Академический Документы

Профессиональный Документы

Культура Документы

Acctg 100C 01

Загружено:

Jose Magallanes100%(1)100% нашли этот документ полезным (1 голос)

294 просмотров6 страницThis document contains a series of multiple choice questions about accounting concepts related to cash and cash equivalents. Specifically, it covers topics like the definition of cash, what qualifies as a cash equivalent, accounting for petty cash funds using the imprest system, internal controls over cash, bank reconciliations, and cash short and over accounts. The questions assess understanding of basic cash accounting principles and procedures.

Исходное описание:

TOA

Оригинальное название

ACCTG-100C-01

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document contains a series of multiple choice questions about accounting concepts related to cash and cash equivalents. Specifically, it covers topics like the definition of cash, what qualifies as a cash equivalent, accounting for petty cash funds using the imprest system, internal controls over cash, bank reconciliations, and cash short and over accounts. The questions assess understanding of basic cash accounting principles and procedures.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

294 просмотров6 страницAcctg 100C 01

Загружено:

Jose MagallanesThis document contains a series of multiple choice questions about accounting concepts related to cash and cash equivalents. Specifically, it covers topics like the definition of cash, what qualifies as a cash equivalent, accounting for petty cash funds using the imprest system, internal controls over cash, bank reconciliations, and cash short and over accounts. The questions assess understanding of basic cash accounting principles and procedures.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

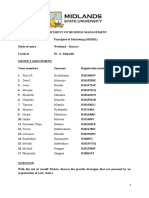

Pamantasan ng Cabuyao

Katapatan Subd., Banay Banay, City of Cabuyao

Accounting Review III - Practical Accounting I (ACCTG100C) P1 - 01

CASH AND CASH EQUIVALENTS

1. As contemplated in accounting, cash includes

A. Money only

B. Money and any other negotiable instruments

C. Any negotiable instruments

D. Money and any other negotiable instrument that is payable in money and acceptable by bank for deposit and immediate

credit.

2. Which of the following statement is false?

A. Not all items included in cash constitute a legal tender

B. Cash may be offset against a liability if the deposit of funds in restricted account clearly constitutes the legal discharge of

the liability.

C. Legally restricted bank deposit held as compensating balance should be segregated from the cash account and reported

under the same caption.

D. One-year BSP treasury bills with remaining maturity of three months on the balance sheet date may be shown as part of

“cash and cash equivalents” provided this is disclosed.

3. To be reported as “cash and cash equivalents”, the cash and cash equivalent must be

A. Unrestricted in use for current operation.

B. Available for the purchase of property, plant and equipment.

C. Set aside for the liquidation of long-term debt.

D. Deposited in bank.

4. Cash equivalent are

A. Short-term and highly liquid investments that are readily convertible into cash.

B. Short- term and highly liquid investments that are readily convertible into cash with

remaining maturity of three months.

C. Short- term and highly liquid investments that are readily convertible into cash and acquired three months before maturity.

D. Short-term and highly liquid marketable securities.

5. Which of the following is not considered as a cash equivalent for the purpose of cash flow statement?

A. A three-year treasury note maturing on May 30, of the current year, purchased by the enterprise on April 15, of the

current year.

B. A three-year treasury note maturing on May 30, of the current year, purchased by the enterprise on January 2 of the

current year.

C. A 90-day T-Bill.

D. A 60-day money market placement.

6. Which is false concerning valuation of cash and cash equivalents?

A. Cash is valued at face value.

B. Cash in foreign currency is valued at the current exchange rate.

C. If a bank or financial institution holding the funds of the company is in bankruptcy or financial difficulty, cash should be

written down to estimated realizable value.

D. Cash equivalents should be valued at maturity value, meaning face value plus interests.

7. The following statement relates to cash. Which statement is true?

A. The term cash equivalents refer to demand credit instruments such as money order and bank drafts.

B. The purpose of establishing a petty cash fund is to keep enough cash on hand to cover all normal operating expenses for

a period of time.

C. Classification of restricted cash balance as current or noncurrent should parallel the classification of the related obligation

for which it is related.

