Академический Документы

Профессиональный Документы

Культура Документы

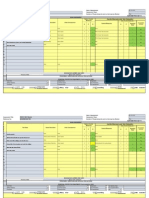

SAMPLE FORMULA SHEET - ENG 111 MIDTERM

Загружено:

john wickonson0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров1 страницаThis formula sheet provides formulas for calculating various financial metrics used to evaluate companies. It includes formulas for market value measures like market capitalization, price-to-earnings ratio, and market-to-book ratio. It also includes accounting ratios for measuring liquidity, leverage, asset efficiency, and profitability. Finally, it lists formulas for calculating cash flow, break-even point, operating cash flow, and salvage value for financial analysis.

Исходное описание:

Оригинальное название

ENG 111 SAMPLE FORMULA SHEET.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis formula sheet provides formulas for calculating various financial metrics used to evaluate companies. It includes formulas for market value measures like market capitalization, price-to-earnings ratio, and market-to-book ratio. It also includes accounting ratios for measuring liquidity, leverage, asset efficiency, and profitability. Finally, it lists formulas for calculating cash flow, break-even point, operating cash flow, and salvage value for financial analysis.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров1 страницаSAMPLE FORMULA SHEET - ENG 111 MIDTERM

Загружено:

john wickonsonThis formula sheet provides formulas for calculating various financial metrics used to evaluate companies. It includes formulas for market value measures like market capitalization, price-to-earnings ratio, and market-to-book ratio. It also includes accounting ratios for measuring liquidity, leverage, asset efficiency, and profitability. Finally, it lists formulas for calculating cash flow, break-even point, operating cash flow, and salvage value for financial analysis.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

SAMPLE FORMULA SHEET - ENG 111 MIDTERM

Market Value Measures Market Capitalization = Price per share * # Shares Outstanding

P/E Ratio = Price Per Share / Earnings Per Share

Market to Book Ratio = Market Value per Share / Book Value per Share

External Financing

Formulas

Accounting Ratios Current Ratio = Current Assets/ Current Liabilities

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Cash Ratio = Cash / Current Liabilities

Total Debt Ratio = (Total Assets – Total Equity ) / Total Assets

Debt/Equity = Total Debt / Total Equities

Equity Multiplier = Total Assets / Total Equity

Times Interest Earned = (Earnings Before Interest And Taxes) / Interest

Cash Coverage = (EBIT + Depreciation + Amortization) / Interest

Inventory Turnover = Cost of Goods Sold / Inventory

Days’ Sales in Inventory = 365 / (Inventory Turnover)

Receivables Turnover = Sales / Accounts Receivable

Days’ Sales in Receivables = 365 / Receivables Turnover

Total Asset Turnover = Sales /Total Assets

Profit Margin = Net Income / Sales

Return on Assets = Net Income / Total Assets

Return on Equity = Net Income / Total Equity

EBITDA Margin = EBITDA / Sales

Capital Intensity = Total Assets / Sales

Financial Cash Flow, Break C(A)=C(B)+C(S)

Even Point, OCF Formulas, C(A) =OCF- Change in NWC – Cash Flow to Fixed Assets

Salvage Value OCF=EBIT+Depreciation-Tax

Change in NWC = Ending NWC – Beginning NWC

Cash Flow to Fixed Assets = Ending NFA-Beginning NFA+Depreciation (if we use the gross

fixed assets, then = Ending Gross Fixed Assets – Beginning Gross Fixed Assets)

C(B) = Interest-(Ending Long Term Debt – Beginning Long Term Debt)

C(S) = Dividends – (Stocks sold- Stocks purchased)

Accounting: (Fixed Costs+Depr.)/(Sales Price-Variable Cost)

Financial(Pres. Value): (EAC+Fixed Costs*(1-t) – t*Depr.) / (Sales Price-Var. Cost)*(1-t)

Top Down: OCF = Sales-Cash Costs-Taxes, Bottom up: OCF = Net Income+Depreciation

Tax Shield: OCF = (Sales-Cash Costs)*(1-t)+t*Dep.

