Академический Документы

Профессиональный Документы

Культура Документы

Amount

Загружено:

Judy Toto0 оценок0% нашли этот документ полезным (0 голосов)

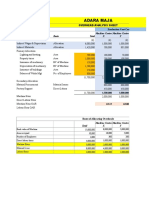

24 просмотров3 страницы1. The document contains calculations for expected contribution values from different products and activities for Allaire Corporation using both traditional costing and activity-based costing.

2. Under activity-based costing, the total expected contribution from TV boards is $69,575 and from PC boards is $53,000.

3. Cost drivers are identified for each overhead activity like procurement, production scheduling, etc. and applied to calculate activity costs and unit contribution values.

Исходное описание:

Management accounting questionaires

Оригинальное название

WC2 copy

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1. The document contains calculations for expected contribution values from different products and activities for Allaire Corporation using both traditional costing and activity-based costing.

2. Under activity-based costing, the total expected contribution from TV boards is $69,575 and from PC boards is $53,000.

3. Cost drivers are identified for each overhead activity like procurement, production scheduling, etc. and applied to calculate activity costs and unit contribution values.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров3 страницыAmount

Загружено:

Judy Toto1. The document contains calculations for expected contribution values from different products and activities for Allaire Corporation using both traditional costing and activity-based costing.

2. Under activity-based costing, the total expected contribution from TV boards is $69,575 and from PC boards is $53,000.

3. Cost drivers are identified for each overhead activity like procurement, production scheduling, etc. and applied to calculate activity costs and unit contribution values.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

=69,575 / 800

INCOME (LOSS) PROBABILITY EXPECTED VALUE

Amount

=86.97

P (70,000) Activity 1.10 500 13.17(7,000)

6,585

10,000 Activity 2.20 2,500 21.60 2,000

54,000

60,000 Gen.factory.40 240 37.4624,0008,990

100,000 Total .20 69,575

20,000 5. ALLAIRE Corporation

140,000 .10 14,000 a. Using standard costs, the total contribution expected

TOTA L 53,000 in 2011 by Allaire Corporation from the TV Board is

1. OLEX Company Totals

Per Unit For 65,000 units

Revenue 150 9,750,000

2. LANEDO Company Direct material 80 5,200,000

Material overhead

Throughput per hour = Total units manufactured = 50,000 (10% of material) 8 520,000

Goods units manufactured 40,000 Direct labor

= 1.25 ($14 x 1.5 hours) 21 1,365,000

Variable overhead

Process quality yield = good units / total units ($4x 1.5 hours)* 6 390,000

= 40,000/50,000 = 80% Machine time ($10 x.5) 5 325,000

Total cost 120 7,800,000

3. Cost driver Budgeted Budgeted act level Unit contribution 30

No. of P 20,000 200 100 Total contribution (65,000 x 30) $ 1,950,000

setups *Variable overhead rate

No. of 130,000 6,500 20 $1,120,000 + 280,000 hours = $4 per hour.

inspections

No. of 80,000 8,000 10 b. Using standard costs, the total contribution expected

materials in 2011 by Allaire Corporation from the PC Board

moves Totals for

Engineering 50,000 1,000 50

Per Unit 40,000 units

hours

Revenue 300 12,000,000

Direct material 140 5,600,000

a. Number of setups------------------1 * 100 = 100 Material overhead

Number of inspection------------20 * 20 = 400 (10% of material) 14 560,000

Number of material move-------30 * 10 = 300 Direct labor

Engineering hours-----------------10 * 50 = 500 ($14x4 hours) 56 2,240,000

JOB 101 (Overhead Cost) ------------------1,300 Variable overhead

($4 x 4 hours)* 16 640,000

b. Direct materials-------------------------------------------12,000 Machine time

Direct Labor--------------------------------------------------2,000 ($10 x 1.5) 15 600,000

Overhead: JOB 102 Total cost 241 9,640,000

Number of setups------------------2 * 100 = 200

Number of inspection------------10 * 20 = 200 Procurement 400,000 / 4,000,000 .10 per part

Production scheduling 220,000 / 110,000 2.00 per board

Number of material move-------10 * 10 = 100

Packaging & shipping 440,000 / 110,000 4.00 per board

Engineering hours-----------------50 * 50 = 2500 3,000 Machine set-ups 446,000 / 278,750 1.60 per board

Divide by Units Completed-----------------------------------/50 Hazardous waste disposal 48,000 / 16,000 3.00 per pound