D. Compensating balance required by a bank should always be excluded from “cash and cash equivalent”.

8. If material, deposits in foreign bank which are subject to foreign exchange restriction should be classified

A. Separately as current asset, with appropriate disclosure.

B. Separately as noncurrent assets with appropriate disclosure.

C. Be written off as an extraordinary loss.

D. As part of cash and cash equivalent.

9. Bank overdraft

A. Is a debit balance in cash in a bank account.

B. Is offset against a demand deposit account in another bank.

C. Which cannot be offset is classified as current liability.

D. Which cannot be offset is classified as noncurrent liability.

10. A compensating balance

A. Must be included in cash and cash equivalent.

B. Which is legally restricted and related to long-term loan is classified as current asset.

C. Which is legally restricted and related to short-term loan is classified separately as current asset.

D. Which is not legally restricted as to withdrawal is classified separately as current asset.

11. Unreleased checks (check drawn before balance sheet date but held for later delivery to creditors).

A. Should be treated as outstanding checks.

B. Should be restored to cash balance.

C. Should be treated as outstanding checks if the date is shortly after the balance sheet date.

D. Should be treated as outstanding checks as if they are ultimately encashed.

12. Which of the following should not be considered cash for financial accounting purpose?

A. Petty cash fund and change fund.

B. Money orders, certified checks and personal checks.

C. Coins, currencies and available funds.

D. Postdated checks and IOUs.

13. Which of the following is usually considered cash?

A. Certificated of deposit.

B. Checking accounts

C. Money market savings certificates

D. Postdated checks

14. Petty cash fund is

A. Separately classified as current asset.

B. Money kept on hand for making minor disbursements of coin and currency rather than writing checks

C. Set aside for payment of payroll

D. Restricted cash

15. The petty cash fund account under the imprest fund system is debited

A. Only when the fund is created.

B. When the fund is created and every time it is replenished.

C. When the fund is created and when the size of the fund is increased.

D. When the fund is created and when the size of the fund is decreased.

16. The internal control feature that is specific to petty cash is

A. Separation of duties

B. Assignment of responsibility

C. Proper authorization

D. Imprest system

17. What is the major purpose of an imprest petty cash fund?

A. To effectively plan cash inflows and outflows.

B. To ease the payments to cash vendors.

C. To determine the honesty of the petty cashier.

D. To effectively control cash disbursement.

18. What happens when a petty cash is in use?

A. Expenses with the petty cash are recorded when the fund is replenished.

B. Most small amounts are paid from cash receipts before they are deposited.

C. Petty cash is debited when the fund is replenished.

D. Petty cash is credited when the fund is replenished.

19. When petty cash fund is used, which of the following is true?

A. The balance of the petty cash fund should be reported on the statement of financial position as long-term investment.

B. The petty cashier’s summary of petty cash payments serves as journal entry that is posted to the appropriate general

ledger account.

C. The reimbursement of the petty cash fund should be credited to the cash account.

D. Entries that include a credit to cash account should be recorded at the payments from petty cash fund are made.

20. In reimbursing the petty cash fund, which of the following is true?

A. Cash is debited

B. Petty cash is debited

C. Petty cash is credited

D. Expense accounts are credited

21. A Cash Over and Short account

A. Is not generally accepted.

B. Is debited when the petty cash fund proves out over.

C. Is debited when the petty cash funds proves out short.

D. Is a contra account to cash.

22. Postage stamps and IOUs found in petty cash drawer should be reported as

A. Supplies and receivables

B. Cash because they represent the equivalent of money

C. Petty cash

D. Investments

23. The following statements pertain to accounting for petty cash fund. Which statement is false?

A. Each disbursement from petty cash should be supported by a petty cash voucher.

B. The creation of petty cash funds requires a journal entry to reflect the transfer of fund out of the general cash account.

C. At any time, the sum of the cash in the petty cash fund and the total of petty cash vouchers should equal the amount for

which the imprest petty cash fund was established.

D. With the establishment of an imprest petty cash fund, one person is given the authority and responsibility for issuing

checks to cover minor disbursements.

24. The following statements pertain to the cash short or over account. Which statement is true?

A. It would be impossible to have cash shortage or overage if employees were paid in cash rather than by check.

B. The entry to account for daily cash sales for which a small amount of cash shortage existed would include a debit to cash

short or over account.

C. If the cash short or over account has a debit balance at the end of the period, it must be debited to an expense account.

D. A credit balance in cash short or over account should be considered a liability because the short-changed customer will

demand return of this amount.

