Академический Документы

Профессиональный Документы

Культура Документы

Donor's Tax

Загружено:

Keith Wally BalambanИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Donor's Tax

Загружено:

Keith Wally BalambanАвторское право:

Доступные форматы

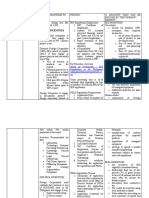

DONOR’S TAX – EXEMPTIONS or DEDUCTIONS

REPUBLIC ACT No. 1606

AN ACT TO PROMOTE SCIENTIFIC, ENGINEERING AND TECHNOLOGICAL

RESEARCH, INVENTION AND DEVELOPMENT.

SECTION 3. To carry out the provisions of this Act there is hereby

appropriated out of any funds in the National Treasury not otherwise

appropriated, or from the proceeds of any bond issues authorized by law,

beginning for the fiscal year nineteen hundred fifty-seven, the sum of four

million five hundred thousand pesos to constitute a special fund to be

known as the Scientific, Engineering and Technological Research Fund for

the first year and there is hereby appropriated two million three hundred

eighty thousand pesos for the second year, and two million two hundred

fifty thousand pesos each year for the third, fourth and fifth years:

Provided, That any unexpended appropriation for any particular year shall

not revert to the General Fund.

Any amount in the form of grants, donations or aids that may be received

by the Philippine Government for scientific, engineering and technological

research, invention, and development, which shall be exempted from all

taxes shall also form part of this Fund.

PRESIDENTIAL DECREE NO. 507

July 16, 1974

EXEMPTING DONATIONS AND/OR CONTRIBUTIONS AND REQUEST TO

SOCIAL WELFARE, CULTURAL AND CHARITABLE INSTITUTIONS FROM

CERTAIN TAXES AND PROVINCIAL TAX ALLOWANCE THEREFOR

WHEREAS, non-profit social welfare, cultural and charitable institutions

operate generally on funds generated through donations;

WHEREAS, these non-profit institutions are viable instruments for social

welfare and cultural development of the country;

WHEREAS, the success of the mission of these institutions depends largely

on the sufficiency of their financial resources; and

WHEREAS, it is necessary to encourage donations to these institutions in

order to enable them to acquire the necessary funds for their continue

operations.

SECTION 1. Any provision of law, decree, rules and regulations to the

contrary notwithstanding, all gifts, bequests, donations and/or

contributions to social welfare, cultural and charitable institutions, no part

of the net income of which inures to the benefit of any individual, shall be

exempt from the donor's and estate taxes and shall be deductible in full in

computing the taxable net income of the donor. Provided, however, that

not more than thirty per centum of said gifts and bequests shall be used

by such donee for administration purposes.

The Secretary of Finance, upon recommendation of the Commissioner of

Internal Revenue, shall promulgate rules and regulations to implement

this Decree.

REPUBLIC ACT NO. 1916

June 22, 1957

AN ACT EXEMPTING FROM THE PAYMENT OF ALL TAXES AND DUTIES ALL

DONATIONS IN ANY FORM AND IMPORTATIONS OF ARTICLES WHICH ARE

DONATIONS TO INTERNATIONAL CIVIC ORGANIZATIONS, RELIGIOUS OR

CHARITABLE INSTITUTIONS AND PROVIDING PENALTIES FOR VIOLATION

THEREOF

SECTION 1. The provisions of existing laws to the contrary

notwithstanding, all donations in any form and all articles imported into

the Philippines, consigned to a duly incorporated or established

international civic organization, religious or charitable society or institution

for civic, religious or charitable purposes shall be exempt from the

payment of all taxes and duties upon proof satisfactory to the

Commissioner of Customs and/or Collector of Internal Revenue that such

donations in any form and articles so imported are donations for its use or

for free distribution and not for barter, sale or hire: Provided, however,

That in case such articles are subsequently conveyed or transferred to

other parties for a consideration, taxes and duties shall be collected

thereon at double the rate provided under existing laws payable by the

transferor: Provided, further, That rules and regulations shall be

promulgated by the Department of Finance for the implementation of this

Act.

REPUBLIC ACT NO. 2707

June 18, 1960

AN ACT TO EXEMPT THE INTERNATIONAL RICE RESEARCH INSTITUTE OR

ITS SUCCESSORS FROM THE PAYMENT OF GIFT, FRANCHISE, SPECIFIC,

PERCENTAGE, REAL PROPERTY EXCHANGE, IMPORT, EXPORT AND ALL

OTHER TAXES, AND THE MEMBERS OF ITS SCIENTIFIC AND TECHNICAL

STAFF FROM THE PAYMENT OF INCOME TAX

SECTION 1. The provisions of existing laws or ordinances to the contrary

notwithstanding, the International Rice Research Institute, or its

successors, shall be exempt from the payment of gift, franchise, specific,

percentage, real property, exchange, import, export, and all other taxes

provided under existing laws or ordinances. This exemption shall extend to

goods imported and owned by the International Rice Research Institute to

be leased or used by members of its staff.

