Академический Документы

Профессиональный Документы

Культура Документы

Important Accounting Principles

Загружено:

Marie Sol GalingОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Important Accounting Principles

Загружено:

Marie Sol GalingАвторское право:

Доступные форматы

IMPORTANT ACCOUNTING PRINCIPLES

➔ Entity Concept

● Organization that stands apart from other organizations and individuals as a

seperate economic unit.

● The transactions of different entities should not be accounted together.

➔ Going Concern

● a business will continue in operation for the foreseeable future.

● assumed that the enterprise has neither the intention/need to liquidate materially

the scale of its operations.

➔ Periodicity Concept

● Allows user to obtain timely information to serve as a basis on making decisions

about future activities

● An entity’s life can be meaningfully subdivided into equal time periods for

reporting purposes.

➔ Stable Monetary Unit Concept

● Peso is a reasonable unit of measure and that its purchasing power is relatively

stable

● The basis for ignoring the effects of inflation in the accouting records

➔ Accrual Basis

● The effects of transactions are recognized when they occur and not as cash is

paid or received.

● Revenues as they are earned and expenses as they are incurred.

➔ Matching Principle

● To match expenses against revenues((expenses-revenue to compute profit/loss)

GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

➢ Rules and procedures to define accepted accounting principle at a particular time.

➔ Objectivity Principle

● Records and statements are based on the most reliable data so they will be as

accurate/useful as possible.

● Reliable date are verifiable when they can be confirmed by independent

observers.

➔ Historical Cost

● Assets should be recorded at their actual cost and not as management thinks

they are worth.

➔ Revenue Recognition Principle

● When goods are delivered or services are rendered or performed.

➔ Expense Recognition Principle

● good/services are consumed,expired and used up to produce revenue

➔ Adequate (full) Disclosure

● Requires all relevant information that would affect the user’s understanding and

assessment of the accounting entity be disclosed in the financial statement.

➔ Materiality

●Financial reporting is only concerned with information that is significant enough to

affect evaluations. // It depends on the size and nature of the item

➔ Consistency Principle

● Firms should use the same accounting method to achieve comparability over

time within a single enterprise.

● Changes are permitted if justifiable and disclosed in the financial statements

Вам также может понравиться

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideОценок пока нет

- Chapter 2: Introduction: Why Accounting Standards Exist?Документ7 страницChapter 2: Introduction: Why Accounting Standards Exist?Danial FaizОценок пока нет

- Fin GyaanДокумент80 страницFin Gyaanmayank patelОценок пока нет

- Accounting As A SystemДокумент10 страницAccounting As A SystemFrankoy RuttyОценок пока нет

- Generally Accepted Accounting Principles (FRA) (Murtaza)Документ5 страницGenerally Accepted Accounting Principles (FRA) (Murtaza)راؤ مرتضیٰОценок пока нет

- 11-ACCOUNTANCY NewДокумент4 страницы11-ACCOUNTANCY Newlakshya kediaОценок пока нет

- 08-17-2020 - PPT - Fundamentals of Accounting 1Документ34 страницы08-17-2020 - PPT - Fundamentals of Accounting 1Kyzy Limsiaco100% (1)

- FUN ACC Basic Accounting Concepts and PrinciplesДокумент2 страницыFUN ACC Basic Accounting Concepts and PrinciplesFranchesca CalmaОценок пока нет

- Accounting PrinciplesДокумент17 страницAccounting PrinciplesAbhijay AnoopОценок пока нет

- Concepts and ConventionsДокумент19 страницConcepts and ConventionsHadi HarizОценок пока нет

- Assignment #1: Submitted by Submitted ToДокумент5 страницAssignment #1: Submitted by Submitted Toabdullah akhtarОценок пока нет

- Day 5 - Fund. Concepts and Basic PrinciplesДокумент7 страницDay 5 - Fund. Concepts and Basic PrinciplesRuzuiОценок пока нет

