Академический Документы

Профессиональный Документы

Культура Документы

Introduction To Accounting

Загружено:

Angelika C. GuevarraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Introduction To Accounting

Загружено:

Angelika C. GuevarraАвторское право:

Доступные форматы

INTRODUCTION TO ACCOUNTING

Definition

Accounting is the process of IDENTIFYING, RECORDING, and COMMUNICATING economic

events of an organization to interested users.

IDENTIFYING – this involves selecting economic events that are relevant to a particular

business transaction

RECORDING – this involves keeping a chronological diary of events that are measured in

pesos

COMMUNICATING – occurs through the preparation and distribution of financial and other

accounting reports

Nature of Accounting

According to Accounting Theory: “Accounting is a systematic recording of financial transactions

and the presentation of the related information to appropriate persons.”

Basic features of accounting:

• Accounting is a service activity. Accounting provides assistance to decision makers by

providing them financial reports that will guide them in coming up with sound decisions.

• Accounting is a process: A process refers to the method of performing any specific job step by

step according to the objectives or targets. Accounting is identified as a process, as it performs

the specific task of collecting, processing and communicating financial information. In doing so,

it follows some definite steps like the collection, recording, classification, summarization,

finalization, and reporting of financial data.

• Accounting is both an art and a discipline. Accounting is the art of recording, classifying,

summarizing and finalizing financial data. The word ‘art’ refers to the way something is

performed. It is behavioral knowledge involving a certain creativity and skill to help us attain

some specific objectives. Accounting is a systematic method consisting of definite techniques

and its proper application requires skill and expertise. So by nature, accounting is an art. And

because it follows certain standards and professional ethics, it is also a discipline.

• Accounting deals with financial information and transactions: Accounting records financial

transactions and data, classifies these and finalizes their results given for a specified period of

time, as needed by their users. At every stage, from start to finish, accounting deals with

financial information and financial information only. It does not deal with non-monetary or non-

financial aspects of such information.

• Accounting is an information system: Accounting is recognized and characterized as a

storehouse of information. As a service function, it collects processes and communicates

financial information of any entity. This discipline of knowledge has evolved to meet the need for

financial information as required by various interested groups.

Function of Accounting in business

Accounting is the means by which business information is communicated to business owners

and stakeholders. The role of accounting in business is to provide information for managers and

owners to use in operating the business. In addition, accounting information allows business

owners to assess the efficiency and effectiveness of their business operations. Prepared

accounting reports can be compared with industry standards or to a leading competitor to

determine how the business is doing. Business owners may also use historical financial

accounting statements to create trends for analyzing and forecasting future sales.

Branches of Accounting

Financial Accounting

Financial accounting is primarily concerned with the recognition, measurement and

communication of economic activities. This information is communicated in a complete set of

financial statements. It is assumed under this branch that the users have one common

information need. primarily concerned with processing historical data. Although financial

accounting generally meets the needs of external

users, internal users of accounting information also use these information for their decision-

making needs.

Users of Accounting Information

Internal Users

Internal users of accounting information are those individuals inside a company who plan,

organize, and run the business. These users are directly involved in managing and operating

the business. These include employees, marketing managers, production supervisors, finance

directors, company officers and owners.

External Users

External users are individuals and organizations outside a company who want financial

information about the company. These users are not directly involved in managing and

operating the business. The two most common types of external users are potential investors

and creditors. Potential Investors use accounting information to make decisions to buy shares of

a company. Creditors (such as suppliers and bankers) use accounting information to evaluate

the risks of granting credit or lending money. Also included as external users are government

regulatory agencies such as Securities and Exchange Commission (SEC), Bureau of Internal

Revenue (BIR), Department of Labor and Employment (DOLE), Social Security System (SSS),

and Local Government Units (LGUs).

Forms of Business Organizations

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Nameless War PDFДокумент36 страницNameless War PDFBrunoOmoreschi100% (1)

- Taxation of RFCs and NFCs in PHДокумент4 страницыTaxation of RFCs and NFCs in PHIris Grace Culata0% (1)

- Computer Fraud & Abuse TechniquesДокумент4 страницыComputer Fraud & Abuse TechniquesAngelika C. GuevarraОценок пока нет

- Land LawДокумент11 страницLand LawJoey WongОценок пока нет

- OBLI Chapter 4 Extinguishment of Obligation PDFДокумент16 страницOBLI Chapter 4 Extinguishment of Obligation PDFOpenbetaОценок пока нет

- LBP V BelleДокумент6 страницLBP V BelleJoshua Quentin TarceloОценок пока нет

- Reynoso Vs CA DIgestДокумент3 страницыReynoso Vs CA DIgestoabeljeanmoniqueОценок пока нет

- Volvo Working Capital ManagementДокумент108 страницVolvo Working Capital ManagementRaj MurthyОценок пока нет