25. Cash controls are the methods and procedures used to ensure

A. That current obligations are met

B. That excess cash does not exist

C. The safeguarding of cash

D. That unused cash is invested

26. A bank reconciliation is

A. A formal statement that lists all of the bank account balances of an enterprise.

B. A merger of two banks that previously were competitors.

C. A statement sent by the bank to depositor on a monthly basis.

D. A schedule that accounts for the differences between an enterprise’s cash balance as shown on its statement and the

cash balance shown in its general ledger.

27. Which of the following items must be added to the cash balance per ledger in preparing a bank reconciliation which ends with

the adjusted cash balance?

A. Note receivable collected by bank in favor of the depositor and credited to the account of the depositor.

B. NSF customer check

C. Service charge

D. Erroneous bank debit

28. Which of the following must be deducted from bank statement balance in preparing a bank reconciliation which ends with the

adjusted cash balance?

A. Deposit in transit

B. Outstanding checks

C. Reduction of loan charged to the account of the depositor

D. Certified check

29. If the balance shown on the company’s bank statement is less than the correct cash balance and neither the company nor the

bank has made any error, there must be

A. Deposits credited by the bank but not yet recorded by the company

B. Outstanding checks

C. Deposits in transit

D. Bank charges not yet recorded by the company

30. If the cash balance shown on a company’s accounting records is less than the correct cash balance and neither the company

nor the bank made any error, there must be

A. Deposits credited by the bank but not yet recorded by the company

B. Deposits in transit

C. Outstanding checks

D. Bank charges not yet recorded by the company

31. Which will not require an adjusting entry on the depositor’s books?

A. NSF check from customer

B. Check in payment of an account payable amounting to P50,000 is recorded by the depositor as P5,000.

C. Deposit of another company is credited to the account of our enterprise

D. Bank service charge

32. Which statement is true?

A. Bank service charge will cause the cash balance per ledger to be higher than that reported by the bank, all other things

being equal.

B. Outstanding checks will cause the cash balance per ledger to be greater than the balance reported by the bank, all other

things being equal.

C. An error made by the bank by charging an amount to the depositor account requires a correcting entry in the depositor’s

own records.

D. The cash amount shown in the statement of financial position must be the balance reported in the bank statement.

33. Which of the following statements is false?

A. A certified check is a liability by the bank certifying it.

B. A certified check will be accepted by many persons who would not otherwise accept personal check.

C. A certified check is one drawn by bank upon itself.

D. A certified check should not be included on the outstanding checks.

34. A proof of cash

A. Is a physical count of currencies on hand on balance sheet date.

B. Is a formal statement showing the cash receipts during the year.

C. Is a four-column bank reconciliation showing the reconciliation of cash balances per book and per bank statement at the

beginning and at the end of the current month and reconciliation of cash receipts and cash disbursement of the bank and

the depositor during the month.

D. Is a summary of cash receipts and cash payments.

35. A proof of cash would be useful for

A. Discovering cash receipts that have not been recorded in the journal

B. Discovering time lag in making deposits

C. Discovering cash receipts that have been recorded but have not been deposited

D. Discovering an inadequate separation of incompatible duties of employees

36. On December 31, 2017, the cash account of Gummy Company shows the following composition:

Petty cash fund, P30,000; Cash in bank (payroll fund), P2,000,000; Travel fund, P150,000; interest and dividend fund,

P250,000; tax fund, P120,000; cash in bank (current account), P3,000,000; certificate of deposit (terms 90 days), P1,000,000;

Certificate of deposit (terms 180 days), P1,500,000; cash in foreign bank-restricted, P500,000; money market funds (6

months), P900,000; Customer’s check dated January 15, 2014, P60,000. Customer’s check dated December 31, 2017

returned for lack of funds, P40,000; A 30-day BSP treasury bill, P1,000,000; A 3 year BSP treasury bill acquired three months

prior to maturity, P1,200,000; Sinking fund cash, P800,000; Preferred Redemption fund, P400,000; Contingent fund,

P300,000; Insurance fund, P200,000: Fund for the acquisition of a long-lived asset, P500,000; traveler’s checks, P60,000; and

cashier’s checks, P100,000.

What is the correct cash and cash equivalents balance to be reported by Gummy Company on December 31, 2017?

A. P7,810,000 C. P9,410,000

B 8,210,000 D. 9,610,000

37. On December 31, 2017, Everlasting Company’s “cash” account balance per ledger of P3,600,000 includes:

Demand deposit, P1,500,000; Certificate of deposit-30 days, P500,000; NSF check of customer, P20,000; Money market

placement (due date: June 30, 2018), P1,000,000; Savings deposit in closed bank, P50,000; IOU from an employee, P30,000;

Pension fund, P400,000; Petty cash fund, P10,000; Customer’s check dated January 31, 2018, P60,000; Customer’s check

outstanding for 18 months, P30,000.

