Академический Документы

Профессиональный Документы

Культура Документы

GST ON Restaurant

Загружено:

jdonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GST ON Restaurant

Загружено:

jdonАвторское право:

Доступные форматы

‘GST ON RestauRant’

The term ‘Restaurant’ has not been defined under GST law. In common parlance,

‘restaurant’ can be understood as a place where people pay to sit and eat meals that are

cooked and served within the premises.

The taxability of the services provided by the restaurants and the scope of the term

‘restaurants’ have been elaborated under GST regime. It is no longer only a place where

people go, sit and eat. Various other terms such as canteen, mess, takeaways, catering,

etc., have been incorporated in restaurant services. Unlike Service Tax law, there are no

restrictions on whether the restaurant is an air conditioned one or non-air conditioned

and whether it is serving alcohol or not.

GST Rates on Accomodation, Food & Beverage Services:

Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017, Serial No. 7 under

Heading No. 9963 (Accommodation, food and beverage services), prescribes the

following GST rates:-

Description Applicable GST

Rate

Food services provided by restaurants including takeaway 5% with No ITC

facility (both air-conditioned and non-air conditioned )

Any food/drink served at cafeteria/canteen/mess operating on 5% with No ITC

contract basis in office, industrial unit, or by any institution or

by any other person on basis of contractual agreement which

is not event based or occasional

Restaurant services provided by restaurants located within a 5% with No ITC

hotel featuring room tariff less than Rs. 7,500

Restaurant services provided by restaurants located within a 18%

hotel featuring room tariff of Rs. 7,500 and above

Meals/food services provided by Indian Railways/IRCTC or 5% with No ITC

their licensees both in trains or at platforms

Food services in a premises arranged for organizing function 18%

along with renting of such premises

Food services at exhibition, events, conferences, outdoor & 18%

indoor functions that are event based or occasional in nature

Other Accommodation, food and beverage services 18%

Food ordered through e-commerce operator:

Cloud kitchens, delivery kitchens and or food delivery applications would be covered by

the definition of e-commerce operators.

Most of these e-commerce operators enter into contracts with the restaurant owners and

offer restaurant search and delivery services through their website or mobile

application. Customer places order by using their website or apps. Aggregators are

responsible to take customer order from the restaurant premises and deliver the food to

end consumer.

The entire transaction in relation to food ordered via e-commerce operator is divided

into 2 parts:-

1. Food is delivered by the e-commerce operator’s hired/ contracted

delivery boy from restaurant premises to place of buyer. Bill of restaurant

is handed over to the buyer

- In this case GST charged by the restaurant will be rate of restaurant services, i.e.,

either 5% or 18% as the case may be.

2. Delivery fee charged by e-commerce operator from buyers

- E-commerce operator will charge GST at 18% from customers on delivery charges

collected from the customer and it shall not form part of restaurant services but would

be classified under HSN 9968, being a part of postal & courier services.

Given below is the summary of food ordered by A in Delhi through XYZ.com (e-

commerce operator):-

Particulars Amount

Burger ordered (1* 129) 129.00

Restaurant Handling Charges 29.00

Delivery Charge 16.00

GST – CGST 3.95

- Delhi GST

3.95

Promo Code: 40% Discount (51.60)

Total 130.30

Let us analysis how GST is charged and at what rate:-

Particulars Amount GST @ Analysis

5%

Burger 129 6.45 Rate of 5% is levied on burger and

Restaurant 29 1.45 handling charges/ Packing charges being a

Handling Charges ‘composite supply’ of restaurant services

Total 158 7.90

Delivery Charges 16 - This amount is inclusive of GST. These

charges are recovered by XYZ.com and

does not form a part of restaurant services.

Applicable GST rate of postal services, i.e.,

18% is levied on this amount.

Promo-(40% (51.60) - It is a form of discount offered by

Discount) XYZ.com. Since it is not offered by

restaurant itself, hence, GST is levied on

the actual value of burger and handling

charges without giving effect to discount

allowed.

