Академический Документы

Профессиональный Документы

Культура Документы

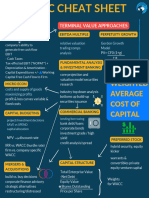

Crib Sheet For Midterm

Загружено:

Sayyedah NanjiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Crib Sheet For Midterm

Загружено:

Sayyedah NanjiАвторское право:

Доступные форматы

Chapter 13.

Capital budgeting Is about investment

Risk Averse- For a given situation, they would decisions and the value they create.

prefer relative certainty to uncertainty. The AVERAGE ACCOUNTING RETURN

wider, the more risk.

Dividend Valuation

Internally Generated – RE PAYBACK PERIOD

Time required to recoup the initial

investment.

NET PRESENT VALUE

The greater the standard deviation, the greater Externally Generated – new common Discounts the cash inflows

INTERNAL RATE OF RETURN

the risk. Get it when working on NPV

The larger the coefficient of variation, the greater the PROFITABILITY INDEX

Capital Asset Pricing Model MODIFIED IRR

Internally Generated Reinvested at cost of capital

NPV PROFILE

Externally Generated

risk .

The project that carries a normal amount of risk

should be discounted at the firm’s cost of capital.

Appendix 11A

CAPM relates the risk-return tradeoffs of

individual assets to market returns.

Risk also increases over time. The certainty

equivalent approach adjusts each cash flow THE SECURITY MARKET LINE

according to its probability distribution to a value

that is equal on the basis of having no inherent risk

and is therefore certain.

PV OF CCA TAX SHIELD

reiD

eC

APPENDIX 11B M. KK

sjbcsks

The efficient frontier graphically represents

portfolios that maximize returns for the risk

assumed.

CHAPTER 11

CHAPTER 12

Вам также может понравиться

- Comprehensive Finance Cheat Sheet Collection 1698244606Документ52 страницыComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- Discounted Cash FlowДокумент36 страницDiscounted Cash Flowapi-3838939100% (12)

- The Basics of Capital BudgetingДокумент5 страницThe Basics of Capital BudgetingChirrelyn Necesario SunioОценок пока нет

- Audit of PpeДокумент6 страницAudit of PpeJonailyn YR Peralta0% (1)

- Business Ratios and Formulas: A Comprehensive GuideОт EverandBusiness Ratios and Formulas: A Comprehensive GuideРейтинг: 3 из 5 звезд3/5 (1)

- Purchasing Must Become Supply Management - Kraljic ModelДокумент3 страницыPurchasing Must Become Supply Management - Kraljic Modelkshf_azamОценок пока нет

- Capital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalДокумент2 страницыCapital Budgeting: Factors of Consideration Net Investments Net Returns Cost of CapitalMary Hazell Victori100% (1)

- The Bright Future of TourismДокумент3 страницыThe Bright Future of TourismSirRobert Comia Enriquez71% (21)

- Webinar 2019 Mining Financial Model ValuationДокумент30 страницWebinar 2019 Mining Financial Model ValuationThanh NguyenОценок пока нет

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESОт EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESОценок пока нет

- InvoiceДокумент1 страницаInvoicesai madhavОценок пока нет

- Capital Budgeting - WorksheetДокумент32 страницыCapital Budgeting - WorksheetnerieroseОценок пока нет

- Cost of CapitalДокумент114 страницCost of CapitalNamra ImranОценок пока нет

- Valuation: Lecture Note Packet 1 Intrinsic ValuationДокумент308 страницValuation: Lecture Note Packet 1 Intrinsic ValuationAlvaro MedinaОценок пока нет

- NP EX19 8a JinruiDong 2Документ14 страницNP EX19 8a JinruiDong 2Ike DongОценок пока нет

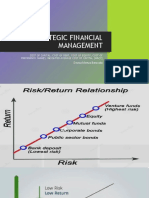

- Strategic Financial ManagementДокумент28 страницStrategic Financial ManagementDayana MasturaОценок пока нет

- Optimum Capital StructureДокумент7 страницOptimum Capital StructureSajid Baloch100% (1)

- Chapter 4Документ2 страницыChapter 4Azi LheyОценок пока нет

- SFM PDFДокумент22 страницыSFM PDFZafar IqbalОценок пока нет

- Strategic Financial Management: A Capsule For Quick RevisionДокумент22 страницыStrategic Financial Management: A Capsule For Quick RevisionدهانوجﻛﻮﻣﺎﺭОценок пока нет