Additional information:

• Check of P100,000 in payment of accounts payable was recorded on December 31, 2017 but mailed to creditors on

January 15, 2018.

• Check of P50,000 dated January 31, 2018 in payment of accounts payable was recorded and mailed December 31,

2013.

• The company uses the calendar year. The cash receipts journal was held open until January 15, 2018, during which

time, P200,000 was collected and recorded on December 31, 2017.

How much “cash and cash equivalents” should be shown on the December 31, 2017 balance sheet?

A. P1,960,000 C. P2,160,000

B 2,050,000 D. 2,360,000

38. Pakwan, Inc. had the following account balances at December 31, 2017:

Cash in bank - Bank A P 50,000

Cash in bank - Bank B (closed by BSP) 60,000

Saving deposit – Bank C 150,000

Petty cash fund, including unreplenished December 2017 petty

cash expenses vouchers for P5,000 and an accommodated

employee’s check for P3,500 dated January 28, 2018 10,000

Treasury bills purchased December 10, 2017 and due March 10, 2018 1,000,000

Time deposits, one year, due March 31, 2018 2,000,000

The amount to be shown as “Cash and Cash Equivalents” on Pakwan’s balance sheet at December 31, 2017 is

A. P1,201,500 C. P1,210,000

B. 3,201,000 D. 1,206,500

39. On December 31, 2017, cash account of Tonette Company showed the following details:

Undeposited collections P 60,000

Cash in Bank – RCBC checking account 500,000

Cash in Bank – PNB (overdraft) (50,000)

Undeposited NSF check received from customer, dated December 1, 2017 15,000

Undeposited check from a customer, dated January 15, 2018 25,000

Cash in Bank- RCBC (fund for payroll) 150,000

Cash in Bank – RCBC (saving deposit) 100,000

Cash in Bank – RCBC (money market instrument, 90 days) 2,000,000

Cash in foreign bank, restricted 100,000

IOUs from officers 30,000

Sinking fund cash 450,000

Listed shares held as trading investment 120,000

The statement of financial position on December 31, 2017 should show “cash and cash equivalents” at

A. P2,660,000 C. P2,770,000

B. 2,810,000 D. 810,000

40. Santol Corporation’s checkbook balance on December 31, 2017 was P180,000. In addition, Santol held the following items in

its safe on December 31

Check payable to Santol, dated January 2, 2018, not included

in December 31, 2017 checkbook balance P 45,000

Check payable to Santol, deposited December 20 and included

in December 31 checkbook balance but returned by bank

on December 30 stamped “NSF”. The check was redeposited

January 2, 2018 and was cleared January 7. 46,000

Postage stamps received from mail order customers 2,000

Check drawn on Santol’s account, payable to vendor, dated and

recorded December 31, but not mailed until January 15, 2018 63,000

The proper amount to be shown on as Cash on Santol’s balance sheet at December 31, 2017 is

A. P244,000 C. P242,000

B. 208,000 D. 197,000

Question 41 and 42 are based on the following information:

The petty cash fund of the Mangga, Co., immediately after the close of business on September 30, 2017, the end of the

company’s fiscal year is composed of the following:

Currency and coins P15,000

Unused postage stamps 500

Petty cash vouchers:

Delivery Expenses P1,500

Postage stamps 800

Office supplies 500

Repairs of office equipments 750

Advances to employees 1,750 5,300

A check drawn by the company payable to the order of

Ms. Policarpia Malagunaw, petty cash custodian

representing her salary 14,000

An employee’s check returned by the bank for insufficiency

of funds 4,000

A sheet of paper with names of several employees together with their

contribution for a departing employee. Attached to the sheet of

paper is currency of 5,000

P43,800

The petty cash fund has an imprest balance of P40,000.

41. The petty cash overage (shortage) is

A. P1,700 C. P3,800

B. (1,700) D. (3,800)

42. What is the amount of petty cash fund that should be shown on the balance sheet as of September 30, 2017?

A. P15,000 C. P29,000

B. 34,000 D. 27,000

Question 43 and 44 are based on the following information:

Avocado Corp. keeps all of its cash in a checking account. An examination of the company’s accounting records and bank

statement for the month ended December 31, 2017 revealed bank statement balance of P80,344 and book balance of

P88,404.

