Академический Документы

Профессиональный Документы

Культура Документы

Quantum Gravity

Загружено:

Subhodeep BanerjeeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quantum Gravity

Загружено:

Subhodeep BanerjeeАвторское право:

Доступные форматы

Personal & Confidential

28-Mar-18

Subhodeep Banerjee

Employee Code: 5039000

Dear Subhodeep,

Sub: Compensation Letter

We are pleased to inform you that your compensation has been revised with effect from 15-Mar-18.

The revised Salary Annexure is enclosed herewith for your reference.

All other terms and conditions of your appointment remain unchanged. All tax liabilities continue to be borne by

you.

We appreciate your contribution and look forward to your continued efforts in making CONCENTRIX the greatest

customer engagement services company in the world, rich in diversity and talent.

Wish you a successful career with Concentrix.

Compensation & Benefits Leader

Concentrix Daksh Services India Private Limited

CNX/C&B/ART/XFR/CL/3.0 Concentrix Confidential

Concentrix Daksh Services India Private Limited

DLF SEZ, Building No. 14, Tower-C, 17th Floor, DLF Cyber City, Sector 25A, DLF Phase-3, Gurgaon - 122 002, India

91 124 463 5100 91 124 426 3311 (fax)

Registered Address: R Cube, Suite Nos- 06 & 07, Lower Ground Floor Level, Shivaji Stadium Metro Station,

Airport Express Line, New Delhi - 110001, India

91 11 4701 6288

CIN:U72200DL1999PTC102972 info@concentrix.com . www.concentrix.com

This is a system generated letter and it does not require any signature.

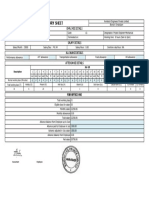

Name: Subhodeep Banerjee

Emp. ID: 5039000

Career Level: 12

Annexure - A

Components

01 Assured Gross Salary Monthly (INR) Annual (INR)

Basic Salary 6,500 78,000

Flexible Benefits Plan * 3,893 46,716

Employer's contribution to ESI ** 620 7,440

Employer's contribution to PF ** 780 9,360

Statutory Bonus/Bonus*** 2,653 31,836

Total Assured Gross 14,446 173,352

02 Variable Earnings**** Monthly (INR) Annual (INR)

Monthly Performance Incentive (Maximum) 2,500 30,000

03 Gratuity** Monthly (INR) Annual (INR)

Gratuity 313 3,756

04 Earning Potential (1 + 2 + 3) Monthly (INR) Annual (INR)

CTC with Variable Earnings at Minimum 14,759 177,108

CTC with Variable Earnings at Maximum 17,259 207,108

Flexible Benefits Plan* :

FBP entitlements will be governed by the Flexible Benefits Plan Policy.

Statutory Contributions** :

All Statutory Deductions [Only to the extent applicable] will be made and deposited with relevant authorities as per the statutory

requirements. All applicable tax liability will be borne by the employee as per relevant statutory tax laws. Gratuity will be

governed by the Payment of Gratuity Act, 1972, which is payable after 5 years of continuous service with the organization.

Statutory Bonus/ Bonus*** :

This is in adherence to the statutory amendments as applicable & is payable monthly through the payroll.

Variable Earnings**** :

This forms a part of the variable pay programs and is as per the defined Company Policies. The management reserves the right

to modify/ amend/ withdraw/ continue with the plans at its discretion. Performance Bonus is subject to individual performance

and shall be paid - monthly/quarterly/annually as defined in the program subject to your meeting the criteria set for specific

process where you have been deployed for that period. Performance Bonus and/or any other performance related incentive(s)

paid will be adjusted against Statutory Bonus payable as per the Payment of Bonus Act as applicable at the time of payment.

Additional Benefit :

Hospitalization, Life Insurance and Accident Coverage as per applicable Company Policies.

This is an information statement only that does not create a contract or any legal rights. Your compensation and the various

constituents are governed by the terms of Concentrix Daksh Services India Private Limited compensation plans and programs,

which may be changed or withdrawn at the sole discretion of Concentrix Daksh Services India Private Limited, based on

company policy and applicable law. If you believe the data shown is inaccurate, please notify your manager.