- Lecture 3-Accounting ConceptsДокумент21 страницаLecture 3-Accounting ConceptsLakshman WijayarathnaОценок пока нет

- Fundamentals of Accounting & Basic PrinciplesДокумент24 страницыFundamentals of Accounting & Basic PrinciplesRyan MartinezОценок пока нет

- Funda ReviewerДокумент7 страницFunda Reviewernightmares1234456Оценок пока нет

- Chapter 2 Accounting Concepts - ConventionsДокумент32 страницыChapter 2 Accounting Concepts - ConventionsfaaОценок пока нет

- Fundamental Accounting Concepts and PrinciplesДокумент12 страницFundamental Accounting Concepts and PrinciplesArvin ToraldeОценок пока нет

- Fundamental Accounting Concepts and PrinciplesДокумент12 страницFundamental Accounting Concepts and PrinciplesChristine Joyce EnriquezОценок пока нет

- ACC117 Chapter 2 Qualitative Characteristics and AДокумент26 страницACC117 Chapter 2 Qualitative Characteristics and AitsmeliyaarmyОценок пока нет

- Basic Accounting Concepts and PrinciplesДокумент4 страницыBasic Accounting Concepts and PrinciplesJohn eric CatayongОценок пока нет

- Accounting Principles 2Документ14 страницAccounting Principles 2Mahesh SindhaОценок пока нет

- The Structure of Accounting TheoryДокумент24 страницыThe Structure of Accounting TheoryvallenciaОценок пока нет

- Accounting Concepts and AssumptionsДокумент11 страницAccounting Concepts and AssumptionsRehman TariqОценок пока нет

- Accounting Concepts and AssumptionsДокумент11 страницAccounting Concepts and AssumptionsRehman TariqОценок пока нет

- Accounting Concepts and AssumptionДокумент3 страницыAccounting Concepts and AssumptionIbrahim HussainОценок пока нет

- GAPPДокумент1 страницаGAPPPranal WaghuleОценок пока нет

- Lesson 4.1 GAAP Acctg ConceptsДокумент19 страницLesson 4.1 GAAP Acctg ConceptsSamantha CabugonОценок пока нет

- Accounting Concepts and Principles, IFRS FrameworkДокумент11 страницAccounting Concepts and Principles, IFRS FrameworkMaya DassaОценок пока нет

- Chapter 5 Principls and ConceptsДокумент10 страницChapter 5 Principls and ConceptsawlachewОценок пока нет

- Fundamentals of AccountingДокумент9 страницFundamentals of AccountingKairo ZeviusОценок пока нет

- Chapter 6 - Accounting Concepts and PrinciplesДокумент19 страницChapter 6 - Accounting Concepts and PrinciplesRyah Louisse E. ParabolesОценок пока нет

- AcctTheory - Chap06 Structure of Accounting Theory (Belkaoui)Документ29 страницAcctTheory - Chap06 Structure of Accounting Theory (Belkaoui)Aurora AzzahraОценок пока нет

- Intacc 1Документ8 страницIntacc 1Apple RoncalОценок пока нет

- An Overview of Fundamental Accounting Concepts & Principles: Dr. Kavitha MenonДокумент56 страницAn Overview of Fundamental Accounting Concepts & Principles: Dr. Kavitha MenonAlex JayachandranОценок пока нет

- Study Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Документ11 страницStudy Materials: Vedantu Innovations Pvt. Ltd. Score High With A Personal Teacher, Learn LIVE Online!Yogendra ShuklaОценок пока нет

- Ch.2b Accounting QCs and AssumptionsДокумент13 страницCh.2b Accounting QCs and Assumptionsyfzhizhi0214Оценок пока нет