A deposit of P 47,500 on December 29, 2017 does not appear on the bank statement. Checks outstanding on December 31,

2017 amounted to P113,500.

The bank statement shows that on December 26, 2017, the bank collected a note for Avocado Corp. and credited the

proceeds of P46,750 to the company’s account. The proceeds included P1,750 interest, all of which Avocado Corp. earned

during the current period. Avocado Corp. has not yet recorded the said collection.

Avocado Corp. discovered that check number 021261 written in December 2017 for P9,150 in payment of an account had

been recorded in the company’s records as P1,590.

Included with the December 31, 2017 bank statement was an NSF check for P112,500 that Avocado Corp. had received from

Buko Company on December 22, Avocado Corp. has not yet recorded the returned check. The bank statement shows a P750

service charge for December 2017.

43. What is the adjusted cash balance for December 31, 2017?

A. P12,594 C. P14,344

B. 21,904 D. 15,904

44. The journal entry to adjust the cash balance as of December 31, 2017 is

A. Net debit to cash of P74,060 C. Debit to cash of P66,000

B. Net credit to cash of P74,060 D. Credit to cash of P46,750

45. The bank statement received by Guyabano, Inc. from Pasig Bank showed a balance of P547,800 at June 30, 2013. Upon

Comparing the statement with cash records, the following facts were determined:

• Customer’s check for P30,000 was originally recorded on the books for P45,000.

• A customer’s note dated March 25 was discounted on April 12. The note was dishonored on June 29 (maturity date).

The bank charged Guyabano’s account for P142,650.

• The deposit on June 24 was recorded on books as P28,950 but was actually a deposit of P27,000.

• Outstanding checks totaled P98,950 as of June 30.

• There were bank charges for June of P2,100 not yet recorded on the books.

• Guyabano’s account had been charged on June 26 for a customer NSF check of P12,960.

• Guyabano properly deposited on June 30 P6,000 but was not yet recorded by the banks.

• Receipts of June 30 for P134,250 were recorded by bank on July 2.

• A bank memo stated that a customer’s note for P45,000 and interest of P1,650 had been collected on June 27, and

the bank charges a P360 collection fee.

What is the cash balance on the books at June 30, 2017?

A. P689,520 C. P687,570

B. 587,160 D. 583,640

Questions 46 through 48 are based on the following information:

The reconciliation of Durian Company’s bank account at May 31, 2017 is shown below:

Balance per bank statement P1,050,000

Deposit in transit 150,000

Outstanding checks (15,000)

Correct cash balance P1,185,000

Balance per book P1,186,000

Bank service charge (1,000)

Correct cash balance P1,185,000

June data are as follows:

Bank Book

Checks recorded P1,150,000 P1,180,000

Deposits recorded 810,000 900,000

Collection by bank (P200,000 note plus interest) 210,000

NSF check returned with June 30 bank statement 5,000

Balances 915,000 905,000

46. What is the total outstanding checks at June 30, 2017?

A. P15,000 C. P30,000

B. 45,000 D. 0

47. How much is the deposit in transit at June 30, 2017?

A. P 90,000 C. P 60,000

B 630,000 D. 240,000

48. What is the adjusted cash balance at June 30, 2017?

A. P1,110,000 C. P1,120,000

B. 630,000 D. 730,000

Questions 49 and 50 are based on the following information:

The cash account in the ledger of Pinya, Inc. shows a balance of P936,000 at September 30, 2017. The bank statement,

however, shows a balance of P840,000 at the same date. The only reconciling items consists of a bank service charge of

P1,000, a large number of outstanding checks, and a deposit in transit of P245,000.

49. What is the adjusted cash balance at September 30, 2017?

A. P785,000 C. P937,000

B. 690,000 D. 935,000

50. The total outstanding checks at September 30, 2017 should be?

A. P150,000 C. P246,000

B. 350,000 D. 151,000

--END--

wep/ACCTG100C/cash&cashequivalents

Вам также может понравиться

- Auditing JPIAДокумент18 страницAuditing JPIAAken Lieram Ats AnaОценок пока нет

- PFRS 3 - Business Combination PDFДокумент2 страницыPFRS 3 - Business Combination PDFMaria LopezОценок пока нет

- Advanced Financial Accounting and Reporting Preweek LectureДокумент19 страницAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisОценок пока нет

