Академический Документы

Профессиональный Документы

Культура Документы

IFRS 15 Session4 Handout 1

Загружено:

Simon YossefАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IFRS 15 Session4 Handout 1

Загружено:

Simon YossefАвторское право:

Доступные форматы

Allocate the transaction price to performance obligations – Kayla’s background

information

I apologize for continuing to talk with you during lunch, but I really couldn't wait to move on to

step 4. I’ve already got a number of questions about how Kyber-Comm should allocate

transaction price to its contracts.

We've got some special terms for certain types of contracts, including discounts and variable

payments. There are also cases with subsequent changes in transaction price. This is

probably a challenging area of the Standard which I need to make sure I’ve got right&

Shall we order some food before I tell you more about these contracts Kyber-Comm has

entered into?”

Fact pattern for ‘Allocating the transaction price’ question (screen 2)

Kyber-Comm enters into a contract with a customer for the provision of internet services for

one year for $250 per month.

As part of the contract, Kyber-Comm provides that particular consumer with a 30% discount

coupon if the consumer subscribes for a one-year access to its pay-TV channel in the

following month.

Kyber-Comm has placed advertisements in the local newspapers offering a free 10%

discount on any new subscriptions to its pay-TV channel for a one-year access as part of its

seasonal promotion in the following month. The stand-alone one-year subscription price to

the pay-TV channel services is $4,200 (to be paid upfront).

Kyber-Comm estimates that there is a 60% probability that the consumer would redeem the

discount coupon. Assume there is no significant financing element in the contract.

Fact pattern for ‘Allocation of material right’ question (screen 4)

Kyber-Comm enters into a contract with a customer to sell three products: multiplexer,

router and optical fibres in exchange for $660.

Kyber-Comm will transfer control of each of those products at different points in time. The

multiplexer does not have a stand-alone selling price that is directly observable, but the

multiplexer has been sold before on its own within a relatively stable price range.

The stand-alone selling prices for the router and optical fibres are directly observable.

Furthermore, Kyber-Comm regularly sells these two products together for $310.

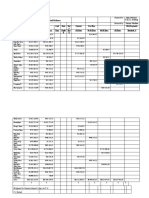

The table below shows the directly observable or estimated stand-alone selling prices of

the three products:

Product Stand-alone Selling Price

Multiplexer $350 (estimated)

Router $120

Optical fibre $200

Total $670

Fact pattern for ‘Allocation of variable consideration’ question (screen 6)

Kyber-Comm enters into a contract with a customer to transfer equipment and software

technology used in post-production editing, which the entity determines to represent two

performance obligations.

In terms of the contract, the stated price for the equipment is a fixed amount of $3,000, and the

price for the software technology is 5% of the customer’s future revenue derived from the use of

this technology.

Using the expected value method, Kyber-Comm estimates the royalties from the software

technology to be $20,000. The royalties vary entirely on the customer’s use of the software

which depends largely on the customer’s clientele and the nature of projects undertaken.

The estimated stand-alone selling price of the equipment and software technology is $8,000

and $15,000 respectively. Kyber-Comm transfers the equipment to the customer at contract

inception and transfers the software technology one month later.

Вам также может понравиться

- Exercises IA 2Документ7 страницExercises IA 2Hanna Melody50% (2)

- 18-32 (Objectives 18-2, 18-3, 18-4, 18-6)Документ8 страниц18-32 (Objectives 18-2, 18-3, 18-4, 18-6)image4all100% (1)

- Bab 6 Intercompany Profit TransactionsДокумент2 страницыBab 6 Intercompany Profit TransactionsAnonymous dMkY9G2Оценок пока нет

- Exercise - Dilutive Securities - AdillaikhsaniДокумент4 страницыExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- Consolidated Financial Statement Practice 3-2Документ2 страницыConsolidated Financial Statement Practice 3-2Winnie TanОценок пока нет

- Audit Report AnalysisДокумент9 страницAudit Report AnalysisRey Aurel TayagОценок пока нет

- Partnership in Class Questions 2015Документ3 страницыPartnership in Class Questions 2015Nella KingОценок пока нет

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsДокумент22 страницыAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaОценок пока нет

- Akutansi Biaya 3 BaruДокумент3 страницыAkutansi Biaya 3 Baruulfania eka0% (1)

- Jawaban GSLC 1Документ2 страницыJawaban GSLC 1Soniea DianiОценок пока нет

- Question and Answer - 60Документ31 страницаQuestion and Answer - 60acc-expertОценок пока нет

- CrockerДокумент6 страницCrockersg31Оценок пока нет

- Audit 12 - Rizq Aly AfifДокумент2 страницыAudit 12 - Rizq Aly AfifRizq Aly AfifОценок пока нет