This is a system generated letter and does not require any signature Concentrix Confidential

Вам также может понравиться

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMДокумент1 страница2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZОценок пока нет

- 2 - 2551442 - Salary - Annexure - 7 - 19 - 2022 9 - 16 - 28 PMДокумент1 страница2 - 2551442 - Salary - Annexure - 7 - 19 - 2022 9 - 16 - 28 PMShauryaОценок пока нет

- India Annexure 2023-05-24Документ2 страницыIndia Annexure 2023-05-24vipin.yadavОценок пока нет

- Adarsh Rao PDFДокумент3 страницыAdarsh Rao PDFAdarsh RaoОценок пока нет

- Adarsh Rao PDFДокумент3 страницыAdarsh Rao PDFPurushothaman AОценок пока нет

- Adarsh Rao PDFДокумент3 страницыAdarsh Rao PDFPurushothaman AОценок пока нет

- Shreenath LNU PDFДокумент3 страницыShreenath LNU PDFshrinathОценок пока нет

- 2 - 2268903 - Salary - Annexure - 1 - 18 - 2022 8 - 08 - 01 PMДокумент1 страница2 - 2268903 - Salary - Annexure - 1 - 18 - 2022 8 - 08 - 01 PMrevanthОценок пока нет

- 3 - 3445522 - Salary - Annexure - 11 - 21 - 2023 1 - 04 - 10 AMДокумент1 страница3 - 3445522 - Salary - Annexure - 11 - 21 - 2023 1 - 04 - 10 AMadithyakadammhadhiОценок пока нет

- India Annexure 2023-05-22Документ2 страницыIndia Annexure 2023-05-22Ankur SinghОценок пока нет

- 2 - 1988712 - Salary - Annexure - 7 - 27 - 2021 5 - 26 - 41 PMДокумент1 страница2 - 1988712 - Salary - Annexure - 7 - 27 - 2021 5 - 26 - 41 PMVi NodОценок пока нет

- SSR CRITERIA V 5.2.1 Student Progression Students Placement Offer LettersДокумент92 страницыSSR CRITERIA V 5.2.1 Student Progression Students Placement Offer LettersNAGARAJ GОценок пока нет

- ACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcДокумент3 страницыACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcFrancis MFAОценок пока нет

- Jain Irrragation SytemДокумент3 страницыJain Irrragation SytemMorya Zerox BuldanaОценок пока нет

- Lot of CompaniesДокумент12 страницLot of Companiesnishanegi9375Оценок пока нет

- Sahil Dilari-Offer LetterДокумент9 страницSahil Dilari-Offer Letterrahul parakhОценок пока нет

- Anusha Yenishetty PDFДокумент2 страницыAnusha Yenishetty PDFSrinivasa Rao JagarapuОценок пока нет

- 3 - 2636092 - Salary - Annexure - 8 - 29 - 2022 5 - 59 - 43 PM PDFДокумент1 страница3 - 2636092 - Salary - Annexure - 8 - 29 - 2022 5 - 59 - 43 PM PDFRitesh ZanjurneОценок пока нет

- Compensation 1682945 2020-2021Документ9 страницCompensation 1682945 2020-2021Alisha riya FrancisОценок пока нет

- Deepank Sharma PDFДокумент9 страницDeepank Sharma PDFgourav sharmaОценок пока нет

- Regd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Документ9 страницRegd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Pragathi MittalОценок пока нет

- 1194 Sneha Babu-Teleperformance (CEE) 2019-2020Документ3 страницы1194 Sneha Babu-Teleperformance (CEE) 2019-2020Dipa PaulОценок пока нет

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Документ3 страницы1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikОценок пока нет

- 1Документ3 страницы1manojОценок пока нет

- ESOPs Policy & CTC Structure - Urban Tribe 2022 2Документ8 страницESOPs Policy & CTC Structure - Urban Tribe 2022 2guptaaditya1108Оценок пока нет

- Offer Letter JyotiДокумент3 страницыOffer Letter Jyotitushar.phalswalОценок пока нет

