEMONSTRATION PROBLEM

Christy’s Apparel has a fiscal year extending from January 1 through December 31. Its ac-

count balances after adjustments are presented below in random order. The beginning mer-

chandise inventory amounts to $35,870. With regard to the outstanding mortgage, $2,000 is

due within the next twelve months.

Notes Receivable $ 7,000 Freight In $ 7,040

Interest Income 5,362 Office Salary Expense 11, 119

Building 45,400 Accounts Receivable 46,627

Accounts Payable 25,245 Store Supplies 1,094

Prepaid Insurance 1,090 Interest Expense 2,100

Insurance Expense 2,505 Cash 3,305

Accumulated Depreciation, Depreciation Expense,

Building 15,133 Building 1,297

Notes Payable 10,250 Purchases Discounts 1,335

Sales 267,111 Accumulated Depreciation,

Sales Salary Expense 60,377 Store Equipment 10,750

Rent Income 2,400 Salaries Payable 3,420

Store Equipment 21,500 C.P. Bennett, Drawing 60,000

Mortgage Payable (current Office Equipment 8,875

portion is $2,000) 31,000 Taxes Expense 4,006

Land 10,000 Accumulated Depreciation,

Sales Commission Expense 6,400 Office Equipment 4,438

Sales Discounts 2,671 Miscellaneous General Expense 1,750

Merchandise Inventory, Store Supplies Expense 1,918

Dec. 31, 20— 41,998 C.P. Bennett, Capital,

Purchases 133,556 Jan. 1, 20— 110,980

Advertising Expense 5,342 Depreciation Expense, Office

Sales Returns and Allowances 3,149 Equipment 1,775

Purchases Returns and Allowances 2,642 Depreciation Expense,

Store Equipment 4,300

Instructions

1. Prepare a classified income statement and subdivide operating expenses.

2. Prepare a statement of owner’s equity.

3. Prepare balance sheet.

4. Determine the amount of working capital and the current ratio.

Copyright © Houghton Mifflin Company. All rights reserved. 1

SOLUTION

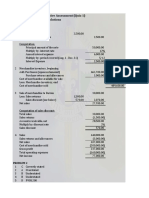

1. Christy's Apparel

Income Statement

For Year Ended December 31, 20 —

Revenue from Sales:

Sales $267,111.00

Less: Sales Returns and Allowances $ 3,149.00

Sales Discounts 2,671.00 5,820.00

Net Sales $261,291.00

Cost of Goods Sold:

Merchandise Inventory, January 1, 20 — $ 35,870.00

Purchases $133,556.00

Less: Purchases Returns and

Allowances $2,642.00

Purchases Discounts 1,335.00 3,977.00

Net Purchases $129,579.00

Add Freight In 7,040.00

Delivered Cost of Purchases 136,619.00

Cost of Goods Available for Sale $172,489.00

Less Merchandise Inventory,

December 31, 20— 41,998.00

Cost of Goods Sold 130,491.00

Gross Profit $130,800.00

Operating Expenses:

Selling Expenses:

Sales Salary Expense $ 60,377.00

Sales Commission Expense 6,400.00

Advertising Expense 5,342.00

Store Supplies Expense 1,918.00

Depreciation Expense, Store Equipment 4,300.00

Total Selling Expenses $ 78,337.00

General Expenses:

Insurance Expense $ 2,505.00

Office Salary Expense 11,119.00

Depreciation Expense, Building 1,297.00

Taxes Expense 4,006.00

Miscellaneous General Expense 1,750.00

Depreciation Expense, Office Equipment 1,775.00

Total General Expenses 22,452.00

Total Operating Expenses 100,789.00

Income from Operations $ 30,011.00

Other Income:

Interest Income 5,362.00

Rent Income $ 2,400.00

Total Other Income $ 7,762.00

Other Expenses:

Interest Expense 2,100.00 5,662.00

Net Income $ 35,673.00

Copyright © Houghton Mifflin Company. All rights reserved. 2

SOLUTION (continued)

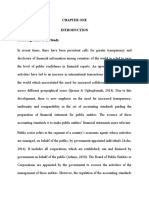

2. Christy's Apparel

Statement of Owner's Equity

For Year Ended December 31, 20 —

C. P. Bennett, Capital, January 1, 20 — $110,980.00

Net Income for the Year $ 35,673.00

Less Withdrawals for the Year 60,000.00

Decrease in Capital 24,327.00

C. P. Bennett, Capital, December 31, 20— $ 86,653.00

Copyright © Houghton Mifflin Company. All rights reserved. 3

3. Christy's Apparel

Balance Sheet

December 31, 20 —

Assets

Current Assets:

Cash $ 3,305.00

Notes Receivable 7,000.00

Accounts Receivable 46,627.00

Merchandise Inventory 41,998.00

Store Supplies 1,094.00

Prepaid Insurance 1,090.00

Total Current Assets $101,114.00

Plant and Equipment:

Land $10,000.00

Building $45,400.00

Less Accumulated Depreciation 15,133.00 30,267.00

Office Equipment $ 8,875.00

Less Accumulated Depreciation 4,438.00 4,437.00

Store Equipment $21,500.00

Less Accumulated Depreciation 10,750.00 10,750.00

Total Plant and Equipment 55,454.00

Total Assets $156,568.00

Liabilities

Current Liabilities:

Notes Payable $10,250.00

Mortgage Payable (current portion) 2,000.00

Accounts Payable 25,245.00

Salaries Payable 3,420.00

Total Current Liabilities $ 40,915.00

Long-Term Liabilities:

Mortgage Payable 29,000.00

Total Liabilities $ 69,915.00

Owner's Equity

C. P. Bennett, Capital 86,653.00

Total Liabilities and Owner's Equity $156,568.00

4. Working capital = Current assets – Current liabilities

= $101,114 – $40,915 = $60,199

Current assets $101,114

Current ratio = = = 2.47

Current liabilities $40,915

Copyright © Houghton Mifflin Company. All rights reserved. 4

Вам также может понравиться

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Schaum's Outline of Principles of Accounting I, Fifth EditionОт EverandSchaum's Outline of Principles of Accounting I, Fifth EditionРейтинг: 5 из 5 звезд5/5 (3)

- Account AssignmentДокумент4 страницыAccount AssignmentNavjeet SandhuОценок пока нет

- Financial Statements FinalssssssДокумент5 страницFinancial Statements FinalssssssHelping Five (H5)Оценок пока нет

- AE 112 - Midterm Summative Assessment (Quiz 1) Suggested Answers and SolutionsДокумент3 страницыAE 112 - Midterm Summative Assessment (Quiz 1) Suggested Answers and SolutionsDjunah ArellanoОценок пока нет

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Документ5 страницJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezОценок пока нет

- Class Case 1 Quick LunchДокумент4 страницыClass Case 1 Quick Lunch9ry5gsghybОценок пока нет

- Chapter-1 Homework Basic Concepts Part 1Документ4 страницыChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburОценок пока нет

- Adjusting - Merchandising BusinessДокумент3 страницыAdjusting - Merchandising BusinessJekoe25% (4)

- 8447809Документ11 страниц8447809blackghostОценок пока нет

- Chapter 13 Homework Assignment #2 QuestionsДокумент8 страницChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Goodwill CompanyДокумент13 страницGoodwill CompanyFiel Marie SateraОценок пока нет

- AkuntansuДокумент36 страницAkuntansusuryati hungОценок пока нет

- Crash Landing On You Company Financial StatementsДокумент6 страницCrash Landing On You Company Financial StatementsEmar KimОценок пока нет

- Cash Flow ExampleДокумент2 страницыCash Flow ExampleAlhassan ShakirОценок пока нет

- Acctg SHДокумент12 страницAcctg SHFiel Zechariah AennaОценок пока нет

- Practice For Test 3 - Copy (1) EbiДокумент9 страницPractice For Test 3 - Copy (1) EbireynaldohizkiaОценок пока нет

- Ice NineДокумент4 страницыIce NinePolene GomezОценок пока нет

- CH 12 Wiley Plus Kimmel Quiz & HWДокумент9 страницCH 12 Wiley Plus Kimmel Quiz & HWmkiОценок пока нет

- Accounting FinancialStatementsДокумент3 страницыAccounting FinancialStatementsyannaОценок пока нет

- Template - MIDTERM EXAM INTERMEDIATE 1Документ7 страницTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuОценок пока нет

- National College of Business and Arts: Fairview, Quezon CityДокумент4 страницыNational College of Business and Arts: Fairview, Quezon CityLouise MchaleОценок пока нет

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyДокумент10 страницFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- Sample Functional Form of Statement of Comprehensive IncomeДокумент2 страницыSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteОценок пока нет

- Solution Key To Problem Set 1Документ6 страницSolution Key To Problem Set 1Ayush RaiОценок пока нет