- ACC117-CON09 Module 3 ExamДокумент16 страницACC117-CON09 Module 3 ExamMarlon LadesmaОценок пока нет

- Audit of Investments - Set AДокумент4 страницыAudit of Investments - Set AZyrah Mae SaezОценок пока нет

- AFAR-02 Corporate LiquidationДокумент2 страницыAFAR-02 Corporate LiquidationRamainne RonquilloОценок пока нет

- Intermediate Acctg A 1 10Документ10 страницIntermediate Acctg A 1 10Leonila RiveraОценок пока нет

- Items 1Документ7 страницItems 1RYANОценок пока нет

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsДокумент29 страницModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneОценок пока нет

- Sol Man Sec 6 SQ1 PDFДокумент4 страницыSol Man Sec 6 SQ1 PDFHope Trinity EnriquezОценок пока нет

- AGNPO Prelims ReviewerДокумент84 страницыAGNPO Prelims ReviewerKurt Morin CantorОценок пока нет

- Which Situation Most Likely Violates The IIA's Code of Ethics and The Standards?Документ5 страницWhich Situation Most Likely Violates The IIA's Code of Ethics and The Standards?ruslaurittaОценок пока нет

- QUIZ 1. Audit of Cash ManuscriptДокумент4 страницыQUIZ 1. Audit of Cash ManuscriptJulie Mae Caling MalitОценок пока нет

- Ap-1403 ReceivablesДокумент18 страницAp-1403 Receivableschowchow123Оценок пока нет

- Ix - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionДокумент12 страницIx - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionKirstine DelegenciaОценок пока нет

- Orca Share Media1523026232654Документ11 страницOrca Share Media1523026232654Twinie MendozaОценок пока нет

- Chapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesДокумент28 страницChapter 7: Audit of Intangibles and Other Assets: Internal Control Over IntangiblesUn knownОценок пока нет

- AP - Loans & ReceivablesДокумент11 страницAP - Loans & ReceivablesDiane PascualОценок пока нет

- Depletion PDFДокумент3 страницыDepletion PDFAlexly Gift UntalanОценок пока нет

- Audit Documentation Test BankДокумент1 страницаAudit Documentation Test BankJadeОценок пока нет

- Audit of EquityДокумент5 страницAudit of EquityKarlo Jude Acidera0% (1)

- I-Theories: Intangibles & Other AssetsДокумент19 страницI-Theories: Intangibles & Other Assetsaccounting filesОценок пока нет

- Audit of ReceivablesДокумент68 страницAudit of ReceivablesJoseph SalidoОценок пока нет

- Assets Book Value Estimated Realizable ValuesДокумент3 страницыAssets Book Value Estimated Realizable ValuesEllyza SerranoОценок пока нет

- Abc Stock AcquisitionДокумент13 страницAbc Stock AcquisitionMary Joy AlbandiaОценок пока нет

- Nfjpia R12 Mock Board Examination: Page 1 of 8Документ8 страницNfjpia R12 Mock Board Examination: Page 1 of 8Leane MarcoletaОценок пока нет

- Problems CCEДокумент10 страницProblems CCERafael Renz DayaoОценок пока нет

- AC - Acctg Gov Quiz 01Документ2 страницыAC - Acctg Gov Quiz 01Erjohn PapaОценок пока нет

- Applied Auditing Quiz #1 (Diagnostic Exam)Документ7 страницApplied Auditing Quiz #1 (Diagnostic Exam)ephraimОценок пока нет

- Applied Auditing Review Course Pre-Board - FinalДокумент13 страницApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGAОценок пока нет

- Chapter 5 Audit of InventoryДокумент10 страницChapter 5 Audit of InventoryMarkie GrabilloОценок пока нет

- PSA 700, 705, 706, 710, 720 ExercisesДокумент11 страницPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungОценок пока нет

- Aud EvidenceДокумент14 страницAud EvidenceJadeОценок пока нет

- Module 4 Business Combination Date of AcquisitionДокумент28 страницModule 4 Business Combination Date of AcquisitionJulliena BakersОценок пока нет

- Polytechnic University of The PhilippinesДокумент16 страницPolytechnic University of The PhilippinesMakoy BixenmanОценок пока нет

- Palmones, Jayhan Grace M. QuizДокумент6 страницPalmones, Jayhan Grace M. QuizjayhandarwinОценок пока нет