Unit Cost----------------------------------------------------------340 Quality control 560,000 / 160,000 3.50 per inspection

General supplies 66,000 / 110,000 .60 per board

4. ACTION Company Machine insertion 1,200,000 / 3,000,000 .40 per part

a. Predetermined overhead rate = Manual insertion 4,000,000 / 1,000,000 4.00 per part

Wave soldering 132,000 / 110,000 1.20 per board

Estimated overhead cost / Estimated direct labor

Unit contribution 59

hours

Total contribution (40,000 x 59) 2,360,000

= 92,023 / 340 =270.66 per direct labor hours

1,120,000 + 280, 000 hours = $4 per hour.

b. Overhead cost per unit (Product B) =

c. Shown below are the calculations of the cost drivers

Predetermined rate x direct labor hours

U

= 270.66 x 0.2 = 54.13 per unit

Using activity-based costing, the total contribution expected

in 2011 by Allaire Corporation from the TV

c. Predetermined overhead rate for Act. 1 (ABC)

Totals for

Activity 1 (Est. Overhead) / Expected activity

Per Unit 65,000 units

= 14, 487 / 1,100 = 13.17

Revenue 150 9,750,000

Direct material 80 5,200,000

d. Overhead cost per unit product A (ABC) Material overhead

Act. Cost Pool Est. Overhead activity Overhead rate Procurement (.10x25) 2.50 162,500

Activity 1 14,487 1,100 13.17 Production scheduling 2 30,000

Activity 2 64,800 3,000 21.60 Packaging & shipping 4 260,000

Gen. factory 12,736 340 37.46 Variable overhead

Machine set-ups (1.60x2) 3.20 208,000

Waste disposal (3 x .02) .06 3,900

Quality control 3.50 227,500

General supplies .60 39,000

Manufacturing

Machine insertion (.40 x 24) 9.60 624,000 Warranty repairs and replacements......................58,000

Manual insertion 4 260,000 Product recalls........................................................91,000

Wave soldering 1.20 78,000 Total..............................................................................149,000

Total cost 110.66 7,192,900 Total quality cost.......................................................396,000

Unit contribution 39.34

Total contribution 2,557,100

d. Using activity-based costing, the total contribution

expected in 2011 by Allaire Corporation from the PC

45. CUTE corporation

Totals for

Per Unit 40,000 units A. Total attempted units-------------6,000,000

Revenue 300 12,000,000 Goods units manufactured------4,800,000

Direct material 140 5,600,000 Defective units 1,200,000

Material overhead

Procurement (.10x55) 5.50 220,000

B. Manufacturing cycle efficiency

Production scheduling 80,000

Value-added processing time / total hours

Packaging & shipping 160,000

Variable overhead = 600 / 800 = .75

Machine set-ups (1.60x3) 4.80 192,000

Waste disposal (3 x .35) 1.05 42,000 C. Process productivity

Quality control (3.50 x 2) 7.00 280,000 = Good units manufactured / total hours

General supplies .60 24,000 = 4,800,000 / 800 = 6,000

Manufacturing

Machine insertion (.40 x 35) 14.00 560,000

Manual insertion (4 x 20) 80 3,200,000 D. Process quality yield

Wave soldering 1.20 48,000

Total cost 260.15 10,406,000

Unit contribution 39.85

Total contribution 1,594,000

E. Hourly throughput

Good units’ manufactured / value-added processing time

= 4,800,000 / 600 = 8,000

42. Manufacturing cycle efficiency 46. Quality cost index

= value-added production time (Process time) = (total quality cost / direct labor cost) x 100

*Total cycle time = (*120,000 / 300,000) x 100 = 40

= 4 / 12 = 33.33%

*Total quality cost: Prevention ---------20,000

*Total Cycle time = 12 Order received to start-------10 Appraisal------------30,000

Process time---------4 Cycle time------------------------12 Internal failure-----60,000

Inspection time---1.5 Total delivery cycle time -----22 External failure-----10,000 120,000

Queue time--------4.5

Move time------------2 47. Raw material account, closing balance

Raw materials, operating balance--------500

43. ROMEL Company Raw materials purchased-----------------4,600

Year 1 Year 2 Cost of goods sold, materials---------- (*4,090)

Prevention cost Raw materials, Balance 1,010

Quality Audits 35,000 50,000

Training 40,000 75,000 80,000 130,000 *cost of goods sold at standard cost -----8,998

Appraisal cost Divide by total cost------------------------------22

Statistical process 70,000 100,000 Cost per unit ----------------------------------409 x 10 = 4,090

Inspection and testing 100,000 170,000 150,000 250,000

Internal failure cost 48. Throughput return per production hour of the bottleneck

Rework 90,000 50,000 Resource = (selling price – material cost) x hours

Spoilage 80,000 170,000 55,000 105,000 = (24.99 – 8.87) x (60/6.5) = 148.8

External failure cost

Warranties 180,000 80,000

Est. customer losses 800,000 980,000 450,000 530,000 49.