- Public Accountancy PracticeДокумент69 страницPublic Accountancy Practicelov3m3100% (2)

- Tutorial 14 Introductory Accounting Teaching Assistant TeamДокумент2 страницыTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanОценок пока нет

- Devie Helen S1 Akuntansi T12 C PAДокумент5 страницDevie Helen S1 Akuntansi T12 C PAShigit PebriantoОценок пока нет

- Quiz 2 Financial ManagementДокумент6 страницQuiz 2 Financial ManagementMARVIE JUNE CARBONОценок пока нет

- Solutions To Problems AFAR2 Chapter 13Документ18 страницSolutions To Problems AFAR2 Chapter 13Jane DizonОценок пока нет

- DELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSДокумент2 страницыDELACRUZ - LORELIN - Financial Statement Preparation Test Problem - XLSX - Copy of SCI AND FSLoren's Acads AccountОценок пока нет

- Solutions To ProblemsДокумент22 страницыSolutions To ProblemsSyeed AhmedОценок пока нет

- 3 Exam Part IДокумент6 страниц3 Exam Part IRJ DAVE DURUHAОценок пока нет

- 1.3.1. Problems - Hoba - General Transactions IllustrationДокумент15 страниц1.3.1. Problems - Hoba - General Transactions IllustrationJane DizonОценок пока нет

- Movida CashtoaccrualДокумент5 страницMovida CashtoaccrualVivienne Rozenn LaytoОценок пока нет

- Davao - Eagle - Com JOSEPHДокумент6 страницDavao - Eagle - Com JOSEPHablay logeneОценок пока нет

- Finman Final ExamsДокумент3 страницыFinman Final ExamsBADAR, Shannen Rae T.Оценок пока нет

- Acc291t Week 5 Apply Exercise Score 100 PercentДокумент7 страницAcc291t Week 5 Apply Exercise Score 100 PercentG JhaОценок пока нет

- SunSet Surfwear Closing EntriesДокумент4 страницыSunSet Surfwear Closing EntriesidontwantyourspambchОценок пока нет

- Pa12 Trần Khánh Vy Hw Ch5Документ5 страницPa12 Trần Khánh Vy Hw Ch5Vy Tran KhanhОценок пока нет

- ACCT 3061 Asignación Cap 4 y 5Документ4 страницыACCT 3061 Asignación Cap 4 y 5gpm-81Оценок пока нет

- Net SalesДокумент8 страницNet SalesKara Sophia BatucanОценок пока нет

- BUS FPX4060 - Assessment2 1Документ14 страницBUS FPX4060 - Assessment2 1AA TsolScholarОценок пока нет

- INCOTAXДокумент4 страницыINCOTAXnicole bancoroОценок пока нет

- Asdos Pert 2Документ2 страницыAsdos Pert 2mutiaoooОценок пока нет

- Cost of Goods Sold WorksheetДокумент4 страницыCost of Goods Sold Worksheetbutch listangco100% (1)

- FS Preparation 1Документ4 страницыFS Preparation 1Bae Tashnimah Farina BaltОценок пока нет

- Assignment-5-Single-Entry-Method-students-DAVID FinalДокумент11 страницAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATOОценок пока нет

- TaThuyDuong 11200993 MidtermTest AccountingPrincipleДокумент3 страницыTaThuyDuong 11200993 MidtermTest AccountingPrincipleThùy Dương TạОценок пока нет

- Financial Accounting hw1Документ5 страницFinancial Accounting hw1Jermaine M. SantoyoОценок пока нет

- FM-Cash Budget)Документ9 страницFM-Cash Budget)Aviona GregorioОценок пока нет

- 8, Problems #7-11Документ7 страниц8, Problems #7-11jowdpugsОценок пока нет

- Class Case 2 - Browning Manufacturing CompanyДокумент5 страницClass Case 2 - Browning Manufacturing Company9ry5gsghybОценок пока нет

- Copies Express Inc - by Cherryl ValmoresДокумент7 страницCopies Express Inc - by Cherryl ValmoresCHERRYL VALMORESОценок пока нет

- Class Problems CH 4Документ9 страницClass Problems CH 4Eduardo Negrete100% (2)

- ABC CompanyДокумент7 страницABC CompanyLouise Kyla CabreraОценок пока нет

- Cash and Accrual BasisДокумент10 страницCash and Accrual BasisNoeme LansangОценок пока нет

