Академический Документы

Профессиональный Документы

Культура Документы

Return

Загружено:

Faisal Islam ButtИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Return

Загружено:

Faisal Islam ButtАвторское право:

Доступные форматы

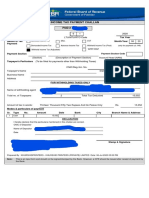

INCOME TAX PAYMENT CHALLAN

PSID # : 35543182

RTO-II LAHORE 6 5 2020

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 09 19

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 236H Purchase by Retailers u/s 236H - Others (ATL Payment Section Code 64150803

@ 0.5% / Non-ATL @ 1%)

(Section) (Description of Payment Section) Account Head (NAM) B01131

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

CNIC/Reg./Inc. No. 3520149098896

Name of withholding agent USHMA RASHID

Total no. of Taxpayers 12 Total Tax Deducted 4,067

Amount of tax in words: Four Thousand Sixty Seven Rupees And No Paisas Only Rs. 4,067

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 Cash 4,067

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor 3520149098896

Name of Depositor USHMA RASHID

Date

Stamp & Signature

PSID-IT-000088177893-092020

Prepared By : 3520149098896 - USHMA RASHID Date: 28-Oct-2019 09:07 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

Вам также может понравиться

- Income Tax Payment Challan: PSID #: 35235957Документ1 страницаIncome Tax Payment Challan: PSID #: 35235957Ayan BОценок пока нет

- Income Tax Payment Challan: PSID #: 30308134Документ1 страницаIncome Tax Payment Challan: PSID #: 30308134Azam mughalОценок пока нет

- Abdul Ghaffar 14-10-19 PDFДокумент1 страницаAbdul Ghaffar 14-10-19 PDFAyan BОценок пока нет

- It 000095777126 2020 06Документ1 страницаIt 000095777126 2020 06Haroon ButtОценок пока нет

- Income Tax Payment Challan: PSID #: 148473028Документ1 страницаIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaОценок пока нет

- Income Tax Payment Challan: PSID #: 47684385Документ1 страницаIncome Tax Payment Challan: PSID #: 47684385gandapur khanОценок пока нет

- Income Tax Payment Challan: PSID #: 34336315Документ1 страницаIncome Tax Payment Challan: PSID #: 34336315kashif shahzadОценок пока нет

- Umair + Shahid PDFДокумент1 страницаUmair + Shahid PDFAyan BОценок пока нет

- It 000136658400 2023 04Документ1 страницаIt 000136658400 2023 04Talha ShaukatОценок пока нет

- It 000092233928 2020 01Документ1 страницаIt 000092233928 2020 01naeem1990Оценок пока нет

- Income Tax Payment Challan: PSID #: 146916470Документ1 страницаIncome Tax Payment Challan: PSID #: 146916470Madiah abcОценок пока нет

- Income Tax Payment Challan: PSID #: 35390320Документ1 страницаIncome Tax Payment Challan: PSID #: 35390320zeshanОценок пока нет

- Income Tax Payment Challan: PSID #: 152672806Документ1 страницаIncome Tax Payment Challan: PSID #: 152672806JosephОценок пока нет

- PSID# 36803358 (Junaid Paracha) PDFДокумент1 страницаPSID# 36803358 (Junaid Paracha) PDFAsif JavidОценок пока нет

- It 000095921232 2020 06Документ1 страницаIt 000095921232 2020 06Haroon ButtОценок пока нет

- Income Tax Payment Challan: PSID #: 21114984Документ1 страницаIncome Tax Payment Challan: PSID #: 21114984Zia Sultan AwanОценок пока нет

- Income Tax Payment Challan: PSID #: 141441493Документ1 страницаIncome Tax Payment Challan: PSID #: 141441493Syed Mudassar GillaniОценок пока нет

- Income Tax Payment Challan: PSID #: 42719670Документ1 страницаIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifОценок пока нет

- It 000095921212 2020 05Документ1 страницаIt 000095921212 2020 05Haroon ButtОценок пока нет

- FBR ITO Assing Contractor 22feb2024Документ1 страницаFBR ITO Assing Contractor 22feb2024Syed TabishОценок пока нет

- DirectTaxesPaymentPSID UpdateNatureДокумент1 страницаDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhОценок пока нет

- Mushtaq & IshfaqДокумент1 страницаMushtaq & IshfaqAʌĸʌsʜ AƴʌŋОценок пока нет

- It 000136741219 2023 05Документ1 страницаIt 000136741219 2023 05wali khelОценок пока нет