Salvage Value = Market Value - t (Market Value-Book Value)

Вам также может понравиться

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- CheatДокумент1 страницаCheatIshmo KueedОценок пока нет

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionДокумент7 страницCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARIОценок пока нет

- A DETAILED LESSON PLAN IN TLE DraftingДокумент16 страницA DETAILED LESSON PLAN IN TLE DraftingJude PellerinОценок пока нет

- Formule Corporate FinanceДокумент6 страницFormule Corporate FinanceБота Омарова100% (1)

- Business Metrics and Tools; Reference for Professionals and StudentsОт EverandBusiness Metrics and Tools; Reference for Professionals and StudentsОценок пока нет

- Individual TaxpayersДокумент3 страницыIndividual TaxpayersJoy Orena100% (2)

- Tally QuestionsДокумент73 страницыTally QuestionsVishal Shah100% (1)

- Task Based Risk Assesment FormДокумент2 страницыTask Based Risk Assesment FormKolluri SrinivasОценок пока нет

- Evoked PotentialsДокумент49 страницEvoked PotentialsparuОценок пока нет

- List of Formulas Used in Different Financial CalculationsДокумент2 страницыList of Formulas Used in Different Financial CalculationsRaja Muaz Ahmad KhanОценок пока нет

- Banking Finance Agile TestingДокумент4 страницыBanking Finance Agile Testinganil1karnatiОценок пока нет

- FINA 2201 and 2209 Final Exam ReviewДокумент5 страницFINA 2201 and 2209 Final Exam Reviewsxzhou23Оценок пока нет

- MS For The Access Control System Installation and TerminationДокумент21 страницаMS For The Access Control System Installation and Terminationwaaji snapОценок пока нет

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverДокумент3 страницыInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwОценок пока нет

- Manual de Motores Vol 4Документ75 страницManual de Motores Vol 4Gabriel Piñon Conde100% (1)

- SSTMCV Retail PowerДокумент5 страницSSTMCV Retail Powervipin.yadavОценок пока нет

- Xu10j4 PDFДокумент80 страницXu10j4 PDFPaulo Luiz França100% (1)

- Dividend Payout Ratio and Retention Ratio FormulasДокумент4 страницыDividend Payout Ratio and Retention Ratio FormulasEliana Katerine Martinez VillamilОценок пока нет

- O o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Документ3 страницыO o o o o Total Costs Q X V + FC o Accounting Break-Even: Q (FC + D) / (P-V)Ana C. RichiezОценок пока нет

- Chapters 2 and 3 Handouts AnalysisДокумент8 страницChapters 2 and 3 Handouts AnalysisCarter LeeОценок пока нет

- Ratio Analysis TemplateДокумент5 страницRatio Analysis TemplateAdil AliОценок пока нет

- FORMULA SHEET GUIDEДокумент3 страницыFORMULA SHEET GUIDEnatlyhОценок пока нет

- FormulasДокумент2 страницыFormulasSana KhanОценок пока нет

- RecipeДокумент4 страницыRecipesasyedaОценок пока нет

- GMR Operating Revenue Operating Expense Sales N MR Net Profit Sales Roa Profit Assets DE Total Debt Total Equity Liabilities EquityДокумент4 страницыGMR Operating Revenue Operating Expense Sales N MR Net Profit Sales Roa Profit Assets DE Total Debt Total Equity Liabilities EquityShahreyar YawarОценок пока нет

- Cash Flows: Using Compound Interest To Be An Annuity, Cash Flows Must Be EQUALДокумент1 страницаCash Flows: Using Compound Interest To Be An Annuity, Cash Flows Must Be EQUALNicole Allyson AguantaОценок пока нет

- Ratio Analysis FormulaeДокумент3 страницыRatio Analysis FormulaeKalyani ShindeОценок пока нет

- Common Financial Ratios Table ExplainedДокумент1 страницаCommon Financial Ratios Table ExplainedJainil ShahОценок пока нет