Tax implications on Tip given to delivery boy:

Sometimes consideration in the form of ‘Tip’ is given to the person who delivers the food

parcel, which is over and above the total amount. Such amount is not fixed and is not

mandatorily required to be paid. ‘Tip’ given by customer depends on the satisfaction

level of the customer, time taken by the delivery boy to deliver the respective order.

Therefore, it is classified as transaction in money (neither goods nor services) and will

not be considered as a part of restaurant or delivery services and, hence, GST is not

applicable on this amount.

Also Read:

GST Rates 2019 - GST Council Meeting Updates & Latest GST Tax Slabs

GST on Second Hand Goods - Margin Scheme

Вам также может понравиться

- Anthony Bourdain Research PaperДокумент3 страницыAnthony Bourdain Research PaperJakeWebb98Оценок пока нет

- Line Cook ManualДокумент41 страницаLine Cook ManualMichael Mueller100% (2)

- Trademark Power of AttorneyДокумент2 страницыTrademark Power of AttorneyjdonОценок пока нет

- Accounts BasicsДокумент144 страницыAccounts Basicsjdon100% (1)

- Cloud KitchenДокумент23 страницыCloud KitchenKritin AgarwalОценок пока нет

- Homes and EstatesДокумент212 страницHomes and EstatesCharles NedderОценок пока нет

- Impact of GST On Automobile IndustryДокумент3 страницыImpact of GST On Automobile Industrypvaibhav08Оценок пока нет

- Impact of GST On Hotel IndustryДокумент14 страницImpact of GST On Hotel IndustryDebika SinghОценок пока нет

- Investment Needs Analysis DraftДокумент62 страницыInvestment Needs Analysis DraftjdonОценок пока нет

- Audit Checklist For Goods and Services TaxДокумент4 страницыAudit Checklist For Goods and Services Taxmani1970% (1)

- Feasibility RestaurantДокумент38 страницFeasibility Restaurantlendiibanez56% (9)

- GST On Restaurants-Abhishek Final2Документ47 страницGST On Restaurants-Abhishek Final2shubhadaОценок пока нет

- A Study On Awareness of GST Filing Among Retail Business in Hyderabad 1528 2635 SI 1 24-1-635Документ21 страницаA Study On Awareness of GST Filing Among Retail Business in Hyderabad 1528 2635 SI 1 24-1-635BasavarajОценок пока нет

- 2.welcoming Guests and Take Food & Beverage OrdersДокумент132 страницы2.welcoming Guests and Take Food & Beverage OrdersIcee Padilla CarreonОценок пока нет

- Restaurant Business PlanДокумент20 страницRestaurant Business PlandavidОценок пока нет

- GST and Its Impact On Various Sectors of Indian EconomyДокумент4 страницыGST and Its Impact On Various Sectors of Indian EconomyRandy DsouzaОценок пока нет

- Diamond Hotel Philippines-Practicum ReportДокумент17 страницDiamond Hotel Philippines-Practicum ReportEgie Malapajo60% (5)

- Impact of GST On Small and Medium EnterprisesДокумент19 страницImpact of GST On Small and Medium EnterprisesEswari Gk100% (1)

- What Is GST? Definition of Goods & Services TaxДокумент9 страницWhat Is GST? Definition of Goods & Services Taxzarfarie aron100% (1)

- Impact of GST On The Indian EconomyДокумент16 страницImpact of GST On The Indian EconomySandeep TomarОценок пока нет

- Presentation On GST: (Goods and Services Tax)Документ11 страницPresentation On GST: (Goods and Services Tax)tpplantОценок пока нет

- GST Impact On Restaurants in IndiaДокумент19 страницGST Impact On Restaurants in IndiaVarun RimmalapudiОценок пока нет

- GST Report About RestaurantsДокумент13 страницGST Report About RestaurantsVarun RimmalapudiОценок пока нет

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsДокумент14 страницSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caОценок пока нет

- Impacts of GSTДокумент3 страницыImpacts of GSTNikhil100% (1)