- Cost of CapitalДокумент28 страницCost of Capitalmeakki1100% (3)

- Week 05 Risk ManagementДокумент26 страницWeek 05 Risk ManagementChristian Emmanuel DenteОценок пока нет

- Val Indonesia 2014Документ151 страницаVal Indonesia 2014Carlos Jesús Ponce AranedaОценок пока нет

- ISS22 ShababiДокумент36 страницISS22 ShababiAderito Raimundo MazuzeОценок пока нет

- PAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureДокумент3 страницыPAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureTimothy james PalermoОценок пока нет

- Chapter 4 - NotesДокумент2 страницыChapter 4 - NotesLovely CabardoОценок пока нет

- Cost of CapitalДокумент10 страницCost of CapitalAyush MishraОценок пока нет

- Ac 506 - Pas 16Документ1 страницаAc 506 - Pas 16Rome SibuyasОценок пока нет

- Financial Management I-Chpter: Financial Goals Profit Maximisation Share Holders Wealth MaximisationДокумент7 страницFinancial Management I-Chpter: Financial Goals Profit Maximisation Share Holders Wealth MaximisationRaghavendra yadav KMОценок пока нет

- Interest Rate SwapДокумент1 страницаInterest Rate SwapChelsea ConcepcionОценок пока нет

- Ra RocДокумент13 страницRa RocAnggraini CitraОценок пока нет

- Fsa c2 - Balance Sheet - Long-Lived Asset AnalysisДокумент2 страницыFsa c2 - Balance Sheet - Long-Lived Asset AnalysisK59 LE NGUYEN HA ANHОценок пока нет

- Capital Budgeting - NotesДокумент7 страницCapital Budgeting - NotesnerieroseОценок пока нет

- EfficientFrontier 02assetcaseДокумент6 страницEfficientFrontier 02assetcasefakayha hasanОценок пока нет

- Marginal Cost of Capital - CFA Level 1 - InvestopediaДокумент4 страницыMarginal Cost of Capital - CFA Level 1 - InvestopediajoysinhaОценок пока нет

- P4 Chapter 03 WACCДокумент38 страницP4 Chapter 03 WACCasim tariqОценок пока нет

- Settlement Difference Is Recognized As Gain or LossДокумент2 страницыSettlement Difference Is Recognized As Gain or LossKimmy ShawwyОценок пока нет

- Referencer For Strategic Financial ManagementДокумент24 страницыReferencer For Strategic Financial ManagementgauravОценок пока нет

- FIN242 - Chapter 6Документ1 страницаFIN242 - Chapter 6alymsrh810Оценок пока нет

- Valuation and MethodologiesДокумент49 страницValuation and MethodologiesCyra GomezОценок пока нет

- Lec 10 Capital Budgeting TechniquesДокумент22 страницыLec 10 Capital Budgeting TechniquesAnikk HassanОценок пока нет

- Stephen H. Penman-Financial Statement Analysis and Security Valuation-McGraw Hill (2013) - 662-672Документ11 страницStephen H. Penman-Financial Statement Analysis and Security Valuation-McGraw Hill (2013) - 662-672Walm KetyОценок пока нет

- SS - 7-8 - Mindmaps - Corporate FinanceДокумент38 страницSS - 7-8 - Mindmaps - Corporate Financehaoyuting426Оценок пока нет

- Corporate Finance Equations Notes 5Документ13 страницCorporate Finance Equations Notes 5Sotiris HarisОценок пока нет

- 418 Exam CheatsheetДокумент2 страницы418 Exam Cheatsheetmsmh.durrantОценок пока нет

- Value Creation - Negara Bagian NSWДокумент16 страницValue Creation - Negara Bagian NSWasliBenoОценок пока нет

- ACC 222 Practice SetДокумент4 страницыACC 222 Practice SetAdam CuencaОценок пока нет

- Chapter 7. Leverage and Capital StructureДокумент2 страницыChapter 7. Leverage and Capital StructureJhazz DoОценок пока нет

- Capital Budgeting SummaryДокумент8 страницCapital Budgeting Summaryparvez ansariОценок пока нет

- How Is Calculate The Value of A Business?: Market CapitalizationДокумент1 страницаHow Is Calculate The Value of A Business?: Market CapitalizationsofiaОценок пока нет

- UEU Penilaian Asset Bisnis Pertemuan 12Документ37 страницUEU Penilaian Asset Bisnis Pertemuan 12Saputra SanjayaОценок пока нет