- This Study Resource Was: Cebu Cpar CenterДокумент9 страницThis Study Resource Was: Cebu Cpar CenterGlizette SamaniegoОценок пока нет

- 08 InvestmentquestfinalДокумент13 страниц08 InvestmentquestfinalAnonymous l13WpzОценок пока нет

- Ap 59 PW - 5 06 PDFДокумент18 страницAp 59 PW - 5 06 PDFJasmin NgОценок пока нет

- PRTC 1st Preboard Solution GuideДокумент48 страницPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Auditing Problems Intangibles Impairment and Revaluation PDFДокумент44 страницыAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaОценок пока нет

- Module 2 - Major Specialized IndustriesДокумент10 страницModule 2 - Major Specialized IndustriesKalven Perry AgustinОценок пока нет

- The Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. AuditorДокумент2 страницыThe Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. Auditoraccounts 3 lifeОценок пока нет

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Документ10 страницCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADОценок пока нет

- Problem 1: Finals - ReceivablesДокумент4 страницыProblem 1: Finals - ReceivablesLeslie Beltran ChiangОценок пока нет

- 2015 Solman AsuncionДокумент219 страниц2015 Solman AsuncionMarwin AceОценок пока нет

- AP-5907 CashДокумент12 страницAP-5907 CashAiko E. LaraОценок пока нет

- Far Review - Notes and Receivable AssessmentДокумент6 страницFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenОценок пока нет

- Comprehensive Reviewer 1-100Документ24 страницыComprehensive Reviewer 1-100kimkimОценок пока нет

- Auditing and Assurance Principles Pre TestДокумент9 страницAuditing and Assurance Principles Pre TestKryzzel Anne JonОценок пока нет

- BAC 318 Final Examination With AnswersДокумент10 страницBAC 318 Final Examination With Answersjanus lopez100% (1)

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Документ3 страницыDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyОценок пока нет

- Business Combi TsetДокумент28 страницBusiness Combi Tsetsamuel debebeОценок пока нет

- At 9013Документ9 страницAt 9013Aljur SalamedaОценок пока нет

- Q1 SMEsДокумент6 страницQ1 SMEsJennifer RasonabeОценок пока нет

- Cash and Cash Equivalents ExamДокумент7 страницCash and Cash Equivalents ExamRudydanvinz BernardoОценок пока нет

- Financial Accounting 1Документ35 страницFinancial Accounting 1Bunbun 221Оценок пока нет

- SolutionsДокумент25 страницSolutionsDante Jr. Dela Cruz100% (1)

- ProbsДокумент27 страницProbsDante Jr. Dela Cruz50% (2)

- Cash and Cash EquivalentsДокумент9 страницCash and Cash EquivalentsPau Santos76% (29)

- Orca Share Media1571749448947 PDFДокумент3 страницыOrca Share Media1571749448947 PDFJose MagallanesОценок пока нет

- Troubleshooting Digital TV Wellav WhiteДокумент11 страницTroubleshooting Digital TV Wellav WhiteJose MagallanesОценок пока нет

- Chapter 13 Preparing For FeedbackДокумент1 страницаChapter 13 Preparing For FeedbackJose MagallanesОценок пока нет

- Document Course Code / Title: College of Business Administration and AccountancyДокумент3 страницыDocument Course Code / Title: College of Business Administration and AccountancyJose MagallanesОценок пока нет

- Business of Investment BankingДокумент35 страницBusiness of Investment BankingHarsh SudОценок пока нет

- Swiss Banking Confidentiality: Perceptions vs. RealityДокумент20 страницSwiss Banking Confidentiality: Perceptions vs. RealityApiez ZiepaОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент17 страниц© The Institute of Chartered Accountants of IndiaFentorОценок пока нет

- Ts Grewal Class 12 Accountancy Chapter 8Документ8 страницTs Grewal Class 12 Accountancy Chapter 8Tarun50% (2)

- NBP Internship UOGДокумент39 страницNBP Internship UOGAhsanОценок пока нет

- ch07 Cash - StudentДокумент9 страницch07 Cash - StudentNhật TâmОценок пока нет

- Amalsad CaseДокумент16 страницAmalsad CaseShobhan MeherОценок пока нет

- Measurement of Bank Profitability, Risk and Efficiency: The Case of The Commercial Bank of Eritrea and Housing and Commerce Bank of EritreaДокумент9 страницMeasurement of Bank Profitability, Risk and Efficiency: The Case of The Commercial Bank of Eritrea and Housing and Commerce Bank of EritreaYemi AdetayoОценок пока нет