- Fin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NДокумент2 страницыFin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NbnОценок пока нет

- I) Short Term Solvency or Liquidity Ratios Or: InterestДокумент2 страницыI) Short Term Solvency or Liquidity Ratios Or: InterestSonia DalviОценок пока нет

- Formula Sheet FIN 300Документ3 страницыFormula Sheet FIN 300Stephanie NaamaniОценок пока нет

- Calculate key financial ratios to analyze business performanceДокумент1 страницаCalculate key financial ratios to analyze business performanceraju710@gmail.comОценок пока нет

- Formula SheetДокумент6 страницFormula Sheethas choОценок пока нет

- النسب المالية - إنجليزىДокумент5 страницالنسب المالية - إنجليزىMohamed Ahmed YassinОценок пока нет

- Accounting Formulas: Short Term Solvency or Liquidity RatiosДокумент2 страницыAccounting Formulas: Short Term Solvency or Liquidity RatiosTambro IsbОценок пока нет

- Financial Ratios ExplainedДокумент2 страницыFinancial Ratios ExplainedhaleeОценок пока нет

- Finman Formulas Prelims 3Документ3 страницыFinman Formulas Prelims 3eiaОценок пока нет

- Cma Formula SheetДокумент7 страницCma Formula Sheetanushkamohanan0Оценок пока нет

- Corporate FinanceДокумент10 страницCorporate Financeandrea figueroaОценок пока нет

- Accounting Ratios and Formulas GuideДокумент6 страницAccounting Ratios and Formulas GuideRavikumar GandhiОценок пока нет

- Formula SheetДокумент4 страницыFormula SheetAdil AliОценок пока нет

- FormulasДокумент2 страницыFormulasHydra JrОценок пока нет

- Fin Cheat SheetДокумент3 страницыFin Cheat SheetChristina RomanoОценок пока нет

- Exam 1 Formula SheetДокумент3 страницыExam 1 Formula SheetYingfanОценок пока нет

- CFA L1 Entire FRA Notes Summary Part 2Документ3 страницыCFA L1 Entire FRA Notes Summary Part 2Nishant SenapatiОценок пока нет

- Ration DefinitionsДокумент5 страницRation DefinitionsMohamedОценок пока нет

- CÔNG THỨC - Google Tài liệuДокумент2 страницыCÔNG THỨC - Google Tài liệuGiang HoàngОценок пока нет

- Advanced PM FormulasДокумент3 страницыAdvanced PM Formulastaxathon thaneОценок пока нет

- Cheat SheetДокумент4 страницыCheat Sheetppxxdd666Оценок пока нет

- Finance RatiosДокумент2 страницыFinance Ratioscoolmaverick420100% (1)

- Key Financial Ratios for Liquidity, Solvency, Profitability and ActivityДокумент2 страницыKey Financial Ratios for Liquidity, Solvency, Profitability and Activityashish_20kОценок пока нет

- Final Exam Cheat-SheetДокумент1 страницаFinal Exam Cheat-SheetPaolo TipoОценок пока нет

- Financial_Analysis_Cheat_Sheet_1709070577Документ2 страницыFinancial_Analysis_Cheat_Sheet_1709070577herrerofrutosОценок пока нет

- S Totalshare Dividends PFD Netincome: Debt (Solvency) RatiosДокумент3 страницыS Totalshare Dividends PFD Netincome: Debt (Solvency) RatiosFarin KaziОценок пока нет

- Liquidity Ratios (Do Not Include Working Capital) : - Longer BetterДокумент3 страницыLiquidity Ratios (Do Not Include Working Capital) : - Longer BetterAlyssa AlejandroОценок пока нет

- 000 REC Working Formula Compiled by GMRCДокумент12 страниц000 REC Working Formula Compiled by GMRCbhobot riveraОценок пока нет

- CheatSheet Midterm v2Документ10 страницCheatSheet Midterm v2besteОценок пока нет