- 1 DCF Cheat SheatДокумент1 страница1 DCF Cheat SheatHan Htun OoОценок пока нет

- Topic 09 Copia 2Документ43 страницыTopic 09 Copia 2marvalle2001Оценок пока нет

- Counterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Документ34 страницыCounterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Mo MokОценок пока нет

- Capital Budgeting Final - PPTX 3Документ112 страницCapital Budgeting Final - PPTX 3Patrishia AlvarezОценок пока нет

- Time Value of MoneyДокумент2 страницыTime Value of Moneyphia triesОценок пока нет

- Unlocking The Value of Real OptionsДокумент17 страницUnlocking The Value of Real OptionseliОценок пока нет

- Capital BudgetingДокумент53 страницыCapital Budgeting88ak07Оценок пока нет

- Fair Value for Financial Reporting: Meeting the New FASB RequirementsОт EverandFair Value for Financial Reporting: Meeting the New FASB RequirementsОценок пока нет

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesОт EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesОценок пока нет

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsОт EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsОценок пока нет

- Legal AspectДокумент12 страницLegal AspectVhin BaldonОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент5 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul KaushikОценок пока нет

- Deloitte CN Tax HK Tax Guide en 210928Документ20 страницDeloitte CN Tax HK Tax Guide en 210928Franklin ClintonОценок пока нет

- Ecotourism Marketing Strategy at Sebangau National Park, Central Kalimantan ProvinceДокумент14 страницEcotourism Marketing Strategy at Sebangau National Park, Central Kalimantan ProvinceMeilaniОценок пока нет

- Tax Audit ManualДокумент314 страницTax Audit ManualVigneshVigneshОценок пока нет

- SCORE Annual Marketing Budget TemplateДокумент1 страницаSCORE Annual Marketing Budget TemplateFadiОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент3 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVivek KhannaОценок пока нет

- Software Architecture Business CycleДокумент11 страницSoftware Architecture Business CycleMahesh MahiОценок пока нет

- Mba ProjectДокумент59 страницMba ProjectAQJ ADMINОценок пока нет

- Marketing Project 2Документ37 страницMarketing Project 2Hetik PatelОценок пока нет

- Repatriation of Human ResourcesДокумент4 страницыRepatriation of Human ResourcesCesare BorgiaОценок пока нет

- GST Accounting PDFДокумент17 страницGST Accounting PDFBOO KIANG MINGОценок пока нет

- Mobily Case StudyДокумент4 страницыMobily Case StudySteve CromptonОценок пока нет

- East Coast Warehouse & Distribution CornДокумент4 страницыEast Coast Warehouse & Distribution Cornjorge128417Оценок пока нет

- Resolution 2021 - 53 Re Privatization - Calapan DPPДокумент6 страницResolution 2021 - 53 Re Privatization - Calapan DPPPatrick MabbaguОценок пока нет

- IAS 35 Discontinuing Operations: International Accounting StandardsДокумент19 страницIAS 35 Discontinuing Operations: International Accounting Standardsrio1603Оценок пока нет

- Vendor Registration Form: Section 1: Company Details and General InformationДокумент4 страницыVendor Registration Form: Section 1: Company Details and General Informationsurya123sОценок пока нет

- Proposed: Authorization Matrix - Human Resource / PayrollДокумент1 страницаProposed: Authorization Matrix - Human Resource / PayrollHussain Al ShakhouriОценок пока нет

- Chapter - 10: Planning & Strategic ManagementДокумент35 страницChapter - 10: Planning & Strategic Managementcooldude690Оценок пока нет

- Ibs Bandar Tenggara SC 1 31/12/21Документ20 страницIbs Bandar Tenggara SC 1 31/12/21Ary PotterОценок пока нет

- Trainee Evaluation FormДокумент6 страницTrainee Evaluation FormIndranilGhoshОценок пока нет

- SDM Module IIIДокумент124 страницыSDM Module IIIMonsters vlogsОценок пока нет

- Chapter 5 - 7 Eleven Case Studies - QuesДокумент3 страницыChapter 5 - 7 Eleven Case Studies - QuesMary KarmacharyaОценок пока нет

- Mcm401 Collection of Old PapersДокумент29 страницMcm401 Collection of Old Paperscs619finalproject.com60% (10)

- 13-B Income Distribution Made by Taxable Estates or Trusts IllustrationДокумент27 страниц13-B Income Distribution Made by Taxable Estates or Trusts IllustrationSheilamae Sernadilla GregorioОценок пока нет