- Income Tax Payment Challan: PSID #: 148094666Документ1 страницаIncome Tax Payment Challan: PSID #: 148094666omer akhterОценок пока нет

- Income Tax Payment Challan: PSID #: 34006892Документ1 страницаIncome Tax Payment Challan: PSID #: 34006892Afu MaanОценок пока нет

- It 000056282735 2016 12Документ1 страницаIt 000056282735 2016 12Muhammad AbdullahОценок пока нет

- Income Tax Payment Challan: PSID #: 48471182Документ1 страницаIncome Tax Payment Challan: PSID #: 48471182Haseeb RazaОценок пока нет

- Income Tax Payment Challan: PSID #: 42751407Документ1 страницаIncome Tax Payment Challan: PSID #: 42751407Muhammad Qaisar LatifОценок пока нет

- Income Tax Payment Challan: PSID #: 42730325Документ1 страницаIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifОценок пока нет

- Income Tax Payment Challan: PSID #: 43320237Документ1 страницаIncome Tax Payment Challan: PSID #: 43320237gandapur khanОценок пока нет

- Income Tax Payment Challan: PSID #: 148472556Документ1 страницаIncome Tax Payment Challan: PSID #: 148472556Haseeb RazaОценок пока нет

- It 000111825668 2020 00Документ1 страницаIt 000111825668 2020 00Muhammad IrfanОценок пока нет

- Income Tax Payment Challan: PSID #: 165866486Документ1 страницаIncome Tax Payment Challan: PSID #: 165866486Ashok KumarОценок пока нет

- Income Tax Payment Challan: PSID #: 42603469Документ1 страницаIncome Tax Payment Challan: PSID #: 42603469gandapur khanОценок пока нет

- It 000126799893 2023 08Документ1 страницаIt 000126799893 2023 08Anas KhanОценок пока нет

- It 000129964508 2022 11Документ1 страницаIt 000129964508 2022 11SkjhkjhkjhОценок пока нет

- Income Tax Payment Challan: PSID #: 165866345Документ1 страницаIncome Tax Payment Challan: PSID #: 165866345Ashok KumarОценок пока нет

- It 000130629196 2021 00Документ1 страницаIt 000130629196 2021 00muhammad faiqОценок пока нет

- It 000143553567 2022 00Документ1 страницаIt 000143553567 2022 00danishahmed2126Оценок пока нет

- Income Tax Payment Challan: PSID #: 141518891Документ1 страницаIncome Tax Payment Challan: PSID #: 141518891IkramОценок пока нет

- It 000100418367 2020 11 PDFДокумент1 страницаIt 000100418367 2020 11 PDFMuhammad Qaisar LatifОценок пока нет

- It 000095721007 2019 00Документ1 страницаIt 000095721007 2019 00Haroon ButtОценок пока нет

- Income Tax Payment Challan: PSID #: 175921882Документ1 страницаIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786Оценок пока нет

- Income Tax Payment Challan: PSID #: 143186538Документ1 страницаIncome Tax Payment Challan: PSID #: 143186538talhaОценок пока нет

- Adjustable Tax-PSIDДокумент1 страницаAdjustable Tax-PSIDWaris Corp.Оценок пока нет

- Income Tax Payment Challan: PSID #: 42125287Документ1 страницаIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifОценок пока нет

- Muhammad Afan Malik-IIДокумент1 страницаMuhammad Afan Malik-IIBabu AnsariОценок пока нет

- Income Tax Payment Challan: PSID #: 148473407Документ1 страницаIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaОценок пока нет

- FBR FerozabadДокумент1 страницаFBR Ferozabadferozabad schoolОценок пока нет

- Goga 2.5Документ1 страницаGoga 2.5advocateyaqootОценок пока нет

- Reema KhanДокумент1 страницаReema Khanattock jadeedОценок пока нет

- Income Tax Payment Challan: PSID #: 144267713Документ1 страницаIncome Tax Payment Challan: PSID #: 144267713umar arshadОценок пока нет

- Income Tax Payment Challan: PSID #: 148471730Документ1 страницаIncome Tax Payment Challan: PSID #: 148471730Haseeb RazaОценок пока нет

- Income Tax Payment Challan: PSID #: 32849321Документ1 страницаIncome Tax Payment Challan: PSID #: 32849321hanzalah aminОценок пока нет

- Income Tax Payment Challan: PSID #: 50454183Документ1 страницаIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqОценок пока нет

- It 000111296083 2020 00Документ1 страницаIt 000111296083 2020 00Usman ArifОценок пока нет

- It 000133172232 2023 01Документ1 страницаIt 000133172232 2023 01omer akhterОценок пока нет