- Chp14 ConceptsДокумент9 страницChp14 ConceptsMohd Hafiz AhmadОценок пока нет

- BY: Sorup Basnet Sudip Sedhain Sujan Kandel Unell Shrestha Unnati ShakyaДокумент8 страницBY: Sorup Basnet Sudip Sedhain Sujan Kandel Unell Shrestha Unnati ShakyaUnnati ShakyaОценок пока нет

- Accounting Concepts and PrinciplesДокумент5 страницAccounting Concepts and PrinciplesJohn Llyod CaluagОценок пока нет

- Accounting Concepts &Документ15 страницAccounting Concepts &Boi NonoОценок пока нет

- Accounting Concepts and ConventionsДокумент17 страницAccounting Concepts and ConventionsKathuria AmanОценок пока нет

- Unit 2 Accounting PrinciplesДокумент17 страницUnit 2 Accounting PrinciplesKanak RathoreОценок пока нет

- FINACC - Income Statement Terms - 012218 A1Документ7 страницFINACC - Income Statement Terms - 012218 A1ventus5thОценок пока нет

- Topic 2 Regulatory and Conceptual FrameworkДокумент15 страницTopic 2 Regulatory and Conceptual FrameworkfeyОценок пока нет

- Foa NotesДокумент6 страницFoa NotesdhruvОценок пока нет

- Lecture 3A ConceptsДокумент35 страницLecture 3A ConceptsLala BelleОценок пока нет

- Chapter 2 (Intro To Concepts & Conventions of Accounting)Документ15 страницChapter 2 (Intro To Concepts & Conventions of Accounting)DanialОценок пока нет

- Accounting Principles or ConceptsДокумент15 страницAccounting Principles or ConceptsHelen B. EvansОценок пока нет

- Cfas-Chapter 1Документ14 страницCfas-Chapter 1batulahazel20Оценок пока нет

- Accounting Concepts and ConventionsДокумент22 страницыAccounting Concepts and ConventionsMishal SiddiqueОценок пока нет

- LESSON 6 Accounting Concepts and PrinciplesДокумент5 страницLESSON 6 Accounting Concepts and PrinciplesUnamadable UnleomarableОценок пока нет

- Fundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerДокумент64 страницыFundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerAliya SaeedОценок пока нет

- What Is AccountingДокумент29 страницWhat Is AccountingTanaa SulimanОценок пока нет

- Accounting PrinciplesДокумент2 страницыAccounting Principlesayson.wynaaОценок пока нет

- Conceptual Framework of AccountingДокумент5 страницConceptual Framework of AccountingRamji TripathyОценок пока нет

- Chapter 2 - Basic Accounting ConceptsДокумент3 страницыChapter 2 - Basic Accounting ConceptsAlthea AsuncionОценок пока нет

- Accounting PrinciplesДокумент22 страницыAccounting PrinciplesAshiq HossainОценок пока нет

- Accounting and AuditingДокумент97 страницAccounting and AuditingAmir Sadeeq100% (1)

- Introduction To AccountingДокумент34 страницыIntroduction To AccountingDhruv BhagatОценок пока нет

- Concepts, Principles and Convensions - AnoverviewДокумент6 страницConcepts, Principles and Convensions - AnoverviewA KA SH TickuОценок пока нет

- Pemanfaatan Blockchain Pada Pembangunan Sistem Informasi Pembiayaan Usaha Mikro Kecil MenengahДокумент6 страницPemanfaatan Blockchain Pada Pembangunan Sistem Informasi Pembiayaan Usaha Mikro Kecil MenengahMishimaОценок пока нет

- Module 2. Airport and Airline Process (Operations Management)Документ9 страницModule 2. Airport and Airline Process (Operations Management)MARITONI MEDALLAОценок пока нет

- Student Information On Fee PaymentДокумент28 страницStudent Information On Fee PaymentAbdimalik mohamed HusseinОценок пока нет

- Citilink Online Refund IndexДокумент1 страницаCitilink Online Refund IndexVaisal DarmawanОценок пока нет