- Latihan Soal Akl CH 1 Dan 2Документ12 страницLatihan Soal Akl CH 1 Dan 2DheaОценок пока нет

- Quiz CH 9-11 SchoologyДокумент8 страницQuiz CH 9-11 SchoologyperasadanpemerhatiОценок пока нет

- P 6-3 DrebinДокумент6 страницP 6-3 DrebinJulia Pratiwi ParhusipОценок пока нет

- Audit Payroll AccrualsДокумент2 страницыAudit Payroll AccrualsNana BananaОценок пока нет

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeДокумент3 страницыMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiОценок пока нет

- ch03, AccountingДокумент27 страницch03, AccountingEkta Saraswat Vig50% (2)

- SOAL LATIHAN MK - AKL - FC TransactionsДокумент4 страницыSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- Beams10e Ch07 Intercompany Profit Transactions BondsДокумент25 страницBeams10e Ch07 Intercompany Profit Transactions BondsIrma RismayantiОценок пока нет

- Cost-plus target return pricing and activity-based costing analysisДокумент7 страницCost-plus target return pricing and activity-based costing analysisAryan LeeОценок пока нет

- Time DrivenДокумент2 страницыTime DrivenwellaОценок пока нет

- Contoh Dan Soal Cash FlowДокумент9 страницContoh Dan Soal Cash FlowAltaf HauzanОценок пока нет

- JOB ORDER COSTING SYSTEM ANALYSISДокумент32 страницыJOB ORDER COSTING SYSTEM ANALYSISSetia NurulОценок пока нет

- Latsol AklДокумент10 страницLatsol AklAlya Sufi IkrimaОценок пока нет

- Accounting Textbook Solutions - 39Документ19 страницAccounting Textbook Solutions - 39acc-expert0% (1)

- Kumpulan Soal UTS AKL IIДокумент19 страницKumpulan Soal UTS AKL IIAlessandro SitopuОценок пока нет

- Problem 21-25 & 21-26 (Nadya Ayundani)Документ3 страницыProblem 21-25 & 21-26 (Nadya Ayundani)Nadya AyundaniОценок пока нет

- AC3102 SemGrp 2 Presentation 3Документ24 страницыAC3102 SemGrp 2 Presentation 3Melati SepsaОценок пока нет

- Practice Transfer Pricing ExamplesДокумент4 страницыPractice Transfer Pricing ExamplesHashmi Sutariya100% (1)

- BMGT 321 Chapter 13 HomeworkДокумент11 страницBMGT 321 Chapter 13 Homeworkarnitaetsitty100% (1)

- Firda Arfianti - LC53 - Equity Method, Two Consecutive YearsДокумент5 страницFirda Arfianti - LC53 - Equity Method, Two Consecutive YearsFirdaОценок пока нет

- CH 06Документ50 страницCH 06Dr-Bahaaeddin Alareeni100% (1)

- Case 1 Dan Case 2 Job Order CostingДокумент6 страницCase 1 Dan Case 2 Job Order CostingChantika JustiaraОценок пока нет

- Section - 5 Case-5.3Документ21 страницаSection - 5 Case-5.3syafira0% (1)

- Inventoriable Costs in Your Audit of Garza Company You Find PDFДокумент1 страницаInventoriable Costs in Your Audit of Garza Company You Find PDFAnbu jaromiaОценок пока нет

- p17 2Документ3 страницыp17 2AryaPratamaPutraОценок пока нет

- Contoh Eliminasi Lap - Keu KonsolidasiДокумент44 страницыContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniОценок пока нет

- Quiz - Inter 2 UTS - Wo AnsДокумент3 страницыQuiz - Inter 2 UTS - Wo AnsNike HannaОценок пока нет

- TUGAS AKM III WEEK 2 KELAS LДокумент10 страницTUGAS AKM III WEEK 2 KELAS LRifda Amalia100% (1)

- Advance Accounting P14-3Документ2 страницыAdvance Accounting P14-3Jeremy BastantaОценок пока нет

- Partnership OperationДокумент37 страницPartnership OperationMuchamad RifaiОценок пока нет

- C-2 Aged Trial Balance Schedule Apollo Shoes, Inc. Accounts Receivable Aged Trial Balance For Year Ended 12/31/2014Документ3 страницыC-2 Aged Trial Balance Schedule Apollo Shoes, Inc. Accounts Receivable Aged Trial Balance For Year Ended 12/31/2014Yefinia OpianaОценок пока нет