- GSTДокумент20 страницGSTSanjaygowda55k100% (2)

- Impact of GST On Agricultural Sector PDFДокумент3 страницыImpact of GST On Agricultural Sector PDFSiddardha Kumar NelapudiОценок пока нет

- Summer Training Report On: "GST Prime Cleaning Services"Документ97 страницSummer Training Report On: "GST Prime Cleaning Services"Master PrintersОценок пока нет

- Project Work: Impact On GST Fast Moving Consumer Goods Sector in IndiaДокумент9 страницProject Work: Impact On GST Fast Moving Consumer Goods Sector in IndiaMadhuri kethineniОценок пока нет

- GST in India - Objectives, Concerns and ChallengesДокумент44 страницыGST in India - Objectives, Concerns and Challengesakhilca87% (15)

- GST Impact On The Supply ChainДокумент8 страницGST Impact On The Supply ChainAamiTataiОценок пока нет

- GST - Textile IndustryДокумент16 страницGST - Textile IndustrykaranОценок пока нет

- Goods & Services Tax (GST) - (One Nation One Tax)Документ40 страницGoods & Services Tax (GST) - (One Nation One Tax)sumukh0% (1)

- Assignment 1: Stanamer CorporationДокумент7 страницAssignment 1: Stanamer CorporationRitarshiChakrabortyОценок пока нет

- Impact of GST On Textile Industry Jan 2017Документ6 страницImpact of GST On Textile Industry Jan 2017Arunima BanerjeeОценок пока нет

- GSTДокумент46 страницGSTAninda SahaОценок пока нет

- Comparision Between Pre GST and Post Gst....Документ26 страницComparision Between Pre GST and Post Gst....Yash MalhotraОценок пока нет

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawДокумент9 страницDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghОценок пока нет

- Group Project - Impact of GST On Supply Chain ManagementДокумент20 страницGroup Project - Impact of GST On Supply Chain ManagementArpit Shah83% (6)

- Impact of GST On Various SectorsДокумент2 страницыImpact of GST On Various SectorsSwathi ReddyОценок пока нет

- GST in IndiaДокумент6 страницGST in IndiaAbhishek ChatterjeeОценок пока нет

- GST ProjectДокумент63 страницыGST ProjectPariОценок пока нет

- Project On GSTДокумент38 страницProject On GSTGourav Pareek100% (1)

- GST Impact On BusinessДокумент33 страницыGST Impact On BusinessMayur PatilОценок пока нет

- GSTДокумент19 страницGSTRiyaz haja MohideenОценок пока нет

- GST ImpactДокумент40 страницGST ImpactKhushi Lalit BokadiaОценок пока нет

- Introduction To Custom Law: Prepared by DR Renu AggarwalДокумент13 страницIntroduction To Custom Law: Prepared by DR Renu AggarwalPramod PrabhasОценок пока нет

- Impact of GST On E-CommerceДокумент4 страницыImpact of GST On E-CommerceIJAERS JOURNALОценок пока нет

- IMPACT OF GST ON INDIAN ECONOMY CovidДокумент6 страницIMPACT OF GST ON INDIAN ECONOMY CovidArushi GuptaОценок пока нет

- Topic: Page NoДокумент21 страницаTopic: Page NoAcchu BajajОценок пока нет

- Prof. Ashish R. Chourasiya: Goods & Service Tax: IntroductionДокумент36 страницProf. Ashish R. Chourasiya: Goods & Service Tax: IntroductionAJAY PHENOMОценок пока нет

- GST and Its ImpactДокумент33 страницыGST and Its Impactbiplav2u100% (1)

- Impact of Implementation of GST Among RetailersДокумент60 страницImpact of Implementation of GST Among RetailersYuvan Venkat100% (1)

- A Study On Goods and Services Tax (GST) : Conference PaperДокумент8 страницA Study On Goods and Services Tax (GST) : Conference PaperRajesh KaliaОценок пока нет

- Implimantation of GSTДокумент43 страницыImplimantation of GSTManoj BeheraОценок пока нет