- People of The Philippines CRIMINAL CASE NO. 10-01688 - Vs - For: Violation of R.A. No. 6539 ULBATA, Et. Al Exhibit Proof PurposeДокумент16 страницPeople of The Philippines CRIMINAL CASE NO. 10-01688 - Vs - For: Violation of R.A. No. 6539 ULBATA, Et. Al Exhibit Proof PurposeGiee De GuzmanОценок пока нет

- Your Combined StatementДокумент10 страницYour Combined StatementN N100% (1)

- A Study On Performance, Efficiency and Solvency Measurement Towards Retail BankingДокумент2 страницыA Study On Performance, Efficiency and Solvency Measurement Towards Retail BankingannamyemОценок пока нет

- MBBcurrent 014301240126 2021-12-31Документ1 страницаMBBcurrent 014301240126 2021-12-31Mohammad RajasegaramОценок пока нет

- 1.arrivals Summary ReportДокумент2 страницы1.arrivals Summary ReportmoisesОценок пока нет

- Plan PDFДокумент1 страницаPlan PDFSuman Kumar100% (1)

- SAP Electronic Bank Statement - Basic Process and Overview - TechloreanДокумент6 страницSAP Electronic Bank Statement - Basic Process and Overview - TechloreaniuriiОценок пока нет

- Resume VivekДокумент3 страницыResume VivekVivek seenivasagamОценок пока нет

- Bauwerk 155822010229 LCДокумент2 страницыBauwerk 155822010229 LCSadid ShahzadОценок пока нет

- ThesisДокумент6 страницThesisKell LynoОценок пока нет

- Banking FraudsДокумент38 страницBanking Fraudssamfisher0528100% (1)

- Direct and Indirect Distribution Channels of Airline Products and Services An OverviewДокумент29 страницDirect and Indirect Distribution Channels of Airline Products and Services An OverviewShijoОценок пока нет

- Assign1 PDFДокумент2 страницыAssign1 PDFPrathiksha RavishankarОценок пока нет

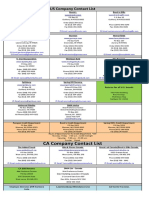

- Company Address List 2018Документ2 страницыCompany Address List 2018Joyce GuecoОценок пока нет

- Treasury Management AssignmentДокумент4 страницыTreasury Management AssignmentJed Bentillo100% (1)

- FA2 and FFA - Fa Examinable Documents S19-Aug20Документ1 страницаFA2 and FFA - Fa Examinable Documents S19-Aug20Älï RäżäОценок пока нет

- Onward Journey Ticket Details: E-Ticket/Reservation VoucherДокумент2 страницыOnward Journey Ticket Details: E-Ticket/Reservation VoucherArun ReddyОценок пока нет

- FABM2 ReviewerДокумент7 страницFABM2 ReviewerMakmak NoblezaОценок пока нет

- Banking RegulationsДокумент5 страницBanking RegulationsManuella RyanОценок пока нет

- iGW Brochure 2021Документ4 страницыiGW Brochure 2021Lâm Trần HữuОценок пока нет

- System-Generated Excel File For January 2022 SalesДокумент120 страницSystem-Generated Excel File For January 2022 SalesGiomar BasalОценок пока нет

- 27-Full Manuscript-489-1-10-20220328Документ7 страниц27-Full Manuscript-489-1-10-20220328TychiqueОценок пока нет

- Assignment 3Документ3 страницыAssignment 3Vasco TorgalОценок пока нет

- Italy Ott Proposition: Andrea PaolettiДокумент7 страницItaly Ott Proposition: Andrea PaolettiAndrea PaolettiОценок пока нет

- HDFC LifeДокумент66 страницHDFC LifeChetan PahwaОценок пока нет

- 1-15 A12060 HMO Manual PDFДокумент460 страниц1-15 A12060 HMO Manual PDFsyunamiОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessОт EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessРейтинг: 4.5 из 5 звезд4.5/5 (28)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)