Wall mirrors – 25 units x 200 hours per unit = 5,000 hrs

44. GAGNON company Specialty windows – 25 units x 200 hours per unit= 5,000 hrs

Prevention costs Systems development...............29,000 Total hours 10,000 hrs

Quality training.....................................................25,000

Total................................................................................54,000 Budgeted materials handling costs 50,000

Appraisal costs Divided by total hours ÷ 10,000

Test and inspection of incoming materials...........73,000 Materials handling cost per hour 5

Supervision of testing and inspection activities....24,000 Hours per unit x 200

Maintenance of test equipment...........................18,000 Costs allocated to one unit 1,000

Total..............................................................................115,000

Internal failure costs Wall Mirrors: 25 mirrors x 5 moves = 125 moves

Disposal of defective products..............................55,000 Specialty Mirrors: 25 mirrors x 15 moves = 375 moves

Net cost of scrap....................................................23,000 Total Material Handling Moves 500

Total................................................................................78,000

External failure costs 50,000 moves cost / 500 moves = 100 per move

Wall mirror: 5 moves per mirror x 100 per move = 500 for a total of 2,560 hours, or $21,760 for 200 units. Variable

Specialty Mirrors: 15 x 100 = 1,500 overhead is applied on the basis of direct labor hours at the

rate of $4 per direct labor hour; so for 2,560 DL hours, variable

50. Direct materials-----------------------1,000 overhead would be $10,240. Thus, the total variable cost for

Direct labor----------------------------4,000 200 units is $6,000 + $21,760 + $10,240, for a total of $38,000.

Maintenance (500 x 4) -------------2,000 Fixed overhead is applied at the rate of 10% of total variable

Inspection (100 x 4) -------------------400 cost, so fixed overhead applied is 10% of $38,000, or $3,800.

Total 7,400 The total cost for 200 units is thus $38,000 + $3,800, or

Activity rate: Inspection (150,000 / 1,500) = 100/inspection $41,800. Subtracting the cost for the first 50 units from the

Maintenance (100,000 / 25,000) = 4/MH total cost for the first 200 units, we get $41,800 í $15,400, or

$26,400 as the cost for units 51 through 200. C

The company is able to charge 125% of the full cost for the

order. The full cost will include $100,000 of fixed costs and B. Since there are two doublings, the number of hours

$240,000 of materials costs. In addition, there will be labor required for 200 units using a 70% learning curve is:

costs, However, we need to determine what those labor costs

1,000 hours × (.7 × 2) × (.7 × 2) = 1,960 hours. 1,960 hours

will be. We can calculate that the learning curve is 80%. The

first 10 units produced cost $120,000 in labor. If no learning

required for 200 units less 1,000 hours required for the

had taken place, the first 20 units would have cost $240,000 in first 50 units = 960 hours required for the last 150 units.

labor. However, the labor cost for the first 20 units was 960 hours ÷ 150 units = 6.4 hours required per unit for

$192,000. By dividing $192,000 by $240,000, we calculate that the last 150 units. C

the learning curve is 80%. We know that labor costs are

$307,200 to produce the first 40 units. However, the company

experiences an 80% learning curve, which means that the labor

cost to produce the next 40 units will not be $307,200, but

$184,320. This is calculated as follows: The first 40 units cost

$307,200 to produce. If no learning had taken place, it would

cost twice that amount, or $614,400 to produce the first 80

units (the first 40 units plus another 40 units). However, as

there is a learning curve of 80%, the total cost for the 80 units

will be 80% of that $614,400 expected amount, or $491,520.

Since the first set of 40 units cost $307,200, the incremental

cost of producing the second set of 40 units was only $491,520

í $307,200, which equals $184,320. Variable overhead will also

be charged at $1 per direct labor dollar, or $184,320.