- Guevarra, Angelika, C. Mendoza, Lan Megan, M. BSA-3AДокумент5 страницGuevarra, Angelika, C. Mendoza, Lan Megan, M. BSA-3AAngelika C. GuevarraОценок пока нет

- Acceptance SlipДокумент1 страницаAcceptance SlipAngelika C. GuevarraОценок пока нет

- Acceptance SlipДокумент1 страницаAcceptance SlipAngelika C. GuevarraОценок пока нет

- Comprehensive Audit of Balance Sheet and Income Statement AccountsДокумент25 страницComprehensive Audit of Balance Sheet and Income Statement AccountsJin KyОценок пока нет

- Conducted A Survey For The Farmers Living Around The Barangays of Balanga CityДокумент2 страницыConducted A Survey For The Farmers Living Around The Barangays of Balanga CityAngelika C. GuevarraОценок пока нет

- HДокумент2 страницыHAngelika C. GuevarraОценок пока нет

- Phi 68080Документ58 страницPhi 68080Angelika C. GuevarraОценок пока нет

- Chapter 6 HandoutДокумент10 страницChapter 6 HandoutAngelika C. GuevarraОценок пока нет

- Chapter 7 For StudesДокумент41 страницаChapter 7 For StudesAngelika C. GuevarraОценок пока нет

- Chapter 8 and 9 HandoutДокумент34 страницыChapter 8 and 9 HandoutAngelika C. GuevarraОценок пока нет

- AISДокумент4 страницыAISAngelika C. GuevarraОценок пока нет

- Mathamatics Part 2 - Grade 11-E - Inner - V3 PDFДокумент156 страницMathamatics Part 2 - Grade 11-E - Inner - V3 PDFThevakaran ArunasalamОценок пока нет

- Commercial BankingДокумент74 страницыCommercial BankingShishir N VОценок пока нет

- Case 1Документ18 страницCase 1Amit Kanti RoyОценок пока нет

- The Role of Commercial BanksДокумент29 страницThe Role of Commercial BanksGeorge Cristinel RotaruОценок пока нет

- Admission Cum Retirement DeedДокумент8 страницAdmission Cum Retirement DeedRohit Yadav50% (2)

- Cost & Finance RTP Nov 15Документ41 страницаCost & Finance RTP Nov 15Aaquib ShahiОценок пока нет

- BACKTEST Bgi PaulaДокумент3 страницыBACKTEST Bgi PaulaGabriel BarbosaОценок пока нет

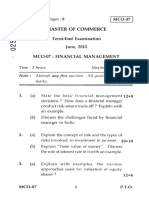

- MCO-7 June12Документ7 страницMCO-7 June12BinayKPОценок пока нет

- Notice: Prohibited Trade Practices: South Carolina State Board of DentistryДокумент4 страницыNotice: Prohibited Trade Practices: South Carolina State Board of DentistryJustia.comОценок пока нет

- Luxurious Stadium Road Apartments from Rs. 550,000Документ7 страницLuxurious Stadium Road Apartments from Rs. 550,000jalees230% (1)

- Interloop Limited Income Statement: Rupees in ThousandДокумент13 страницInterloop Limited Income Statement: Rupees in ThousandAsad AliОценок пока нет

- Report On Verka Working Capital MGTTTДокумент64 страницыReport On Verka Working Capital MGTTTPreet PreetОценок пока нет

- E.O. No. 518Документ3 страницыE.O. No. 518Rene ValentosОценок пока нет

- TDS Certificate Form 16 SummaryДокумент3 страницыTDS Certificate Form 16 SummarySvsSridharОценок пока нет

- Title: Enrollment and Payment System of Davao City Sdaelementary SchoolДокумент9 страницTitle: Enrollment and Payment System of Davao City Sdaelementary SchoolAlberto CagataОценок пока нет

- BASIX-BSFL Social Rating ReportДокумент17 страницBASIX-BSFL Social Rating Reportakhi_lesh001Оценок пока нет

- Tutorial1 GuidingSolution-2Документ11 страницTutorial1 GuidingSolution-2Rick0% (1)

- 42 Sps. Andal vs. PNBДокумент6 страниц42 Sps. Andal vs. PNBRobert Jayson UyОценок пока нет

- Practical Accounting 1Документ13 страницPractical Accounting 1Sherrizah Ferrer MaribbayОценок пока нет

- Analyzing Financial Statements and RatiosДокумент17 страницAnalyzing Financial Statements and Ratiosanonymathieu50% (2)

- SMEs (Students Guide)Документ11 страницSMEs (Students Guide)Erica CaliuagОценок пока нет

- Icici BankДокумент56 страницIcici BankvishwanathvrОценок пока нет

- BUSI 1001/1004 - Financial Accounting Sample Final ExaminationДокумент19 страницBUSI 1001/1004 - Financial Accounting Sample Final ExaminationThe oneОценок пока нет