- Sai Nandini KandulaДокумент9 страницSai Nandini KandulanandiniОценок пока нет

- Alphonse Irudayaraj Offer LetterДокумент4 страницыAlphonse Irudayaraj Offer Letteralphonse IОценок пока нет

- INTL FCStone-Offer Letter - Shweta - ITMS - EncryptedДокумент1 страницаINTL FCStone-Offer Letter - Shweta - ITMS - Encryptedshweta moreОценок пока нет

- Suresh Bethavandu: Global Head-Talent AcquisitionДокумент3 страницыSuresh Bethavandu: Global Head-Talent AcquisitionThejeshReddyОценок пока нет

- 1Документ9 страниц1Shabi EntertainerОценок пока нет

- India Offer Letter 2024-02-07Документ9 страницIndia Offer Letter 2024-02-07jagdishkumawat22576Оценок пока нет

- LetterДокумент5 страницLetterJyotirmay SahuОценок пока нет

- Ashwinisudhakarrao EmekarДокумент2 страницыAshwinisudhakarrao EmekarswatiОценок пока нет

- Confirmation LetterДокумент2 страницыConfirmation LetterdineshgenopharmaОценок пока нет

- Dinesh Babu NatarajanДокумент9 страницDinesh Babu NatarajanTeja 17bf1a04h1Оценок пока нет

- EunosДокумент2 страницыEunosOkDiReportОценок пока нет

- 273-Offer Letter - Raghul VДокумент2 страницы273-Offer Letter - Raghul VRaghul Shangarthiyan100% (1)

- Ramya M 16-479Документ4 страницыRamya M 16-479Nagaraja RaoОценок пока нет

- Cand 22270 PDFДокумент1 страницаCand 22270 PDFraju sallaОценок пока нет

- Cand 22270 PDFДокумент1 страницаCand 22270 PDFraju sallaОценок пока нет

- Offer From InterviewBit To Bikramjeet SinghДокумент2 страницыOffer From InterviewBit To Bikramjeet SinghBikramОценок пока нет

- Ashok Kumar RamakrishnanpadmanabanДокумент2 страницыAshok Kumar Ramakrishnanpadmanabanudayasankar KОценок пока нет

- Anusha AervaДокумент2 страницыAnusha Aervamrcopy xeroxОценок пока нет

- Compensation LetterДокумент6 страницCompensation LetterRashmikant RautОценок пока нет

- Gillela Raghavender 6029273 2022 SALARY REVISION LETTER1Документ3 страницыGillela Raghavender 6029273 2022 SALARY REVISION LETTER1Careersjobs IndiaОценок пока нет

- Amruthyunjaya Hruser 4 1670936962502Документ7 страницAmruthyunjaya Hruser 4 1670936962502Anusha RampalliОценок пока нет

- Offer Letter Kather Oli AbdulДокумент2 страницыOffer Letter Kather Oli AbdulKarupusamy PОценок пока нет

- Current Holding OfferДокумент9 страницCurrent Holding Offernizar mohammedОценок пока нет

- Regd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Документ9 страницRegd Office: 115/535, Old Mahabalipuram Road, Okkiam Thoraipakkam, Chennai - 600 097Bhargav DragneelОценок пока нет

- Offer Letter-Siddharth KukrejaДокумент5 страницOffer Letter-Siddharth KukrejaSiddharth100% (1)

- Compensation 880590 20172018 PDFДокумент2 страницыCompensation 880590 20172018 PDFShefali SrivastavaОценок пока нет

- Offer Letter - UniqloДокумент2 страницыOffer Letter - UniqloSagar Shiriskar100% (1)

- Appraisal Letter Apr'23 - 2022-23 - FY 2023 - 2024.Документ2 страницыAppraisal Letter Apr'23 - 2022-23 - FY 2023 - 2024.salimmama1919Оценок пока нет

- MR Bipin Offer PDFДокумент3 страницыMR Bipin Offer PDFBipin SinghОценок пока нет

- RanjitДокумент5 страницRanjitjawedaman123Оценок пока нет

- Mr. Noor Ali SayyedДокумент3 страницыMr. Noor Ali Sayyedfaaiza.sayyedОценок пока нет

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОт EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОценок пока нет