Therefore, the total costs of production are $708,640

($100,000 + $240,000 + $184,320 + $184,320). Adding 25% to

this, we get $885,800. B

The learning curve is calculated as the percentage of reduction

in costs that occurs when production is doubled. In looking at

the information provided, we see that the materials costs do

not have any efficiencies as production increases. For all levels

of production the materials cost is $6,000 per unit. So, ours

attention is focused on the labor. In order to produce 10 units,

the company incurred $120,000 of labor. If that same

productivity level were to continue (i.e., if no learning were

taking place), in order to produce 20 units, they would incur

$240,000 of labor costs. However, they incurred only $192,000

of labor costs, which is 80% of $240,000. And at 20 units at a

cost of $192,000, if no learning were taking place, it would

have cost $384,000 to produce a total of 40 units, including the

first 20. However, it cost only $307,200, which is 80% of

$384,000. So, every time production doubles, the company is

experiencing a learning curve of 80%. B

We need to include the first 50 units manufactured in this

analysis, since they contributed to the learning curve. So we

will analyze the cost for the first 200 units and then subtract

from that the cost for the first 50 units in order to calculate the

cost for units numbered 51 through 200, which are the units in

the second order of 150. The first doubling takes place at unit

no. 100. The second doubling takes place at unit no. 200.

Therefore, the time required for the total 200 units was 2,560

hours, calculated as follows: 1,000 hours × (.8 × 2) × (.8 × 2) =

2,560 hours for 200 units. 2,560 hours for 200 units minus the

1,000 hours required for the first 50 units = 1,560 hours

required for the last 150 units. The next step is to calculate the

total cost for the whole 200 units and then subtract from that

the cost for the first 50 units, which is given in the problem as

$15,400. Using the costs for 50 units provided in the problem,

we can calculate the variable costs for 200 units as follows:

Direct Materials cost per unit is $1,500 ÷ 50 units, or $30 per

unit. Therefore, for 200 units, the total direct materials cost

would be 30 × $200, or $6,000. Direct labor is $8.50 per hour

Вам также может понравиться

- F1Документ84 страницыF1Mike Antolino76% (29)

- Quiz 2 - Job Costing - Printable, V (5.0)Документ7 страницQuiz 2 - Job Costing - Printable, V (5.0)Edward Prima KurniawanОценок пока нет

- Rahma Yeni Rosada - F0120105 - EPДокумент6 страницRahma Yeni Rosada - F0120105 - EPRahma RosadaОценок пока нет

- Quick Revisionary NoteДокумент22 страницыQuick Revisionary Noteshivamdubey12Оценок пока нет

- Bacc232 .309 Management Accounting Assignment 1Документ13 страницBacc232 .309 Management Accounting Assignment 1TarusengaОценок пока нет

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalДокумент6 страницCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTОценок пока нет

- Budgetory Control Flexible Budget With SolutionsДокумент6 страницBudgetory Control Flexible Budget With SolutionsJash SanghviОценок пока нет

- Absorption (Total) Costing AnswersДокумент7 страницAbsorption (Total) Costing AnswersNalan TafanaОценок пока нет

- TOMAS, Marielle Celine F. MODULE 10 & 15 Bsa - BCB 10/19/21 IДокумент10 страницTOMAS, Marielle Celine F. MODULE 10 & 15 Bsa - BCB 10/19/21 IMARIELLECELINE TOMASОценок пока нет

- Book 1Документ12 страницBook 1Vincent Luigil AlceraОценок пока нет

- Unit 2 - Question BankДокумент34 страницыUnit 2 - Question BankTamaraОценок пока нет

- Combinepdf 2Документ6 страницCombinepdf 2saisandeepОценок пока нет

- Activity Based Costing SystemДокумент18 страницActivity Based Costing SystemMAXA FASHIONОценок пока нет

- Gapas, Daniel John L. (Etivity 10)Документ4 страницыGapas, Daniel John L. (Etivity 10)Daniel John GapasОценок пока нет

- Classic Pen Company: Syndicate 101Документ4 страницыClassic Pen Company: Syndicate 101Silvia WongОценок пока нет

- Cma ProblemsДокумент25 страницCma ProblemsPridhvi Raj ReddyОценок пока нет

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsДокумент9 страницSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadОценок пока нет

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 3: Section A-Cost AccountingДокумент17 страницAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 3: Section A-Cost AccountingIshaan guptaОценок пока нет