SECTION 2. All gifts, bequests, donations and contributions which may be

received by the International Rice Research Institute from any source

whatsoever, or which may be granted by the Institute to any individual or

non-profit organization for educational or scientific purposes, shall be

exempt from the payment of the taxes imposed under Title III of the

National Internal Revenue Code. All gifts, contributions and donations to

the Institute shall be considered allowable deductions for purposes of

determining the INCOME TAX of the donor.

SECTION 3. Non-Filipino citizens serving on the technical and scientific

staff of the International Rice Research Institute shall be exempt from the

payment of INCOME TAX on salaries and stipends in dollars received

solely and by reason of service rendered to the Institute.

PRESIDENTIAL DECREE NO. 373

January 9, 1974

EXEMPTING FROM TAXATION ALL DONATIONS TO THE NATIONAL MUSEUM,

THE NATIONAL LIBRARY AND THE ARCHIVES OF THE NATIONAL

HISTORICAL INSTITUTE

WHEREAS, museums, national libraries and archives depend mostly on

donations for the support of their projects or the acquisition of items for

their collections.

WHEREAS, in most countries donations to museums, national libraries and

archives are tax-exempt, like donations to charitable institutions.

WHEREAS, many collectors have expressed willingness to donate items to

the National Museum, the National Library and our archives under the

National Historical Institute but are deterred by present taxation policies.

SECTION 1. All monetary contributions and the equivalent monetary

value of works of art, manuscript, books or other articles of cultural,

historical or scientific significance, donated to the National Museum, the

National Library and the National Historical Institute, are tax exempt and

deductible from the taxable income of the donor.

SECTION 2. The Director of the National Museum, the Director of the

National Library and the Chairman of the National Historical Institute, in

the case of the national archives, are each hereby authorized to convene a

panel of experts who shall pass on the merit of the item or items offered

as donation to their respective collections and shall determine the

VALUATION thereof.

PRESIDENTIAL DECREE NO. 690

April 22, 1975

CREATING THE SOUTHERN PHILIPPINES DEVELOPMENT ADMINISTRATION

AND ABOLISHING THE COMMISSION ON NATIONAL INTEGRATION, THE

MINDANAO DEVELOPMENT AUTHORITY, THE PRESIDENTIAL TASK FORCE

FOR THE RECONSTRUCTION AND DEVELOPMENT OF MINDANAO, AND THE

SPECIAL PROGRAM OF ASSISTANCE FOR THE REHABILITATION OF

EVACUEES (SPARE), APPROPRIATING FUNDS THEREFOR, AND FOR OTHER

PURPOSES.

Section 20. Tax Exemptions. The Administration shall be exempt form

payment of all income taxes, franchise taxes, realty taxes and all kinds of

taxes and licenses to the National Government, its provinces, cities,

municipalities, and other government agencies and instrumentalities:

Provided, that its subsidiary corporations shall be subject to all said taxes

five years after their establishment under a graduated scale as follows:

twenty per centum of all said taxes from the sixth to the seventh year,

sixty per centum of all said taxes from the eight to the tenth year, after its

establishment. Such exemption shall include any tax or fee imposed by

the government on the sale, purchase or transfer of foreign exchange. All

notes, bonds and debentures and other obligations issued by the

Administration shall be exempted from all taxes, both as to principal and

interest, except inheritance and gift taxes.

Section 21. Donations and Gifts. The Administration shall have the right

to receive donations or bequests which shall be utilized only for the

implementation of the programs and projects of the Administration. Such

donations or bequests shall be exempt from the payment of gift taxes and

the full amount of such donation or bequest shall be deductible from the

gross income of the donor for the year during which the same is made.

PRESIDENTIAL DECREE NO. 1616

CREATING THE "INTRAMUROS ADMINISTRATION" FOR PURPOSES OF

RESTORING AND ADMINISTERING THE DEVELOPMENT OF INTRAMUROS

SECTION 16. Grants/contributions. — The administration is authorized to

accept and receive grants/contributions from private parties to the

obligated and disbursed in such manner as the Authority may, in the

exercise of sound discretion, deem best to accelerate the restoration or

enhance the maintenance of historical facilities in Intramuros and

contribute to their development and preservation. The Administration is

likewise authorized to give grants and contributions to private parties for

the restoration or maintenance of historical facilities in Intramuros. All

grants and donations to the Intramuros Administration shall be exempt

from donors and other taxes and shall be fully deductible, over and above

what is ordinarily allowable under the national internal revenue code, for

purposes of computing liabilities of the donor on income tax, estate tax, or

gift or donor's tax on other donations: Provided, That the value or

donations in kind shall be determined in consultation with the

Commissioner of Internal Revenue.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Common Estate Planning TechniquesДокумент35 страницCommon Estate Planning TechniquesMcKenzieLawОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 1099-INT 2023 - Tax FormДокумент3 страницы1099-INT 2023 - Tax Form16baezmcОценок пока нет

- W9Документ4 страницыW9pall2509Оценок пока нет

- Capital Commitment - Subscription FinanceДокумент16 страницCapital Commitment - Subscription FinanceTelly V. Onu100% (1)