- It 000016485106 2011 00Документ1 страницаIt 000016485106 2011 00AMMAR REHMANIОценок пока нет

- It 000132223866 2023 01Документ1 страницаIt 000132223866 2023 01mazharehsan08Оценок пока нет

- Shawacademy Invoice Hr5518nRSAQFc0YeC PDFДокумент1 страницаShawacademy Invoice Hr5518nRSAQFc0YeC PDFAdrian Joseph NuñezОценок пока нет

- Estmt - 2024 02 22Документ10 страницEstmt - 2024 02 22jpneebОценок пока нет

- ATM - PPT - de Guzman Aladin Quinola PascuaДокумент25 страницATM - PPT - de Guzman Aladin Quinola PascuaJohn Michael Gaoiran GajotanОценок пока нет

- Prof. K. S. Jaiswal: Department of CommerceДокумент13 страницProf. K. S. Jaiswal: Department of CommerceR VОценок пока нет

- 072) Parle Agro - Civil - Extra Work Qty - 3804Документ4 страницы072) Parle Agro - Civil - Extra Work Qty - 3804Vikrant KoulОценок пока нет

- International Banking: Structure of MT940/MT942 Records S.W.I.F.T. / Non-S.W.I.F.TДокумент43 страницыInternational Banking: Structure of MT940/MT942 Records S.W.I.F.T. / Non-S.W.I.F.TDiana GrajdanОценок пока нет

- Bill Pay Features FunctionsДокумент18 страницBill Pay Features FunctionsZorex ZisaОценок пока нет

- 2011 Pub 4491WДокумент208 страниц2011 Pub 4491WRefundOhioОценок пока нет

- QPDsДокумент4 страницыQPDsDanisa NdhlovuОценок пока нет

- 255 Bob StatementДокумент2 страницы255 Bob Statementrajesh kumar rawatОценок пока нет

- Surya YasaДокумент2 страницыSurya YasaAh MuhayОценок пока нет

- Direct Import Payment - RL 01.04.2016Документ3 страницыDirect Import Payment - RL 01.04.2016Prakash PandeyОценок пока нет

- E-Ticket For Agra Fort: Important InformationДокумент3 страницыE-Ticket For Agra Fort: Important InformationAshish RaiОценок пока нет

- Debit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedДокумент1 страницаDebit Mandate Form NACH / ECS / DIRECT DEBIT: Mthly Qtly H-Yrly Yrly As & When PresentedVermaОценок пока нет

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKДокумент9 страницTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuОценок пока нет

- Oluwale AdebayoДокумент1 страницаOluwale Adebayowhitneydemetria007Оценок пока нет

- Compensation IncomeДокумент5 страницCompensation IncomePaula Mae Dacanay100% (1)

- Error Correction Entries The First Audit of The Books of PDFДокумент1 страницаError Correction Entries The First Audit of The Books of PDFAnbu jaromiaОценок пока нет

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2017Документ7 страницBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2017khellany guerzonОценок пока нет

- Payment Registration SlipДокумент1 страницаPayment Registration SlipDaniel Kyeyune MuwangaОценок пока нет

- Prefinals Exam in Income TaxationДокумент3 страницыPrefinals Exam in Income TaxationYen YenОценок пока нет

- COR19982 Nat 5367 FormДокумент3 страницыCOR19982 Nat 5367 Formishtee894Оценок пока нет

- Upi Response CodesДокумент20 страницUpi Response Codesletihi9143Оценок пока нет

- Bills of Exchange ProjectДокумент7 страницBills of Exchange ProjectNishaTambe100% (1)

- Ashutosh Sohil Salary 2020-03 PDFДокумент1 страницаAshutosh Sohil Salary 2020-03 PDFMohit Sharma100% (1)

- AXIS Bank RTGS & NEFT FormДокумент11 страницAXIS Bank RTGS & NEFT FormNeha JunejaОценок пока нет

- 2 - BootДокумент3 страницы2 - Bootsubham duttaОценок пока нет

- 0432 Merkblatt Zur Anmeldepflicht Von Barmitteln - Englisch - (2012) Seite - 1 - Von 3Документ3 страницы0432 Merkblatt Zur Anmeldepflicht Von Barmitteln - Englisch - (2012) Seite - 1 - Von 3Эльзар МаликовОценок пока нет

- 978402applied Math Test Paper - Xi Set 2 - Sem 2Документ4 страницы978402applied Math Test Paper - Xi Set 2 - Sem 2MehulОценок пока нет

- FPДокумент20 страницFPRadhika ParekhОценок пока нет