- Predetermined Factory OverheadДокумент5 страницPredetermined Factory OverheadCharléОценок пока нет

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 1: Paper - 8: Cost Accounting & Financial ManagementДокумент17 страницAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 1: Paper - 8: Cost Accounting & Financial ManagementParag SharmaОценок пока нет

- Financial Plan (Illustration)Документ6 страницFinancial Plan (Illustration)Syed ArslanОценок пока нет

- 03 Overhead CostingДокумент9 страниц03 Overhead CostingPappu LalОценок пока нет

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Документ5 страниц2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarОценок пока нет

- Group 5Документ16 страницGroup 5Amelia AndrianiОценок пока нет

- Colin - BookДокумент15 страницColin - BookrizwanОценок пока нет

- 4 2006 Dec AДокумент5 страниц4 2006 Dec Aapi-19836745Оценок пока нет

- Ch8 PDFДокумент11 страницCh8 PDFGiang NguyenОценок пока нет

- The Other: Cost AccowntingДокумент7 страницThe Other: Cost AccowntingLakshmi SОценок пока нет

- Charles AKMENДокумент11 страницCharles AKMENCharles GohОценок пока нет

- WK4 Abc Ii HMWRK QДокумент1 страницаWK4 Abc Ii HMWRK QFungaiОценок пока нет

- Life Cycle Q&aДокумент48 страницLife Cycle Q&aanjОценок пока нет

- Accounting For FOH Part 11Документ16 страницAccounting For FOH Part 11Shania LiwanagОценок пока нет

- Solution JUN 2018Документ7 страницSolution JUN 2018anis izzatiОценок пока нет

- Unit and Batch Homework SolutionsДокумент2 страницыUnit and Batch Homework Solutionsnikhilcoke7Оценок пока нет

- Additional Chapter AssignmentДокумент4 страницыAdditional Chapter AssignmentM GualОценок пока нет

- Question No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursДокумент3 страницыQuestion No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursRiya SharmaОценок пока нет

- Tugas Sesi 3 - AML PDFДокумент2 страницыTugas Sesi 3 - AML PDFcatharina arnitaОценок пока нет

- Suggested Answer - Syl2008 - June2015 - Paper - 8Документ2 страницыSuggested Answer - Syl2008 - June2015 - Paper - 8Mohammed RafiОценок пока нет

- Financial Plan (Illustration)Документ6 страницFinancial Plan (Illustration)rana samiОценок пока нет

- Tutorial 2 CH 3Документ4 страницыTutorial 2 CH 3Codreanu AndaОценок пока нет

- Q-6 Spr-08 (Yahya Limited) Q AДокумент2 страницыQ-6 Spr-08 (Yahya Limited) Q AiamneonkingОценок пока нет

- Zegu Cac 414 Practice QuestionsДокумент9 страницZegu Cac 414 Practice Questionsloise zvizvaiОценок пока нет

- Budgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Документ3 страницыBudgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Yanwar A MerhanОценок пока нет

- 12914sugg Pe2 gp2 1Документ33 страницы12914sugg Pe2 gp2 1harshrathore17579Оценок пока нет

- Managerial Accounting Answer - Final ExaminationДокумент3 страницыManagerial Accounting Answer - Final ExaminationElsie GenovaОценок пока нет

- CH5 CostДокумент33 страницыCH5 CostNickey DickeyОценок пока нет

- Engaging Activity B - Bruegas, Elaiza Rein A.Документ2 страницыEngaging Activity B - Bruegas, Elaiza Rein A.Akawnting MaterialsОценок пока нет

- Cost & Management AccountingДокумент3 страницыCost & Management AccountingAnurag AwasthiОценок пока нет

- Management Development Institute Gurgaon: InstructionsДокумент2 страницыManagement Development Institute Gurgaon: Instructionspgpm20 SANCHIT GARGОценок пока нет

- Chapter 3 Cost AccountingДокумент2 страницыChapter 3 Cost AccountingJacob DiazОценок пока нет

- Overhead Analysis Solution 1Документ2 страницыOverhead Analysis Solution 1Humphrey OsaigbeОценок пока нет

- SINGH007 Ans Homework Lec 14 To 21Документ47 страницSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiОценок пока нет

- 28 Solved PCC Cost FM Nov09Документ16 страниц28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Income Statement Under Job Order and Activity-Based CostingДокумент10 страницIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanОценок пока нет