- FAR Pre-Week Part 1Документ24 страницыFAR Pre-Week Part 1John DoeОценок пока нет

- Letter of From Class-XI (VIKAAS-JA) To Class-XII (VIJETA-JP)Документ4 страницыLetter of From Class-XI (VIKAAS-JA) To Class-XII (VIJETA-JP)Manjushri SoniОценок пока нет

- AVF HDFC Bank FormДокумент2 страницыAVF HDFC Bank Formakash agarwalОценок пока нет

- Global QuickBooks Online User Guide 2019635Документ76 страницGlobal QuickBooks Online User Guide 2019635Lynoj Abang100% (3)

- End of StatementДокумент1 страницаEnd of Statementbrazil server0Оценок пока нет

- Impact of Bank Mergers On The Efficiency of Banks A Study of Merger of Bharat Overseas Bank With Indian Overseas BankДокумент22 страницыImpact of Bank Mergers On The Efficiency of Banks A Study of Merger of Bharat Overseas Bank With Indian Overseas Banknikhu_shuklaОценок пока нет

- 01Документ2 страницы01ishtee894Оценок пока нет

- Application - Form - Car LoanДокумент6 страницApplication - Form - Car LoanSanjay SolankiОценок пока нет

- Philippine Deposit Insurance Corporation ActДокумент12 страницPhilippine Deposit Insurance Corporation ActAmorMeaThereseMendozaОценок пока нет

- 549 The Revised Rules of The Ethiopia Commodity ExchangeДокумент107 страниц549 The Revised Rules of The Ethiopia Commodity ExchangeKumera HaileyesusОценок пока нет

- The Rise and Fall of Banco FilipinoДокумент7 страницThe Rise and Fall of Banco FilipinoJaypee JavierОценок пока нет

- 18 AppendixДокумент9 страниц18 Appendixsonia khuranaОценок пока нет

- Loan AgreementДокумент22 страницыLoan Agreementlokesh Budek-100Оценок пока нет

- LANDBANK Iaccess FAQs PDFДокумент16 страницLANDBANK Iaccess FAQs PDFYsabella May Sarthou CervantesОценок пока нет

- Ijser: Banking: Definition and EvolutionДокумент9 страницIjser: Banking: Definition and EvolutionnehaОценок пока нет

- University of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Документ1 страницаUniversity of The West Indies, Mona Department of Management Studies ACCT 3043 - Auditing I Tutorial Questions 7Priscella LlewellynОценок пока нет

- Authorization To Release Account InformationДокумент2 страницыAuthorization To Release Account InformationamiОценок пока нет

- 1.1 Background of The StudyДокумент18 страниц1.1 Background of The StudyPrakash KhadkaОценок пока нет

- Ansoff Matrix Final DocДокумент7 страницAnsoff Matrix Final DocPatie WaTennysonОценок пока нет

- Guideline On Call CenterДокумент3 страницыGuideline On Call CenterFahad RaoОценок пока нет

- A Research On Understanding and Exploring Job Description in Standard Chartered BankДокумент59 страницA Research On Understanding and Exploring Job Description in Standard Chartered BankMd Saimum HossainОценок пока нет

- G99 - Application FormДокумент9 страницG99 - Application Formbigdealsin14Оценок пока нет

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- The Value of a Whale: On the Illusions of Green CapitalismОт EverandThe Value of a Whale: On the Illusions of Green CapitalismРейтинг: 5 из 5 звезд5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyОт EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyРейтинг: 3 из 5 звезд3/5 (1)

- Corporate Finance Formulas: A Simple IntroductionОт EverandCorporate Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceОт EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceРейтинг: 4 из 5 звезд4/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsОт EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsРейтинг: 4.5 из 5 звезд4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfОт EverandProduct-Led Growth: How to Build a Product That Sells ItselfРейтинг: 5 из 5 звезд5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОт EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОценок пока нет

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Financial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessОт EverandFinancial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessРейтинг: 4 из 5 звезд4/5 (2)

- Mind over Money: The Psychology of Money and How to Use It BetterОт EverandMind over Money: The Psychology of Money and How to Use It BetterРейтинг: 4 из 5 звезд4/5 (24)

- YouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineОт EverandYouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineРейтинг: 4.5 из 5 звезд4.5/5 (2)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressОт EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressОценок пока нет