- Pointers in Taxation (Atty. Roberto Lock) PDFДокумент97 страницPointers in Taxation (Atty. Roberto Lock) PDFReinald Kurt VillarazaОценок пока нет

- Justice Abad - Judicial Affidavit TranscriptsДокумент72 страницыJustice Abad - Judicial Affidavit TranscriptsKeith Wally BalambanОценок пока нет

- Your Money 2020: Key Tax Changes to KnowДокумент58 страницYour Money 2020: Key Tax Changes to KnowLan NguyenОценок пока нет

- (Cpar2016) Tax-8001 (General Principles of Taxation)Документ16 страниц(Cpar2016) Tax-8001 (General Principles of Taxation)Ralph SantosОценок пока нет

- Financing Ecotourism: By: Roxanne Isabelle T. BarolДокумент39 страницFinancing Ecotourism: By: Roxanne Isabelle T. BarolRichard Christian Buenacosa ConterasОценок пока нет

- Brochure For Potential Investors in Tourism SectorДокумент20 страницBrochure For Potential Investors in Tourism SectorMerima GZNRОценок пока нет

- ADIT Principles of International Taxation Module Brochure PDFДокумент36 страницADIT Principles of International Taxation Module Brochure PDFBhalchandra Dhopatkar0% (1)

- Form No. 16: Part BДокумент4 страницыForm No. 16: Part Britik tiwariОценок пока нет

- CORPO Finals Case DigestsДокумент71 страницаCORPO Finals Case DigestsKeith Wally Balamban88% (17)

- 10 Common Mistakes Franchisees MakeДокумент3 страницы10 Common Mistakes Franchisees MakeKeith Wally BalambanОценок пока нет

- Dna and Electronic EvidenceДокумент22 страницыDna and Electronic EvidenceKeith Wally BalambanОценок пока нет

- Estate TaxДокумент3 страницыEstate TaxKeith Wally BalambanОценок пока нет

- Torts Project CompilationДокумент27 страницTorts Project CompilationKeith Wally BalambanОценок пока нет

- Primer On The IP CodeДокумент23 страницыPrimer On The IP CodeIan LaynoОценок пока нет

- W-9 Tax FormДокумент4 страницыW-9 Tax FormMika DjokaОценок пока нет

- PAYSLIP DETAILSДокумент3 страницыPAYSLIP DETAILSamitОценок пока нет

- Community Service Report AnkitДокумент73 страницыCommunity Service Report Ankitg87.ankit3095100% (1)

- Major Changes To Enhanced STAR and Senior Exemption RenewalsДокумент1 страницаMajor Changes To Enhanced STAR and Senior Exemption RenewalsNewzjunkyОценок пока нет

- Mutual Fund Awareness Study Among Insurance AdvisorsДокумент77 страницMutual Fund Awareness Study Among Insurance AdvisorsHatim Ali100% (1)

- Immigrating or Returning To Live in CanadaДокумент14 страницImmigrating or Returning To Live in CanadaRosa VillarroelОценок пока нет

- Mactan Cebu International Airport Authority vs. MarcosДокумент27 страницMactan Cebu International Airport Authority vs. MarcosTia RicafortОценок пока нет

- RPH Taxation ReportДокумент38 страницRPH Taxation ReportLois SabadoОценок пока нет

- Econmics SyllabusДокумент3 страницыEconmics SyllabusjimmyОценок пока нет

- RPH M4 - TaxationДокумент5 страницRPH M4 - Taxation樺倉光莉Оценок пока нет

- Republic v. GonzalesДокумент4 страницыRepublic v. GonzalesJoshua Rizlan SimbilloОценок пока нет

- Tax 1 Case Digest - Atty. BonillaДокумент4 страницыTax 1 Case Digest - Atty. BonillaFredSiegAglusegОценок пока нет

- G.R. No. 149110 - National Power Corporation v. City of CabanatuanДокумент24 страницыG.R. No. 149110 - National Power Corporation v. City of CabanatuanCamille CruzОценок пока нет

- RR 14-2005-VatДокумент68 страницRR 14-2005-VatEmil A. MolinaОценок пока нет

- Lladoc vs. Commissioner of Internal Revenue, 14 SCRA 292, No. L-19201 June 16, 1965Документ3 страницыLladoc vs. Commissioner of Internal Revenue, 14 SCRA 292, No. L-19201 June 16, 1965PNP MayoyaoОценок пока нет

- 11 Main Features of The Foreign Trade Policy of IndiaДокумент4 страницы11 Main Features of The Foreign Trade Policy of Indiarash4ever2uОценок пока нет

- Eastern Theatrical Co Vs AlfonsoДокумент6 страницEastern Theatrical Co Vs AlfonsomilkteaОценок пока нет

- For Boi IncentivesДокумент7 страницFor Boi Incentiveskimberly fanoОценок пока нет

- Cases For StatconДокумент176 страницCases For StatconGlenda Mae GemalОценок пока нет