- 1) Activity RatiosДокумент28 страниц1) Activity RatiosNyanОценок пока нет

- Acctg 14 NotesДокумент22 страницыAcctg 14 NotesJeciel Mae M. CalubaОценок пока нет

- Edited Formula SheetДокумент2 страницыEdited Formula Sheetlinhngo.31221020350Оценок пока нет

- Ratio WorkДокумент6 страницRatio WorkNATIONAL FARMERS PRODUCER COMPANYОценок пока нет

- Butler Lumber Glossary of Financial Ratios and TermsДокумент1 страницаButler Lumber Glossary of Financial Ratios and TermsBusiness ConsultancyОценок пока нет

- RatiosДокумент4 страницыRatiosSoham SubhamОценок пока нет

- Accounting Equations: SubjectДокумент2 страницыAccounting Equations: SubjectYuxuan ChenОценок пока нет

- Basics of key financial ratiosДокумент5 страницBasics of key financial ratiosAditya SharmaОценок пока нет

- CMA USA Ratio Definitions 2015Документ4 страницыCMA USA Ratio Definitions 2015Shameem JazirОценок пока нет

- Aesculap Qatar UniversityДокумент3 страницыAesculap Qatar UniversityAl Quran AcademyОценок пока нет

- People VS Yancon-DumacasДокумент2 страницыPeople VS Yancon-Dumacasvincent nifasОценок пока нет

- 19286711Документ8 страниц19286711suruth242100% (1)

- Draft SemestralWorK Aircraft2Документ7 страницDraft SemestralWorK Aircraft2Filip SkultetyОценок пока нет

- Wizard's App Pitch Deck by SlidesgoДокумент52 страницыWizard's App Pitch Deck by SlidesgoandreaОценок пока нет

- CPWD Contractor Enlistment Rules 2005 SummaryДокумент71 страницаCPWD Contractor Enlistment Rules 2005 Summaryvikky717Оценок пока нет

- An - APX18 206516L CT0Документ2 страницыAn - APX18 206516L CT0Maria MartinsОценок пока нет

- Lesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019Документ2 страницыLesson 3 - Subtract Two 4-Digit Numbers - More Than One Exchange 2019mОценок пока нет

- The Mpeg Dash StandardДокумент6 страницThe Mpeg Dash Standard9716755397Оценок пока нет

- Keyence Laser MicrometerДокумент20 страницKeyence Laser MicrometerimrancenakkОценок пока нет

- Leader in CSR 2020: A Case Study of Infosys LTDДокумент19 страницLeader in CSR 2020: A Case Study of Infosys LTDDr.Rashmi GuptaОценок пока нет

- Circuit Project Electronic: Simple Pulse Generator by IC 555 TimerДокумент1 страницаCircuit Project Electronic: Simple Pulse Generator by IC 555 TimerM Usman RiazОценок пока нет

- Guidelines For Planning Conjunctive Use of SUR Face and Ground Waters in Irrigation ProjectsДокумент34 страницыGuidelines For Planning Conjunctive Use of SUR Face and Ground Waters in Irrigation Projectshram_phdОценок пока нет

- Interpretation 1Документ17 страницInterpretation 1ysunnyОценок пока нет

- Philips Lighting Annual ReportДокумент158 страницPhilips Lighting Annual ReportOctavian Andrei NanciuОценок пока нет

- Everything You Need to Know About Distribution TransformersДокумент2 страницыEverything You Need to Know About Distribution TransformersDONNYMUCKTEEОценок пока нет

- Guidelines Regarding The Handling of Cable Drums During Transport and StorageДокумент5 страницGuidelines Regarding The Handling of Cable Drums During Transport and StorageJegan SureshОценок пока нет

- Piroxicam (Wikipedia)Документ4 страницыPiroxicam (Wikipedia)Adrian ArnasaputraОценок пока нет

- Washington State Employee - 4/2010Документ8 страницWashington State Employee - 4/2010WFSEc28Оценок пока нет

- E. Market Size PotentialДокумент4 страницыE. Market Size Potentialmesadaeterjohn.studentОценок пока нет