- Nurul Aryani - Quis 2Документ3 страницыNurul Aryani - Quis 2Nurul AryaniОценок пока нет

- Audit Plan Tests Financial StatementsДокумент27 страницAudit Plan Tests Financial StatementsAbdul Malik FajriОценок пока нет

- Meyers Pharmaceutical CompanyДокумент7 страницMeyers Pharmaceutical CompanyJhon F SinagaОценок пока нет

- Tugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Документ3 страницыTugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaОценок пока нет

- Chapter 21 Latihan SoalДокумент10 страницChapter 21 Latihan SoalJulyaniОценок пока нет

- Expenditure Cycle Case - GARCIAДокумент2 страницыExpenditure Cycle Case - GARCIAARLENE GARCIAОценок пока нет

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldДокумент2 страницыKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- The Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceДокумент3 страницыThe Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceElliot RichardОценок пока нет

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeДокумент14 страницSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Cost and Management Accounting - Tugas 6 - 5 November 2019Документ3 страницыCost and Management Accounting - Tugas 6 - 5 November 2019AlfiyanОценок пока нет

- Chapter 09 Indirect and Mutual HoldingsДокумент12 страницChapter 09 Indirect and Mutual HoldingsNicolas ErnestoОценок пока нет

- The Size of Government: Measurement, Methodology and Official StatisticsОт EverandThe Size of Government: Measurement, Methodology and Official StatisticsОценок пока нет

- Performance Management: Assessing Changes at SquarizeДокумент8 страницPerformance Management: Assessing Changes at Squarizecatcat1122Оценок пока нет

- Acca QNSДокумент10 страницAcca QNSIshmael OneyaОценок пока нет

- CLV and Pricing Analytics Case 3Документ2 страницыCLV and Pricing Analytics Case 3kejalОценок пока нет

- The Essentials of Materiality Assessment: Sustainable InsightДокумент19 страницThe Essentials of Materiality Assessment: Sustainable InsightSimon YossefОценок пока нет

- Sales Order Cycle Review ReportДокумент37 страницSales Order Cycle Review ReportSimon YossefОценок пока нет

- An Approach To Examination Questions On The Auditing of Group Financial Statements PDFДокумент3 страницыAn Approach To Examination Questions On The Auditing of Group Financial Statements PDFSimon YossefОценок пока нет

- Larrys CVДокумент6 страницLarrys CVSimon YossefОценок пока нет

- Free Real Estate Business Plan TemplateДокумент12 страницFree Real Estate Business Plan TemplateSimon YossefОценок пока нет

- NCERT Class 9 English Part 2 PDFДокумент69 страницNCERT Class 9 English Part 2 PDFSimon YossefОценок пока нет

- Ch02 Tool KitДокумент18 страницCh02 Tool KitPopsy AkinОценок пока нет

- Roberto Rocco CV Poster 20111Документ369 страницRoberto Rocco CV Poster 20111Simon YossefОценок пока нет

- Mock 1Документ14 страницMock 1Simon YossefОценок пока нет

- f6 Uk Examreport d15 PDFДокумент5 страницf6 Uk Examreport d15 PDFSimon YossefОценок пока нет

- Krista Ann Brown Healthcare Functional Tcm24-8292Документ1 страницаKrista Ann Brown Healthcare Functional Tcm24-8292Simon YossefОценок пока нет

- Seperating Chairman and CEO Role Business ArticlesДокумент2 страницыSeperating Chairman and CEO Role Business ArticlesSimon YossefОценок пока нет

- Tax Exam Main TopicsДокумент2 страницыTax Exam Main TopicsSimon YossefОценок пока нет

- Profit Adjustment Article IndividualsДокумент1 страницаProfit Adjustment Article IndividualsSimon YossefОценок пока нет

- QuestionsДокумент1 страницаQuestionsSimon YossefОценок пока нет

- Linkedin 10-K 20140213Документ173 страницыLinkedin 10-K 20140213Simon YossefОценок пока нет

- UK Corporate Governance Code 2014Документ36 страницUK Corporate Governance Code 2014Simon YossefОценок пока нет

- UK Corporate Governance Code 2014Документ36 страницUK Corporate Governance Code 2014Simon YossefОценок пока нет

- HTTP WWW Investopedia Com Exam-Guide Cfa-Level-1 Financial-Statements Cash-Flow-Statement-Basics ASPДокумент8 страницHTTP WWW Investopedia Com Exam-Guide Cfa-Level-1 Financial-Statements Cash-Flow-Statement-Basics ASPSimon YossefОценок пока нет

- Tax Exam Main TopicsДокумент2 страницыTax Exam Main TopicsSimon YossefОценок пока нет