- Sources of FinanceДокумент53 страницыSources of Financejessica0% (1)

- A Synopsis On Impact and Challenges of GST in IndiaДокумент8 страницA Synopsis On Impact and Challenges of GST in IndiaPrince RamananОценок пока нет

- Guide To CGST, SGST and IGST: Inter-State Vs Intra-StateДокумент6 страницGuide To CGST, SGST and IGST: Inter-State Vs Intra-StateSuman IndiaОценок пока нет

- Introduction of GSTДокумент9 страницIntroduction of GSTdevika7575Оценок пока нет

- Advance Payment of TaxДокумент4 страницыAdvance Payment of Taxparag03Оценок пока нет

- Project LaikaДокумент77 страницProject LaikaManju JhurianiОценок пока нет

- A Study On Impact of GST On RetailersДокумент9 страницA Study On Impact of GST On RetailersKrishna Nandhini Viji100% (1)

- 6 ItcДокумент114 страниц6 ItcRAUNAQ SHARMAОценок пока нет

- GST ArticleДокумент5 страницGST ArticleKumar SurajОценок пока нет

- A Study On Swachh Bharat Abhiyan and Management LessonsДокумент2 страницыA Study On Swachh Bharat Abhiyan and Management LessonsarcherselevatorsОценок пока нет

- Project ReportДокумент24 страницыProject ReportanilОценок пока нет

- Assessment of Various EntitiesДокумент31 страницаAssessment of Various Entitiesinsathi0% (1)

- Impact of GST On Indian SCMДокумент9 страницImpact of GST On Indian SCMVinodh Kumar Perumal100% (2)

- PROJECT of Service TaxДокумент34 страницыPROJECT of Service TaxPRIYANKA GOPALE100% (2)

- CS Professional Programme Tax NotesДокумент47 страницCS Professional Programme Tax NotesRajey Jain100% (2)

- GST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateДокумент17 страницGST On Restaurants GST Regime: Rate of Bills Type of Restaurants Tax RateshyamОценок пока нет

- National Securities Clearing Corporation Limited: Capital Market Date: September 29, 2017 Daily Settlement StatisticsДокумент3 страницыNational Securities Clearing Corporation Limited: Capital Market Date: September 29, 2017 Daily Settlement StatisticsjdonОценок пока нет

- ESOP Calculator IndiaДокумент2 страницыESOP Calculator IndiajdonОценок пока нет

- Rule 25A: Active Company Tagging Identities and Verification (ACTIVE) .Документ1 страницаRule 25A: Active Company Tagging Identities and Verification (ACTIVE) .jdonОценок пока нет

- Form MBP - 1: Notice of Interest by DirectorДокумент1 страницаForm MBP - 1: Notice of Interest by DirectorjdonОценок пока нет

- To Whom It May ConcernДокумент3 страницыTo Whom It May ConcernjdonОценок пока нет

- Form MBP - 1 Notice of Interest by Director: (Pursuant To Section 184 (1) and Rule 9 (1) )Документ5 страницForm MBP - 1 Notice of Interest by Director: (Pursuant To Section 184 (1) and Rule 9 (1) )jdonОценок пока нет

- Reply To ROCДокумент1 страницаReply To ROCjdonОценок пока нет

- DoordarshanДокумент10 страницDoordarshanjdonОценок пока нет

- Dividend DecisionsДокумент3 страницыDividend Decisionsjdon50% (2)

- PDF File Print Remove HighlightingДокумент2 страницыPDF File Print Remove HighlightingjdonОценок пока нет

- Committees of The Board of Directors Statutory Committees of The BoardДокумент3 страницыCommittees of The Board of Directors Statutory Committees of The BoardjdonОценок пока нет

- NandankananДокумент10 страницNandankananjdonОценок пока нет

- What Is Tax Deducted at SourceДокумент6 страницWhat Is Tax Deducted at SourcejdonОценок пока нет

- Project Report Recruitment-Selection Process Insurance CompaniesДокумент24 страницыProject Report Recruitment-Selection Process Insurance CompaniesRakesh ParmarОценок пока нет