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Credit Union Revenues World Summary: Market Values & Financials by CountryОт EverandCredit Union Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Case 4 4 National Office MachinesДокумент3 страницыCase 4 4 National Office MachinesMary Rose C. Lodrico0% (2)

- SMETA Audit Criteria GuideДокумент24 страницыSMETA Audit Criteria Guidetony s100% (2)

- ACCA - AA - Camomile SD18Документ4 страницыACCA - AA - Camomile SD18ChrisОценок пока нет

- Voyage Charter AgreementsДокумент56 страницVoyage Charter AgreementsMahdi Bordbar83% (12)

- Ashtech Promark 700 Datasheet 651Документ4 страницыAshtech Promark 700 Datasheet 651Miftahus SiddiqОценок пока нет

- LibinДокумент1 страницаLibinLibin R SОценок пока нет

- Dep Prep Adj Noun CollocationДокумент3 страницыDep Prep Adj Noun CollocationarioliОценок пока нет

- Which Is Good For You": Mujtaba M. MominДокумент7 страницWhich Is Good For You": Mujtaba M. Momincaesar victorianОценок пока нет

- Air India Report Operations ManagementДокумент14 страницAir India Report Operations ManagementK.Kiran KumarОценок пока нет

- Mgt210 Case 2Документ4 страницыMgt210 Case 2Saidul Alam Rahat 1721598Оценок пока нет

- PALEДокумент23 страницыPALElawschoolwaveОценок пока нет

- Template Letter Post DoctoralДокумент3 страницыTemplate Letter Post DoctoralPamela Grace AnzuresОценок пока нет

- Forensic Investigation: Appendix - M. Sack CompaniesДокумент63 страницыForensic Investigation: Appendix - M. Sack CompaniesSipekne'katikОценок пока нет

- LU 1 Introduction To MicroДокумент83 страницыLU 1 Introduction To Microviey91Оценок пока нет

- The 7 Elements of High Performing TeamsДокумент18 страницThe 7 Elements of High Performing TeamsSara MazzarellaОценок пока нет

- Strategies For Growth and Managing The Implications of GrowthДокумент28 страницStrategies For Growth and Managing The Implications of GrowthRehmani MehboobОценок пока нет

- International Cities NewyorkДокумент6 страницInternational Cities NewyorkDaniela StaciОценок пока нет

- The Application LetterДокумент10 страницThe Application LetterChristineОценок пока нет

- Chapter 2 - Management AspectДокумент18 страницChapter 2 - Management AspectPiolen NicaОценок пока нет

- Am No 11-6-10-Sc Guidelines For Litigation - QCДокумент13 страницAm No 11-6-10-Sc Guidelines For Litigation - QCMark LojeroОценок пока нет

- Terminal ReportДокумент4 страницыTerminal ReportshamilleОценок пока нет

- ETAR Course Syllabus PDFДокумент5 страницETAR Course Syllabus PDFReinaОценок пока нет

- (APPENDIX B) CHAROEN-POKPHAND-GROUP-attachment-human-rights-policy PDFДокумент5 страниц(APPENDIX B) CHAROEN-POKPHAND-GROUP-attachment-human-rights-policy PDFLionel TanОценок пока нет

- Assignment 5 - AW Ltd.Документ2 страницыAssignment 5 - AW Ltd.Kunal SharmaОценок пока нет

- Future Rewards Valuation ModelДокумент2 страницыFuture Rewards Valuation ModelWelcome 1995Оценок пока нет

- Duncan V GlaxoДокумент6 страницDuncan V GlaxoRey BenítezОценок пока нет

- CHRA Labor Code Reviewer PDFДокумент23 страницыCHRA Labor Code Reviewer PDFMitch CantosОценок пока нет

- New Bajaj Co. FinalДокумент28 страницNew Bajaj Co. FinalNihal Mehta50% (2)

- KLF Nirmal Industries (P) LTD.: KRKCH00139340000000650Документ1 страницаKLF Nirmal Industries (P) LTD.: KRKCH00139340000000650Hytech Pvt. Ltd.Оценок пока нет

- Softronic HCMS Brochure (Recruitment Edition)Документ10 страницSoftronic HCMS Brochure (Recruitment Edition)Asif MaqboolОценок пока нет