- WWW Theguardian ComДокумент5 страницWWW Theguardian ComSimon YossefОценок пока нет

- P2 Examinable DocumentДокумент2 страницыP2 Examinable DocumentSimon YossefОценок пока нет

- AcountancyДокумент123 страницыAcountancySimon YossefОценок пока нет

- Executive MBA Placement Brochure of IIM Bangalore PDFДокумент48 страницExecutive MBA Placement Brochure of IIM Bangalore PDFnIKKOOОценок пока нет

- Fuels and Chemicals - Auto Ignition TemperaturesДокумент5 страницFuels and Chemicals - Auto Ignition TemperaturesyoesseoyОценок пока нет

- UDRPДокумент10 страницUDRPDomainNameWire100% (1)

- Bennic (Bi-Polar Radial) PB-PX SeriesДокумент3 страницыBennic (Bi-Polar Radial) PB-PX Seriesester853Оценок пока нет

- Request Documents or InfoДокумент6 страницRequest Documents or InfoRashika RampalОценок пока нет

- Explosion Proof Control Device SpecificationsДокумент12 страницExplosion Proof Control Device SpecificationsAnonymous IErc0FJОценок пока нет

- Dome AbcsДокумент1 страницаDome AbcsRiddhi BhutadaОценок пока нет

- Resume Mithun UpdatedДокумент7 страницResume Mithun UpdatedmithunОценок пока нет

- Validity Checks: Processing ControlsДокумент3 страницыValidity Checks: Processing Controlsjhela18Оценок пока нет

- Participatory Technology DevelopmentДокумент20 страницParticipatory Technology DevelopmentSri HimajaОценок пока нет

- Overcurrent Protection and Voltage Sag Coordination in Systems With Distributed GenerationДокумент12 страницOvercurrent Protection and Voltage Sag Coordination in Systems With Distributed GenerationAli AhmadОценок пока нет

- Hydraulic Excavator GuideДокумент9 страницHydraulic Excavator Guidewritetojs100% (1)

- NATO Tactical Nuclear Weapons in EuropeДокумент35 страницNATO Tactical Nuclear Weapons in EuropeMaria Mont' SerratОценок пока нет

- Sda-02-Dd-02 - Pile & Pile Cap - Sheet-1 - R0Документ1 страницаSda-02-Dd-02 - Pile & Pile Cap - Sheet-1 - R0Himani PatelОценок пока нет

- Fault Database - Flat TVДокумент3 страницыFault Database - Flat TVZu AhmadОценок пока нет

- Cie - Publist - 2008 Penerangan PDFДокумент11 страницCie - Publist - 2008 Penerangan PDFAli RosidiОценок пока нет

- Wet Scrapper Equipment SpecificationДокумент1 страницаWet Scrapper Equipment Specificationprashant mishraОценок пока нет

- AIR Intelligence Manual 33 308100 004 RemoteДокумент88 страницAIR Intelligence Manual 33 308100 004 RemoteLeChancheОценок пока нет

- The Comeback of Caterpillar (CAT), 1985-2001Документ12 страницThe Comeback of Caterpillar (CAT), 1985-2001Anosh IlyasОценок пока нет

- Barangay Profile: (BP DCF No. 1 S. 2022)Документ4 страницыBarangay Profile: (BP DCF No. 1 S. 2022)AiMae BaobaoenОценок пока нет

- A Young Lasallian Is US Environmental ScholarДокумент1 страницаA Young Lasallian Is US Environmental ScholarDia DimayugaОценок пока нет

- Chapter 19 - Managing Personal CommunicationДокумент37 страницChapter 19 - Managing Personal CommunicationAmit Thapa100% (2)

- Chapter 1: Introduction: 1.1 The Construction ProjectДокумент10 страницChapter 1: Introduction: 1.1 The Construction ProjectamidofeiriОценок пока нет

- Bio BatteryДокумент29 страницBio BatteryDileepChowdary100% (1)

- Rtad Heat Recovery CatalogДокумент48 страницRtad Heat Recovery Catalogaidoudi walidОценок пока нет

- HS1L DatasheetДокумент8 страницHS1L DatasheetBlAdE 12Оценок пока нет

- SB Pac 1402002 CeДокумент11 страницSB Pac 1402002 CesergeyОценок пока нет

- LRP I Approved ProjectsДокумент1 страницаLRP I Approved ProjectsTheReviewОценок пока нет

- Palm Tower 3 Coverage ReportДокумент61 страницаPalm Tower 3 Coverage ReportHassan DaudОценок пока нет

- The Future of HovercraftДокумент3 страницыThe Future of Hovercrafthovpod6214100% (4)