- Basics of Excise Duty LiabilityДокумент17 страницBasics of Excise Duty LiabilityjdonОценок пока нет

- FAM 1st Sem Module 2Документ22 страницыFAM 1st Sem Module 2jdonОценок пока нет

- Vijender Jain Independence of JudiciaryДокумент8 страницVijender Jain Independence of JudiciaryVinu PriyangaОценок пока нет

- Alexandra Kollontai, 'The Family and The Communist State', Soviet Russia, Soviet Russia, Vol. 1, June-Dec 1919, Pp. 14-20.Документ7 страницAlexandra Kollontai, 'The Family and The Communist State', Soviet Russia, Soviet Russia, Vol. 1, June-Dec 1919, Pp. 14-20.danielgaidОценок пока нет

- Module 1 Table ReservationДокумент11 страницModule 1 Table ReservationGretchen G. VillacortaОценок пока нет

- VocabularyДокумент3 страницыVocabularyHouda BakasОценок пока нет

- 01 Handout 1 PDFДокумент7 страниц01 Handout 1 PDFClea BationОценок пока нет

- Effects of Word - of - Mouth Com PDFДокумент178 страницEffects of Word - of - Mouth Com PDFAgung PrayogaОценок пока нет

- Sequence 2: Greet and Seat The GuestДокумент3 страницыSequence 2: Greet and Seat The GuestNguyễn Ngọc TrâmОценок пока нет

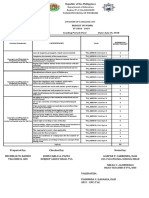

- Trainees' Current Competencies Can Be Identified by The Following Training Needs Analysis (Tna) FormsДокумент17 страницTrainees' Current Competencies Can Be Identified by The Following Training Needs Analysis (Tna) FormsPJ ProcoratoОценок пока нет

- Move It 3.workbook.u3-4Документ17 страницMove It 3.workbook.u3-4Fabian AmayaОценок пока нет

- RTC Full Magazine - FullSetДокумент30 страницRTC Full Magazine - FullSetBoni de SouzaОценок пока нет

- GEO250 Doc 2Документ5 страницGEO250 Doc 2muhammad fahriОценок пока нет

- Dinner in The Sky: Course: MembersДокумент3 страницыDinner in The Sky: Course: MembersJorge HornaОценок пока нет

- Rosemary Kitchen and Coffee Shop Is The One of The Best Restaurant in ThamelДокумент2 страницыRosemary Kitchen and Coffee Shop Is The One of The Best Restaurant in ThamelPrajwal James AcharyaОценок пока нет

- Services Marketing AssignmentДокумент6 страницServices Marketing AssignmentNabeela NoorОценок пока нет

- UWIN BIE05 s36 DraftДокумент36 страницUWIN BIE05 s36 DraftelearninglsprОценок пока нет

- Chapter OneДокумент8 страницChapter OnealyricsОценок пока нет

- Restaurants: 5 Listening & SpeakingДокумент1 страницаRestaurants: 5 Listening & SpeakingYahya Al-AmeriОценок пока нет

- Kings Pearl Cheese Launch Press ReleaseДокумент2 страницыKings Pearl Cheese Launch Press Releaseapi-281661447Оценок пока нет

- The Complete Guide For Travel AgentsДокумент128 страницThe Complete Guide For Travel AgentshuntinxОценок пока нет

- Styles of Table Service: Chapter 2 HighlightsДокумент20 страницStyles of Table Service: Chapter 2 HighlightsAbhinavОценок пока нет

- Cambodia Restaurant GuideДокумент1 страницаCambodia Restaurant GuideAlluring TravelerОценок пока нет

- FBS Budget of Work TSFДокумент1 страницаFBS Budget of Work TSFFlor GagasaОценок пока нет

- Caso Just Kitchen TaiwanДокумент13 страницCaso Just Kitchen TaiwanTITO WILBERT FLORES TORRESОценок пока нет