- Lecture 14 POAДокумент7 страницLecture 14 POALau Chun GuiОценок пока нет

- Manac3 Main Exam Memo June 2023Документ9 страницManac3 Main Exam Memo June 2023LuciaОценок пока нет

- Module 2 - Problems On Cost SheetДокумент8 страницModule 2 - Problems On Cost SheetSupreetha100% (1)

- TUT 3 - Relevant Information&decision MakingДокумент10 страницTUT 3 - Relevant Information&decision MakingKim Chi LeОценок пока нет

- 5 Job CostingДокумент22 страницы5 Job CostingAbimanyu Shenil0% (1)

- Lecture-7 Overhead (Part 3)Документ9 страницLecture-7 Overhead (Part 3)Nazmul-Hassan SumonОценок пока нет

- Project Report On Grocery Shop: Mrs Atsü PhomДокумент5 страницProject Report On Grocery Shop: Mrs Atsü PhomShyamal DuttaОценок пока нет

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- Akun Impor Ud BuanaДокумент1 страницаAkun Impor Ud BuanaYusnita dwi kartikaОценок пока нет

- Retail Math'Sppt1Документ40 страницRetail Math'Sppt1nataraj105100% (8)

- Guimbungan, Core Competency Module 1 - Part 3 PDFДокумент11 страницGuimbungan, Core Competency Module 1 - Part 3 PDFSharlyne K. GuimbunganОценок пока нет

- Chapter 12Документ31 страницаChapter 12KookieОценок пока нет

- Chapter 5 - Job Order CostingДокумент36 страницChapter 5 - Job Order CostingviraОценок пока нет

- Roll Forward Analysis2Документ4 страницыRoll Forward Analysis2CJ alandyОценок пока нет

- CPAR MAS Preweek - May 2005 EditionДокумент47 страницCPAR MAS Preweek - May 2005 EditionIvhy Cruz Estrella100% (5)

- 1Документ3 страницы1Sunshine Vee0% (1)

- Ch28 Test Bank 4-5-10Документ9 страницCh28 Test Bank 4-5-10bluephoe100% (1)

- Arens14e ch08 PPTДокумент48 страницArens14e ch08 PPTSekar Ayu Kartika SariОценок пока нет

- 1st ExamДокумент51 страница1st Examsimplegirl17100% (3)

- Ae 212 Midterm Departmental Exam - Docx-1Документ12 страницAe 212 Midterm Departmental Exam - Docx-1Mariette Alex AgbanlogОценок пока нет

- Ae 13 Inventories: InventoryДокумент11 страницAe 13 Inventories: InventorySaclao John Mark GalangОценок пока нет

- Cost Accumulation Comp PDFДокумент29 страницCost Accumulation Comp PDFGregorian JerahmeelОценок пока нет

- MG WE FNSACC517 Provide Management Accounting InformationДокумент9 страницMG WE FNSACC517 Provide Management Accounting InformationGurpreet KaurОценок пока нет

- Intermediate AccountingДокумент58 страницIntermediate AccountingSismiko eka Putra60% (5)

- CAC C1M1 Cost Concepts and Cost ClassificationsДокумент9 страницCAC C1M1 Cost Concepts and Cost ClassificationsKyla Mae AllamОценок пока нет

- ACCO 019 Course Guide AY2023-2024Документ4 страницыACCO 019 Course Guide AY2023-2024Joem TarogОценок пока нет

- Data Analysis 5aДокумент4 страницыData Analysis 5aAndemariamОценок пока нет

- K-Chapter 1-5 (To Instructer Elias)Документ32 страницыK-Chapter 1-5 (To Instructer Elias)asheОценок пока нет

- CA Work Sheet Unit 2Документ23 страницыCA Work Sheet Unit 2Shalini SavioОценок пока нет

- 2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Документ16 страниц2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Beverlene BatiОценок пока нет

- Q.9. Differentiate Direct Cost and Direct Costing?Документ10 страницQ.9. Differentiate Direct Cost and Direct Costing?Hami KhaNОценок пока нет

- Tugas 8 - 24Документ7 страницTugas 8 - 24Dhany AkbarОценок пока нет

- Ent600 Blueprint Guidelines & TemplateДокумент15 страницEnt600 Blueprint Guidelines & Templatezatty kimОценок пока нет

- Chapter 2Документ5 страницChapter 2Ibrahim Khalil UllahОценок пока нет

- Integrated and Non Integrated System of AccountingДокумент46 страницIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)