- FS Financial StudyДокумент6 страницFS Financial StudyMarina AbanОценок пока нет

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Документ3 страницыProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Modul Pembelajaran Akuntansi Keuangan 1 Pra UTSДокумент10 страницModul Pembelajaran Akuntansi Keuangan 1 Pra UTSirsaОценок пока нет

- Michael Mauboussin - Great Migration:: Public To Private EquityДокумент24 страницыMichael Mauboussin - Great Migration:: Public To Private EquityAbcd123411Оценок пока нет

- Investors AdarДокумент9 страницInvestors AdarErwin UmaiyahОценок пока нет

- Oradea Assessment PDFДокумент33 страницыOradea Assessment PDFtoaderpopescu2673Оценок пока нет

- Ichimoku (AATI)Документ22 страницыIchimoku (AATI)Anthony FuОценок пока нет

- Aqua Gear in Business Since 2008 Makes Swimwear For ProfessionДокумент1 страницаAqua Gear in Business Since 2008 Makes Swimwear For ProfessionAmit PandeyОценок пока нет

- How To Add Money To Your Investment A/cДокумент2 страницыHow To Add Money To Your Investment A/cNarendra VinchurkarОценок пока нет

- Akash Tiwari - 4 Year(s) 0 Month(s)Документ4 страницыAkash Tiwari - 4 Year(s) 0 Month(s)22827351Оценок пока нет

- Final Uds Sukkur With AddendumДокумент463 страницыFinal Uds Sukkur With AddendumAtifKhanОценок пока нет

- Infrastructure Financing And: Business ModelsДокумент9 страницInfrastructure Financing And: Business ModelsAbhijeet JhaОценок пока нет

- PCL Chap 1 en Ca PDFДокумент42 страницыPCL Chap 1 en Ca PDFRenso Ramirez Jimenez100% (1)

- Chapter One 1.1 Background of The StudyДокумент34 страницыChapter One 1.1 Background of The StudyChidi EmmanuelОценок пока нет

- McDonald's CDMP - Group PresentationДокумент32 страницыMcDonald's CDMP - Group PresentationNorhan AymanОценок пока нет

- The Ledger & Trial BalanceДокумент4 страницыThe Ledger & Trial BalanceJohn Marvin Delacruz Renacido80% (5)

- Aswath Damodaran - Technology ValuationДокумент115 страницAswath Damodaran - Technology Valuationpappu.subscription100% (1)

- San Jose City Electric Service Cooperative, Inc. (SAJELCO) vs. Ministry of Labor and EmploymentДокумент5 страницSan Jose City Electric Service Cooperative, Inc. (SAJELCO) vs. Ministry of Labor and EmploymentKanglawОценок пока нет

- Wage and Tax StatementДокумент4 страницыWage and Tax StatementRich1781Оценок пока нет

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGДокумент6 страницProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Basfin2 Syllabus PDFДокумент5 страницBasfin2 Syllabus PDFRebekahОценок пока нет

- To Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedДокумент6 страницTo Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedShiela E. EladОценок пока нет

- PPT-Performance AppraisalДокумент56 страницPPT-Performance Appraisalshiiba2287% (84)

- Energy Policy: Laura Tolnov Clausen, David RudolphДокумент10 страницEnergy Policy: Laura Tolnov Clausen, David RudolphDr. Muhammad ImranОценок пока нет

- ACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioДокумент3 страницыACCT 429 DeVry University Chicago Tax Form Computations Case ScenarioHomeworkhelpbylanceОценок пока нет

- Rural Development SyllabusДокумент2 страницыRural Development Syllabustrustme77Оценок пока нет

- A Study On Financial Performance AnalysisДокумент81 страницаA Study On Financial Performance AnalysisGayathri Rs0% (1)

- NDSM Oct 15 - QPДокумент14 страницNDSM Oct 15 - QPkeerthadinnuОценок пока нет

- APT ExerciseДокумент3 страницыAPT Exercise노긔0% (1)

- Form 16 BДокумент1 страницаForm 16 BSurendra Kumar BaaniyaОценок пока нет

- 4 Commissioner - of - Internal - Revenue - v. - Court - ofДокумент8 страниц4 Commissioner - of - Internal - Revenue - v. - Court - ofClaire SantosОценок пока нет

- NIC ASIA BANK Surkhet NepalДокумент62 страницыNIC ASIA BANK Surkhet NepalAshish Kumar100% (1)

- DerivДокумент47 страницDerivMahesh SabharwalОценок пока нет